Four Must-Know Facts About Investing in Physical Gold

Sometimes all that glitters is gold. The precious metal has been a recognised store of value and investment staple throughout history, and this sentiment holds true today. Even during the most volatile market conditions in recent years, such as the 2008 Global Financial Crisis and the 2020 Covid crash (and the years which followed), the gold price held its ground as investors sought out proven, safe haven assets.

Gold piqued the interest of many investors when prices hit record highs in May 2023 – beckoning the question: why should you consider investing in gold?

1. Diversification and Lack of Correlation

In asset allocation, gold’s role is diversification. This makes it different from property, shares, and bonds – which provide income, capital growth and stability, respectively. Gold tends to perform well when other assets struggle, helping to limit losses. It does this due to its tendency to perform well during crises and low correlations with other assets. For this reason, adding even a small about of gold to a portfolio can help protect it against drawdowns. That is not to say it will prevent capital loss across your portfolio, but it asks as a kind of insurance during volatile market conditions.

2. Potential Returns

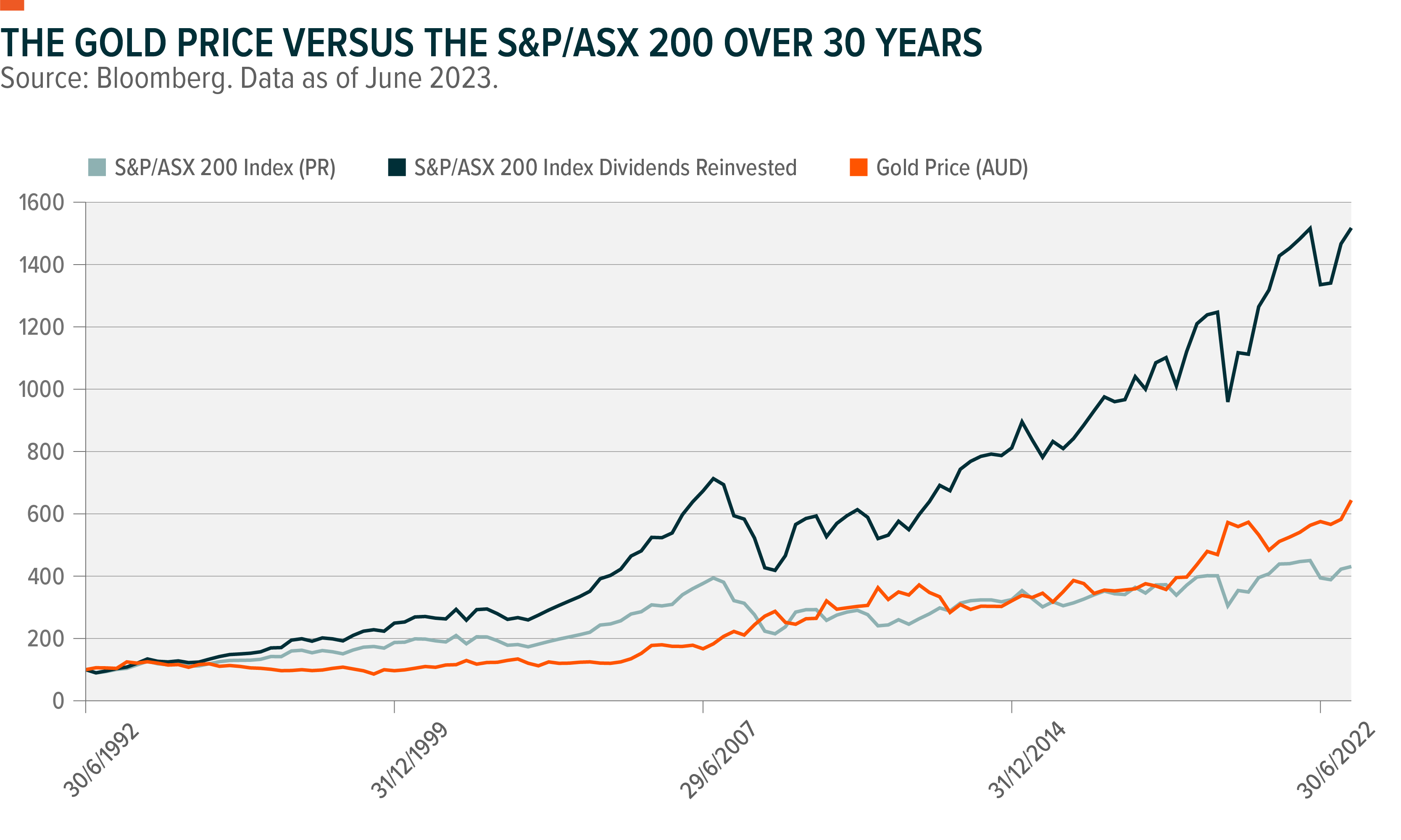

Another potential reason to invest in gold is the investment returns it has provided over the long term.

Since the gold standard ended in 1971 and a free gold market was born, the gold price has performed more or less in line with the S&P 500 on a price return basis (meaning the capital appreciation of the asset). Closer to home, gold has outperformed the S&P/ASX 200 Index on a price return basis but underperformed on a total return basis (which assumes all dividends are fully reinvested). This suggests that gold has been a relatively strong performing asset for Australians.

Furthermore, when you consider that only 39% of ASX-listed companies have provided positive total returns over their listed lifetimes between 1991 and 2021, it means most ASX-listed companies have lost money during that period and therefore underperformed gold, which has annually returned approximately 9% over the past 20 years.

3. Gold Price Drivers

Investors considering gold may also wonder what drives the gold price. Gold does not have an internal rate of return like shares and bonds. So, it cannot be valued using conventional methods like discounted cash flow analyses. Statistically, the best two predictors of the gold price are real yields on 10-year US government bonds and the US dollar.

The reason behind gold’s relationship with real yields on US government debt is that gold, like other assets, is directly impacted by prevailing interest rates. And gold generally does best when real interest rates (which include the impact of inflation) are low – or even negative.

The other major predictor is the strength of the US dollar because gold, like other commodities, trades primarily in US dollars. Despite this, the US only accounts for a minority of gold purchases, while China and India are the biggest gold-buying nations. This means that when the US dollar falls, it becomes easier for people outside the US to buy gold. This can then translate into greater gold buying, which supports prices.

4. Physical Gold ETFs – Simple, cost-effective exposure.

Since Global X launched the world’s first physical gold exchange-traded product (ETP) in 2003, physical gold ETPs have significantly increased in popularity. They house over US$210 billion worth of gold worldwide, according to the World Gold Council. They are also the most common kind of ETP, appearing on exchanges globally from India to Russia to Egypt.

Gold ETPs are units in physical gold bars that trade on an exchange like stocks. They are fully backed by gold bars held in bank vaults – helping to reduce storage risks and costs for individual investors. As a result, gold ETPs are often the preferred route for investing in gold for many .

Gold ETPs are units in physical gold bars that trade on an exchange like stocks. They are fully backed by gold bars held in bank vaults – helping to reduce storage risks and costs for individual investors. As a result, gold ETPs are often the preferred route for investing in gold for many investors.

Strengthening a Portfolio with Physical Gold

No matter if markets are smooth sailing or capitulating, there is a role for gold in portfolios. It can diversify, protect, and provide returns when incorporated alongside a well-diversified asset mix. Physical gold ETPs like Global X Physical Gold (ASX: GOLD), provide investors with cost-effectively access in one simple trade. To dig even deeper into physical gold investing, read the full investment case here.