What is Fintech?

Fintech is a combination of the words finance and technology.

A fintech company is a business that uses technology to enhance financial services. In so doing, fintechs unsettle incumbents – banks, wealth managers, insurers – and make financial services cheaper and more efficient.

Free share trading, instant international money transfers, robo-advice, digital wallets—we have seen much fintech disruption already. With blockchain adoption looming, the world steadily turning cashless, and the global payments infrastructure becoming standardised—there is still much disruption to come.

In this article we give an overview of the fintech industry and some of its major trends and opportunities.

Fintech today: 5 disruptive themes

Fintech disruption is around us today as well. We believe there are five major fintech trends reshaping finance. They are:

- Cashless society

- Blockchain adoption

- Wealth moves online

- The rise of alternative credit

- Cloud, big(ger) data

Below we give a survey of these trends and look at what they have to offer investors.

Cashless society

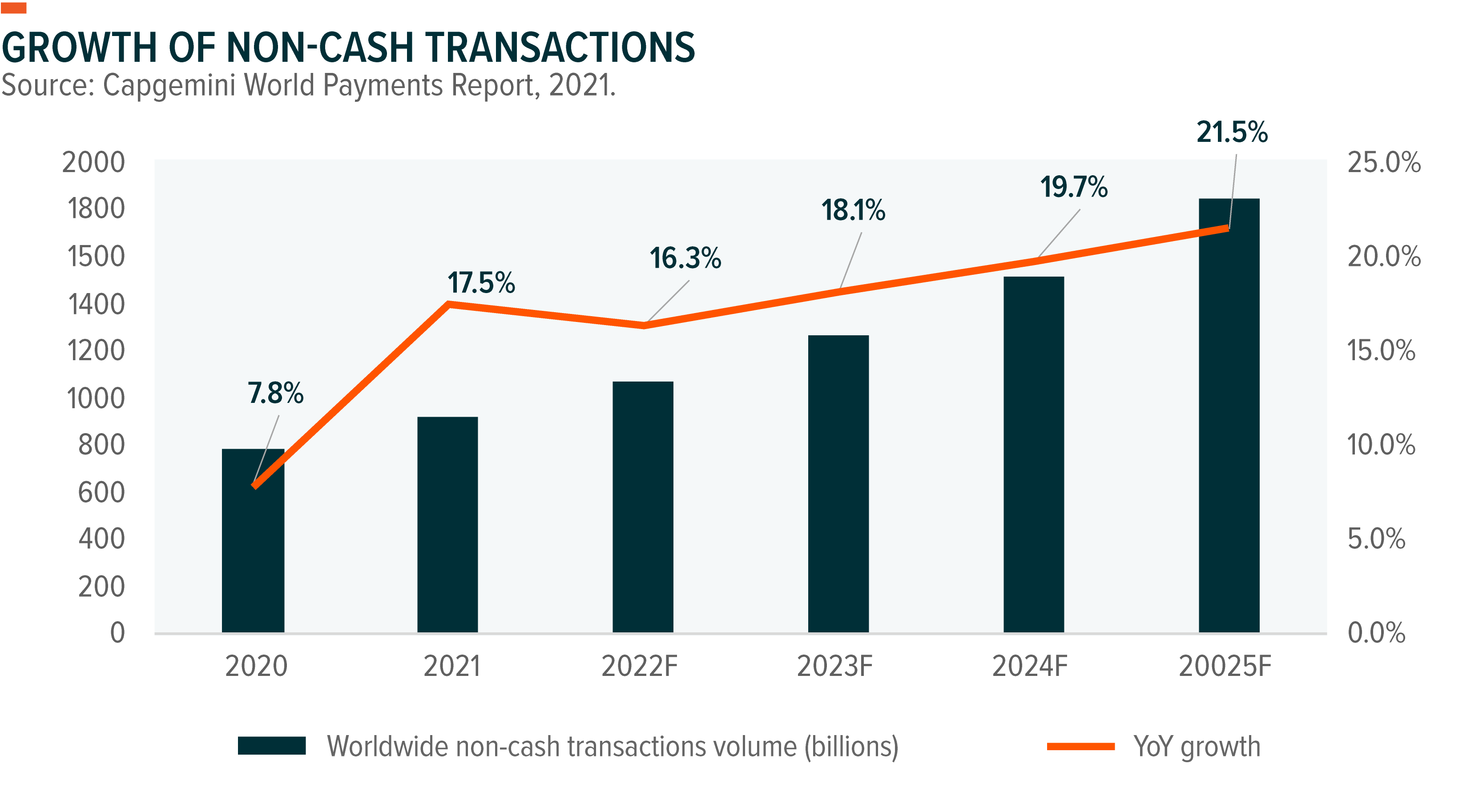

Businesses and consumers are using cash less than ever. According to a study from Capgemini, non-cash transactions are forecast to grow at a compound annual growth rate of 18.6% up until 2025. The reason for this is that digital payments are simpler and safer. Safer because they are easier to trace and audit—cashless money is also harder to steal. Simpler because the fit more neatly with online shopping.

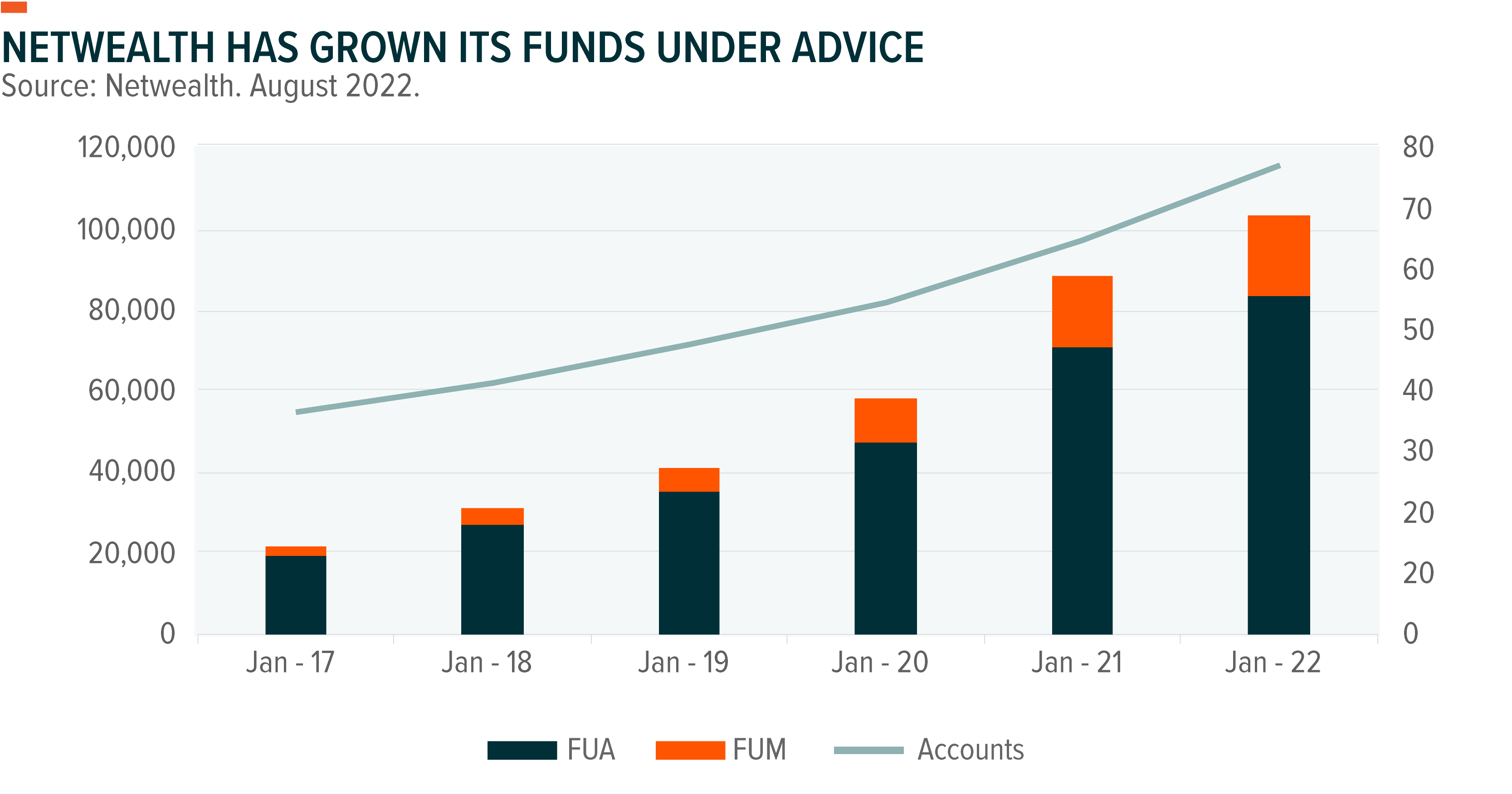

Fintechs have also opened access to financial advice. Automated financial advice – known as “robo-advice” – has given investors with lower balances access to personal advice (whereas traditional flesh and blood financial advisers typically require high minimums in liquid assets to take on a client). Flesh and blood advisers have benefitted from fintech too, as new online platforms – like Netwealth and Hub24 – provide them with a one-stop-shop for managing all their clients’ portfolios.

The rise of alternative credit

Regulations introduced after the 2008 financial crisis – known as “tier 1 capital requirements” – have reigned in the banks from making riskier loans. The regulations have had a particularly strong impact on banks’ willingness to lend to poorer businesses and households, who carry a higher risk of being unable to repay.

Banks’ reluctance to make these loans has created opportunities for fintechs. And into this breach alternative credit fintechs have entered, providing the riskier loans to consumers. Afterpay’s, which been acquired by Square, enormous success is largely explainable by these banking regulations. As its business model, based on “factoring without recourse”, is largely off-limits for the banks.

Fintech peer-to-peer lenders (P2P) like LendingClub in the US and Lufax in China have also joined this space. Rather than just targeting the borrowers like Afterpay does, they also target the lenders. They aim to identify consumers needing loans and match them with consumers willing to lend them money.

Cloud, big(ger) data

Data has always been crucial for financial markets as it allows assets to be priced accurately and quickly. Data is also the fuel of automation.

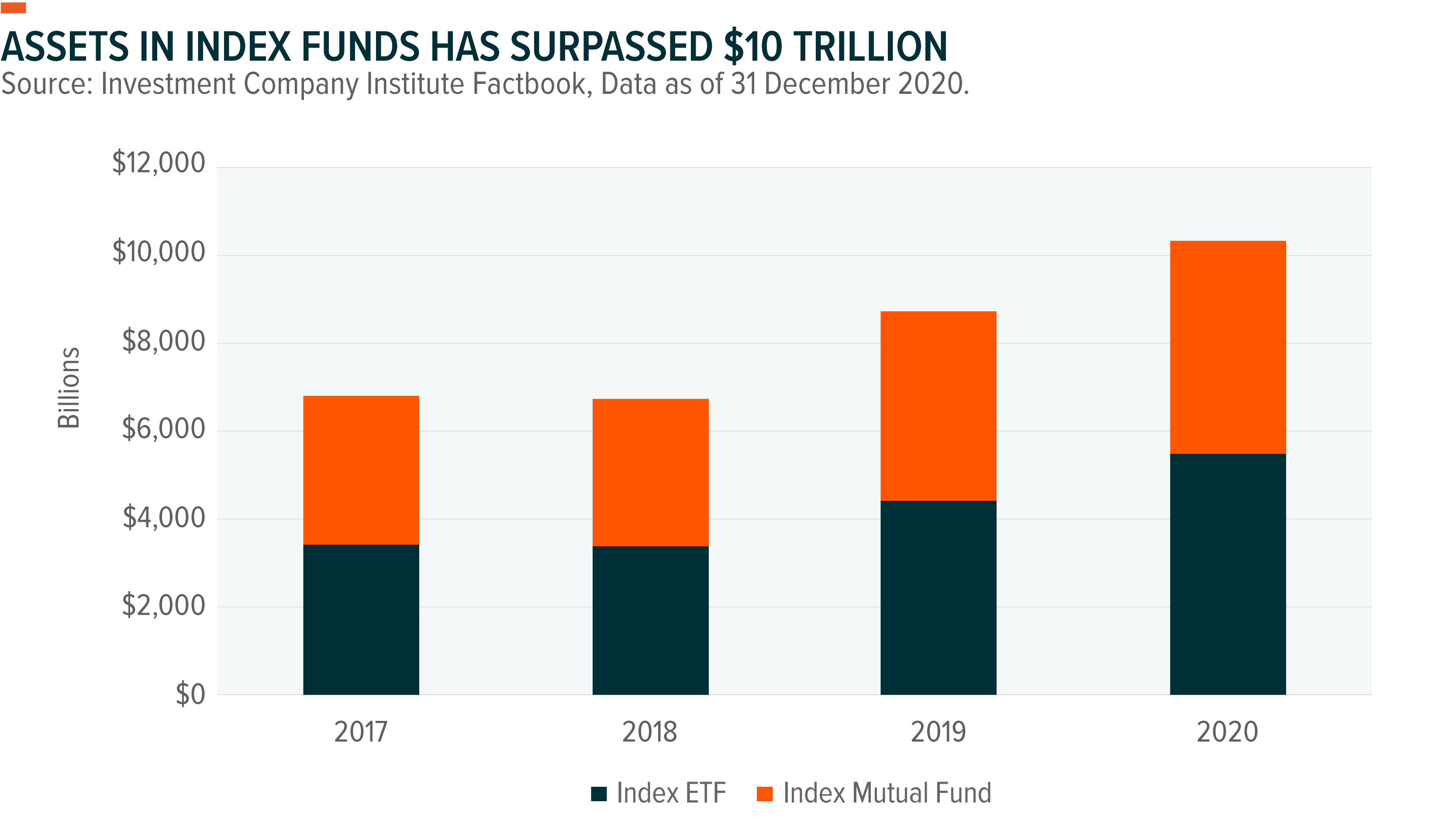

There are many kinds of data that fintech companies are using. An example from our own industry – funds management – is index data, provided by companies like MSCI and S&P Global. Index data has been used – with considerable success – to create low-cost index funds and ETFs. Index funds and ETFs essentially automate securities selection and analysis, which then allows fund managers to scale more efficiently. These cost savings then get passed onto investors. Index funds have grown like wildfire the past five years.

Personal credit and property data – from FICO and Black Knight – is another example. Mortgage brokers and the banks require data to accurately assess individuals’ and companies’ creditworthiness. This then allows them to decide whether to lend them money.

Sitting alongside these are fintech software companies, which are increasingly migrating to the cloud. Software companies are helping remove much of the drudge paperwork and time spent boring into spreadsheets – which there is no shortage of in finance. To give a local example, Xero, the Australian-New Zealand company, has built software that allows companies to monitor their revenue, cash flow and accounts in real time rather than periodically when they update spreadsheets.

Related Funds

FTEC: The Global X Fintech & Blockchain ETF (FTEC) tracks the Indxx Developed Markets Fintech and DeFi Index. The index is made from companies derived from several fintech subthemes, including: digital payments, point of sale, peer-to-peer lending and crowdfunding, personal finance software—and more. It holds Afterpay, Zip, Xero – and many others. Companies are chosen based on revenue purity, to ensure they truly fintech businesses. It aims to capture the major trends we are seeing in fintech discussed above.

Click the fund name above to view the fund’s current holdings. Holdings are subject to change. Current and future holdings are subject to risk.