Whither China, and Thematic Implications

The Fed might not be the most important game in town for the global financial markets these days. The AI revolution and coming U.S. elections will stay in the headlines, but in my view, China may take top billing. China’s economy is slowing, the real estate sector is under pressure, and diplomatic connections with the West are tenuous.1 Once thought of as indispensable to the global economy, COVID-19 revealed cracks in the foundation of China’s current Communist-Capitalist system. China will likely remain a global juggernaut, but the future has grown opaque and the central government now faces difficult choices. Investors should consider the potential spillover effects of a weakened China both in economics and international politics. No matter which path China chooses, the thematic story may well remain the same.

Key Takeaways

- Predictions of China’s “inevitable” surpassing of the United States as the world’s foremost economic power rested on a series of assumptions that required everything to go right. Data suggest that China’s economic growth miracle may be ending.

- China’s exports have been declining and the government has been slow to develop a consumer economy strong enough to offset the trade slowdown. This scenario may push China’s leadership to be more aggressive either with domestic stimulus, the international agenda, or both.

- China could chart a competitive or cooperative course, but many themes like Robotics, AI, Cleantech, and Infrastructure remain pertinent in either case. A contrarian theme such as China or U.S. Consumer Discretionary could also be interesting.

Getting Lost on the Way to the New Global Order

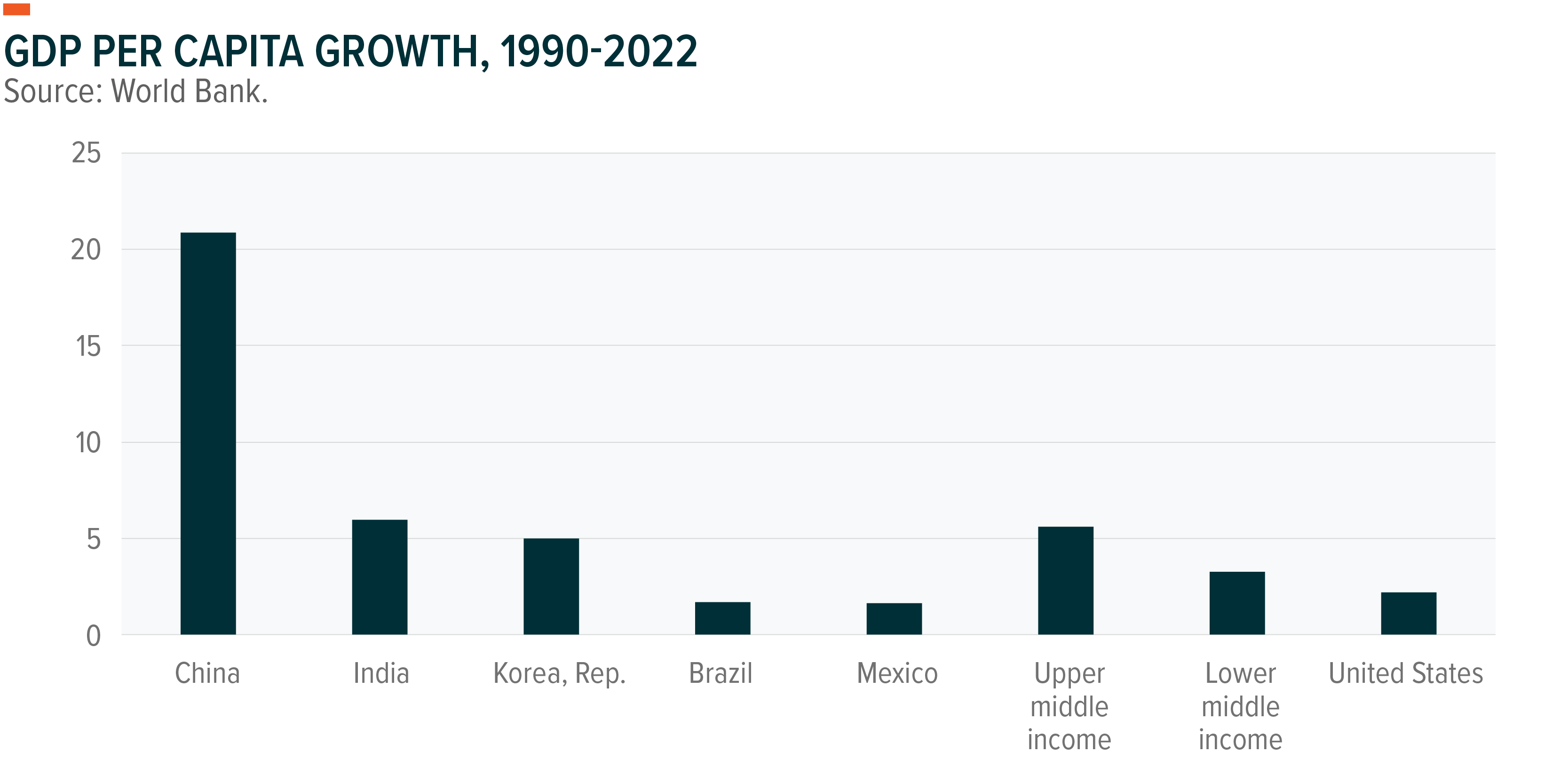

China has been perhaps the biggest beneficiary of the U.S. and western-led trading system established after World War II, and the last 30 years is proof. The chart below shows that China’s economic wealth, measured by GDP per capita growth, grew by leaps and bounds over every other major emerging market.2 Despite this success, some believe China is increasingly interested in revising the current global order.3

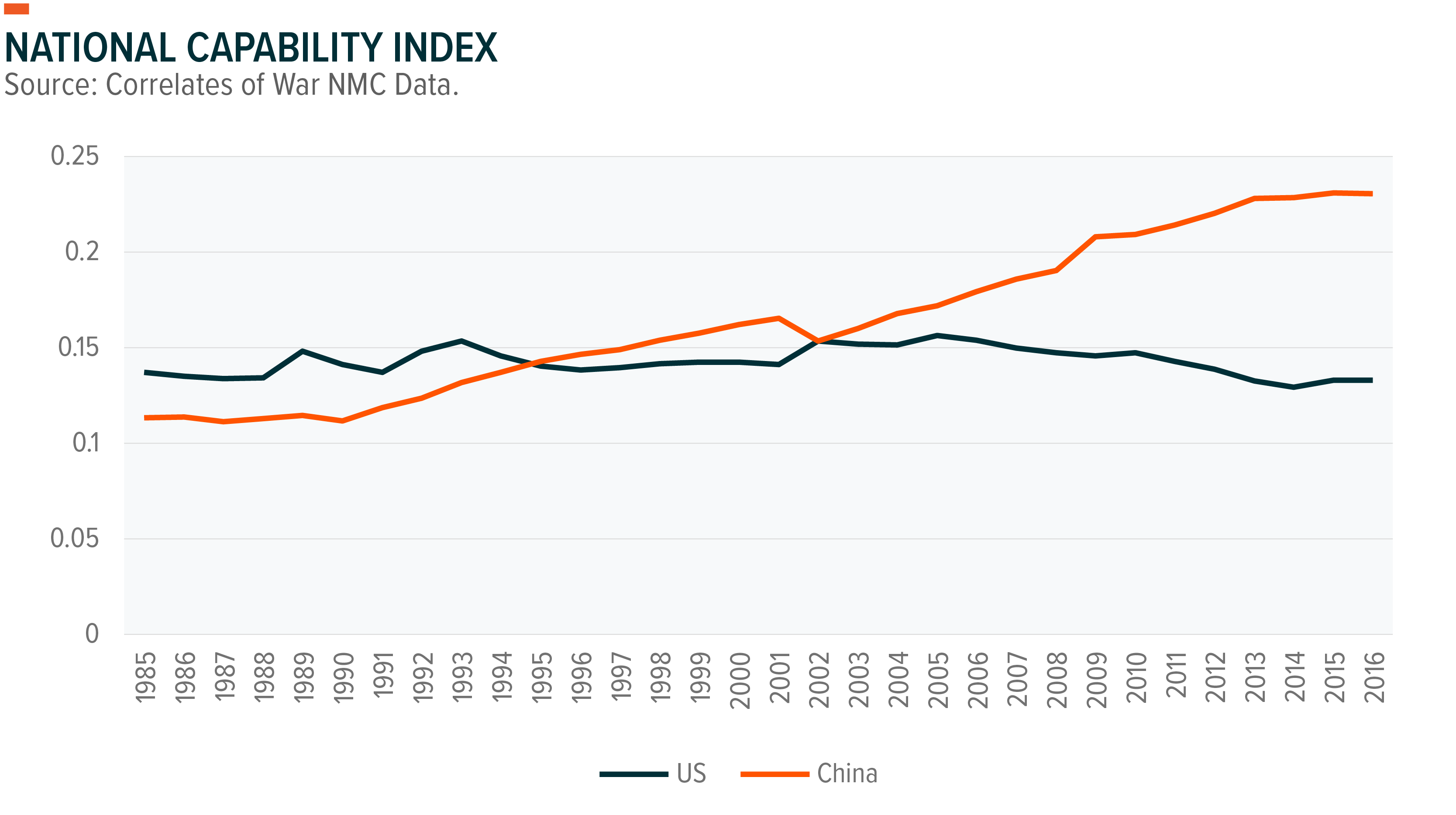

For years, experts have attempted to estimate when China would overtake the U.S. economy. On a pure GDP basis, the U.S. is expected to remain the world’s largest economy for the foreseeable future, but adjusted for purchasing power parity, China is supposed to jump ahead in the next few years.4 Another metric that political scientists consider is national capabilities based on variables like defence spending, population, and access to raw materials.5 According to the National Capabilities Index below, China caught up to the U.S. in the early 2000s, though some might disagree with this methodology of assessing capabilities given modern defence technology.

The problem with forecasts of China’s inevitable economic and military supremacy was that many of them assumed that everything would go right for China (and possibly wrong for the U.S.). The assumption seemed fair given China’s remarkable economic growth, including the rise of a vibrant manufacturing sector, their critical role as an exporter, and some astute foreign policy management. At the moment, though, one would be hard pressed to suggest that everything is going right.6

Centrally managing a rapidly growing economy with over a billion people is remarkably complex. COVID-19 and its aftermath brought the challenges of managing such a massive system to light. China remains the second largest economy in the world and a leading global political power, but the once seemingly “inevitable” economic and power transition may be worth revisiting.7

Where for Art Thou China

With U.S. relations deteriorating on several policy fronts, China made a series of diplomatic decisions that could be described as isolationist in recent months. President Xi sat out September’s G20 Summit in India, and as of yet has not committed to attending the highly anticipated Asia-Pacific Economic Cooperation (APEC) meeting in California set for November.8

Beyond the isolationist signals, the lack of attendance also does not instil confidence in China’s current state of economic affairs. China’s post-Covid reopening was met with anticipation and investor interest, but quickly fizzled.9 The reopening was partial, at best, and executed hastily. In turn, the economy struggled to get going, and China found that after almost two years of lockdown, global supply chains had shifted to account for lower Chinese output.10

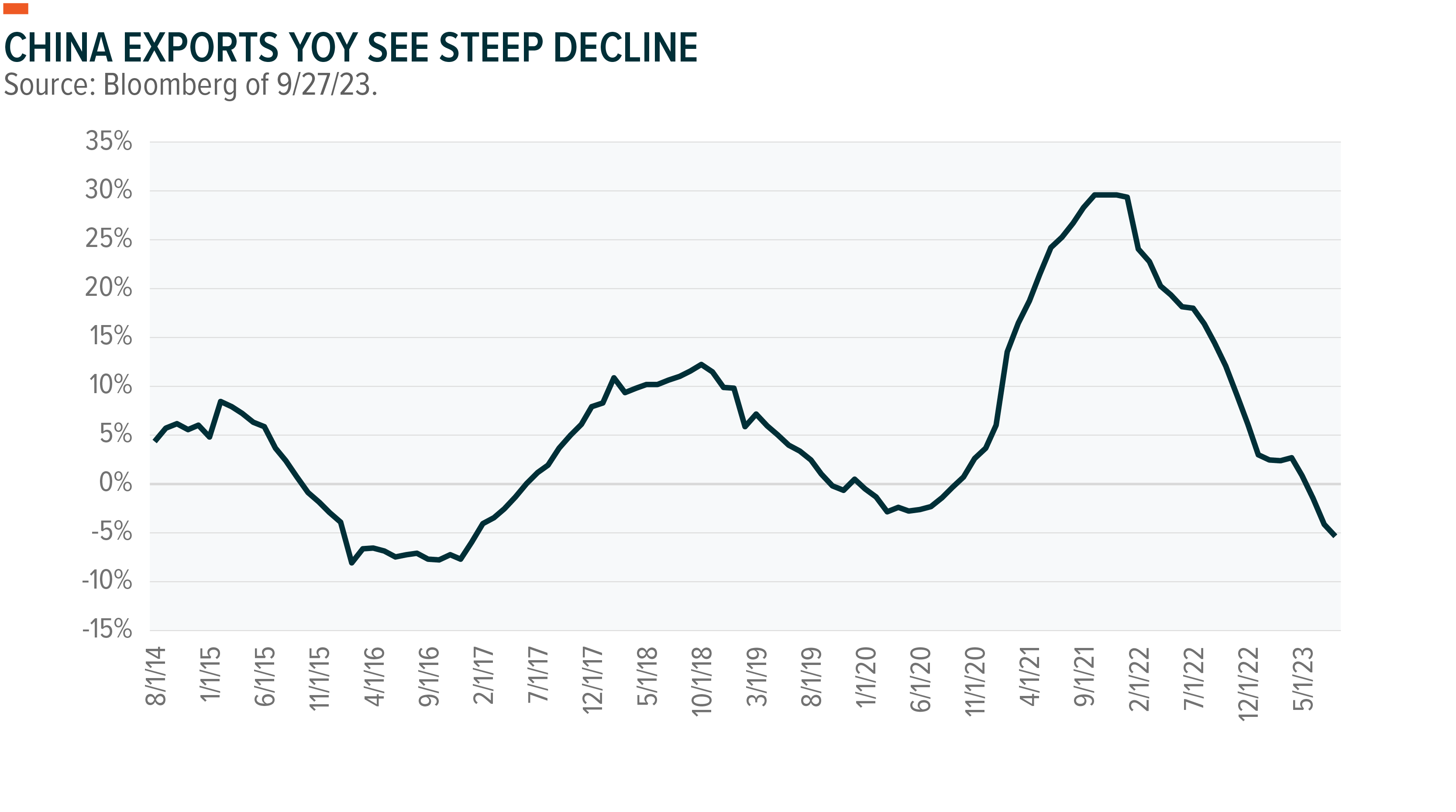

The chart below shows that the drop in export growth in recent months as the largest move in a decade.11 Whether the drop is a product of the sluggish reopening, the reorganisation of supply chains to reduce concentration risk, a concerted policy of economic isolationism, or some combination of the three, the fact remains that the economic impact is meaningful. Economic growth slowed and the government has taken some basic steps like reducing short selling and margin requirements in an effort to sure up financial markets. Historically, the stabilising effects of such measures are short-lived.12 The government has also taken steps toward lowering borrowing standards and transaction costs to bolster the slowing real estate sector.

While many investors continue to wait on some type of massive government stimulus, long-term structural shifts may be required if China is to revive its historic growth trajectory. Should exports decline in a vacuum, economic growth will decline as well, unless China can stimulate new sources of demand.

Domestic consumption is likely critical in meeting the shortfall. The rise in GDP per capita fuelled the growth of China’s middle class and household consumption, but China has struggled to generate a consumer-led economy. Household consumption is higher today than in generations past, but savings rates are also high.13 Consumers are leaning cautious. China is technically a socialist country led by the Communist Party, but provision of social safety nets are limited. While the country has recently taken steps to expand some social safety programs, the changes offer only a modest reprieve for some citizens.

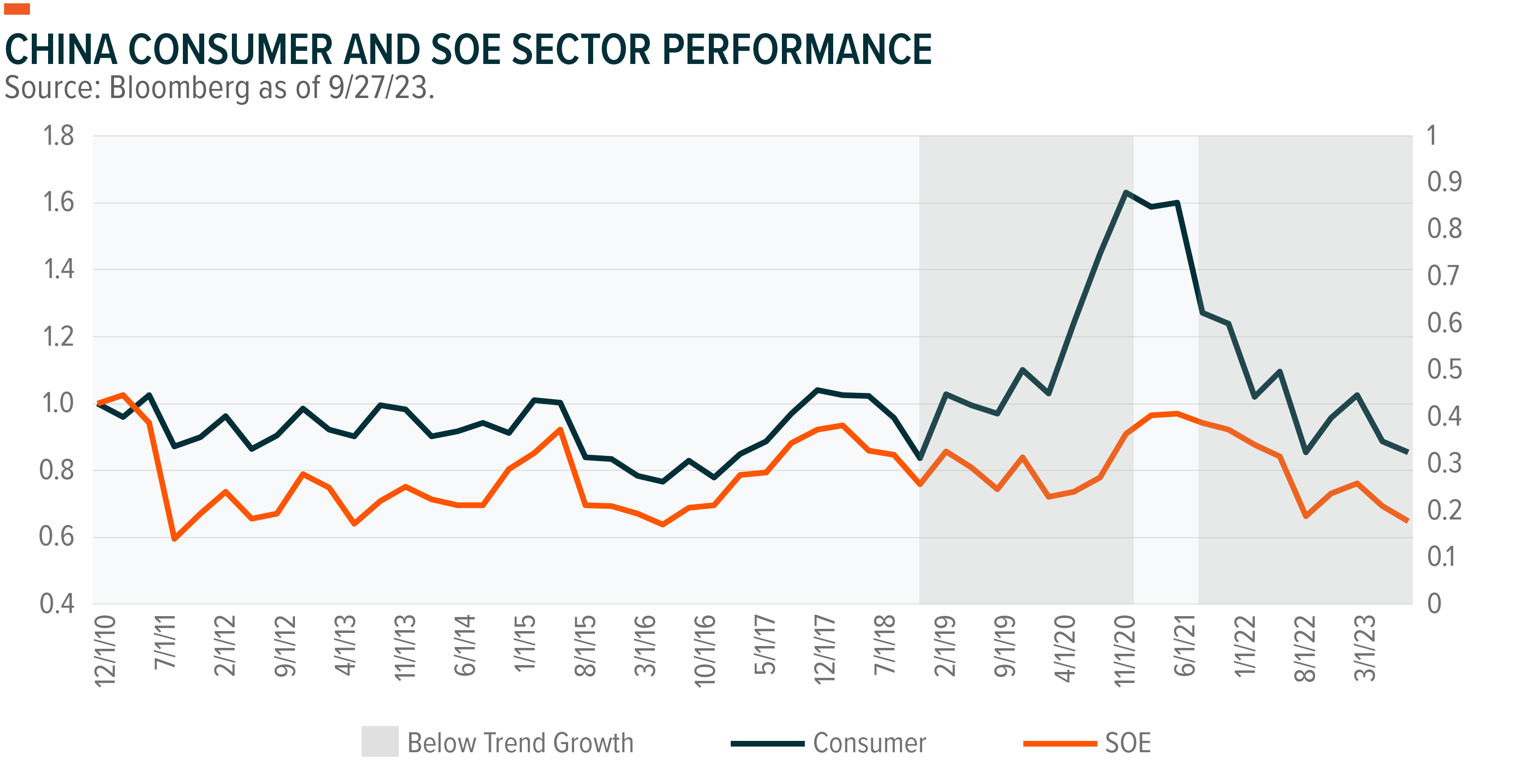

Consumer-oriented sectors ebb and flow along with the consumer in China, as the chart illustrates. Sectors tied to the consumer such as Consumer Discretionary, Staples, and Communications Services have been more volatile in slow growth periods than state-owned enterprise (SOE) sectors like Industrials, Materials, and Financials, which benefit from government support.14

Sluggish consumer culture is nothing new, despite China’s attempts to encourage spending. China certainly has the resources to stimulate consumer demand, but when faced with a slowing economy, China often flinches.15 Influencing the behaviour of state-sponsored business sectors is likely easier than guiding the decisions of 500 million or 1 billion consumers. So, funds that could be used to build a safety net and drive consumption frequently go into industrial and real estate projects backed by local banks instead.16

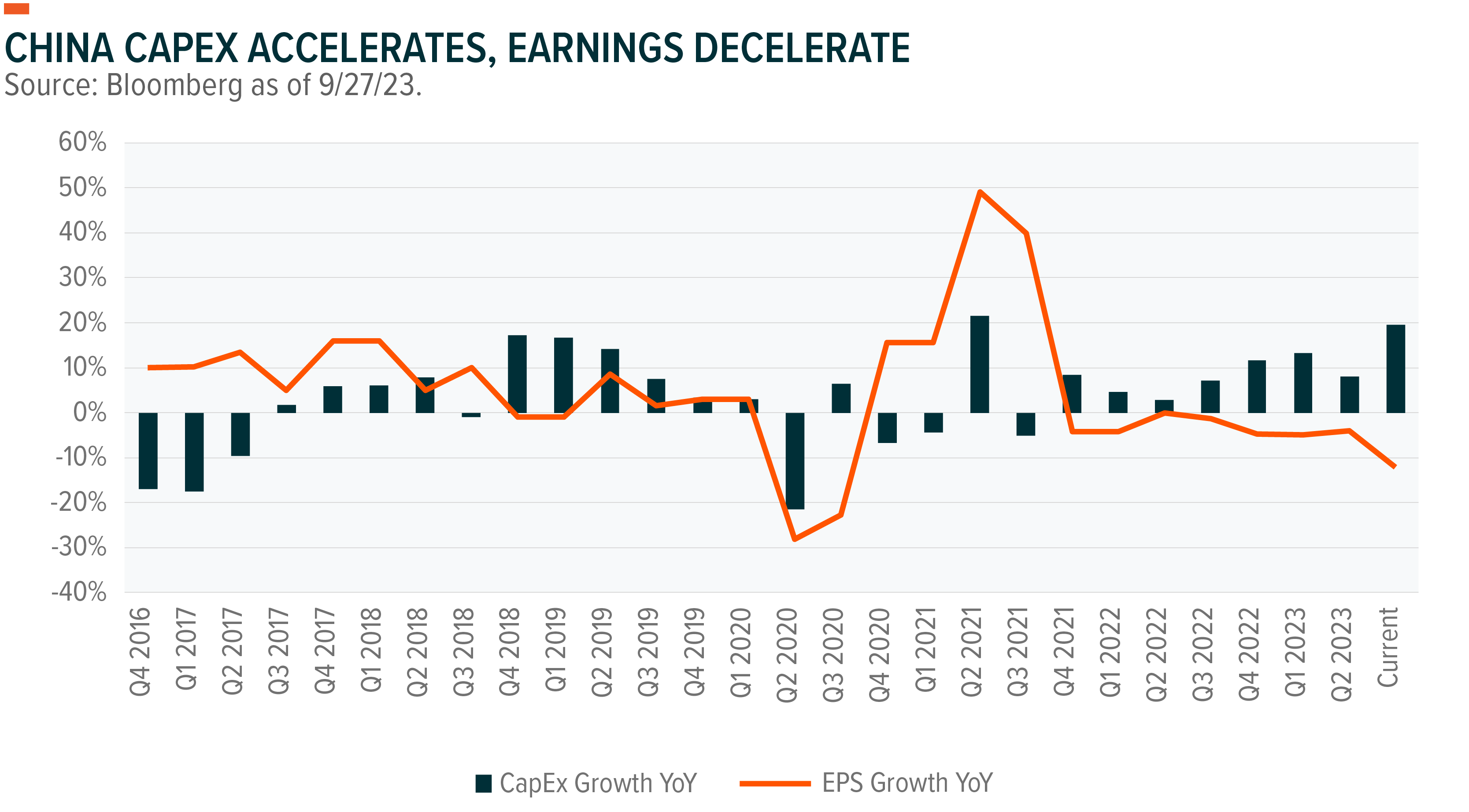

China faces a similar decision during this slowdown. The chart below shows corporate earnings contracting and capital expenditure increasing over multiple quarters.17 U.S. capex growth is higher in recent quarters, likely as companies move to adopt new productivity-enhancing technologies. China may be going through a similar period of technological adoption, but the expenditures may also represent government policies aimed at encouraging business spending to offset limited consumer demand.

In either case, the slowdown in corporate earnings and the broader economy presents a challenge for China. The government could adopt policies aimed at reducing tensions with the West to limit the economic damage. Alternatively, the government could keep policies on an isolationist trajectory and provide support for consumers in the hope that domestic demand compensates for lost exports. Another option is continued support for SOEs, which could come at the cost of long-term economic growth. The third option, and perhaps most concerning for international security, borrows from diversionary war theory.18 This theory suggests that leaders facing economic trouble may embark on foreign adventurism, which in this case may translate into Beijing ratcheting up its territorial claims over Taiwan and the South China Sea.

Thesis Changes, but Themes Remain the Same

Many of the investment themes critical to the China story remain relevant no matter if tensions rise or cooperation renews with the U.S.

In this analysis, rising tension remains a base case. The U.S. and China have different interests, and in my view, recent political leadership on both sides has not been fully cognisant of that or able to chart policies to bridge the gap. Differences now span major policy areas including the future of military power in the Pacific, territorial (and maritime) boundaries, the structure of the world trading system, approaches to domestic governance, rules about intellectual property, climate change, the intersection of state machinery and corporations, and norms in cyberspace, among others.19 The 2024 U.S. election could also play a role in stoking tensions should candidates stake out hawkish positions on China.

Investors may want to consider a series of themes should the relationship remain strained or tensions escalate. The U.S. will likely continue to pursue onshoring and nearshoring, relying on technologies like robotics and AI to help limit the inflationary pressures and remain globally competitive. Infrastructure proves critical as economic competition heats up, which could help determine the relative productivity of the two countries. New “arms races” may start in areas like renewable energy and clean technology, cybersecurity, and defence technologies. Should China look to fill the demand void by focusing on a consumer culture, China consumer discretionary could be a contrarian option.

Renewed cooperation seems more elusive. The pathway towards robust relations likely involves recognition of the relationship’s mutual importance. After all, China’s been the biggest beneficiary of the global trading order, and the U.S. consumer economy benefited from the extended period of low inflation and abundant goods manufactured in China. With China’s role as leading exporter potentially in decline and the U.S. facing higher structural inflation from policies like nearshoring, there may be interest in renewed cooperation. At present, China looks to be in the weaker position, but a weakening of the U.S. consumer and labour market amid higher inflation may balance the scales.

Cooperation likely requires both economies to weaken. Demographic challenges are common to both, including a decline working aged people relative to total population. As a result, significant investments in automation and productivity-enhancing technologies such as robotics and AI to offset labour shortage are likely.20 Renewable energy and cleantech are important as these economies increasingly rely on electricity-reliant tools, and well-built infrastructure improves efficiency. The U.S. consumer sector and areas such as the Millennial Consumer and Ecommerce likely benefit in this scenario as lower tariffs and lower inflation help stimulate spending.