A Healthy Economy Could See Doctor Copper Thrive

Copper is known in the financial markets as “Doctor Copper” due to its tendency to predict turning points in the global economy. This is due to copper’s wide range of applications, from everyday appliances to infrastructure and construction. The amount of copper the world consumes can be seen as a rough measure of the economy’s health. Overall, it’s undeniable the metal is a constant in the global economy. But with macro conditions up in the air, should you be invested in copper?

The Pulse of the Economy

According to data from the Copper Development Association, around 46% of the copper supply is used in building construction, 21% for electrical, 16% for transportation and the remaining 17% for consumer products and industrials.1 Tellingly, copper serves as a vital cog in the wheels of numerous industries. As a result, the changes in copper prices often reflect the economy’s pulse. In saying that, there are two main components that investors should consider when studying the copper investment thesis:

- Emerging Market Economies

- Supply Disruptions

Emerging and fast-growing economies such as China, are critical to the pricing of copper. These countries, which usually maintain a state of constant economic expansion, are the largest users of copper globally. Housing construction, technology adoption and a general increase in consumer spending due to wealth accumulation are all drivers of copper demand and price. Overall, emerging markets contribute to over 55% of the global copper demand.2

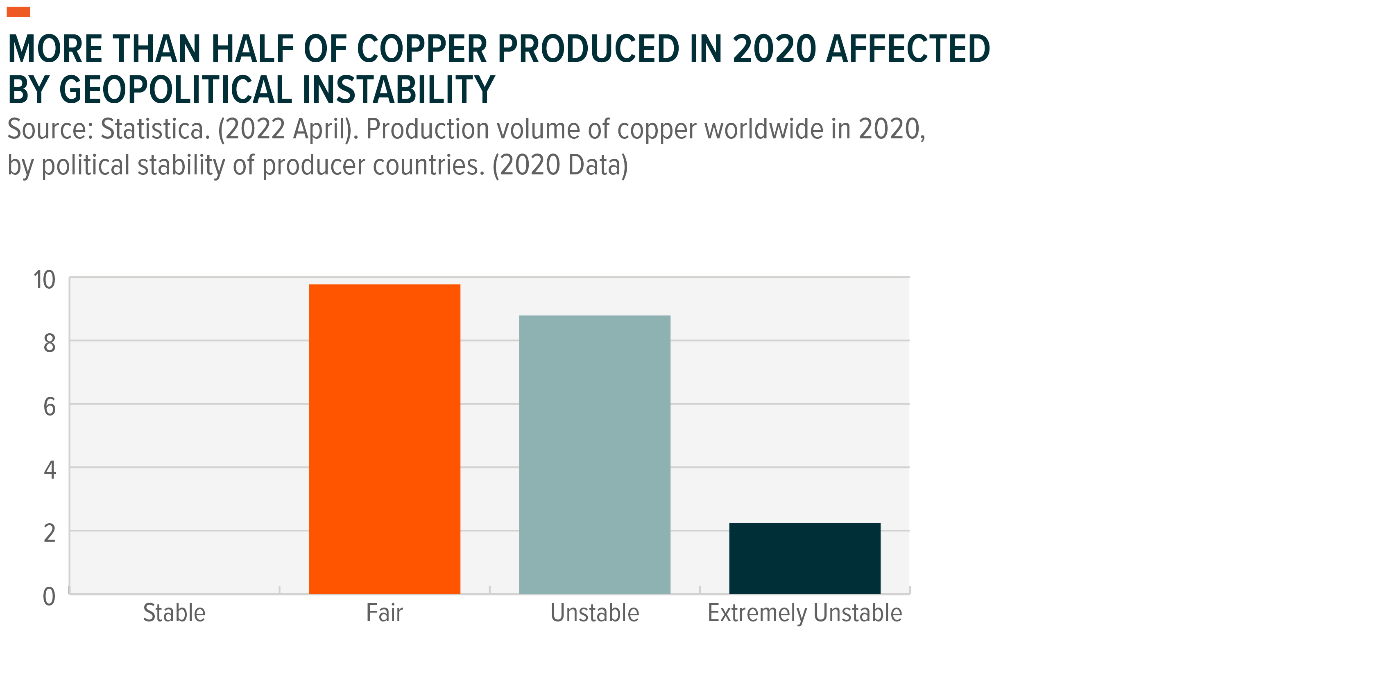

The top three copper-producing nations are responsible for almost half of the world’s copper supply. Chile, a country the size of New South Wales, contributes 27% of the global supply.3 This production concentration (higher than that of crude oil) naturally raises questions surrounding the risk of supply disruption. Point in case, Chile and Peru, the second largest producer in the world, have recently gone through political fluctuations that have been directly relevant to or severely impacted copper production.

This May, lawmakers in Chile gave final approval for a mining tax reform that requires large copper producers to pay much higher taxes and royalties to the government.4 A higher cost base for accessing Chilean deposits will inevitably be passed on by producers to the buyers, raising copper prices. In terms of Peru, the nation has been rocked by political turmoil since late 2022. Though concerns have now subsided, multiple months of daily rioting meant that at the time roughly 30% of the country’s production was under threat.5

Looking at the major contributors in the copper mining clique, more than half of the copper produced stemmed from nations of relative political instability. As demand looks to increase thanks to the clean energy transition, supply risks will likely continue to be a major consideration in copper pricing.

Copper: The Electrifier

When talking about copper as an investment, it is hard to ignore its use as a battery metal and the massive projected demand headed our way. Currently, the global output of copper is roughly 25 million tonnes, just about matching the 25 million tonnes of demand worldwide in 2021.6 Thanks to the COVID-19 pandemic and recent uncertainty surrounding China’s economic vitality, copper demand will likely remain in control until 2024. However, when taking a long-term outlook, especially through the lens of a clean energy transition, the potential for supply crunch becomes more evident.

The deeper electrification that is necessary for our evolution toward clean energy will be built on a bed of wires, and wires are primarily made from copper. Technologies such as EVs, solar photovoltaics, wind power and battery storage all require significantly more copper than their conventional counterparts. Hence, as the world seeks to reach net-zero emissions by 20507, copper demand will also drastically increase.

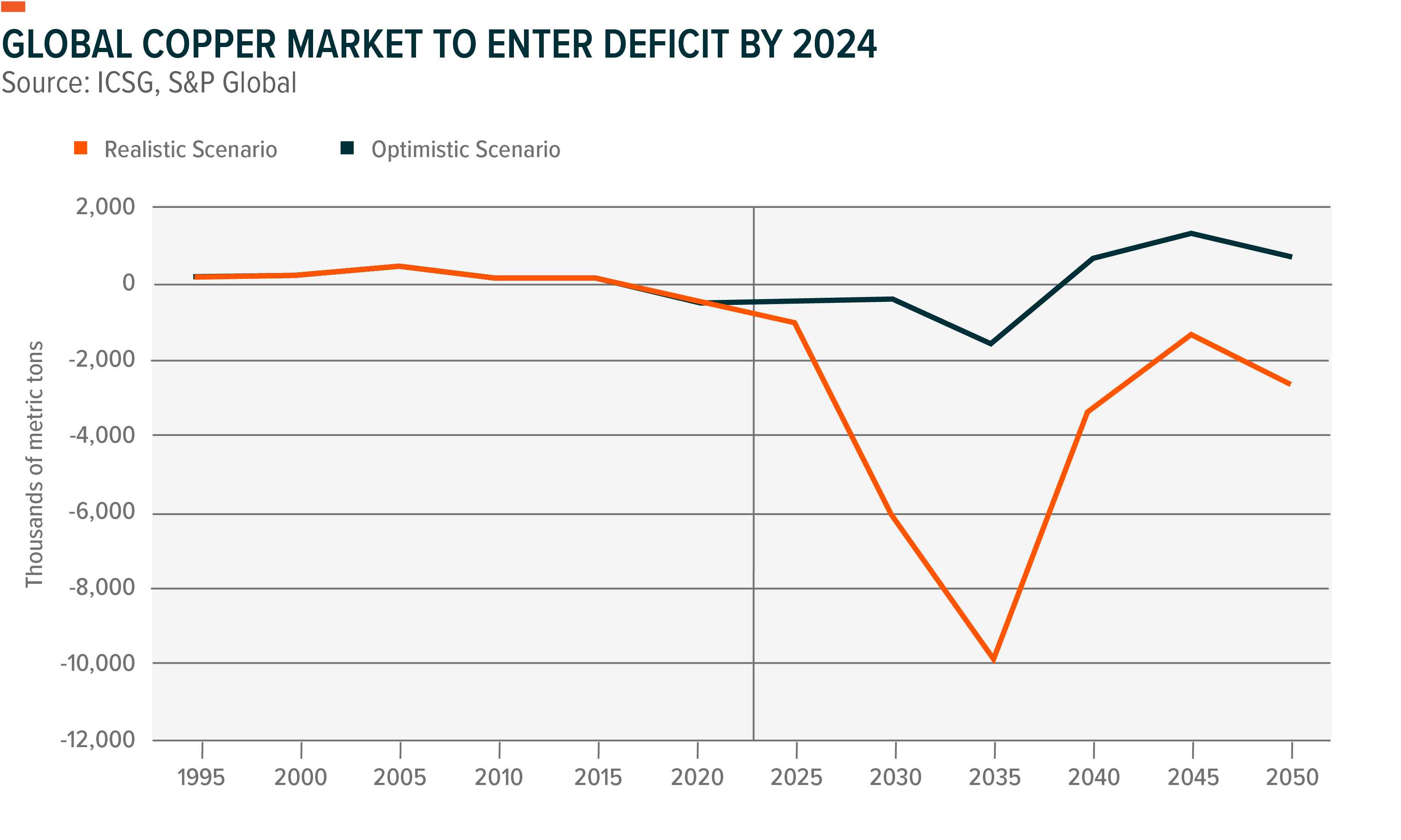

A 2022 report by S&P Market Intelligence forecasts that, in a realistic scenario, the world will face a chronic shortfall in copper supply from 2024 onward, with the annual supply gap reaching nearly 10 million metric tonnes by 20358. In the same scenario, surpluses would never arise, and, alarmingly, net-zero emissions by 2050 would thus be unachievable simply due to copper supply limitations. It would seem apparent then that the supply side has a desperate incentive to increase at a rapid pace, and that the investment runway for copper and copper miners has a long way to go.

Investing in Copper with WIRE

For those looking to invest in “Doctor Copper”, there is a notable opportunity as we approach the mid-point of this decade. As systematic supply risks and skyrocketing demands cause rising copper prices, copper miners stand to benefit from the demand flux.

Despite Australia having the second largest deposit of copper in the world9, Australian investors ironically have very little exposure to copper. With the acquisition of Oz Minerals by BHP earlier this year for $ 9.6 billion, there are now less than a handful of pure-play copper companies on the ASX.10 This is where investing in a copper miners ETF can benefit your portfolio.

Global X Copper Miners ETF (ASX: WIRE) provides investors access to a global basket of copper miners that stand to benefit from growing copper demand. By accessing the totality of the copper mining trend, investors don’t have to contend with company financials and can reap rewards from the overall potential of the industry. Find out more about WIRE here.

Related Funds

WIRE: For those wishing to invest in the energy transition through copper miner exposure, Global X Copper Miners ETF (WIRE) provides access to a global basket of copper miners which stand to benefit from being a key part of the value chain facilitating growth in major areas of innovation such as technology, infrastructure and clean energy – including solar and wind power.