AI Opens Opportunity for Chipmakers

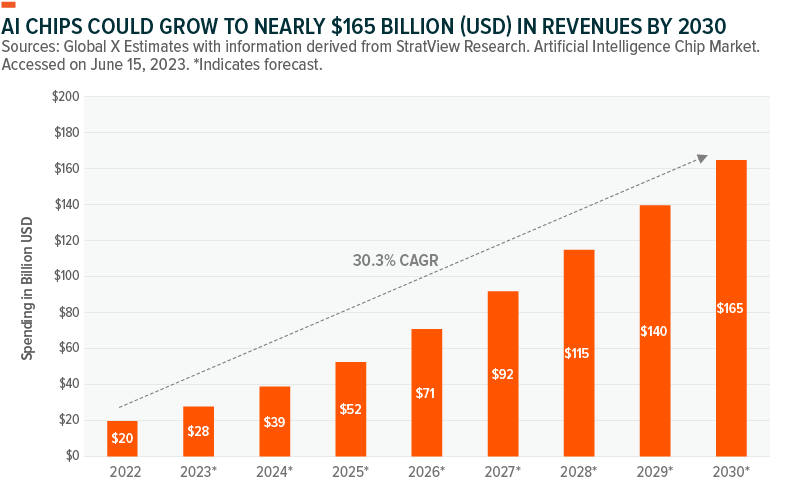

As artificial intelligence (AI) applications expand in scope, existing computational infrastructure, both in the data centre and at the edge, will require rewiring to support emerging needs for data intensive computing. This shift had been in the works, but the rapid proliferation and grand potential of large language models (LLMs) will likely accelerate the timeline. By the end of this decade, annual spending on AI chips is projected to grow at a compound annual growth rate (CAGR) of over 30% to nearly US$165 billion.1 Graphic processing unit (GPU) based chip providers will benefit the most and remain the primary choice, driven by superior performance and developer preference. Other associated hardware, including memory and networking gear, could also benefit from this wave.

Key Takeaways

- AI applications are expanding in scope and will require new computing infrastructure, leading to significant investment in AI chips, memory, and networking gear.

- AI infrastructure providers are considering investments and partnerships to secure themselves against shortages.

Infrastructure Spending Strong as Demand for AI Services Rises

Large language models AI, such as GPT-4, went mainstream in 2023. Available as both application programming interfaces (APIs) and via chat-based interfaces, these AI systems are catalysing a whirlwind of user and developer activity, making AI a definitive battleground for technology and non-technology enterprises.

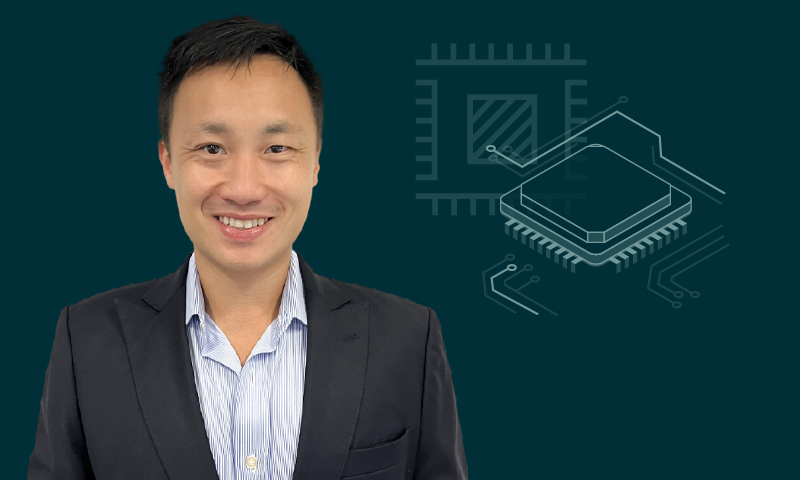

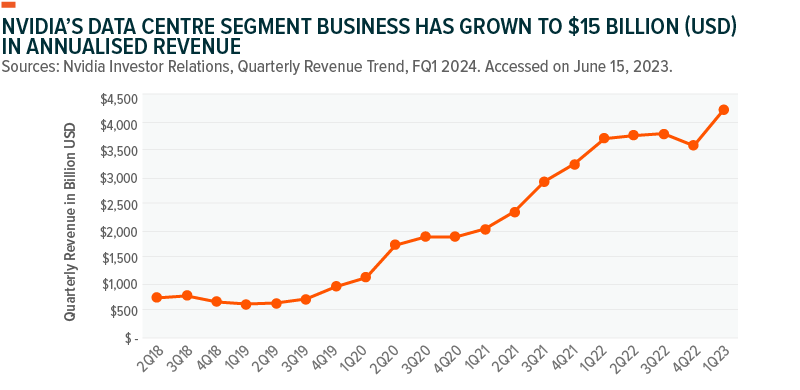

As adoption picks up steam, so is the demand for AI infrastructure providers. Nvidia, one of the primary suppliers of chips to train AI models, grew its data centre segment revenues by nearly 14% Year-over-Year (YoY) in Q1 2023 and revised guidance to the upside by over 50% YoY for Q2.2 This overwhelming demand raises concerns about the sustained availability of AI hardware necessary to train, test, and deploy models.3 Global X believes there is the potential for a long-term capital investment cycle for AI hardware and infrastructure providers. Of which, a major part will go towards replacing legacy computing stacks in data centres with hardware that can effectively support the adoption of data-intensive AI.

Artificial Intelligence Makes GPUs a Must-Have

Traditional processors, also known as CPUs, were designed to perform general purpose computing tasks efficiently in a single cycle.4 GPUs are purpose-designed to process less complex but multiple logic-based computations in parallel, which makes them incredibly efficient for data heavy processing, and, thus, popular for AI training and inference tasks.5

Nearly US$16 billion worth of GPUs went into AI acceleration-related use cases worldwide in 2022.6 Nvidia is the dominant supplier, owning nearly 80% of the market share in GPU-based AI acceleration.7 Nvidia’s investments in software frameworks, including the CUDA architecture, ensures that developers and engineers can harness computational efficiency from the GPUs, giving the company a sustained edge over its competition, which lacks similar software support.

Outside of GPUs, field-programmable gate arrays (FPGAs) and application-specific integrated circuits (ASICs) from companies such as Infineon and Texas Instruments make up the rest of the AI chip market. Together, FPGAs and ASICs resulted in roughly US$19.6 billion in sales for 2022, growing an estimated 50% YoY.8 Over the next eight years, combined spending is expected to grow at a nearly 30% annual growth rate to top US$165 billion by 2030.9

IT buyers spend close to US$224 billion on data centre systems annually, including processors, memory and storage, networking components, and other hardware products.10 Assuming data centre systems are replaced every four years, more than a trillion dollars’ worth of computational infrastructure will likely be up for replacement over the next few years, presenting a generational opportunity for AI-first hardware to gain ground amid the rapid adoption of generative AI solutions.

Rising Chip Demand will Spur Investments

Developers and engineers are rushing to bring AI-first products to market amid a shortage of AI processing hardware. Orders for new GPUs have a six-month backlog, and prices for Nvidia’s A1000 and H1000 line-up of GPUs have shot up significantly, with chips being sold in secondary marketplaces at hefty premiums.11,12

But with such high prices and demand, we believe the entire semiconductor value chain, including foundries, chip designers, and semi equipment suppliers, will benefit as AI spreads. Multi-trillion-dollar markets such as advertising, e-commerce, digital media and entertainment, online services, communications, and productivity are all likely to ramp up spending on turnkey AI hardware setups. Thus, Global X also believes the industry will likely become prone to deal activities, both in partnerships and acquisitions, as large accelerator vendors will look to solidify research and development and product innovation.

Conclusion: There’s No AI Without Specialised AI Hardware

The AI boom will likely spur a wave of data centre upgrades that, in turn, gives rise to a new semiconductor investment cycle with the GPU at its core. The rapid proliferation of LLMs will likely result in exponential demand for AI processing and accelerated spending on specialised chips, which could open a hundred-billion-dollar plus market for the semiconductor industry in the near future.13 Meanwhile, large cloud hyperscalers will likely continue to invest in R&D to build and deploy chips of their own in a bid to reduce dependence on large chip providers and reduce costs. While AI chip demand may be lumpy for now, Global X believes that the semiconductor value chain is well positioned to capture this opportunity and create a potential investment alternative as AI penetrates new markets.

Relevant Funds

SEMI: For investors seeking to gain exposure to companies that stand to potentially benefit from the broader adoption of tech-enabled devices that require semiconductors, the Global X Semiconductor ETF (SEMI) provides a solution. This thematic includes the development and manufacturing of semiconductors.

Click the fund name above to view the fund’s current holdings. Holdings are subject to change. Current and future holdings are subject to risk.