Crypto Market Monitor – 5th October 2022

Powered by 21Shares

This Month in Crypto:

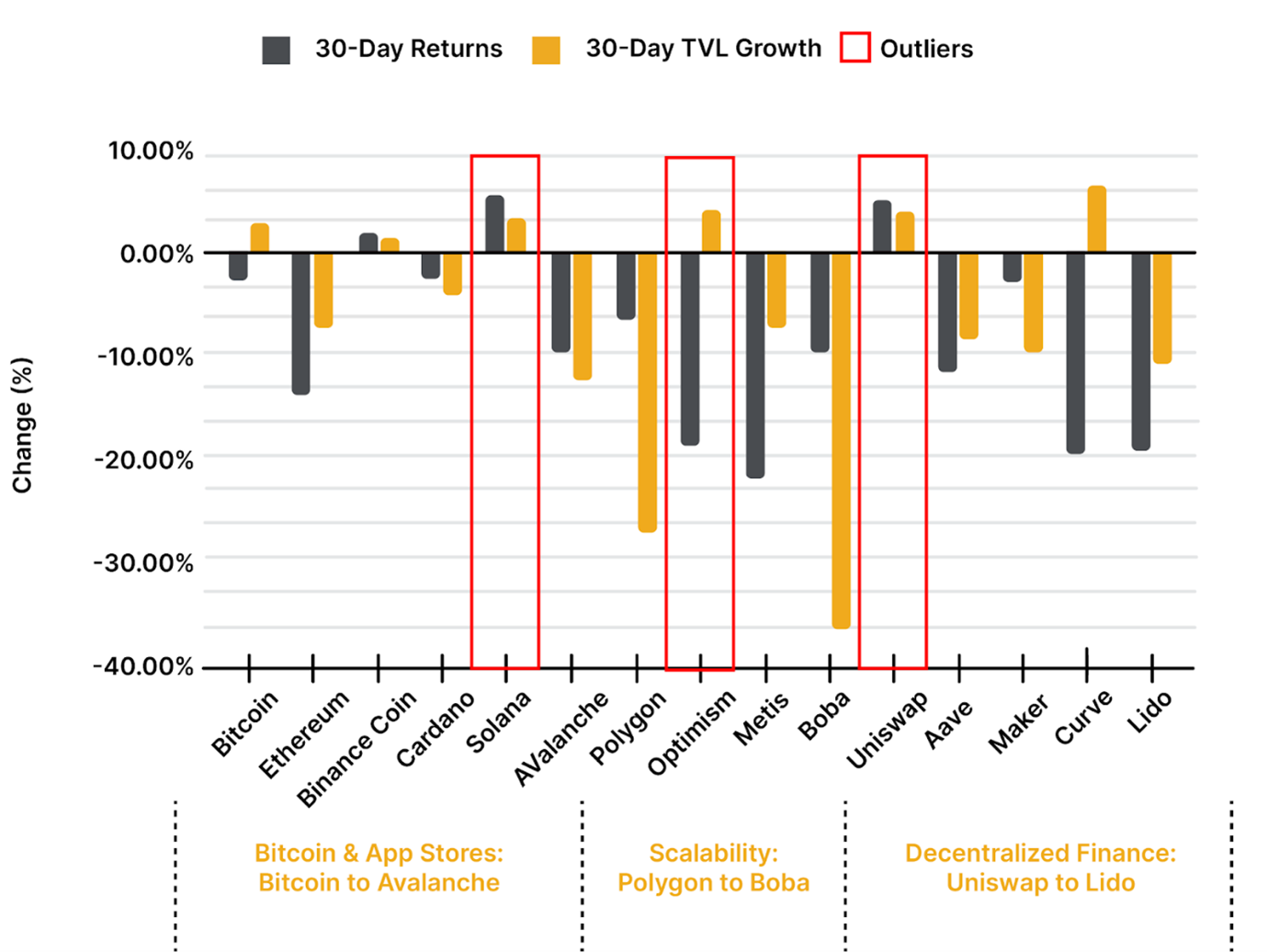

The overall cryptoasset market tumbled by almost 5% over the past month to rest at $933.7B. Bitcoin and Ethereum declined by 3% and 14% over the past month. This month’s winners were Solana and Uniswap, which jumped by 6% and 5% respectively. Optimism performed better than its peers within the major L2s in terms of total value locked (TVL). The figure below shows the performance of the top cryptoassets within the major categories, month over month.

Figure 1: TVL and Price Development of Major Crypto Sectors

Source: 21Shares, CoinGecko, DeFi Llama

Key Takeaways:

- Bitcoin under-levered for the first time this year

- Stablecoins and proof-of-work mining have been the talk of regulators

- The Merge settled, boosting development in Ethereum’s scalability solutions

- OpenSea and Decentraland introduce innovations to the NFTs industry

Spot and Derivatives Markets

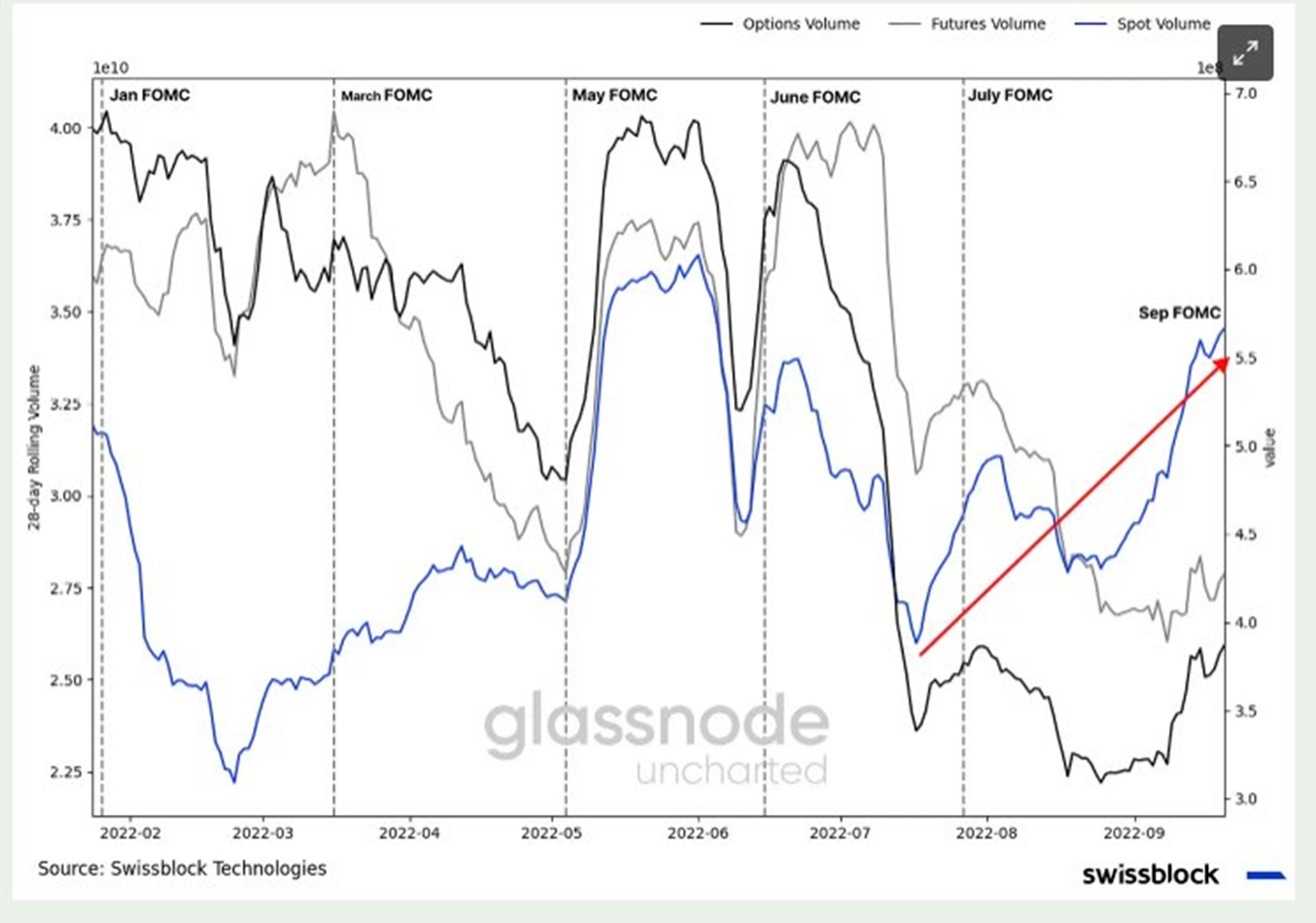

Figure 2: FOMC against 28-day Spot/Derivative Rolling Volume

Source: Glassnode, Swissblock Technologies

The figure above plots this year’s meetings of the Federal Open Market Committee (FOMC) against spot and derivatives 28-day rolling volume. The chart reveals that Bitcoin is under-levered for the first time this year, which in itself is a sign of true capitulation.

On-chain Indicators

Figure 3: Ethereum’s NUPL ratio

Source: Glassnode

On September 30, Ethereum’s NUPL ratio was at -0.09, which means that the second-largest cryptoasset by market capitalization is still at the capitulation zone. The current level is similar to levels seen in December 2016 when ETH was at $8.4, with a market cap of $626M, a few months before it jumped within the belief and euphoria levels for a little over a year.

Figure 4: Ethereum’s Network Value to Transaction Signal

Source: Glassnode

The NVT Signal (NVTS) is a modified version of the original NVT Ratio, using a 90-day moving average for transaction volume instead of the raw daily transaction volume, making it function better as a leading indicator. NVTS in Figure 3 indicates that ETH’s ratio reached the same level as the prior bear market around June 2018. At that time, ETH was valued at $73.9B which is currently 45% of today’s value while the daily number of transactions on the number today is 1.5x as much as the last crypto winter. In other words, ETH value increased significantly more than its fundamentals.

Macro and Regulations

The Federal Reserve raised the interest rate by 75 basis points for the third time in a row, making it the highest level in 14 years. Europe’s food and energy crisis set the EU inflation to unprecedented highs, at 9.1%. On the back of these circumstances, French lawmakers are fighting against proof-of-work mining, saying that energy shouldn’t be wasted on such practices in times of war.

The White House published a report on crypto mining that recommends disclosing energy consumption and environmental standards to be set by inter-federal agencies such as the Environmental Protection Agency and the Department of Energy. The report could have been more comprehensive if it had mentioned the improvements in mining chips that could boost energy efficiency and reduce consumption, noise, and water waste. Moreover, the report also failed to differentiate between Bitcoin’s proof-of-work mining from Ethereum’s, as the latter runs on an ASIC-resistant network which makes it consume about 200% less energy. In the meantime, Iran has been licensing crypto miners within its jurisdiction under a new regulatory framework that allows licensed miners to use their mined crypto to pay for imports. The framework also prioritizes supplying the crypto mining industry with renewable energy. Due to sanctions coupled with political reluctance about crypto mining, Iran accounts for only 0.12% of the global hash rate according to Cambridge Center for Alternative Finance. However, it is worth noting that Iran is the world’s third-largest producer of natural gas, on which most of its energy supply is generated, covering its consumption needs in addition to a surplus that could potentially power a more significant hash rate.

US law enforcement agencies will collaborate with global security apparatuses, namely the financial intelligence agency Egmont Group, to combat financial crime within the cryptoassets industry. Ten days after this announcement came as part of the first-ever framework for developing digital assets, Interpol issued a Red Notice for Terraform Labs’ co-founder Do Kwon. Moreover, a new White House draft bill proposed to put a ban on algorithmic stablecoins for two years. Given the de-pegging of UST last May, it comes as no surprise that algorithmic stablecoins aren’t being upheld like their dollar-pegged counterparts. However, imposing an outright ban on emerging technologies like algorithmic stablecoins can impede the progress of this vertical and future improvements.

More on that front, New York Judge Katherine Failla ordered Tether to provide financial statements to prove the 1:1 backing of the company’s dollar-pegged stablecoin, USDT. The court order is attached to a 2019 lawsuit, where a group of investors accused Tether’s parent company iFinex of manipulating the cryptoassets market by issuing unbacked USDT to inflate the price of Bitcoin and other cryptoassets. On the flip side, Tether’s rival Circle and the issuer of USDC became the first stablecoin to be featured on Robinhood. In fact, USDC has been dominating the stablecoin transfer volume in the past 30 days by 54.5%.

Crypto Infrastructure

The Merge. Ethereum’s most significant upgrade to date on switching to a proof-of-stake consensus mechanism has finally materialized on September 15 without experiencing any malfunctions. The excitement around the network’s new monetary policy is perceptible as we saw Binance offer 6% APY for ETH staking on the retail side, while crypto-friendly Swiss-based SEBA bank launched its staking service for its institutional clients. Ethermine, the world’s largest Ethereum mining pool, unveiled it would offer ETH staking pools after the Merge, paying an annual 4.4% to its participants. This move by the mining giant paints a major pivot and reiterates the notion that ETHPOW is more likely a speculative play. This belief is backed by the continued refusal of several established service providers to extend support towards the newly contentious bifurcated chains. On the other hand, Antpool will cease support for ETH accounts and exclusively focus on other POW-powered networks following the Merge. The firm, holding the 10th largest pool in terms of hash rate, expressed that ETH2.0 carries a heightened risk of censorship due to the ‘centralized vertical of validators’ who might be forced to comply with regulators if the Tornado Cash saga reoccurs.

Read more about the Merge.

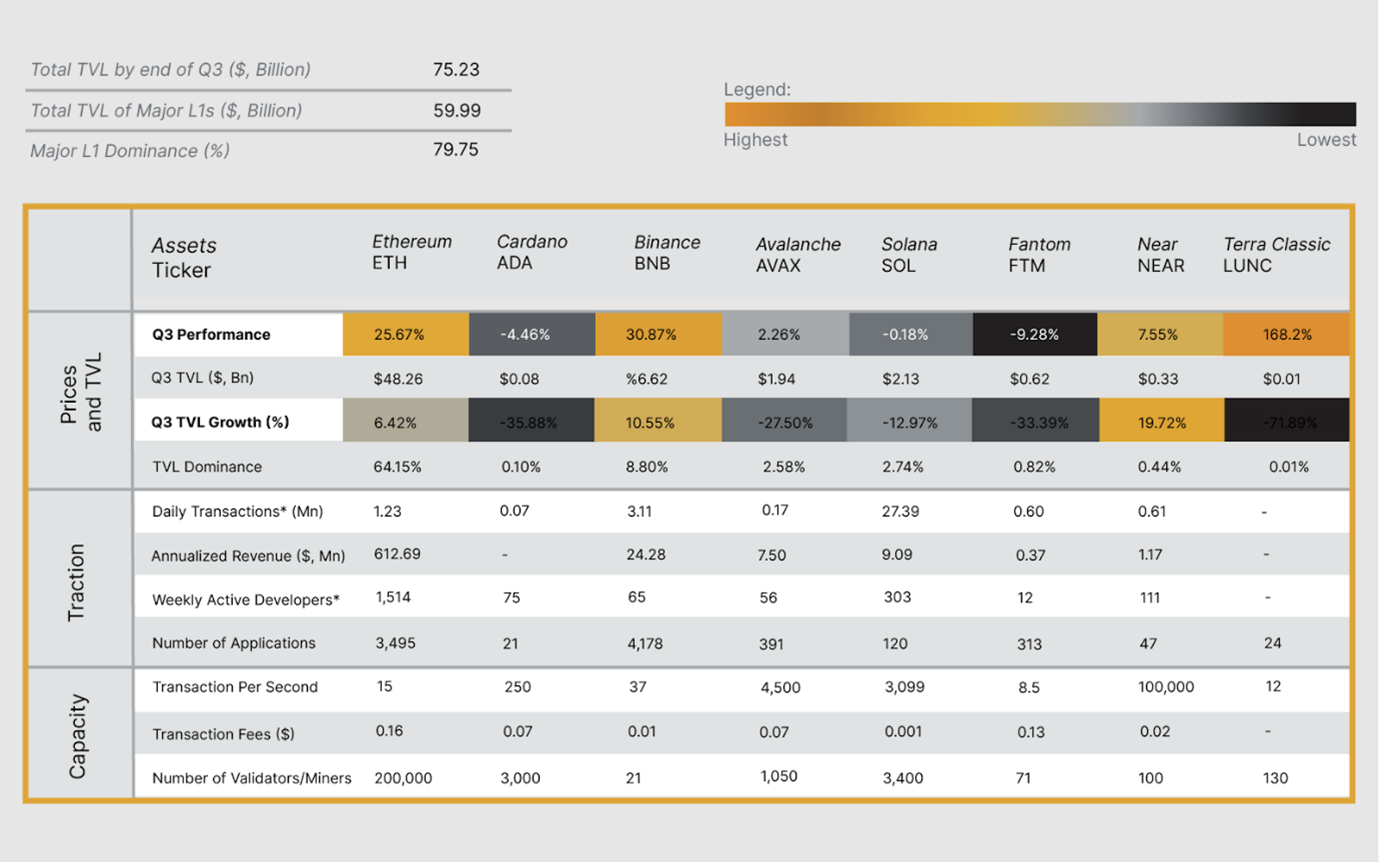

Figure 5: Performance of L1 in Q3

Source: 21Shares, DefiLlama, Artemis, Token Terminal, DappRadar, Native Block Explorer, Coingecko

Ethereum Competitors. The Merge didn’t impede other L1 network developments from pushing at full speed:

- Solana will have archival nodes from Coinbase launched on the its blockchain to help developers scale and focus on their products instead of propping up the network’s costly infrastructure. This feature will allow access to historical data, which can be further used to examine the chain’s state at any moment and perform complex queries. Fireblocks also revealed their Web3 engine now supports the Solana ecosystem, giving users and developers access to a plurality of DeFi and NFT dApps on the burgeoning network.

- Helium will migrate to the Solana blockchain, after a community vote ratified the resolution. The decentralized wireless provider struggled with scaling their network, so porting the ecosystem to Solana will help the developers focus on the application itself instead of maintaining their own infrastructure. Solana also offers superior transactional capacity and ecosystem interconnectedness where the HNT token will enjoy higher utility via integrating with the L1’s wider DeFi vertical.

- BNB Chain will introduce the ZK-rollups architecture to their blockchain by early 2023, with plans to unveil a testnet in November. The upgrade will reduce gas fees and amplify the network’s capacity in processing 5-10K Txs/sec.

- NEAR protocol completed Phase 1 of their NightShade Sharding, where 200-300 chunk-only producers would be introduced to the network to assemble chunks (small pieces of a block generated via sharding). This will result in further decentralization of the network. Phase 2 is scheduled for Q1 2023.

- Algorand executed its latest upgrade, where it is now hosting state-proofs critical for improving cross-chain communication and augmenting the network’s ability to process up to 6K Tx/sec, up from 1.5K.

- Luna Classic implemented the 1.5% cut on every on chain transaction, driving a surge in its price. The decision by the battered project is designed to reduce the highly inflated circulating supply that ensued from the collapse of UST back in May.

- Cardano triggered its long-anticipated Vasil upgrade after achieving three significant indicators. The fork will chiefly focus on enhancing the capabilities of the smart-contract platform via releasing Plutus V2. Amongst the core improvements will be reduced transaction size and batched transactions, resulting in cheaper dApp interactions and increased throughput.

Upticking Scalability. It has been a busy month for L1s’ guerilla army of scalability solutions:

- Optimism announced the launch of the Bedrock alpha testnet on the network’s Goerli layer. The new layer isn’t suitable for production-ready development, which is why it’ll shut down by October.

- Starkware announced the first significant upgrade to the chain’s programming language, Cairo 1.0. The new iteration will augment the network’s security by introducing an intermediated security layer. At its core is Sierra (safe intermediate representation), a new feature designed to offer longer-term stability for the Cairo dApps.

- Coinbase Cloud also extended its cloud-based staking support towards Polygon.

- Solana will be presented with a tailored VM enabling interconnectivity with the Cosmos ecosystem, and accordingly, its IBC-based interoperability.

- Nitro, the SVM compatible chain, is set to launch early next year, with a testnet expected by the end of Q4.

- Boba network spearheaded Avalanche’s first L2 deployment. Launched in September 2021 as an optimistic rollup anchored to ETH, the move by the scalability solution won’t be the first as they have already expanded to Moonbeam and Fantom following Ethereum’s initial launch.

- Node provider Infura revealed their latest integration with the ZK-based roll-up solution, Starknet. The new partnership should allow aspiring developers to deploy their solutions and interact directly with the scalable L2 alongside Ethereum, Filecoin, Optimism, Abritrum Avalanche, NEAR, and Aurora.

- Arbitrum implemented the long-awaited migration to the ‘Nitro’ layer. The upgrade introduces improved fraud proofs alongside updated sequencers and call-data compression mechanisms, which all lead to processing higher transactions per second. This was exciting especially as it primed the ETH ecosystem for fireworks post-Merge.

Interoperability. Although Polygon revealed their app-specific, EVM-compatible and interoperable chains called supernets back in April, the technology hasn’t picked up much traction yet. That’s why Polygon announced a new partnership with ANKR, the L1’s official approved infrastructure vendor, to streamline the development experience of supernets. ANKR’s Appchains-as-a-Service will offer an end-to-end engineering solution to build custom blockchains on top of Polygon seamlessly. Another critical development is the enduring expansion of service providers into the Aptos network, the spin-off for the Meta-led Diem blockchain. The network, expected to launch its mainnet in Q4, welcomed the specialized oracle solution PythOracle and the crosschain messaging protocol Wormhole to its devnet last week. This is crucial as it signals the foundation team’s determination to equip the network with its core infrastructure needs that will prepare it to host a vibrant L1 with functioning DeFi and NFT ecosystems once it goes live.

Decentralized Finance

Stablecoins: Binance has been taking aggressive steps as of late to consolidate its efforts. Its latest decision involves auto-converting the balances of three major stablecoins (USDC, USDP, TUSD) into its own BUSD, while allowing withdrawals to happen in the desired stablecoin. The move, intended to foster deeper liquidity and bring about less slippage with faster order matching, might have contributed to BUSD recently surpassing $20B in market capitalization. In a similar vein, USDT is now natively supported on the Near protocol and Polkadot network, totalling up the stablecoin’s deployment on a total of 12 networks. Coinbase proposed that MakerDAO deposit its idle USDC into its prime vault earning 1.5% annual yield to generate additional revenue of $24M for the protocol. After discussing the need for abandoning censorable assets and potentially switching the peg-reliance model to accept ETH, MakerDAO decided to raise its stETH debt ceiling. The move is designed to reduce the ratio of USDC against other supported assets, and which was achieved via reducing fees for six vaults to incentivize collateralizing decentralized currencies. Binance also took cue as they revealed they’ll be expanding BUSD native deployment towards Avalanche and Polygon. Similarly, the all-in-one DeFi shop Coin98 disclosed they would be releasing an overcollateralized stablecoin following suit of Aave and Curve’s decision towards amalgamating their ecosystems. Dubbed CUSD, the new stablecoin is expected to be backed by a 1:1 ratio of USDC (on SOL, ETH) and BUSD (BNB) reserves.

Consolidation. This month saw DeFi’s blue chips embark on federating their ecosystems. First, we saw Aave trifle with the untapped derivatives market by revealing ShortAave. The website is currently a mockup of what will be a one-stop shop to open short positions on the platform by borrowing from Aave and swapping on Uniswap in one go. Another was the announcement of Aztec, where the privacy-oriented L2 will integrate YearnFinance’s vault for its private DeFi ecosystem. We also saw Compound debut crypto-backed loans for institutions. The new product offers borrowing USD/USDC at a fixed 6% APR, accepts BTC, ETH and a slew of other ERC20 tokens without a repayment schedule, and its sole condition is to remain over-collateralized. Finally, Ribbon took a cue from FraxFinance’s move into the debt market by launching its money market protocol dubbed RibbonLend. The new offering will present high yields in exchange for unsecured lending to vetted institutional market makers of users’ preferences. As seen, DeFi protocols are fortifying their financial primitives to augment the flow of value accrual back to their underlying native token, in the process, building out more sustainable models over the longer term. Another example of consolidation was Frax’s money-market platform. The protocol, named Fraxlend, is a permissionless lending and borrowing dApp that allows the utilization of any token supported by Chainlink’s oracle price feeds. The venturing of the original algorithmic stablecoin issuer into the money market space, represents a broader trend within the industry’s blue chips to consolidate all their respective economic activities into a single ecosystem to capture the most value. For instance, the additional cash flow generated via lending the stable FRAX currency to other DeFi projects, in conjunction with the protocol’s FraxSwap, will be used to buy back more shares of FXS tokens. A move that mirrors MakerDao’s strategy of burning its MKR token through its stability fees. Frax is not the first to take such a measure, as we already saw the leading money-market Aave delve into the stablecoin space by introducing GHO. Meanwhile, the pioneering DEX for stables (CRV) unveiled they’ll likely be releasing their stablecoin before the end of September. This approach is a crucial development for DeFi projects to start building sustainable business models that rely less on new token emissions and would equip them better to endure long drawdowns on the back of a growing treasury.

Metaverse and NFTs

Strategic Partnerships. Ronin Network’s mother company SkyMavis partnered with Google Cloud to become an Axie Infinity Ronin sidechain validator. After losing $625M on Ronin Bridge to an exploit back in March, this partnership is expected to strengthen security and safeguard the assets under management by monitoring validator uptimes. It’s not only Ronin that Google Cloud is helping, Binance is also partnering with the cloud computing giant for Web 3 mentorship and startups support.

New Innovations. OpenSea launched OpenRarity, a new NFT protocol that will bring about standard mathematical algorithms that evenly assign rarity attributes regardless of the project size and popularity. This is good news for the industry that has been criticized for the hype over overpriced JPEGs; OpenRarity will aim to prioritize rarity over hyped up attributes. Another innovation in the NFT space are NFT Emotes, which will be making a special appearance at Metaverse Music Festival on Decentraland in November. NFT Emotes are animated graphics that repeat the movements of their creators, which made their first-ever Metaverse Fashion Week back in March. This time, things will be a little different as Decentraland called on creators to experiment with NFT Emotes, design dance moves or anything that comes to mind and sell them on Decentraland’s marketplace as NFTs.