Powered by 21Shares

This Month in Crypto: Executive Summary

Markets have crumbled over the past month on the back of the collapse of FTX, a debacle that we will delve deeper into later in this report. Other factors that added fuel to the fire were political unrest in China and Iran, in addition to inflationary pressures around the world. The overall cryptoasset market decreased by almost 15% over the past month to rest at a little over $860B in value. Bitcoin and Ethereum dropped by 16% and 17% respectively over the past month. Aside from that, Solana was one of the most affected by the second-order effect of the market turmoil with a monthly performance of -56%. November’s outlier was Polygon, increasing by 3%, which makes the L2 stand out as the only cryptoasset within the major sectors to have progressed despite selling pressures across the board.

Figure 1: TVL and Price Development of Major Crypto Sectors

Source: 21Shares, Coingecko, DeFi Llama

Key takeaways from this report:

- Bitcoin inflows top the ETP market in November

- Regulators piggyback on the FTX debacle to lobby for their proposals.

- Contagion spreads and ring-fencing unites crypto infrastructure layers.

- DeFi shows resilience compared to centralized platforms.

Spot and Derivatives Markets

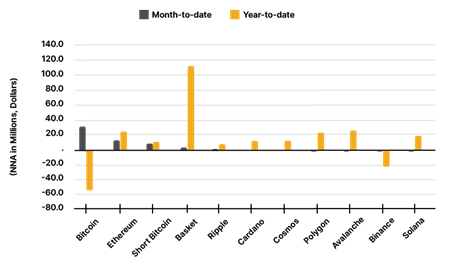

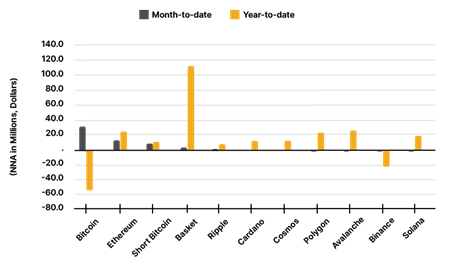

Figure 2: Net New Assets by ETP Underlying (In $M)

Source: 21Shares

The chart above indicates that investors this year have been keener on diversifying their exposure to crypto than in a single asset. For the more directional trades to single assets to single assets, investors value scalability with more inflows into Polygon and deem the infrastructure play to remain relevant, as year-to-date, Ethereum and Avalanche also benefited from more than $20M inflows each.

On-chain Indicators

Figure 3: Bitcoin Balance on Centralized Exchanges

Source: Glassnode

From November 8 to 28, BTC balances on centralized exchanges like Binance, KuCoin and Kraken fell by 6%. Such a decline in such a short time hasn’t happened in the history of the industry. After the collapse of FTX, users moved over 170K BTC either to cold storage, DeFi applications, or sold some of them. This can attest that there is a growing mistrust or uncertainty against centralized crypto entities and in contrast, more confidence in their decentralized counterparts.

Macro and Regulations

The war in Ukraine, deadly protests in Iran and just this month China have all added to the selling pressure of cryptoassets this past month. The FTX debacle, however, had a more direct impact across the board. To recap, we have laid out what happened chronologically in the timeline below.

Figure 4: Timeline of FTX Debacle

Source: 21Shares

The US House Committee on Financial Services announced it will hold the first hearing investigating the collapse of FTX, subpoenaing executives of the exchange including SBF on December 13. The committee also invited some executives from Binance, on the back of the acquisition deal it walked away from. Binance had been a shareholder in FTX since 2019, exited last year, and received $2.1B, part in Binance's stablecoin (BUSD) and the other in FTT as part of the deal.

Congress is also planning to question Gary Gensler, chairman of the Securities and Exchanges Committee (SEC), over how his agency handled FTX before the bankruptcy filing. However, some senators are not sure the SEC had jurisdiction over FTX International being an offshore exchange vs. FTX US. Although FTX International is headquartered in the Bahamas, its US arm, FTX.US is an exchange actually regulated in the US but it remains unclear by which authority. While the search results on the CFTC portal don’t include FTX.US, they include LedgerX, a crypto options and futures exchange and clearinghouse that FTX acquired last year. LedgerX has been licensed as a swap execution facility (SEF) since 2017, which may allude to that FTX.US inherited LedgerX’s license since it claims to be licensed as an SEF among other licenses without mentioning the respective regulating entity. However, Chair of the CFTC Rostin Behnam argued his agency still needs authority over spot markets to protect retail investors since it can more easily clamp down on bad actors. Behnam was namely referring to the Digital Commodity Consumer Protections Act, which SBF helped draft as a then-industry leader. Given the latter, Senator Cynthia Lummis argued otherwise. Her Responsible Financial Innovation Act introduced in June is still pending discussion, which will reconvene in January, requiring companies to separate their user funds from their corporate balance sheets. On the other side of the globe, Member of the European Parliament Ondrej Kovarik said that Europe’s Markets in Cryptoassets bill, set to pass in February and effective as of 2024, would have enhanced transparency and limited the implications of the FTX collapse on users based in Europe.

Although FTX’s collapse was dominating the debate between policymakers over the past month, there were still other matters being celebrated and others being discussed. Brazil legalized the use of cryptoassets in payments. Although the country didn’t designate Bitcoin as a legal tender like El Salvador did last year, this is still considered a leap towards adoption. Whereas in Europe, the European Commission wants to crack down on tax avoidance in crypto and thus is exploring ways to tighten taxation rules enforced on cryptoassets ahead of the new crypto tax proposals expected to be published on December 7. At Gillmore Centre Policy Forum at Warwick Business School in London, New York Federal Reserve Advisor Antoine Martin said that as “formidable” as stablecoins are to regulations, they would probably be easier to use instead of managing a central bank digital currency for retail use. This counts as a change of heart for Martin who was highly skeptical of stablecoins and the role they can play in the future of payments.

Crypto Infrastructure

Contagion spread across centralized money markets and decentralized entities linked to FTX, which we’ll break down in the next section. Institutional crypto lender BlockFi filed for bankruptcy on November 28, and the proceedings unveiled that it had $355M worth of cryptoassets frozen on FTX in addition to $671M in outstanding loans defaulted to Alameda, FTX’s trading subsidiary. Crypto lender Genesis however plans to mitigate bankruptcy by raising funds. Digital Currency Group, which owns both the cryptoasset manager Grayscale and Genesis, owes the latter $575M. The contagion also spread in the form of layoffs as Kraken made the decision on November 30 to shrink its manpower by 30% to weather crypto winter. To help contain the contagion, Binance announced the establishment of a recovery fund serving as a backstop that would invest in “projects which are otherwise strong, but in a liquidity crisis” on the back of the FTX collapse. The founder of Binance claims that many players from the space have shown significant interest, without revealing who it might be yet.

Figure 5: Bitcoin Exchange Balance and Net Position Change

Source: Glassnode. Data as of November 14.

Centralized exchanges experienced an exodus of funds flocked to self-custody at a historic rate, as seen in Figure 5. This heightened cynicism prompted exchanges to share proof-of-reserve balances of their holdings, which a handful of companies have already published while others are still preparing. Our team prepared a Dune Dashboard to provide real-time coverage of Binance’s published wallet reserves on Ethereum.

In collaboration with Kraken, Coinbase, and Binance, Ethereum’s co-founder Vitalik Buterin proposed improvements to the current iteration of Proof of Reserves based on Merkle Trees. Ethereum’s founder suggested that centralized exchanges could leverage zk-SNARK (zero-knowledge succinct non-interactive argument or knowledge) technology to improve on privacy rather than opting to publicize a comprehensive list of wallets and assets that might compromise the operational security of users and entities. The privacy-preserving mechanism would help users validate the platform’s solvency without having unnecessary access to information about other individuals' accounts.

In other news, Ethereum developers decided on eight EIPs (Ethereum Improvement Proposals) for the Shanghai hard fork slated to take place in H2 2023:

- EIP-4895 Beacon Chain Withdrawals: users with staked Ethereum prior to the Merge will be able to access those tokens, as well as any other rewards.

- EIP 4844: focuses on leveraging proto-danksharding technology, and is expected to boost network throughput and reduce transaction fees on L2 rollups, which is a significant improvement for scalability.

In addition, there are five EIPs dedicated to enhancing the Ethereum Virtual Machine (EVM), a computation engine which acts like a decentralized computer that has millions of executable projects. The EVM governs what nodes can or cannot do to the distributed ledger maintained by the Ethereum blockchain and also defines the specific rules of changing state from block to block. Furthermore, Ethereum developers also announced that they’re relaunching Shandong, the Shanghai testnet version that first launched in October, and will be testing out Beacon Chain Withdrawals.

Decentralized Finance

Figure 6: Monthly TVL Change on Top 10 DeFi Protocols

Source: 21Shares, DeFi Llama

Figure 7: Total Market Cap of Stablecoins in November

Source: 21Shares, DeFi Llama

Stablecoins: The total market cap of stablecoins has declined from $146B to $141B in November. However, if we zoom out and compare the market cap of stablecoins to the overall crypto market, the market share of stablecoins has increased from 13.8% to 16.3%. It has shown that stablecoins continue to be an integral part of the crypto market, especially during the market downturn or amidst black swan events. Out of the 4 largest stablecoins, the market cap of USDT and DAI has decreased by 5.9% and 8.7% respectively whereas the market cap of USDC and BUSD has increased by 0.15% and 4.86%.

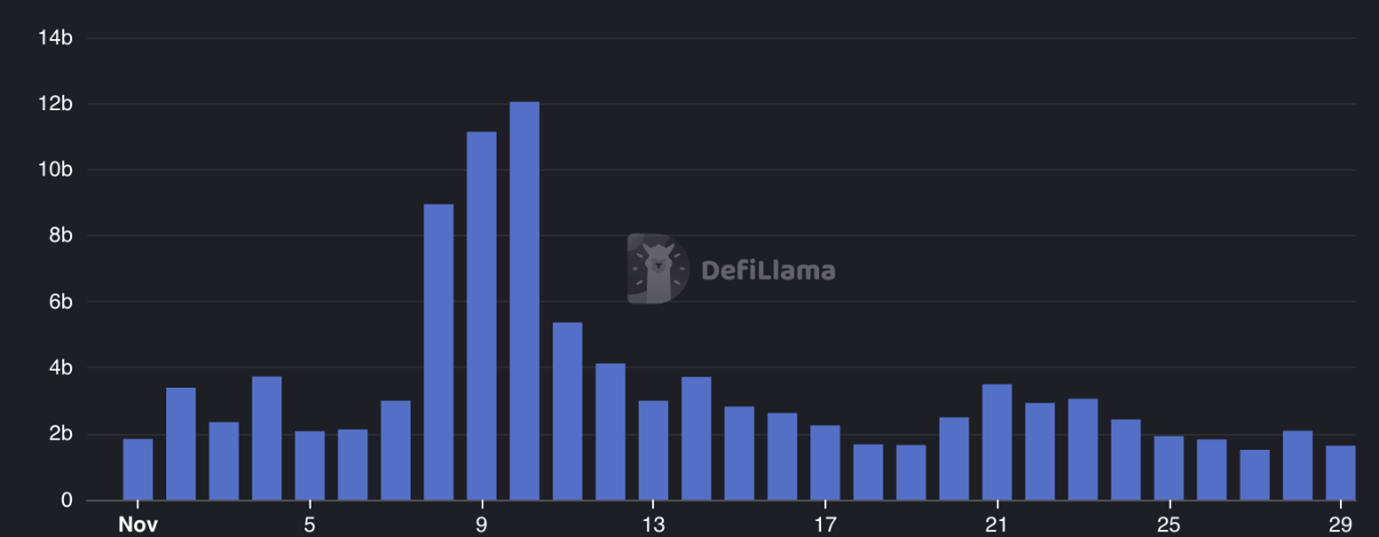

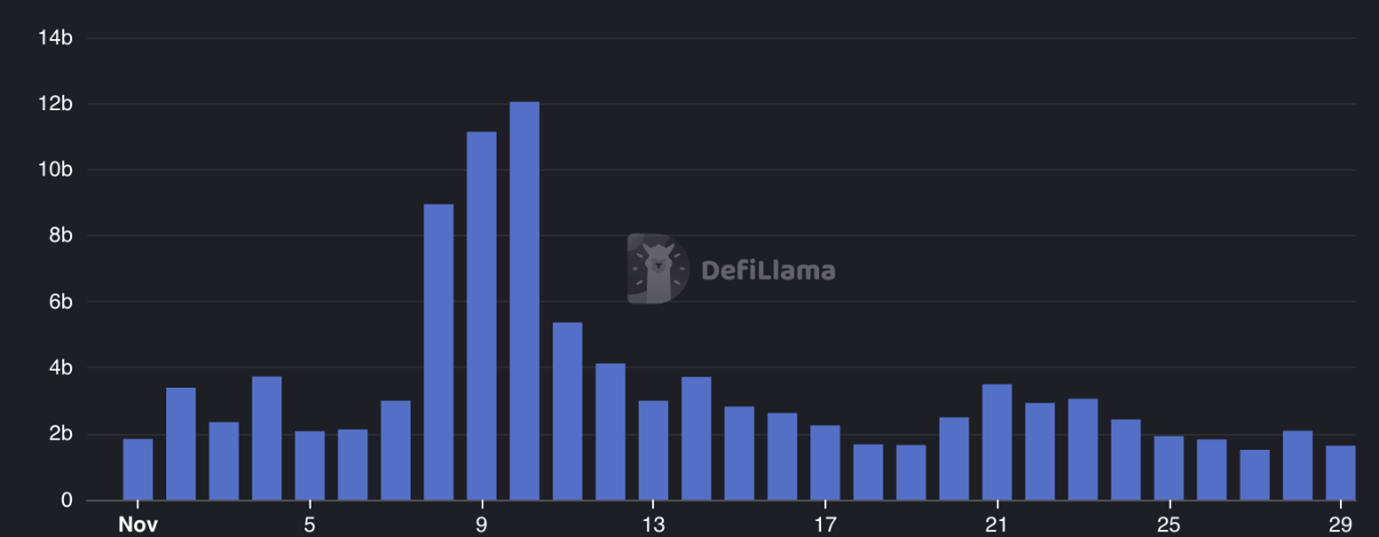

Figure 8: Daily Volume on Decentralized Exchanges

Source: 21Shares, DeFi Llama

Decentralized Exchanges (DEXs): Since FTX halted withdrawals, the volume on DEXs had a huge spike from November 8 to November 10. The largest DEX, Uniswap, even surpassed Coinbase’s daily volume in ETH/USD pair on November 15. A potential reason is that during distress times, users would turn to DEXs for liquidity to de-risk their portfolios. DEXs can protect users from unwanted surprises as the assets held within the liquidity pool are fully transparent and all the operations are executed via code instead of a centralized entity. In comparison to Centralized Exchanges, DEXs have appeared to be more resilient and continue to operate flawlessly.

Lending & Borrowing: Mango Market exploiter has launched an attack on Aave. With $60M USDC as collateral, he managed to take out a huge loan of CRV tokens and sent it to OKX. It is likely that he dumped the tokens and caused a huge price drop on CRV. Market participants believed that the intention behind the attacker is to short-squeeze CRV and incur bad debt on Aave. CRV is relatively illiquid compared to ETH and WBTC as most of CRV’s supply is locked in Centralized Exchanges, Curve Finance/Convex Finance for staking, or other lending protocols. Thus, when a short-squeeze happened and pushed the price of CRV up 60% within 2.5 hours, on-chain liquidity was insufficient to buy back all the CRV the attacker had borrowed using the $60M USDC collateral. As a result, Aave is left with a $1.6M bad debt. In light of the illiquid nature of smaller tokens, Aave and Compound will implement new measures including freezing lending pools and setting borrow caps.

Other Key Developments:

- Curve released a whitepaper on their overcollateralized Stablecoin, crvUSD

- J.P. Morgan executed its 1st live trade on Polygon using modified version of Aave

- Telegram set to build a non-custodial wallet and a decentralized exchange

- FTX Hacker swapped $56M ETH to renBTC and bridged it back to the BTC network. The hacker moved the remaining 185,746 ETH to 12 new wallets

- Cardano Stablecoin projects Djed will launch in January 2023 and USDA will launch in early 2023

- Serum will back the community fork as the upgrade authority is held by FTX. Raydium and Jupiter Exchange will leave Serum

- Uniswap launched Permit2 and Universal Router that allow token approvals to be shared across different applications and unify ERC20/NFT swapping into a single swap router

Metaverse and NFTs

Figure 9: YTD NFT Trading Volume on Ethereum, Solana, Avalanche, and BNB Chain

Source: 21Shares, Dune Analytics

Metaverse and NFTs: NFT trading volume in November hits a new low in 2022, it is down 16% MoM and 95% YTD. Despite a huge drop in DeFi TVL, Solana’s NFT volume increased by 30.8% unexpectedly compared to last month. NFT project Degods and their sister project, y00ts are leading the volume in November with $23M combined. On the other hand, NFT projects under Yuga Labs continue to dominate the volume on Ethereum. Bored Ape Yacht Club, Mutant Ape Yacht Club, and Otherdeed combined for $114M total volume in November.

Contagion of FTX & Alameda Research: Blue-Chip NFT projects are not only popular amongst retail investors but also larger entities, Alameda Research included. According to our Alameda & FTX Tracker, Alameda Research currently holds 11 CryptoPunks, 7 Art Blocks Curated, 12 Meebits, 81 Sandbox Land, 2 Mutant Ape Yacht Club, 2 Otherdeed, and 1 MFER. The downfall of FTX not only affected the price of NFTs, but also directly to NFT projects. Wassies and Star Atlas have a portion of their treasury and liquid funds stuck on FTX. Azuki despite not having funds on FTX, part of their assets are on BlockFi, which has also filed for bankruptcy recently.

Figure 10: Dominance of Ethereum NFT Marketplaces

Source: 21Shares, Dune Analytics

NFT Marketplaces: OpenSea continues to be the go-to NFT platform for NFT traders on Ethereum. A new NFT platform, Blur, has successfully gained huge traction by providing airdrops, 0 marketplace fees, and optional creator royalties to users. Their market dominance has jumped from 3% to 21% within a month thanks to their strategies. However, it also sparks a huge controversy as this model hurts the income of NFT creators. To protect NFT projects and creators, OpenSea has launched a tool for on-chain enforcement of creator fees. At the current stage, it will only be of service for new collections only. The tool will filter the contract address of NFT Marketplaces that do not honor royalties, such as SudoSwap, Blur, and LooksRare. Even though it can help projects safeguard their creator fees, the community raises the concern of potential anti-competition as the tool will bar any trading activities of any NFT on OpenSea’s competitors.

Other Key Developments:

- Animoca Brands planned to set up a $2B Metaverse fund next year

- OpenSea extended support to BNB Chain

- Nike launched a Web3 platform, Swoosh, which will offer Polygon-based NFT products

- Uniswap launched an NFT aggregator covering listings from major NFT marketplaces

Next Month's Calendar

Source: 21Shares, Forex Factory