HGEN Investment Case

Welcome to the hydrogen economy

As the world careens towards lower greenhouse gas emissions, new ideas for running the world’s energy system are being explored. Hydrogen, which has three times the energy potential of petrol on a weight-for-weight basis and produces no greenhouse gas emissions, is receiving a lot of attention from investors and governments.

Sometimes called the “Swiss army knife” of decarbonisation, hydrogen is versatile, and can remove carbon dioxide from many industries – like steelmaking, ammonia production and shipping – that have proved hard to clean up in the past.

Hydrogen is not a new alternate energy source, but today more than 95% of it comes from fossil fuels like methane and coal and its primary use is oil refining.[1] What is new – and potentially exciting – is the growth of green hydrogen, which is created by using clean energy to split water into hydrogen and oxygen. Green hydrogen promises a quiet energy revolution, as it can replace hydrogen generated from fossil fuels. Furthermore, it can then be extended into other areas of the economy where solar power and batteries are unworkable. (For a list of use cases for green hydrogen, please see the appendix).

Turning hydrogen green, and then using it to decarbonise industry, is sometimes called the “hydrogen economy”.

The $11 trillion opportunity

The hydrogen economy is a greenfield investment opportunity still in early development, however, its potential applications are limitless. These applications include how the world feeds itself, as hydrogen is used to make fertilisers which help crops grow, the world’s transport system via aeroplanes and ships that are already exploring hydrogen fuel, household heating which presently often uses hydrogen blended with natural gas and lastly, making construction materials like steel and iron.

In this aspect, hydrogen may be like the internet in the 1990s, or semiconductors in the 1970s. In these instances, disruptive technologies reached tipping points and saw exponential uptake. Their uptake was driven by megatrends – which are one-off structural shifts in the economy and society.

Hydrogen could be set to go the same way thanks to four stars aligning: technology, cost, governments and the environment.

The stars align

Star #1: Technology

Most technology in the hydrogen industry today is based around producing hydrogen from fossil fuels. But new technology is coming online that promises to change that, paving the way for more green hydrogen.

Some examples of up-and-coming tech include solid oxide electrolysers (SOEs), produced by Californian power company Bloom Energy and British fuel cell maker Ceres Power. Electrolysers are used to split H2O into hydrogen and oxygen. They are the backbone technology of green hydrogen. Whereas most electrolysers try and split water, SOEs split steam instead. Doing so allows them to

make green hydrogen faster and in greater volumes. They are also potentially more energy efficient as they can use “waste heat” – such as that produced at nuclear power plants – to boil the water.

Another example is advanced coal seam gas technology which can extract hydrogen from abandoned oil fields while leaving the carbon underground. Canadian firm Proton Technologies is exploring this. This technology works quite like steam reforming – the traditional way of creating hydrogen, by reacting methane with steam – but done underground and with a special palladium filter that only collects hydrogen.

Another example is biomass processing, which turns human waste – such as sewage, landfill or farm waste – into hydrogen. It is especially environmentally positive because it not only provides a source of green hydrogen, but it can also remove waste in the process. Xebec, also from Canada, is producing processing plants that can do this.

Star #2: Cost

Green hydrogen has been a known climate solution for decades. But it has been held back because it is expensive. Now it costs US$3 – $8 per kilogram to produce green hydrogen, with the wide variance due to different renewable energy costs around the world. This compares with just US$0.50 – $1.70 for fossil fuel hydrogen, according to the International Energy Agency (IEA).[2]

However, the price of green hydrogen is falling rapidly, helping to support demand. Putting things in perspective, in 2010 it cost US$10- 15 per kg to produce green hydrogen. This means costs have already more than halved.

Source: IEA. Data as of 1 December 2021.

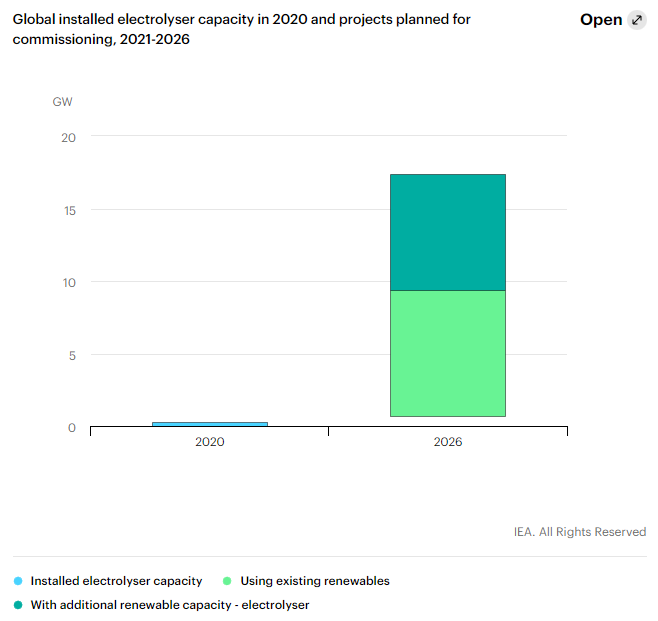

Costs are also likely to continue falling as businesses and governments around the world make more electrolysers. Electrolyser manufacturing today is a niche industry, with most electrolysers used to make chlorine. Presently, there simply aren’t enough electrolysers to make meaningful quantities of green hydrogen. To meet climate obligations, more electrolysers need to be built.

And here, progress is being made. According to the IEA, companies and governments have planned to increase electrolyser capacity from less than 1 gigawatt in 2020 to up to 17 gigawatts by the end of 2026. What’s more, project sizes are also increasing.[3]

Source: Lazard Levelised Cost of Energy Analysis, Version 15.0. Data as of October 2021

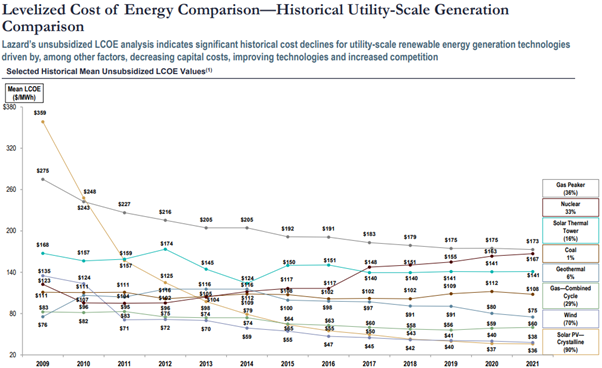

Helping costs fall is the price of renewable electricity. Decades of investment in solar and wind power have lowered renewable energy costs by 50% in the past five years, according to an analysis from Lazard, especially in the west coast of the US and north Europe. The costs of solar panels themselves have declined precipitously, helping to encourage the production of clean energy.

Star #3: Environment

Due to continuing population growth and the expansion of cities, global energy consumption is increasing worldwide. Meanwhile, the world needs clean alternatives to see off the mounting threat of global warming.

Hydrogen is one of the only viable alternatives to fossil fuels as it ticks several crucial boxes. These include high energy density, which is many times greater than oil, meaning it can produce enough energy to power cities. Environmental friendliness, as it produces only water when combusted and no greenhouse gases. And extensive availability, given it is present in sea water.

Source: BofA Global Research, IEA, Industry Associations

Green hydrogen’s potential to reduce global greenhouse gas emissions is real. Most obviously, it could clean up the hydrogen industry as it stands, which is currently a major source of carbon dioxide. Extending green hydrogen to “use case” areas (appendix) can reduce emissions further. The Hydrogen Council, the lobby group, estimates that hydrogen can remove six gigatons of carbon emissions annually[4]. While Bank of America believes that hydrogen can take more than 20% of carbon emissions out of “hard to abate” areas.

Star #4: Governments

Global governments are committing to lowering greenhouse gas emissions. With the election of Joe Biden, the US has recommitted. These commitments were codified into the Paris Accords, which gives governments until 2050 to hit net zero greenhouse gas emissions.

To support their commitment, governments globally are providing vast subsidy and support to help grow renewable energy companies. This includes our own government in Australia, which has rolled out a National Hydrogen Strategy.

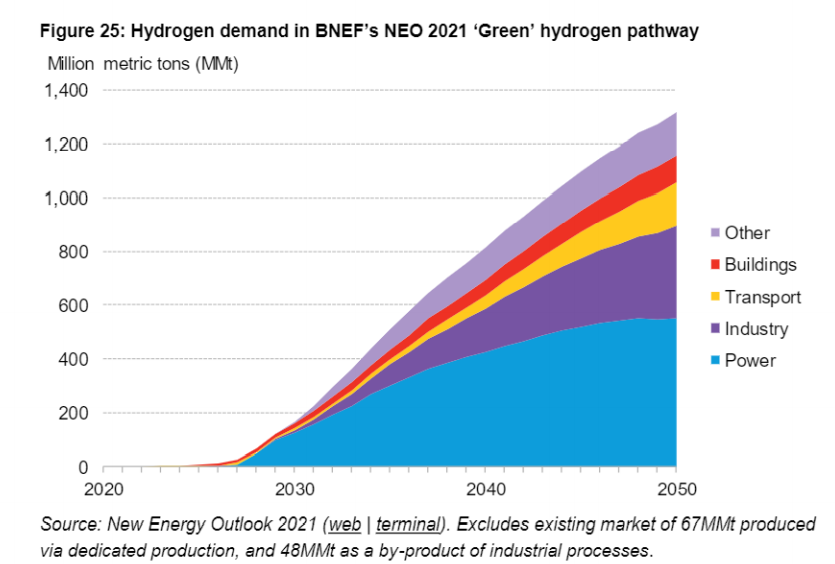

Source: BloombergNEF, 5 August 2021

Governments approaches differ considerably. According to BloombergNEF, there is more than US$11.4 billion a year getting poured by national governments into subsidising hydrogen projects.

The leader by far is Europe. The European Commission recently unveiled its “hydrogen strategy for a climate-neutral Europe” and directed part of its €750B covid-19 recovery plan to hydrogen. According to Walter Mérida, professor at the University of British Columbia, European investments in water electrolysis alone could be €24 – €42B this decade. Iceland leads the pack, having committed to going fully hydrogen-powered by 2030.

There is also a strong take up in Asia. South Korea has committed to producing 6 million hydrogen vehicles by 2040. This has meant that 8 out of 10 of Korea’s biggest companies have started investing heavily in producing hydrogen vehicles.[5] Japan has also begun subsidising hydrogen fuelled trucks and cars and committed billions of dollars towards it.

This is by no means an exhaustive list of committed government subsidies. For example, the US, Canada, Australia, China and many other countries have also made pledges to subsidise hydrogen. Watching how these subsidies unfold and where they are directed in the coming years will be crucial for investors.

Where to invest in hydrogen?

For those wishing to invest in the hydrogen economy, Global X provides the Global X Hydrogen ETF (HGEN). The fund invests in a concentrated 30 stock portfolio of companies from developed markets, Korea and Taiwan with heavy exposure to hydrogen.

It targets pure play companies that produce hydrogen fuel cells and their components, make hydrogen refuelling stations and other infrastructure like storage, and companies that generate hydrogen or build electrolysers.

Wanting to avoid greenwash, oil, coal and gas companies – which help produce grey and brown hydrogen – are removed from the index. As an additional measure, the fund includes an ESG filter.

using data from Minerva Analytics to exclude companies involved in controversial weapons, small arms, gambling, tobacco, and fossil fuels or who are non-compliant with the United Nations Global Compact.

Appendix – Hydrogen use cases

Overcoming the limitations of solar and batteries

By all accounts, the main road to a greener planet is solar power with battery storage. Around the world, governments are introducing incentives to steer consumers and businesses towards adopting them. Investors are also getting rewarded along the way. This has been most visible in recent years with the rise of Tesla and the rapid growth of electric cars.

However, not every sector of the economy can use solar and battery power. Reasons can include the size and weight of batteries, which makes them prohibitive on aircraft or giant ships (fuel cells, which are used to turn hydrogen into electricity, are much lighter and smaller than batteries). But also, because fossil fuels are burnt for reasons other than producing electricity. One example is making steel, which burns huge amounts of coal to purify iron ore. This means that a substitute chemical is needed, not just a clean source of electricity like solar. Hydrogen is therefore not a competitor to solar and batteries but goes into other markets. Specific areas where hydrogen is needed include the below.

Specific use cases

Ships, aeroplanes, and transport

As a rule, the larger the vehicle, the better suited it is to hydrogen over batteries. This is because a full tank of hydrogen produces more energy than a fully charged battery. Heavier vehicles – such as cargo ships and aircraft – are more energy intensive due to their greater weights. Airbus, the world’s largest aeroplane maker, has already said that it will produce hydrogen fuelled aeroplanes by 2035 as batteries alone cannot work for long distance flights. While Maersk, the largest shipping company, is investing in hydrogen, with ammonia seeming to be the likely form of hydrogen fuel for containerised shipping.

Clean steel and ironmaking

Blast furnaces have been working the same way for 1000 years. They turn iron ore into purified iron and steel by adding coking coal to iron ore pellets and melting them together at very high temperatures in a furnace. The coal removes the impurities in the iron ore, while producing vast quantities of carbon dioxide and slag. Hydrogen, however, can be used as a substitute for coal as it too can react with the impurities in iron ore and do so while producing no carbon dioxide. ArcelorMittal, the world’s leading steelmaker, has already completed a successful trial of a hydrogen steel plant in Germany. They have invested €1 billion to construct the world’s first green hydrogen plant in Spain.[6]

Heating homes and buildings

Keeping houses warm in winter is one of the biggest producers of carbon dioxide in the world. Exact numbers differ between countries but in the United States, residential heating accounts for an estimated 20% of US greenhouse gas emissions.[7] In the UK, it’s estimated to account for one-third of GHG emissions.[8] In colder climates – like Canada’s – it can be even higher still. The attraction of hydrogen is that it can be substituted for natural gas in household heating without consumers noticing a difference. In cold climates, households can continue using a boiler to heat their homes running on hydrogen instead.

Green ammonia

Ammonia is arguably the most important chemical in the world. This is because it is essential in fertilisers and allows our planet to grow enough crops to feed 7 billion people. It is the second largest use of hydrogen, butthe hydrogen it uses is almost all derived from fossil fuels. Green hydrogen can remove fossil fuels from ammonia production and produce “green ammonia”, Aker Clean Hydrogen has already started doing this in Norway. While German industrial giant Thyssenkrupp and US fertiliser maker CF Industries have started trialing it in the US.