Introducing N100: The Top 100 US Innovators

US stock markets are home to some of the most successful companies of all time. Many are household names whose products or services play a vital role in modern everyday life. They include – but are not limited to – the largest technology companies in the world such as Apple, Microsoft and Alphabet, international consumer players like Pepsi, Starbucks and Costco, as well as a range of healthcare giants and digital juggernauts. Over time, this group of innovative companies have also been attractive to investors due to their growth characteristics. However, it can be difficult to access individual US-domiciled stocks in Australia.

The companies at the forefront of innovation have outperformed in recent years and their place at the cutting-edge of megatrends positions them for promising growth over the near and long-term. The Global X US 100 ETF (ASX: N100) invests in the 100 largest companies listed on the Nasdaq exchange, excluding financials and REITs, by tracking the Global X US 100 Index, providing Australian investors access to this opportunity.

Key Takeaways

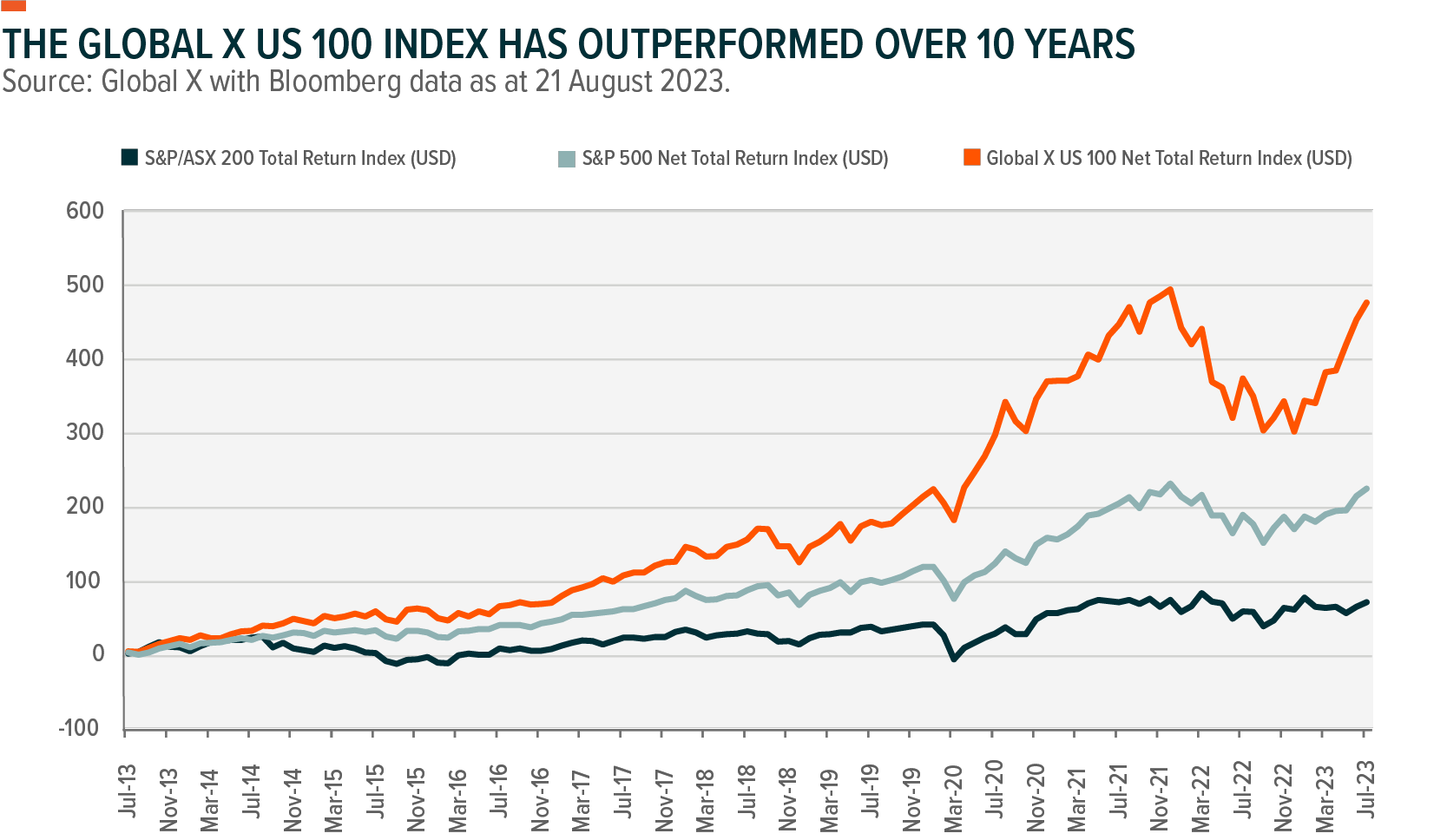

- The top 100 US-listed stocks have significantly outperformed other major indices such as the S&P 500 and ASX 200 over the past five years.

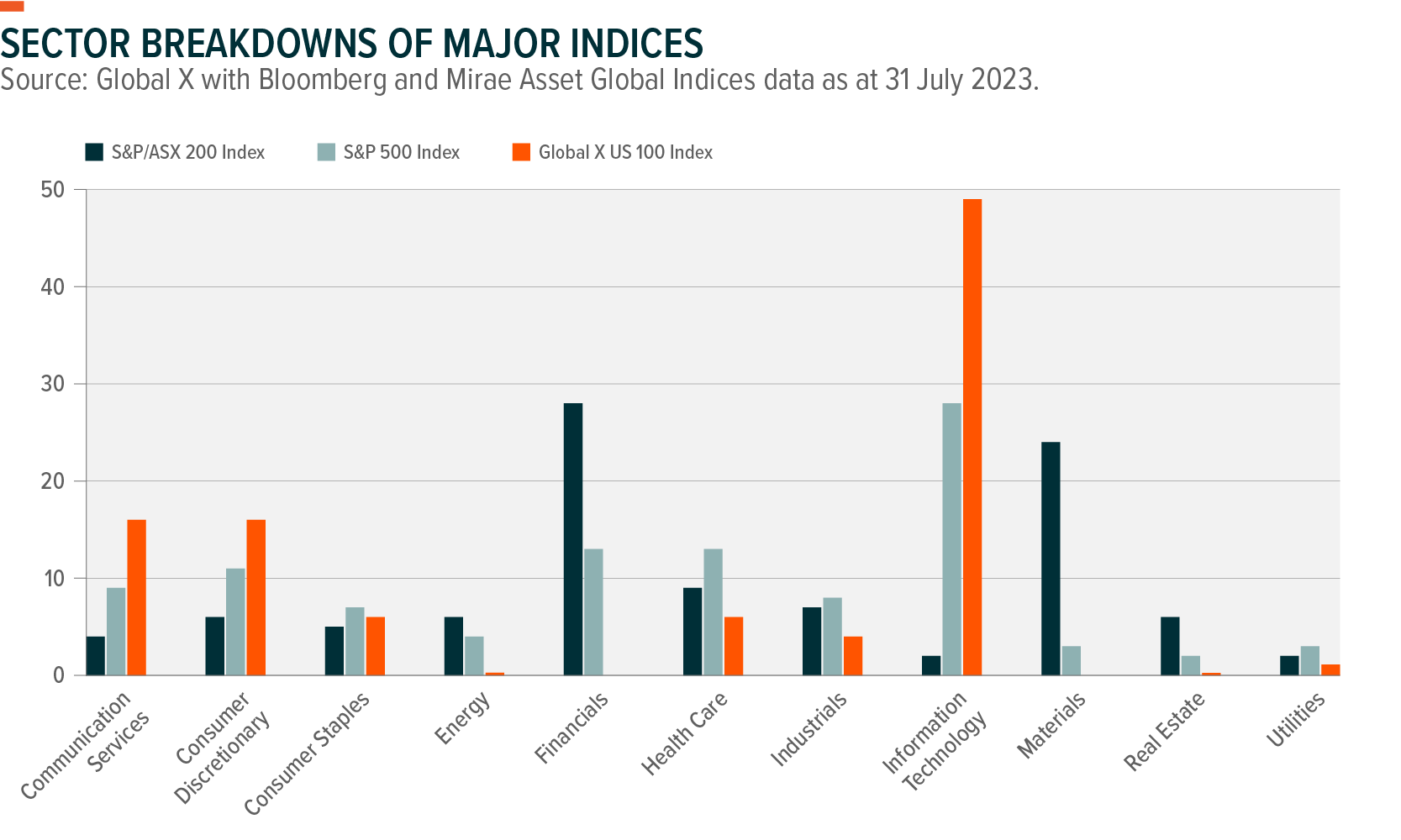

- US markets have a strong tilt towards innovative and growth stocks in key industries such as information technology, consumer services and healthcare, which varies from sectors generally held by Australian investors such as financials and materials.

- The Global X US 100 ETF (ASX: N100) helps remove barriers to entry to the largest US companies in a cost-effective vehicle.

Understanding the Top 100 Companies Listed on the US Market

The top 100 US-listed companies are widely considered some of the most innovative and growth-orientated in the world. It consists of a mix of sectors, with a tech-heavy focus as well as consumer services, staples and discretionary stocks, healthcare, industrials and utilities. The sector breakdown is significantly different to other major indices such as the US’s S&P 500 and the Australian S&P/ASX 200.

Tellingly, the influence of different sectors in each index has played a notable role in overall performance. The information technology sector makes up more than half of the top 100 US-listed companies, excluding financials and REITs.1 The below performance chart shows the total returns of the top 100 US-listed stocks versus the S&P 500 and S&P/ASX 200 over the last 20 years. It underscores how technology companies have been a key driver for the overall performance of the stocks in the Global X US 100 Index. These stocks also account for the majority of the index’s market capitalisation. In fact, the top five stocks, Apple, Microsoft, Amazon, Nvidia and Tesla make up more than a third of the index’s total weight.2

Past performance in not a reliable indicator of future performance.

Investment in Innovation Drives Performance

The technology industry has seen significant growth in the past decade as the world has shifted towards digitalisation. From smartphones and social media to medical devices and agriculture, the proliferation of advanced technologies has infiltrated modern life across every industry. As such, investment in the space has skyrocketed and companies leading innovation in their respective fields have greatly benefited.

The success of the highest-performing US technology companies largely comes down to being the first movers in larger megatrends. Take Apple for example – the biggest listed company in the world – it began its life in personal computers but expanded its product offering to include smartphones, wearables, and Bluetooth headphones, which influenced the broader industry. Its ability to do so links back to a concept called positive feedback loops. In short, the more innovative a company can be, the more likely it is to generate revenue from new products and services – and so the positive feedback loop continues.

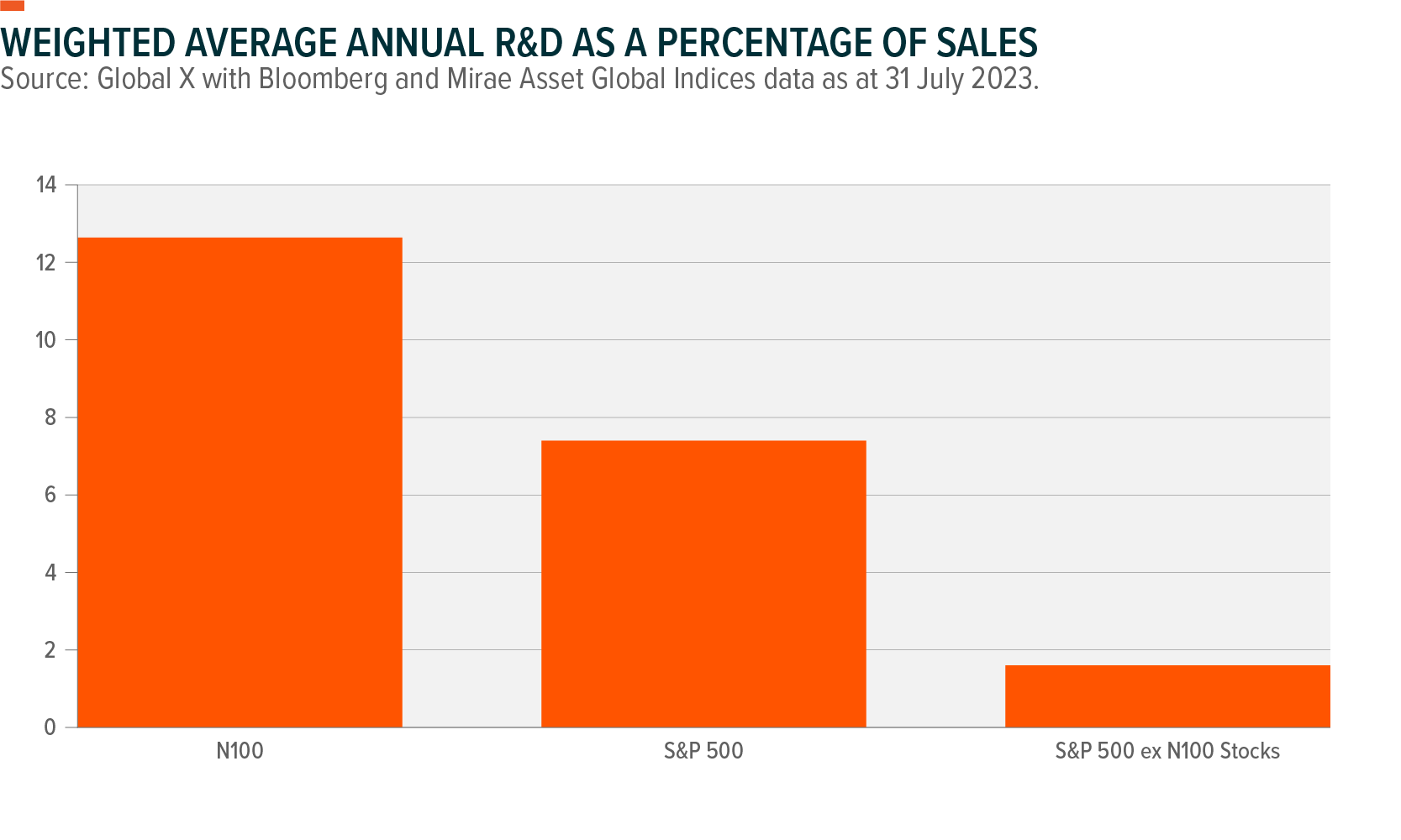

Apple is one company seeing success from constant innovation. In fact, these companies prioritise research and development (R&D) to ensure they remain at the forefront of innovation. Companies in the Global X US 100 Index, on average, spend almost double the amount on R&D annually compared to those in the S&P 500. In 2022, companies listed in the index spent almost US$18 billion on R&D, while the S&P 500 (minus the stocks which are also included in the Global X US 100 Index) only committed US$1.2 billion.3 The below chart highlights how this initial investment in innovation plays out in terms of sales.

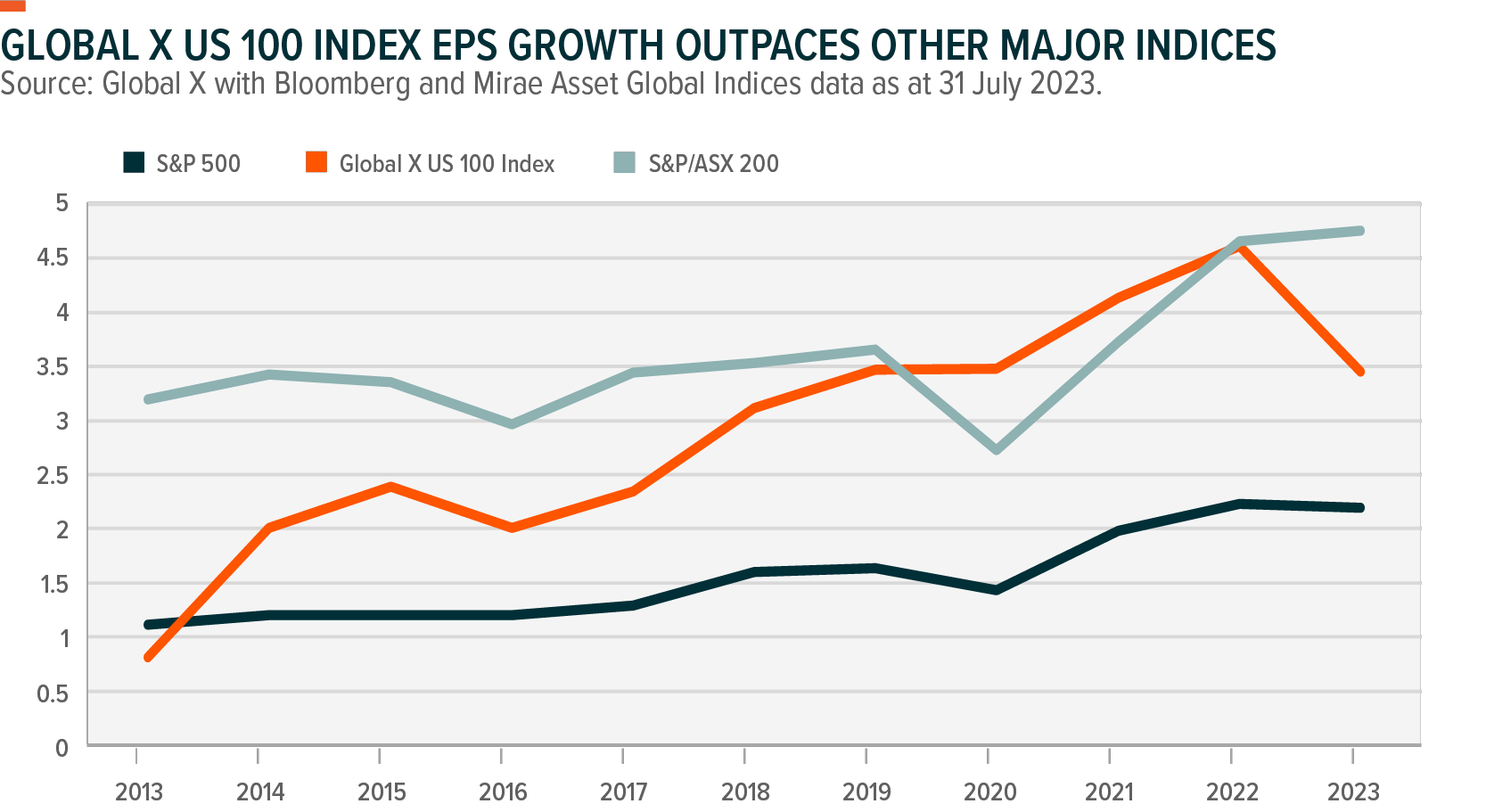

This investment into innovation has also positively affected these companies’ bottom lines. In the last 10 years, stocks in the Global X US 100 Index have seen significant growth in key metrics such as earnings per share (EPS) – a key determiner of a company’s profitability. The EPS of the Global X US 100 Index has tripled, while the S&P 500 and S&P/ASX 200 have increased 2 and 1.5 times respectively.4

Looking ahead, innovation will remain a linchpin for companies’ success. Those who create and embrace technological advancements are set to benefit the most from megatrends that are shaping the future, such as artificial intelligence, electrification and renewable energy, advanced connectivity, cloud computing, cybersecurity, automation and machine learning, and healthcare and bioengineering.5 The largest US companies are so multifaceted, so as a collective they are well-positioned to capitalise on these structural shifts in society in the shorter and longer term.

Building Growth into a Core Portfolio

The top 100 US-listed stocks can play a crucial role as a core portfolio holding. They offer three key benefits:

- Consistent historic performance.

- Long-term growth potential.

- Sector and geographic diversification.

These advantages are particularly relevant for Australian investors as they are generally underweight in international and technology stocks.

Directly held Australian shares have remained the most popular option for local investors into 2023 and only 16% directly hold international shares – meaning they have a strong home bias.6 This can be detrimental to portfolio performance and hinder potential returns as the Australian share market represents around 2% of the total global market, while the US makes up around 60%. As such, Australian investors who lack exposure to other regions like the US may find it difficult to construct a well-diversified portfolio and even eliminate potential returns. Insufficient diversification may also be due to the high concentration of financial and materials companies which make up more than 50% of the S&P/ASX 200.7 However, the information technology sector only represents 2.5%.8 This is underscored by the ASX’s 2023 Investor Study which shows that the number of investors that believe they have a diversified portfolio has fallen, with 38% saying their portfolio lacks diversification.9 Ultimately, when incorporated into a broader portfolio, US-listed companies can help mitigate issues caused by home bias by providing exposure to a different region, and to sector concentrations, such as technology.

ETFs Make International Success Accessible

While US-listed stocks can be an attractive investment opportunity, they can be difficult to access for Australian investors. These stocks can be purchased individually, however, this increases stock concentration risk and may lead to investors missing out on the returns of the whole basket of stocks. Additionally, to access direct US shares, Australian investors need to find a broker that offers US shares, take into consideration trading costs (brokerage and currency conversion fee) and complete a W-8BEN form (which allows foreign investors to gain a special tax status to avoid paying excess tax on US shares and dividends).

Hence, the Global X US 100 Index is designed to simplify the process in a cost-effective vehicle. It uses an index to identify and weight the largest companies listed on the Nasdaq exchange by market capitalisation. This allows investors to access the largest and most innovative companies in one trade and capture their collective performance, without the need for currency conversion or a W-8BEN form. As with all investments, there are considerations for investing in US-listed companies including market risk, country risk and currency risk, as well as individual investment goals and risk tolerance.

US-listed companies have seen some of the most astounding growth from any market in recent years. These companies are leaders in their respective fields and are at the fore of the most prevalent megatrends and structural shifts taking shape across the world. With innovation and technological advances driving their products and services, the top 100 US-listed companies are set to experience ongoing success well into the future.

Related Funds

N100: The Global X US 100 ETF (ASX: N100) invests in the top 100 companies listed on the Nasdaq exchange, excluding financials and REITs. N100 seeks to provide investment results that correspond generally to the price and yield, before fees and expenses, of the Global X US 100 Index.