Investing in gold is as old as investing itself. In ancient times, gold enchanted pharaohs moved kingdoms and was taken as currency by empires — from Ancient Rome to Ming Dynasty China. Since the industrial revolution, gold has caused wars like the Boer War, inspired the American and Australian frontier movements, and provided the glue for international payments under the gold standard.

Outside politics, gold has inspired fairy tales, legends, and myths across the ages, from Rumpelstiltskin to Leprechauns at the end of rainbows to Jason and the Argonauts.

The world has changed today, but some things have stayed the same. Gold is still used extensively in jewellery and ornamentation, much like in Tutankhamun’s day. However, its role as a store of value has evolved. This investment case unpacks why investors add gold to their portfolio, takes a closer look at how to access gold, with a focus on miners, coins, bars and gold ETFs, and dives into what determines the gold price.

Key Takeaways

- With an annual average return of 9% over the past 20 years, gold has outperformed most Australian shares.1

- An uncorrelated asset that has performed well long-term, gold is a valuable tool for a well-diversified portfolio.

- Physical gold ETFs have become more popular as investors seek liquid alternatives.

- Statistically, the best predictors of the gold price are real yields on 10-year US government securities and the value of the US dollar.

Why Invest in Gold?

Diversification that Works

The first step in portfolio building is asset allocation. This involves choosing among asset classes – shares, bonds, cash, and alternatives – to minimise risk and maximise returns.

The importance of asset allocation cannot be overstated. The best evidence suggests that the most important determinant of portfolio performance is time in the market.2 After adjusting for inflation, US shares and bonds, which dominate global benchmarks, have produced an annualised average return of 6.4% and 1.7% a year, respectively, since 1900. Given this, the best predictor of long-term success for investors is simply how long they stay invested.3

However, the second most important factor is asset allocation, with some academic estimates suggesting 91% of the difference between funds’ performance is caused by asset allocation.4 And unlike time in the market, which can be heavily determined by age and life expectancy, investors have more direct control over their chosen assets.

Gold’s Role in Asset Allocation – Portfolio Insurance

In asset allocation, gold’s role is diversification. This makes it different from property, shares, and bonds – which provide income, capital growth and capital stability, respectively. The idea of a “diversifier” can strike some investors as a bit strange. However, the concept should be familiar to anyone who has bought insurance.

Insurance is the ultimate form of diversification. When the value of one’s car or house – or whatever else is insured – falls or disappears entirely, an insurance policy can pay out. This is because the payments received from an insurance policy are inversely related to the value of the insured asset.

While not the same, gold’s role in asset allocation can be understood in similar terms. Gold tends to perform well when other assets struggle, thereby limiting losses. It does this due to its tendency to perform well during crises and its low correlations with other assets (discussed later). Demonstrating gold’s effect on portfolios is best done by looking at portfolio simulations, illustrating how adding gold to an Australian portfolio changes outcomes.

Adding Gold – the Efficient Frontier

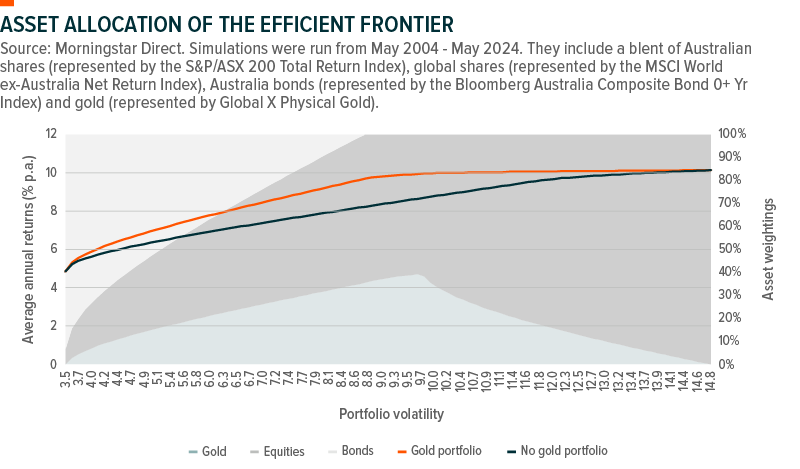

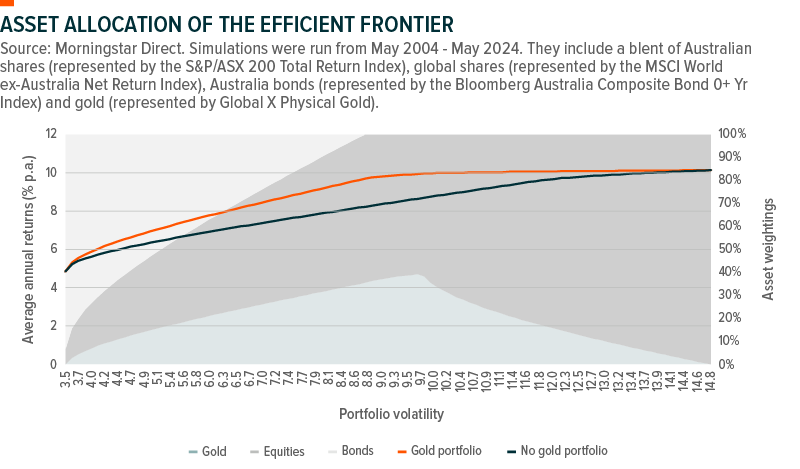

To demonstrate this, we created two conventional Australian portfolios on Morningstar Direct and simulated their returns over the past 20 years. The simulation involved the conventional blending of different asset classes to find the best performing blend for a given amount of risk (called the efficient frontier, in finance jargon).

The first portfolio comprised entirely of Australian shares, global shares, and Australian bonds (“no gold portfolio” in the black line). The second comprised the same three asset classes but also had the option to include gold (“gold portfolio” in the orange line). As the simulations show, adding gold has increased the annual returns of Australian portfolios for a given amount of risk for most levels of risk and return over the past 20 years (i.e. pushed out the efficient frontier).

The exact numbers may cause some surprise, as they suggest an optimal weighting to gold of almost 40% at one point on the frontier. (This could be regarded as too high, given common allocations to gold are typically closer to 5%, as used in the section on maximum drawdowns below).

However the results broadly align with common sense. At the extreme ends of risk and return, our simulations found that the optimal allocation to gold is zero. And that the gold and no gold portfolios converge. This is certainly logical. For those wanting the lowest possible volatility irrespective of returns, it makes sense to only own bonds (or cash) and leave out shares and gold (shares and gold are more volatile than bonds and cash). While for those wanting the highest possible returns irrespective of risk, it makes sense only to own shares. The real value gold offers is for those looking to occupy some middle ground.

Adding Gold – Maximum Drawdowns

Adding gold also reduced portfolio drawdowns. To demonstrate this, we ran another simulation in Morningstar Direct. This time, however, we used the Vanguard LifeStrategy Conservative Index Fund’s historical returns, both with and without a small addition of gold (5%). Our reason for using the Vanguard fund is that it holds its allocations to shares and bonds fixed at each rebalance, allowing us to isolate the effects of adding gold. Meanwhile, Vanguard’s index approach enables us to capture the average returns experienced by investors using a conventional and popular asset allocation framework.

As can be seen, a small addition of gold noticeably reduced maximum drawdowns—creating a smoother ride for investors. These lower drawdowns were especially noticeable during the 2008 financial crisis and in 2020 following the Covid-19 pandemic.

The Causal Mechanism – Why Gold Pushes out the Efficient Frontier and Lowers Drawdowns

Those reading these simulations may naturally wonder why gold does this. And relatedly wonder whether the results are just luck.

Gold has had these effects because the gold price is uncorrelated with Australian risk assets (shares, property). Furthermore, and crucially, gold maintains these low correlations while performing relatively strongly over the longer-term. In sum: gold provides diversification that works.

What are correlations? For those unfamiliar, correlations are the most common way of measuring diversification in finance. Measuring them involves counting the extent to which asset prices rise or fall together and to what degree. If two assets always rise and fall together, and by a strictly proportionate amount every time, they are regarded as the same (less diverse). This sameness is reflected in a correlation of 1. By contrast, if two assets’ prices always shoot off in different directions, they are considered unrelated (more diverse, more different). This is reflected in a correlation of 0.

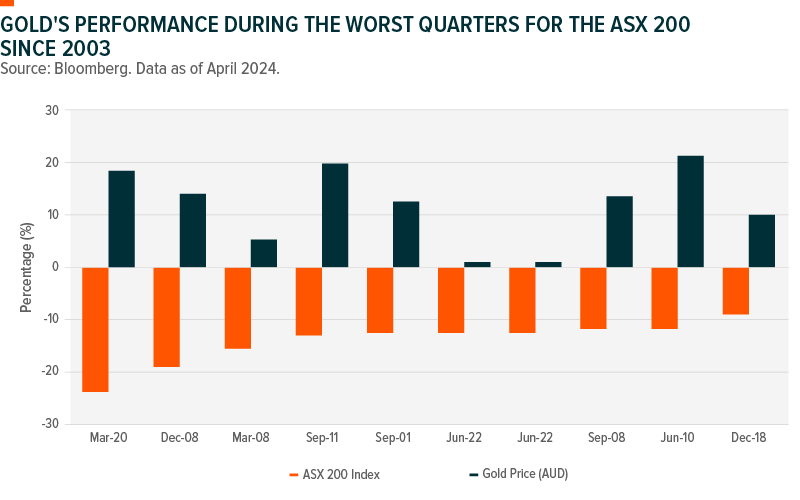

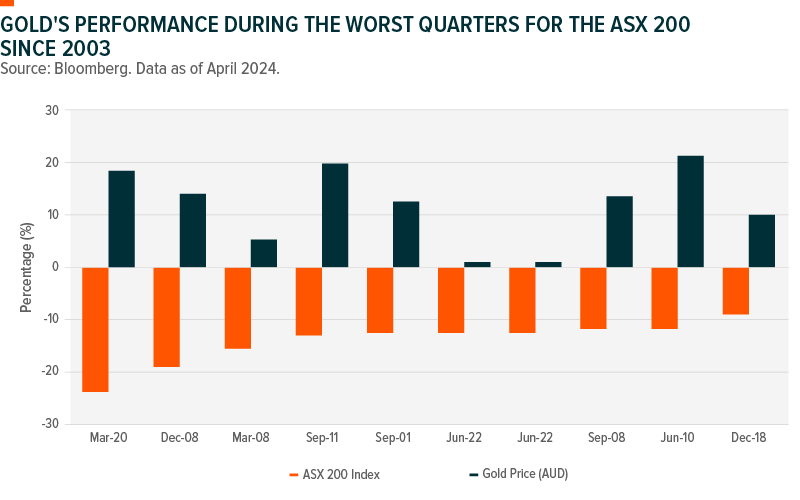

As shown in the table above, gold’s correlation with Australian and global shares is negative, suggesting it tends to move in the opposite direction. Furthermore, gold’s tendency to shoot off in a different direction to shares tends to kick in when it matters most. For example, in the worst performing quarters for the S&P/ASX 200 over the past 20 years, gold has outperformed almost every instance. This has been particularly true during the most significant corrections: the 2008 financial crisis and the 2020 Covid pandemic. The same is true for the worst performing quarters for global shares, seen in the MSCI World-ex-Australia Index. These are reflected in the graphs below and largely explain why gold has the effect of lowering drawdowns.

Potential Investment Returns

Another potential reason to invest in gold is the investment returns it has provided long term.

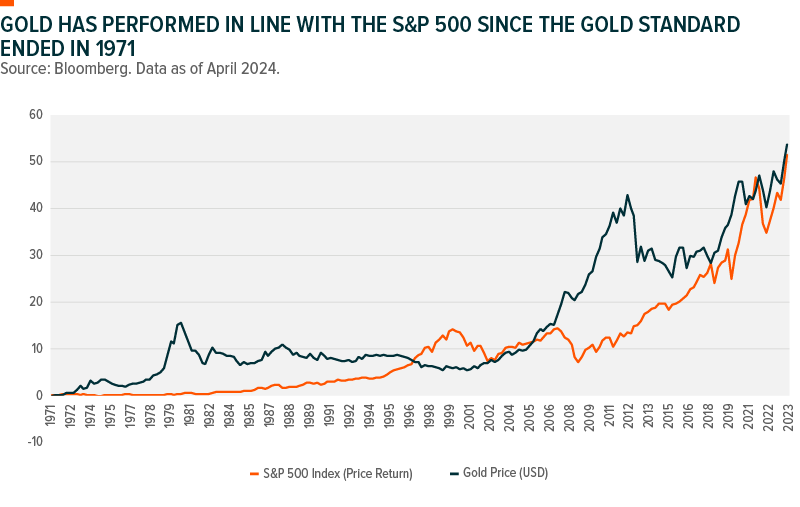

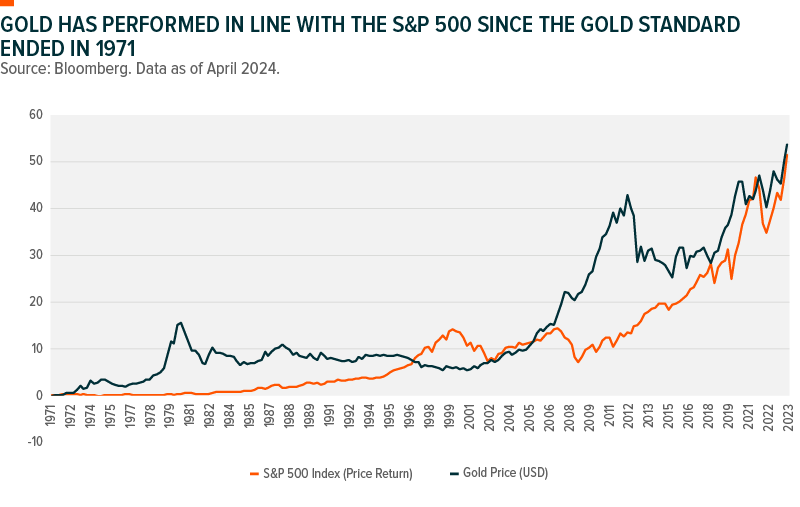

Measuring gold’s performance must start in November 1971, after the gold standard ended. In the prior century, the gold price was largely state managed under the gold standard. Many governments, including China, the US and Australia, significantly restricted the ability of private individuals and companies to trade gold, viewing the metal as too strategically important for controlling their exchange rates. This means measuring the gold price pre-1971 is largely meaningless for investors today.

Since the gold standard ended and a free gold market was born, the gold price has performed more or less in line with the S&P 500 on a price return basis.

For Australia, available data only allows us to go back to July 1992.5 However, looking over this stretch, we can see that gold has outperformed the S&P/ASX 200 Index on a price return basis but underperformed on a total return basis (which assumes all dividends are fully reinvested). This suggests that gold has been a relatively strong performing asset for Australians.

Gold’s performance comes into greater focus when we compare how gold has performed against specific Australian shares. It is worth remembering an index like the S&P/ASX 200 is a weighted average. Some stocks perform above average, others below. It is also worth remembering thousands of stocks are listed on the ASX, yet only 200 of them – usually the 200 biggest, arguably higher quality – make the cut. The S&P/ASX 200 represents a curated list.

Looking at ASX-listed shares in their entirety, an influential study by Prof Hendrik Bessembinder at the University of Arizona found that only 39% of ASX-listed companies have provided total returns greater than 0% over their listed lifetimes between 1991 and 2021 (the period of his study). Most ASX-listed companies have lost money (and therefore underperformed gold).6

When looking at total returns for individual companies, the readily available data from Bloomberg only goes back 5 years, but it tells the same story. While top companies produce outsized returns, most companies completely underperform, and gold outperforms most companies. The following table shows that only the top 40 companies (only the top 20% of all companies in the ASX 200) have been able to outperform gold and that a big part of the overall index returns is due to a small number of high performers.

How to Invest in Gold?

Investors seeking access to gold have three main avenues. Two of which are quite old-fashioned. But the last of which, buying physical gold ETFs, is modern and now the most popular investment option. These options are:

- Buying shares in gold mining companies

- Buying gold bars, coins, or jewellery

- Gold ETFs

Strengths and Weaknesses of Gold Miners

Gold miners are many investors first thought when investing in gold. Gold miners have the advantage of offering dividends and potentially franking credits, as Australia is home to some of the world’s largest gold miners.

Gold miners are a crude way to invest in gold. This is because their share prices, like other kinds of miners, correlate closely with the price of what they mine. But more specifically, due to operating leverage, gold miners are usually regarded as providing “geared” exposure to the gold price. For this reason, gold miners are often used as a higher-risk, higher potential reward way to trade the gold price.

There are two major drawbacks to using gold miners. First, they have underperformed in line with the gold price and the broader equity market over the past 15 years. Second, gold miners, unlike physical gold, are correlated to the share market – meaning they cannot fulfil the asset allocation function (diversifier) described above.

Strengths and Weaknesses of Gold Coins, Bars or Jewellery

Buying gold coins, gold bars or gold jewellery from a bullion dealer or jeweller is another way to invest in gold.

The drawbacks here, however, are security and transaction costs. Storing gold bars, coins, and jewellery is a tricky business. In 1995 Kerry Packer, then Australia’s richest man, had $5.4 million worth of gold bars (roughly $25 million at today’s gold price) stolen from his office in Sydney.

The other drawback is transaction costs. When you buy a gold coin or bar, you must find someone to sell it to when you don’t want it anymore. Often, the only entity investors can sell their bars or coins back to is the dealer they bought them from. But selling gold coins and bars to bullion dealers is expensive. Below is our analysis of the spreads a major Australian dealer charged in May 2023. Spreads reflect the difference in price at which dealers will buy from and sell to you.

Physical Gold ETFs

The final among the most popular ways to invest in gold is through physical gold ETFs. Physical gold ETFs have risen dramatically in popularity in the past 20 years and house over US$210 billion worth of gold worldwide, according to the World Gold Council.7 They are also the most common kind of ETF, appearing on exchanges globally from India to Russia to Egypt.

Gold ETFs are shares or units in physical gold bars that trade on an exchange. They are fully backed by gold bars held in bank vaults. And their trading spreads are significantly tighter than those charged by bullion dealers (i.e. above). As a result, gold ETFs are often the preferred route for investing in gold for most investors.

What Drives the Gold Price?

Investors considering gold may also wonder what drives the gold price. Gold does not have an internal rate of return like shares and bonds. So, it cannot be valued using conventional methods like discounted cash flow analyses.

Statistically, in recent history, the best two predictors of the gold price are:

- Real yields on 10-year US government bonds

- The strength of the US dollar

Real Yields on 10-year US Government Bonds

The reason behind gold’s relationship with real yields on US government debt is that gold, like other assets, is directly impacted by prevailing interest rates. And gold generally does best when real interest rates (which include the impact of inflation) are low – or even negative.

Why? Because gold pays no income. As such, it can be most appealing when cash and bonds pay no real income either. Furthermore, gold tends to be used as a safe haven by investors. Investors often take up gold during crises, causing its price to rise. And central banks tend to lower interest rates during crises to support the economy. As the graph below shows, over the past 20 years, yields on US 10-year TIPS have exhibited an R-squared of 68% to the gold price. This suggests that 68% of gold’s price movement over this period is explained by movements in 10-year US real yields.

The US Dollar

The other major predictor is the strength of the US dollar. The reasons for this should be familiar to those understanding global commodities markets. Gold, like other commodities, trades primarily in US dollars. The world's most influential gold trading venues – the LBMA in London and COMEX in New York – trade gold exclusively in USD.

Despite most gold trading in US dollars, the US only accounts for a minority of gold purchases. Instead, China and India are the biggest gold-buying nations. This means that when the US dollar falls, it becomes easier for people outside the US to buy gold. This can then translate into greater gold buying, which supports prices.

The strength of the relationship between the gold price and the US dollar can also be measured by looking at the correlation (or R-squared) between the gold price and the DXY Index, which measures the US dollar against a basket of six developed currencies. For example, at the time of writing (June 2023), the gold price has had an R-squared of 80% to the US dollar index over the past 12 months (per the graph above). However, the longer-term average is closer to 50%.