Should You Currency Hedge Your Gold Exposure?

Executive Summary

- Gold has three main uses in an investment portfolio: diversification, crisis hedging, and tactical trading.

- Of these three uses, we find that unhedged gold provides better diversification and crisis hedging, as the US dollar rallies (and the Aussie dollar falls) during crises.

- Hedged gold may be appropriate at times of extreme Aussie dollar weakness.

Introduction

Investors considering gold sometimes wonder about currency hedging. As gold trades in US dollars, Australians who buy it make a twofold bet:

- That the gold price will rise.

- That the US dollar will rise or stay broadly the same vis-à-vis the Aussie dollar.

While the first of these bets is self-evident, the second can give investors cause for pause. Investors might ask: can exchange rate movements undermine gold’s role in my portfolio? When the US dollar is at record highs or lows, am I better off in hedged or unhedged gold? What are the strengths and weaknesses of each approach?

This white paper answers these questions. In doing so, we lay out the three main ways gold gets used: diversification, crisis hedging, and tactical trading. We then examine the effects of currency hedging on each.

We find that unhedged gold is better for diversification and crisis hedging, as most Australians are overweight the Aussie dollar1 and the Aussie dollar tends to fall during turmoil. This means that unhedged gold, which bets on the US dollar due to the US dollar being its base currency, provides a second line of defence.

By contrast, we find that both hedged and unhedged gold are both appropriate for tactically trading the gold price. When the Aussie dollar is at extreme lows or highs, such as below US$0.60 or above US$0.90, expressing a currency view may be appropriate.

Currency Hedging in Context

When considering currency hedging for any asset class, the starting point is what role that asset class plays in a portfolio. With that in view, investors can consider whether currency hedging helps or hinders an asset class’s ability to play that role.

International equities’ primary use is enhancing long-term total returns, as global shares – both hedged and unhedged – have been the best performing major asset class for Australian investors over the past 30 years. Choosing between hedged and unhedged international equities therefore is typically based on whichever investors believe will be better performing.

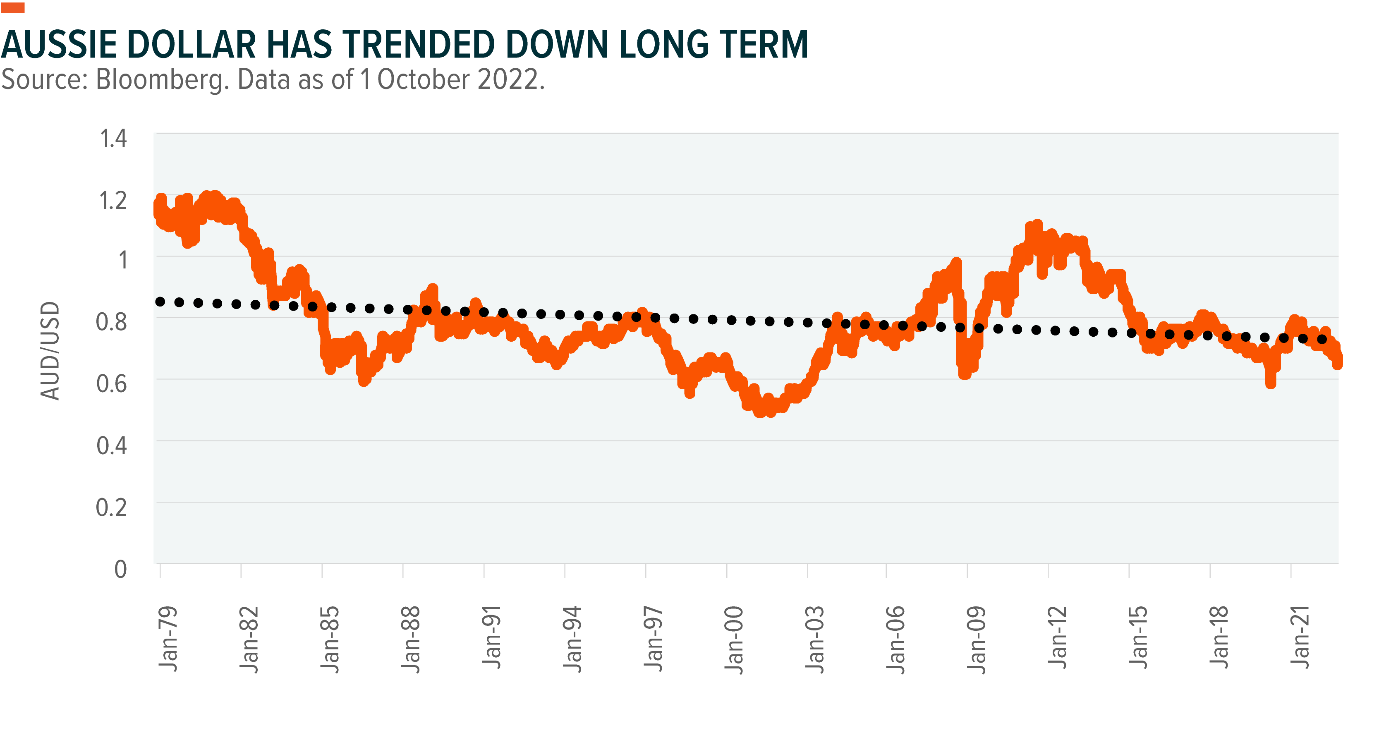

Over the past 30 years, the choice has been straightforward. Since the 1980s the Australian dollar has broadly trended down against the US dollar, making unhedged global shares the better bet.

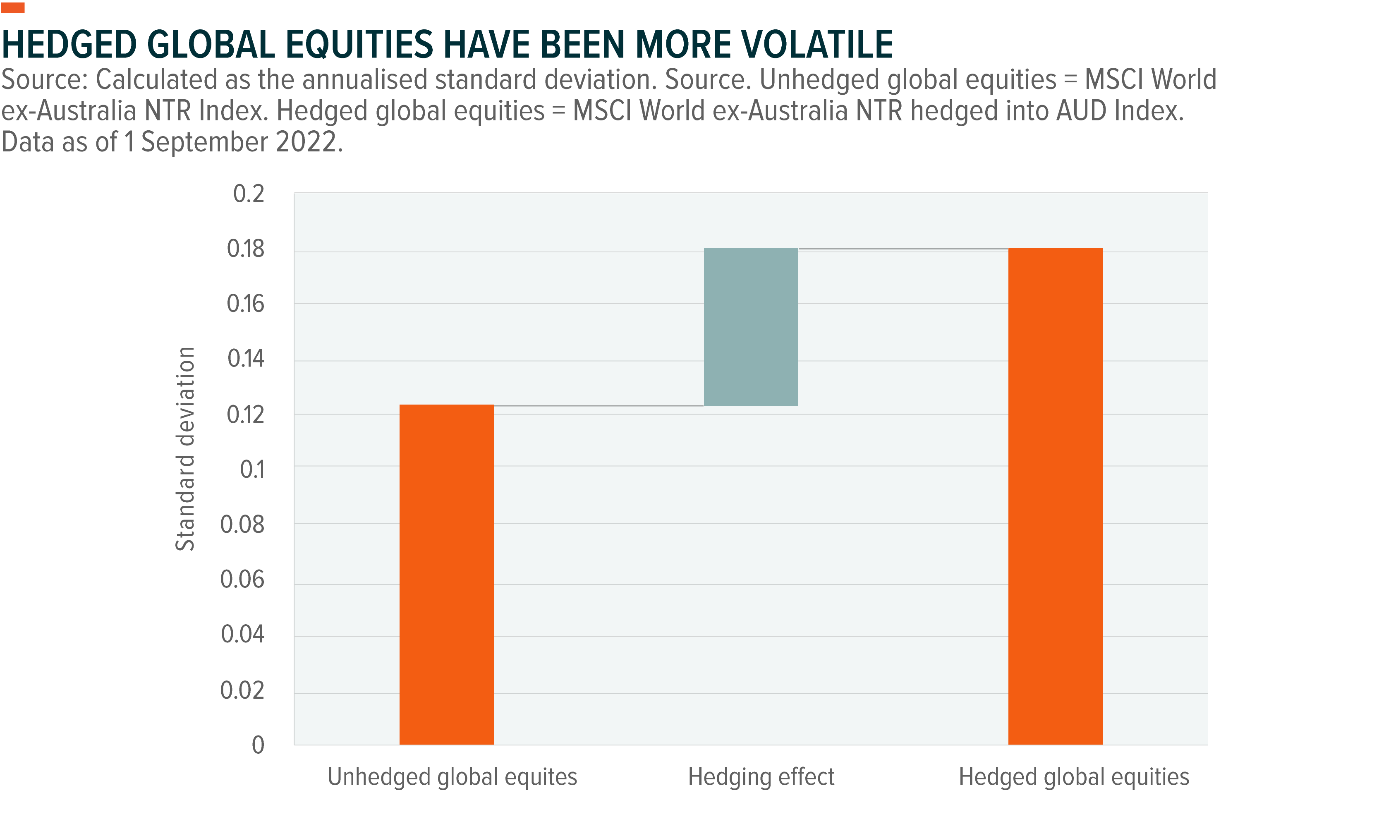

Potentially simplifying the decision further is the fact that currency hedging international equities has added volatility and potentially costs. These dynamics are illustrated in the graphs below.

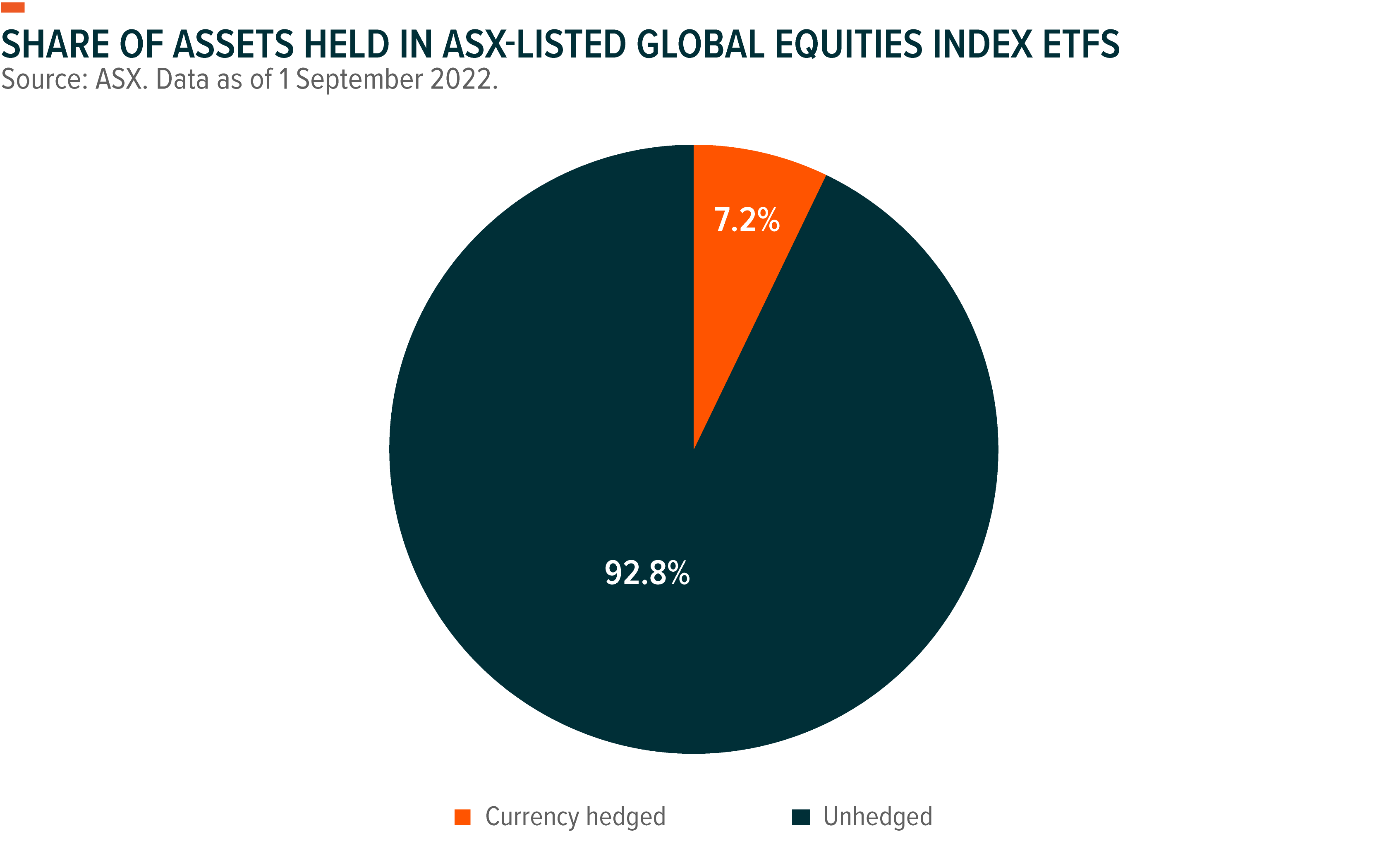

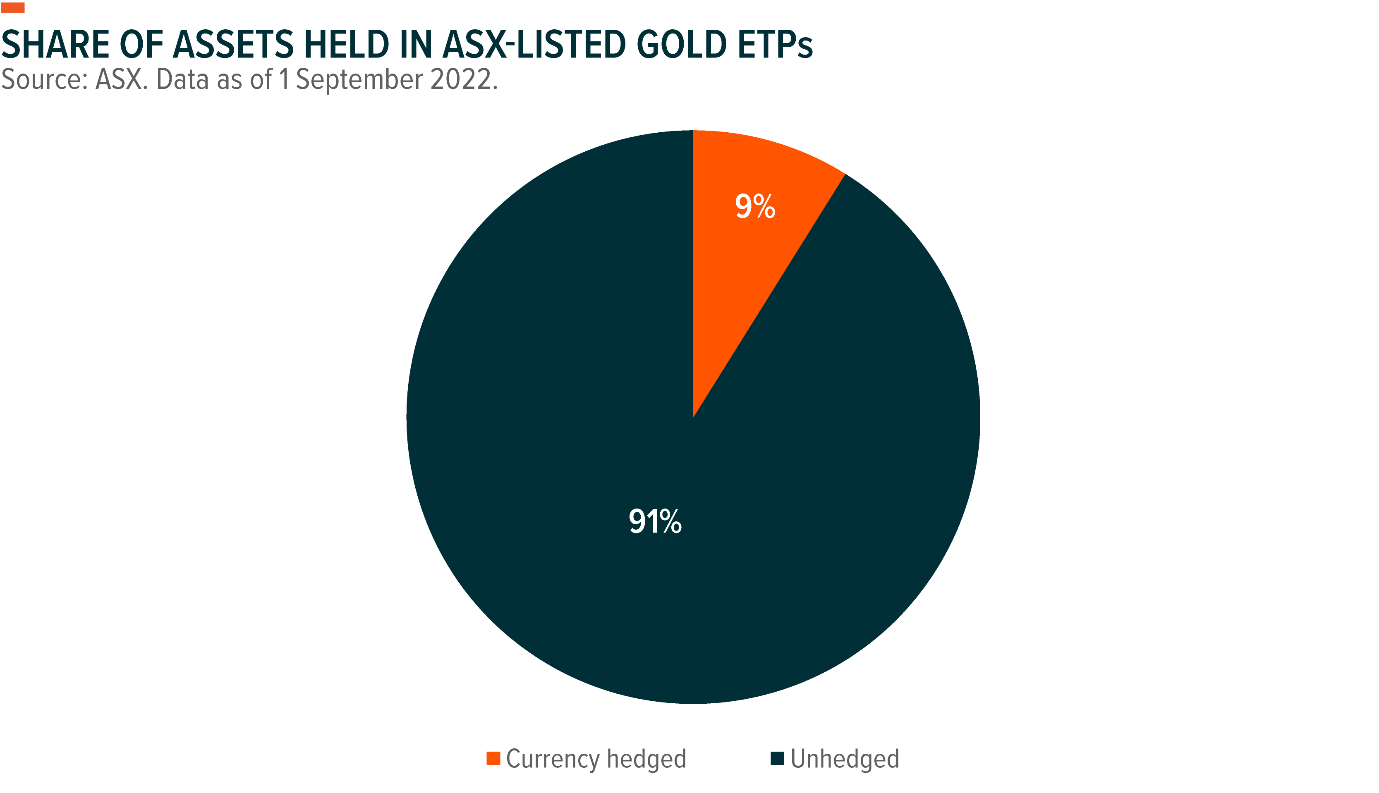

This situation is arguably reflected in the assets under management of ASX-listed international equity ETFs. Currency hedged international equity ETFs account for less than 10% of total segment assets. Where currency hedging has seen greatest traction in international equities is as trading instruments – such as geared and inverse ETPs – which are usually held for shorter time frames.

The higher volatility and lower long-term returns do not imply that currency hedged international equities are ineffective. On the contrary, currency hedged international equities can be useful to investors with shorter time horizons. Shorter term investors are less worried about long term returns and may view the higher volatility as a trading opportunity.

Bonds are another matter. Most Australians use international bonds for income and capital stability. Yet their ability to fulfil these functions can be undermined entirely by the Australian dollar. As the exchange rate is usually more volatile than bond prices, left unhedged, currency movements have the potential to wipe out the income generated from global bonds, undermining the character of the asset class.2 By our estimates, changing currency values can account for two-thirds of international bond volatility in any given year.

As such, currency hedging international bonds is the norm for Australian investors—even for longer-term investors. This is also reflected in the ETF market, with every international bond ETF on the ASX using currency hedging.

Gold’s role within a portfolio is different to shares and bonds. Gold, for its part, is usually used for three reasons: diversification, flights to safety and trading. Answering whether currency hedging is appropriate for gold requires investigating what its implications are for each of these roles. We turn to each below.

Use Case #1 – Diversification

The primary use of gold in a portfolio is diversification. The natural thing to think may be that unhedged gold – which, to reiterate, trades in US dollars – is the better diversifier. Australians are heavily invested in the Aussie dollar – before portfolio construction begins – as their salaries and residential property are in Aussie dollars. And most Australian portfolios exhibit a “home bias” towards Australian equities anyway, as Australian shares are tax advantaged thanks to franking credits.3 Buying gold in US dollars is therefore the natural choice for diversification.

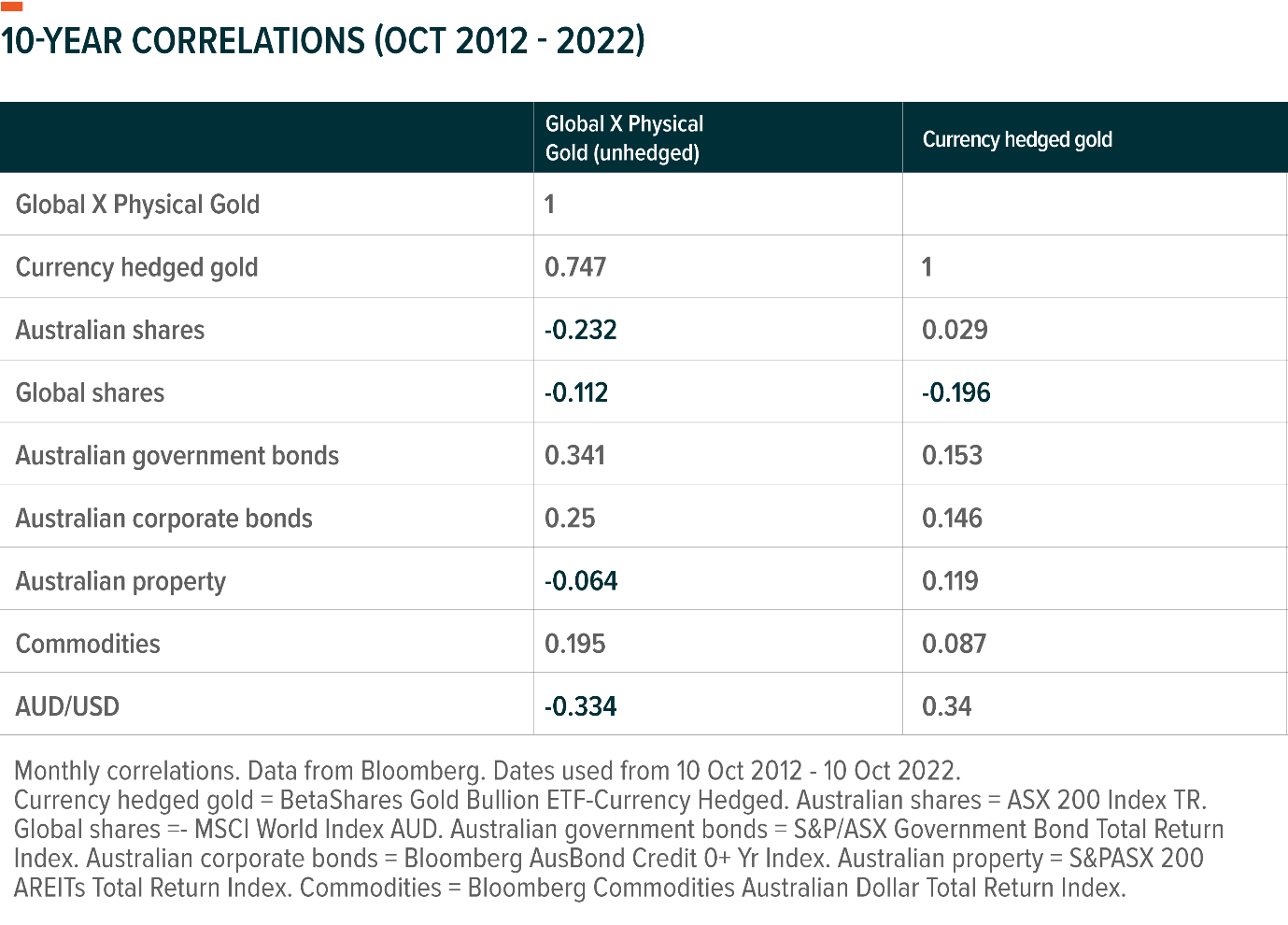

The data broadly supports this line of thought. Diversification is usually measured by correlations. Looking at the 10-year monthly correlations between gold and other asset classes considered important to Australian investors (see table below, noting that a correlation of 1 implies no diversification, and a correlation of -1 implies perfect diversification), we can see that unhedged gold has lower correlations to local risk assets (Australian shares and property). While hedged gold is less correlated with risk-off assets, like bonds. The correlation with global shares has been very similar. On this basis, we’d expect an Australian investor with more Australian shares and property in their portfolio to derive more diversification from unhedged gold, in keeping with the natural view.

What these correlations mean for portfolios can be tested using simulations, which allow us to measure the impact that adding hedged and unhedged gold has on Australian portfolios. We would expect the better diversifier to produce a portfolio that is better performing in the majority of months—with outperformance being most notable during down markets. And expect the better diversified portfolio to have better risk characteristics, as measured by conventional measures such as drawdowns, volatility and Sharpe ratio. (The Sharpe ratio measures how much risk a portfolio takes for any given percentage of return it generates. The higher the Sharpe ratio, the better.)

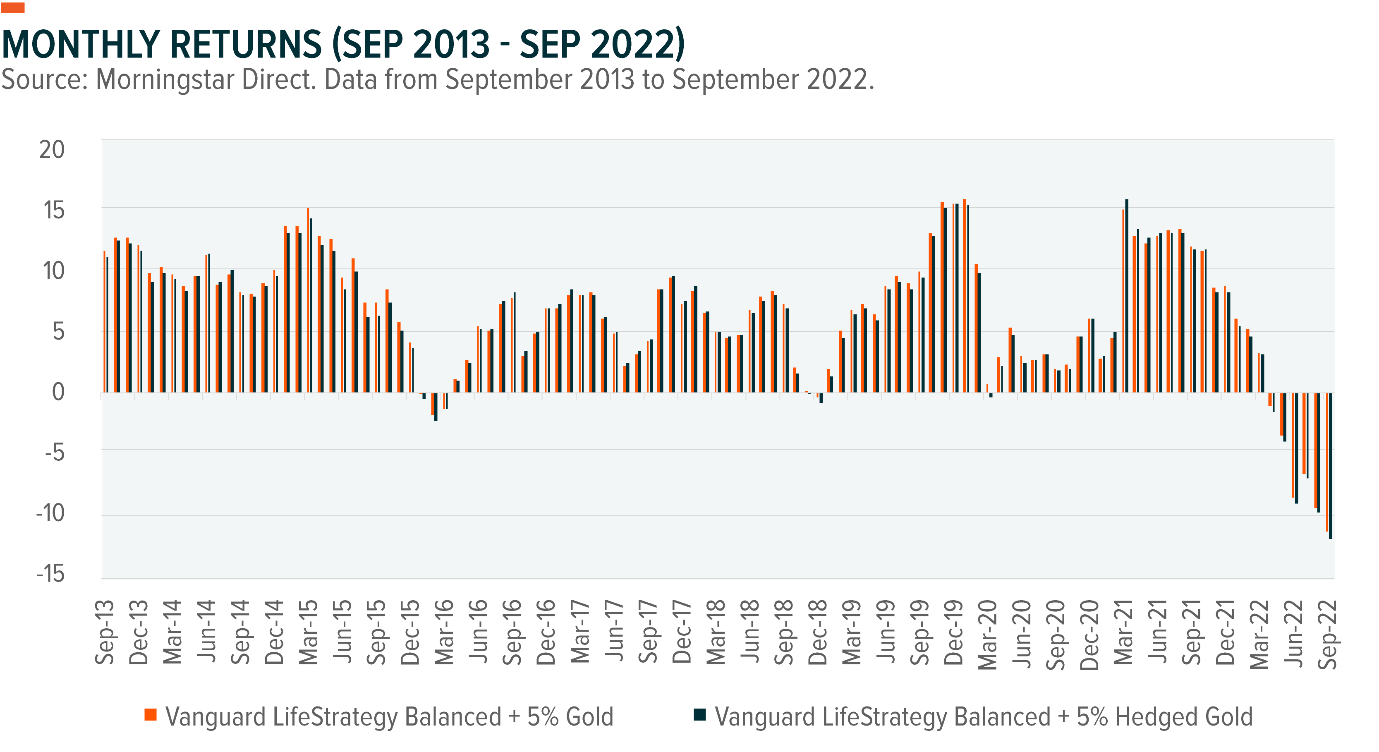

For our simulation, we have chosen the Vanguard LifeStrategy Balanced Fund with a 5% allocation to unhedged and hedged gold. We chose Vanguard’s fund because of its popularity and the fact that its index approach aims to capture the average outcomes experienced by investors. The 5% gold allocation has been chosen as it represents something near a conventional allocation to gold.

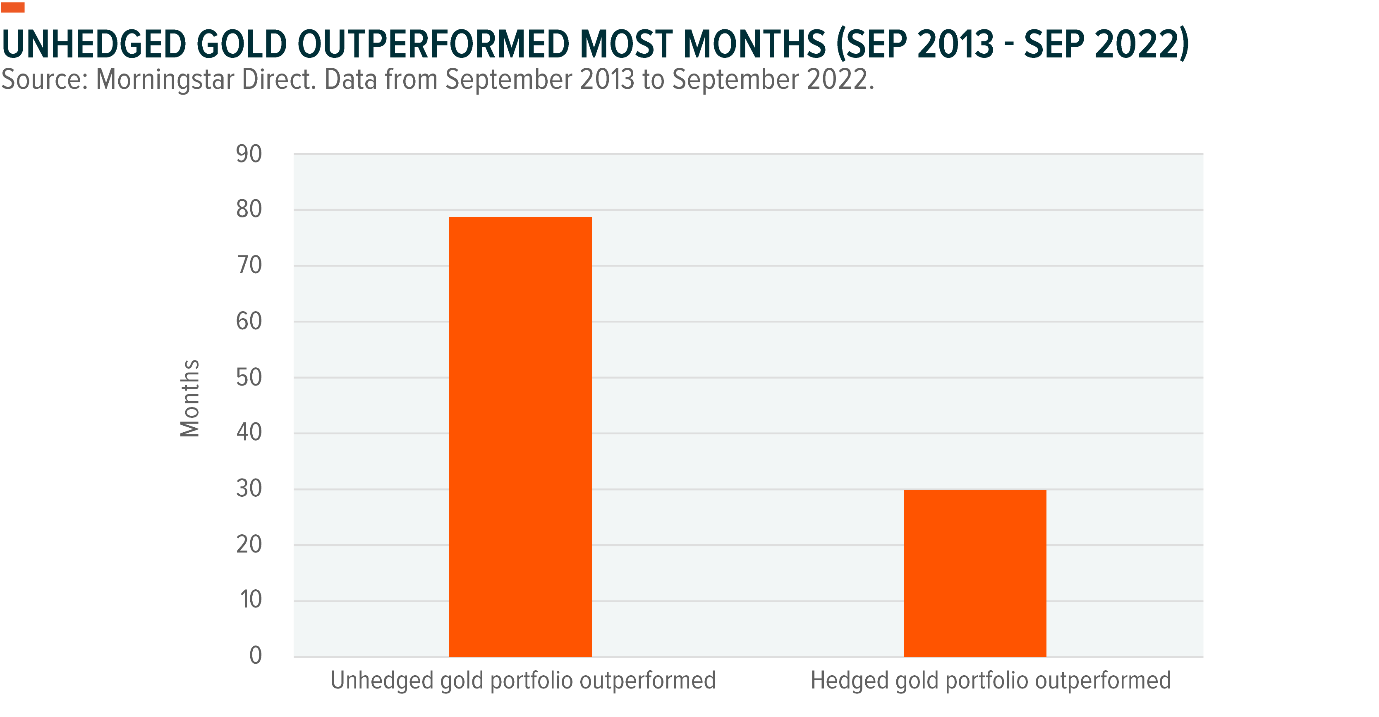

We have used two different timelines. To measure performance, we look at monthly returns over the past 10 years. This allows us to see whether a hedged or unhedged gold portfolio was better performing in any given month. We have used monthly rather than cumulative returns in order to wash out the effects that short term currency movements can have on long-term compounding.

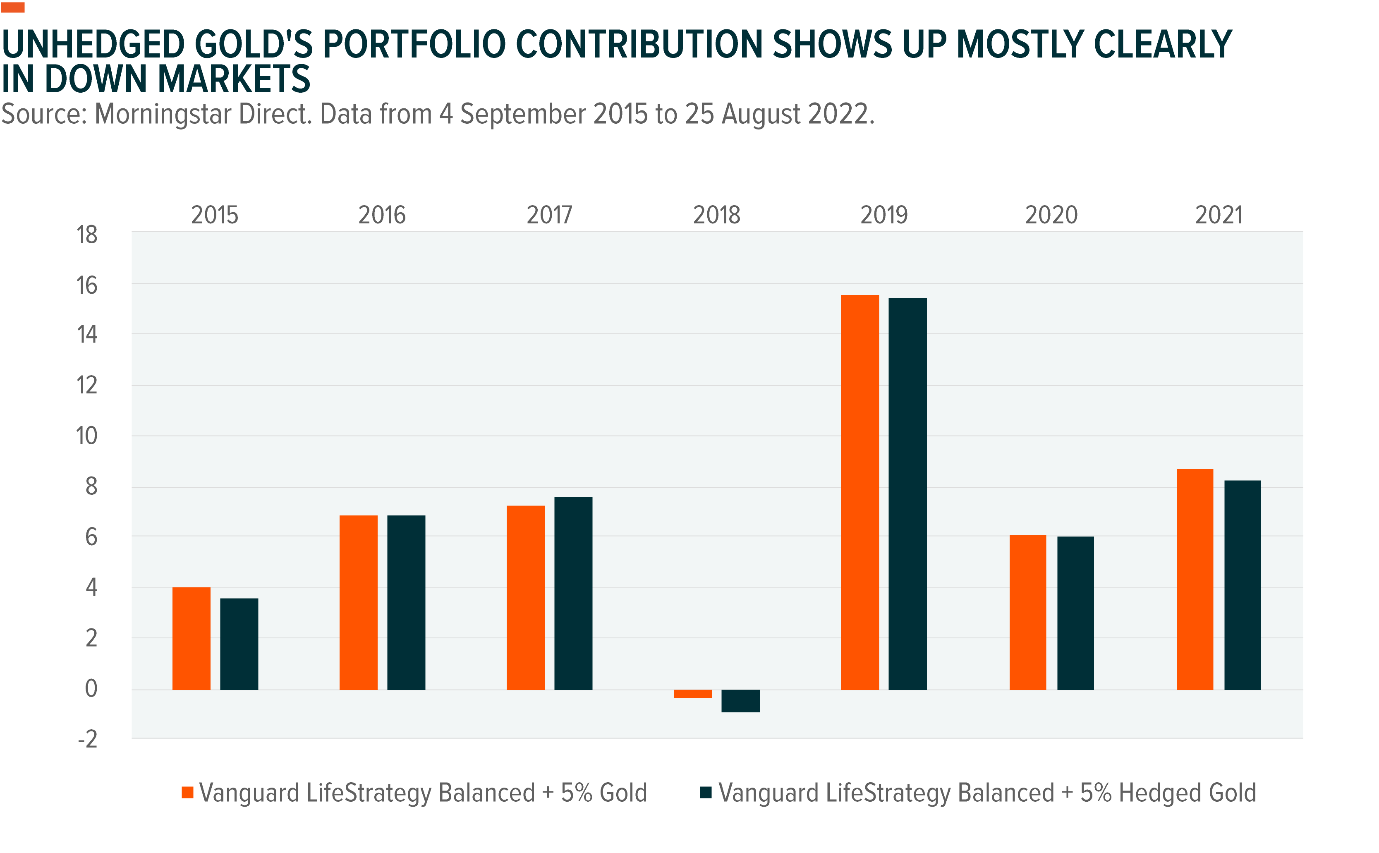

The second timeline looks narrowly at the period between 4 September 2015 to 25 August 2022. This, admittedly short and arbitrary-looking period, was chosen because the Aussie dollar remained rangebound at around US$0.70 throughout this time. This is the only period of its kind in recent times, given that the Australian dollar has fallen from US$1.02 in Oct 2012 to US$0.62 in October 2022. The reason for choosing a supplementary rangebound period is that it allows us to better isolate the effect that hedging gold has on portfolio risk, as it removes the uplift that the strengthening US dollar has provided unhedged gold investors.

The results show that the unhedged gold portfolio has been better performing in most months. The outperformance was strongest during drawdowns, such as during the December 2018 correction and the Covid-19 panic in March 2020. These lower drawdowns owe to the tendency of the US dollar to rise during crises. We discuss this in more detail in the section below (Use case #2 – flights to safety).

Looking at the curated timeline of 4 September 2015 to 25 August 2022, we can see that even when the Aussie dollar trades sideways an unhedged gold portfolio can reduce risk. This shows up in the lower drawdowns, lower standard deviation, and higher Sharpe ratio. These results strongly suggest that unhedged gold provides better diversification.

Use Case #2 – Flights to Safety

Gold is often said to be a safe haven asset. During crises, gold often outperforms. Inflows into global gold ETPs often rise when markets melt down. This raises the question of whether currency hedging supports flight to safety trades.

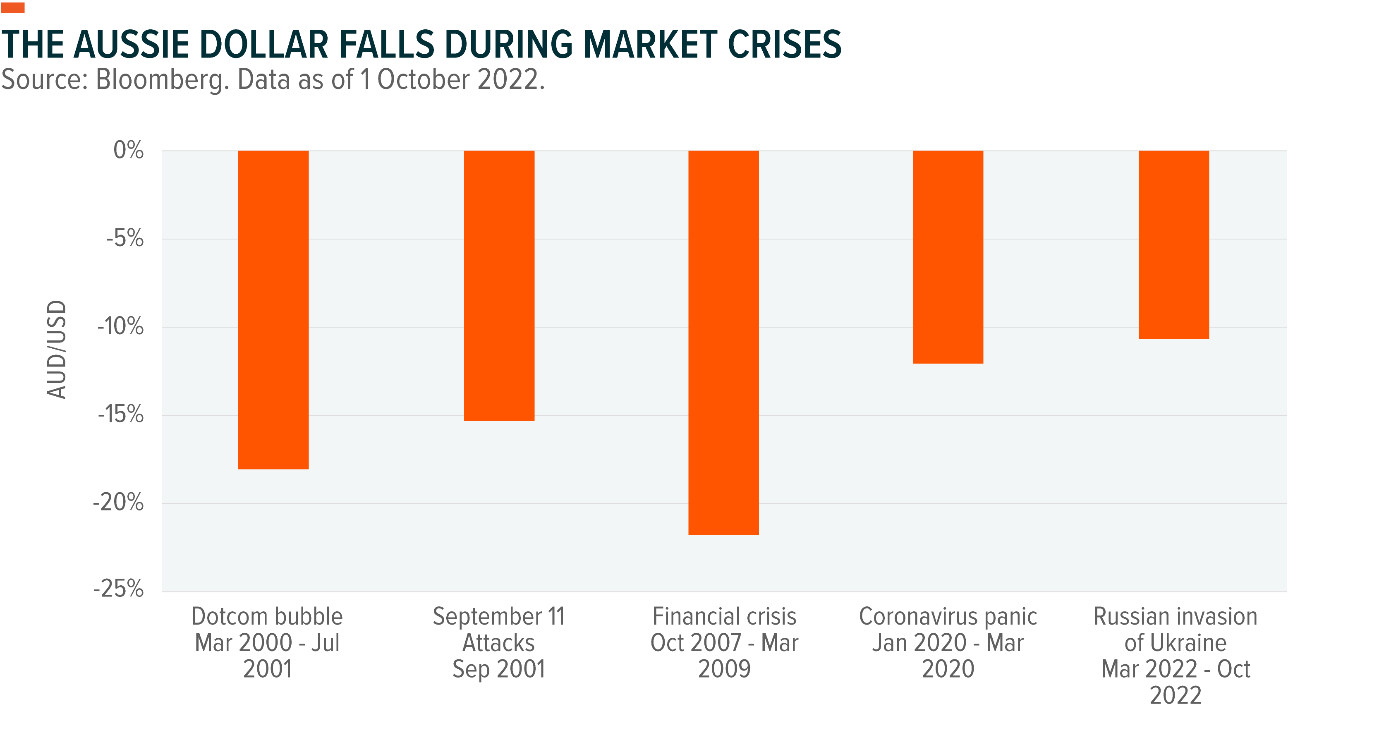

Investigating this requires looking at crises past. In our view, there have been five such moments this century: the dotcom bubble bursting; 9/11; the global financial crisis; the onset of Covid-19; and the Russian invasion of Ukraine. In each case, the Aussie dollar fell significantly against the US dollar, leaving no ambiguity in the results.

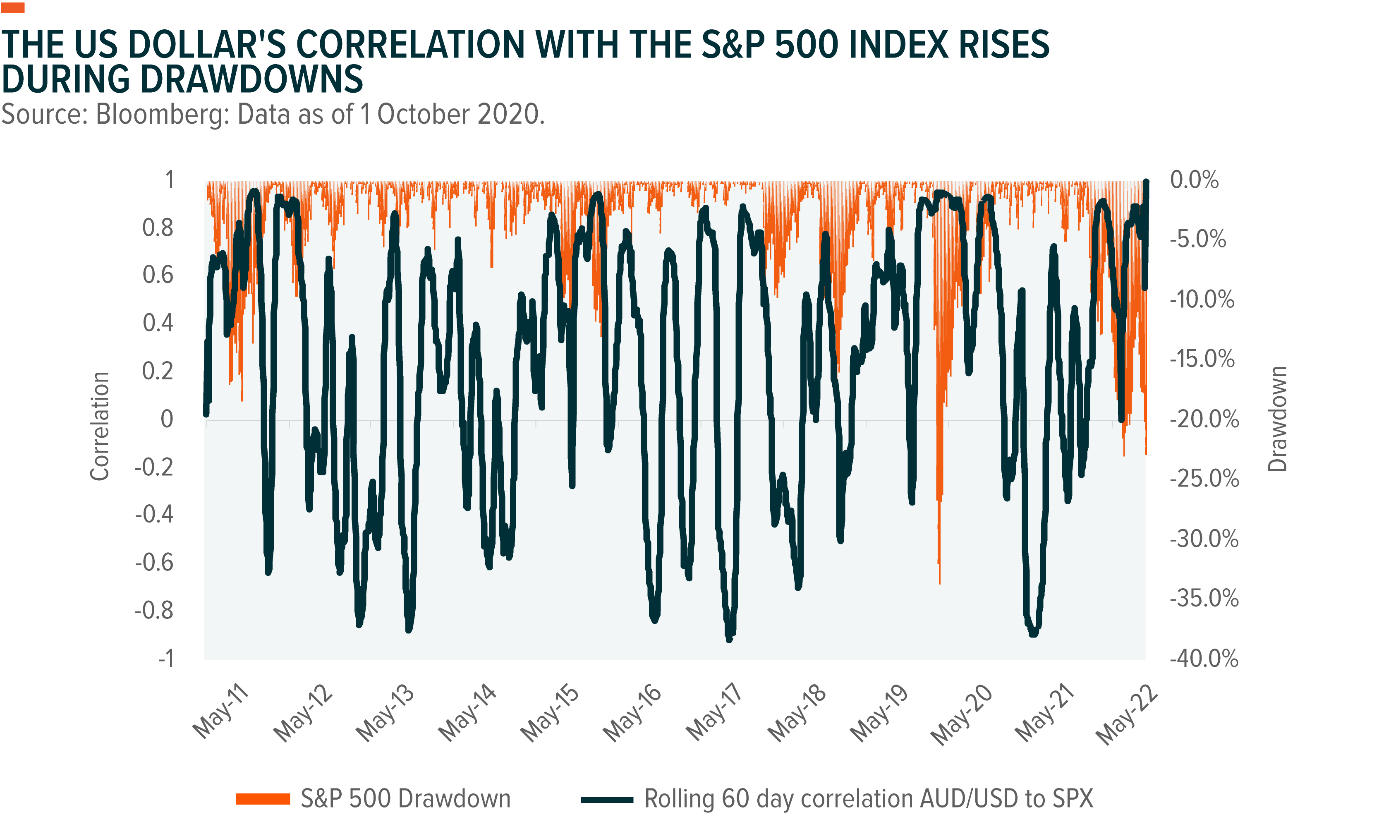

Looking at the same thing in another light, when the S&P 500 falls the Aussie dollar tends to fall too. This is reflected in the graph below, which shows that the Australian dollar and the S&P 500 index (SPX) tend to move in the same direction (a rolling 60-day correlation close to 1) at times when the S&P 500 falls (large drawdowns).

The Australian dollar’s behaviour in this regard was encapsulated by the Reserve Bank of Australia, which writes: “movements in the Australian dollar exchange rate have broadly followed those observed in global equity markets… Typically, the Australian dollar appreciates when prices in global equity markets increase, and depreciates when prices in equity markets decline.”4

This all suggests that currency hedging gold would not have helped investors during flights to safety, due to the tendency of the Aussie dollar to weaken. As the US dollar has acted like a vanilla put option – rising when markets fall – unhedged gold has had a second line of defence.

What is more, the Aussie dollar is likely to continue behaving this way. Why? Because during share market corrections financial institutions – especially fund managers, and the superannuation giants – become forced sellers of the Australian dollar to maintain their hedging ratios.5 And as financial institutions’ currency trading volumes dwarf those of the ‘real economy’ over short periods, they set prices due to order book effects.

Use Case #3 – Trading

A final consideration for currency hedged gold is what’s most appropriate for short term trading. In our experience, most Australians use gold strategically. However, some do trade it tactically, nonetheless.

It should be noted at the outset that investors wanting to trade currencies outright have better options available than hedged or unhedged gold. And stressed that this use case is different to use cases #1 and #2 in that it is less about how gold and exchange rates interact, and instead more about expressing a view on another asset class (currencies).

There is a vast academic literature on currency trading and forecasting. This literature finds currency movements admit very little predictability, except where they are centrally controlled—such as in China. Relatedly, it finds that professional currency forecasts are unreliable.

One recent study concluded: “the naïve no change prediction seems to outperform the [professional] survey forecasts,” over shorter periods especially.6 Meaning that guessing that exchange rates will not change beats professional forecasters. Another recent study concludes bluntly that forecasts do “not seem to carry much information about the actual future developments of exchange rates”.7 The unstated corollary of this literature is that speculative currency trading – for gold ETFs or otherwise – could be best avoided.

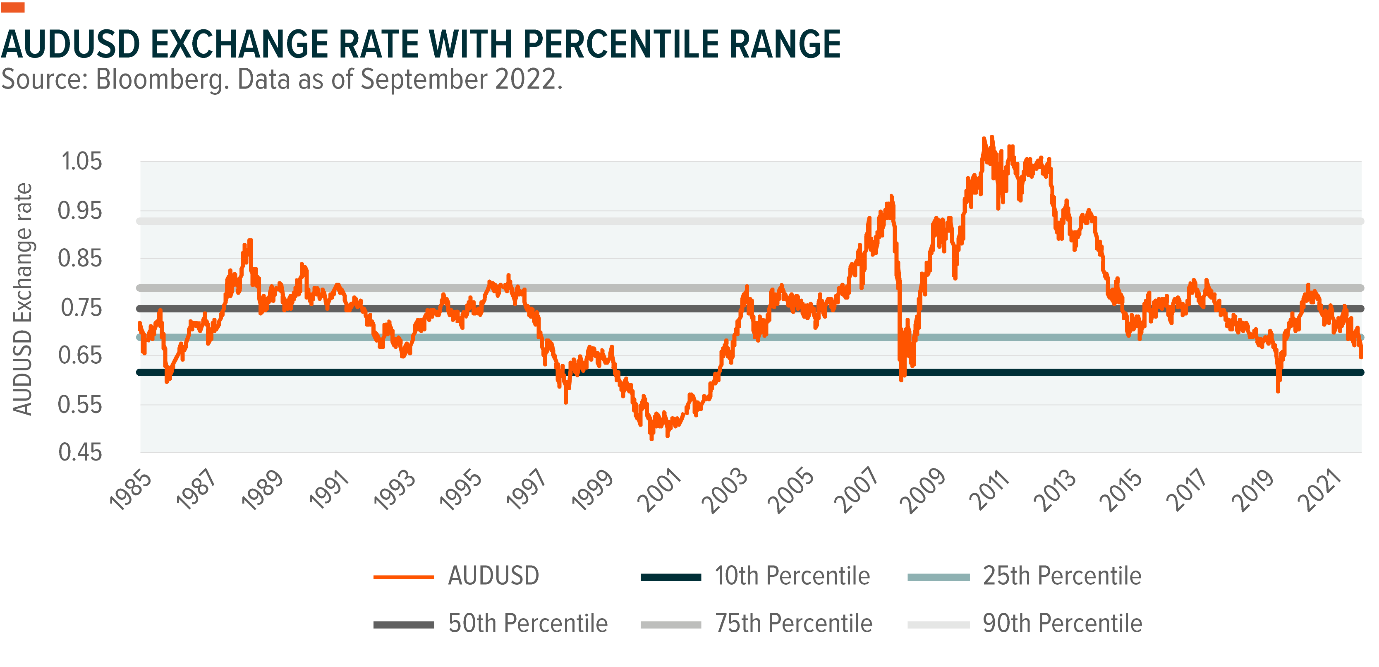

Still, when the Australian dollar is at near-record lows or near-record highs, some may feel that taking a view on future currency movements is appropriate. This may prove especially tempting at times when the Aussie dollar is in its cheapest 10th percentile or most expensive 90th percentile, as occurs when it falls below US$0.61 or above US$0.93. History suggests that the Aussie dollar does not remain above or below these values for long.

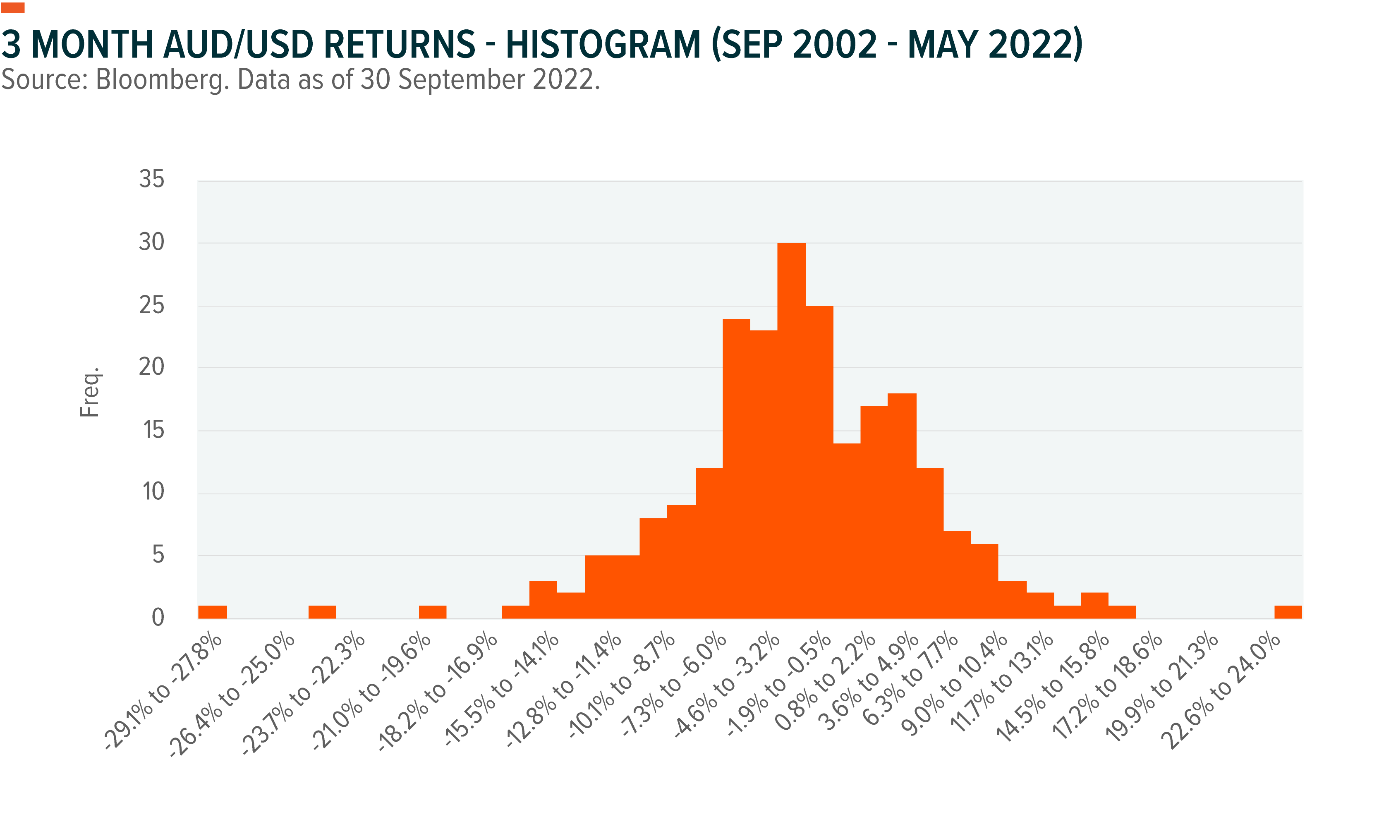

However, timing any currency trade is notoriously difficult—even after the Aussie dollar has moved up or down to an unusual extent. For investors considering “buying the dip” on the Aussie dollar, our analysis shows that if the Aussie dollar falls more than 5% in any given three-month period, then there’s only a 25% chance of it bouncing back over the next three months. While these odds are decent, they aren’t great.

For those considering “selling the rip” we find that when the Aussie dollar rises by 5% in any given three months the chance that it will fall back down is just 7%. These crude statistics show what should be common knowledge about market timing.

The distribution of these three-month movements over the past 20 years is represented in the histogram above. It shows how common exchange rate movements are within any given 1.35% band. As can be seen, exchange rate movements over the past twenty years have been relatively normally distributed. This even distribution reflects the fact that the Aussie dollar has been mean reverting from 2002 – 2022. Although the past is not ipso facto a guide to the future.

Conclusion

Every asset class is used for a specific purpose. For gold, there are three central uses: diversification, flight to safety, and more speculative trading. Our analysis finds that currency hedged gold is more correlated with Australian risk assets like shares and underperforms during crises compared with unhedged gold. This arguably makes it less appropriate for diversification and hedging against crises. And this is reflected in the AUM of ASX-listed gold ETFs, with unhedged gold ETFs being the preferred vehicle. Currency hedged gold still has uses though. Its primary use may be for traders looking to bet on gold at times when the Aussie dollar is near historical lows.

Related Funds

GOLD: For investors wanting to access physical gold exposure or diversify their portfolio, Global X Physical Gold (GOLD) offers a low-cost and secure way to access physical gold via the stock exchange and avoids the need for investors to personally store their own bullion.

Click the fund name above to view the fund’s current holdings. Holdings subject to change. Current and future holdings subject to risk.