The Bitcoin Halving: A Recurring Decimation of Supply

Bitcoin (BTC) is poised for another seismic shift with its next halving event likely in April 2024. This unique mechanism embedded within the Bitcoin protocol periodically slices the current reward for mining new blocks in half. Past halving events have heralded surges in Bitcoin’s price, but peering into the future remains an exercise in uncertainty, especially considering the volatility of digital assets. What is certain is that halving events inject scarcity, and Bitcoin’s predetermined ceiling of 21 million coins is about to be that much closer.

Key Takeaways

- Estimated to occur on April 19th, this halving event is expected to reduce the mining reward from 6.25 BTC to 3.125 BTC.1

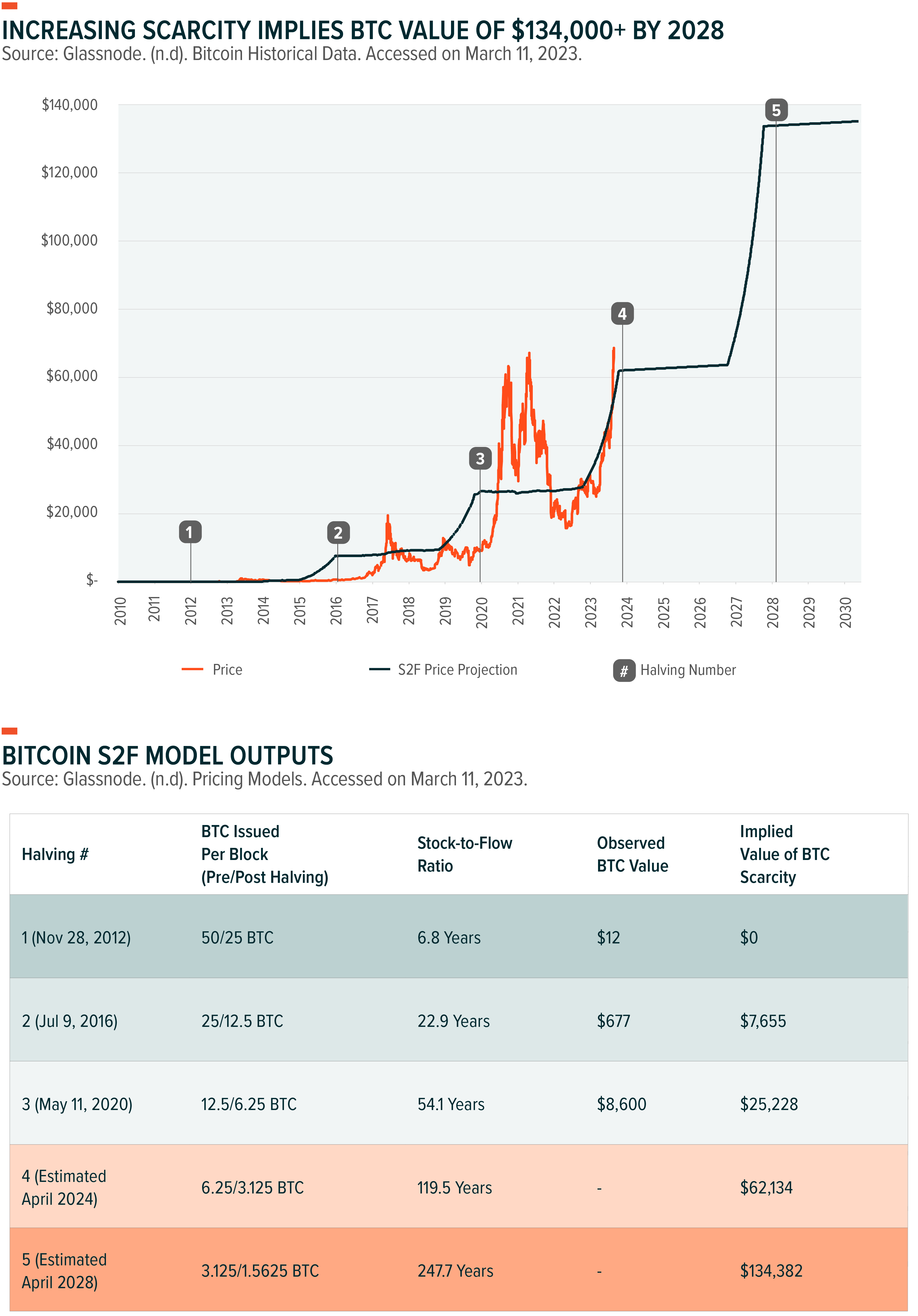

- Historically, there is a correlation between halving events and subsequent increases in BTC’s price. Based on a stock-to-flow model, BTC could increase to $130,000+ by 2028.i

- Economies of scale become more significant with each halving, and this halving could lead to a rise in large-scale mining operations. Energy efficiency is a rising consideration for miners as well, including by way of renewables.

Bitcoin Halving Events Highlight Scarcity Economics

Bitcoin halving is a programmed event within the Bitcoin protocol that cuts the reward for mining new blocks in half. Halving events occur roughly every four years, or after every 210,000 blocks are mined. The halving concept is rooted in scarcity economics. By limiting the total number of bitcoins in circulation, the halving events are designed to make bitcoin more scarce over time, potentially driving up its price due to increased demand.

The April 2024 halving will be Bitcoin’s fourth since its inception in 2009.2

- 1st halving: November 28, 2012, reduced the reward from 50 BTC to 25 BTC.

- 2nd halving: July 9, 2016, reduced the reward from 25 BTC to 12.5 BTC.

- 3rd halving: May 11, 2020, reduced the reward from 12.5 BTC to 6.25 BTC.

- 4th halving: Estimated April 19, 2024, and expected to reduce the reward from 6.25 BTC to 3.125 BTC.

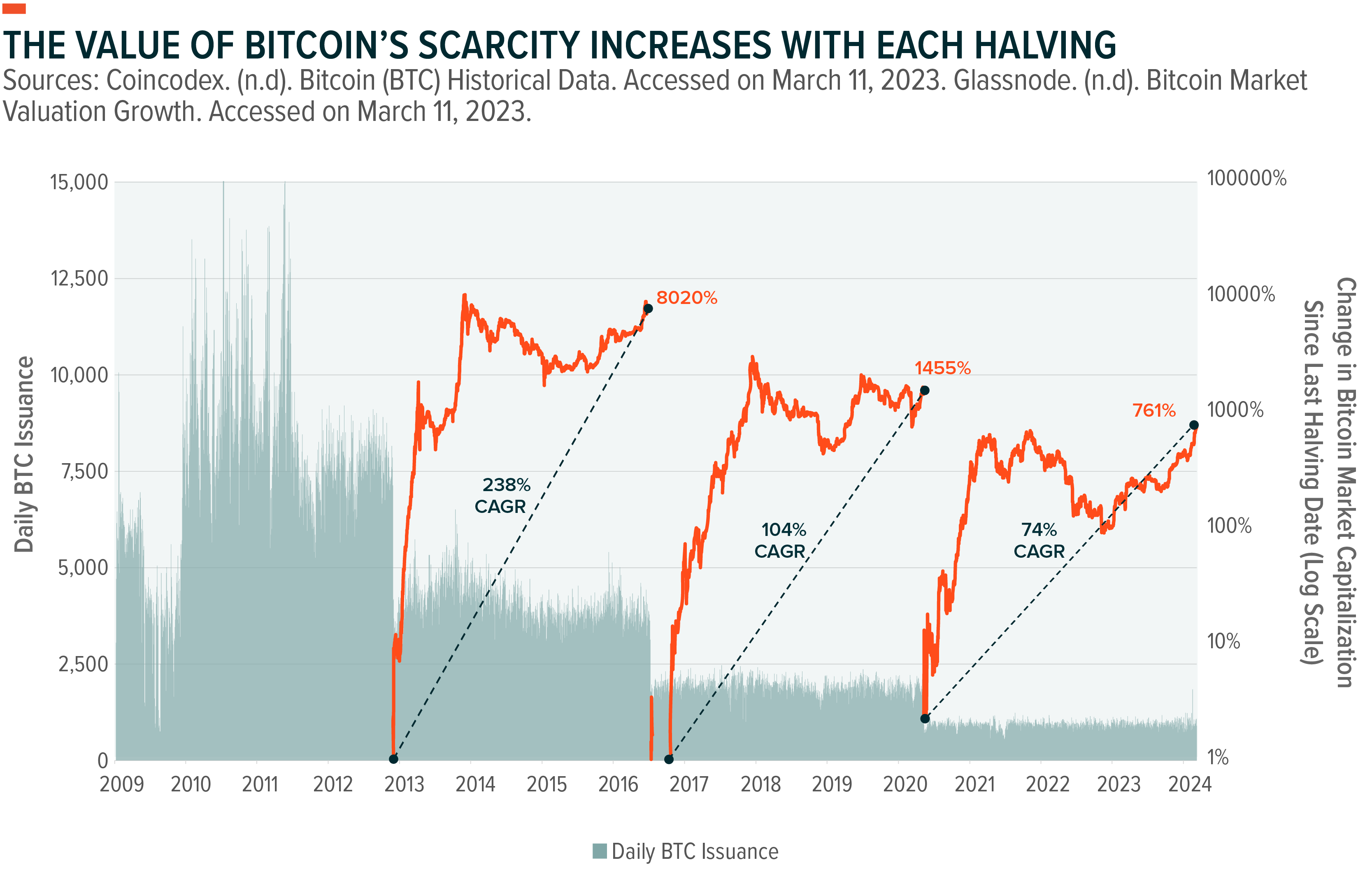

BTC’s Value Has a Positive Correlation with Halving Events

Following the 2012 halving, Bitcoin’s value, measured by market capitalisation, rose by over 8,000%.3 Similarly, Bitcoin’s value rose by over 1,400% following the 2016 halving and by over 700% after 2020’s.4

While not perfect, one method of valuing Bitcoin is the stock-to-flow (S2F) model, originally applied to commodities like gold. The S2F model posits a relationship between an asset’s scarcity and its value. It calculates a ratio by dividing the existing stock (total amount of the asset in circulation) by the annual flow (new units produced each year). A higher ratio signifies greater scarcity, which, according to the model, should correspond to a higher price.

The S2F model has shown some historical correlation with Bitcoin’s price movements. Increasing scarcity implies that the value of BTC could rise from approximately $70,000 currently to $130,000+ by 2028.

Bitcoin Miners to Contend with New Economies of Scale

Miners are the individuals or businesses that use specialised computers to solve complex mathematical puzzles to verify Bitcoin transactions and add new blocks to the blockchain. When the block reward is cut in half, miners will receive less Bitcoin for their work.

The halving could lead to the rise of large-scale mining operations, as economies of scale become even more important. Post-halving, large Bitcoin mining companies may have opportunities to absorb smaller, less-efficient miners. The larger the operation, the more likely they are to have the computational power to remain profitable, even with the lower block reward.

In addition, the halving incentivises miners to prioritise operational efficiency. Upgrading to the latest application-specific integrated circuits (ASICs) offers increased processing power while consuming less energy. Optimising mining rigs to minimise electricity usage further enhances profitability. Increasingly, renewable energy sources like solar and geothermal power may be attractive solutions for miners to mitigate the impact of fluctuating energy costs.

Conclusion: BTC Scarcity Rising

Bitcoin’s issuance rate is set to be cut by another 50%. This scarcity feature of bitcoin not only adds to its intrigue, but historically it has a positive effect on its price. Though the timing of these halving events is predictable, the market only tends to find a new equilibrium market cap after the event occurs. That equilibrium bears watching, with Bitcoin being a bellwether for the digital assets market.

Related Funds

EBTC: The Global X 21Shares Bitcoin ETF (Exchange Code: EBTC) invests in physical Bitcoin to provide exposure to the price of Bitcoin in Australian dollars.

i. Projection by Global X ETFs US.

Forecasts are not guaranteed and undue reliance should not be placed on them. This information is based on views held by Global X as at 27/03/2024. Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

Brokerage commissions will reduce returns.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalised investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.