When a new product launches, sometimes it takes a while to gain some traction with only a minority tending to be the early adopters. For example, when the first home microwave was introduced in the late 1960’s, sales were limited to only tens of thousands of units. It was only a decade later after cost improvements that led to a surge of purchases amongst households.1 However, sometimes the opposite occurs, and a new product sees instant success. For example, when the first smartphone (the iPhone) got launched in 2007, over 122 million smartphone units were sold that year, in what has been one of the most revolutionary technologies of the twenty first century.2

Bitcoin ETFs have emerged as a similar transformative vehicle, demonstrating a symbiotic connection between decentralised finance (cryptocurrency) and traditional finance (like a pooled investment fund). Bitcoin ETFs enable investors to purchase the digital asset through their regular share trading broker, bypassing the need to engage a crypto exchange or funds that hold bitcoin futures.

Although still an infant at the tender age of three months old, spot Bitcoin ETFs in the US have attracted mass amounts of money and are soaring in popularity.

Key Takeaways

- US spot bitcoin ETFs have experienced remarkable growth attracting tens of billions of dollars within three months of launching.

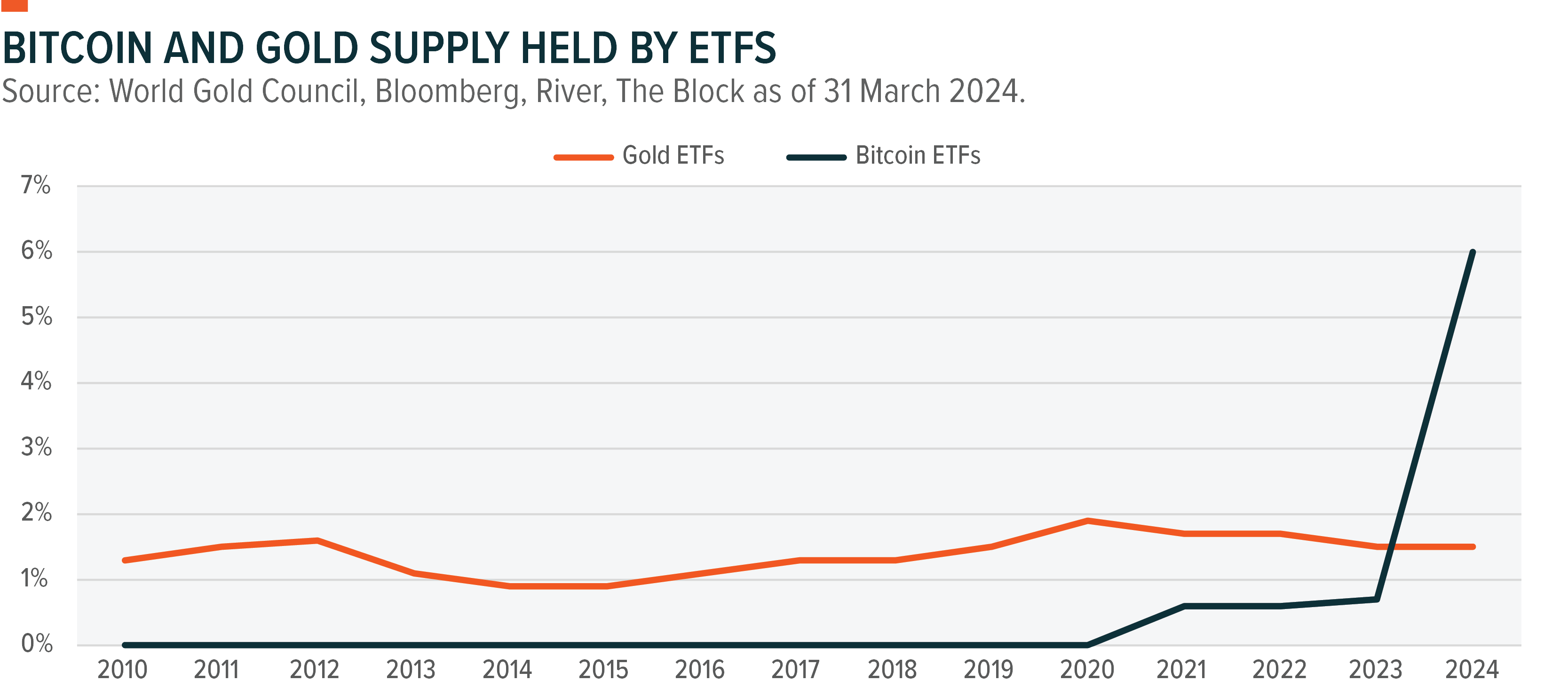

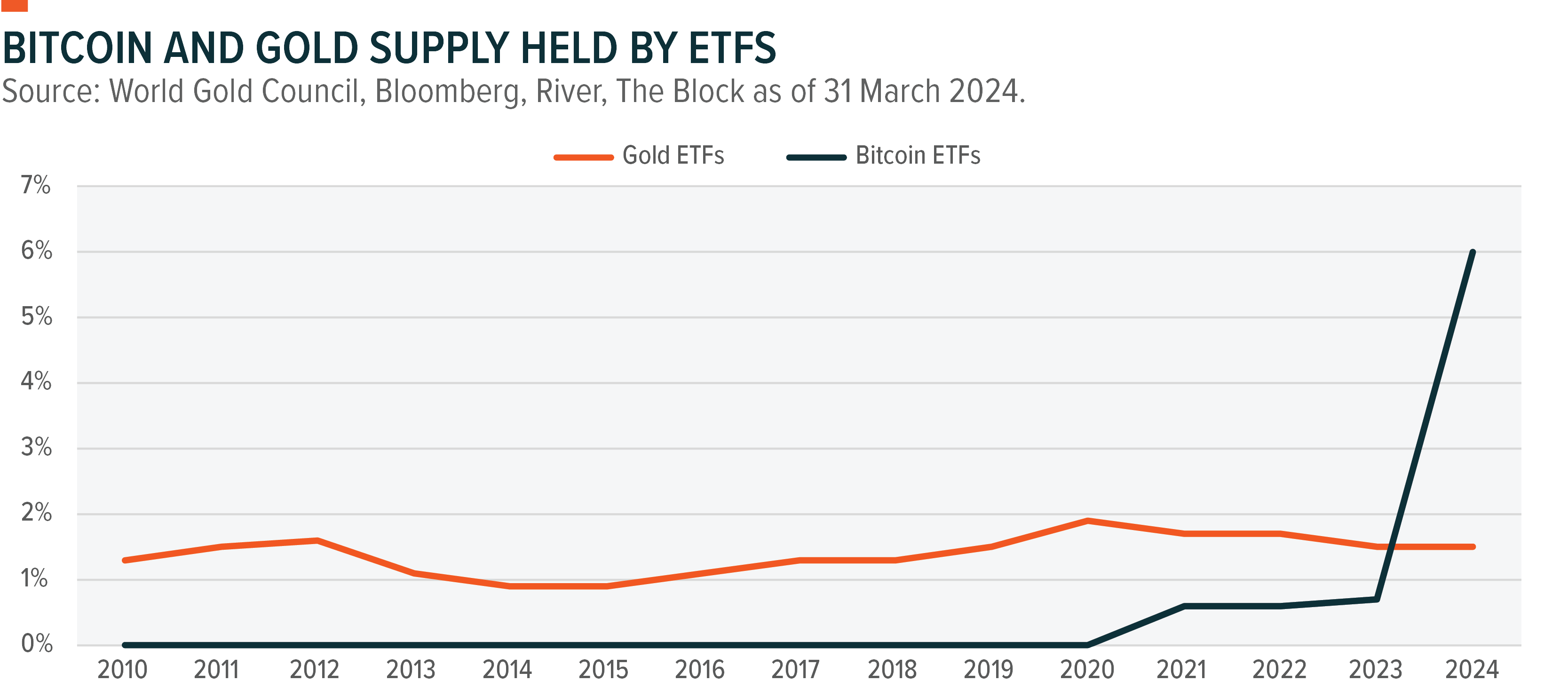

- Bitcoin ETFs now hold nearly 6% of the worldwide bitcoin supply, potentially influencing underlying demand, surpassing the 2% of global gold supply held by gold ETFs.

- The demand for bitcoin is expected to persist, driven by the upcoming bitcoin halving event and the increasing allocation by large money managers.

- Cryptocurrencies and digital assets like bitcoin can be volatile and are considered on the higher end of the risk spectrum.

- Australian investors can invest in the only spot bitcoin ETF listed in Australia (as of April 2024) via the Global X 21Shares Bitcoin ETF (EBTC).

US Spot Bitcoin ETFs Shine

Following the decision by the US Securities and Exchange Commission (SEC) to approve 10 spot bitcoin ETFs in January, the market’s reaction has been swift with billions of dollars pouring into these ETFs at an impressive speed.

There is no denying that this was a smashing success for the ETF industry, with US spot Bitcoin ETFs now worth over US$57 billion.3 The iShares Bitcoin ETF (IBIT) was the fastest ETF in history to hit the US$10 billion mark, breaking the record in under two months which was previously held by the SPDR Gold Shares (GLD) which took over two years to reach this feat.4

While outflows have been pronounced for the Grayscale Bitcoin Trust (GBTC) due to investors moving to lower fee ETFs, and investors/arbitrageurs taking profit from the ETF conversion, flows into the broader category have been impressive. So much so, that the market is curious how ETFs can move the price of the cryptocurrency market given over US$26 billion has moved into these funds (excluding GBTC) so far this year. Since the launch of the spot bitcoin ETFs in the US, bitcoin is up over 50% to reach all-time highs at US$70,845.5

Do Bitcoin ETFs Impact the Price?

The short answer is Yes. Given bitcoin ETFs buy underlying bitcoin, it will add to the source of demand which naturally raises prices. For example, IBIT holds over 250,000 bitcoins, and collectively all spot bitcoin ETFs now hold close to 6% of the worldwide supply of bitcoin.6 Comparatively gold ETFs only hold about 2% of the world’s gold supply.7

However, it is not just the demand from ETFs driving up the price of bitcoin to record highs. The strong inflows is colliding with the looming reduction in bitcoin’s supply growth (known as the ‘halving’) and a more “risk-on” sentiment following the potential easing of interest rates from global central banks like the Federal Reserve.

While some may be worried about the potential impact on price from ETFs, the structure also plays an important role in being a market participant. Daily ETF purchases (i.e. creations) have regularly been around 10x that of the total amount of bitcoin produced by miners daily.8

Large money managers have initiated allocations to Bitcoin through ETFs as well. For instance, Fidelity allocated 1-3% of their model portfolios in a Bitcoin ETF.9 With numerous financial advisers showing interest in integrating spot Bitcoin ETFs for their clients and an impending push from institutions to enter structures such as Bitcoin ETFs, the demand for bitcoin might see a continual uptick.

How do I invest in Bitcoin ETFs in Australia?

Australia was an early adopter in the spot bitcoin market with Global X having the only bitcoin ETF available for Australian investors (as of April 2024) via the Global X 21Shares Bitcoin ETF (EBTC).10 The ETF is fast approaching reaching $100m in assets due to significant flows and price appreciation.11 While Australians can invest in the US spot bitcoin ETFs via brokerage platforms offering international ETFs, investors need to take note of the embedded foreign exchange fees and currency impacts given EBTC tracks Australian Dollar Bitcoin (rather than US Dollar Bitcoin).

Global X also has an ETF offering investors exposure to spot Ethereum via the Global X 21Shares Ethereum ETF (EETH). The potential approval of spot Ethereum ETFs in the US this year could further fuel demand, opening opportunities for increased investment interest.

While Sam Bankman-Fried was just sentenced to 25 years in federal prison after being convicted for a wide range of fraud charges tied to the collapse of FTX in 2022, the ETF wrapper has instilled a sense of confidence for investors.12 The protection mechanism involves employing an institutional-grade custodian with stringent security measures and segregated wallet infrastructure. This setup not only ensures compliance with regulatory obligations but also undergoes independent third-party audits for added assurance. Although cryptocurrency prices can be volatile, the ETF wrapper offers a degree of security.

Conclusion

Spot Bitcoin ETFs have unquestionably achieved significant success as a product, evidenced by their rapid adoption. This development marks an exciting milestone, underscoring the innovation of the ETF and its diverse investment applications. With the floodgates of spot Bitcoin ETFs now open, it's plausible that the new crypto bull market has commenced.