Why a High Dividend Strategy Makes Sense in Australia

Most investors across the world buy shares to achieve capital growth. In the US for example, 64% of investors have ‘investing to grow’ as their top objective, and 65% of investors in EMEA feel similarly.1 But in Australia, dividends reign supreme. According to the ASX, investing for a ‘sustainable income stream’ is a top priority across nearly every age group.2 Why is dividend investing so attractive in Australia? And in this setting, does a dividend-focused strategy make sense?

Key Takeaways

- Australian stocks have some of the highest dividend yields in the world.

- Franking credits mean companies have firm incentives to keep them high.

- High dividend yielding companies on the ASX have grown their dividend pools consistently and are not yield-traps.

- High yielding companies have outperformed non-dividend companies on the ASX over the past five years.

Why is Australia’s Yield So High?

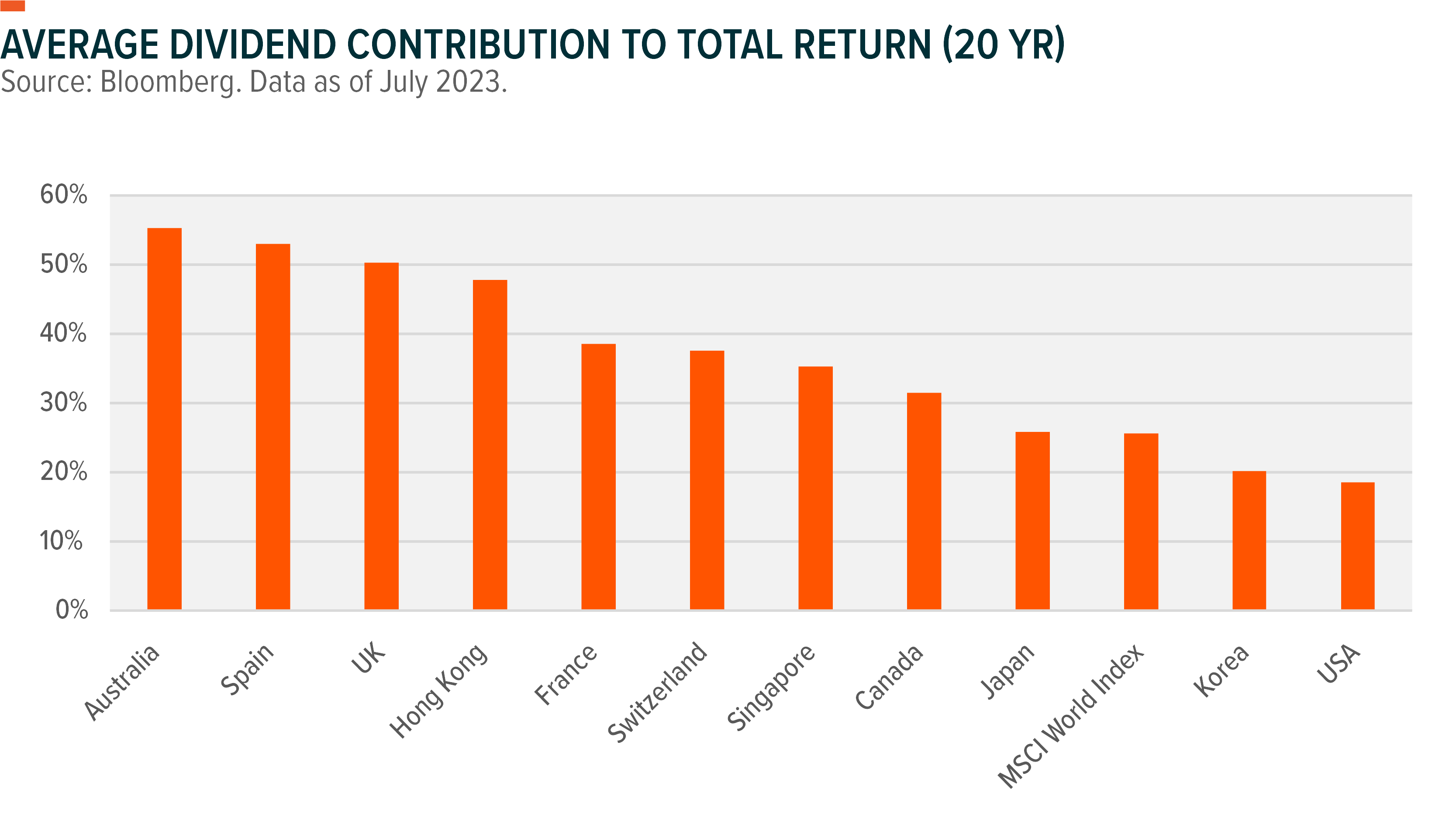

Everyone loves a fat dividend cheque‚ but Australians more than most. Just look at the data and you can see why. Australian companies have paid far higher dividend yields than other markets. And what is more: dividends have also contributed more to their long-term total returns.

Why do Aussies love dividends so much? And why are our yields so high? It’s partly due to franking credits, an Australian tax peculiarity which allows dividends to be excluded from taxable income. But also due to what Alan Kohler, the veteran financial journalist, has called “dividends culture.”3

Aussie companies that try reinvesting dividends are often punished by investors (like Telstra back in 2018). Thus, Australia has very few pure growth companies, like Berkshire, Tesla or Amazon, that continually reinvest earnings into creating cheaper and better products or services. The dividend culture has drawn comment from the Reserve Bank of Australia, which blames it on Australia’s retail-driven equity market.

Does a High Dividend Strategy Make Sense in Australia?

Given that the local share market is already naturally dividend-rich anyway, does a dividend-focused strategy make sense?

There are two good reasons to believe that a high dividend strategy can make sense in Australia: the stable and growing dividend pool of ASX 200’s high dividend stocks – which shows they are not yield traps; and the ability of high dividend companies to withstand a high-rate environment.

Looking Out For Yield Traps

Yield traps are companies that appear to pay out attractive dividend yields, but are either financing their dividends through excessive borrowing, or only appear lucrative due to declining share prices. Neither of these cases are desirable for investors – in fact, yield traps are one of the biggest concerns when targeting a high dividend strategy.

One of the easiest ways to identify a yield trap is to show the total cash distributed at each dividend period, rather than a percentage compared to equity price. Looking at the chart below, we can see the ASX 200’s total dividend pool up against the dividend pool of the S&P/ASX 200 High Dividend index, which seeks to capture the 50 highest dividend paying companies in the ASX 200.

Immediately, one can see that the growth and stability of the two dividend pools are near identical – meaning these high yielding companies are paying stable and growing dividends at a nominal level, and are not high yielding due to depreciating fundamentals. Furthermore, these companies have strong balance sheets and are not funding these dividends through irresponsible borrowing. This can be seen in the chart below, which shows their consistently low debt-to-equity ratios when compared to the ASX 200.

Withstanding Rate Hikes

Yield traps aside, companies paying high dividends tend to do so as they have lower growth prospects and as such, believe the most efficient use of capital is returning it to investors. While many investors may view the lower growth prospects of these companies as a disadvantage, it has advantages in rising rate environments.

All things being equal, companies with large dividends are less impacted when interest rates rise. To illustrate this, we’ve built an example with CSL – a high growth, low dividend company – and Telstra, which is the opposite.4 In both cases, we’ve used Gordon’s growth formula (dividend/ [cost of equity – perpetual growth rate]) to come up with fair value estimates for each company’s shares, and show how they interact with changes in prevailing interest rates (the risk-free rate on the horizontal axis).

As the chart below shows, when interest rates (risk-free rates) rise, both company’s fair value estimates fall. However, CSL’s share price falls more steeply due to the non-linear way that the higher cost of equity (driven up by higher interest rates) erodes its smaller dividend.

As further proof of the above concept, the S&P/ASX 200 High Dividend index has significantly outperformed the generic ASX 200 index over the past few years. Since 2019, the index has returned 12.8% annually, and gained 84% in total return.5 This result despite all the market uncertainty of 2020 and more, perfectly demonstrates the stability of Australia’s top dividend yielding companies.

*Past performance does not guarantee future returns.

In conclusion, all of the above points – the resilience of the Australian dividend pool, the significant contribution of dividends to ASX 200’s performance, and the ability to protect against a high interest rate environment – make a strong case for a dividend-focused strategy in Australia. Investors, especially those aiming for consistent income and portfolio protection, may find a low-cost, high-dividend, index tracking ETF to be a good fit.

Related Funds

ZYAU: The Global X S&P/ASX 200 High Dividend ETF (ASX: ZYAU) seeks to track the S&P/ASX 200 High Dividend index. It invests in 50 high-dividend stocks from the S&P/ASX 200 Index.