Why Opportunity in India Continues to Grow

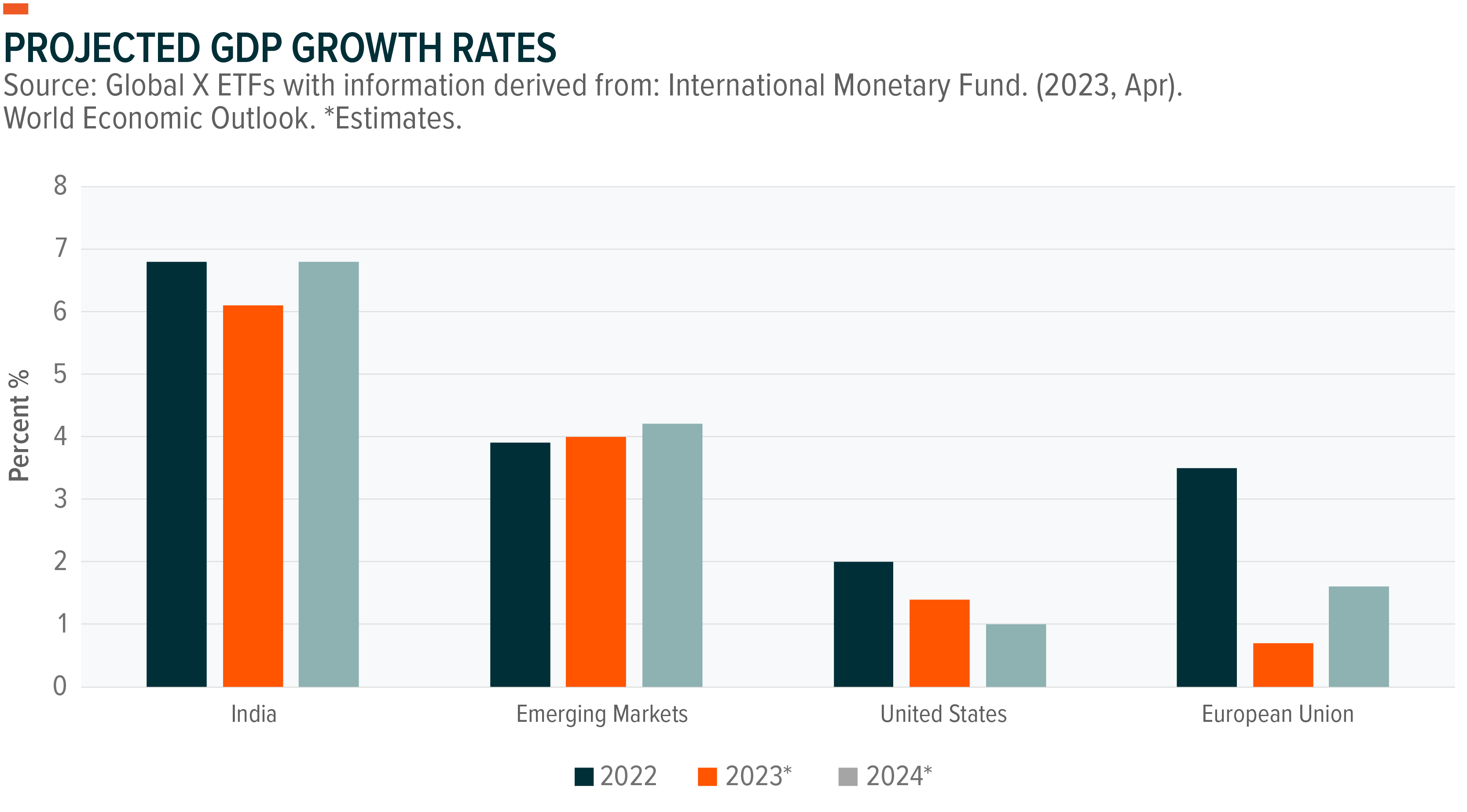

India is one of the world’s largest (by population and gross domestic product) and most dynamic emerging market (EM) economies in the world.1,2 There are numerous potential long-term growth drivers and reasons for optimism, from favourable demographic trends and abundant natural resources to market-friendly political reforms and the nearshoring trend, particularly as the Indian economy is rapidly moving away from asset-heavy, low-return business models towards innovative, well-run, profitable sectors.

Overall, these shifts in India’s social and economic structures can create higher-paying jobs as employees move up the value chain, which can inherently grow the middle class. These entrants often spend their newfound discretionary income on education, healthcare, technology, goods, and services – all of which fall into the latter category of business models. This has the potential to create a self-fulfilling cycle of domestic consumer-driven growth and in turn, provide an attractive opportunity for those looking to invest in international growth markets.

The World’s Largest Emerging Market Continues to Grow

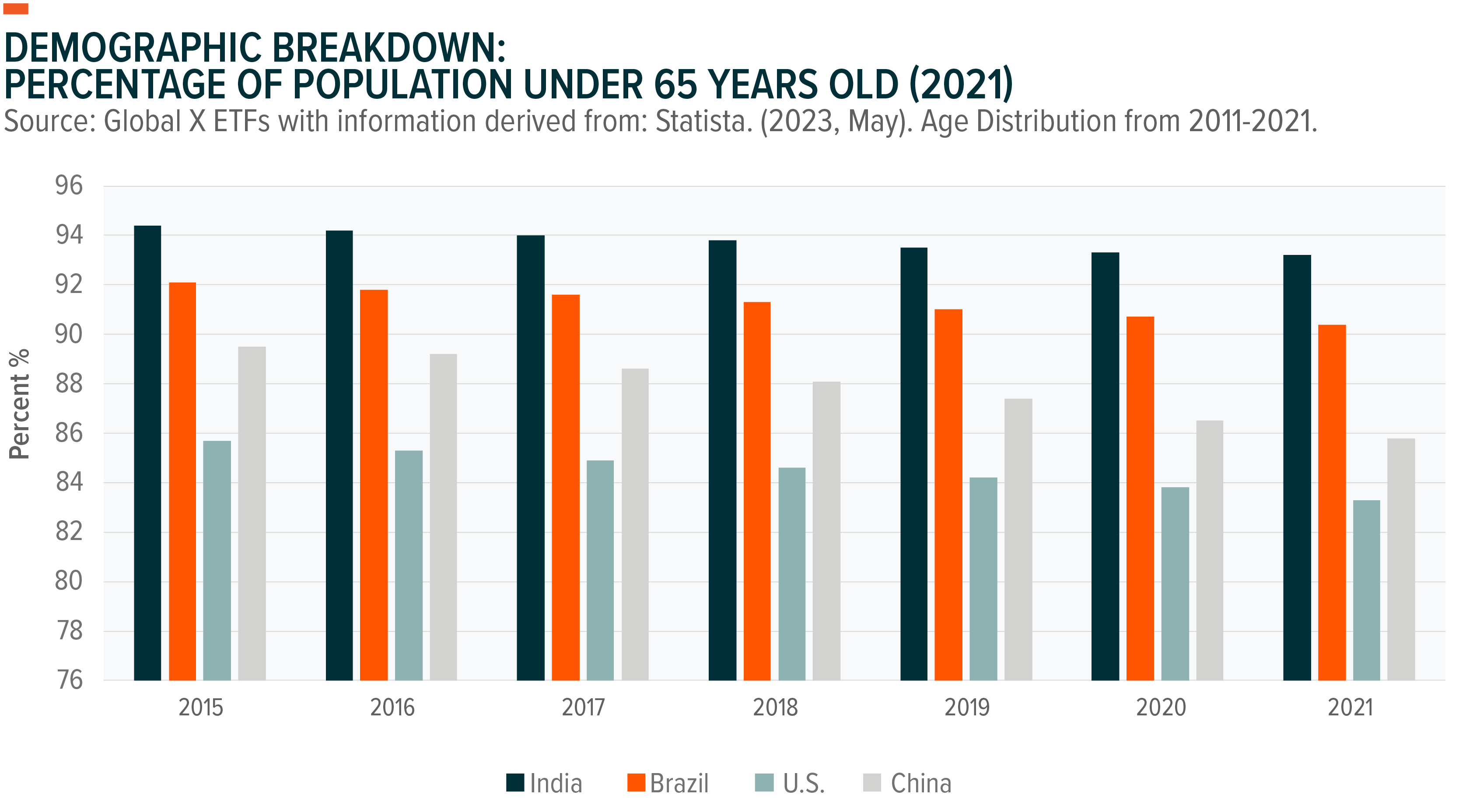

India recently became the world’s most populous country, overtaking China.3 In our view, the country also boasts a sound structural story complemented by government-driven growth and reforms. More than 50% of India’s population is below 25 years old, meaning that India offers a young and growing workforce in a world of shrinking populations.4 In addition, we believe that low per-capita income levels in India could provide a scope for catch-up rates of productivity-driven growth. Other structural highlights include:

- The youth literacy rate is high at roughly 78%.5

- India is home to the third largest group of STEM (science, technology, engineering, and math) graduates in the world.6

- Consumers and businesses have increasing access to credit, a key driver of economic growth. Credit-to-GDP (gross domestic product) levels are still only around 50%, much lower than emerging market peers like China and Vietnam, but could rise to 80% by 2030.7

- The business environment has grown more friendly in recent years. India jumped 79 positions, from 142nd in 2014 to 63rd in 2019, according to the World Bank’s Ease of Doing Business Ranking 2020, the last survey before the rankings were discontinued.8

- India’s labour cost is roughly 40% of China’s.9

- Rising affluence is driving increasing consumption in India, and the nation is expected to have the fastest growing disposable income level in the world, at nearly 10%, between 2022 and 2026.10

Government Backing Boosts Economic Conditions

Importantly, India’s attractive backdrop continues to receive support from the national and state governments with targeted reforms. In our view, the key change in India’s structural story lies within the shift in policy focus towards lifting both capacity and productivity within the economy. Policymakers have taken up a series of reforms that have supported and could continue to support a capital spending cycle, likely leading to sustainable growth.11 These reforms include:

- Demonetization and the creation of a more expansive digital economy;

- Market formalisation;

- Simplification of the tax system through the introduction of a goods and services tax (GST);

- Lower corporate tax rates;

- Production-linked incentive schemes;

- Property rights reform;

- Structural reforms like lower taxes, production-linked incentive schemes (most notably for the IT hardware sector), and positioning India as a potential beneficiary of supply-chain diversification could catalyse and sustain domestic investments.

We expect capital spending investments to pick up ahead of the general election in 2024, which could drive further job growth and, in turn, support domestic demand.

The Nifty Fifty in Focus

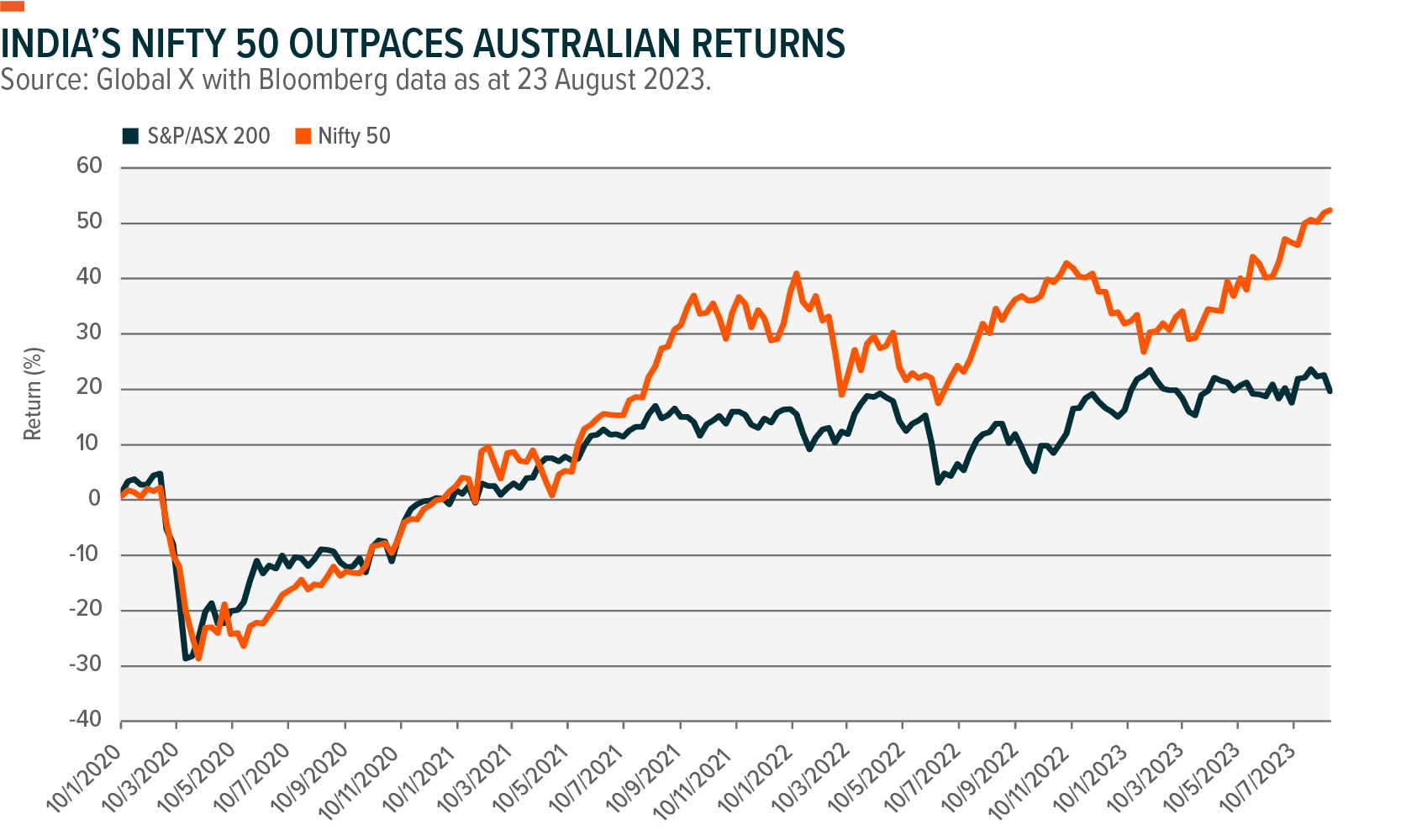

The Nifty 50 is an index of the largest 50 companies listed on India’s National Stock Exchange (NSE). Much like the S&P/ASX 200 generally points towards the health of the Australian market, the Nifty 50 is a key indicator for India. It includes a mix of sectors including financials, information technology, energy and consumer staples. Hence, India’s growth across its economy has translated to strong performance for the Nifty 50 – with its total returns outperforming the S&P/ASX 200 over the past three years as shown in the below chart.

Looking ahead, companies in the Nifty 50 are well-positioned to capitalise on India’s growing population and economy, including several areas where India is playing “catch up” with more developed markets. There are many companies that Australian investors may not have heard of but have a deep impact on global and Indian consumers and have a strong runway for growth. These include Tata Motors who are owners of brands such as Land Rover and Jaguar, Reliance Industries who amongst their many subsidiaries have recently opened up the very first Tiffany’s within India, and Hero Motocorp who are responsible for more than a third of the world’s motorcycle and scooter manufacturing.12,13

Despite now having a larger population than China, India lags China in relation to car sales, domestic air travel, internet users and e-commerce.14 Meanwhile, its services sector is tracking to make up just shy of half the country’s GDP – with IT and business services projected to be worth almost US$20 billion by 2025.15 “Green Growth” is also a focus area for India as it aims to meet ambitious climate-change and renewable energy targets by 2030. In 2021, more than 50% of India’s power capacity came from coal, however, this is forecast to drop to 33% by 2023 as solar power overtakes as the primary source of power.16

Australian investors can gain exposure to India’s growing potential via ETFs. The Global X India Nifty 50 ETF (ASX: NDIA) seeks to provide investment results that correspond generally to the price and yield performance of the NSE Nifty50 Index. Ultimately, it offers Australian investors simple access to an expanding opportunity in the world’s largest emerging market.