ZYAU: Managing Reporting Season Risk

Key Takeaways:

- Australian companies reported more beats than misses in the August reporting season.

- Yet many investors were bearishly positioned, highlighting the risks of direct stock picking during this period.

- Smart beta, which provides something of an active-passive hybrid, may offer a solution.

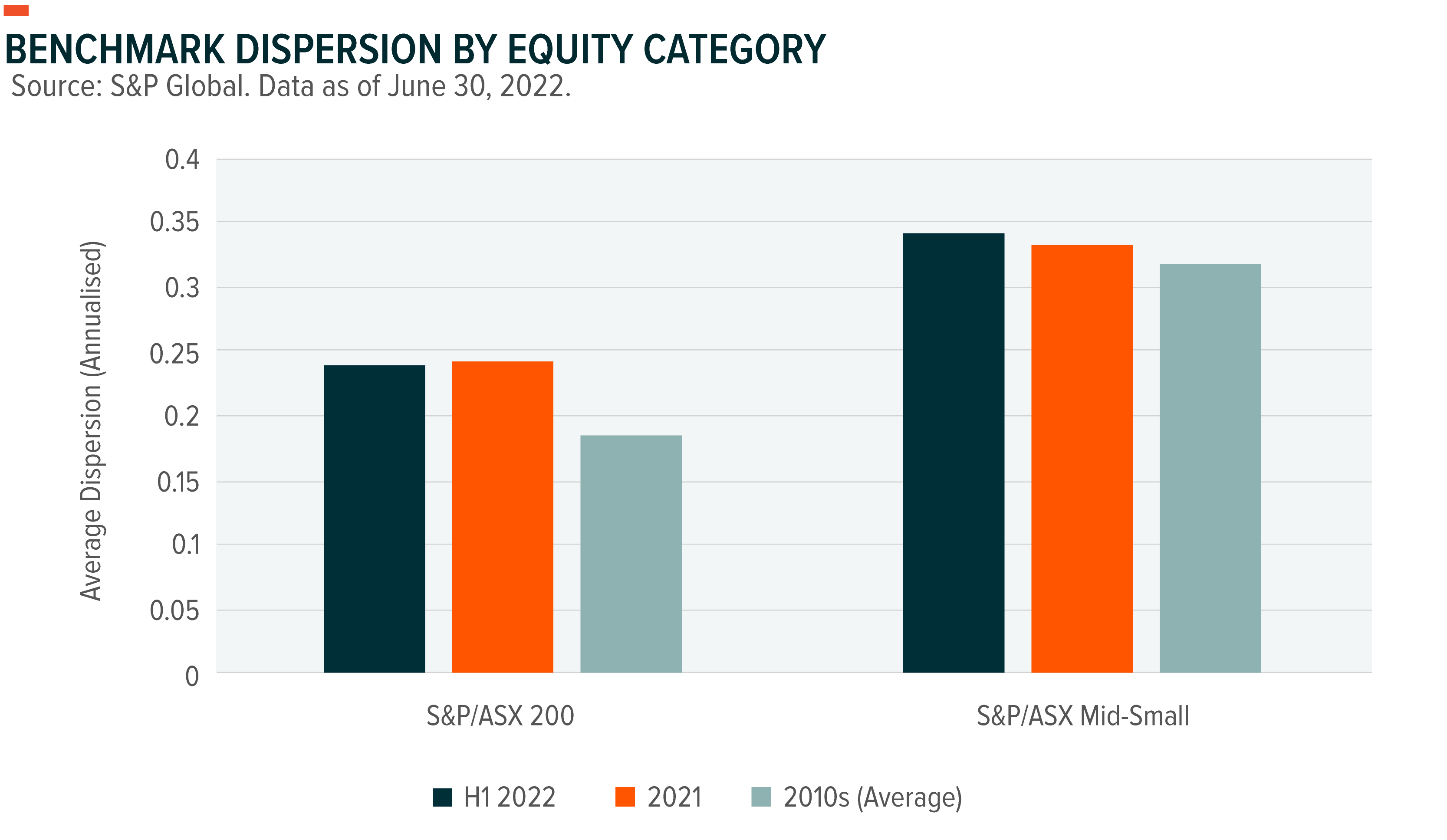

Reporting season is sometimes said to be a feast from heaven for active managers. Dispersions – which measure the difference between the best and worst performing stocks – are usually higher in February and August, when companies report. And dispersions have been especially high this year and last, according to data from S&P Global. Inflation, the war in Ukraine, Covid-19 and rising interest rates have all stoked the flames.

A lot of investors think that when dispersions are high, it is a good time to be an active manager. After all, active managers spend their days studying companies and markets in an effort to gain an edge. When

August 2022 reporting season was something of a case study for this. In this article, we examine what happened.

Reporting Season in H2 2022

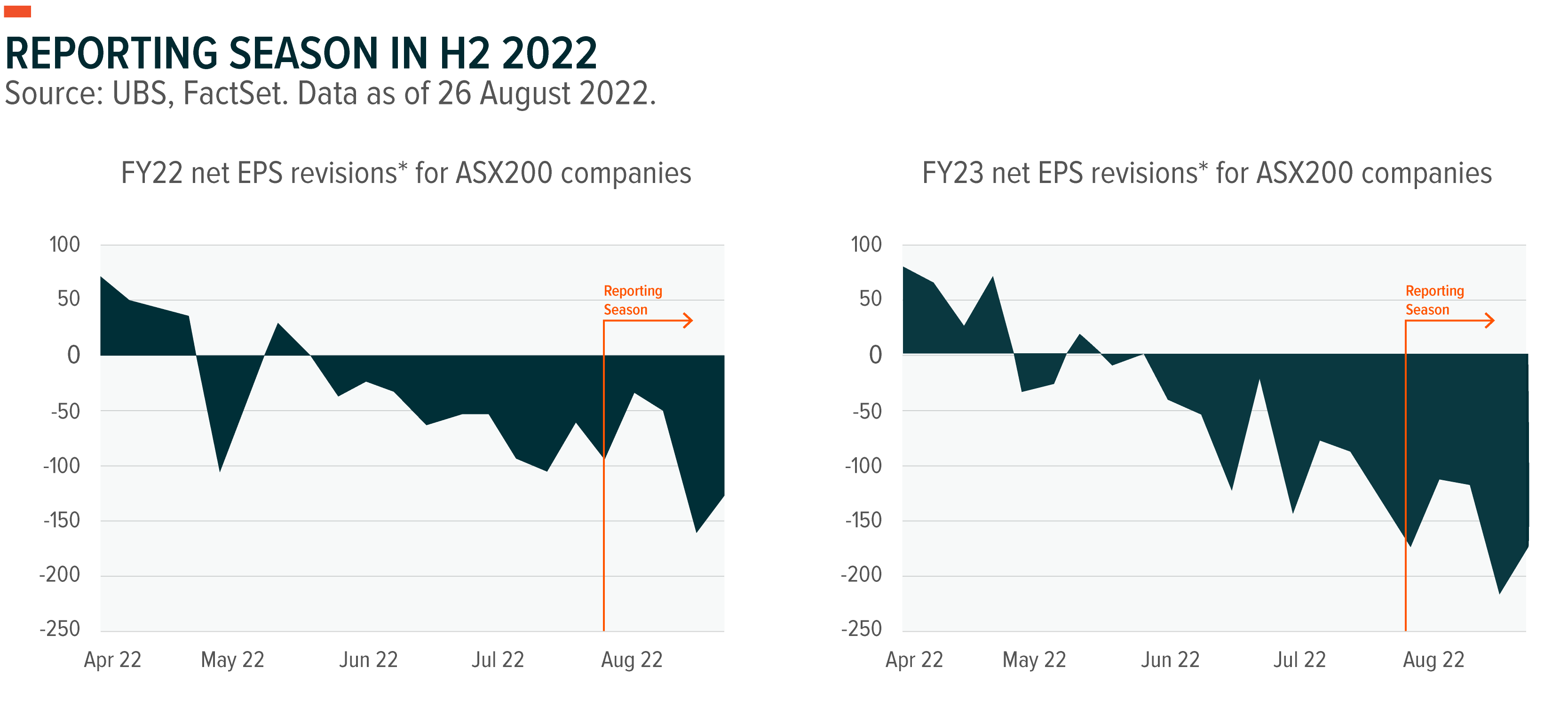

Labour shortages and inflation were major concerns heading into the middle of the year. Reflecting this, headlines were downbeat, and analysts at major investment banks were downgrading their earnings expectations for ASX 200 companies.

For a lot of active fund managers, the big question was whether the winners from Covid-19 lockdowns – such as online shopping companies – would keep their gains as the country re-opened. Some investors thought business would return to how it was pre-pandemic. But many thought the changes the pandemic induced were permanent. The share prices of many online shopping companies – Adore Beauty, Redbubble, Kogan – rose in July as earnings season approached.

Then results came in.

Contrary to expectations, more companies beat their earnings expectations than missed them – and on a ratio of 3:2. Inflation costs were largely being passed on, allowing margins to hold. Labour shortages were less problematic than some had feared. Many fund managers got this wrong.

Perhaps most interestingly, though, the pandemic’s online shopping boom proved transient. Results posted by Adore Beauty, Kogan, Redbubble and other online shops suggest that Australian consumers have gone back to shopping at bricks and mortar stores again like they did before the pandemic. These three companies saw their share prices fall sharply after reporting. Many active fund managers got this wrong too.

Active Funds’ Performance: a Long-term View

It would be unfair to generalise off the back of one bad reporting season. And active fund managers themselves may rightly argue that not all of them made bad bets on online shopping.

But fund managers’ performance has been studied for a long time. And the results suggest that this reporting season may not have been a one off.

Perhaps the most widely followed study of active fund managers performance is the SPIVA scorecard, published and updated by S&P Global every six months. The scorecard compares fund managers performance against an index. For Australian fund managers, the index used is usually the ASX 200.

In the most recent SPIVA scorecard, published in September 2022, it found that 50% of fund managers were beaten by the index in the first half of 2022—meaning it was essentially a coin toss. But taking a longer-term view, it found that over 73% of fund managers were beaten by the index over 5 years. Over 10 years, 77% were beaten. And over 15 years, 83% were beaten.

Smart Beta: a Compromise?

For those unpersuaded by the benefits of active management, but not fully sold on simply buying the ASX 200 either, smart beta may offer something of a middle ground.

Smart beta investing is a kind of hybrid between index investing and active management. Like an active fund manager, smart beta funds study companies’ balance sheets, sort between better and worse performers, and all the rest. But this approach comes packaged in an index—meaning it is cheaper and more transparent than a regular active fund.

Related Funds

ZYAU: For those interested in smart beta investing, the Global X S&P/ASX 200 High Dividend ETF (ASX: ZYAU) provides a solution.

Click the fund name above to view the fund’s current holdings. Holdings are subject to change. Current and future holdings are subject to risk.