How to Use US Bonds in an Australian Portfolio

Bonds have been used in portfolios by advisers since the profession began. They play a vital role in helping investors achieve their goals, especially in retirement.

While bonds can be a core holding in portfolios, the global bond market is vast, often leaving many investors confused about where to start. And as most bonds do not trade on exchange, Australians have fewer ways to buy them.

In Global X’s view, investors are best served buying US dollar bonds. While they have historically been out of reach, bond ETFs are starting to change that.

Key Points

- The US dollar bond market is large and diverse, meaning investors can diversify across issuers, geographies, credit quality, durations, and structures within a single currency.

- Bond ETFs are arguably the most efficient way to directly access US bonds, as they come with smaller spreads and are exchange traded.

- There are three main kinds of US dollar bond: US treasuries, investment grade corporates, and high yield bonds.

Why Invest in Bonds?

Bonds have historically provided lower returns than investment property and shares. Yet bonds play an important role in most portfolios due to the capital stability and income they offer. Income and capital stability are rooted in the legal claims that bond holders have over companies’ cash flows and assets.

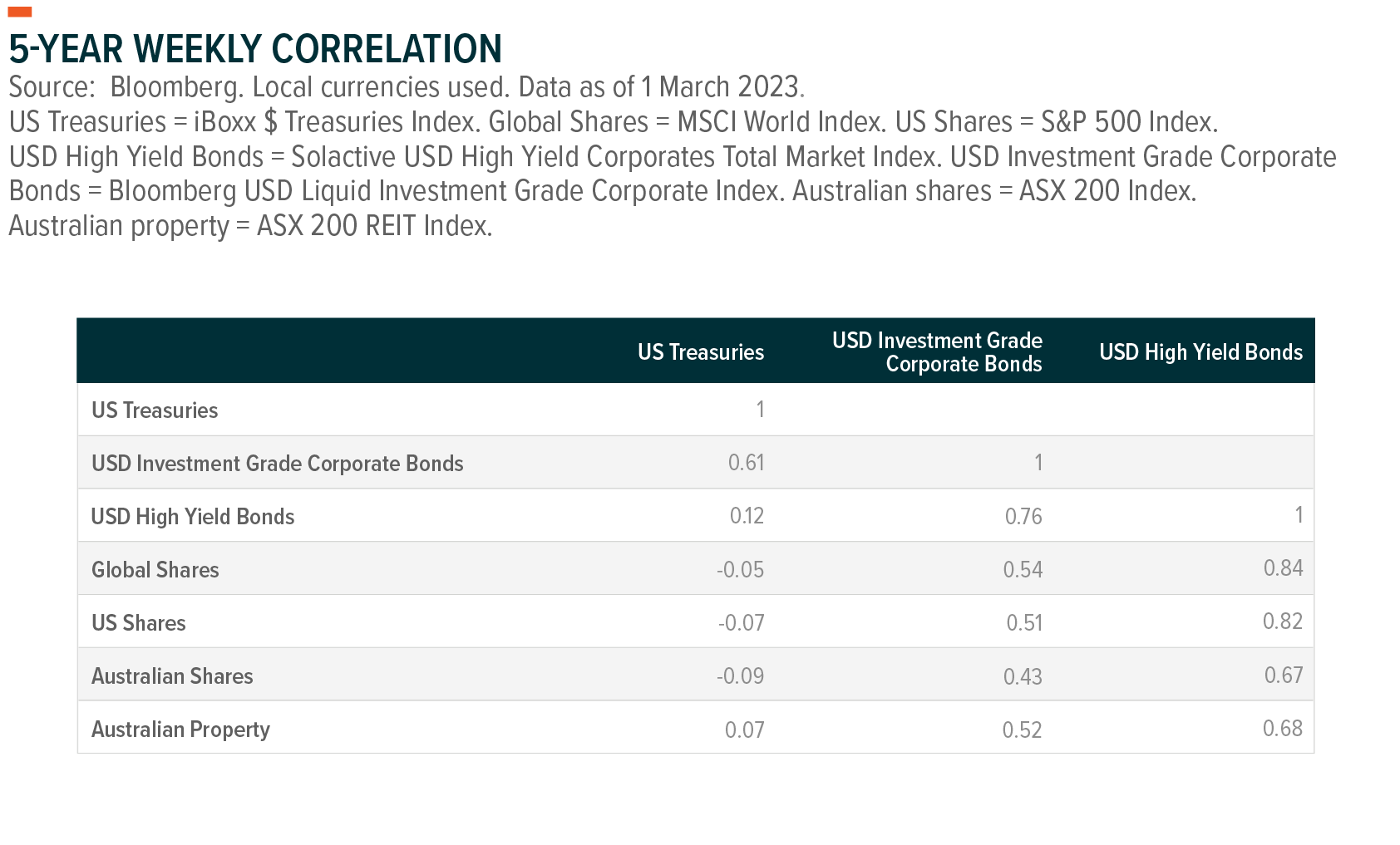

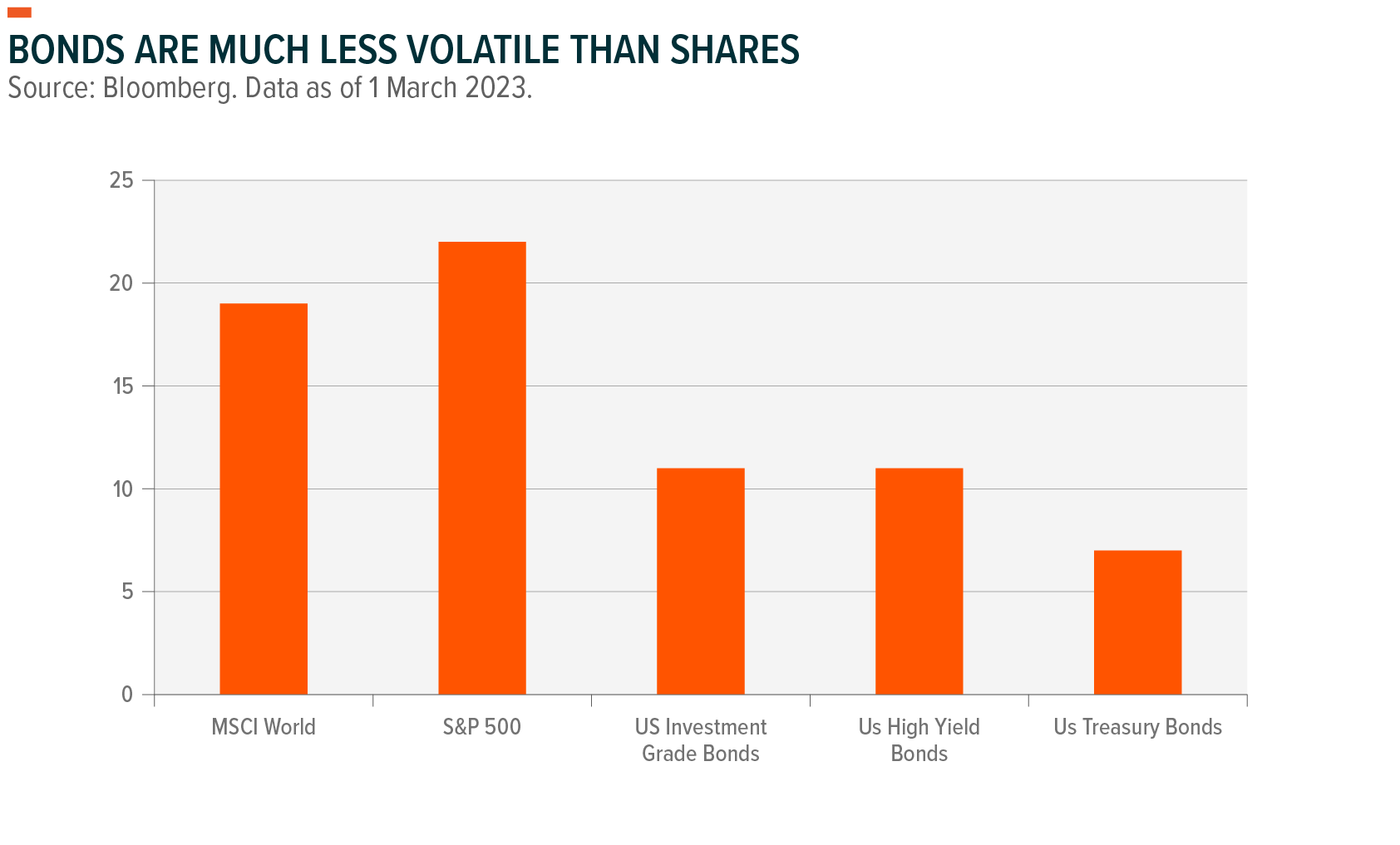

Companies are legally required to pay interest to bond holders before they can give anything to shareholders (i.e. buybacks, dividends). Companies that fail to meet obligations to bond holders must default. These greater legal protections translate directly into lower volatility for investors (i.e. reduced uncertainty and risk) as cash flows and assets are more guaranteed. This is reflected in the table below.

Adding to this is the fact that many bonds globally are either issued (i.e. treasuries) or guaranteed by (i.e. mortgage-backed securities) governments, making them a potentially safer bets than companies’ shares or investment properties.

Why Invest Specifically in US Dollar Bonds?

Bonds are issued in almost every currency. Yet at Global X, we prefer US dollar bonds.

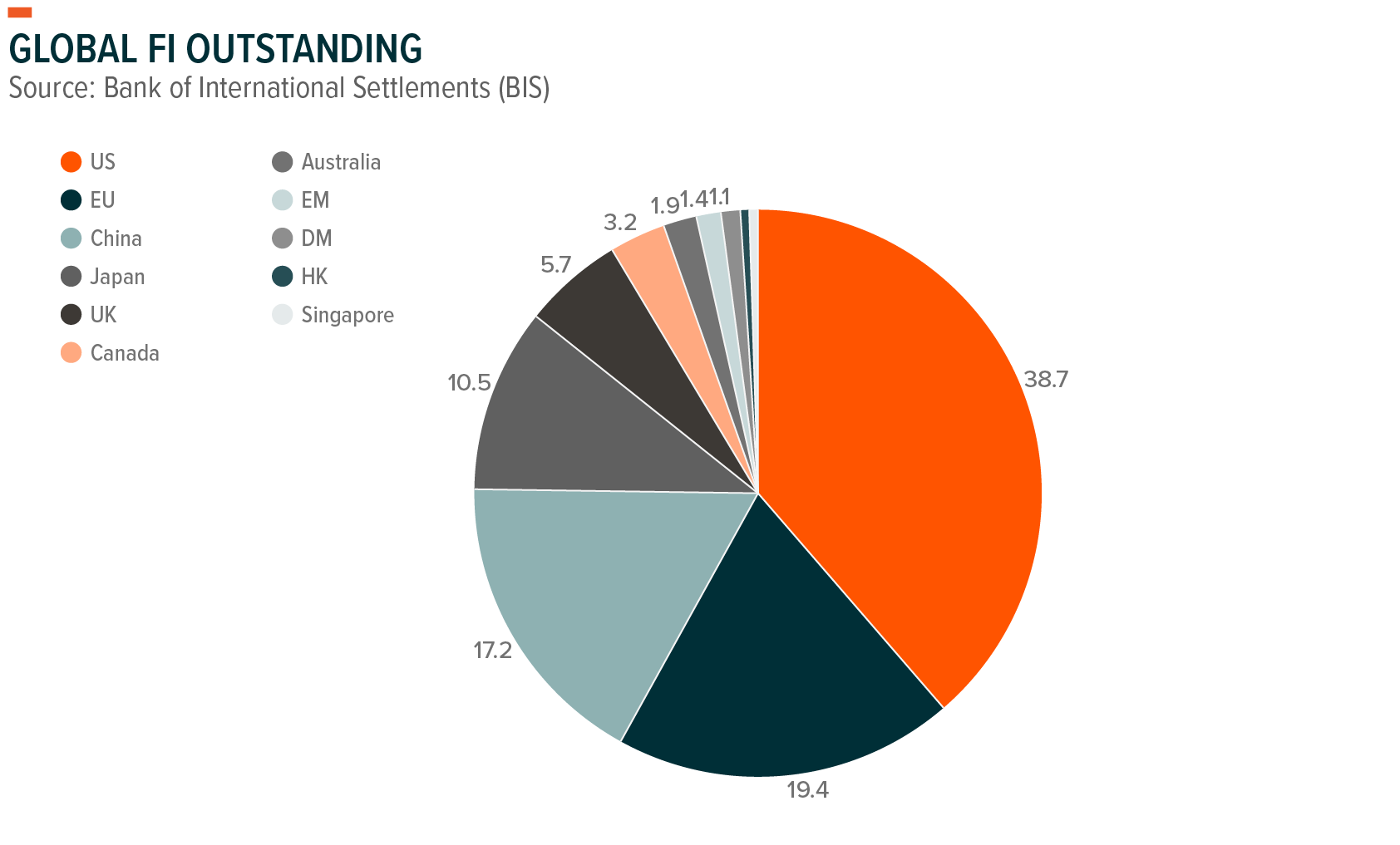

The US dollar is the world’s reserve currency, meaning US dollar income is potentially more useful than other currencies. As a function of its reserve currency status, the US dollar bond market is the largest in the world. According to the Bank of International Settlements, the world’s central bank, there was US$127 trillion worth of global bonds outstanding at the end of 2021. Of this, US bonds made up US$49 trillion, which represents around 41%. The next largest issuer was the EU, which took 18% of the global market. In comparison, Australia only represented 1.9%.1

The sheer size of the US dollar bond market means investors can diversify among issuers, credit qualities, maturities, and structures to a greater extent in US dollars without necessarily needing to use other currencies. US dollar bonds are also more liquid, meaning bond portfolios can be assembled more cheaply and efficiently. This greater liquidity extends to US dollar currency forwards, ensuring ease of currency hedging as well. (Currency hedging international bonds is essential for Australian investors, as doing so prevent exchange rate changes eroding bond yields).

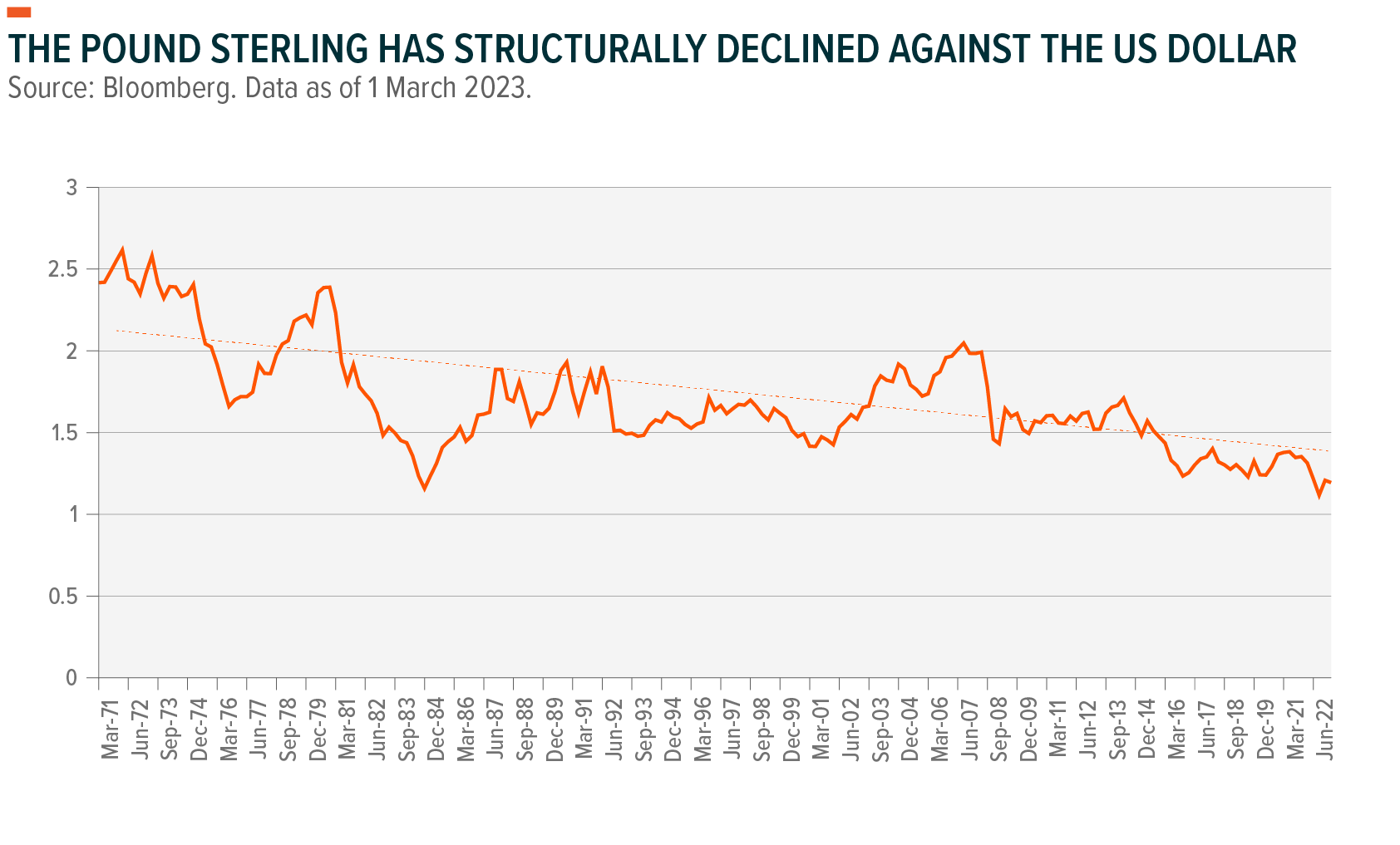

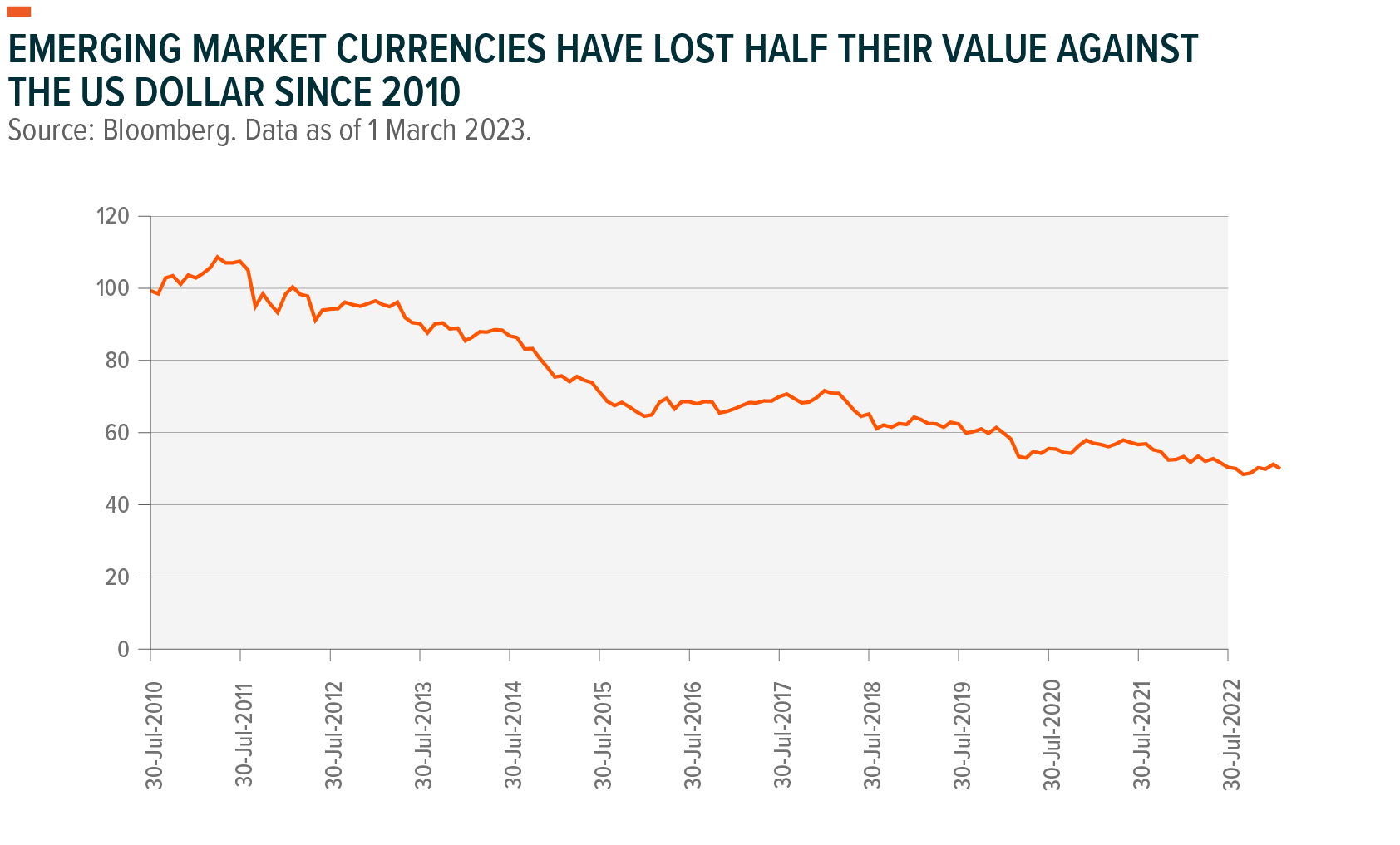

Further advantages reside in the fact that the US dollar retains its value more reliably. Many emerging market currencies have structural decline in value over the years, making these countries’ bonds unappealing irrespective of yield. So too have some developed currencies, like the British pound. While short term exchange rate movements can be effectively mitigated with currency hedging, structural currency devaluation cannot be. The US dollar by contrast has seen its value hold steady, as is reflected in the long-term performance of the DXY Index, which measure the strength of the US dollar against a basket of other currencies.

These features can make the US dollar more appropriate for bonds.

Why Buy US Dollar Bonds Through ETFs?

Buying bonds is not straightforward. Bond markets are complex, with the primary market controlled by the banks. This is because bonds are debts, which are created when banks make loans.

As a result of regulations introduced after the 2008 financial crisis, the banks have become greatly constricted in their ability to make markets for bonds—and especially corporate bonds. Nowadays, the average investment grade corporate bond does not trade on a daily basis. While the average high yield bond trades only once every six weeks.2

In this setting, bond ETFs can be a useful tool. Bond ETFs are not restricted by the same regulations on banks’ balance sheets. And bond ETFs trade on exchange, meaning liquidity is inherently centralised. As such, bond ETFs are far more cheaply and easily traded than cash bonds. This is reflected in the tighter spreads and higher trading volumes of bond ETFs.

What Are The Different Kinds of US Dollar Bonds?

Any financial asset has a trade-off between risk and reward, with more risk implying more potential reward and vice-versa. This is especially true of bonds, where both the amount and type of risk investors take (be it credit, duration, or inflation risk) and the potential rewards they receive (yield to maturity) are subject to precise quantification.

From Global X’s perspective, there are three main categories of US dollar bonds investors can buy. They are:

US Treasuries

- These are debts of the US government; they are safe but typically have low yields.

- US treasuries are often taken as the ‘risk free rate’ of interest – which feeds into all asset prices globally.

- The yield received on these is extremely closely tied to the US Federal Reserve’s funds rate.

Investment Grade Corporate Bonds

- They are issued by companies judged by credit agencies like S&P, Fitch, and Moody’s to be more likely to repay.

- Investment grade corporate bond issuers are often well-known household names such as Apple, Microsoft, Boeing, and Goldman Sachs.

- These bonds are higher yielding than US treasuries, but come with more credit risk.

US High Yield Bonds

- These have the highest yields, but are judged by ratings agencies as having greater credit risk.

- The companies will be less well known but there are still some household names in the category, like Ford, Uber and American Airlines.

- Investors will be compensated for the higher risk by receiving higher income potential.

- These bonds have a reasonably close correlation to equity markets.

Conclusion

For investors wishing to invest in US dollar bonds, Global X provides a suite of bond ETFs, which are available below.

USTB: For investors wishing to invest US treasuries, the Global X US Treasury Bond ETF (Currency Hedged) (USTB) offers a solution. USTB invests in a diversified portfolio of US treasury bonds, across the yield curve.

USIG: For investors wishing to invest in investment grade corporate bonds, the Global X USD Corporate Bond ETF (Currency Hedged) (USIG) provides a solution. The fund invests in the bonds of the more creditworthy US dollar corporate bond issuers.

USHY: For those wishing to invest in high yield bonds, the Global X USD High Yield Bond (Currency Hedged) ETF (USHY) provides a solution. USHY invests in US dollar denominated bonds from global issuers on a currency hedge basis.

Considerations For Investing in US Bonds

- The value of your investment may go down as well as up. Past performance does not predict future returns. Investor capital may be at risk up to a total loss.

- The Fund is exposed to market movements in a single country or region which may be adversely affected by political or economic developments, government action or natural events that do not affect a fund investing in broader markets.

- Bonds are exposed to credit risk and interest rate risk. There is a risk that the bond issuer may be unable to pay interest or repay the bond principal, resulting in your investment suffering a loss. If interest rates rise, typically the value of the bond will fall, which could also affect the value of your investment.