Charting Disruption: Crypto & Blockchain Quests

This piece is part of a series that dives deeper into the most prevalent themes of this year’s iteration of our flagship research piece, Charting Disruption. This Crypto & Blockchain Quests section focuses on alternative currencies and stores of value, Ethereum’s infrastructure, and applications of blockchain technology.

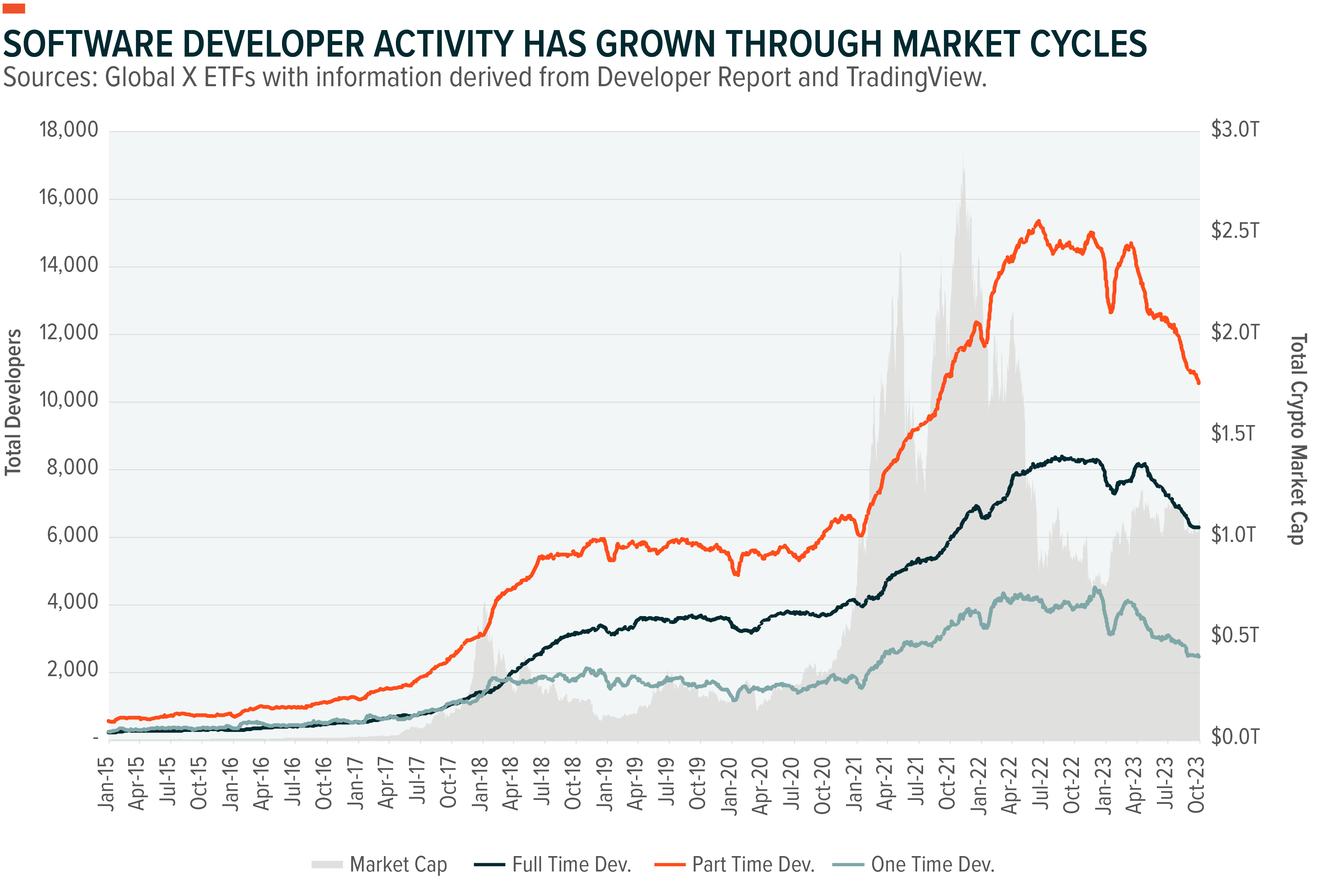

Innovations in blockchain technology have given rise to a burgeoning ecosystem of applications and use cases that have the potential to improve the financial independence of global populations, drive exponential efficiency gains across business and industry, and bring the form factor of value into the digital age. Central to these innovations are the software developers who build the infrastructure, creator tools, and user-facing applications that endow blockchain networks with utility.

Through cycles past, strong market activity has incentivised software developers to enter the digital asset industry, a significant percentage of whom become full-time contributors to blockchain development. Encouragingly, these developers have continually remained committed to the industry even when the cyclical hype triggered by rising asset prices retreats. It is during these periods of more sober public sentiment surrounding blockchain technology that today’s most valuable products have been built. The most recent market cycle seems to be no different, with infrastructure development over the past year providing a robust foundation that may give rise to new use cases, driving the next wave of blockchain adoption.

Key Takeaways

- The role of crypto assets as credible, location-agnostic mediums of exchange and stores of value can provide a critical lifeline for populations struggling with social, economic, and political instability.

- Benefitting from infrastructure upgrades of the Layer 1 (L1) blockchain with “The Merge” and a growing network of Layer 2 (L2) scaling solutions, Ethereum is laying the foundation needed if it is to achieve its goal of becoming a globally adopted value settlement layer.

- The diversity of applications on blockchain networks is continually growing and ranges today from decentralised finance (DeFi) to asset tokenisation, to a host of non-financial use cases such as social media and resource sharing.

Unlocking Digital Assets: Alternative Currencies & Stores of Value

The role of crypto assets as location-agnostic stores of value and mediums of exchange is perhaps the most prominent application of digital assets today. These use cases can provide a critical lifeline to those without access to a stable national currency or a viable means of storing and growing wealth.

Growing from a US$1 billion industry in 2017 to a US$120 billion industry today, stablecoins have emerged as an efficient vehicle for short-term preservation of purchasing power for many global populations, especially those struggling with hyperinflationary conditions and systematic currency debasement.1 Though still a nascent industry, stablecoins are regularly involved in trillions of dollars of global value transfer annually, rivalling payments giants such as Visa.

Bitcoin, on the other hand, has solidified its role as a powerful hedge against currency debasement and global uncertainty. Supported by assurances that the total supply of bitcoin will never exceed 21 million tokens and that the network will never be controlled by a central authority, bitcoin’s value proposition as a credibly scarce and neutral asset has continued to gain traction globally.

Ethereum’s Blueprint: Exploring Infrastructure Upgrades

Ethereum’s transition from proof-of-work to proof-of-stake-—“The Merge”— represented a broad overhaul of Ethereum’s infrastructure. The outcome of The Merge was a 99.9% reduction of Ethereum’s energy consumption and a simultaneous slashing of network expenses to 0. Today, Ethereum’s minimal environmental footprint and sustainably profitable operations put the network in a position to achieve its goal of becoming a global settlement layer.

Upgrades to the canonical Ethereum blockchain (L1) were also supported by innovations in “Layer 2” (L2) networks aimed at scaling Ethereum and reducing transaction costs to support the viability of a wider range of consumer applications. Since 2021, over 30 L2 scaling networks have been launched on Ethereum, including optimistic and zero-knowledge (zk) rollups. To date, L2s have increased Ethereum’s transactional throughput by 5x and reduced average transaction costs by orders of magnitude.2 These myriad benefits have catalysed a migration of blockchain activity away from L1 and on to L2s which now host the majority of Ethereum’s transaction execution.

Blockchain Trends: Applications of the Technology

Driven by drastic improvements in blockchain infrastructure and user experience, the diversity of blockchain applications is quickly expanding. Decentralised finance (DeFi) protocols that enable activities such as asset exchange, yield generation, and lending have garnered the greatest mind share and adoption to date, with billions of dollars of capital regularly processed by the most popular applications. Further, asset tokenisation has made significant strides in progressing from a promising concept to one that is being applied to investment fund management, real estate, stablecoins, and more.

A growing cohort of non-financial applications are being developed as well. These include novel experiments to extend the efficiencies of the sharing economy to areas such as data storage and internet hot spots, crowdsourcing initiatives to incentivise activities such as real-time 3D mapping, and a new social media paradigm whereby content creators are empowered to own their content as well as their entire social graph.

Conclusion

Frontier technological movements challenge societal notions of what is and is not possible. Eventually, the most successful of these movements distinguish themselves by progressing beyond a conceptual phase and into phases of active experimentation and implementation. With significant advancements in blockchain scalability and security over the past few years, blockchains have emerged as increasingly viable solutions for a wide range of applications, with multinational businesses, governments, and a growing global user base taking note and actively experimenting with the technology. As innovation continues, the expectation is that blockchain capabilities will become increasingly relevant to a growing swath of use cases and will eventually become fully integrated into everyday activities.

Related Funds

EBTC: The Global X 21Shares Bitcoin ETF (Exchange Code: EBTC) invests in physical Bitcoin to provide exposure to the price of Bitcoin in Australian dollars.

EETH: The Global X 21Shares Ethereum ETF (Exchange Code: EETH) invests in physical Ethereum to provide exposure to the price of Ethereum in Australian dollars.