Financial markets last year were defined by the rise of Artificial Intelligence (AI), with some analysts describing AI as the “saviour” of the S&P 500. Among those AI stocks, Nvidia was a clear standout, climbing more than 230% in 2023 and becoming the eighth ever company to hit US$1 trillion in valuation.1 However, with such an explosive rise to stardom, some questions have naturally arisen:

- How did Nvidia become so important to AI?

- Is Nvidia a bubble?

- What are the risks for Nvidia looking forward?

How Did Nvidia Become So Important to AI?

GPUs (a.k.a. graphics cards) are microchips designed to output graphics onto computer screens; and Nvidia, with its origins in the video games industry, has long been the industry leader in that market, maintaining almost 80% market share in 2023.2

But Nvidia’s GPUs mattered in the AI rally not due to their graphics rendering capabilities, instead it was their prowess in data processing that was the focus, a feat largely attributed to Nvidia’s proprietary software CUDA (Compute Unified Device Architecture).

Introduced in 2006, CUDA transformed Nvidia’s GPUs by enabling developers to harness each processor’s computing power for whatever programs they wished – including AI development, which favoured the fast computational speeds of GPUs over the accuracy of a traditional CPU. Since then, Nvidia has continued to develop and support CUDA, and today the platform is used by over 4 million software developers, representing the world’s most robust AI ecosystem.3

Following the launch of ChatGPT, Nvidia, with its extensive history in AI development, found itself in the prime position to meet the growing demand for AI GPUs. It benefitted from your classic network effects and switching costs, as programmers worldwide were deeply ingrained in its CUDA software. Furthermore, GPUs fine-tuned for AI workloads already existed within Nvidia's hardware line-up, meaning extra development was mostly unnecessary. These factors combined entitled Nvidia to unrivalled pricing power (the premium end of the GPU market observes the most pricing power - Nvidia’s high-end AI chips can cost upward of US$40,000), allowing for margins of up to 1,000% of production costs on chipsets such as the H100.4

Is Nvidia A Bubble?

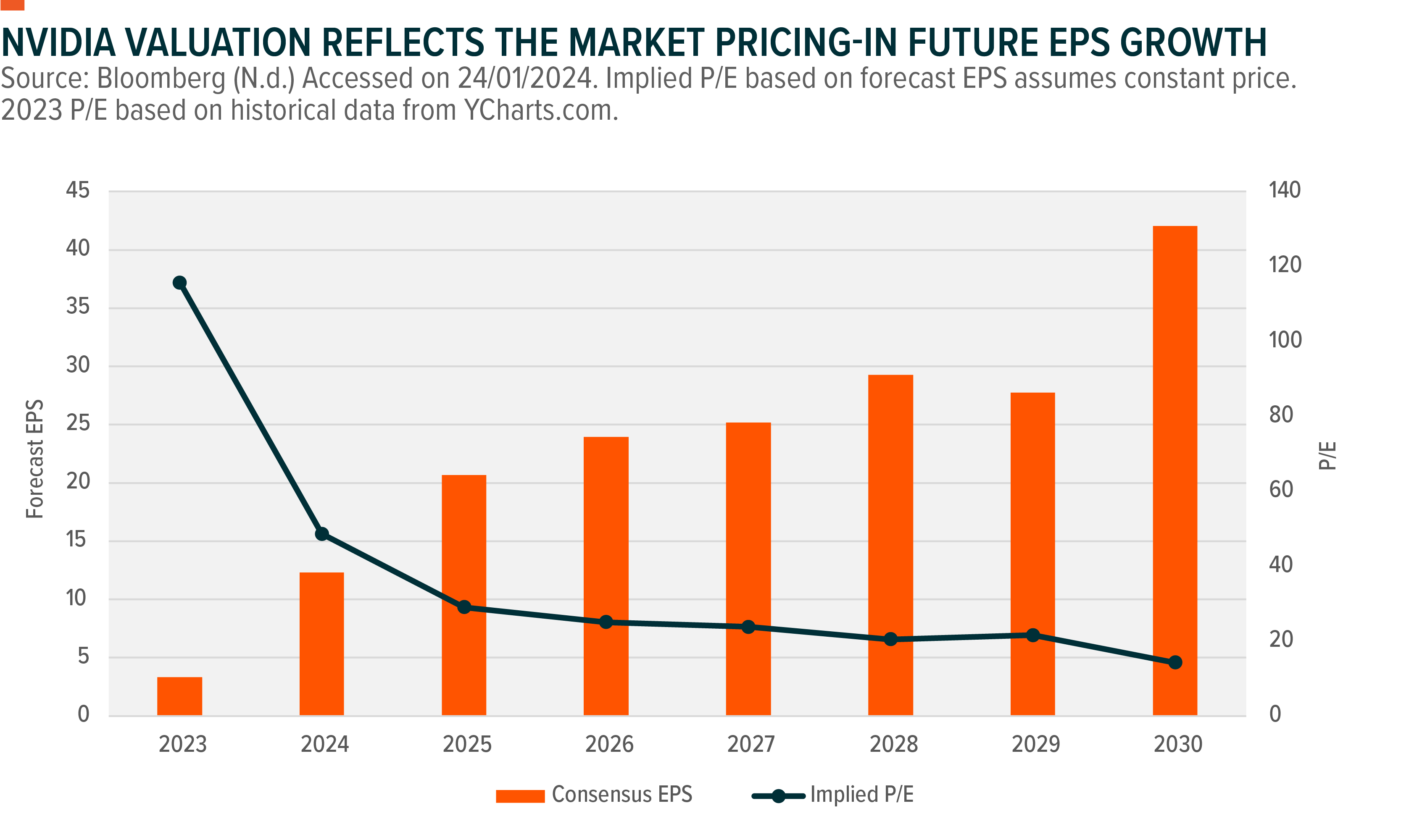

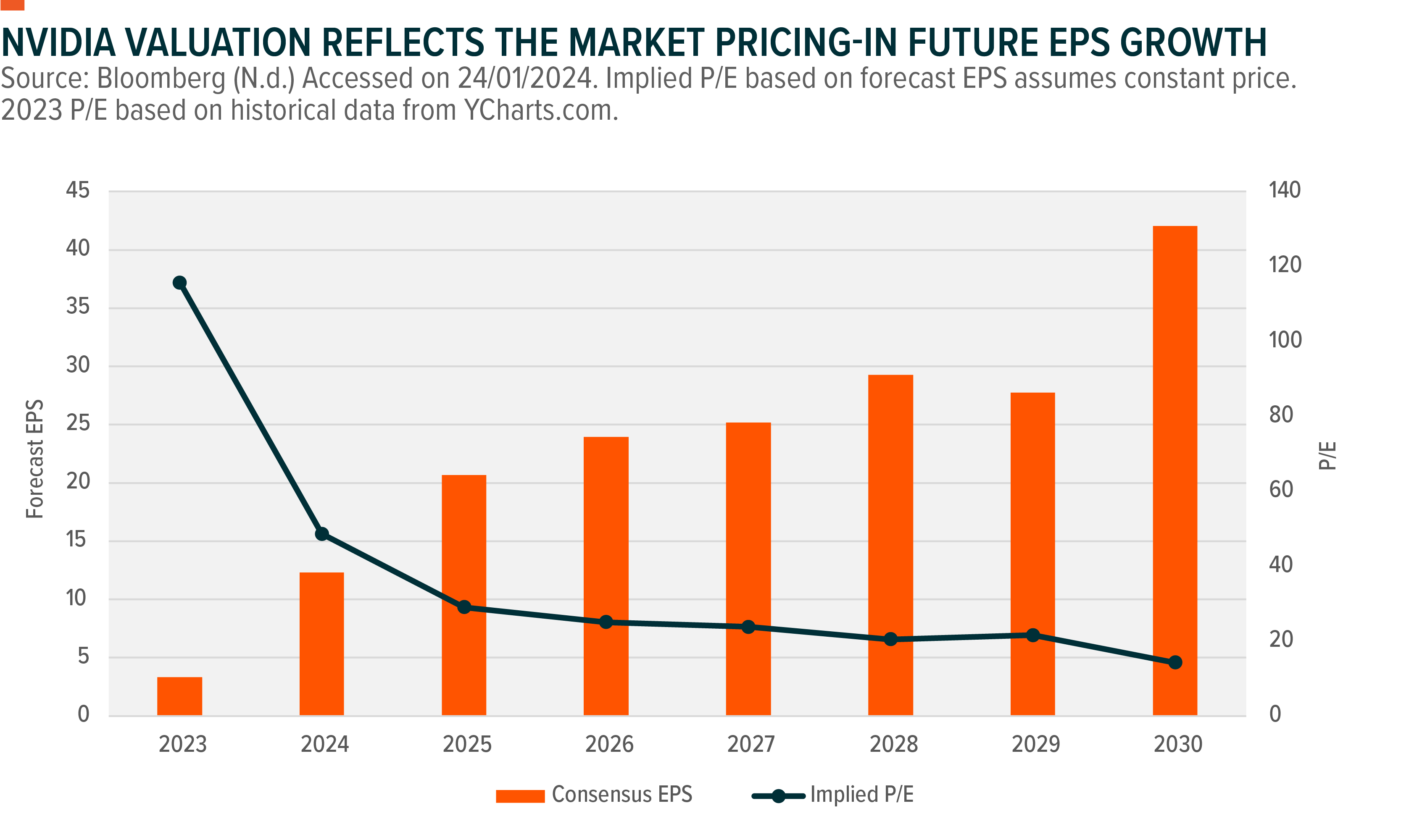

At the time of writing, Nvidia has just hit a new all-time high of US$603.31, marking a 12-month return of 210% and a total market cap of more than US$1.3 trillion.5 With such immense growth, questions have naturally arisen over its valuation. It is our view that, despite Nvidia’s dizzying rally over the past year, there is no clear evidence of a bubble. Furthermore, evidence suggests the rally has been driven by the market pricing-in consensus future earnings rather than by hype. This is reflected in the table and graph below.

Breaking down Nvidia’s growth for the next few years, we can see the following:

- The market believes revenue growth will overwhelmingly come from datacentres and AI. Forecasts suggest the segment is set to make up ~90% of the company’s total revenue by 2025-26 – marking a major strategic pivot away from video games and bitcoin mining.6

- Nvidia currently has ~90% market share in the AI accelerator/datacentre industry. And thanks to its CUDA ecosystem and technology moat, discussed above, the market thinks this market share is robust in the face of this stellar growth.7

- Given the previous two points, Nvidia’s AI and datacentre revenues is likely to grow at the forecasted 35-40% CAGR of the AI accelerator industry until the early 2030s. These forecasts derive from the public commitments of tech giants such as Facebook, Amazon, Apple, Bloomberg, and others—all of which have stated their intention to launch large language models—which, to be competitive, must be based on Nvidia’s GPUs as things stand today.8

- While promising, Nvidia’s growth trajectory will likely be front-loaded as the tech giants invest heavily into AI infrastructure in the near term, before normalising to a semiconductor industry average in the latter half of the decade as infrastructure demand saturates.9

- Nvidia's decision to shift from a 2-year to 1-year product launch cadence will improve its ability to run interference on competitors and stop technology decay.10 As an example: AMD recently announced its MI300 series GPUs which could successfully rival Nvidia’s flagship H100 in performance. However, the threat of Nvidia’s upcoming B100 chipset (which is set to supersede the H100), slated for release in late-2024, significantly dulled market demand for the AMD release.

What Are The Risks for Nvidia Looking Forward?

While we view Nvidia as an ongoing opportunity, we also see two possible risks for its growth assumptions. Crucially, as with any hardware company, Nvidia’s success relies on future demand. Should Google, Facebook, or Amazon pull back from developing large language models or AI capabilities, future chip demand could slow.

Furthermore, Amazon, Google, and Microsoft are all developing custom silicon in an attempt to detach from Nvidia’s datacentre GPU monopoly.11 We see this as a low-risk development in the near term as Nvidia maintains a significant technological moat over competitors, but meaningful in the mid to long term as custom hardware will eventually form tangible economic and performance advantages.

Not Cheap, But No Evidence Of A Bubble

While Nvidia has certainly had an impressive run over the past 12-months, we believe valuation for the stock remains realistic and is rooted in fundamentals. Strong earnings outlook, high market demand, an extensive technological moat, and growing AI adoption are all factors that we see driving Nvidia forward in the coming years. As such, it is our view that Nvidia continues to be one of the best companies to capitalise on the growth of artificial intelligence and should not be considered to be ‘in a bubble’.