ETF Express Week Ending 7 July 2023

ETF Express is Global X’s weekly coverage of the latest ETF Market Moves, Thematic Spotlight and Commodity Calls.

For crypto enthusiasts, don’t forget to check out this month’s New in Digital Assets report.

- Crypto ETFs (CRYP, EETH) outperformed last week as major institutional moves reignited interest in the digital assets space. BlackRock’s surprise filing for a spot Bitcoin ETF has since been followed by numerous other leading asset managers such as Fidelity, VanEck and Wisdom Tree.

- Alternative energy and transition ETFs (ATOM, TANN, URNM) were the poorest performing non-leveraged funds for the week as uncertainty continues to surround China’s economic outlook. China has the world’s largest pipeline of solar panel and nuclear energy instalments, as well as the biggest market for clean and renewable energies overall.12

- There were $665 million in reported industry inflows last week and only $312 million in outflows, marking a week of net positive flows for the Australian ETF industry.

Download our weekly ETF monitor here.

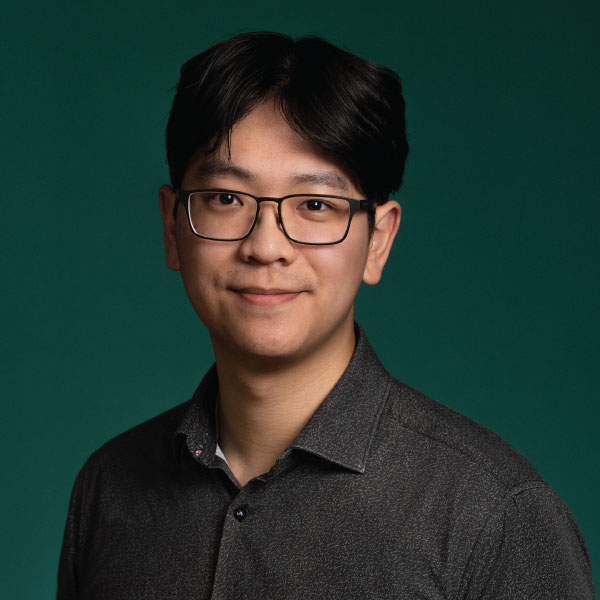

Australia’s EV Adoption Crosses Crucial Threshold

Lithium and Battery Technology

Australia’s projected electric vehicle (EV) market penetration has passed the 5% threshold3 which could be a catalyst for explosive growth over the next 12 months.

EVs have made up 7.4% of new vehicle sales in Australia this year and of the 124,926 vehicles sold in June, 8.8% were EVs, according to the Federal Chamber of Automotive Industries.4

Historically, when nations surpass 5% EV market penetration, sales jumped nearly 300% the following year.5 Both Norway and China followed this trend in 2013 and 2018 respectively, growing from 5% to 15%.6

Government policy will be crucial factor to support Australia’s accelerated transition to EVs – particularly as Australia is the only developed nation (except Russia) to not have pollution restrictions on road vehicles.7 But in April the Labor government announced intentions to impose mandatory pollution caps on traditional vehicles to drive EV uptake.8

Australia is also in talks with Indonesia to sign a joint effort on battery metal mining and battery production.9 The deal would have Australia gaining direct access to the largest nickel reserves in the world and Southeast Asia’s prospective battery tech manufacturing centre, a boon for the security of Australia’s EV supply chain.10

Copper

Bullish

- Supply disruption concerns: Chile reported a decline in copper production last Friday, continuing a string of disappointing data from the world’s top copper producing nation. May’s monthly output was down 14% year over year, and projected copper output for the year ahead is estimated to sink as much as 7%.11 12

- Chinese stimulus announcements could be the key to improved investor sentiment. Current markets appear to be in “wait and see” mode until the politburo meeting in July, in which details on new fiscal measures are expected to be revealed.

Bearish

- Hawkish outlook on US monetary policy: The US Federal Reserve’s June policy meeting minutes revealed that most officials would be in favour of future rate rises to counter persistently rising inflation. Investors now expect a 25-basis point rate hike in the next Fed meeting. 13

- Expectations of low manufacturing demand amid the concerning macroeconomic backdrop. As a leading indicator, the June China Manufacturing PMI is signalling for a potential contraction.

Precious Metals and PGMs

Bullish

- Rising industrial input demand for solar panels, particularly in China, looks to increase silver usage: the Silver Institute reported that solar panel manufacturers are expected to account for 14% of the world’s silver use this year, up from 5% in 2014. In contrast to a 2% increase in supply, the institute predicts a 4% increase in consumption this year.

Bearish

- Hawkish outlook on US monetary policy: The US Federal Reserve’s June policy meeting minutes revealed that most officials would be in favour of future rate rises to counter persistently rising inflation. Investors now expect a 25-basis point rate hike in the next Fed meeting.

Uranium

Bullish

- BHP Group is calling for Australia to lift a longstanding ban on nuclear power as the country moves to decarbonise its energy infrastructure.

- Citi revised its uranium price outlook for 2023-2024, improving its bull case, citing uncertainty about future Russian supplies.

Bearish

- Macroeconomic headwinds kept pressure on the broader energy sector.

Forecasts are not guaranteed, and undue reliance should not be placed on them. This information is based on views held by Global X or referenced sources as at 7th July 2023.