How Does Crypto Staking Work?

Blockchains are a unique type of database whose structure makes them ideal platforms for distributed data management. Characterised by a single ledger that is shared and maintained by a global community of users, public blockchain networks can be thought of as engines that enable highly efficient and trust-less coordination among unrelated parties. Critical to this role is a blockchain’s ability to create consensus among users: the bedrock of the network’s integrity and security. Effective consensus coordination, however, requires explicit consideration in the process of blockchain design. Staking is one such method and has proven effective in its operation of the proof-of-stake consensus mechanism. But how does it work?

Key Takeaways

- Public blockchains offer decentralised data management, eliminating the need for the trust assumptions associated with centralised systems. Decentralised management, however, introduces the challenge of ensuring honest and unbiased participation from a large community of independent validators.

- In proof-of-stake systems, validators are required to collateralise (or stake) digital assets to participate in the oversight of the distributed ledger. Consensus mechanisms utilise these financial commitments to create positive and negative incentives to align validators’ interests.

- In addition to having a vested interest in the observance of network rules, validators are financially compensated for adhering to and enforcing these rules. Failure to comply, however, can result in slashing penalties whereby a portion or the entirety of a validator’s stake can be confiscated by the network.

The Power of Financial Incentives and Rational Actors

Public blockchains are distributed databases managed by a global community of users. In contrast to centralised databases, which are governed by one or a handful of administrators, the right to contribute to the management and oversight of public blockchains is open to anyone. In practice, these various approaches to data management present trade-offs. While centralised data management is much more efficient and less resource-intensive than decentralised data management, the centralised model relies on trust assumptions. By conceding the authority to manage the database to an external party, users are obliged to trust that the administrators will behave neutrally and in line with pre-established rules. Of course, history is full of examples where these trust assumptions have been violated, and users, developers, and the community at large have been collateral damage.

Blockchains offer a means to eliminate these trust assumptions through the implementation of decentralised data management. Doing so, however, introduces challenges, namely: how to ensure that thousands of independent, unrelated community members manage and validate data in a manner that is honest, unbiased, and according to the rules of the network.

To address these complexities, blockchain protocols impose rules that must be followed to participate in the management and validation of blockchain data. Commonly referred to as consensus mechanisms, these rules define the specific ways that blockchain data is packaged together, arbitrated and/or validated by the community, and ultimately instantiated into the blockchain’s distributed ledger. In short, these rules set the guidelines for how a community of users come to a consensus on the state of a distributed dataset.

Stating these rules, however, is not enough to prevent deviation if it is in the best interest of a self-interested actor. Rather, consensus mechanisms need a way to enforce compliant participation while disincentivising attacks on the network. Towards this end, most consensus mechanism designs require a financial commitment as a prerequisite for participating in the consensus process. In a proof-of-stake system, such as Ethereum, this commitment comes in the form of collateralised, or staked, crypto assets.

The Carrot and Stick Approach: Aligning Validator Interests

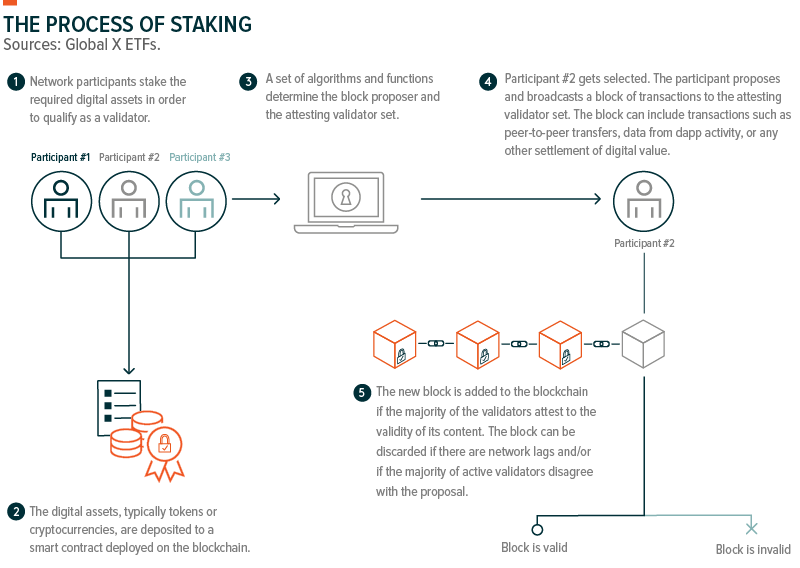

Staking involves network participants, known as validators, who pledge a certain amount of a blockchain’s native digital asset to a smart contract. These collateralised digital assets provide an assurance to the network that the validator will only attest to and/or disseminate changes to the distributed ledger that are consistent with the established rules of the network. Though the minimum amount of staked assets required to operate a validator varies from network to network, the dollar value tends to be relatively high. For example, becoming a validator on the popular Ethereum blockchain requires a minimum active stake of 32 ether (ETH), worth approximately $93,000 Australian dollars at current market prices.1 If a user cannot meet the minimum validator threshold, they can delegate their assets to other validators within the network, usually in exchange for a fee.

Positive Incentives to Encourage Honest Behaviour

Staking helps to align the interests of individuals and self-interested validators through both implicit and explicit financial incentives. Implicitly, by requiring a significant capital investment to participate in the validation and protection of a network, validators have a strong vested interest in the success of the network. Because public confidence in blockchain networks stems partly from the network’s ability to coordinate consensus efficiently and accurately, the value of a validator’s stake would be impaired by any deviant behaviour undermining this confidence. In other words, if a blockchain fails to provide the service it was designed for, confidence in the network will evaporate, and the value of its native token will likely decline. As such, it is in every validator’s best interest to uphold and abide by established network rules in order to protect the credibility of the network and, by association, the value of their staked assets.

Explicitly, validators are financially compensated for the service of validating transactions and protecting the network’s historical state. Specifically, the validator that disseminates an updated state of the ledger—a block proposal—that garners consensus by the rest of the network is compensated with a reward from the network. These rewards are paid in the blockchain network’s native asset. Validators on the Ethereum network, for example, receive these block rewards in ETH. It is also important to note that block proposals that do not garner consensus by the network do not receive these compensatory block rewards. Assuming that the majority of the network’s validators are self-interested economic actors, the ability to earn block rewards means that it is in each validator’s best interest to only make proposals that abide by network rules.

Negative Incentives to Discourage Deviant Behaviour

A proof-of-stake network’s ability to precisely punish deviant behaviour is an equally powerful tool in aligning the behaviour of independent validators. In the same way that staking rewards provide validators with a positive financial incentive to comply with network rules, the prospect of losing staked tokens for non-aligned behaviour provides a financial disincentive for non-compliance.

Consensus protocols are often configured such that behaviour inconsistent with network rules results in the partial or full confiscation of staked assets in a process referred to as slashing. The magnitude of the punishment is usually dependent on the severity of the deviant activity. For example, attesting to the validity of two different states of the network can result in minor slashing penalties. Validators that are offline and which fail to attest to the state of the distributed ledger for extended periods of time can also incur minor slashing penalties. More malicious infractions, such as repeated or explicit attacks targeted at destabilising a blockchain network, can result in more severe penalties, including the complete confiscation of staked assets. Through this approach, placing capital at risk of slashing becomes a fundamental tool for a consensus mechanism to ensure that all validators are operating in a manner consistent with established network rules.

Staking Achieves Accountability in Blockchain Consensus

The staking model operates on the fundamental principle that validators are self-interested economic actors. By requiring validators to stake assets in exchange for the right to validate and secure the network, consensus protocols can ensure that disparate actors across the globe can coordinate effectively and reliably without relying on significant trust assumptions. With a more than decades-long track record of resiliency and efficiency, proof-of-stake has emerged as one of the most popular consensus mechanisms, playing a major role in the leading public blockchains today.

Related Funds

EETH: For those wishing to gain direct exposure to Ethereum, the Global X 21Shares Ethereum ETF (EETH) offers a solution. Invest in the only physically backed Ethereum ETF in Australia.