One question I get asked often is how US equities can keep rising even as the US dollar weakens. At face value, it feels contradictory but the dollar’s weakness is not just making US equities more attractive versus global peers. It is also lifting earnings for US-listed multinationals with global revenue streams. The S&P 500 and Nasdaq Composite Indices are both near record highs, while the dollar index has fallen to levels last seen in early 2022.1 What we’re seeing is not a broad rally driven by falling yields or currency effects. It is a targeted rotation into companies with strong earnings momentum, resilient margins, and meaningful global revenue exposure. These businesses are benefiting from a weaker dollar through translation gains and are amplifying those effects through margin discipline and cost control.

Key Takeaways

- A weaker US dollar is not just making US dollar assets “cheaper” but is lifting earnings for globally exposed US-listed companies.

- S&P sub-sectors like tech and communication services are benefiting most, thanks to strong offshore revenues and pricing power.

- Investors expecting further US dollar weakness may not need to go offshore. Targeted exposure within US-listed names can capture the upside more efficiently.

Where the Revenue Is Matters

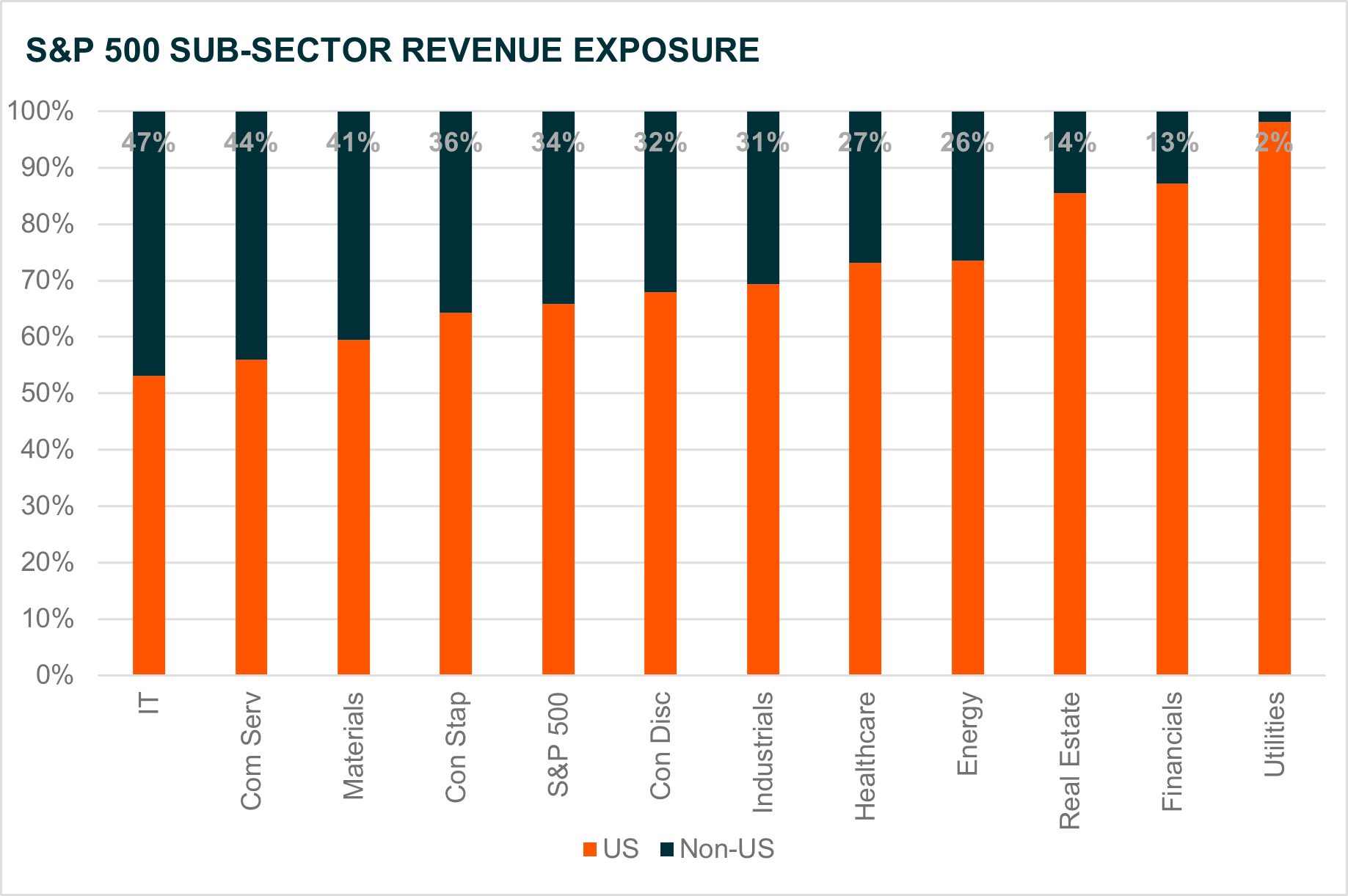

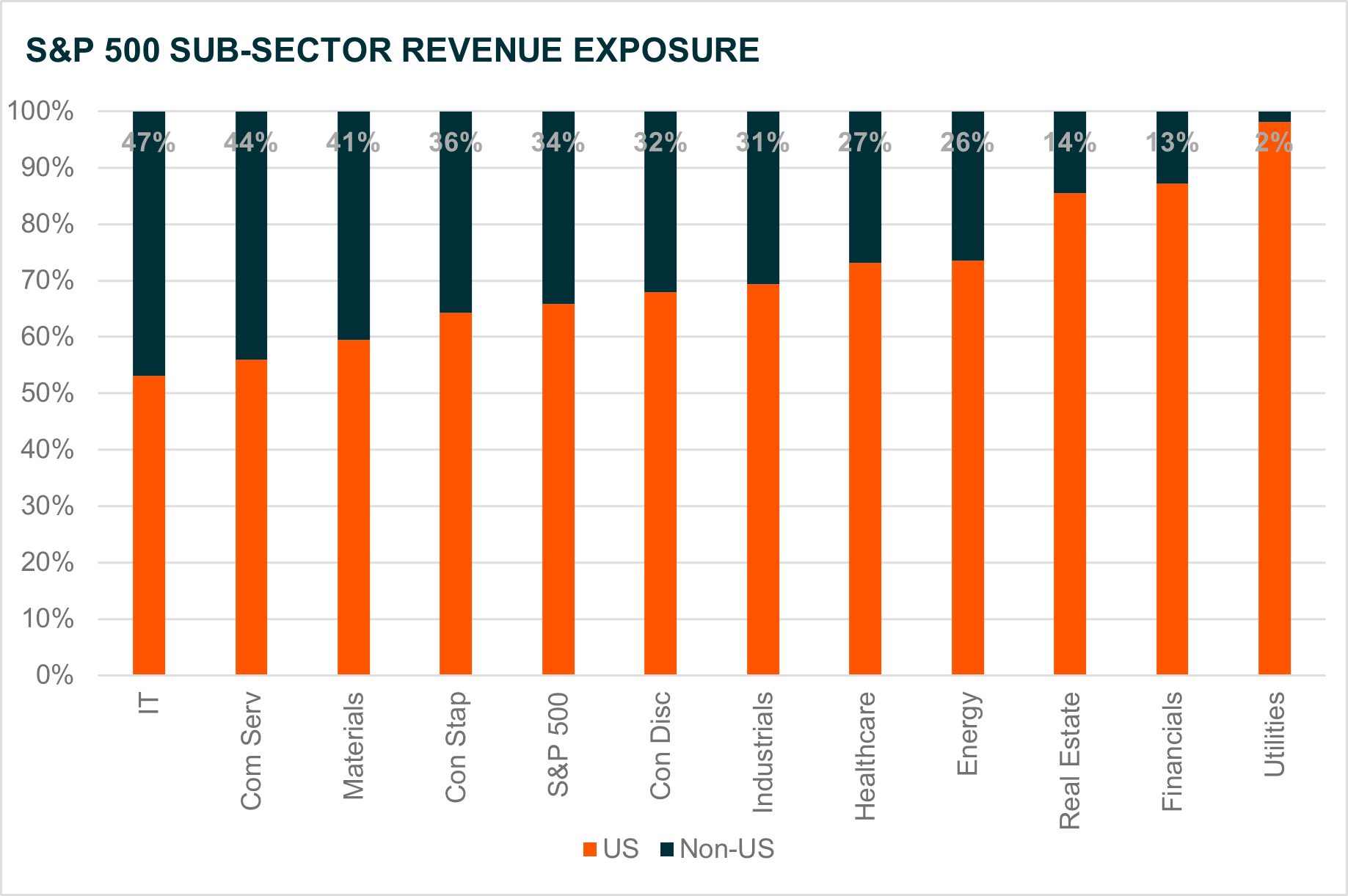

Not all sectors are positioned to benefit equally from a weaker US dollar, and that divide is visible when you break the S&P 500 into its revenue exposures. Utilities, financials and real estate derive almost all their earnings from within the US, meaning currency moves have little impact. On the other hand, sectors like information technology and communication services generate a much higher share of revenue offshore - in some cases close to 50%.2 These are the also some of the sectors that have led the US market this year.3

The reason is twofold. First, the dollar's decline has provided a foreign translation tailwind, inflating their reported earnings in US dollar terms. Second, these companies also tend to dominate in their respective verticals, with strong pricing power, high margins and the ability to grow even in a weaker global macro environment. That resilience, combined with foreign currency exposure, gives them a rare combination of global leverage and earnings quality. It also means that for investors looking to position around dollar weakness, the right approach may not just be shifting offshore but to lean further into the specific parts of the US market that benefit most from it.

Source: Bloomberg data as of 22 Jul 2025 with sub-sectors based on S&P GICS level categorisation.

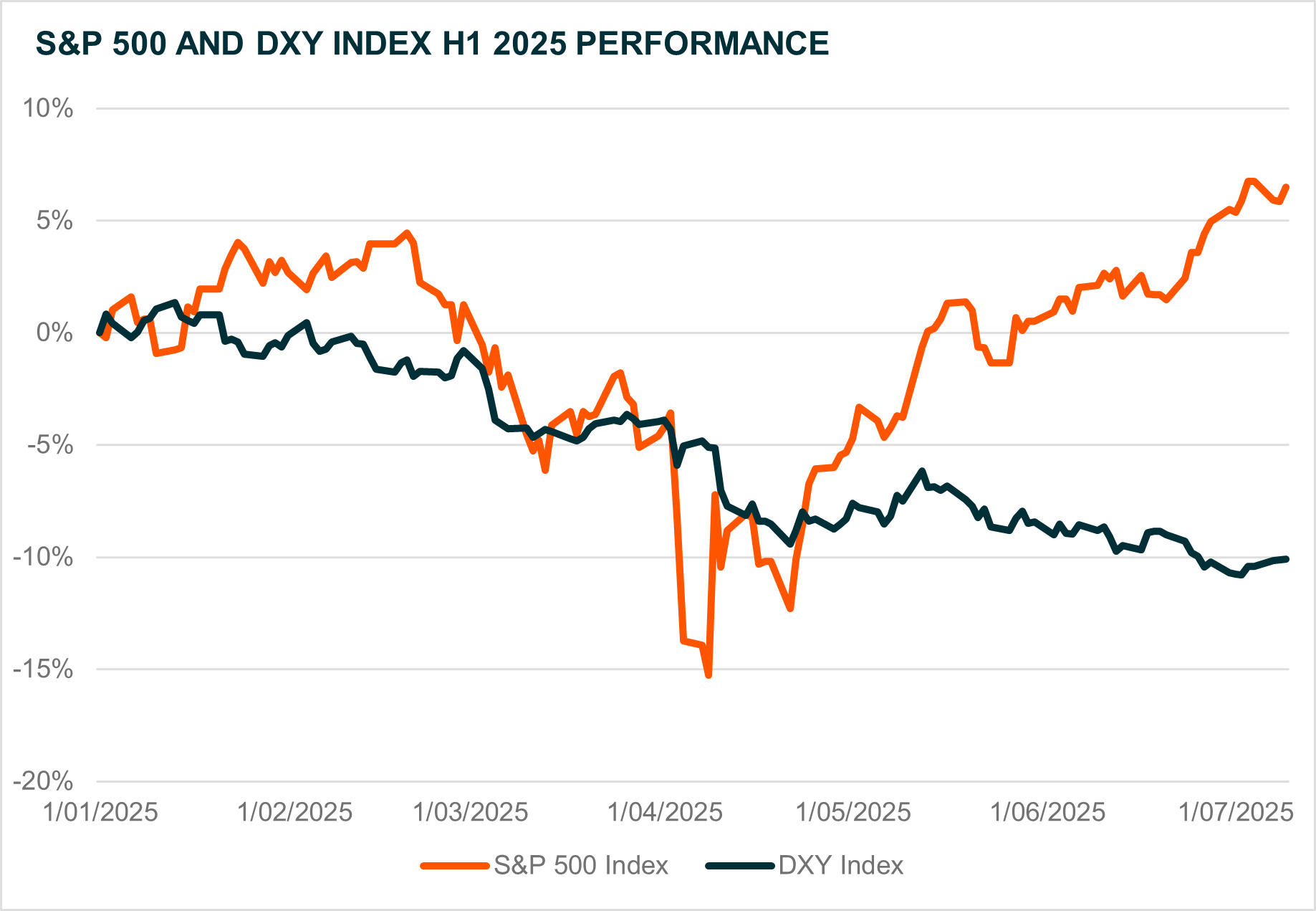

Why This Dollar Move Is Different

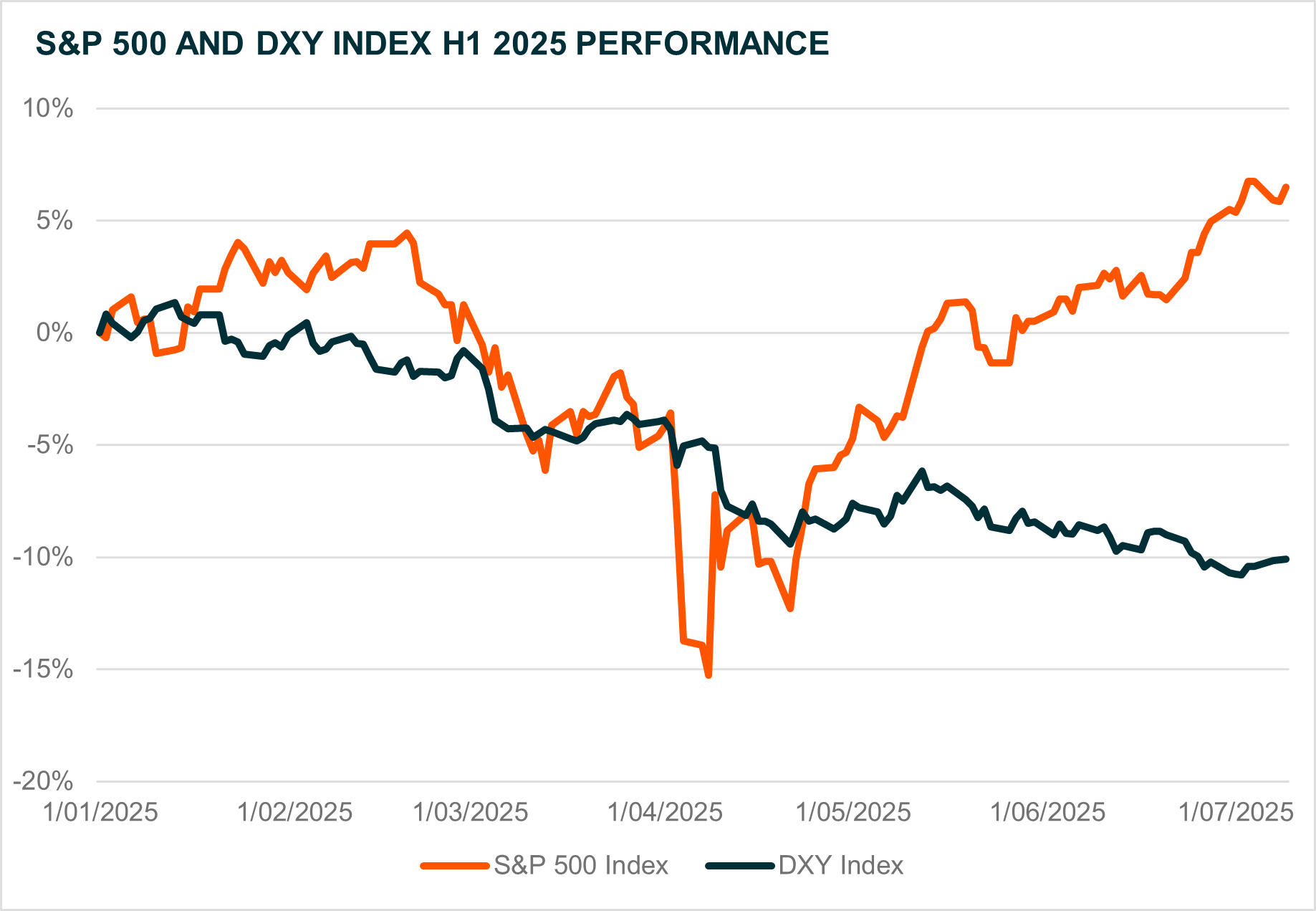

The US dollar has declined sharply since the start of the year, falling from a peak of 107 on the US Dollar Index (DXY) to below 99. Historically, a move like this might have raised concerns about domestic weakness or capital flight, but that is not what the current environment reflects. The recent softness in the dollar has come despite monetary policy divergence that should favour the US. While the Federal Reserve has remained on hold, central banks in Europe, Canada and elsewhere have already begun cutting rates, widening the interest rate differential in favour of the US. However, the dollar has still weakened, a move more likely driven by looser financial conditions, positioning, and shifting risk appetite rather than policy rates alone.

At the same time, the US economy continues to show underlying strength. Consumption remains steady, the labour market remains tight, and credit spreads have stayed contained. US yields have come off their highs, helping to loosen financial conditions even as the Fed holds steady.4 This combination is unusual. It allows the dollar to weaken while risk assets remain supported, and it reflects a broader recalibration of global capital flows rather than a signal of macro stress.

Source: Bloomberg data as of 22 Jul 2025

Being Selective Within the US Matters More Than Ever

This is not a market where holding the entire US equity index delivers the best results. Valuation gaps have widened, earnings dispersion is rising, and sector leadership is shifting more on fundamentals than sentiment.5 Investors are no longer buying the US simply because it is the largest and most liquid market. They are rewarding businesses that can defend margins, reinvest intelligently, and grow earnings without relying on a perfect macro backdrop. That is where select exposures come in.

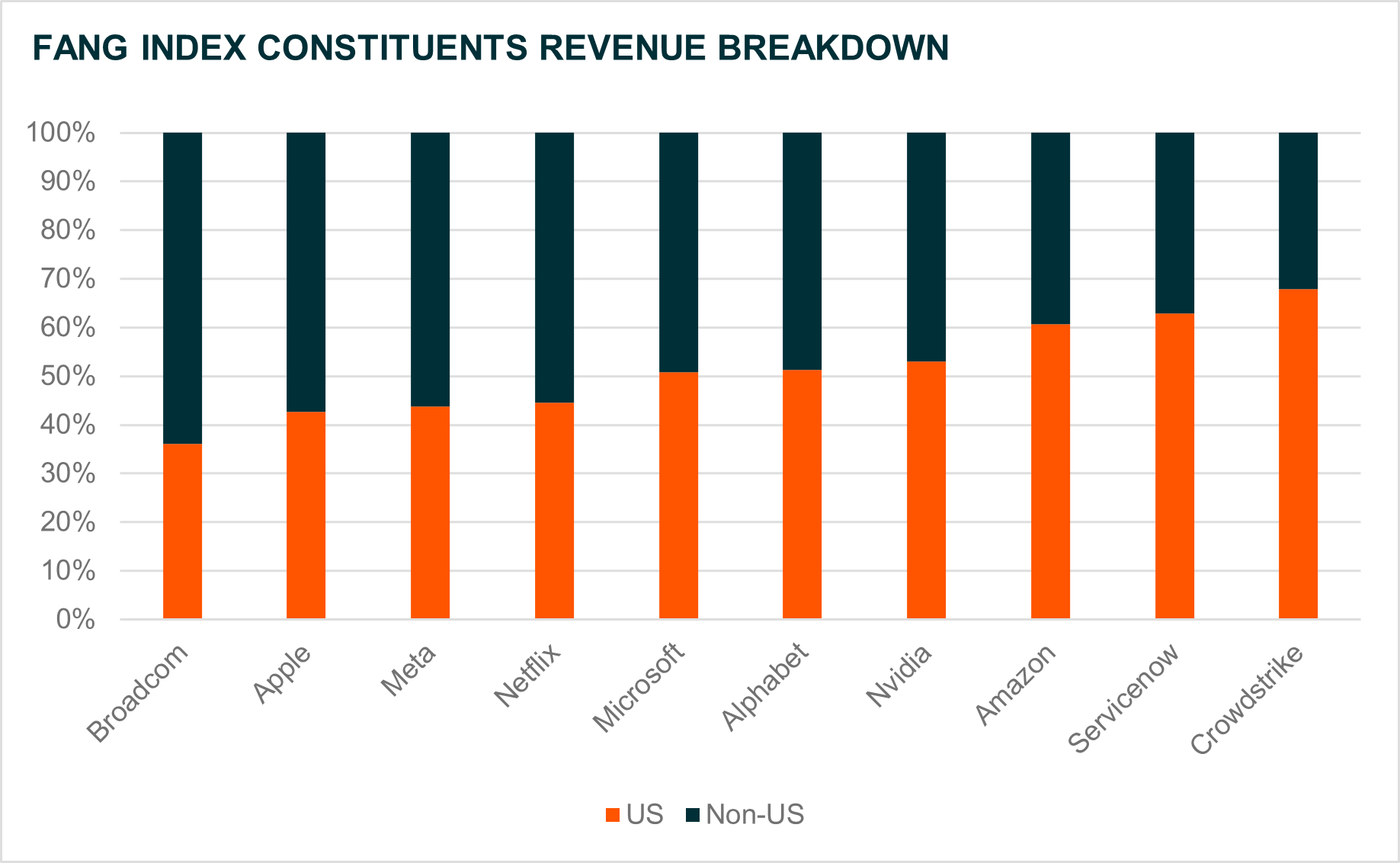

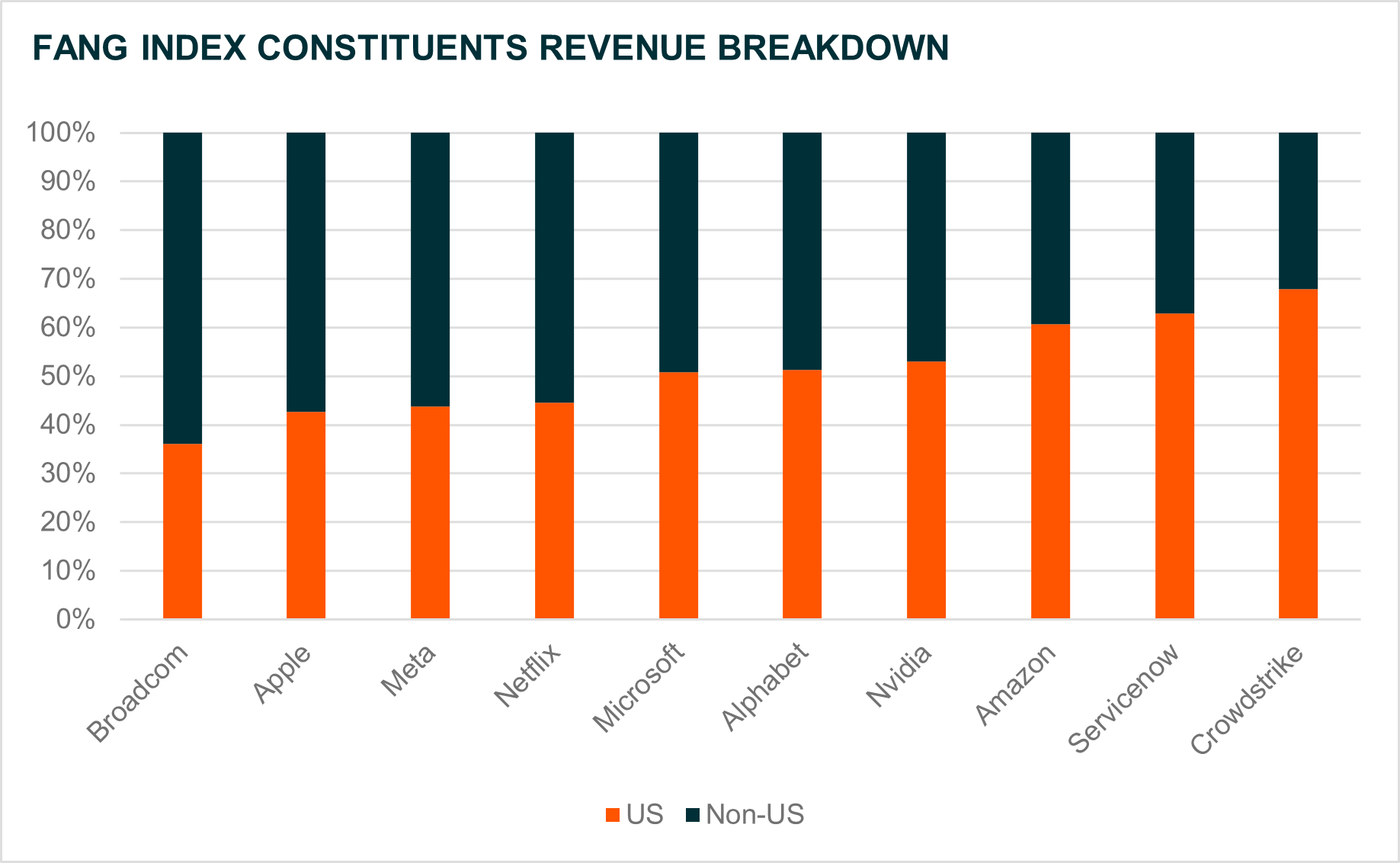

Exchange traded funds (ETF)'s like the Global X FANG+ ETF and Global X FANG+ (Currency Hedged) ETF offer a more targeted approach. Both funds include innovative, global companies that generate a large share of revenue offshore. In the current environment, that international footprint is becoming an advantage. As the US dollar weakens, these companies stand to benefit from positive foreign exchange translation effects on their earnings, particularly when those earnings are also underpinned by strong balance sheets and disciplined capital allocation.

Below are examples of companies which we believe potentially benefit from stronger foreign currency translation:

- Meta and Netflix are seeing advertising and subscription revenue lift in non-US markets, and those earnings translate more favourably into US dollars when the currency weakens.

- Microsoft and Alphabet continue to grow their global cloud and software platforms, with FX now acting as a tailwind to reported results.

- Outside of these names, the Global X FANG+ ETF and Global X FANG+ (Currency Hedged) ETF also hold exposure to global leaders in software, semiconductors and platforms that are generating meaningful offshore revenue with high operating leverage.

Rather than rotating away from US-listed equities entirely, investors who expect the dollar to remain under pressure may benefit from tilting toward names that convert global growth into stronger reported earnings. This is not about favouring domestic over international exposure but about identifying global earnings leverage within US-listed companies.

For investors with stronger conviction and a view that the AUD may strengthen, the Global X FANG+ (Currency Hedged) ETF offers an additional benefit by capturing the FX uplift in US company earnings and again through the hedge when USD weakens against the AUD.

Source: Bloomberg data as of 22 Jul 2025. Data is based on trailing twelve months’ revenue and index holdings as of 22 Jul 2025.

Dollar Down Does Not Always Mean Go Global

The conventional playbook suggests that a weakening US dollar should prompt a rotation into emerging markets or ex-US developed equities. In previous cycles, that move made sense. A softer dollar typically eased financial conditions abroad, helped lift global risk assets, and potentially assisted in financing costs. But this cycle is moving differently with many international equity markets still under pressure, weighed down by soft earnings revisions, policy uncertainty and slower domestic growth.

At the same time, several US-listed multinationals are converting currency weakness into a direct earnings tailwind. These companies are not just weathering the macro slowdown but are outperforming on fundamentals and leading upgrades to profit forecasts.6 That dynamic has shifted the way investors are thinking about FX exposure. Rather than moving capital offshore in response to dollar weakness, there is growing interest in tilting toward global revenue exposure within US-listed names. That kind of positioning aims to capture the FX benefit while maintaining exposure to stronger balance sheets and more stable policy settings.

This is not to say that global equities should be ignored. There is still a role for international diversification. But in this cycle, the more effective expression of a weaker dollar may come from within existing allocations, through a sharper focus on where earnings are coming from and how currency moves flow through to reported results. Selectivity, rather than geographic rotation, appears to be what matters most.

Source: Bloomberg data as of 22 Jul 2025 with sub-sectors based on S&P GICS level categorisation.

Source: Bloomberg data as of 22 Jul 2025 with sub-sectors based on S&P GICS level categorisation.

Source: Bloomberg data as of 22 Jul 2025

Source: Bloomberg data as of 22 Jul 2025