Japan has evolved from being viewed solely as a frontier innovator to becoming a global foundation for many of today’s most important megatrends. While the US and China currently dominate headlines in areas such as artificial intelligence, robotics and electric vehicles, Japan’s corporates continue to stand out for their exceptional quality, precision engineering and deep integration across global supply chains. These firms remain indispensable to the world’s technological progress – providing the core components, manufacturing expertise and specialised capabilities that underpin semiconductors, automation and next-generation energy systems.

In this piece, we highlight three key companies within the Global X Japan TOPIX 100 ETF (ASX: J100). Each plays a central role in powering a major global megatrend across semiconductors, nuclear energy, and artificial intelligence.

Disco Corporation: Silicon Michelangelo

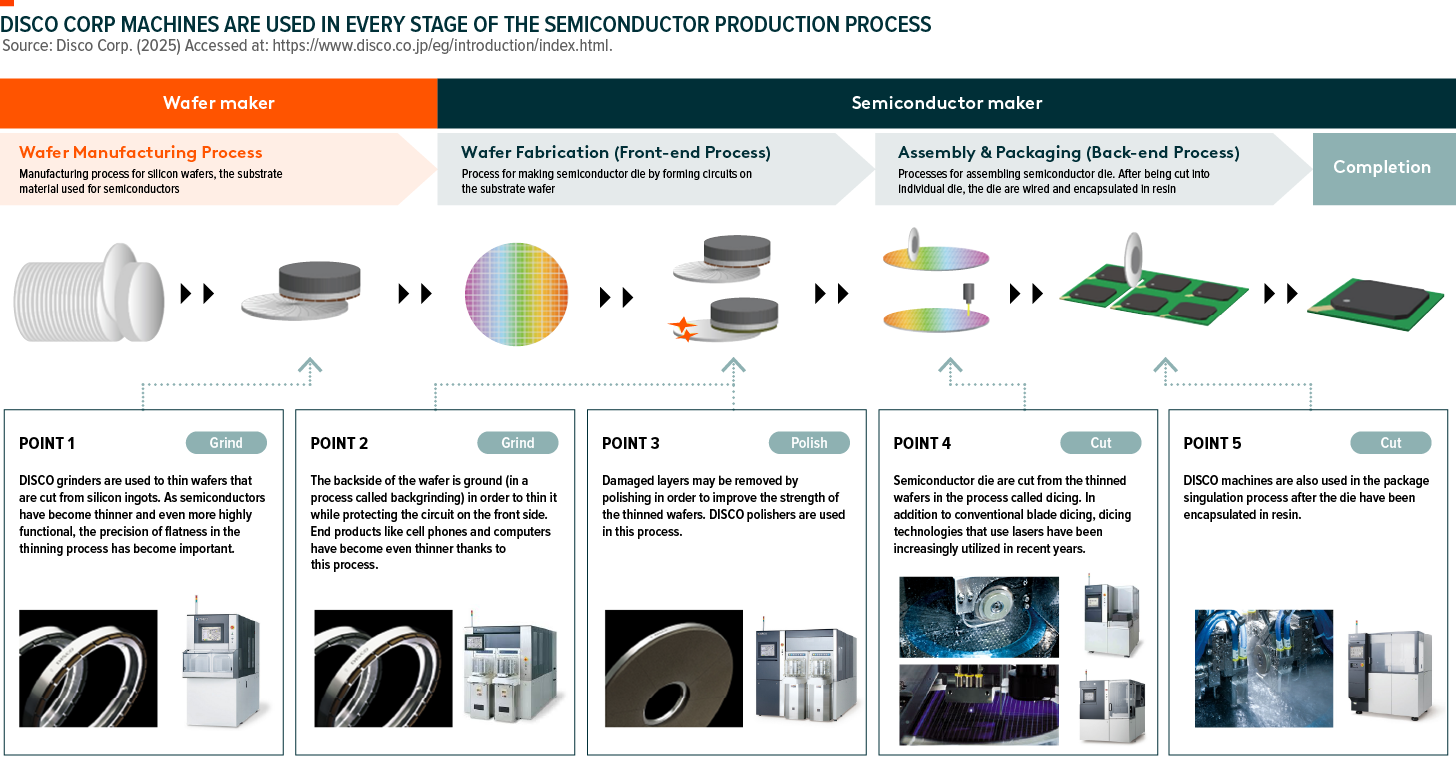

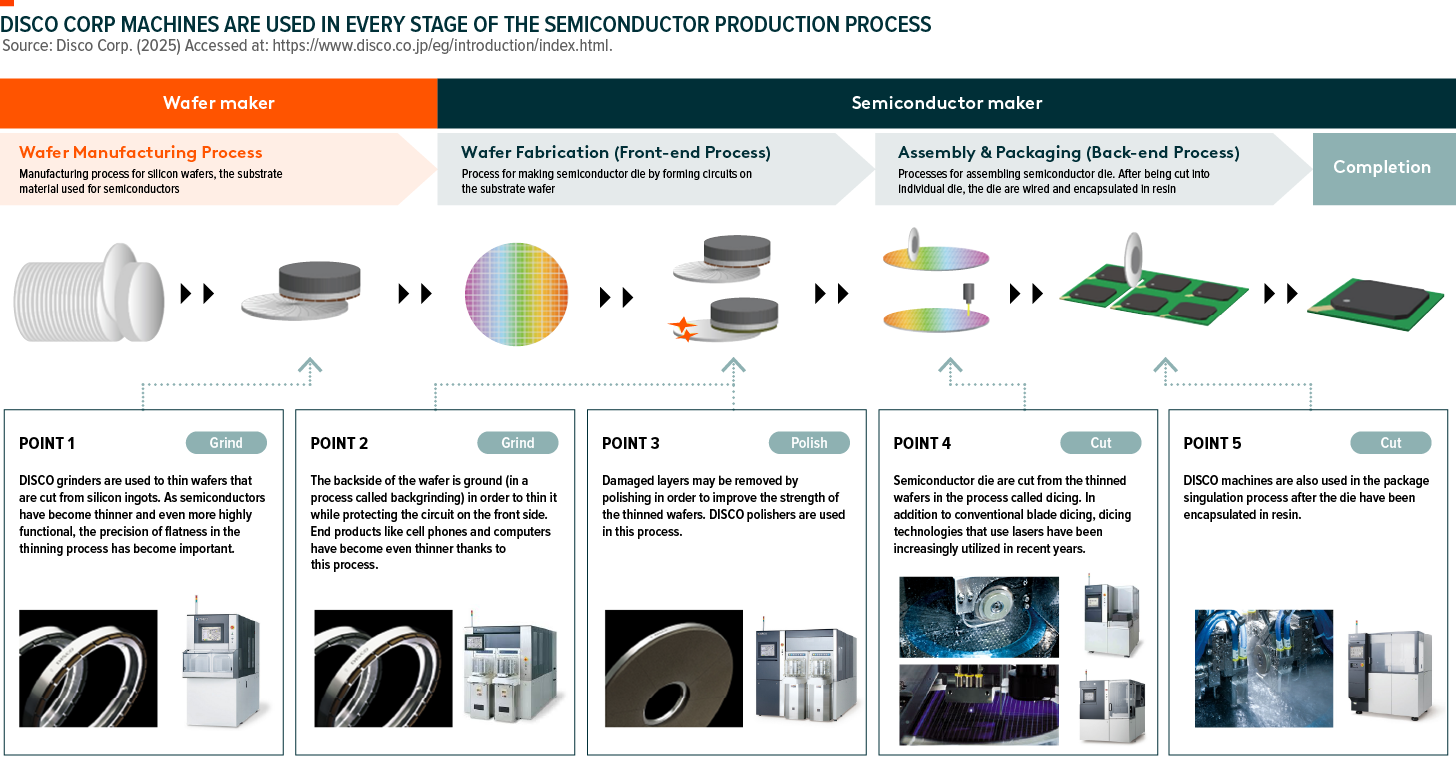

Disco Corporation is a Japanese precision-equipment manufacturer headquartered in Tokyo, best known for its critical role in the semiconductor fabrication process. Established in 1937 originally as a grinding-wheel and compact disc (CD) producer, the company has evolved into a global leader in wafer-processing technologies. Today, Disco commands a dominant share of the dicing and grinding equipment market – essential steps that allow silicon wafers to be cut, shaped, and prepared for use in integrated circuits.

Beyond its long industrial heritage, Disco differentiates itself through its proprietary blade and laser-dicing technologies, ultrafine grinding systems, and its highly defensible consumables business. These specialised tools enable chipmakers to maximise wafer yield, reduce material loss, and achieve ever-smaller geometries – advantages that become increasingly crucial as semiconductor nodes continue to shrink. Disco’s deep technical know-how and tight integration with leading foundries give it a competitive moat that is difficult for new entrants to replicate.

As the world becomes more dependent on high-performance computing, artificial intelligence, electric vehicles, and advanced consumer electronics, the demand for next-generation chips continues to accelerate. Disco sits at the heart of this megatrend: every increase in wafer complexity, miniaturisation, and production volume flows directly into higher utilisation of its equipment and consumables. For investors seeking exposure to the global semiconductor boom, Disco exemplifies the type of Japanese firm that provides differentiated access to major global megatrends; one tied not to cyclical chip pricing, but to the critical, high-margin processing technologies that enable the entire industry to advance.

Mitsubishi Heavy Industries: Nuclear Energy Heavyweight

Mitsubishi Heavy Industries (MHI) is one of Japan’s oldest and most diversified engineering groups, headquartered in Tokyo and with roots dating back to the late 19th century. While the company spans aerospace, maritime, defence, and industrial machinery, it has long been a central pillar of Japan’s nuclear-technology ecosystem. MHI designs and manufactures advanced nuclear reactors, turbines, steam generators, and critical components used across the global nuclear fleet. Its longstanding engineering heritage and deep institutional knowledge position the firm as one of the world’s most experienced and reliable nuclear-equipment suppliers.

What truly sets MHI apart is its unique vertical integration and technical breadth across the nuclear value chain. Unlike peers that specialise in just one segment of the reactor system, MHI’s capabilities extend from containment vessels and safety systems to fuel-handling equipment and long-term maintenance services.1 The company is also deeply involved in next-generation technologies, including advanced light-water reactor upgrades, modular system architectures, and Japan’s government-backed demonstration fast-reactor program.2 This engineering depth is further reinforced by the breadth of expertise required of their recent global contract wins, including:

ITER (France): Awarded additional units of divertor components for the world’s largest fusion-reactor project, cementing MHI’s role in ultra-advanced nuclear hardware.3

Sanmen Nuclear Power Plant (China): Secured orders to supply circulating-water pumps for Units 5 and 6 in collaboration with Dongfang Electric Machinery.4

Sizewell C (United Kingdom): Contracted to deliver multiple pump models, 34 units in total, for the UK’s next major nuclear-newbuild project through Trillium Flow Technologies.5

Japan Fast-Reactor Demonstration Project: Selected by the Japanese government to lead development of a next-generation sodium-cooled fast reactor, reaffirming its position at the forefront of advanced nuclear design.6

As governments worldwide revisit nuclear energy as a core pillar of the clean-energy transition, companies supplying reactor hardware and long-lifecycle engineering services are poised to benefit. MHI sits at the centre of this global nuclear-buildout megatrend: every new project, life-extension, and refurbishment requires the kind of specialised equipment and deep engineering expertise that the company has spent generations refining. For investors looking to participate in the resurgence of nuclear power, Mitsubishi Heavy Industries offers a compelling pathway through its indispensable role in enabling the expansion and modernisation of the world’s nuclear infrastructure.

Softbank Group: Capital Meets Vision

SoftBank Group Corp. is one of Japan’s most globally recognised conglomerates, headquartered in Tokyo. Founded in 1981 as a software distributor, the company transformed into a telecommunications and technology investment titan under the leadership of Masayoshi Son, whose aggressive vision has shaped the firm’s evolution. Today, SoftBank is best known for its influential Vision Funds and a portfolio that spans semiconductors, robotics, cloud infrastructure and next-generation software platforms, placing the firm at the centre of some of the world’s most transformative digital industries.

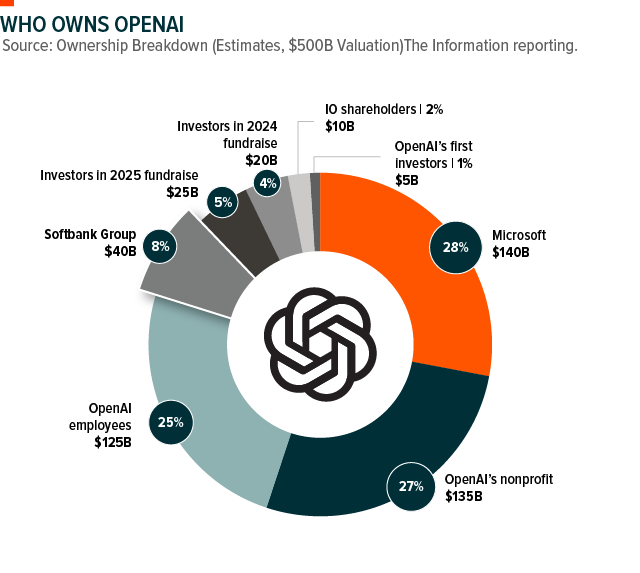

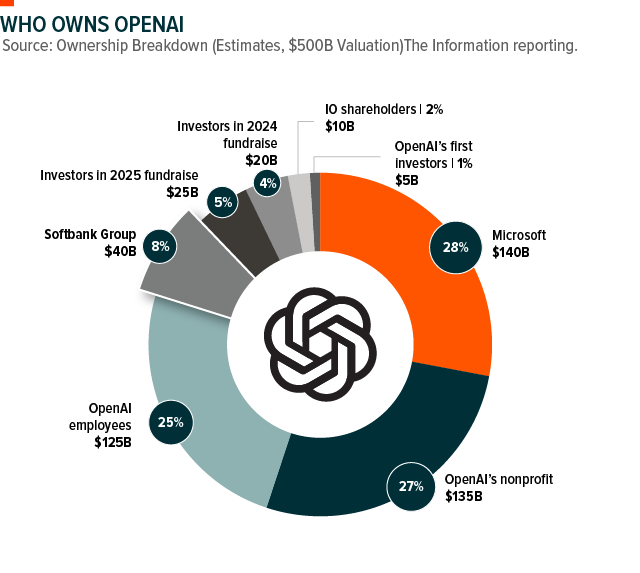

What sets SoftBank apart is its scale, its global reach and its willingness to invest in moonshot technologies ahead of mainstream adoption. While many investors favour incremental innovation, SoftBank seeks paradigm shifts. This is evident in its deep exposure to artificial intelligence, ranging from stakes in foundational semiconductor players and enterprise-AI startups to robotics and automation platforms that embed AI into real-world systems. The firm’s strategic asset in this ecosystem is its close association with OpenAI: SoftBank announced an agreement to invest up to USD 40 billion in OpenAI in a follow-on deal announced on April 1, 2025.7 That deal positions SoftBank among the only investors with meaningful direct exposure to OpenAI’s growth trajectory and gives it one of the most leveraged entries into the generative-AI frontier.

SoftBank’s vertical advantages don’t stop at OpenAI. Its ownership of Arm Holdings (via its stake) provides strategic access to the semiconductor architectures that increasingly underpin AI workloads.8 Meanwhile, its global Vision Fund invests across the AI stack, which helps create synergy.

With artificial intelligence now one of the defining megatrends of this decade, SoftBank is in a uniquely leveraged position. Every wave of AI adoption, from cloud-based model training to edge-device inference, to AI-enabled robotics, drives demand across multiple segments of SoftBank’s portfolio. For investors seeking exposure to the global AI boom, SoftBank offers a uniquely diversified, high-conviction portfolio of companies that play major roles in shaping the next era of intelligent technology. Its direct link to OpenAI further adds to its appeal as one of the few firms globally with meaningful exposure to the epicentre of the generative-AI revolution.

Investing in Japan

We believe Japan represents a uniquely compelling opportunity for investors, offering both a structural recovery story following decades of deflation and direct exposure to some of the world’s most significant megatrends, from semiconductors to nuclear energy and artificial intelligence.

For those seeking access to Japan’s largest and most liquid companies, the Global X Japan TOPIX 100 ETF (ASX: J100) provides a diversified avenue into the firms highlighted in this article, including Disco Corp, Mitsubishi Heavy Industries, and SoftBank.