ETF Express: Week Ending 3 November 2023

ETF Express is Global X’s weekly coverage of the latest ETF Market Moves, Thematic Spotlight and Commodity Calls.

- Risk-on and leveraged funds (CURE, CRYP, GGUS, HGEN, IPAY, LPGD, LNAS) rallied across the board last week as the US Fed decided to pause rates for the second meeting in a row. Markets now forecast US interest rates have peaked, increasing investor risk appetite and easing equity price pressure.1

- Precious metals (ETPMAG, ETPMPD, ETPMPM) were the poorest performers as markets stabilised. A positive earnings season, decreasing concern in the Middle East, and the fed rate pause have stifled flows into safe-haven assets.

- There were $637.2 million in reported inflows for the week, and only $144.7 million in outflows, marking a strong week of net inflows for the Australian ETF industry.

Download our weekly ETF monitor here.

Apple Earnings Disappoint on China Growth

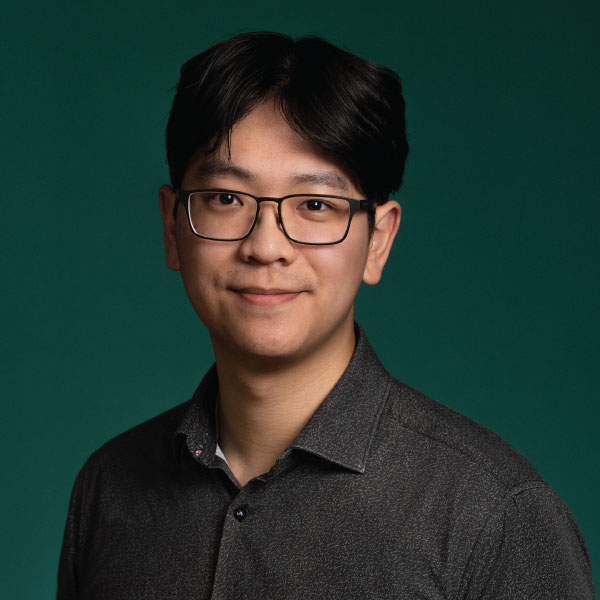

Technology and International Equities

Apple’s Q3 earnings had a mix of good, bad, and potentially ugly updates. The good news is both Apple’s revenue and earnings per share (EPS) beat analyst expectations, with the electronics giant making US$89.5 billion in sales for the quarter.2 The services sector of the business (e.g., Apple Pay, App Store) was also a highlight, growing at a healthy pace, up 16% year-over-year.3

The bad news comes as Apple posted its fourth consecutive quarter of annualised revenue declines – indicating people are opting to stay with old phones for longer in this harsh economic environment.4 More importantly, the earnings report also revealed sales growth was slowing in China. Chinese market sales are viewed as one of the most important growth areas for Apple and reported growth for Q3 missed estimates by more than 10%.5 The newly released iPhone 15 saw a 6% decrease in Chinese launch month sales year on year, and overall Apple shipments to China were down 4%.6 This comes as Huawei Technologies, a rival consumer electronics giant in China, grew domestic sales by 37% year-on-year and saw record sales figures for their new flagship smartphones Mate 60 and Mate 60 Pro.7

Apple currently receives roughly 20% of their revenue from China, second only to the US, but with strong competition cropping up, investors may be feeling uncertain about the company’s projected dominance in the Asian market.8 Apple’s share price fell 4.5% on its report after markets.9

Explore US Technology Titans with FANG.

Gold

Bullish

- Gold could rise as markets have begun to predict that US rates have peaked.10 The European Central Bank has also implied they are done with rate hikes, and some analysts believe rate cuts may be in play for early 2024.11

Bearish

- Market conditions have started to stabilise, which could potentially pull safe-haven demand away from precious metals. A positive US earnings season, decreasing concern around the Middle East, and rate pauses from central banks around the world, have seen investors increase their risk appetite.

Explore physical gold with GOLD.

Crude Oil

Bullish

- The world’s two largest producers of crude oil, Saudi Arabia and Russia, have confirmed they will continue voluntary oil output cuts through to the end of the year.12

Bearish

- The US Lower House has approved a plan to potentially tighten sanctions on Iranian oil. The sanctions will specifically target international ports and refineries that handle Iranian oil exports.13

- Crude oil prices fell last week as worries the Israel-Hamas conflict would impair Middle East supplies lessened.

Explore crude oil with BCOM.

Copper

Bullish

- South American mining operational issues have caused miners such as Southern Copper, Teck, and Anglo American to decrease their copper output predictions for the year.14

Bearish

- Stockpiles in LME and SHFE warehouses climbed last week, and demand weakened in power, transportation, and construction sectors.7 A patchy Chinese economic recovery also continues to raise concerns over demand stability.

Explore copper with WIRE.

Forecasts are not guaranteed, and undue reliance should not be placed on them. This information is based on views held by Global X or referenced sources as at 7th November 2023.