Everyone loves an extra scoop of ice cream. Two is good. But that third scoop? That’s the treat that makes your day. In the world of investing, vanilla is sometimes seen as plain and boring. But in our view, vanilla can be powerful and brilliant, especially when it’s low-cost and forms the core of your portfolio. The only question is: how many scoops do you need to be fully satisfied?

Australia’s Market - By The Scoop

When you tune into the finance section of the news and hear “the Australian share market rose today,” what does that actually mean? Most of the time, it refers to the top 200 companies on the ASX. That’s like getting two scoops of ice cream, which might be familiar and tasty, but could be missing the final layer of satisfying those taste buds.

At Global X, we think the real flavour comes with a third scoop.

The first scoop? That’s the top 100 companies – think large companies like BHP, CSL, and CBA.

The second scoop? The next 100 companies – solid but more mid-sized than their larger counterparts.

But the third scoop (i.e. the 201st to 300th largest companies) is where you’ll find some of the most exciting new ingredients. These are the potential rising stars and innovators of tomorrow, offering broader market exposure that can often fly under the radar.

That’s what the Global X Australia 300 ETF (ASX: A300) is all about. A300 tracks the top 300 Australian-listed companies on the ASX, giving investors a broader, more complete taste of the local market. Best of all, it’s like getting a third scoop of ice cream for the price of two - bigger market coverage without paying a cent more.1

Why Add the Extra 100?

While the top 200 Aussie companies often get all the attention, stopping there means missing out on a chunk of the Australian market.

A300 gives investors exposure to that broader universe, without dipping into more risky microcaps or illiquid names. The companies ranked 201–300 are still sizeable, liquid, and well-established. They include emerging leaders across sectors like tech, industrials, and consumer, names that have the potential to grow into tomorrow’s blue chips.

Over the past 10 years, more than 150 companies have graduated from the 201–300 bracket into the top 200.2 These include well-known names like Nick Scali, Lovisa, Xero, Netwealth, Hub24, and Pro Medicus, all of which started in the third scoop. By investing in the top 300 Australian ASX-listed companies, you’re getting exposure to the next wave of market leaders before they become household names.

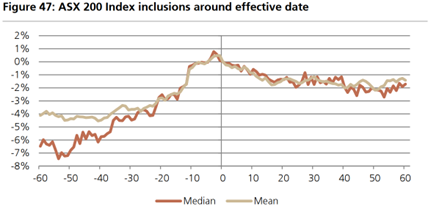

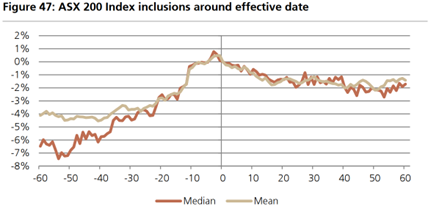

Research supports the notion of a “graduation effect,” where the outperformance of smaller companies tends to diminish once they are promoted into larger indices (e.g. graduating from the 201-300 to the 1-200).3 This phenomenon highlights the importance of gaining exposure early to smaller companies. Further, stocks often experience an initial price “pop” in the lead-up to inclusion in a larger index.

Source: UBS

Small Companies, Big Potential

It’s not just about having more companies, but also the mighty potential, as there’s a long-term investment case for allocating a part of investment portfolios to smaller companies. While they may come with more volatility, they’ve also historically demonstrated some periods of outperformance against their large-cap peers. Small and mid-caps tend to be more nimble, innovative, and better positioned to benefit from emerging economic trends.

While Australia’s largest banks have driven much of the market’s recent gains, that hasn’t always been the case. In fact, Australian small caps have outperformed large caps during several periods, including from 2003-2007, 2015-2018, and 2020-2021, highlighting the value of looking beyond just the top end of the market.

Broad, Balanced, and Low Cost

There’s a misconception that adding more stocks means you’re diluting quality. In reality, A300 is built on a similar rules-based foundation as the traditional top 200 companies, simply extending the exposure.

You still get the classic Aussie blue-chips to household names, but also benefit from greater diversification, more opportunity, and access to the broader tail of growth potential that exists further down the market capitalisation (i.e. size) spectrum. Best of all, A300 does this while remaining a low-cost, index-based solution, giving investors a scalable, long-term core to build portfolios around.

The Final Scoop

So, why settle for two scoops, when three scoops can give you a fuller experience without paying more? With A300, investors aren’t just getting more companies, they’re getting more opportunity. It’s a subtle but meaningful shift in how investors build a core Australian equities exposure. Think of it like upgrading your investment portfolio from plain vanilla to a deluxe extra scoop. It’s still a simple flavour, but richer, broader, and packed with the diversification your portfolio may need to fulfill those nourishing cravings.