Japan is experiencing one of its most meaningful shifts in decades. After years of low growth and deflation, the country is undergoing structural reforms, encouraging companies to lift profitability, improve governance and return more capital to shareholders. At the same time, Japan remains a global powerhouse in fields such as semiconductors, robotics, advanced manufacturing and next-generation energy technologies.

For many investors, this combination of reform, resilience and global relevance has renewed interest in Japanese equities. In this guide, we break down what makes the market unique, why investors are taking notice, and how an ETF can offer simple, diversified access.

Let’s X-Plain:

- What makes Japanese equities distinct?

- Why is Japan back on investors’ radars?

- What sectors and companies shape the Japanese market?

- How can investors access Japan through ETFs?

What Are Japanese Equities?

Japanese equities refer to companies listed on Japan’s major stock exchanges, primarily the Tokyo Stock Exchange (TSE). The TSE is one of the world’s largest equity markets and includes companies that have shaped global industries for decades.

What stands out about Japanese companies is their mix of strong global brands and high-tech expertise. Many everyday products, from gaming consoles to cars and consumer electronics, come from Japan’s most recognisable firms. Yet, the country is also a leader in advanced fields such as robotics, semiconductors and precision technology. For investors, this blend of familiar brands and world class innovation creates a corporate landscape that is both recognizable and strategically important in global markets.

Many of Japan’s leading companies also generate a substantial portion of their revenue outside Japan. This means investors are not only accessing the domestic economy but gaining exposure to global demand trends across the US, Europe and emerging markets.

Why Are Investors Looking at Japan

1. Corporate governance reforms are driving change

Over the past several years, Japanese regulators and the TSE have implemented policies encouraging companies to improve capital efficiency, lift return on equity and align more closely with global governance standards. Companies have responded by increasing dividends, conducting more share buybacks and simplifying corporate structures.

2. Japan is emerging from decades of deflation

After nearly 30 years of deflation, Japan is transitioning toward a more normal inflation environment. Stable inflation can benefit corporate earnings, support wage growth. A more balanced economic backdrop may also help re-rate Japanese equities, which have long been perceived as undervalued compared to their global peers.

3. Exposure to global megatrends

Japan remains a global leader in several high-growth, innovation-driven sectors:

- Semiconductors and precision materials, including companies supplying indispensable components to global chip manufacturers.

- Robotics and automation, where Japan is widely considered the world leader in industrial robotics.

- Advanced manufacturing, spanning aerospace, precision equipment and energy-efficient technologies.

- Electrification and mobility, including hybrid technologies, EV components and hydrogen infrastructure.

Many investors see Japan as a way to access these long-term themes in a stable, developed-market setting.

4. Diversification benefits

Japan behaves differently from the US and European markets due to its unique corporate culture, economic cycle and sector composition. Adding Japanese equities can help diversify a portfolio and reduce concentration in Western markets, especially for investors already heavily weighted toward US growth stocks.

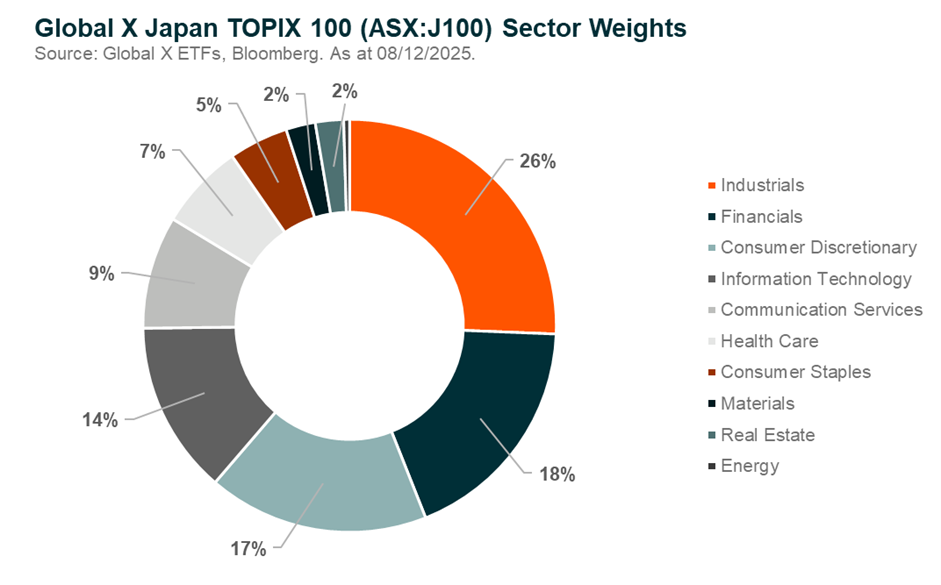

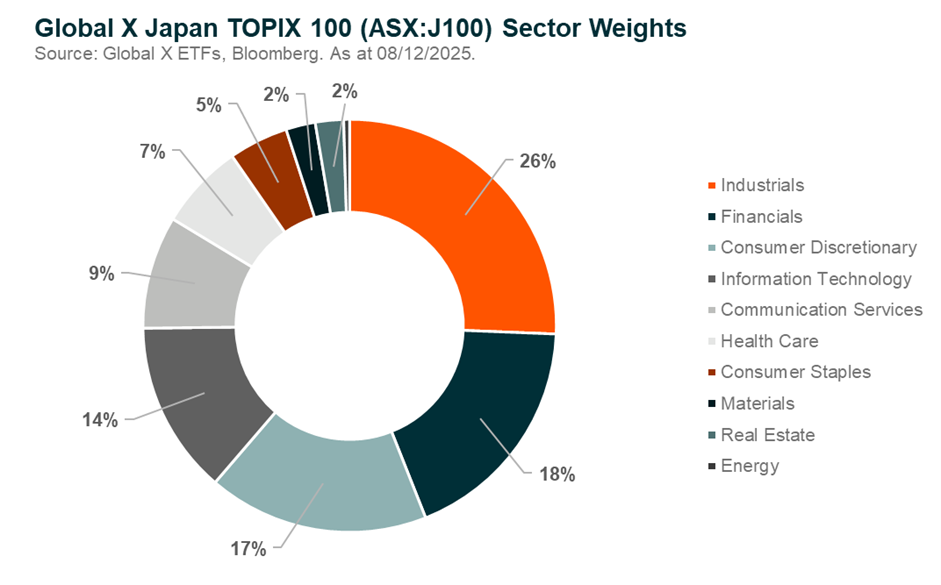

What's Inside the Japanese Market?

Japan’s equity market spans several major sectors, each home to some of the country’s most recognisable global brands. Below are a few of the most influential sectors in the market and the well-known companies that sit within them.

Industrials: Japan is widely known for its industrial strength, particularly in automation, machinery and precision engineering. Companies like Fanuc and Keyence are global leaders in factory robotics and automation systems, while Mitsubishi Heavy Industries is famous for its aerospace, defence and large-scale engineering projects. These firms help power global manufacturing and continue to drive Japan’s reputation for reliability and high-quality engineering.

Financials: Japan’s financial sector includes some of the world’s largest and oldest banking institutions. Names such as Mitsubishi UFJ Financial Group (MUFG) and Sumitomo Mitsui Financial Group (SMFG) are well known both domestically and internationally, providing banking, lending and investment services across Asia and around the world.

Consumer Discretionary: This sector includes many of Japan’s best-known global brands. Toyota, the world’s largest automaker, is synonymous with hybrid technology and manufacturing excellence. Sony and Nintendo also fall into this category, each famous in their own right: Sony for electronics and entertainment, and Nintendo for its globally loved gaming franchises. The sector also includes Fast Retailing, the parent company of UNIQLO, which has become one of the most influential apparel retailers in the world thanks to its focus on simple, functional and affordable clothing.

Information Technology (IT): Japan’s IT sector combines hardware expertise with components that power the global technology ecosystem. Companies like Tokyo Electron are key suppliers to the semiconductor industry, while Sony Group (via its semiconductor division) produces some of the world's most advanced image sensors used in smartphones and cameras.

Why can investors gain access to Japan through ETFs?

Buying Japanese shares individually can be difficult for Australian investors due to foreign brokerage requirements, currency considerations and limited access to Japanese listings. ETFs provide a simple alternative by offering diversified exposure through a single ASX-listed product.

Using an ETF to access Japan allows investors to benefit from:

- Instant diversification across Japan’s largest and most influential companies

- Cost efficiency compared with building an entire portfolio of individual shares

- Ease of trading during ASX hours

- Transparent holdings and consistent index tracking

One example is the Global X Japan TOPIX 100 ETF (ASX: J100). J100 provides exposure to 100 of the largest and most liquid Japanese companies, covering robotics, semiconductors, industrials, automotive innovation and financial services. For investors looking to incorporate Japan into a long-term portfolio, an ETF like J100 can offer straightforward and efficient access to Japan’s corporate leaders.