Most investors don’t struggle with knowing what to do. The real challenge is sticking to it. Investors may have heard the common saying “time in the market is better than timing the market” and know that we should invest for the long term, avoid emotional decisions, and keep costs down. However, in practice, the noise of markets and the temptation to “do something” or act on news/headlines often get in the way.

The good news? Investors don’t need a complicated strategy or perfect timing to succeed. Often, the simplest approach of owning the market through a broad-based ETF can help investors stay disciplined and avoid the behaviours that hold many back.

Why Investors Underperform the Market?

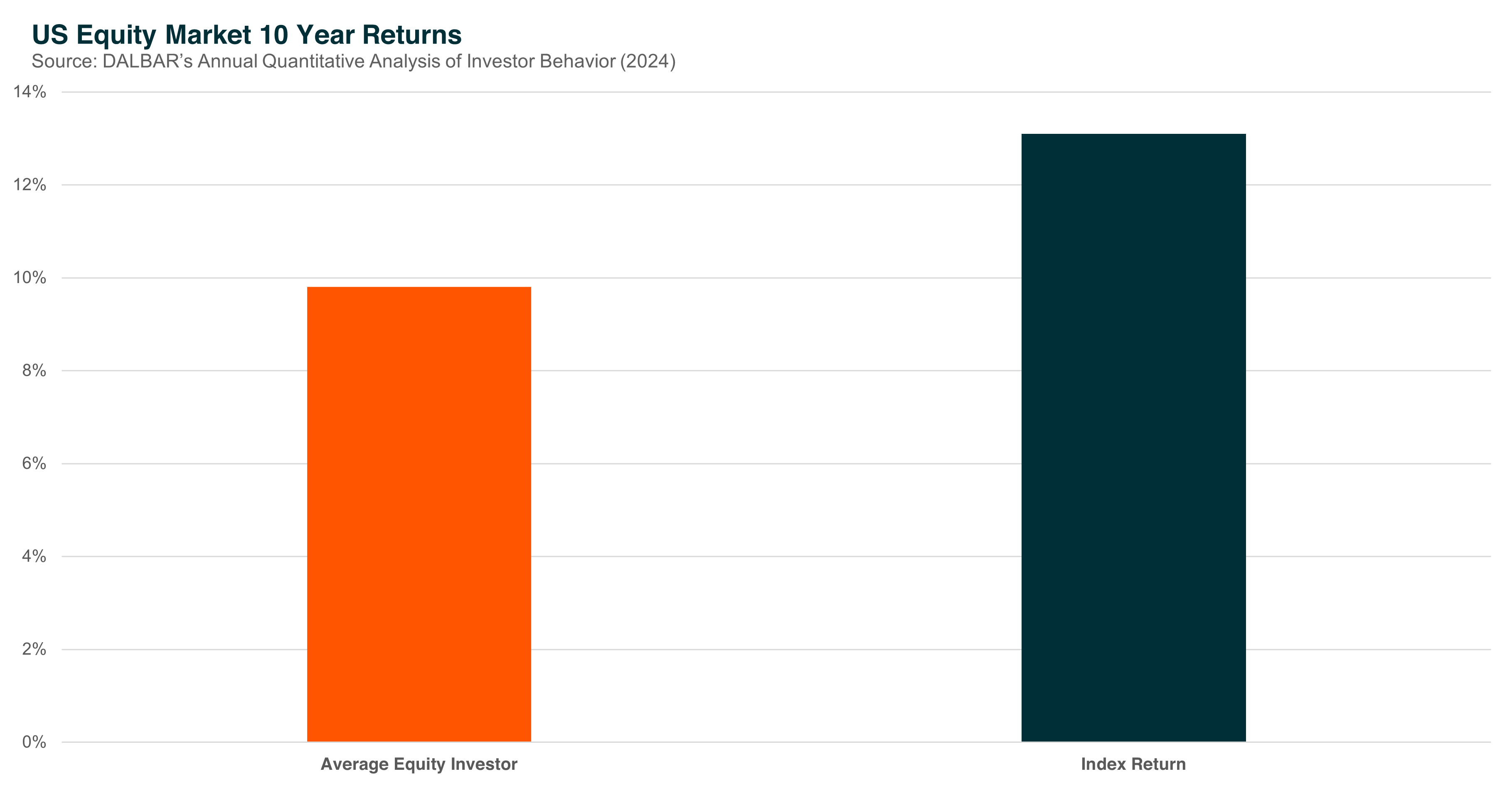

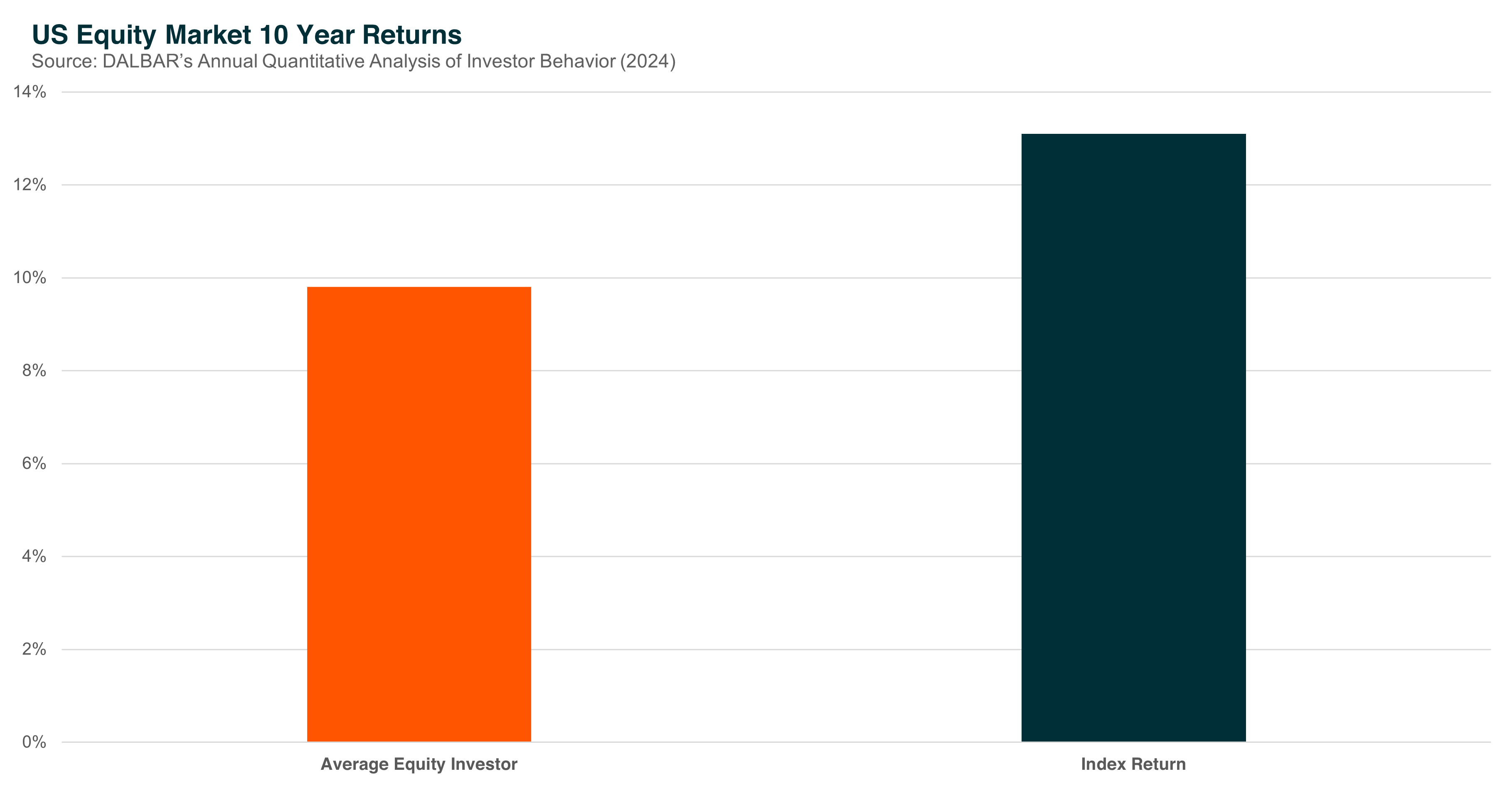

Decades of research show that investors often earn fewer returns than the funds they invest in. Morningstar found that investors frequently buy after strong performance and sell during downturns, leading to lower realised returns.1 Dalbar’s research shows a similar pattern: over long periods, the average investor underperforms the broader market by several percent a year due to poor timing and decision-making.

In other words, behaviour matters as much as the investments themselves. That’s why building good habits is key. The right investment helps, but it’s the discipline to stay the course that ultimately determines success.

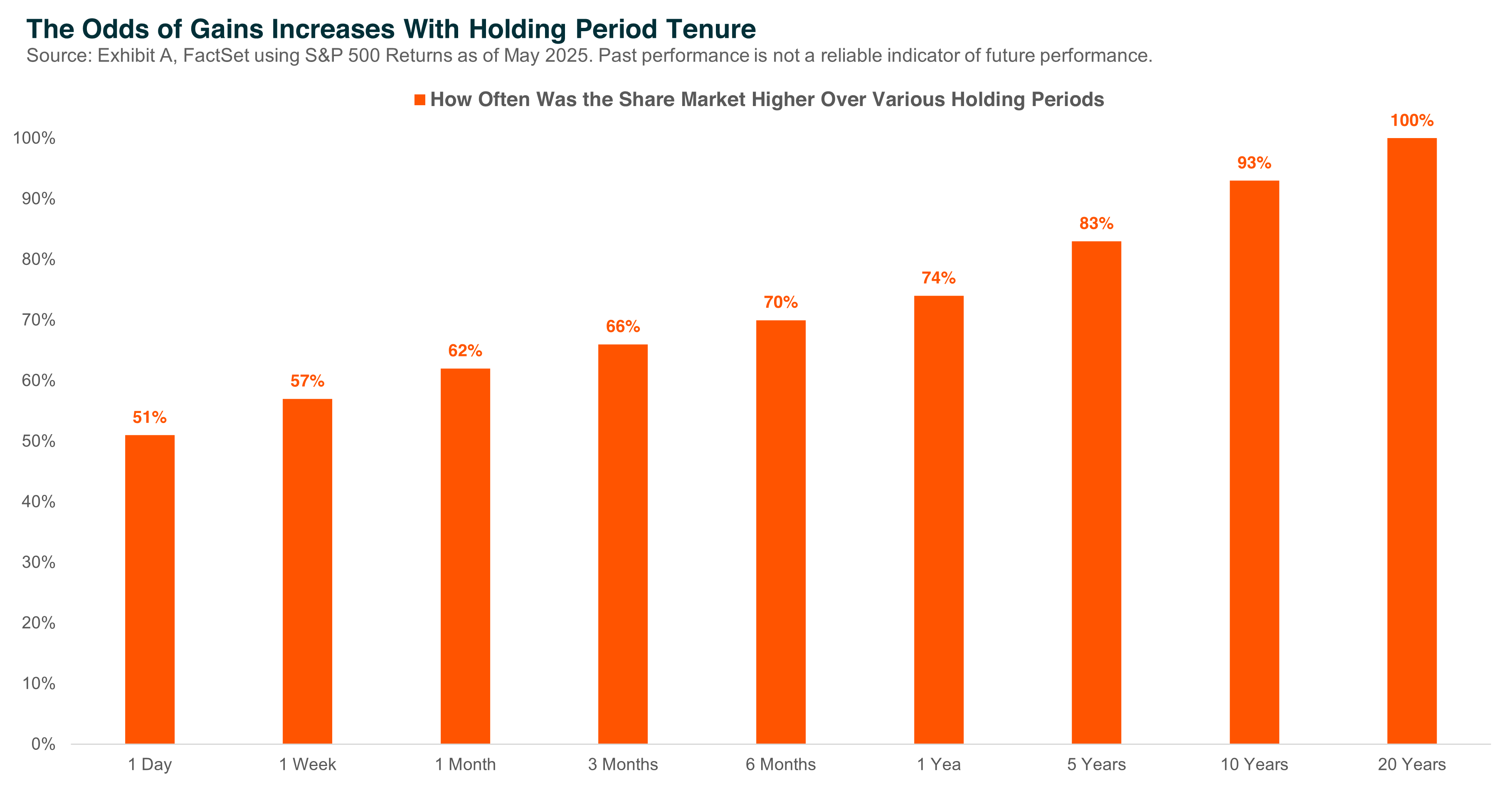

Think Long-term

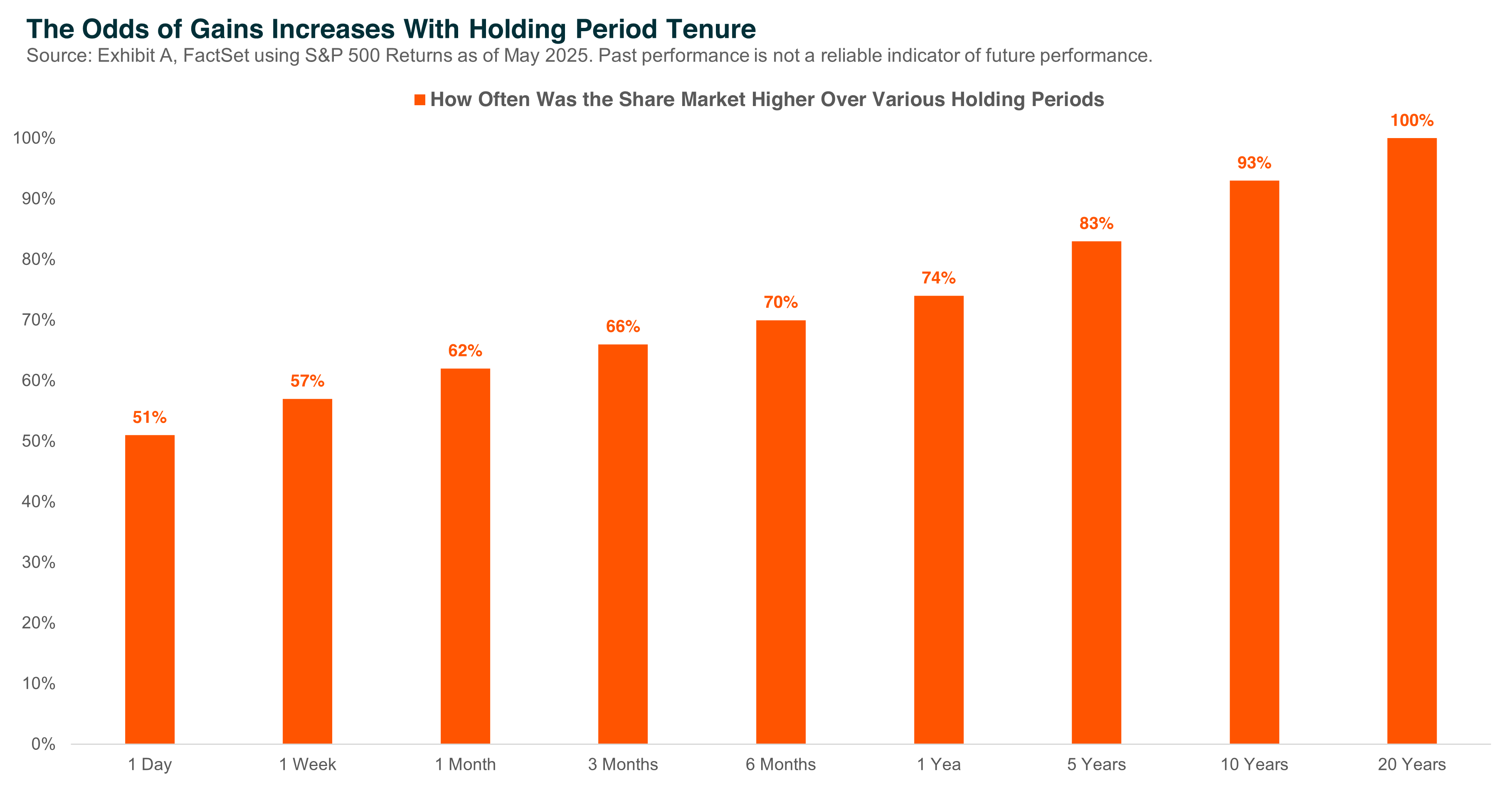

Markets can be volatile in the short run, but they’ve historically rewarded patient investors. Day to day, market movements are close to a coin toss on whether they are up or down, but the longer investors stay invested, the greater the odds tilt in favour of positive returns.

One of the best ways to harness this is through dollar-cost averaging, investing a set amount regularly, regardless of whether markets are up or down. This takes the pressure off trying to pick the “right” time. Often, the best time to invest is simply regularly. Reinvesting dividends can further boost returns by compounding gains over time.

Tune Out the Noise

Headlines, market chatter, and even social media can make it tempting to chase fads or panic during downturns. But often, the investors who stick with their plan through the ups and downs come out ahead. Staying invested through volatility, rather than reacting to every swing, is one of the simplest ways to protect long-term returns.

One famous anecdote by one of the largest share trading platforms in the world found that the most successful cohort of clients were those who forgot they had an account or forgot their passwords.2 By effectively “locking themselves out”, these investors avoided making emotional trades and let their money quietly compound.

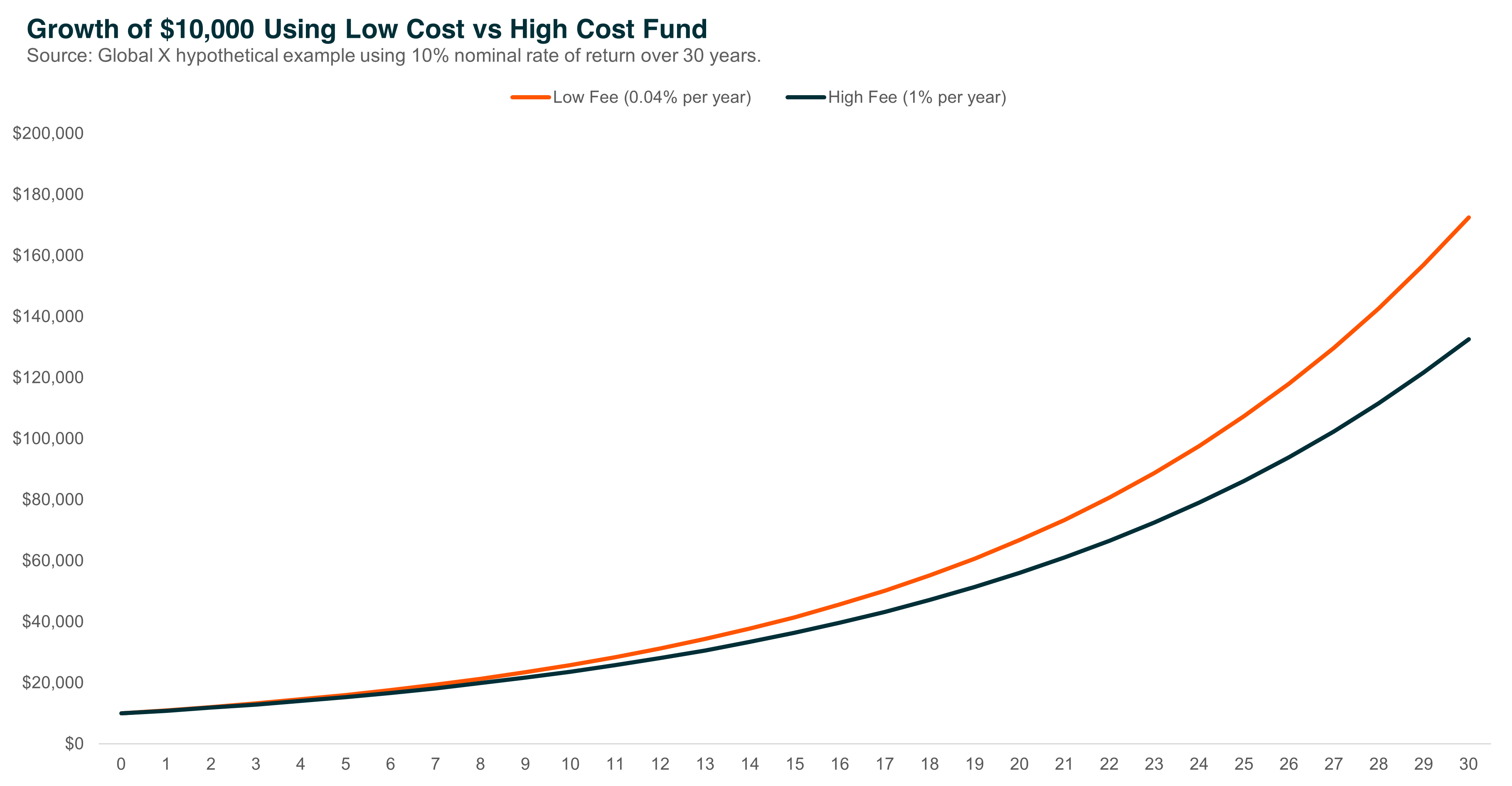

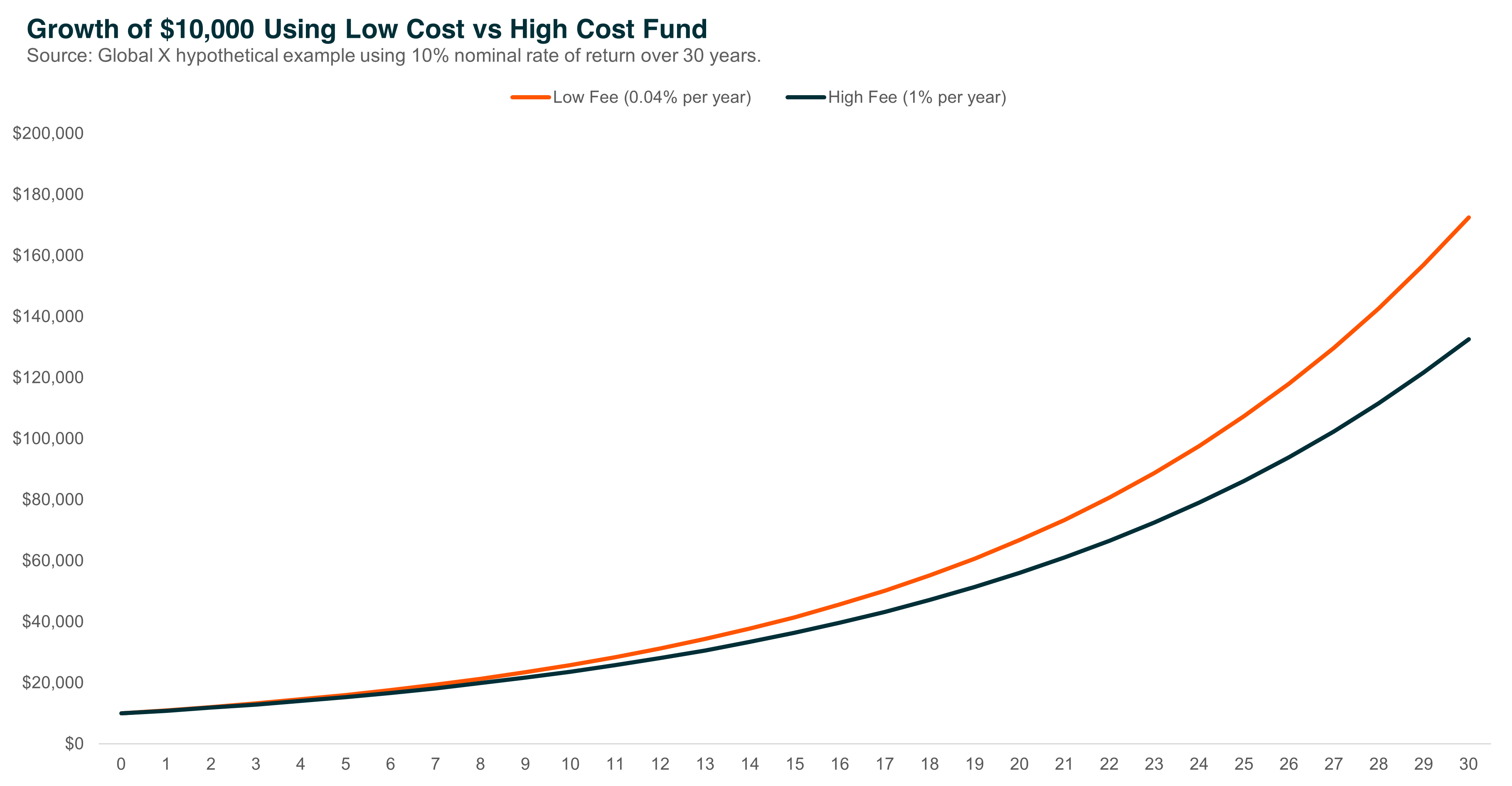

Avoid Unnecessary Fees

Unlike most things in life, in investing, you don’t get what you pay for. Higher fees don’t guarantee better outcomes. In fact, they’re one of the surest ways to eat into your wealth. Think of fees like termites: small, often unnoticed, but over time, they can cause real damage, eating into your returns.

ETFs like the Global X Australia 300 ETF (A300) are designed to be cost-effective compared with traditional managed funds or listed investment companies (LICs)3, helping you keep more of your money working for you.

Diversify with One Trade

Diversification is another hallmark of smart investing. A300 makes it simple, giving you exposure to 300 of the largest ASX-listed Australian companies in one trade. Rather than betting on a handful of stocks or sectors, you’re buying the market itself, spreading risk and smoothing returns over time. Instead of paying brokerage on all of the individual trades, A300 gives you instant exposure to hundreds of companies in one cost-effective transaction.

It also helps avoid the pitfalls of stock picking. Research shows that only around 4–6% of companies generate the bulk of long-term market wealth.4 By owning the market through an index ETF like A300, you automatically capture those winners, without needing to predict who they’ll be.

The Bottom Line

Becoming a better-behaved investor isn’t about predicting what markets will do next. It’s about creating habits that help you stay the course: think long term, invest regularly, ignore the noise, minimise fees, and diversify.

With a tool like the Global X Australia 300 ETF (A300), those habits are easier to build and easier to stick with. Sometimes the smartest strategy is also the simplest - buy the market, and let time do the work for you.