The Global X Australia 300 ETF (ASX: A300) offers investors exposure to a broader spectrum of Australian companies, encompassing the top 300 Australian companies listed on the ASX. This expanded coverage includes 100 additional companies beyond the traditional ASX 200, providing access to emerging sectors and innovative businesses.

We delve into four such companies that, as at 18 August 2025, are not currently in the top 200 companies in Australia but are part of the broader top 300: DroneShield, Catapult, Domain Holdings, and oOh!media Ltd.

DroneShield (ASX: DRO) – Market Cap: $2.9b

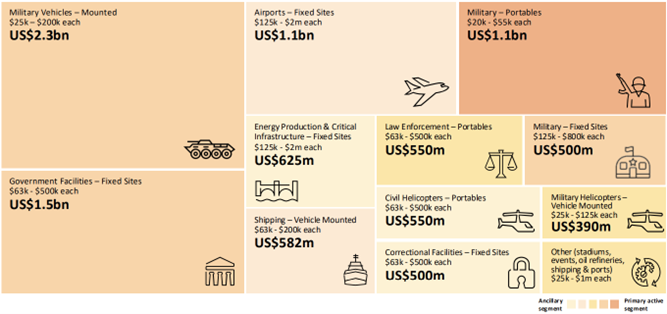

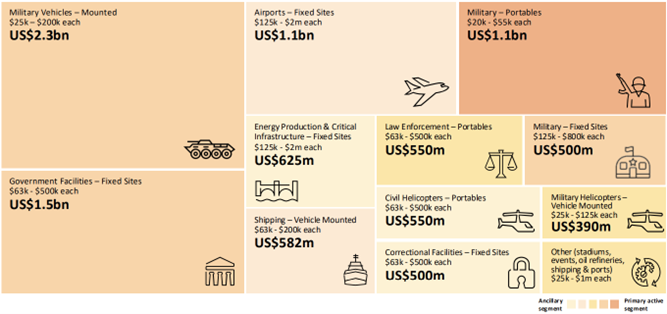

Founded in 2013, DroneShield is an Australian technology company specialising in counter-unmanned aerial systems. The company develops hardware and software solutions designed to detect, track, and neutralise drones that may pose risks to critical infrastructure, military operations, and public events. Its offerings include radio frequency sensing devices, AI-enabled threat detection, and electronic warfare systems, enabling clients to secure airspace across commercial, government, and defense sectors. DroneShield is key player in the counterdrone market, estimated to be worth US$10 billion globally (see chart below).

Source: DroneShield 2Q25 Results Investor Presentation (July 2025)

DroneShield has been a market-darling standout, being the best performing stock in the top 300 companies in Australia, with its share price soaring more than 400% since the start of 2025 compared to 12% for the broader Australian share market.1 This remarkable rise reflects a combination of factors, including growing global demand for counter-drone solutions and a surge in repeat orders from both government and commercial clients. Investors have also been responding to DroneShield’s expanding international footprint across regions including North America, Europe, and Asia, combined with the growing strategic importance of drone mitigation technology in an era of rising security concerns. With NATO members committing to increase spending from 2% to 5% of GDP on defense, and placing greater focus on emerging threats, the company has been positioned as a key player in the global defence technology market.

Catapult (ASX: CAT) - Market Cap: $1.7b

Established in 2006, Catapult provides elite sports performance analytics to teams, leagues, and athletes worldwide. By combining wearable technology, video motion analysis, and AI-driven insights, Catapult helps organisations optimise performance, reduce injury risk, and make data-driven coaching decisions. Its client base spans thousands of professional sports, including the AFL, NBA, Premier League Football, F1 and NFL, positioning the company at the forefront of sports tech innovation.

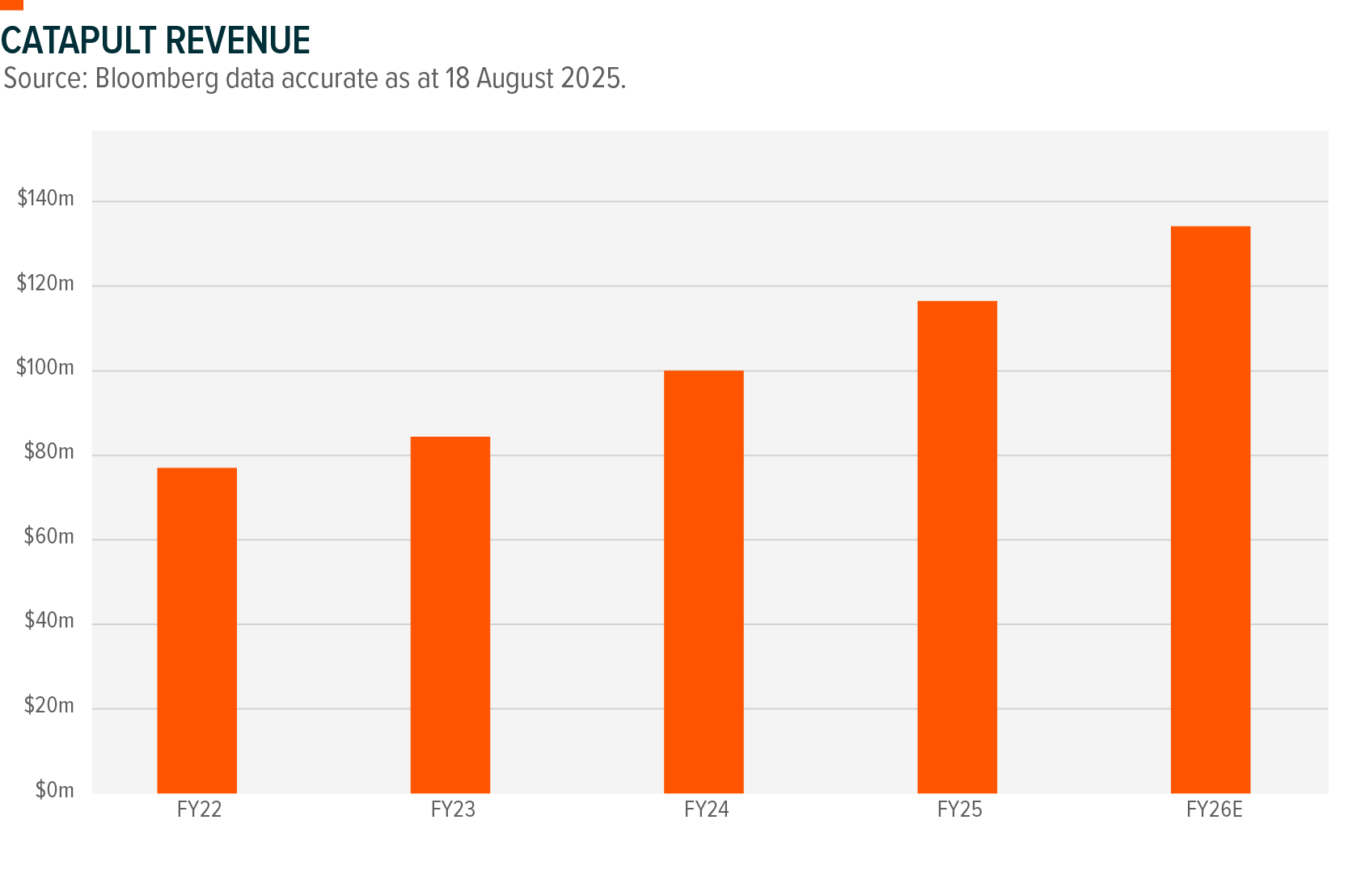

Source: Catapult U.S. Investor Roadshow Investor Presentation (December 2024)

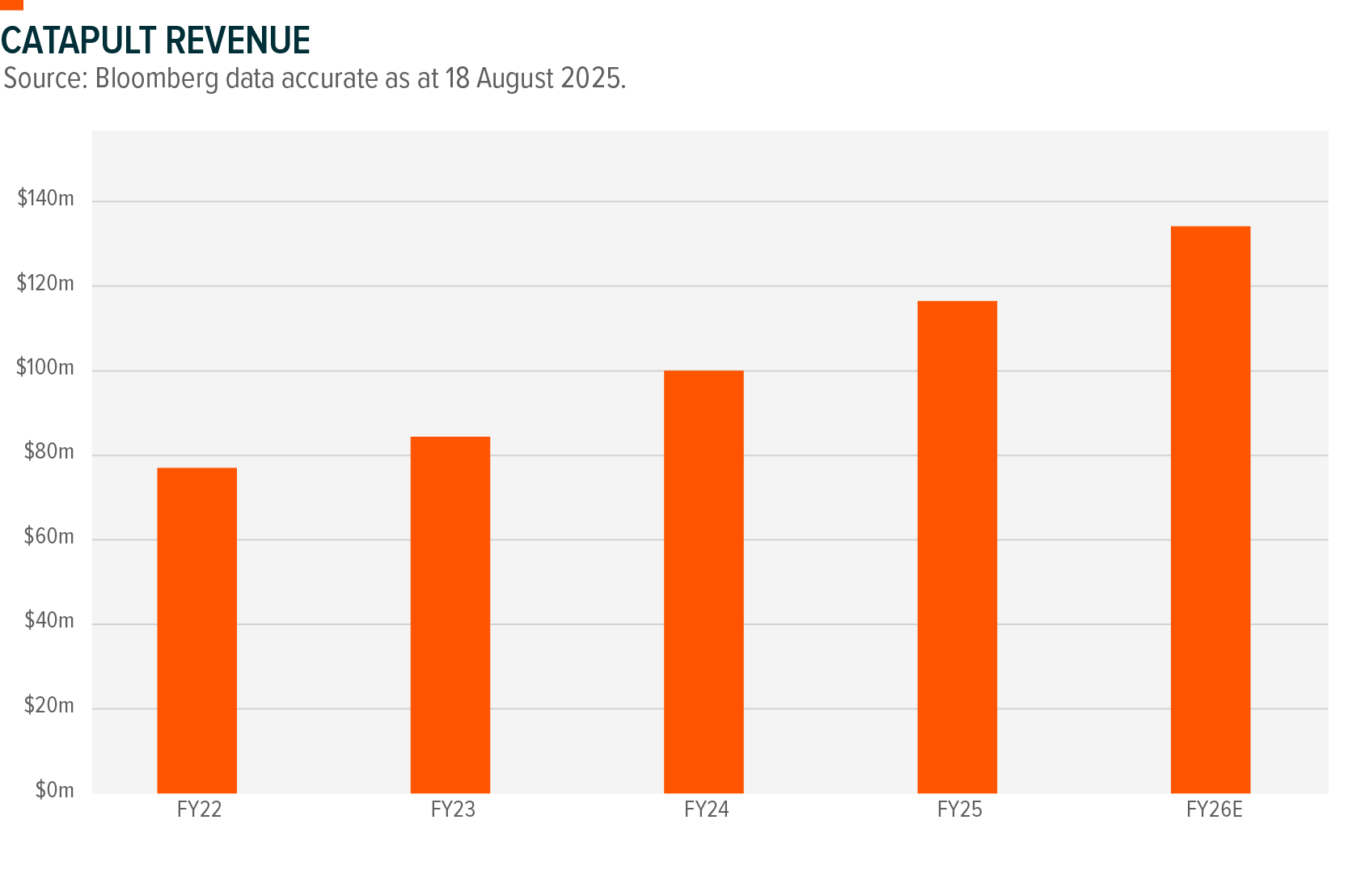

Catapult operates primarily on a software-as-a-service (SaaS) model, after transitioning to a full SaaS business in 2021 with subscription revenue now accounting for 92% of total revenues2, complemented by the sale of wearable devices and analytics platforms. The recurring subscription model ensures predictable revenue while allowing for expansion into new sports and geographies. The company has delivered consistent double-digit year-on-year revenue growth, supported by strong gross margins of 79% and positive free cash flow.

This highlights both the scalability of its business model and the growing market adoption of its solutions, further reinforced by long-standing customer relationships averaging more than seven years.

Domain Holdings Australia Ltd (ASX: DHG) - Market Cap: $2.8b

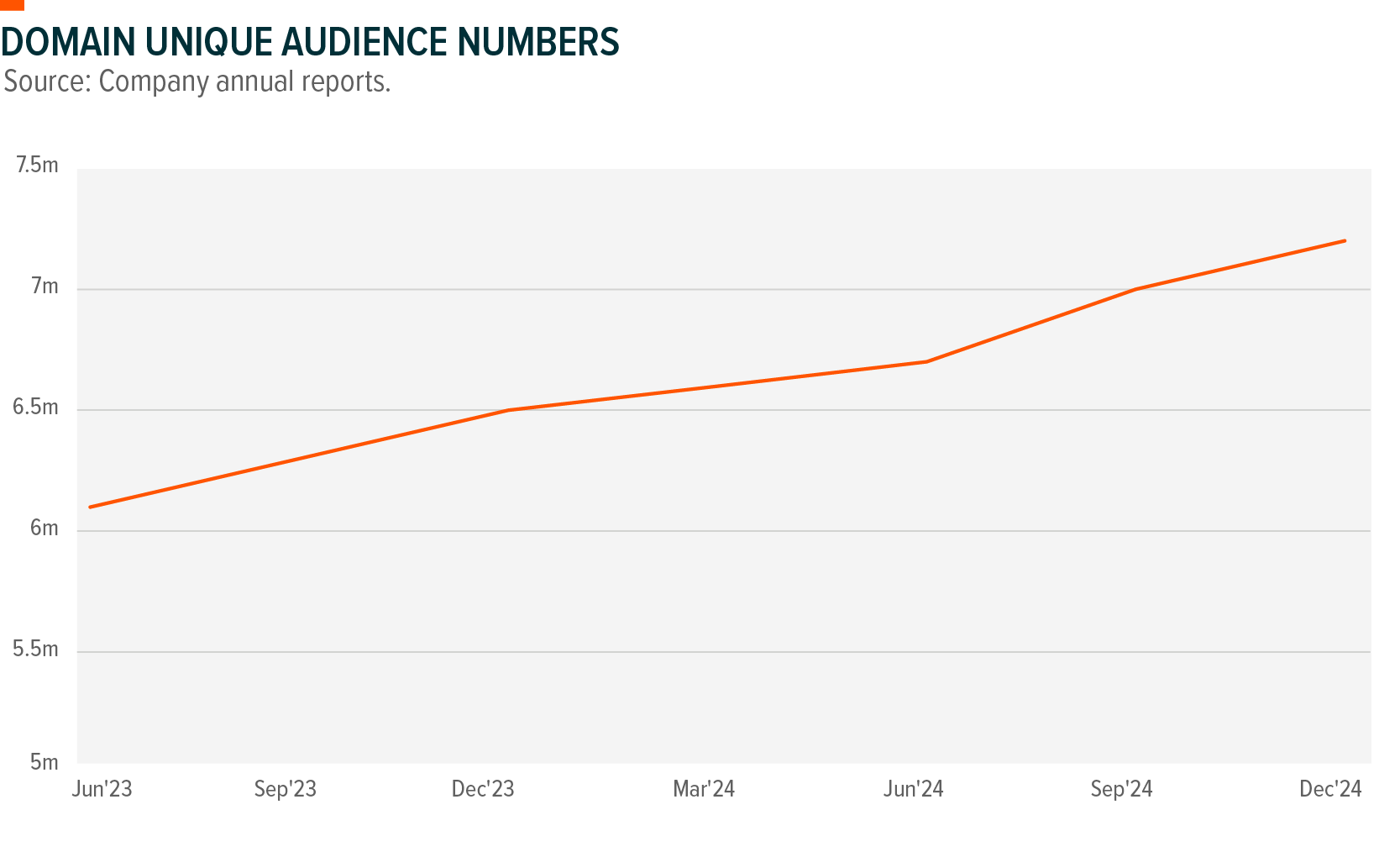

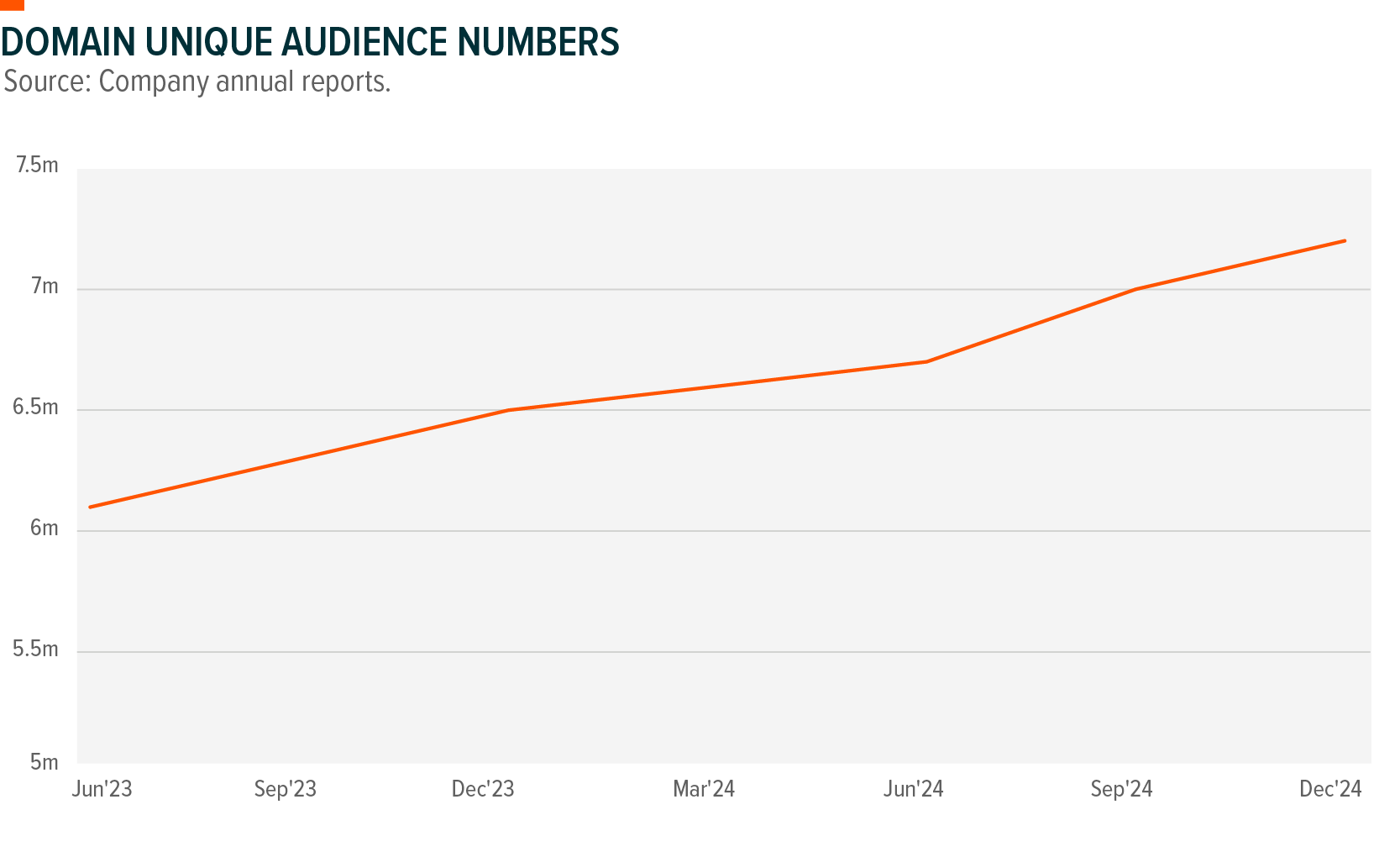

Domain Holdings, launched in 1999, is a leading digital real estate platform in Australia. It operates key consumer-facing websites providing property listings, data analytics, and advertising services to real estate professionals, developers, and consumers. The company plays a central role in how Australians search, buy, and sell property, bridging technology and traditional real estate markets. Given the sheer size of the Australian property market, valued at around $12 trillion3, Domain sits at the centre of an effective duopoly with REA Group, making it an essential gateway for how Australians search, buy, and sell property. Domain draws in more than 7 million Australians every quarter on its platform - that’s nearly one in three adults across the country.4

Domain generates revenue mainly through advertising services, premium listings, and data-driven solutions. Its digital-first model continues to attract new users while deepening relationships with real estate professionals, reinforcing Domain’s position as a key player in Australian property technology. This strategic importance was highlighted when global real estate data giant CoStar made a takeover bid, which saw Domain’s share price rise on the news.5 With strong market position, valuable data assets, and continued investor interest, Domain remains well-placed to capture growth in Australia’s digital real estate landscape.

oOh!media Ltd (ASX: OML) - Market Cap: $0.9b

oOh!media is an Australian out-of-home (OOH) advertising leader, delivering campaigns across roadside, retail, transit, and digital networks. Founded in 1989, the company has evolved from traditional billboard advertising into a fully integrated, tech-enabled OOH platform, offering clients data-driven insights and dynamic media solutions. Its diverse portfolio includes digital displays in high-traffic locations, connecting advertisers with consumers in real-world environments.

Chances are, the next time you glance at a billboard, bus stop, or digital screen, it’s powered by Ooh!media – bringing brands to life right where people are looking the most.

Source: Ooh!media Limited 2025 Half Year Presentations (August 2025)

Despite challenges in certain international markets, the company continues to benefit from the recovery of the advertising industry and the increasing importance of location-based digital campaigns. Revenue comes from advertising sales, with growth supported by long-term client contracts and expanding digital offerings. The company now commands a 16.5% market share of agency media (up from 11% in 2021) and is Australia’s largest and most diverse network with over 35,000 assets.6

With its robust digital infrastructure, strategic expansion into premium locations, and a data-driven approach to campaign effectiveness, oOh!media is poised to capitalise on the growing demand for targeted, measurable OOH advertising, reinforcing its position as a leader in the Australian market.

Go Broader with A300

While the ASX 200 covers the largest and most familiar Australian companies, the Global X Australia 300 ETF (A300) provides exposure to a broader market universe, including the 201st to 300th largest companies. These additional 100 companies often include emerging leaders, innovative businesses, and potential future blue chips that may not yet feature in the top end of the market.

By investing in A300, investors gain diversified exposure across a broader spectrum of well-established Australian companies. This approach offers the potential to capture growth opportunities beyond the largest caps, enhancing portfolio diversification while maintaining a low-cost, rules-based core investment in the Australian equity market.

Related Funds

A300: The Global X Australia 300 ETF (ASX: A300) provides investors with exposure to the largest 300 Australian companies listed on the ASX.