The Global X S&P Australia GARP ETF (ASX: GRPA) offers investors exposure to around 50 quality Australian companies that combine strong growth potential with attractive valuations. While the Australian market is often seen as income-focused rather than growth-oriented, this article highlights four companies currently in the GRPA portfolio (as of October 2025) that are successfully expanding their revenue and earnings, yet remain compellingly priced from a valuation perspective.

Netwealth (ASX: NWL)

Founded in 1999, Netwealth is a leading Australian wealth management platform provider offering superannuation and investment solutions, along with administration and reporting for investors and advisers. Platform providers such as Netwealth enable financial advisers to run their businesses more efficiently. As one of the few independent platforms not tied to the major banks, Netwealth has seen strong inflows, with funds under administration now exceeding $120 billion.1 While its overall asset market share remains around 9%, largely reflecting the dominance of legacy platforms, Netwealth has captured around half of net flows into Australian platforms over the past year, highlighting its growing influence in the market.

Past performance is not a reliable indicator of future performance.

Netwealth is strongly trusted by the financial community in Australia and was rated as the top platform provider for overall satisfaction for 11 consecutive years.2 It is a highly profitable business with strong margins and high levels of recurring revenue, without any debt and has strong cash reserves on its balance sheet. Its high growth and efficient business model have helped it achieve the “Rule of 40” with its 27% YoY revenue growth and 50% EBITDA margins3, underscoring why Netwealth continues to be a standout growth player in the Australian share market.

Wesfarmers (ASX: WES)

Founded in 1914 as a Western Australian farmers’ cooperative, Wesfarmers has grown into one of Australia’s largest and most diversified conglomerates. Today, the group owns and operates a portfolio of well-known and trusted household brands, including Bunnings (which accounts for over half of the group’s earnings), Kmart, Target, Officeworks, and Priceline, spanning retail, industrial, and healthcare sectors.

Source: Wesfarmers

Wesfarmers has consistently grown both its revenue and earnings, while maintaining an impressive return on equity (ROE) of 34%, almost three times the broader market, highlighting its strong ability to generate substantial profits from shareholder capital and efficiently reinvest earnings to drive long-term value creation.

Past performance is not a reliable indicator of future performance.

Ramelius Resources (ASX: RMS)

While many Australian investors may be more familiar with major gold producers such as Evolution Mining and Northern Star, looking further down the market capitalisation spectrum can reveal hidden mid-cap gems through a GARP investing lens. One such example is Ramelius Resources, an Australian gold producer involved in the exploration, development, and operation of mining projects, with key assets at Mount Magnet, Edna May, and several other sites across the country.

Ramelius Resources embodies the key qualities of a GARP stock – delivering consistent double-digit revenue growth, upgraded earnings forecasts, and maintaining robust margins and returns on equity, all while trading on a compelling single-digit earnings multiple.

Past performance is not a reliable indicator of future performance.

With expanded exploration budgets targeting high-quality deposits, strong cash flows (especially when normalised for the level of production), and one of the highest dividend yields in the gold sector, Ramelius is well positioned to potentially benefit from record gold prices and unlock further production growth.

Past performance is not a reliable indicator of future performance.

Qantas (ASX: QAN)

Founded over 100 years ago, Qantas is Australia’s flagship carrier and one of the world’s oldest continuously operating airlines. Known as “The Flying Kangaroo,” Qantas operates a diversified aviation business that includes domestic, international, and freight services, as well as loyalty programs through Qantas Frequent Flyer and Qantas Business Rewards.

Past performance is not a reliable indicator of future performance.

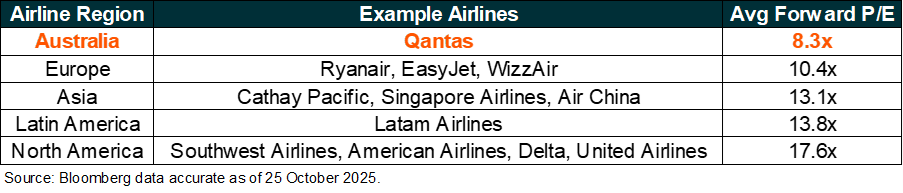

Despite the cyclical nature of the airline industry, Qantas has managed to deliver steady earnings growth through cost discipline, fleet renewal, and a strategic focus on its high-margin Loyalty division. Its balance sheet has strengthened significantly post-pandemic, with strong cash generation and a disciplined capital management framework. Meanwhile, Qantas is trading at an average valuation multiple discount of up to half relative to other global airlines.

Looking ahead, Qantas is well-positioned for sustained growth as travel demand normalises and expands. The airline’s ongoing “Project Sunrise” initiative aims to launch non-stop long-haul flights connecting Australia directly to major global cities such as London and New York, opening new revenue streams and reinforcing its global brand leadership. Their dual-brand strategy of Qantas and Jetstar, alongside strong loyalty growth (since 2018, loyalty member growth has reached 17.6 million with a CAGR of 5.2% p.a.)4 and disciplined cost management driving improved profitability, underscores why Qantas remains a compelling example of a GARP investment within the Australian market.

Bringing Value-Disciplined Growth to Australia

By combining the principles of growth, quality, and value, investors can uncover opportunities that deliver sustainable earnings expansion while remaining disciplined on price. While scrolling through the entire Australian stock universe to find these types of companies can be time-consuming and cumbersome, using an exchange traded fund (ETF) such as GRPA allows investors to take a structured and systematic approach to Australian equity investing, focusing on companies that fit a GARP profile in a disciplined and cost-effective way.

Source: Wesfarmers

Source: Wesfarmers