The Nifty 50 Index reflected a complex interplay of domestic fundamentals, global cues, and corporate earnings performance during the Q4FY25 earnings season. The quarter unfolded against a strong domestic macroeconomic backdrop, though it was tempered by persistent global uncertainties — including volatility in crude oil prices, geopolitical tensions, and shifting expectations around US Federal Reserve rate actions. On the domestic front, while inflation remained within the RBI’s comfort zone, consumption demand stayed subdued, with volume growth across most companies limited to low- to mid-single digits. Although rural consumption showed moderate improvement, urban demand remained weak. These factors set the tone for a muted earnings season, where expectations were already modest.

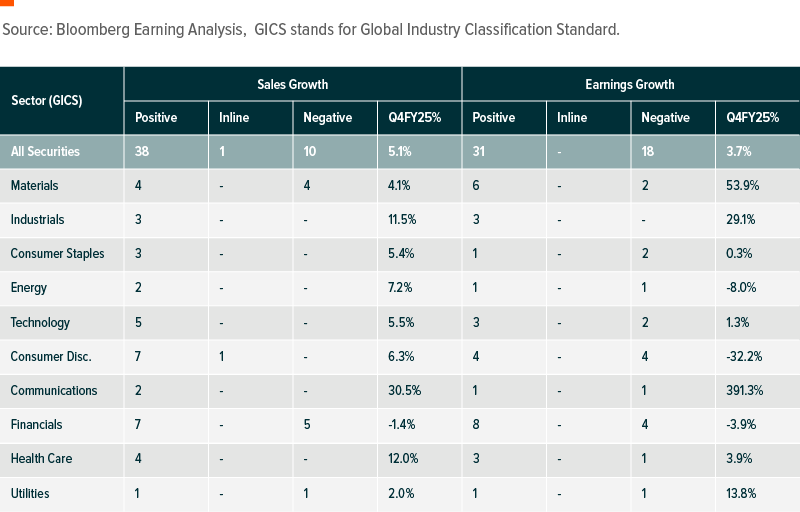

The Q4FY25 earnings season came muted as expected with low single digit earnings growth. The Nifty 50 companies have collectively posted around 3% year-on-year (YoY) net profit growth and 7% EBIDTA Growth (YoY). Nifty 500, a combination of Large, Mid and Small cap companies, posted PAT growth of 9% (YoY) and EBIDTA growth of 11%. Earnings for the quarter were primarily driven by key sectors such as Metals (+47% YoY), Public Sector Banks (+13% YoY), Healthcare (+46% YoY) and Telecom (loss-to-profit), contributing positively. In contrast, Automobiles (-22% YoY), O&G (-4% YoY), and Private Banks (-3% YoY) dragged overall earnings. The earnings performance of Nifty-500 companies was led by Midcaps in both 4QFY25 and FY25. The aggregate earnings of Nifty-100, Nifty Midcap-150, Nifty Smallcap-250 grew 5%, 29% & 8% YoY respectively in 4QFY25. 1

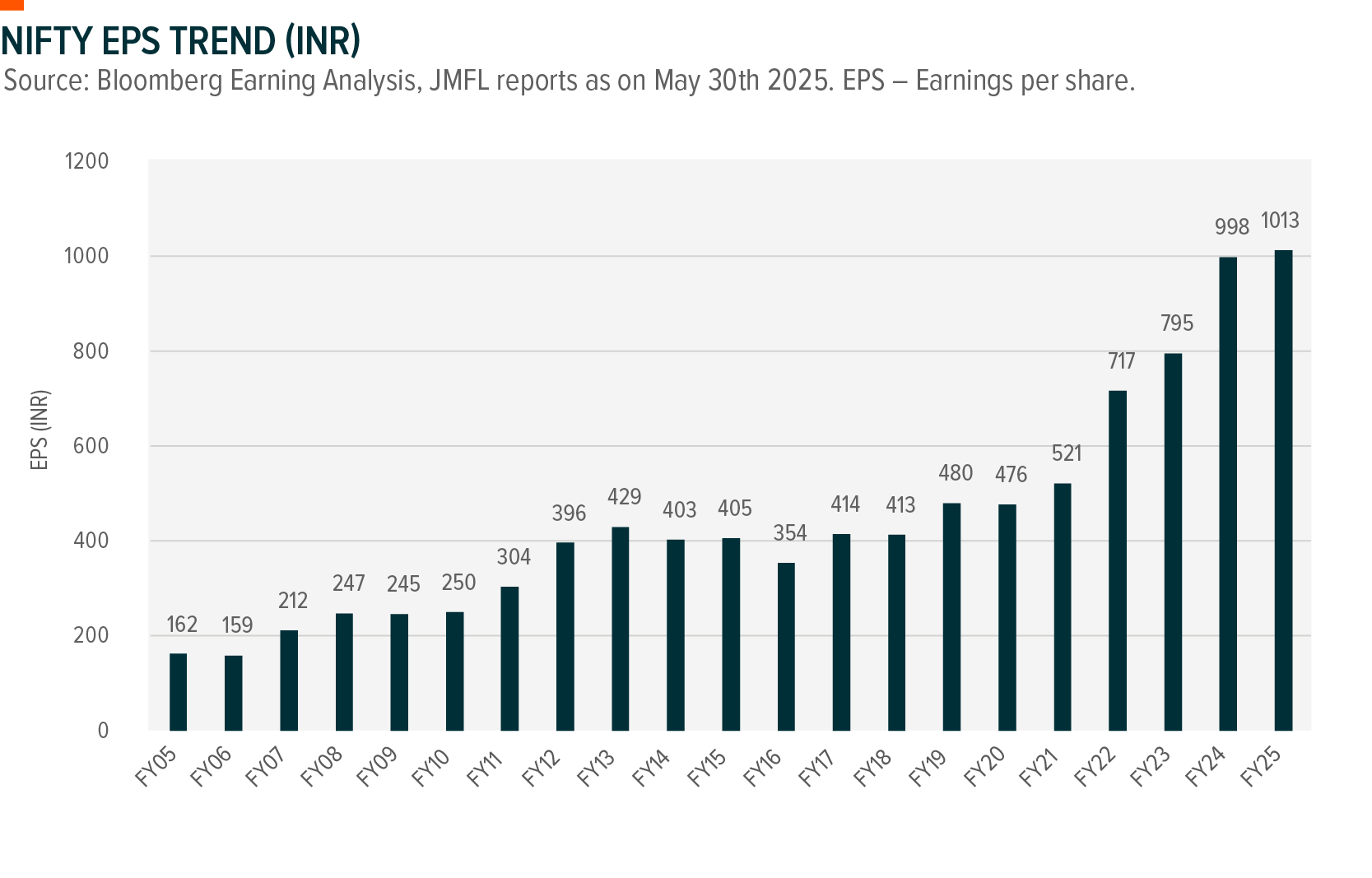

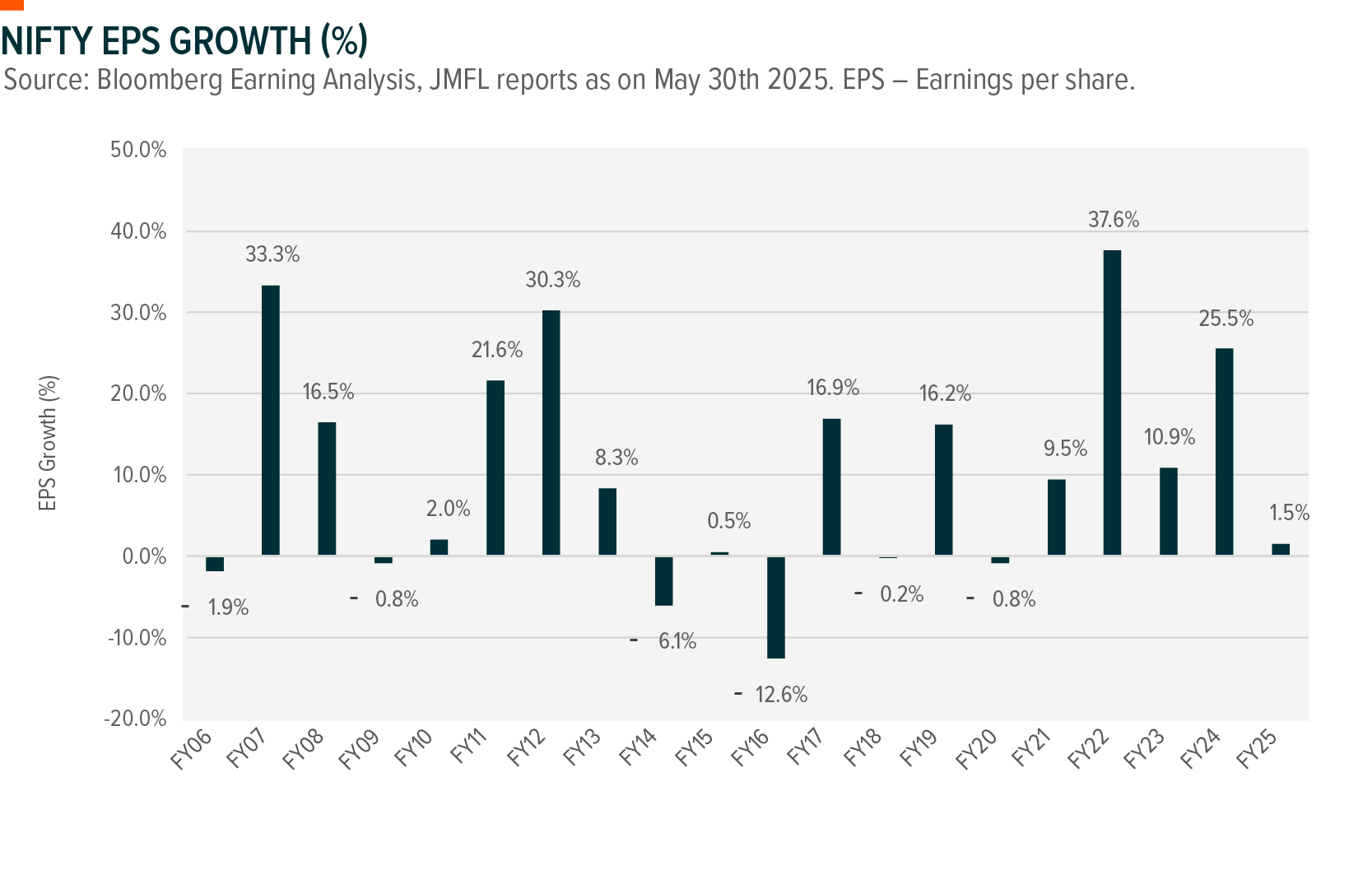

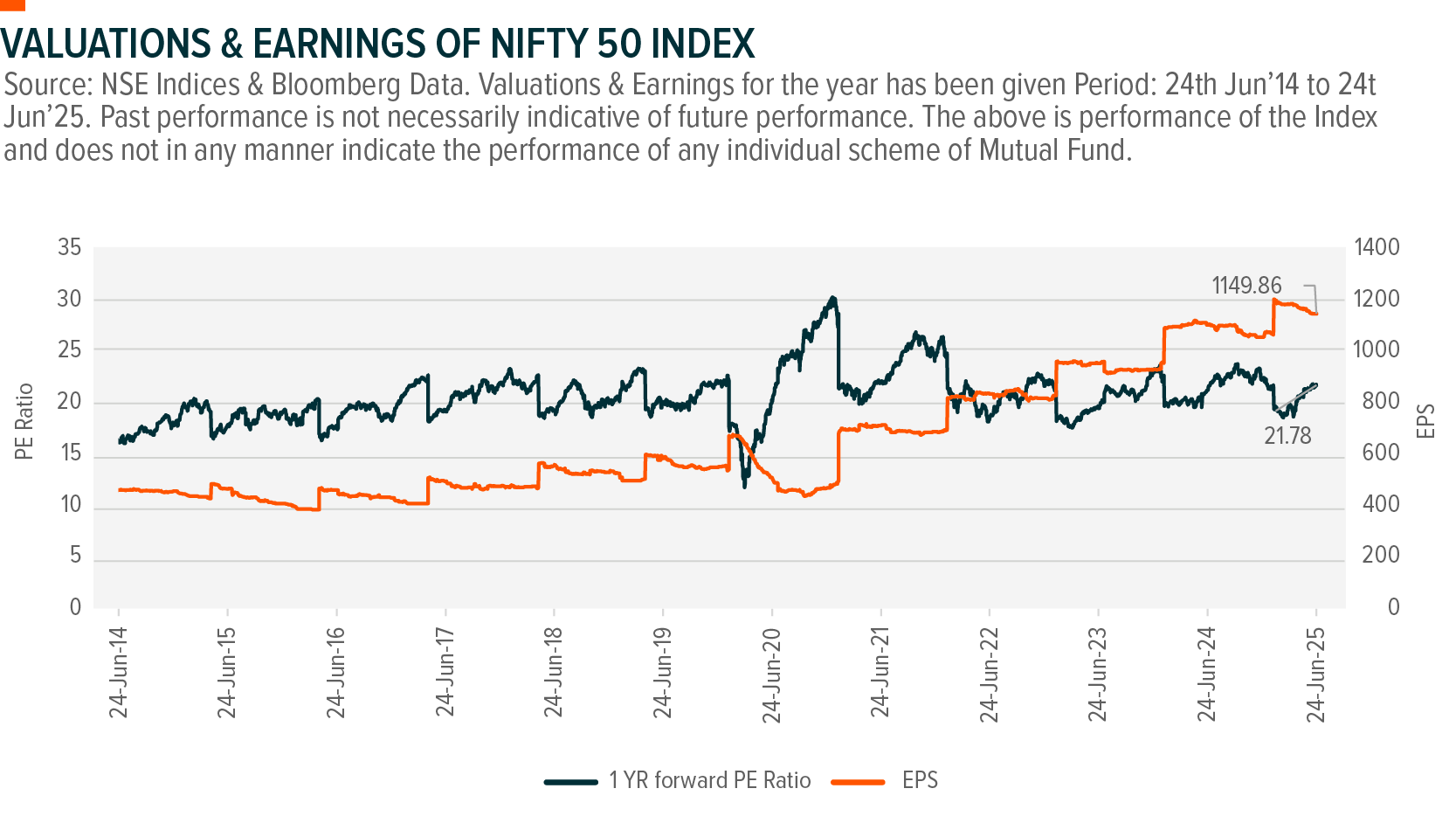

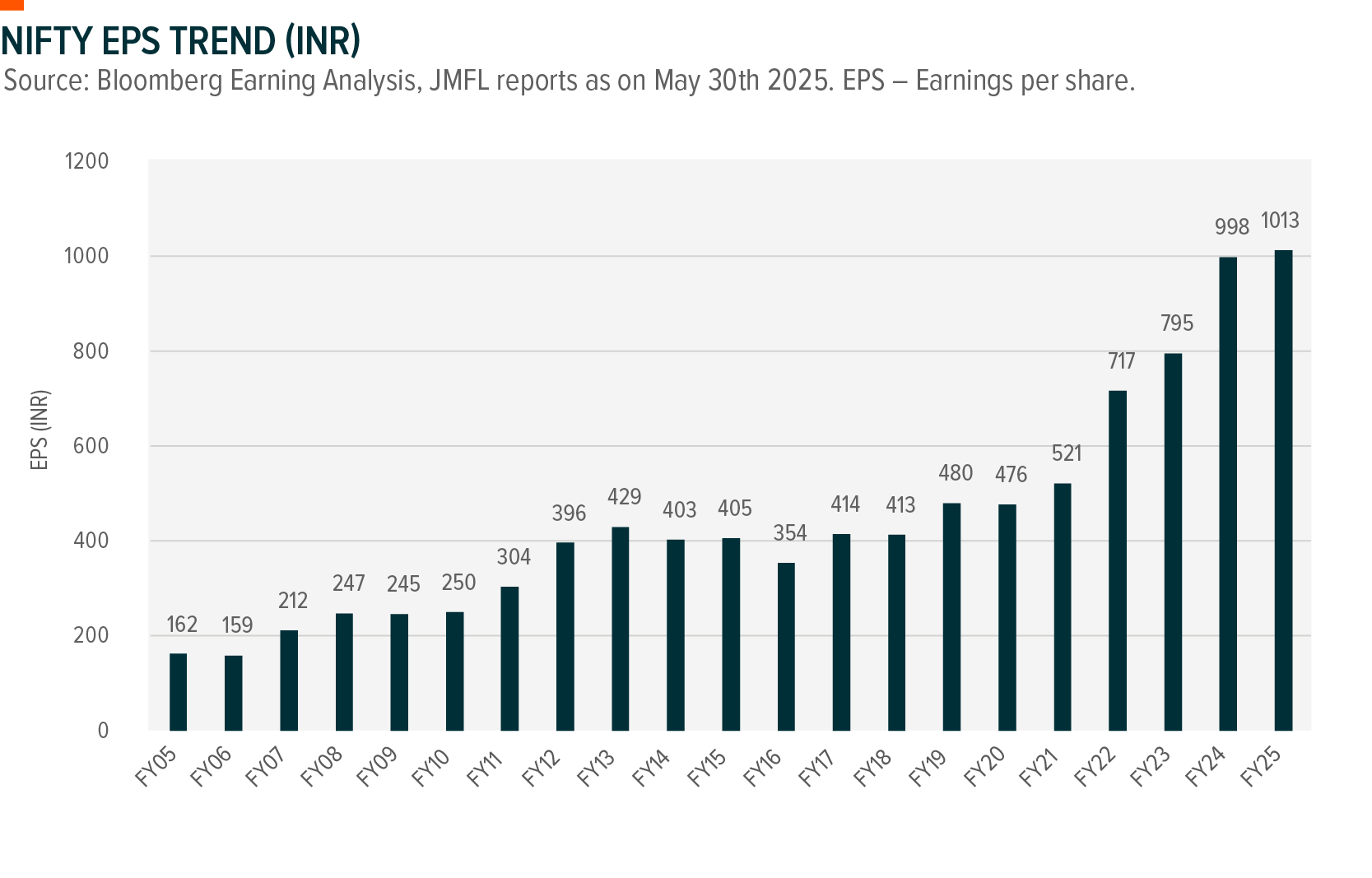

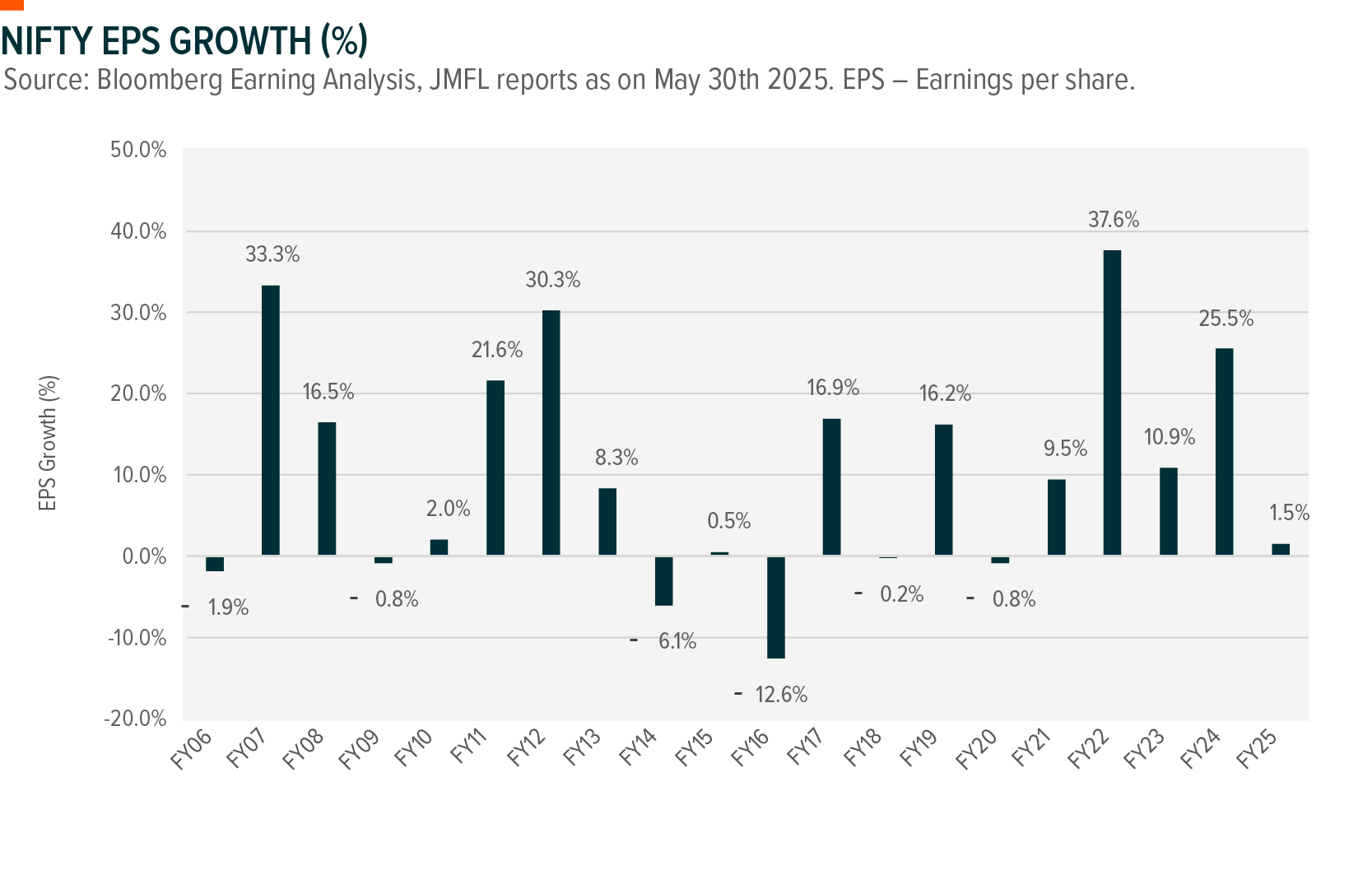

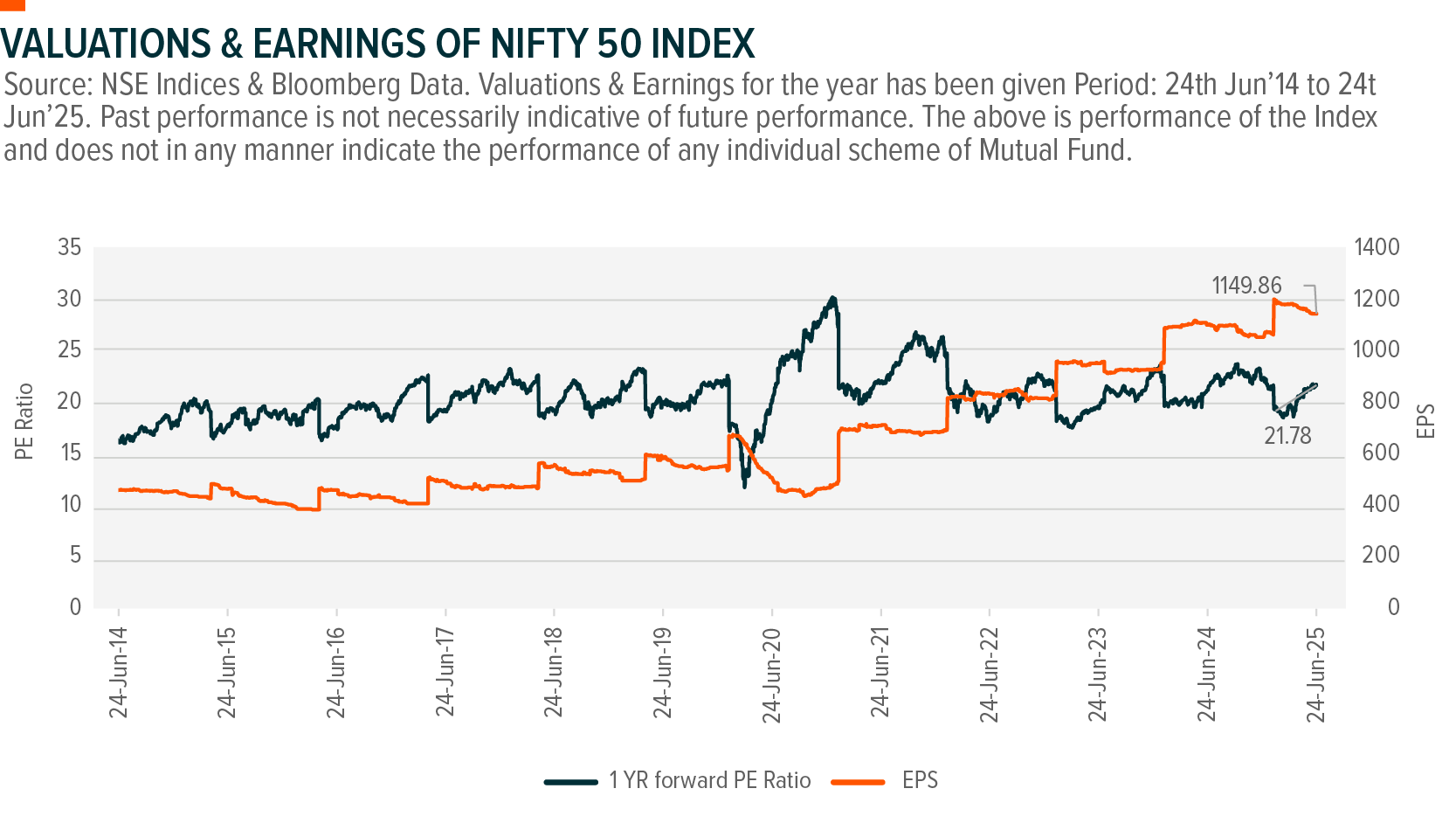

In many ways, this quarter marks a transition from the high-base, post-pandemic recovery years to a more normalised growth cycle, with earnings no longer inflated by margin tailwinds or one-off operational leverage effects. This moderation is reflected in the Nifty’s forward Earnings Per Share (EPS). For FY25, the index posted an EPS of Rs. 1,013, a modest 1.5% increase from FY24, which had previously surged by 24%. As of now, EPS FY 26 estimates stands at 1,135 (expectation of ~12% growth) and EPS FY27 estimates stands at 1,314 (expectation of ~15% growth). 2

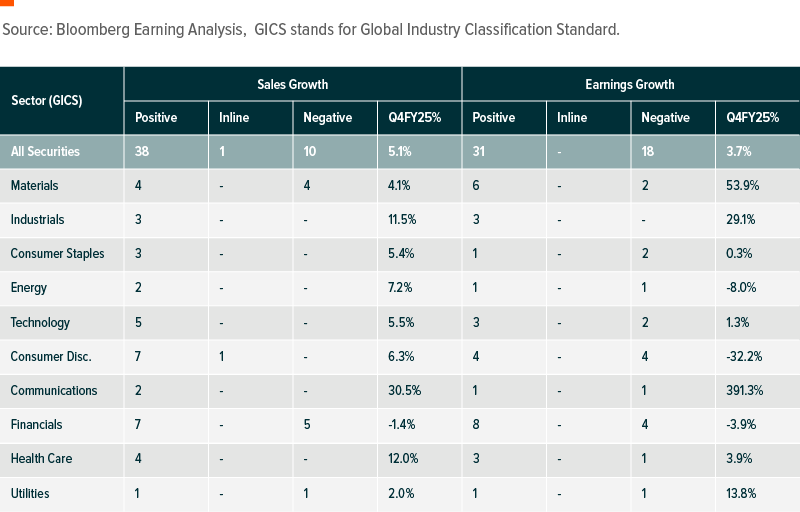

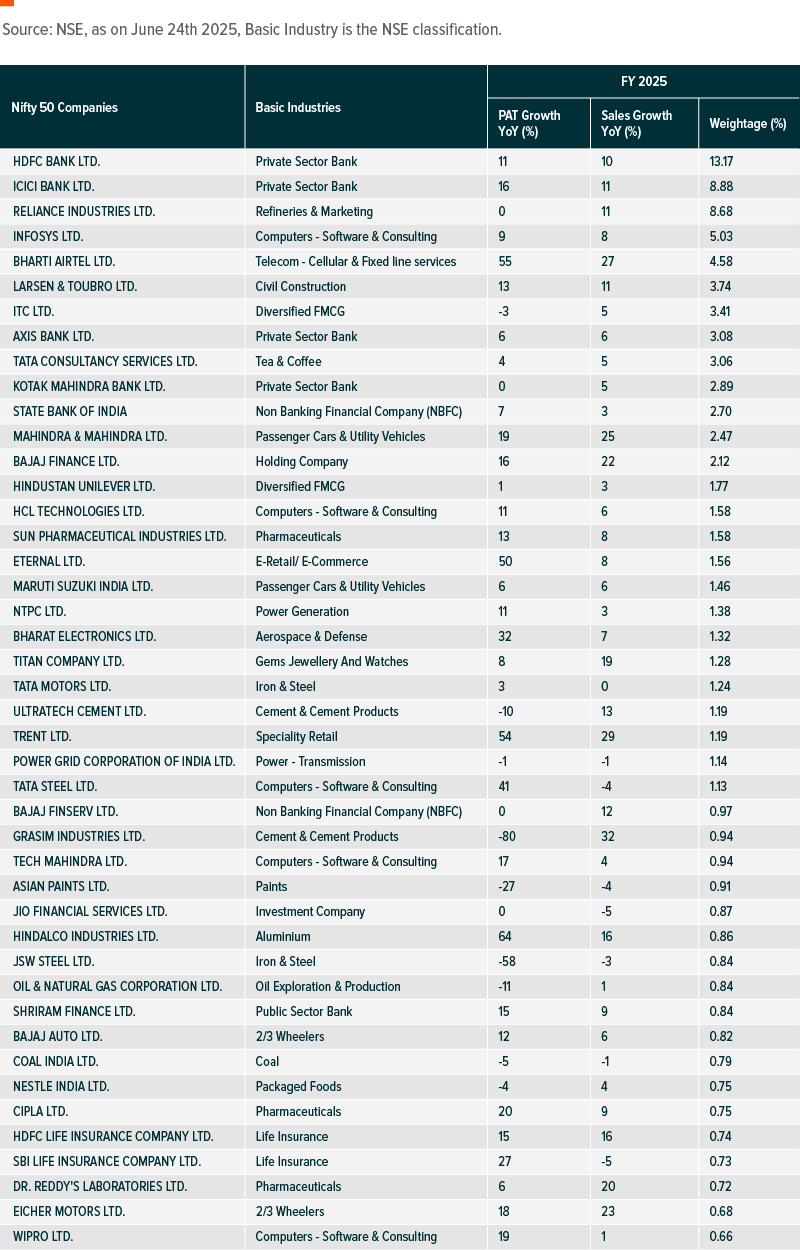

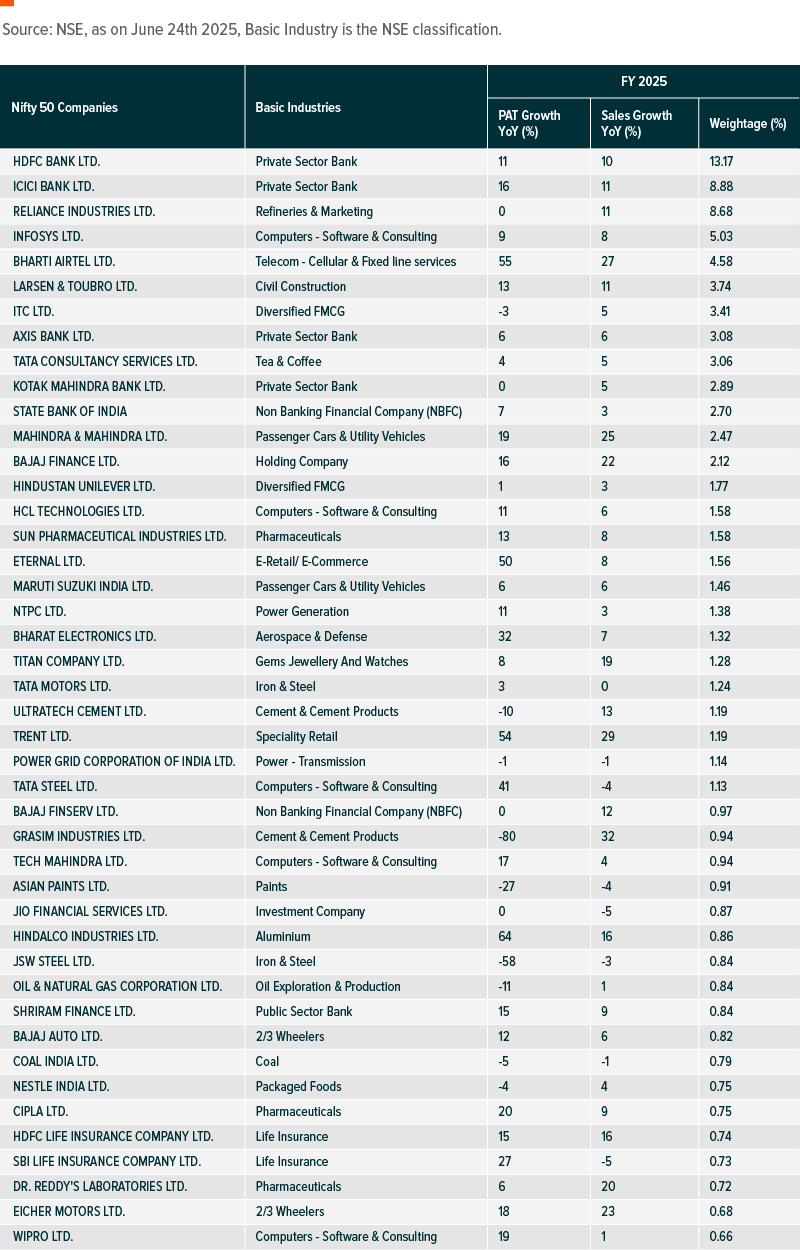

31 companies within Nifty reported beat in earnings whereas 18 companies reported below estimated earnings growth. In terms of Sales growth, 38 companies reported positive sales growth, 1 reported in line estimates and 10 companies reported negative sales growth.

Latest Monetary Policy Committee (MPC) Impact**:

Overlaying this fundamental backdrop was the Reserve Bank of India’s (RBI) unexpected and aggressive policy action. The central bank not only cut the repo rate by 50 basis points but also slashed the Cash Reserve Ratio (CRR) by 100 basis points, signalling a strong push towards reviving domestic demand and credit expansion. This was the third consecutive rate cut this year, underscoring the RBI’s commitment to nurturing growth. The shift to a “neutral” stance from an “accommodative” one indicates a more balanced approach going forward, with the RBI now likely to be data-driven rather than pre-emptive.

A massive 100 bps cut in CRR to 3% was more surprising, as the 4% CRR floor has generally been breached only in times of crisis. The cut has come at a time when systematic liquidity has been in surplus for the last couple of weeks. The cut would be staggered in four equal tranches of 25 bps each which alone is expected to infuse nearly Rs. 2.5 lakh crore into the banking system by Dec’25, significantly enhancing bank’s lending capacity and liquidity profile. This should also positively impact Net Interest Margin (NIM) / Return of Asset (ROA) by 7–8 bps / 4–5 bps respectively across banks.

The underlying tone of Monetary Policy Committee (MPC) is uncharacteristically pro-growth. RBI’s measures are expected to support credit demand, particularly in retail and small-medium enterprises (SME) segments, while the increased liquidity provides room for improved balance sheet expansion. Although lower rates may exert some near-term pressures on net interest margins, the potential volume growth and improved asset quality could offset this impact. Overall, the policy appears to provide a supportive backdrop for the banking sector which has a significant weightage within the Nifty 50 Index.

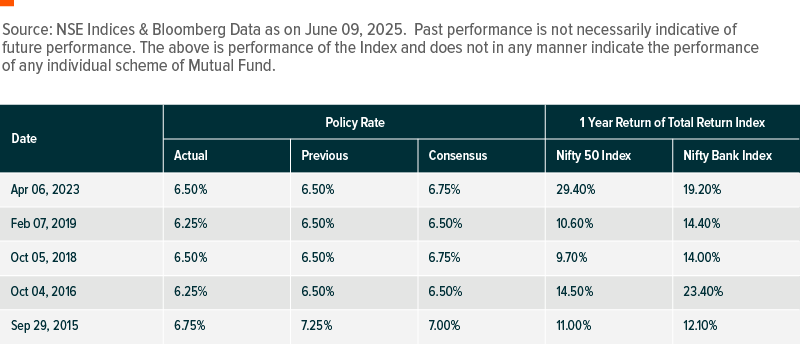

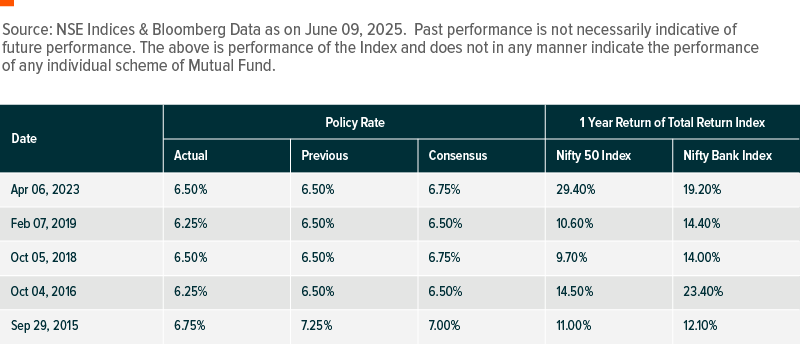

Behavior of Nifty 50 Index to positive surprise in Repo Rate**:

We have analyzed historically from June 03, 2014 to June 06, 2025, all MPC policy decision. Following are the dates where MPC delivered surprise of 25 bps in repo rate. Historically, on all such instances, Nifty 50 Index has been positive for the course of next one year.

Performance of Nifty 50 Index

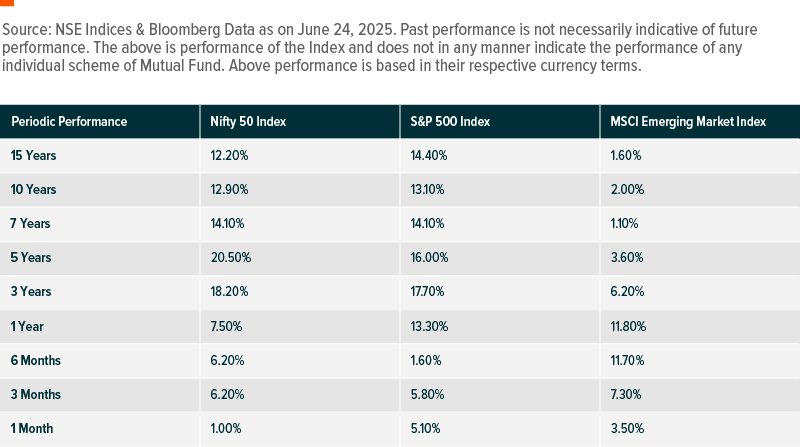

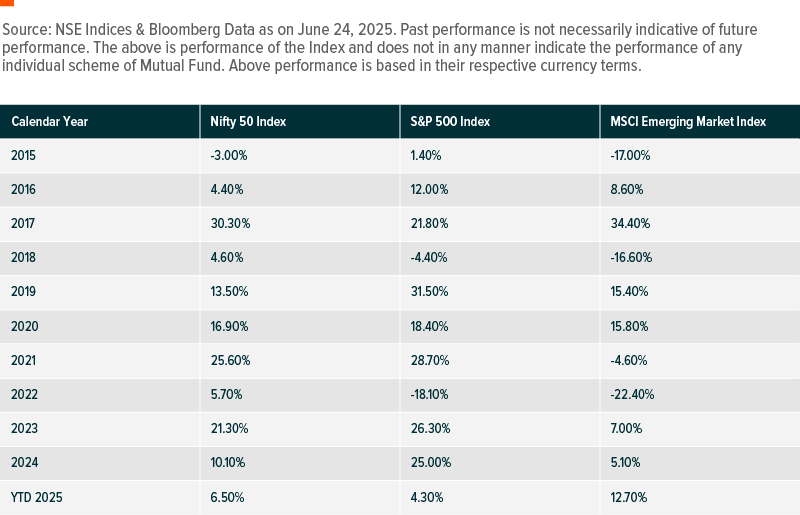

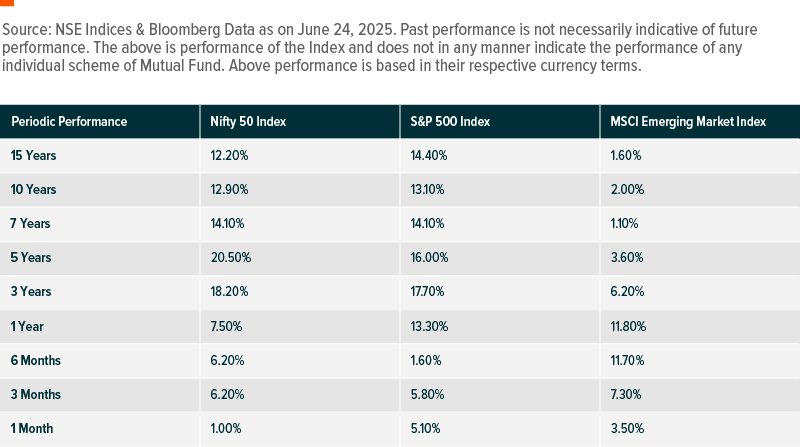

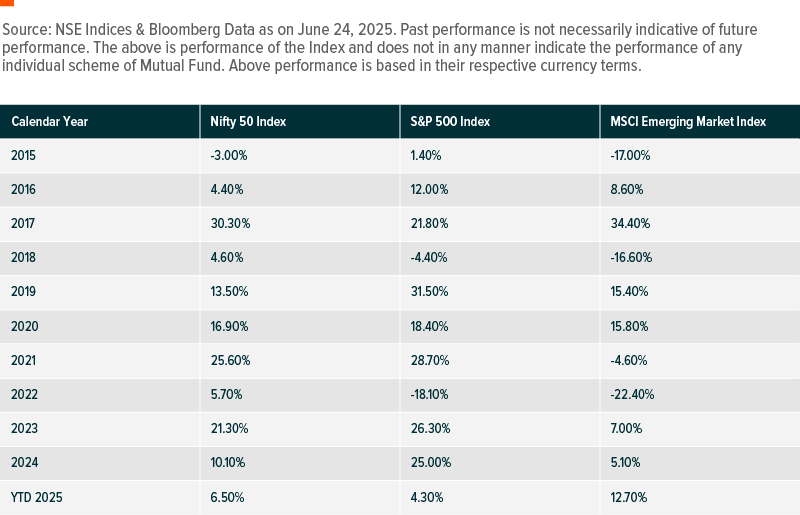

The Nifty 50 Index, India’s benchmark representing the country’s largest and most liquid blue-chip companies, delivered a relatively lower return of ~7.5% over the past one year, underperforming both the S&P 500 Index (13.3%) and the MSCI Emerging Markets Index (11.8%). This relative underperformance can be attributed to a combination of subdued corporate earnings, elevated valuations, global geopolitical tensions and uncertainties, which weighed on investor sentiment. Additionally, heavy foreign institutional investor (FII) outflows and sector-specific drags added to Nifty's short-term lag. However, over a longer investment horizon, Indian equities continue to exhibit strong structural outperformance. On a five-year CAGR basis, the Nifty 50 has delivered an impressive 20.5%, outpacing both the S&P 500 (16.0%) and MSCI EM Index (3.6%).3

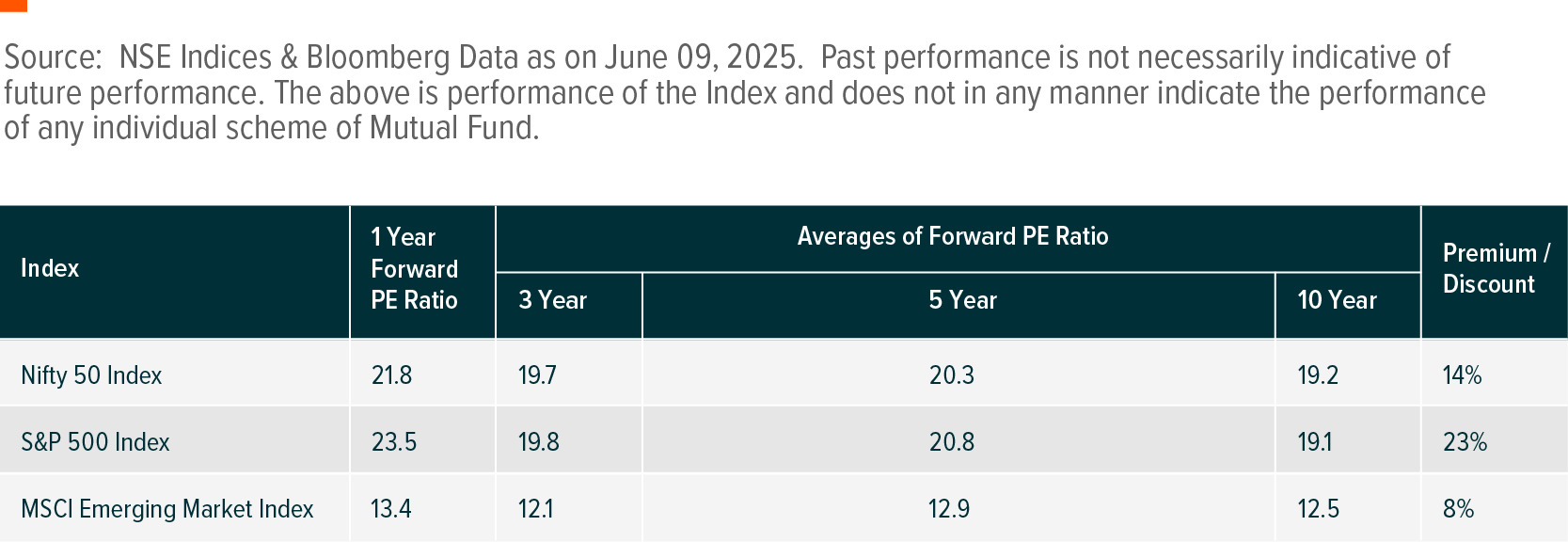

Valuations

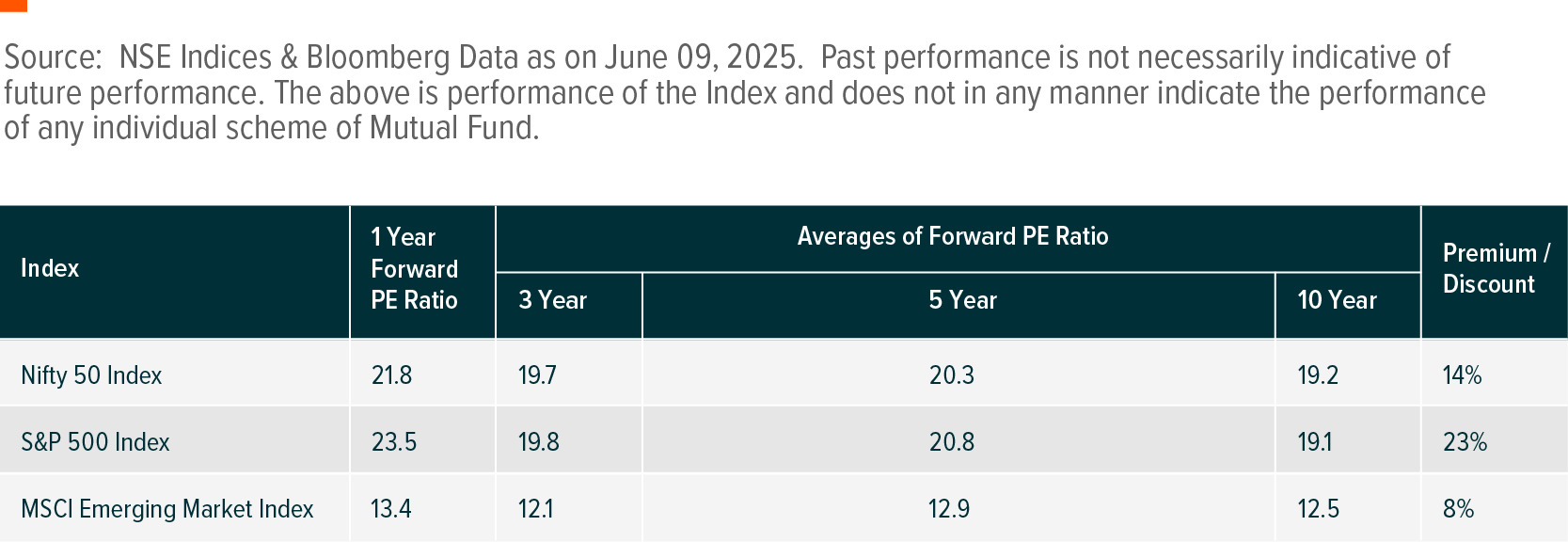

The Nifty 50 Index is currently trading at forward PE (Price-to-Earning) Ratio of ~21x, slightly above its long-term averages, indicating that current prices reflect expectations of continued earnings growth. Compared to the MSCI EM (Emerging Market) Index, Nifty 50 valuations are at premium, while they are largely in-line with the S&P 500 when adjusted for sector composition and earnings quality. The relative valuation differentially highlights India’s position as a preferred allocation within emerging markets.

Nifty 50 Index Companies (Earnings Snapshot)

Sectoral Commentary

Financial Sector (which constitutes a significant weight in Nifty 50 Index): Public Sector Banks (PSBs) led earnings for the quarter, while private banks underperformed. Most large private banks witnessed a sequential improvement in Net Interest Margins (NIMs), whereas PSBs continued to see margin compression. Credit growth across the sector remained moderate. Among Non-Banking Financial Companies (NBFCs), retail lending was muted — particularly in personal loans and vehicle finance — alongside a marginal uptick in delinquencies within the unsecured loan book. NBFCs credit growth (20%) outpaces that of Banks (12%) in FY25 led by Gold NBFC category. Bank profits grew ~16% YoY due to lower provisions, while NBFCs reported ~8% PAT growth, driven by Gold and Housing NBFCs; MFIs saw sharp decline.4

Information Technology: IT companies reported a muted 4QFY25 performance with revenue growth impacted by uncertainty in US. PAT growth of just around 3% YoY though margins remained largely stable. Tier-1 companies remained weak due to lower-than-expected growth and subdued demand. The global & macroeconomic uncertainty continues to remain an overhang on IT spending.

Consumer: The consumer sector delivered a muted performance in Q4FY25, with volume growth in lower single digits range across most players. FMCG companies witnessed relatively stable demand, supported by moderating input costs and early signs of rural recovery, though urban consumption remained sluggish. Hotels, value retailers and jewellery cos continued to shine in Q4FY25 posting double-digit revenue growth and improved profitability on robust domestic demand and network expansion. Premium retailers, QSRs, footwear and textile players saw yet another muted quarter with subdued revenue growth and operating deleverage impacting margins.

Construction: Construction companies reported a healthy performance in Q4FY25, driven by strong order inflows and continued execution momentum, particularly in government-led infrastructure projects. Revenue growth remained robust, supported by steady progress in roads, railways, and urban infra segments. Improved labor availability and easing supply chain pressures contributed to execution efficiency. Margins remained stable despite elevated input costs, aided by better operating leverage and project mix. Cement and building material companies benefited from seasonal demand uptick and price stabilisation. These pockets are increasingly drawing investor interest, riding on the infrastructure-led growth narrative.

Energy Sector: The Oil & Gas sector dragged the 4QFY25 performance, there was 1%-2% single digit growth in sales and EBITDA 2% YoY, while PAT on an adjusted basis declined 4% YoY. Excluding OMCs, the performance was weaker, with sales growing 5% YoY, while EBITDA and PAT declined 1% and 13% YoY, respectively.5

Auto Sector: The Auto sector reported a soft quarter, with domestic volume growth of just 2% YoY. Passenger Vehicles (PV) and Commercial Vehicles (CV) posted muted growth of 2% and 1% respectively. In contrast, 3-Wheelers and Tractors outperformed with ~7–8% and 17% YoY growth, respectively. Margin pressures persisted due to input costs and competitive pricing.6

Healthcare: Healthcare sector delivered a strong quarter with 46% YoY earnings growth, driven by increased momentum in chronic therapies within the DF segment. Domestic sales grew YoY and US segments saw YoY/ QoQ growth. Operational profitability continued to remain stable with mid-teen growth trajectory. For Hospitals, Margins stable despite capacity additions and slight dip in occupancy in Q4.

Telecom: The telecom sector witnessed a strong turnaround in Q4FY25, reporting a consolidated profit of INR 61 billion, compared to a loss of INR 15 billion in the same quarter last year. Revenue growth was modest but supported by steady improvement in ARPU (Average Revenue Per User) and rising data consumption. Profitability was largely led by Bharti Airtel, while others continued to face operational and financial headwinds. 5G deployment progressed gradually, though monetization remains limited. The sector's outlook is stable, with expectations of further ARPU improvement and potential tariff revisions supporting earnings growth.

Metals: Within metals and mining sector, non-ferrous players reported strong earnings recovery, supported by stable prices, healthy export demand, and lower energy costs. Aluminium & copper producers benefited from margin expansion and better realizations. Ferrous companies reported robust growth as imports softened and resumption of construction activity, clocking a sales volume growth of 9% YoY and 12 % QoQ.

Are corporate earnings turning a corner?

- Tax relief provided in budget is expected to provide boost to consumption along with 8th Pay Commission.

- Supportive monetary policy with 100 bps rate cut on YTD basis and CRR cuts is expected to improve system liquidity further and drive credit recovery, aided by other measures

- Positive inflows from FPI since April provides boost to the market.

- Lower inflation, Fiscal discipline (adhering to fiscal glide path) and healthy macroeconomic indicators continue to be a positive for India.

Related Funds

NDIA: The Global X India Nifty 50 ETF (NDIA) invests in 50 of the largest companies listed in India.