The Nifty 50 Index has been trading on a cautious ground through the first half of FY26. Despite supportive liquidity conditions domestically, the index has largely mirrored the underlying softness in corporate earnings and volatile geo-political environment. Strong domestic flows have anchored the market, limiting downside risks, while the index’s performance has been range-bound, shaped by muted sectoral growth and persistent foreign outflows. The index itself gained 8.5% in the quarter primarily recovering from 2025 Q1 correction, supported by strong domestic inflow and domestic macros, even as global headwinds like trade tensions weighed on export-oriented sectors.

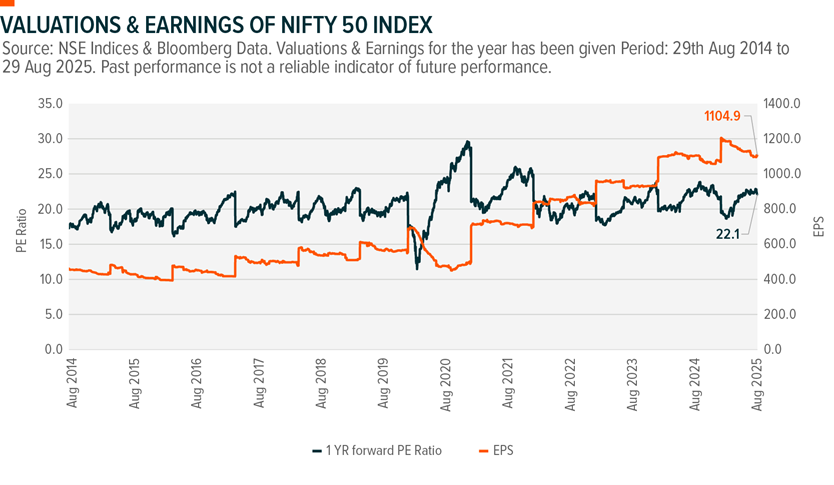

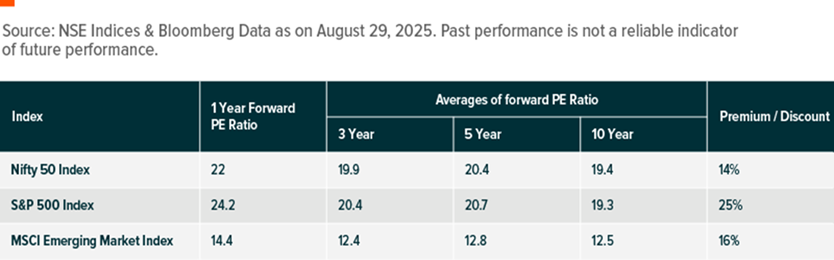

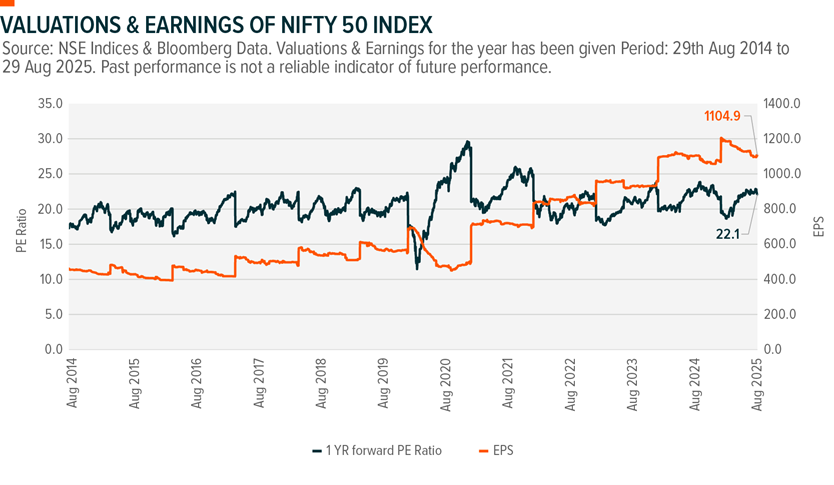

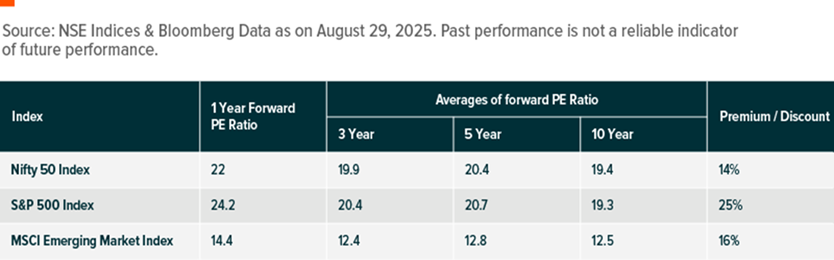

Valuations remain elevated at around 21-22 times forward earnings, suggesting that sustained earnings growth will be critical to justify current price levels. By sector, oil and gas, cement, real estate and retail outperformed, while autos and metals lagged due to weak rural demand and global oversupply pressures..1

Domestic and Foreign Investors Flows were a mixed bag. Foreign institutional investors (FIIs) were buyers in April 2025 and June 2025 but turned net sellers in July 2025, pulling out nearly Rs.18,000 crore as global risk-off pressures and tariff-related headlines spurred profit-taking. Domestic institutional investors (DIIs), led by mutual funds and insurance companies, continued to provide steady support with sizeable net inflows, cushioning the impact of foreign selling. In August 2025, FIIs have largely remained in selling mode pulling out over Rs. 46,000 crores while DIIs have absorbed the pressure stepping in strongly with net purchases exceeding Rs. 94,000 crores, reflecting the ongoing strength of domestic liquidity. As of September 2025, so far, FIIs have sold Rs. 1,305 crores worth of equities, whereas DIIs have bought Rs. 1,821 crores.2

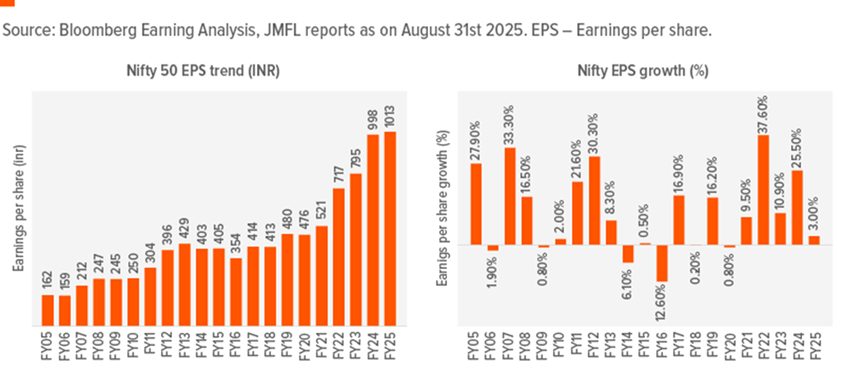

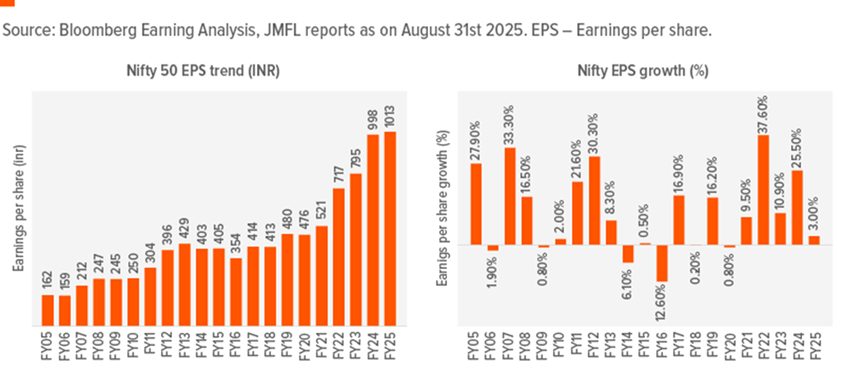

The outlook for Nifty 50 Index over the next two quarters of FY26 is cautiously optimistic, though it comes with a mix of opportunities and risks. The earnings trajectory is expected a rebound with EPS growth of 10-13% for FY26, driven by macro stability, policy support and easing inflation. Key drivers for this outlook include stimulative fiscal and monetary measures, structural reforms like GST simplification and expectation of recovery in domestic demand. External risks particularly US tariffs on Indian goods and global economic volatility could temper foreign investor sentiment even as domestic liquidity remains strong. The recent S&P upgrade to “BBB” adds a positive long-term dimension by lowering borrowing costs and improving India’s credit profile, which could attract incremental capital flows over time.3

First Quarter FY26 Earnings:

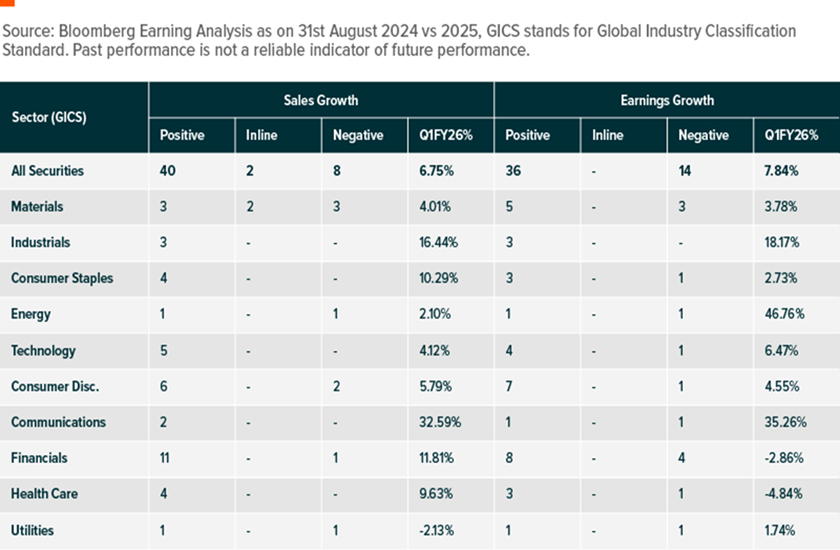

The Q1FY26 earnings season has not offered any major surprises, but rather brought a complex mix of optimism and caution across sectors in the Nifty 50 universe, leading to a wave of earnings estimate revisions. While the headline index performance was strong, the underlying earnings momentum was uneven, resulting in overall more downgrades than upgrades. The upgrades were selective and driven by company-specific factors, while the downgrades were more broad-based and influenced by sectoral headwinds, geo-political environment and domestic demand.4

- Sectors Upgraded: Telecom, Capital Goods, Select NBFCs and Defence related companies (benefitted from structural tailwinds, rising consumer demand, government infrastructure push, improved operational efficiencies)

- Sectors Downgraded: Financials (NIM Compression and higher buffer provisions), export-facing IT (weak discretionary spends), and parts of Autos and Staples (mixed volumes and pricing)Buying shares in gold mining companies

Profit growth for Nifty 50 Index has been modest, averaging around 9.5% year-on-year (vs. expectation of +10.3% YoY). Revenue growth, however, remained weak, coming in closer to 5-6% reflecting subdued demand conditions in both urban and rural segments. However, the saving this Q1FY26 quarter has been the sharp correction in input costs, particularly raw material prices, which allowed several companies to protect margins and, in some cases, post better-than-expected bottom-line growth. This persistent divergence between revenue and margins suggests that earnings stability has so far leaned on cost optimisation rather than a strong demand recovery.

A handful of sectors, particularly banking and financial services, technology, oil & gas, cement and utilities accounted for the bulk of incremental profits. Within the index, large-cap bellwethers such as Reliance Industries, ICICI Bank, HDFC Bank, Bajaj Finance, JSW Steel and L&T helped support earnings, while others like Coal India, IndusInd Bank and Kotak Bank posted weaker prints that weighted on aggregate numbers.

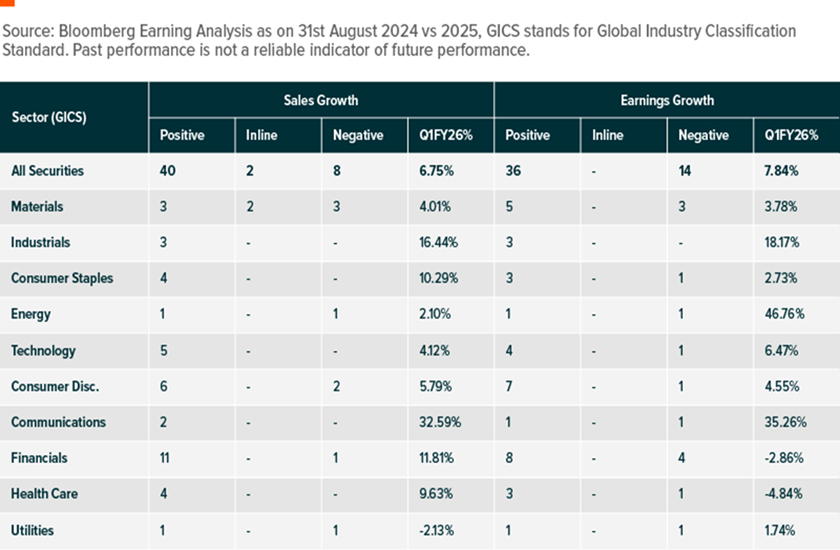

36 companies within Nifty 50 Index reported beat in earnings whereas 14 companies reported below estimated earnings growth. In terms of Sales growth, 40 companies reported positive sales growth, 2 reported in line estimates and 8 companies reported negative sales growth.5

The Nifty 50’s Q1 outcome points to a steady phase. Earnings are intact but concentrated, and small downward revisions to FY26 and FY27 estimates – around 1%- reinforce the view of consolidation. This cautious tone from large constituents emphasizes the need for broader participation. With growth still reliant on a narrow set of sectors and global headwinds affecting foreign flows, the next leg of the rally will likely hinge on demand recovery and sectoral breadth improving.

Macro-Economic Backdrop:

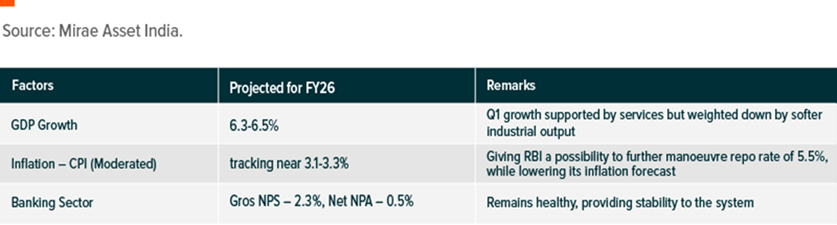

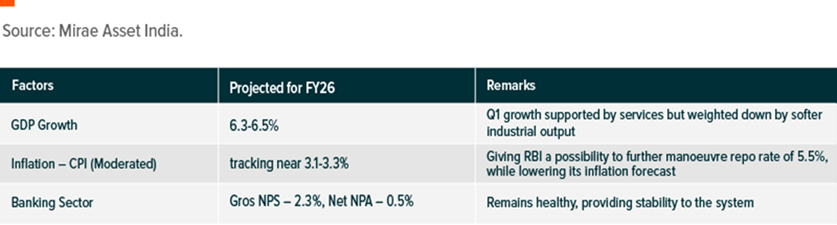

The macroeconomic backdrop remains stable but not without challenges:

However, the past few days have witnessed a confluence of three key developments that could rekindle sentiments in the Indian equities market.

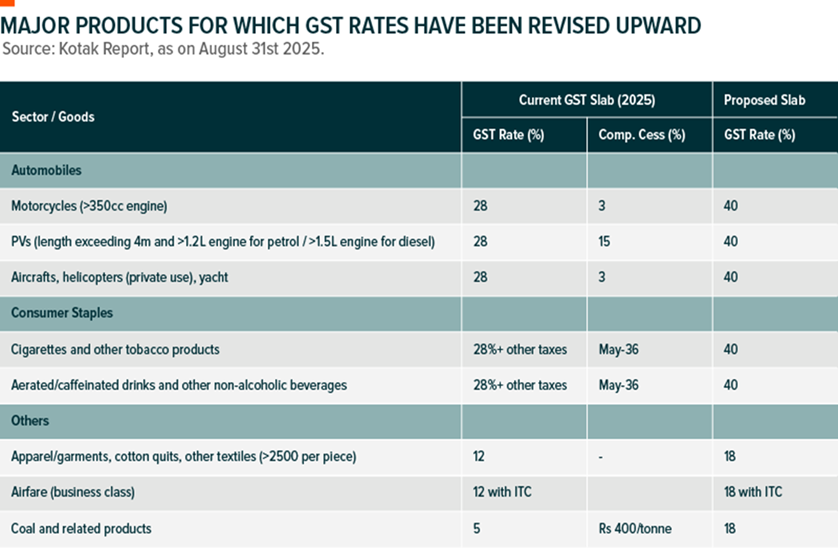

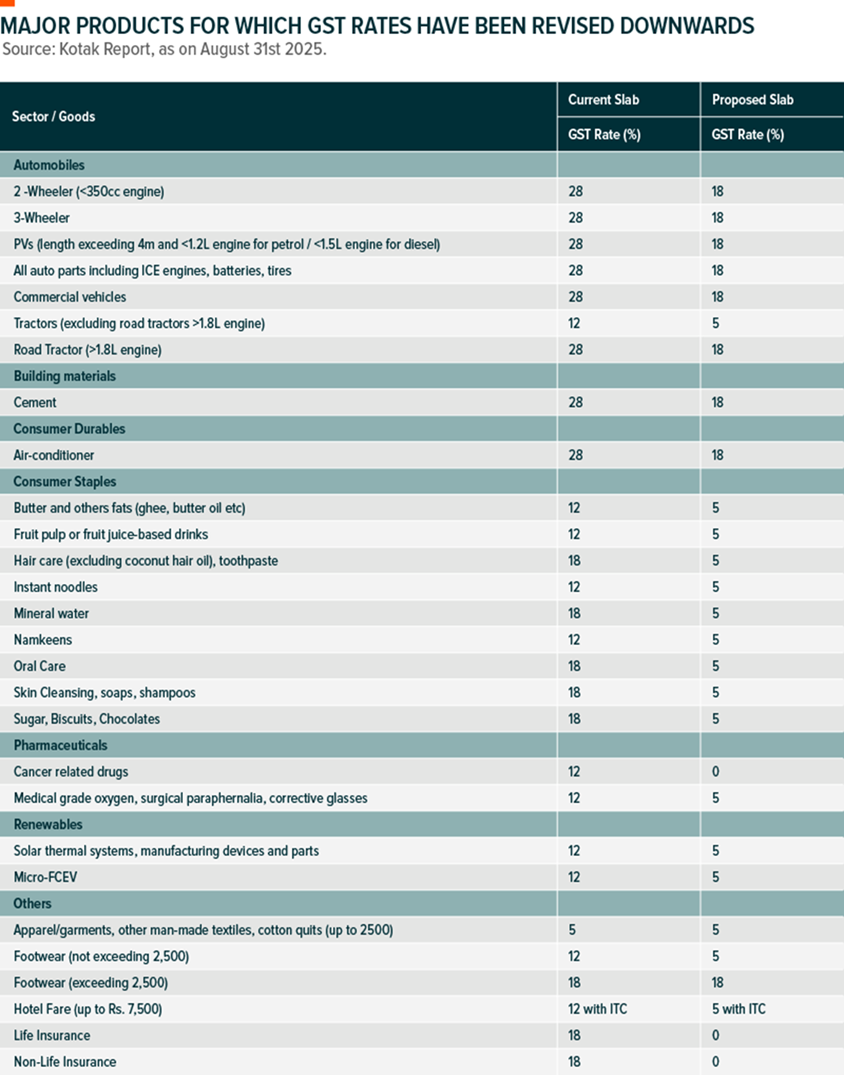

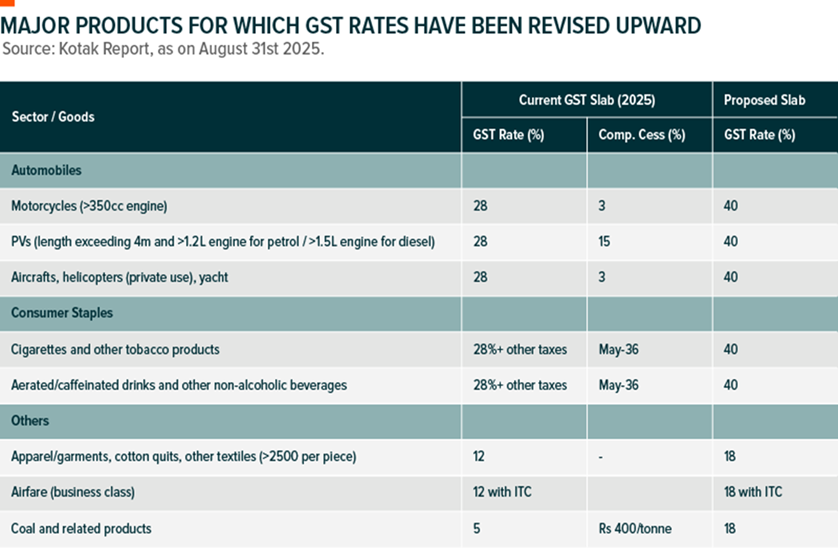

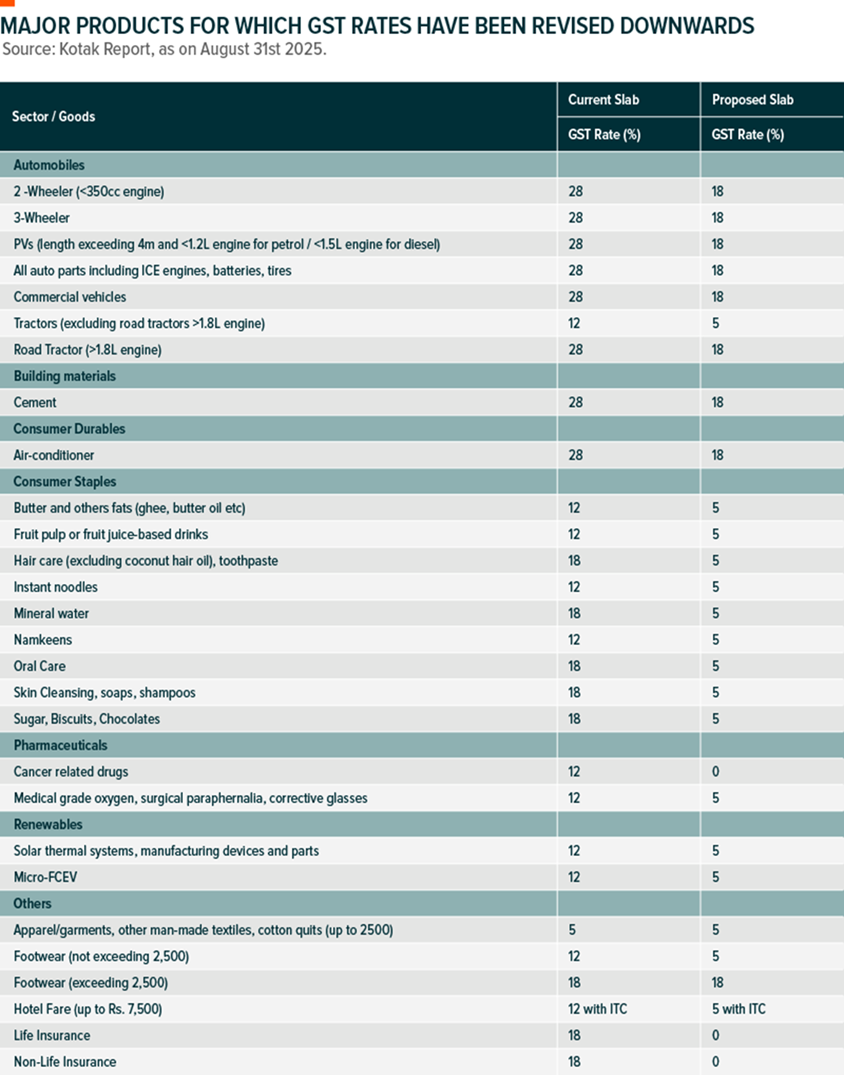

GST Reform 2.0 – The GST reform effective from September 22, 2025 combined with the removal of the compensation cess represents one of the most significant shifts in the GST policy. This will involve rationalising rates into two slabs vs. the existing four slabs for most items while select luxury goods and sin goods are taxed at 40%. The central government has proposed that most goods be subsumed in the 5% and 18% GST slabs vs. the existing 5%, 12%, 18% and 28% slabs. Almost 99% of the goods currently in the 12% slab (standard goods) are expected to be transitioned to the 5% slab, which should lower retail prices by ~4-5%, aiding household budgets. 90% of the goods in the 28% slab will likely be moved to 18%. Here too, households are expected sizable savings, owing to some higher ticket consumption items bracketed in the 28% tier.

Lower tax rates in essentials, FMCG products, healthcare, and consumer durables reduce the cost of living and increase disposable income, which is expected to boost consumption significantly. Since private consumption accounts for nearly 60% of India’s GDP providing uptick to GDP with around Rs 1.8 Tn household saving driving consumption.

The government estimated the revenue impact at Rs480 bn (on the FY2024 consumption base). Based reports, the loss from the rate changes is estimated at Rs930 bn and gains from the shift to the new 40% slab at Rs450 bn (the compensation cess removal should be an additional benefit for households).

The removal of the compensation cess amplified this effect. The cess had been a distortionary element, especially for sectors like automobiles, coal and luxury goods, where it inflated prices and dampened demand. Its elimination reduces the overall tax burden on these sectors, making high-value goods more affordable and reviving discretionary spending. This is particularly important for the automotive and real estate sectors, which have strong backward linkages to manufacturing, steel, cement and services. Lower costs in these sectors will spur investment, create jobs, and generate a multiplier effect across the economy. Additionally, the removal of the cess simplifies the tax structure further, signalling policy stability and improving investor confidence, which could attract more domestic and foreign investment.

From a macroeconomic perspective, the reform marks a strategic shift towards a more consumption-driven economy. The government anticipates that increased compliance and higher demand will offset any short-term revenue loss from the cess removal. Moreover, this reform is likely to have a moderating effect on inflation, as lower indirect taxes on essential and consumer goods ease price pressures, supporting real income growth and sustaining demand momentum.

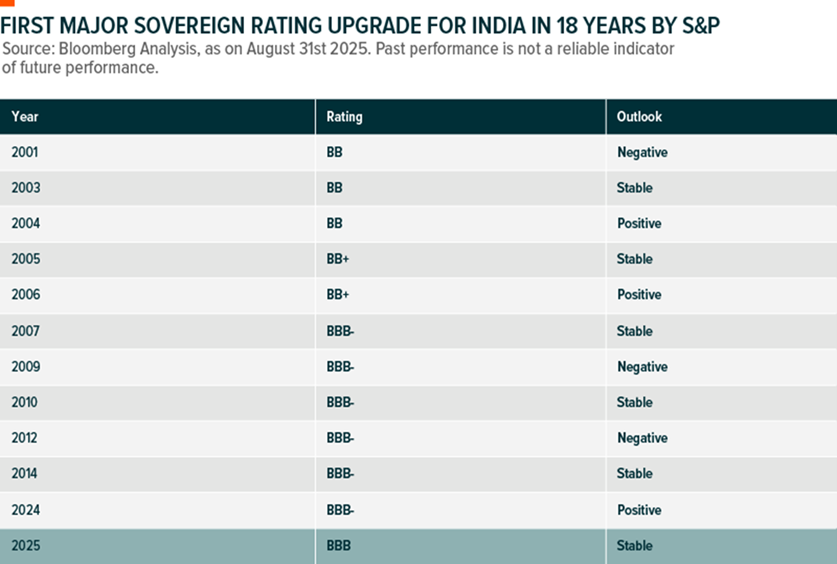

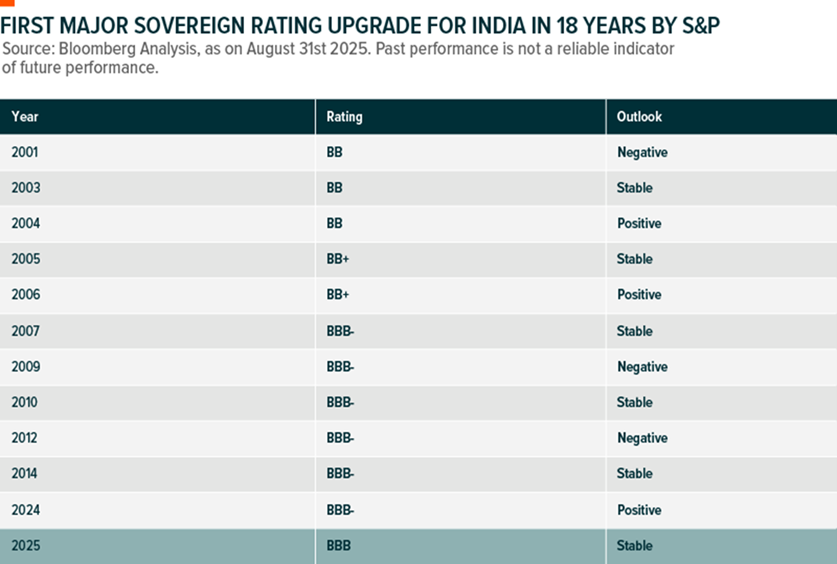

S&P’s upgrade of India’s sovereign credit rating to investment grade (BBB- to BBB): This is a macro and structural positive for the overall Indian market – as it has been the first upgrade in 18 years and the highest S&P rating received in the past 35 years. The real effects of the rating upgrades will be visible only over the longer term in the form of lower external interest costs, more FPI flows and enhanced investor goodwill. However, in the immediate term, it is a key sentiment booster for markets especially in the context of ongoing tactical geopolitical headwinds.

US-Tariff Related: India exported goods worth $80.7 billion to the United States in 2024, making the US India’s largest export destination. The leading categories included electrical and electronic equipment, gems and jewellery, pharmaceuticals, machinery, mineral fuels etc.

In August 2025, the United States announced additional tariffs on Indian goods, raising the total tariff burden to 50% on most categories, with exemptions for pharmaceuticals, electronics, energy products and critical minerals. It includes 25% penalty which were explicitly linked to India’s continued purchase of discounted Russian oil.

The sectors most affected by these tariffs are Textile & Apparel, Gems & Jewellery, Leather & Footwear, Marine products, Chemicals, Auto Components, Iron, Steel, Aluminium, Furniture & Wood Products with significant impact on margins and threat from other lower tariffed countries which may enjoy cost advantage in US market.

The economic impact is significant, with $87 billion worth of exports at risk, equivalent to 2.5% of India’s GDP. GDP growth could be impacted by 0.2-0.5%. MSMEs in textile, leather and gems are the most vulnerable. Pharmaceuticals and IT remain unaffected for now, though the US has hinted at possible future tariffs on pharma. Electronics are exempt, but solar exports may face indirect barriers. Strategic sectors like steel and auto face long-term competitiveness challenges, making diversification to the EU, Middle East and Africa critical for Indian exporters.

While the recent escalation in US tariffs poses challenges for Indian exports, the broader market outlook remains cautiously stable. Exporters are gradually exploring alternative geographies, and domestic demand may offer support especially post GST reforms. Policy measures and currency dynamics may help soften the impact over time. Though near-term pressure persists, India’s structural growth drivers remain intact.

The Indian market enters the rest of FY26 on a strong footing, supported by domestic macro stability, easing inflation and a strong domestic liquidity base, though concerns around US-India relation remains. While this quarter is being seen as a “crossover” phase, where earnings have consolidated at low single-digit growth but are expected to improve in the coming quarters. The aforementioned developments, along with several other existing factors can collectively improve market sentiments and set the stage for an move upward after a muted performance over the past 12 months.

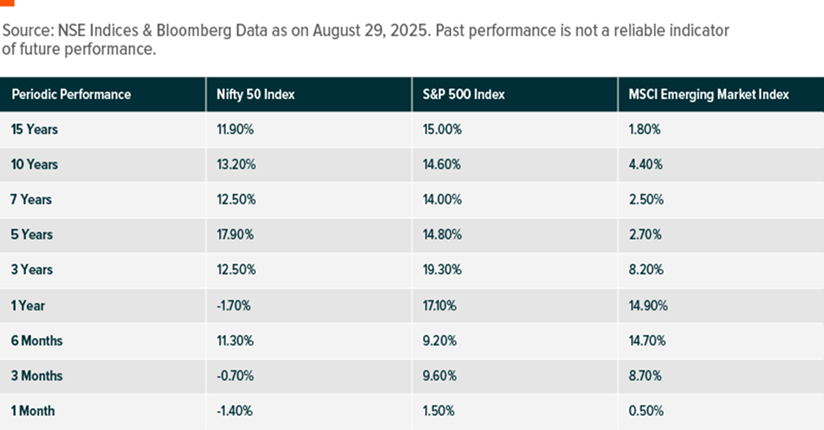

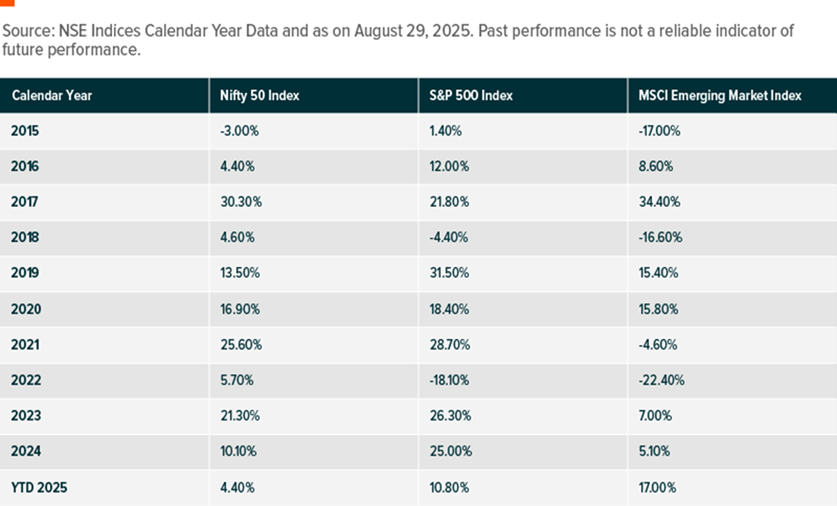

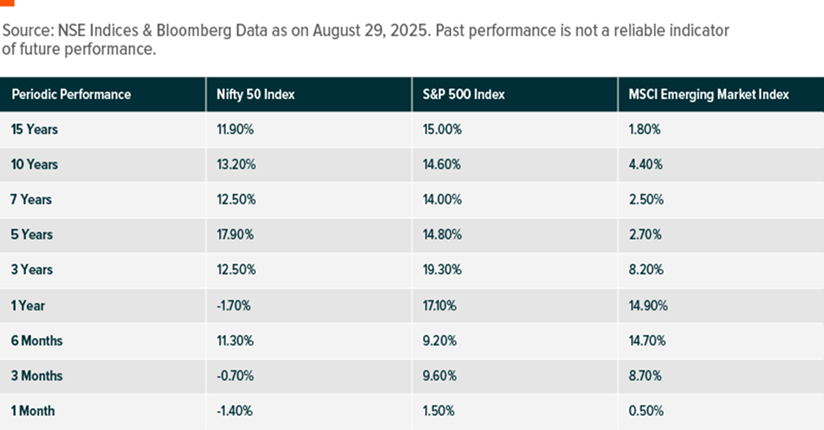

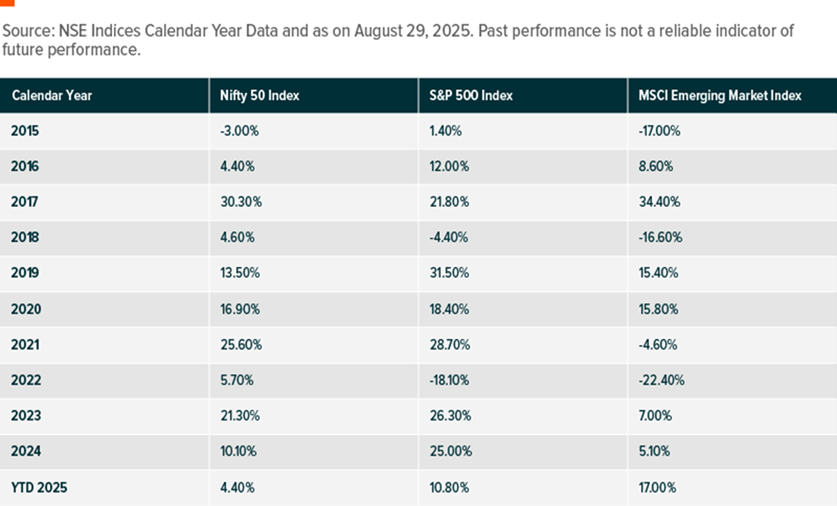

Performance of Nifty 50 Index

The Nifty 50 Index, India’s benchmark representing the country’s largest and most liquid blue-chip companies, delivered a relatively lower return of ~2% over the past one year, underperforming both the S&P 500 Index (17.1%) and the MSCI Emerging Markets Index (14.9%). This relative underperformance may be attributed to a combination of subdued corporate earnings, elevated valuations, global geopolitical tensions and uncertainties, which weighed on investor sentiment. Additionally, heavy foreign institutional investor (FII) outflows and sector-specific drags added to Nifty's short-term lag.

The Nifty 50 Index is currently trading at forward PE (Price-to-Earning) Ratio of ~21x, slightly above its long-term averages implying that earnings delivered through the remainder of the year will be critical for sustaining momentum. With global uncertainties, foreign investor outflows, and uneven demand recovery acting as near-term headwinds, the index appears likely to remain in a consolidated phase until stronger earnings visibility emerges.

Replacement in Nifty 50 Index

As part of the Semi-annual review by NSE Indices Limited, the Nifty 50 Index will undergo constituent changes effective September 30, 2025. The Nifty 50 Index is being replaced to reflect evolving market dynamics and ensure representation of the most liquid and high-cap companies. InterGlobe Aviation and Max Healthcare Institute have demonstrated strong growth in free-float market capitalisation, qualifying them for inclusion. Their entry replaces Hero MotoCorp Ltd and IndusInd Bank Ltd, which will now move to the Nifty Next 50 Index. This reshuffle aligns with NSE’s methodology of maintaining index relevance and liquidity, and similar changes are being mirrored in related indices like Nifty 50 Equal Weight and Nifty Next 50.

Rationale for Inclusion: The Inclusion of InterGlobe Aviation and Max Healthcare is based on their 6-month average free-float market capitalisation, which was at lease 1.5 times that of the smallest existing constituents, which are getting excluded in parallel. This meets the eligibility criteria for Nifty 50 inclusion, which also requires the stock to be available for trading in the Futures & Options (F&O) segment.6

Sectoral Commentary (Earnings)

Banking & Financial Sector: This sector which together account for more than a third of Nifty 50 earnings, the quarter was characterised by stable credit growth but visible margin compression. Private Banks reported mixed Q1FY26 results, with a few banks posting healthy earnings while most PSBs experienced some decline. Margins for all banks contracted due to repo rate cuts, margins are expected to further moderate in Q2 as the effect of rate cuts is yet to be transferred. Business growth for most banks remained modest, with large private banks’ deposits growing more than advances. This led to a controlled CD ratio. Asset quality trend varied – with private banks seeing some deterioration mainly due to seasonality and unsecured advances, whereas the PSU banks maintained healthy to stable asset quality. NBFCs reported subdued performance in terms of asset quality and loan growth in Q1FY26, impacted both by seasonal factors such as early monsoons and weak macroeconomic environment. Overall, the sector contributed meaningfully to index-level earnings but with less strength than in prior quarters.7

Information Technology: IT companies entered the quarter with subdued expectations, and results broadly matched that tone. Deal pipelines were steady and large deal wins offered comfort, but revenue growth in constant currency terms remained muted at sub-one percent sequentially. Margins were stable due to cost optimisation, but topline momentum remains weak. Hiring stayed subdued, reflecting cautious client budgets. Tier-1 companies reported low single-digit revenue growth and continued pressure on discretionary spending. Mid-tier firms outperformed large caps on growth, aided by niche capabilities and cost agility. This left IT as a sector in a demand recovery wait and watch mode, rather than driving upgrades.8

Energy Sector: The energy and oil & gas sector emerged as one of the strongest performers in Q1FY26, providing a significant cushion to overall index earnings. Reliance Industries remained the standout contributor driven by robust refining margins and continued strength in its telecom and retail operations. Upstream companies benefited from stable crude prices, while downstream players saw refining spreads hold up better than anticipated, aided by favourable product cracks and inventory gains. While this sector was a key anchor for Nifty earnings this quarter, it’s worth noting that part of the outperformance was supported by one-off factors, suggesting that sustaining this momentum will depend on global crude dynamics and domestic demand trends in the coming quarters.9

Auto Sector: The auto sector had a mixed quarter, with overall volumes declining ~5% YoY. Automakers faced headwinds from uneven demand- particularly in two wheelers and entry-level cars – though premium segments and commercial vehicles held steadier. Input costs were not a major headwind this quarter, but lack of broad-based demand revival weighed on overall performance. Passenger Vehicles (PVs) fell 1.4%, but utility vehicles (UVs) grew 3.8%, now forming two-third of PV sales. Two-wheelers dropped 6.2% YoY due to weak rural demand, though exports surged 23% providing some relief. Commercial Vehicles (CVs) were stable, supported by infra activity but growth moderated.10

Industrials, Infrastructure & Capital Goods Sector: This sector stood out positively, aided by the government’s continued thrust on capital expenditure, construction activity and improving private investment. Larsen & Toubro delivered strong execution and order inflows (33% YoY). Demand was strong across power T&D, renewables and industrial capex. Margins improved on operating leverage and better execution mix. This group of stocks reflected the broader theme of India’s investment-led growth cycle continuing to underpin corporate earnings.11

Fast-Moving Consumer Goods (FMCG) and Consumer Staples: The FMCG sector posted a steady quarter with volume-led growth and selective premiumisation, while pricing contribution remained muted. Urban demand ( ~4% ) continued to outpace rural ( ~3.2% ), though rural showed early signs of recovery. Commodity cost pressures eased in some categories, supporting margins but inflation in edible oils, wheat and cocoa persisted for select portfolios.

Staples (HUL, ITC, Nestle, Tata Consumer) reported low-to-mid single-digit growth, driven by premium and value-added products, while discretionary categories saw mixed performance – jewellery and QSR outperformed, value fashion remained resilient, but paints and footwear lagged due to softer discretionary spending.12

Metals: The metal sector delivered a mixed performance in Q1FY26, with ferrous players (steel) benefiting from improving spreads and lower costs, while non-ferrous (aluminium, zinc) saw margin pressures due to softer global prices despite strong domestic demand. Steel profitability may normalise after Q1 highs, while aluminium players will rely on cost control and downstream value-add to offset global price weakness. Overall, the sector remains sensitive to global commodity trends and Chinese demand patterns, making the outlook less stable.13

Healthcare & Pharmaceuticals: This sector provided a more constructive tone, with steady growth in domestic formulations and some recovery in US generics. Pharma companies delivering mid-to-high single-digit revenue growth and hospitals sustaining strong double-digit growth. Margins improved on cost control and a better product mix. However, this sector has a smaller weight in the Nifty 50 and thus its contribution to index earnings was modest.14

Telecommunication: The telecom sector delivered a strong quarter, driven by ARPU expansion, premiumisation and rising data consumption. Operators benefited from higher 4G/5G adoption, increased penetration of bundled plans and steady subscriber additions. Profitability improved on operating leverage and lower capex intensity post-5G rollout.15

Are corporate earnings turning a corner?

- Government initiatives, including GST tax reforms coupled with Income tax rate cuts are expected to boost consumption, particularly in discretionary categories aiding demand revival.

- High public capex and PLI schemes continue to drive structural growth opportunities

- Positive domestic flows provide a strong base to the market.

- Lower inflation, and healthy macroeconomic indicators continue to be a positive for India.