For decades, Japan sat quietly on the sidelines of global portfolios. Investors would often acknowledge its companies, praise their craftsmanship, brand strength, and technological excellence, yet ultimately turn their attention to other markets in search of faster growth or greater excitement. Although Japan’s many businesses were fundamentally sound, with strong balance sheets, loyal customer bases, and steady cash flows, they were also slow to change. Years of deflation, reinforced by persistent quantitative easing and a culture of managerial conservatism, encouraged companies to hoard cash rather than take risks, which in turn limited innovation and weakened shareholder returns.

But after years of stagnation, that perception is beginning to shift. A new wave of corporate and structural reform has taken root, encouraged by both policymakers and investors. For the first time in decades, Japan’s equity market is not only displaying signs of growth but also of transformation, as long-standing cultural and financial barriers give way to a more dynamic and shareholder-focused era.

The Global X Japan TOPIX 100 ETF (J100) provides exposure to Japan’s largest and most established companies, spanning sectors such as technology, industrials, consumer goods, and finance. Tracking the top 100 names in Japan’s marquee Index, it captures the core of Japan’s equity market through a focused basket of blue-chip, high-quality names.

Key Takeaways

- Japan’s return to moderate inflation is lifting wages, restoring pricing power, and incentivising investment, marking a lasting shift from deflationary stagnation toward sustainable earnings growth.

- Shareholder reforms, growing activist pressure are pushing Japanese companies to deploy excess cash more efficiently, improving balance sheets and unlocking long-suppressed shareholder value.

- Japan’s deep integration across global supply chains ensures participation in major megatrends such as AI, electric vehicles, and energy transition, providing stable exposure with lower volatility than front-line innovators.

Inflation Normalisation to Grow Wages, Consumption, Investment

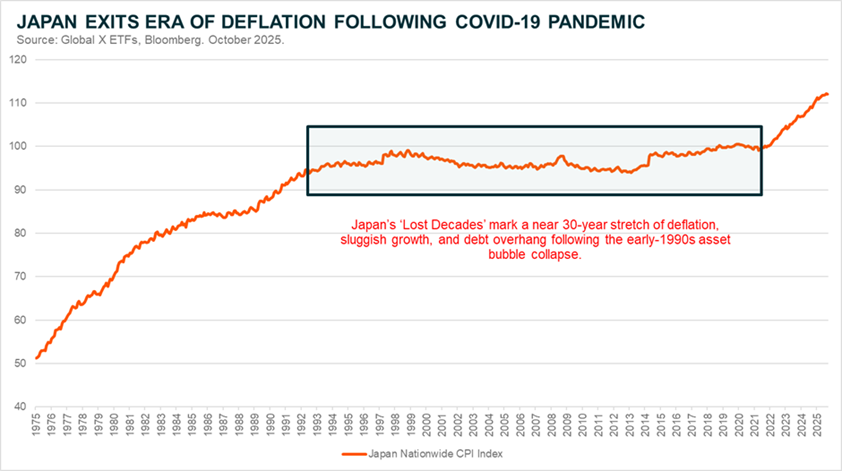

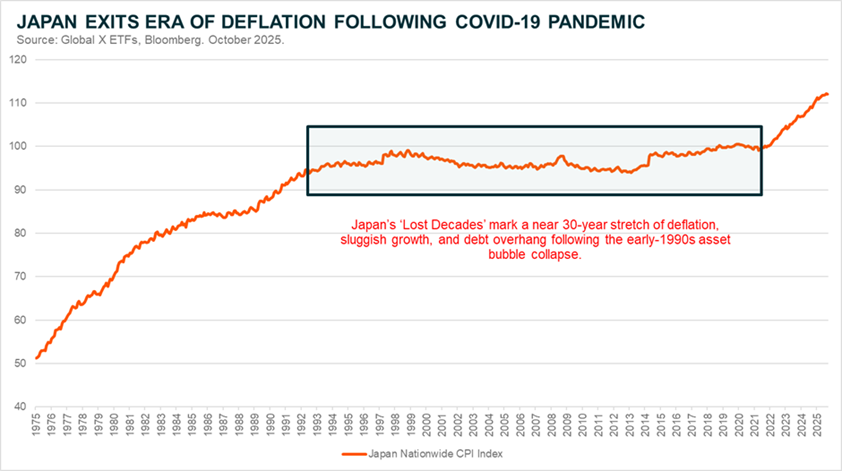

For decades, Japan’s economy was defined by stagnation. The burst of its late-1980s asset bubble sent property and equity prices crashing, erasing household wealth and crippling the financial sector. What followed became known as the “Lost Decades” – a prolonged era of weak growth, deflation, and entrenched pessimism that persisted despite aggressive monetary easing and government stimulus.

Decades later, the COVID-19 pandemic delivered an unexpected twist. While the pandemic was devastating for most economies – disrupting global supply chains and triggering a global health crisis – it also unleashed a wave of inflation as governments injected liquidity to sustain spending and support growth. Most countries have struggled with the consequences, but Japan may prove an exception, benefiting instead from a structural shift away from decades of deflation toward a more normalised inflation environment.

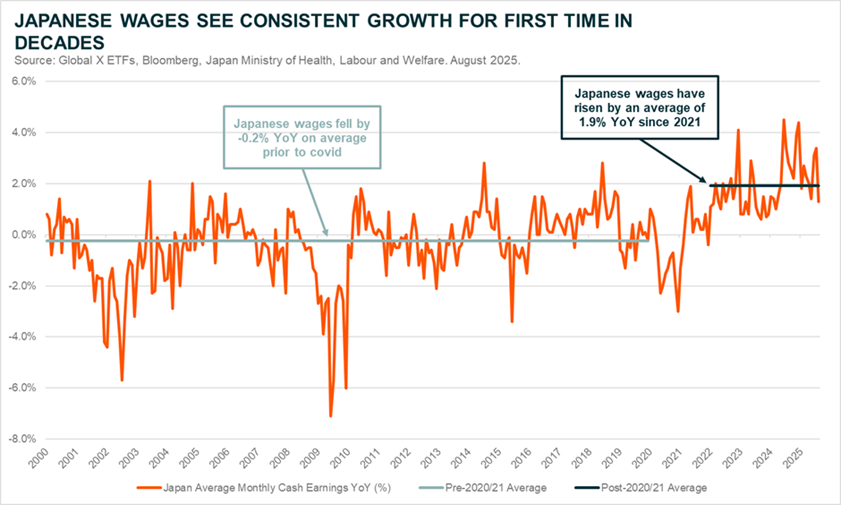

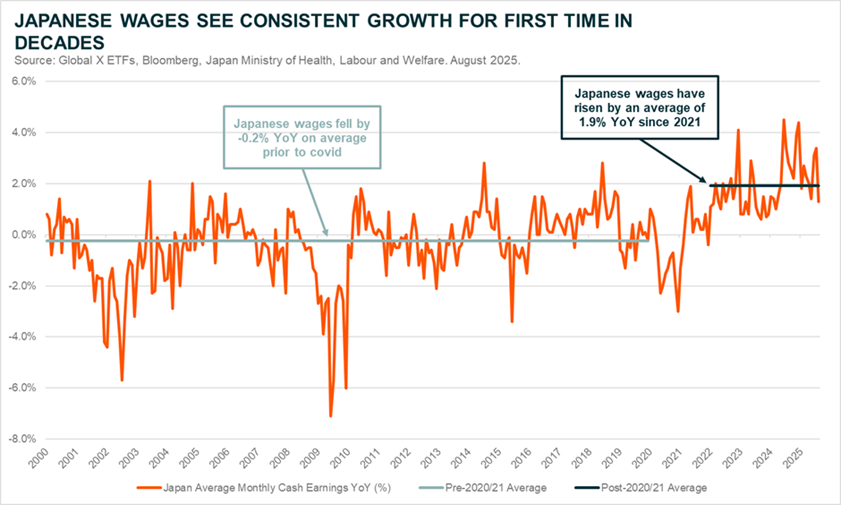

A return to normalised inflation has far-reaching benefits for Japan’s economy. Moderate price growth encourages firms to (or unions to demand) raise wages which in turn supports consumption and domestic demand. For corporates, this environment often translates into stronger revenue growth, which in turn can be monetised through healthier margins, leading to rising earnings.

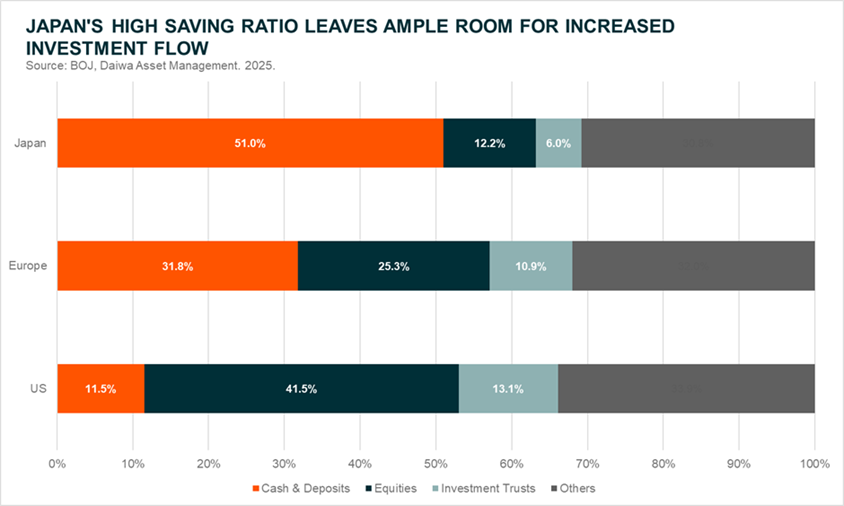

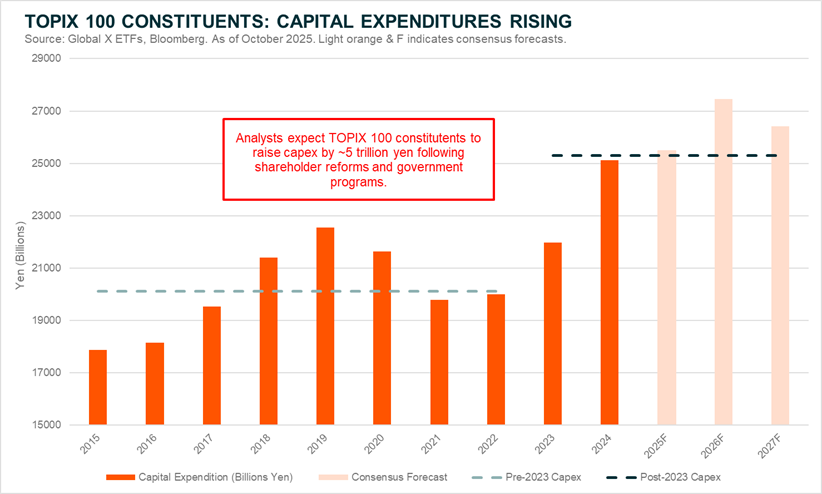

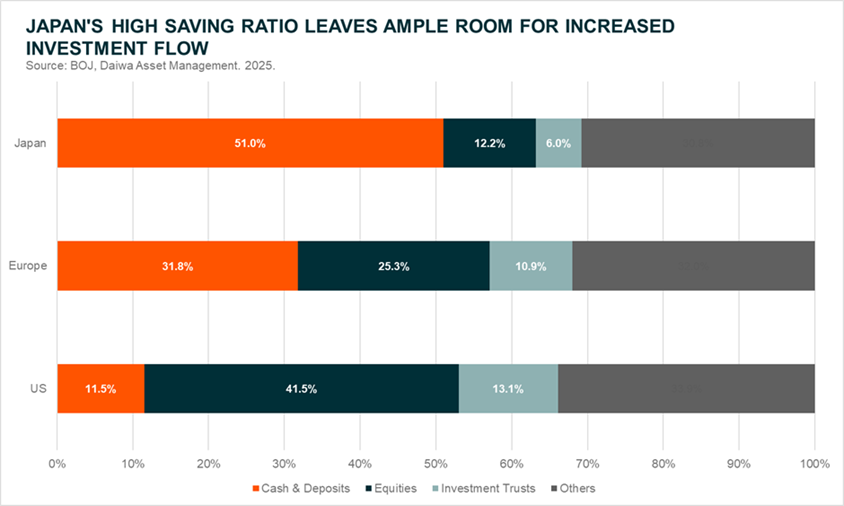

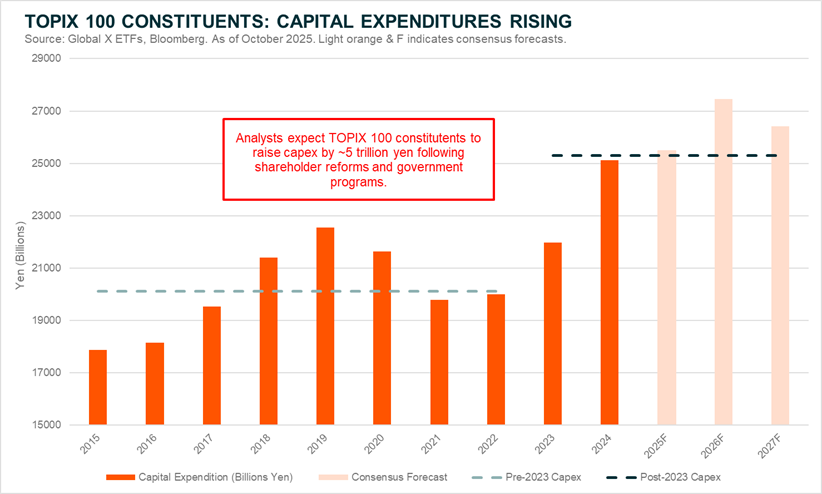

Rising inflation in itself also reignites the incentive to invest. In a deflationary environment, cash gains value over time, discouraging risk-taking and capital deployment. But with moderate inflation, the opposite holds true. Investors seek higher returns to outpace rising prices, channeling funds into equities, property, and productive assets. This shift could be especially significant in Japan, where households remain among the most under-invested globally, holding around 51% of their assets in cash and deposits and just 18% in equities or investment trusts, compared with 12% and 55% respectively in the United States.1

Japan Enters Its Shareholder-Focused Era

For years, Japanese firms were content to sit on excess cash, shaped by a legacy of high debt burdens, persistent deflation, limited competition, and cultural norms of financial conservatism. This led to chronically low returns on capital and a general indifference toward shareholder demands. However, that environment has been changing, driven by policy initiatives and a rise in shareholder activism.

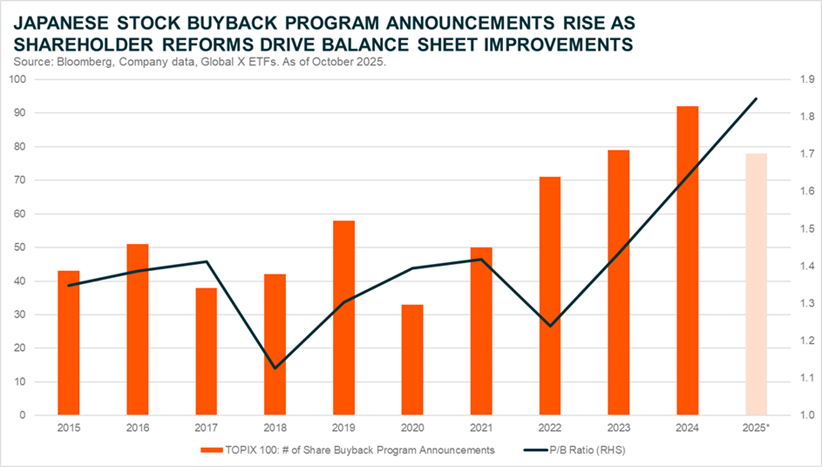

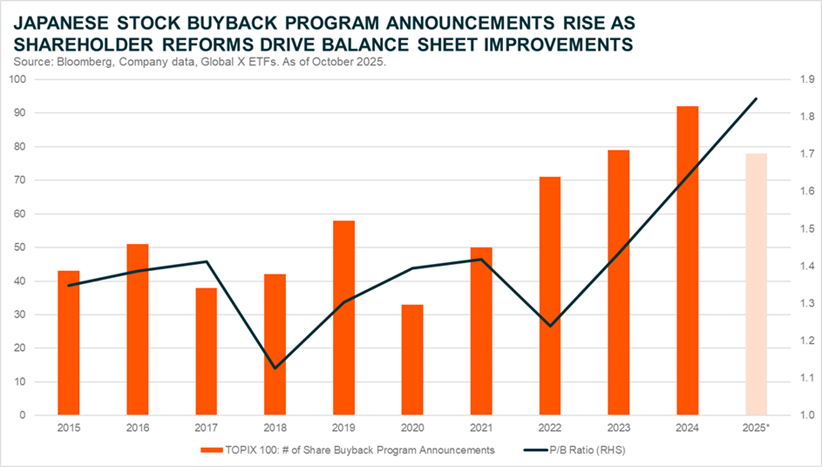

In 2023, for example, the Tokyo Stock Exchange (TSE) called on all companies listed on its Prime and Standard Markets to “implement management that is conscious of cost of capital and stock price”.2 Firms were asked to disclose why they had failed to achieve profitability, or, if profitable, why their market valuations remained low. The exchange also encouraged more active investor engagement and set performance benchmarks such as maintaining a price-to-book ratio above one or achieving a return on equity (ROE) of at least 8%.

Those demands have, thus far, been met with compliance. Stock buy backs - one of the most effective methods of increasing price-to-book ratios through reducing the denominator while driving shareholder returns – have risen in popularity every year since the pandemic with companies on the TSE announcing more stock buyback programs in 2024 than any time in history.3

Meanwhile, government reforms such as the Financial Services Agency’s “Action Programmes for Corporate Governance Reform” (introduced in 2023 and refined in 2024) have targeted harmful corporate practices like cross-shareholdings, driving a wave of M&A and divestments.4 These shareholder-focused initiatives have also emboldened activist investors, enabling them to push management toward value-creating actions such as raising dividends, shedding underperforming ventures, and pursuing growth opportunities.

Innovation-Based Growth Doesn’t Have to Be Bleeding Edge

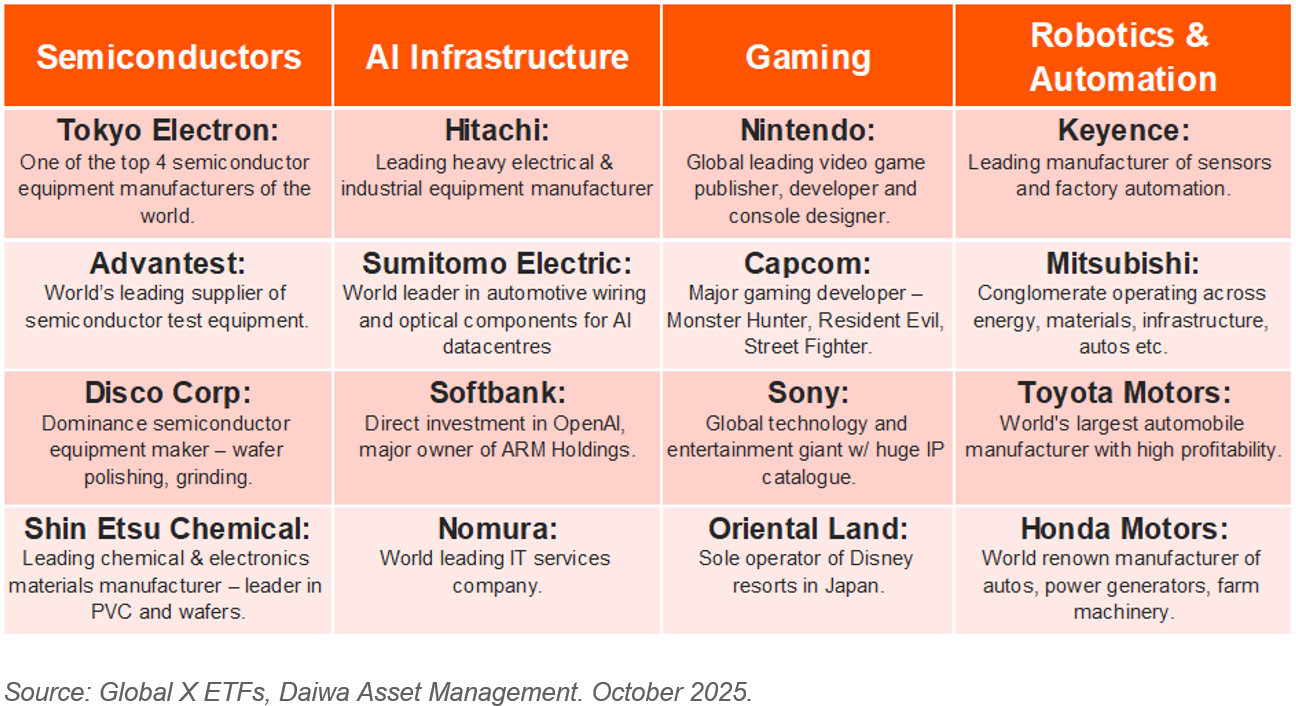

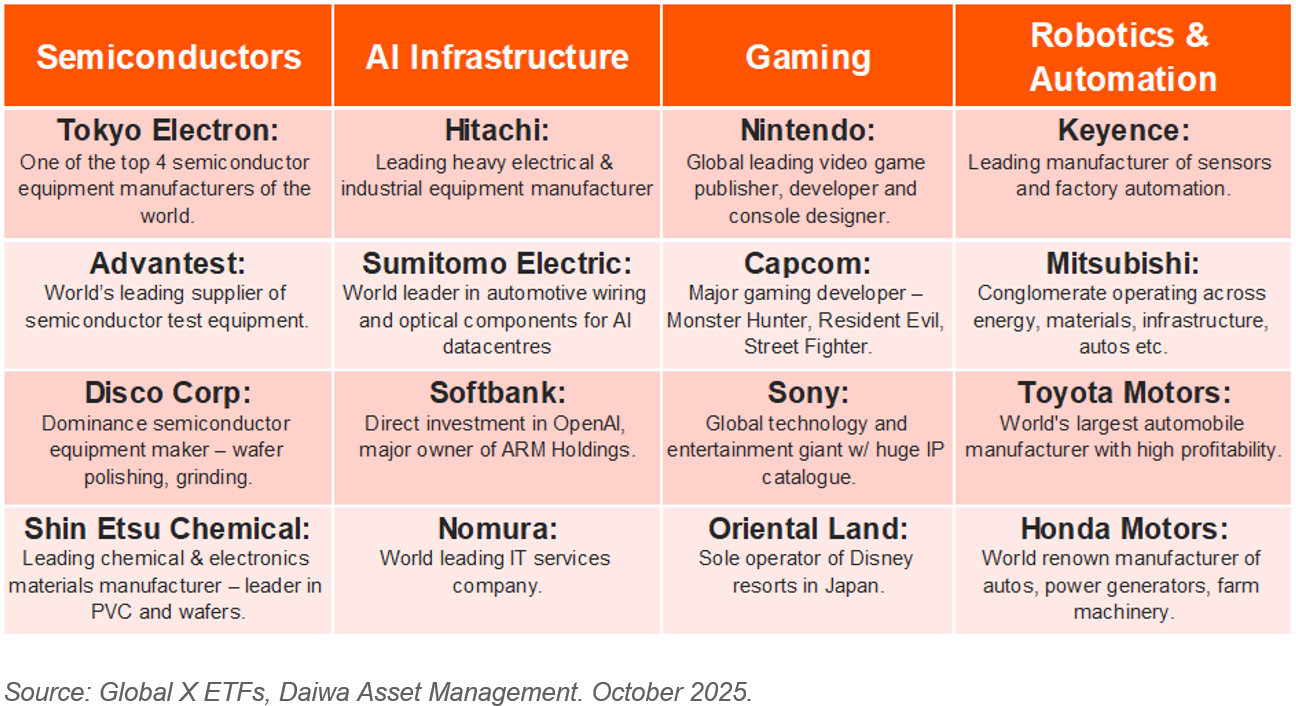

While Japan, for many, is no longer considered the leading force of global innovation, it is still home to a cadre of the world’s most recognisable and elite businesses. These include companies which, while not at the bleeding edge, are still deeply embedded in the supply chain of some of the world’s most important megatrends.

The table below highlights selected constituents of the TOPIX 100 Index (as of October 2025) that have been, or could become, key participants in some of the world’s most prominent and enduring megatrends:

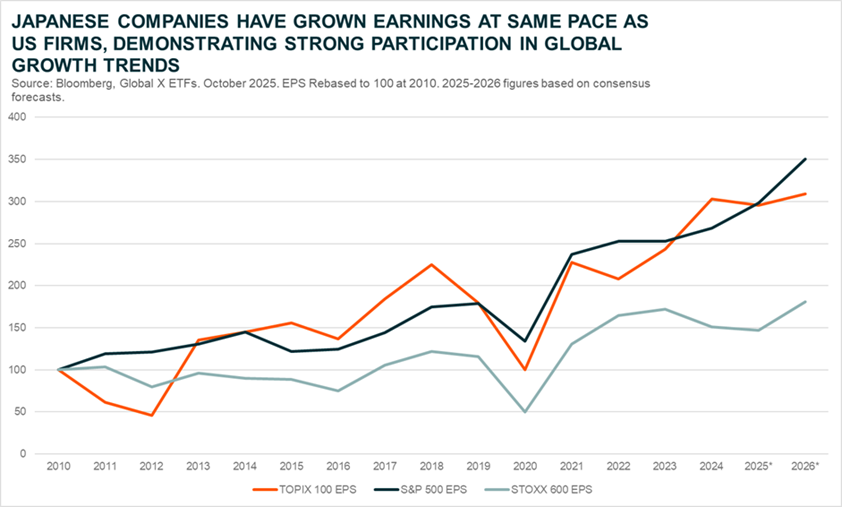

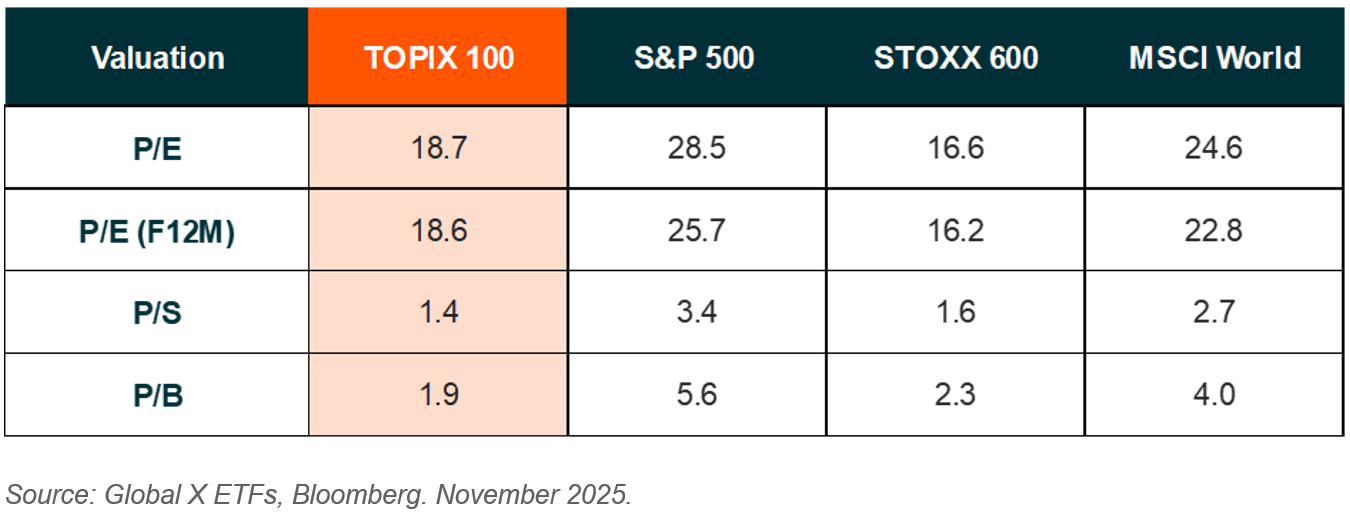

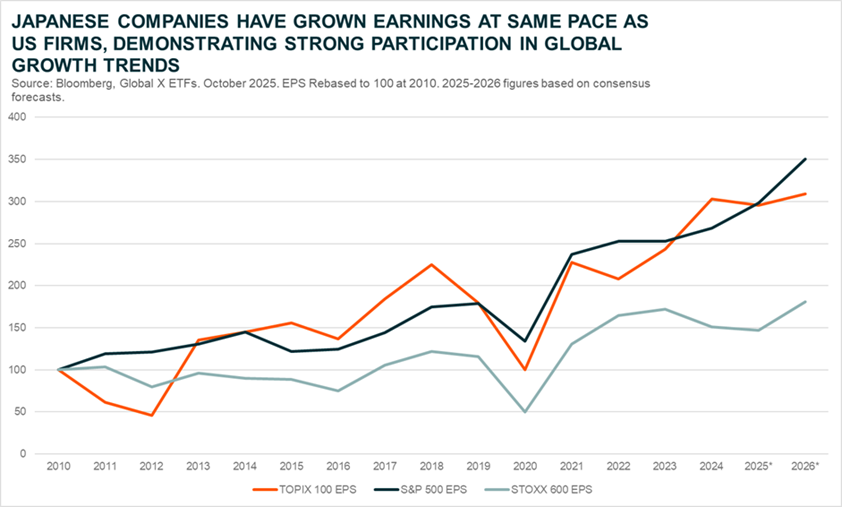

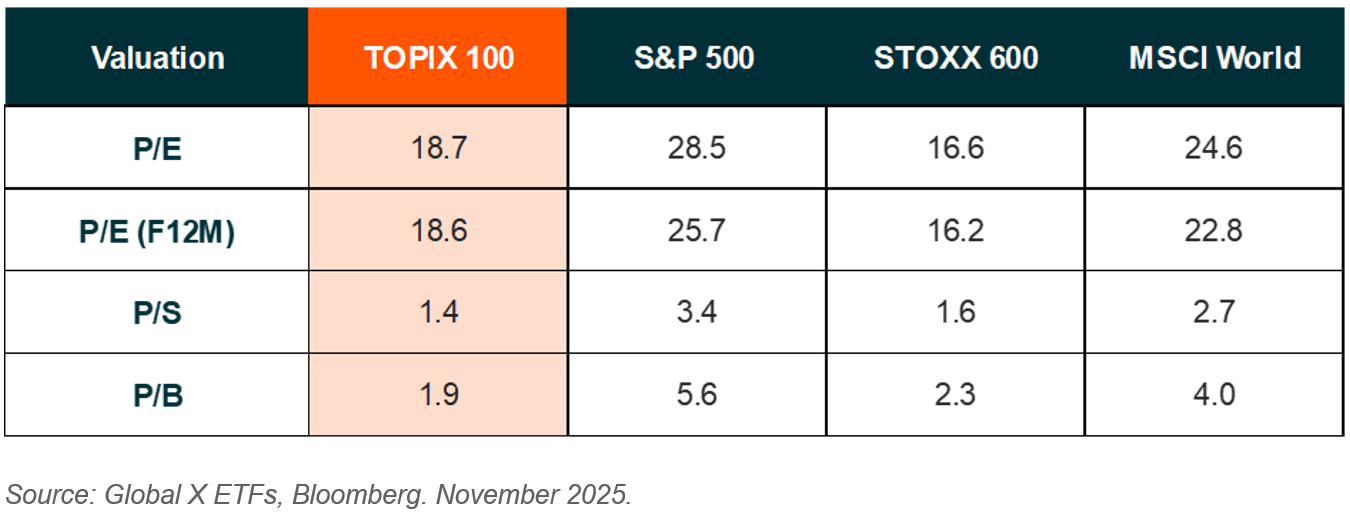

These firms are not only key participants in the global trends outlined above; they’re also material beneficiaries. This is demonstrable through their strong EPS growth over the past decade which has roughly kept pace with the US, even as innovation-driven narratives such as artificial intelligence, electrification, and robotics have dominated global markets. Far from being left behind by technological progress, Japanese companies have become its enablers – the infrastructure of global innovation, so to speak. Coupled with attractive valuations and strong market positioning, they offer some of the most compelling value-oriented exposures to today’s leading growth themes.

Conclusion: A New Era for Japanese Equities

After decades of hesitation, Japan’s equity story is entering a new chapter - one defined not by deflation and inertia, but by reform, resilience, and renewed ambition. Structural changes are aligning in ways unseen for a generation: inflation has normalised, corporate governance has matured, and capital is finally being put to work. Together, these shifts are unlocking long-dormant value and ushering in a more dynamic, shareholder-focused market.

The Global X Japan TOPIX 100 ETF (J100) captures this transformation at its core. By investing in Japan’s largest, most established, and globally integrated companies, J100 provides investors with diversified exposure to the country’s evolving growth narrative. For those who once overlooked Japan, the story is changing. The “Land of the Rising Sun” is once again living up to its name, as its equity market basks in a renewed dawn of growth and optimism.