China’s economic growth has long been defined by scale, speed, and state direction. But the narrative is shifting. While headlines still focus on short-term sentiment and cyclical pressures, China is quietly executing on a multi-decade innovation strategy - one that combines industrial scale with self-sufficiency in critical technologies. This is not an early-stage story. From semiconductors to robotics, AI to EVs, China is now home to globally relevant companies with real market share, policy support, and commercial deployment.

The Global X China Tech ETF (ASX: DRGN) offers targeted access to this evolution. It tracks 20 leading technology companies listed in China and Hong Kong, selected using a rules-based methodology that captures growth, cash generation, and value. With exposure across A-shares (mainland-listed) and H-shares (Hong Kong-listed), DRGN provides investors with a differentiated way to participate in China’s next growth engine spanning sectors such as semiconductors, EV’s, robotics, Internet of Things (IoT), and AI infrastructure.

Key Takeaways

- Decades of groundwork are now unlocking scale: China’s technology sector has been built on industrial expansion, digital infrastructure and long-term policy planning. That foundation is now supporting commercial innovation across core sectors.

- Strategic technologies are moving into deployment: China’s semiconductors, robotics, and AI infrastructure industries are no longer future ambitions. They are being scaled through national investment, real-world use cases and cost advantages.

- Exposure to the full spectrum of China’s innovation economy: DRGN includes both domestically focused A-share companies in automation and AI infrastructure, and H-share names with global reach in platforms and semiconductors, offering investors a more complete view of China’s technology landscape.

A Planned Shift from Industrial Buildout to Innovation Scale

China’s growth model has never stood still. Each decade has marked a deliberate shift in focus. What began in the 1980s with export manufacturing evolved in the 2000s into a wave of infrastructure investment and urban development. In the 2010s, rising incomes and internet access gave rise to consumer platforms and digital services. Now the next phase is taking shape, driven by domestic technology, industrial automation and national scale data infrastructure, with semiconductors, AI and robotics at its core.2

This transition did not emerge in response to short-term shocks. It was planned. During 2015, the government introduced The Made in China 2025 policy which outlined ten strategic sectors, including advanced information technology, industrial machinery, electric mobility and smart manufacturing. It was backed by national funding, five-year plans and state procurement. Today, that framework is being realised through tangible progress.

The size of China’s digital economy has more than tripled since 2015, reaching over US$9 trillion in 2024. Its share of GDP has risen from 27% to 45% over the same period, with forecasts pointing to 57% by 2030.3 This is not just growth in internet services. It reflects a wider digitisation of industry, infrastructure and productivity systems.

Policy support has also shifted in character from R&D subsidies to deployment incentives. Capital is flowing into scaled rollout of AI, automation and semiconductor capabilities. This is no longer a trial phase. It is a transition from experimentation to national execution. And with that, a redefinition of how China grows.

Undisputed Leadership in EVs, Robotics and AI Deployment

In multiple verticals, China is already the global leader.

In electric vehicles (EV), China accounted for over 60% of global production in 2023. BYD alone delivered more than 3 million units, more than Tesla and Volkswagen combined. Domestic firms now control key parts of the supply chain, from vehicle assembly to battery manufacturing. Six of the top ten battery suppliers globally are Chinese, led by CATL.4

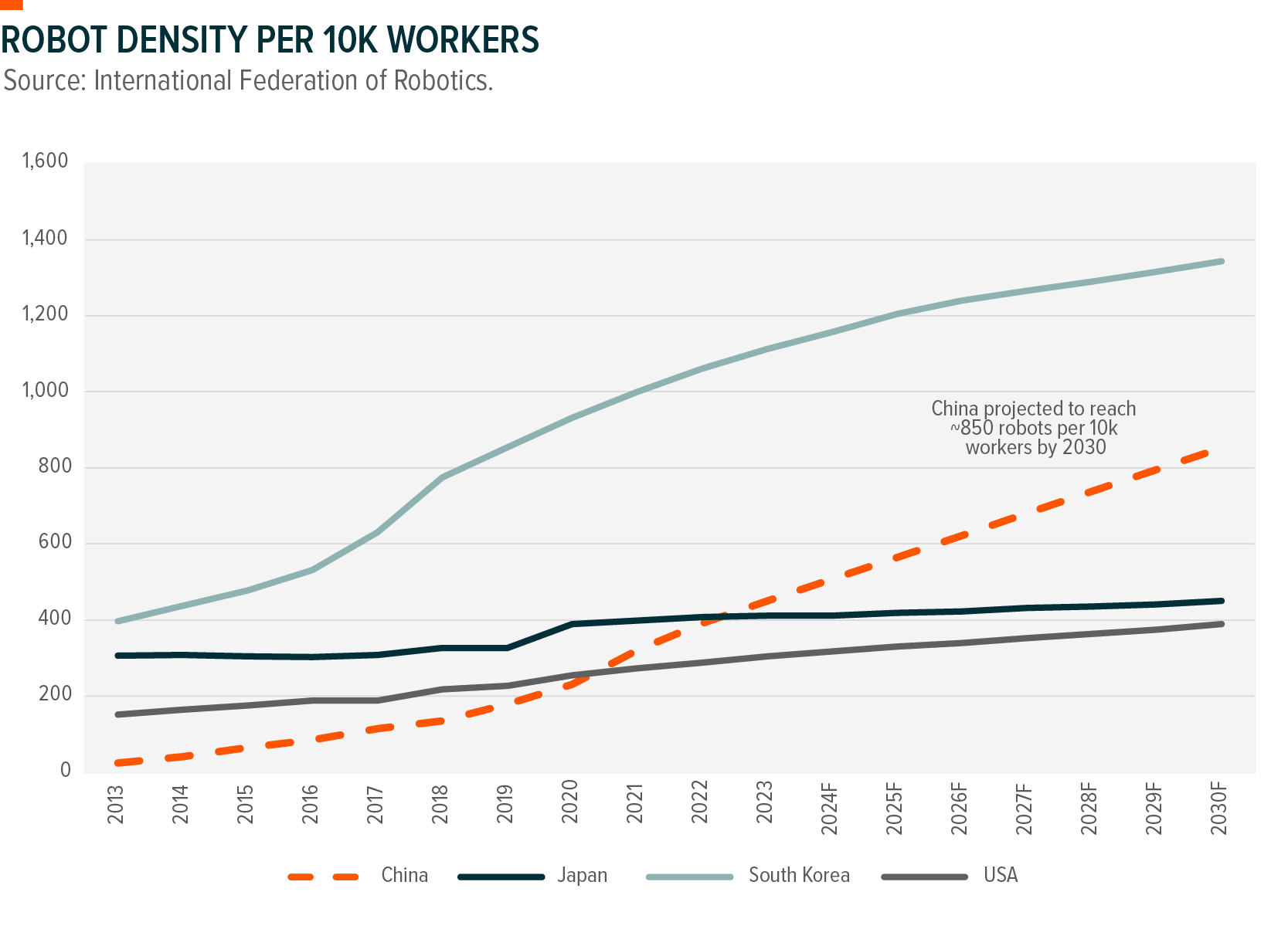

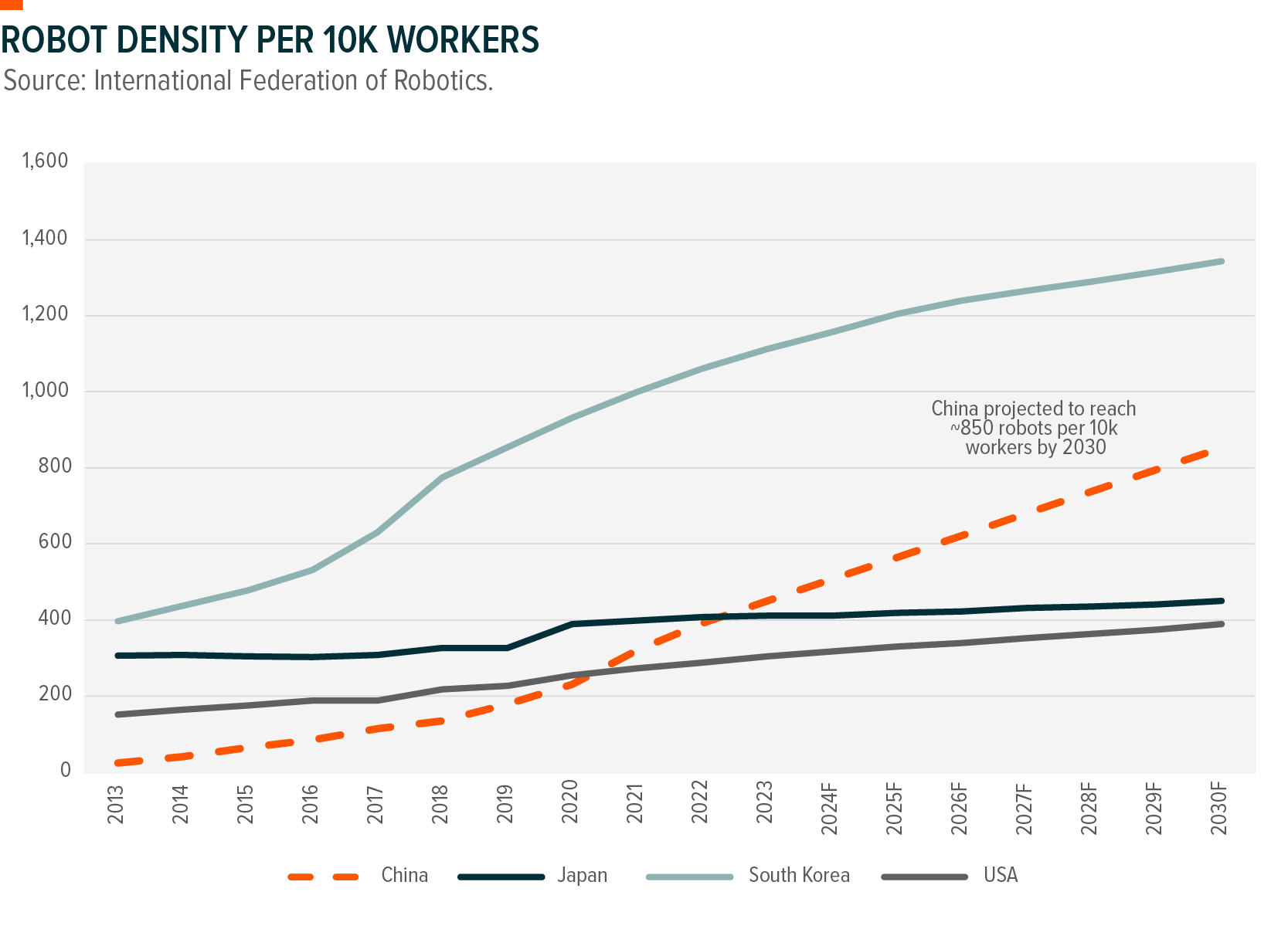

In robotics, China installed over 50% of the world’s industrial robots in 2023. Robot density has increased tenfold in a decade but still trails Japan and South Korea, leaving further headroom for adoption. This is partly due to China’s larger manufacturing workforce and later start in automation, which dilutes robot-to-worker ratios despite high installation volumes. China’s dominance in installation also reflects a structural shift, moving from imported systems to domestic producers, supported by policy and procurement.5

In semiconductors, China has accelerated production in mature nodes and power chips. While advanced design remains constrained, companies are gaining edge in areas like packaging and automotive grade silicon. These are not prestige segments. They are high volume, high application components used in EVs, data centres and automation.6

In AI, cost and deployment scale are the edge. Inference costs in China are now more than 90% lower than in the US. This is driving enterprise rollout across logistics, manufacturing and finance. Model scale is catching up, but cost efficiency is already a differentiator, allowing for faster experimentation and ROI across sectors.7

A Clear and Rules-Based Approach to Innovation

The Global X China Tech 20 Index is designed to capture the companies most exposed to this structural transition. It selects 20 stocks, 10 A-shares and 10 H-shares across 11 technology-aligned sectors. The selection process uses a transparent methodology that combines:

- Market capitalisation and trading liquidity

- One-year revenue growth and earnings growth

- Free cash flow yield

This approach filters out persistently unprofitable names while tilting toward financially sound innovators. The final portfolio is capped at 8% per name and rebalanced quarterly.

A-shares represent companies deeply tied to China’s domestic transformation including automation, software, and AI infrastructure. H-shares reflect global-facing names listed in Hong Kong, with more institutional ownership and export orientation.

Together, the combined exposure reflects a broader and more complete view of China’s innovation economy than traditional Emerging Markets (EM) or tech indices, which remain heavily weighted to legacy industries or offshore consumer platforms.

Related Fund

DRGN: The Global X China Tech ETF (ASX: DRGN) invests in companies leading China’s shift from industrial scale to innovation sovereignty, providing exposure to the structural, long-term growth drivers underpinning China’s technology transformation.