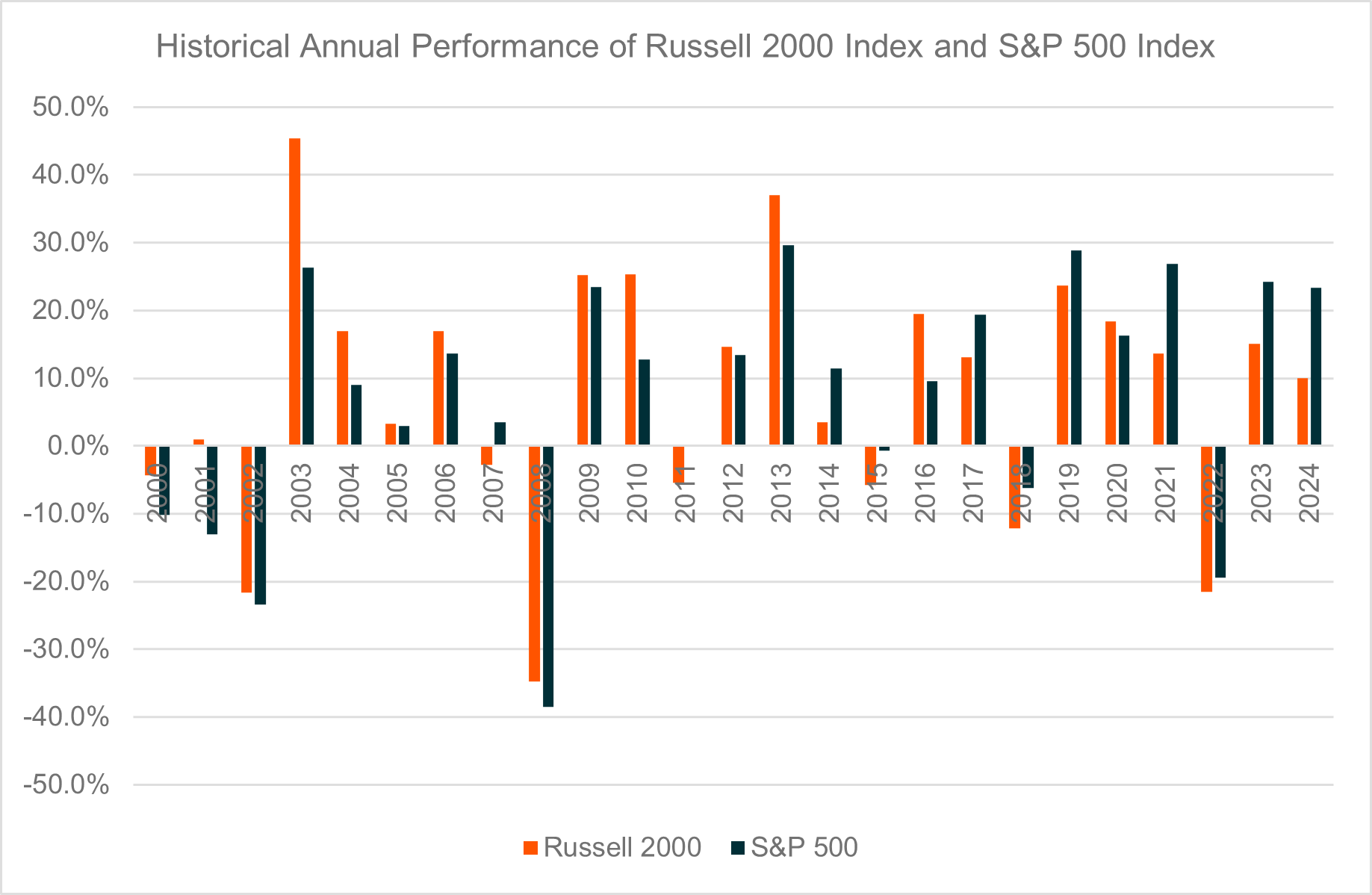

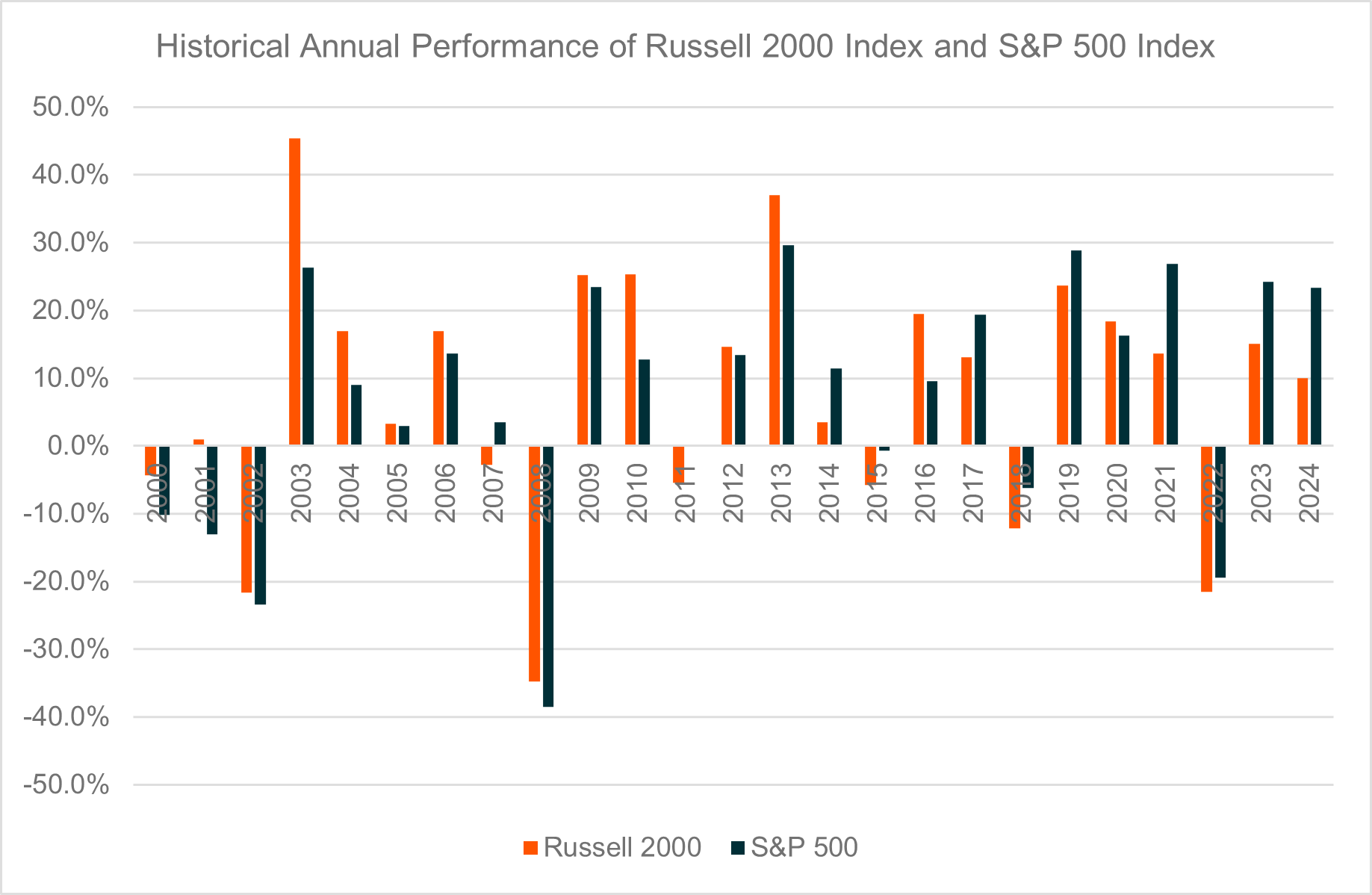

Small and mid caps are typically discussed through a familiar macro framework. Lower interest rates, easier financial conditions, and higher sensitivity to economic acceleration are often cited as the primary drivers of Russell 2000 performance. That relationship is well documented and widely accepted by the market. As a result, much of the rate-cut narrative is already well understood1.

The more relevant question for 2026 is not whether small caps benefit from rate cuts, but what determines whether that benefit translates into sustained outperformance versus the S&P 500 Index. History suggests that rates are a necessary condition, but rarely a sufficient one. When Russell 2000 leadership has been durable, it has been driven by something more fundamental than policy alone2.

Key Takeaways

- Russell 2000 outperformance has historically been earnings-led rather than valuation-driven

- Relative EPS momentum, not margin expansion or starting multiples, has mattered most

- The current earnings setup points to a regime shift rather than a typical rate-cycle bounce

What Tends To Matter Less Than Investors Think

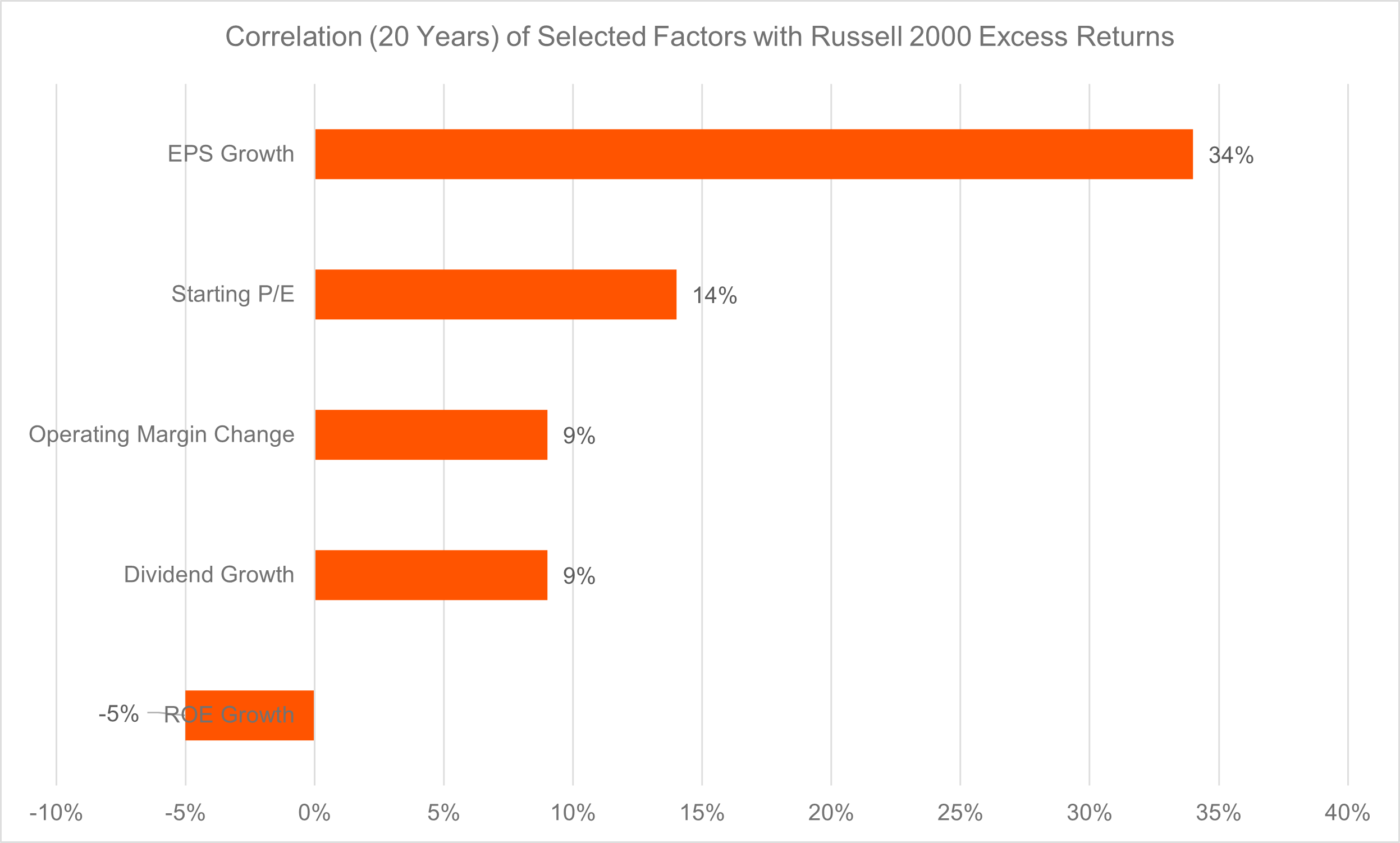

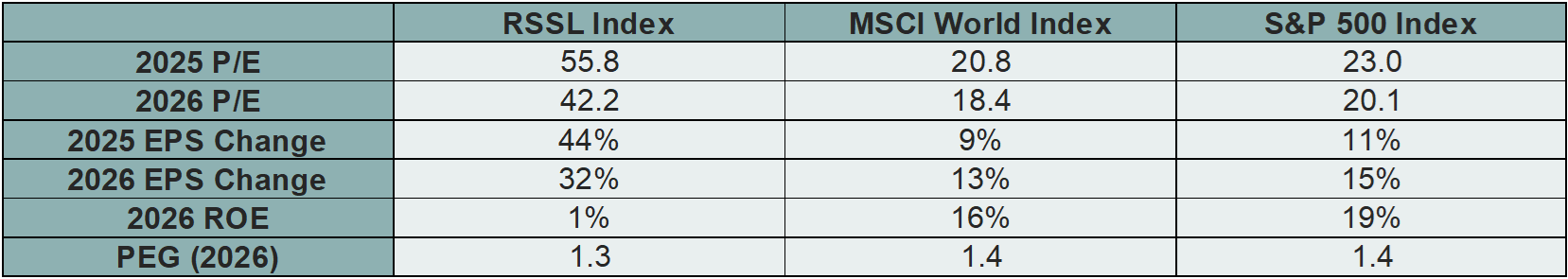

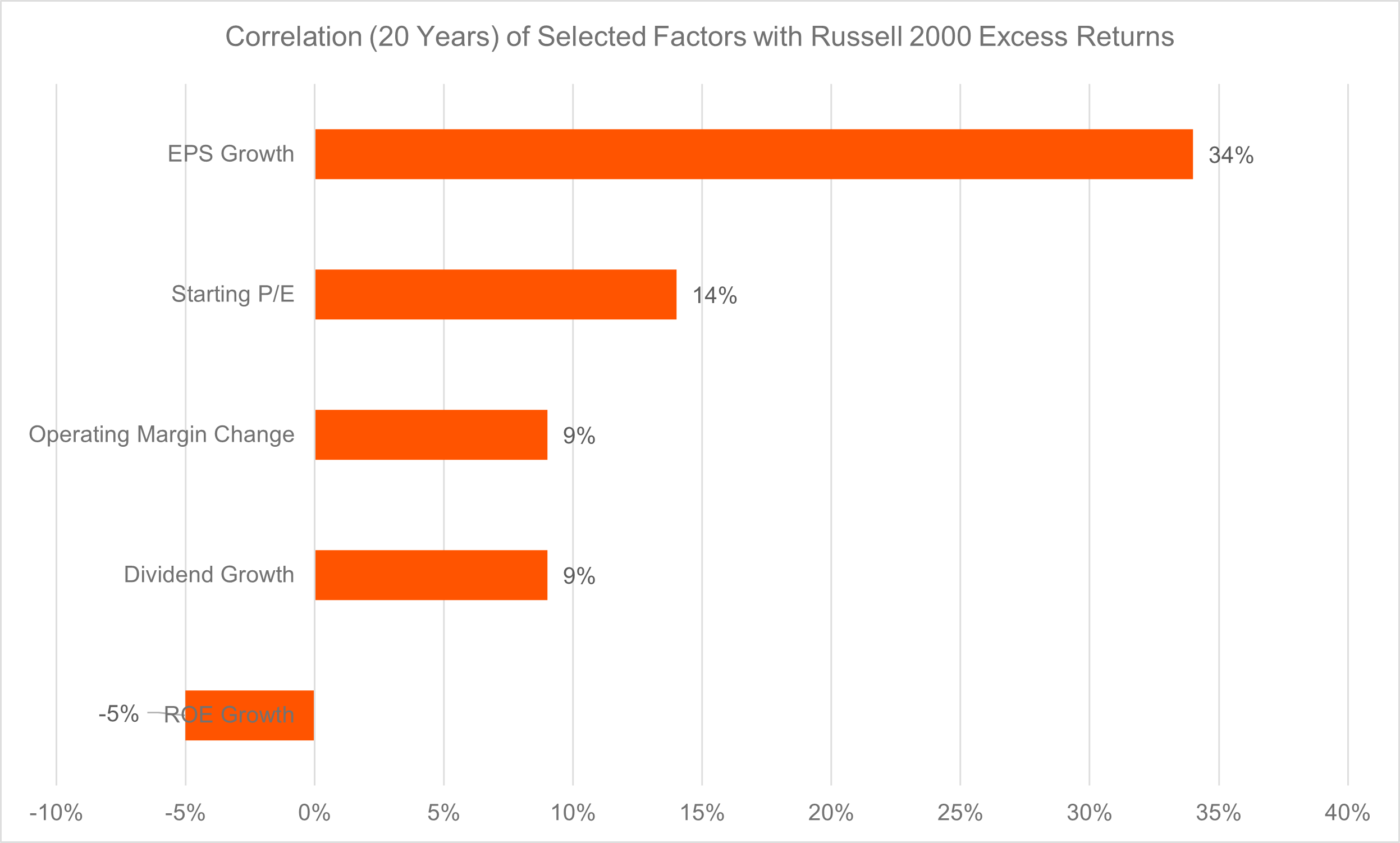

Small caps are often framed as a valuation story. They tend to be cheaper, more cyclical, and more sensitive to improvements in profitability. In theory, that should make them natural beneficiaries of recoveries. In practice, many of these commonly cited factors have had limited power in explaining Russell 2000 outperformance at the index level3.

Starting valuation multiples, for example, have shown little consistency as a signal. Cheap can stay cheap, particularly when earnings visibility is uncertain. Similarly, changes in operating margins, return on equity, or dividend growth tend to move unevenly across the Russell 2000’s diverse constituent base. Improvements in one segment are often offset by pressure elsewhere.

Source: Bloomberg data as of 24 December 2025

Excess returns based on Russell 2000 Index vs. S&P 500 Index.

These factors may matter for individual stock selection, but they are blunt tools for timing index-level leadership. The Russell 2000 is broad and heterogeneous, with exposure across a wide range of industries. As a result, slow-moving balance sheet and profitability metrics tend to lag turning points and show little alignment with periods of sustained relative outperformance.

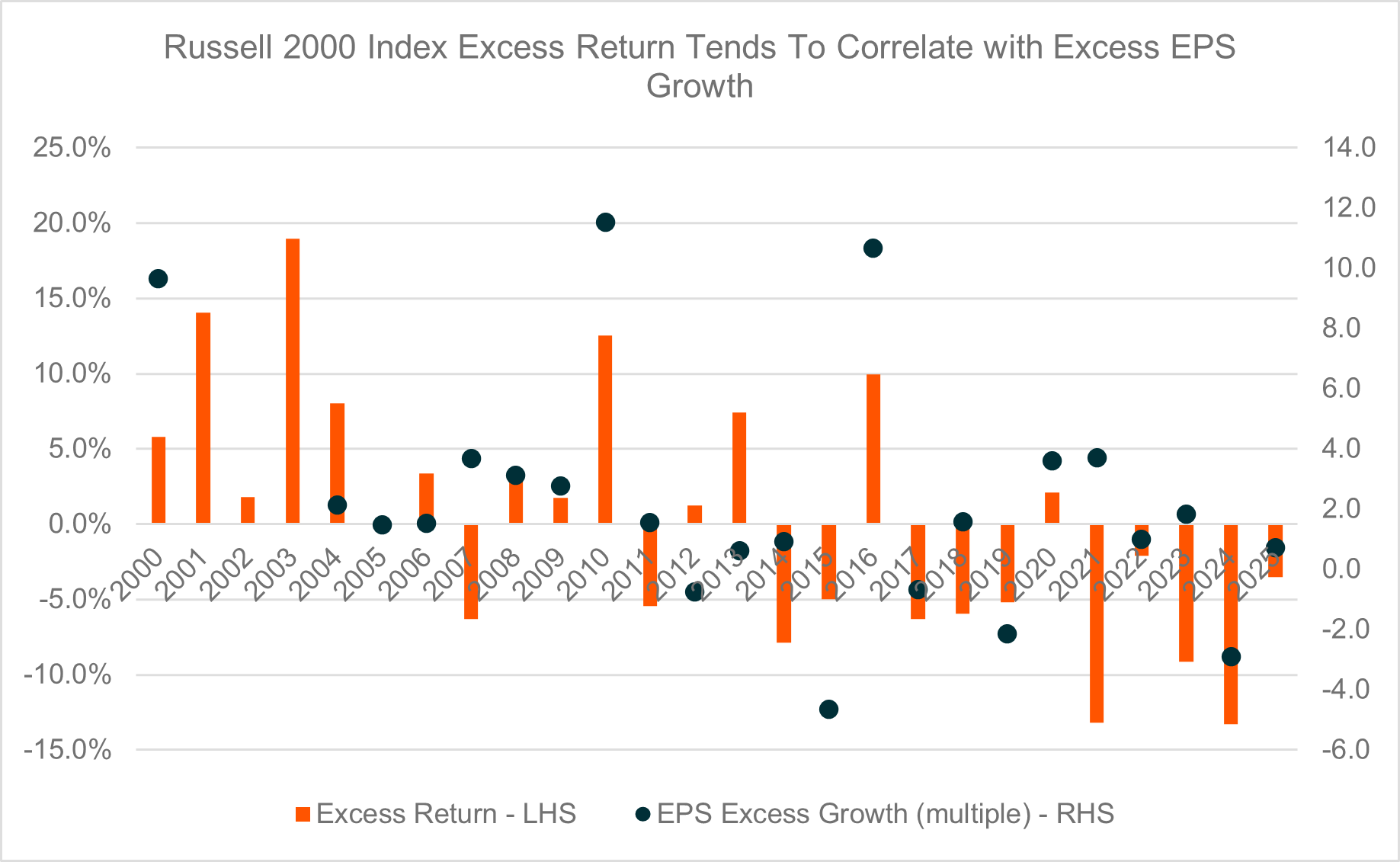

Earnings Leadership Is The Differentiator

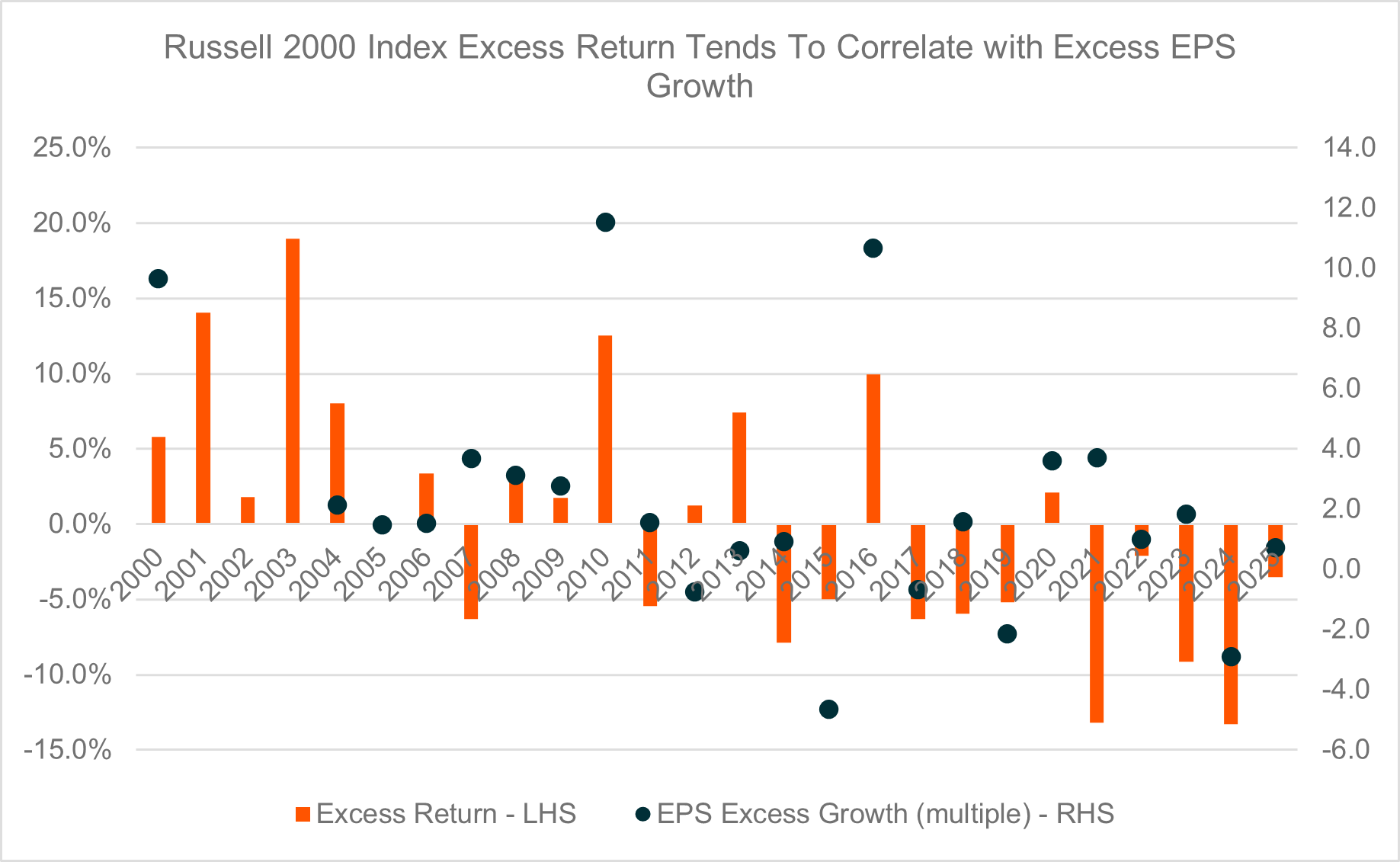

What has mattered far more consistently is relative earnings growth. When Russell 2000 earnings growth has outpaced that of the S&P 500, relative outperformance has tended to follow. Small caps do not need aggressive multiple expansion to outperform. They need earnings growth to shift in their favour. When viewed in relative terms, this relationship strengthens meaningfully, with excess Russell EPS growth showing a correlation of over 50% with subsequent relative performance compared to 34% correlation to EPS growth.

Source: Bloomberg data as of 24 December 2025

Past performance is not indicative of future results.

You cannot invest directly in an index. Indices are unmanaged and do not include fees or expenses.

Source: Bloomberg data as of 24 December 2025

Excess EPS growth based on Russell 2000 Index vs. S&P 500 Index ratio

This reframes the small-cap discussion away from mean reversion and towards earnings momentum. Large caps, particularly those dominating the S&P 500, are typically mature, globally exposed, and already operating at scale. Their earnings growth is often steadier, but materially harder to accelerate once expectations are high.

By contrast, small caps are more operationally leveraged. When revenues recover, costs are largely embedded, allowing earnings to inflect sharply. As financial conditions ease, funding constraints relax, reinforcing this earnings acceleration. Historically, Russell 2000 leadership tends to emerge when this inflection becomes visible and clearly differentiated from large caps.

Importantly, this also explains why rate cuts alone are not enough. Rates can improve the backdrop, but they only translate into performance when earnings respond. The Russell 2000 leads when earnings growth does the work, not when investors simply anticipate it.

Why The Current Setup Matters For 2026

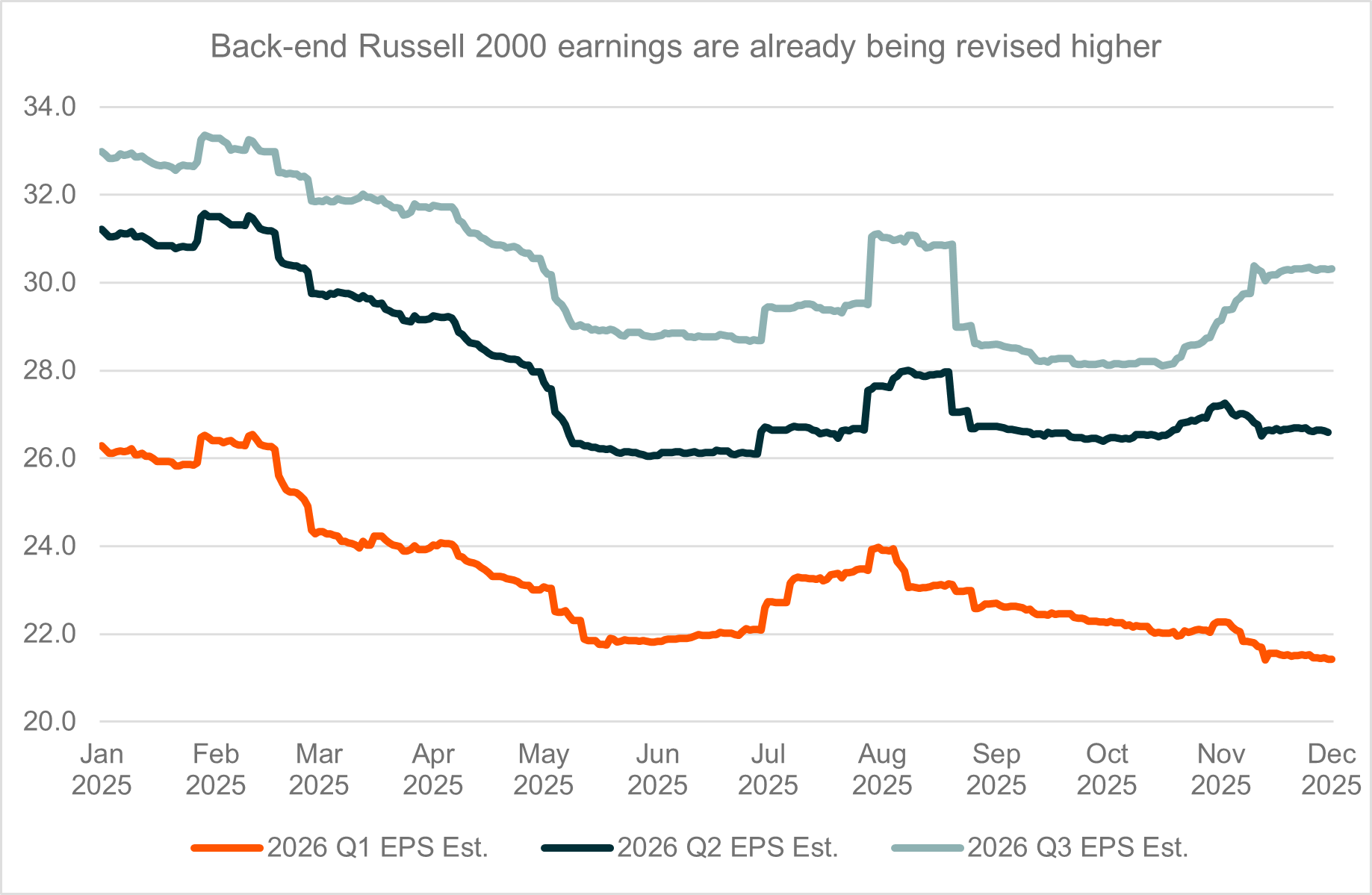

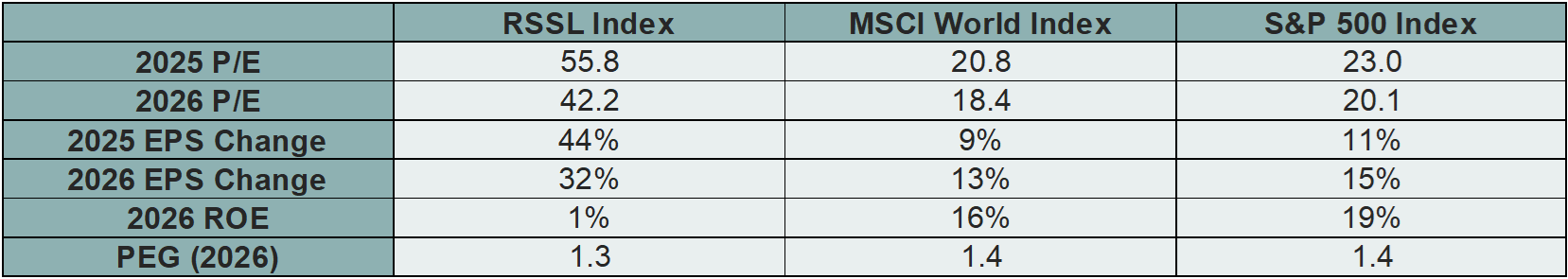

Heading into 2026, the earnings setup is unusual, with small-cap earnings coming off a weaker base following a period of margin pressure, tighter financial conditions, and subdued investment, while large-cap earnings have already benefited from several years of strong delivery, scale advantages, and pricing power. That divergence matters because it shifts the burden of earnings acceleration disproportionately toward large caps, where expectations are already elevated and incremental growth is harder to generate.

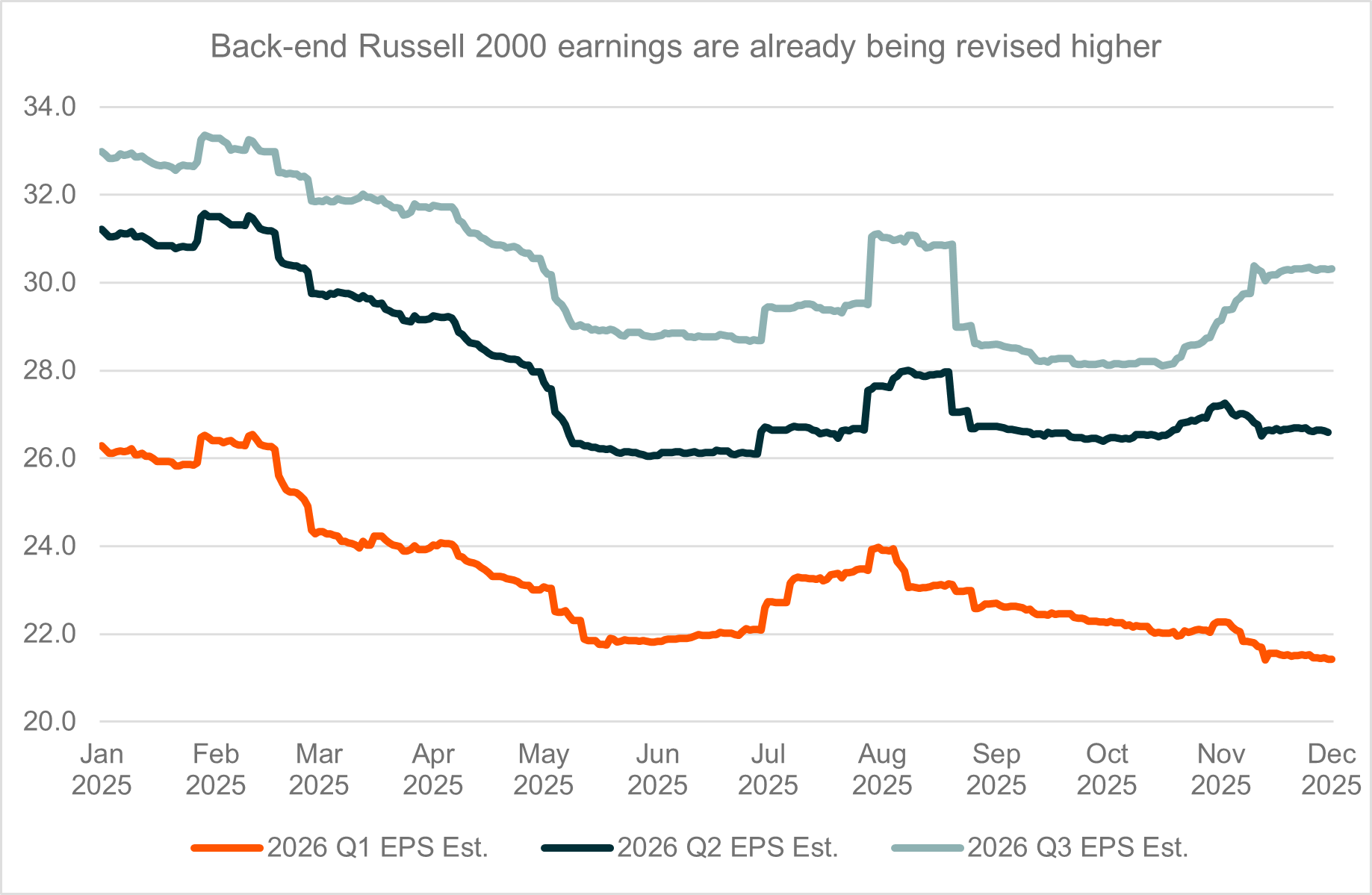

At the same time, consensus expectations for Russell 2000 earnings are beginning to stabilise, with estimates further out along the curve now moving higher even as near-term forecasts remain cautious. The direction of revisions suggests improving earnings visibility rather than continued deterioration, supporting the case that small-cap earnings growth can accelerate from depressed levels without relying on aggressive assumptions or a sharp change in macro conditions.

Source: Bloomberg data as of 31 December 2025

Large-cap earnings growth, by contrast, faces a higher bar given the scale at which those businesses already operate and the difficulty of sustaining outsized growth once expectations are firmly anchored. That asymmetry creates a more favourable setup for earnings leadership to rotate toward smaller, more operationally leveraged companies if conditions continue to normalise.

Policy settings further reinforce this backdrop, with recent US administration measures favouring domestically oriented businesses through tax incentives, investment pull-forwards, and support for physical activity and employment. As the US approaches the mid-term phase, policy narratives have historically tilted toward visible economic outcomes rather than global platform expansion, dynamics that tend to align more closely with the Russell 2000’s domestic exposure than with the S&P 500’s global footprint4.

Taken together, the current environment increasingly resembles past periods in which Russell 2000 outperformance was driven by earnings leadership rather than valuation rerating or macro speculation.

An Earnings-Led Setup for 2026

The Russell 2000 opportunity into 2026 is best understood as an earnings-led regime rather than a tactical rate-cut trade. History suggests that when relative earnings growth shifts decisively in favour of small caps, performance tends to follow, even without multiple expansion or aggressive margin recovery assumptions.

Source: Bloomberg data as of 31 December 2025

Source: Bloomberg data as of 24 December 2025

Source: Bloomberg data as of 24 December 2025 Source: Bloomberg data as of 24 December 2025

Source: Bloomberg data as of 24 December 2025 Source: Bloomberg data as of 24 December 2025

Source: Bloomberg data as of 24 December 2025 Source: Bloomberg data as of 31 December 2025

Source: Bloomberg data as of 31 December 2025

Source: Bloomberg data as of 31 December 2025

Source: Bloomberg data as of 31 December 2025