Indian Economy

India's economic growth slowed more than expected in H1FY25 (Indian Financial Year: Apr 1, 2024 -Mar 31, 2025). The country's GDP growth in the Q2 FY25 eased to 5.4%, its slowest since late 2022.1 A subdued performance by corporates in Q2 FY25 and a slowdown in general economic activity were likely responsible for this muted GDP growth.

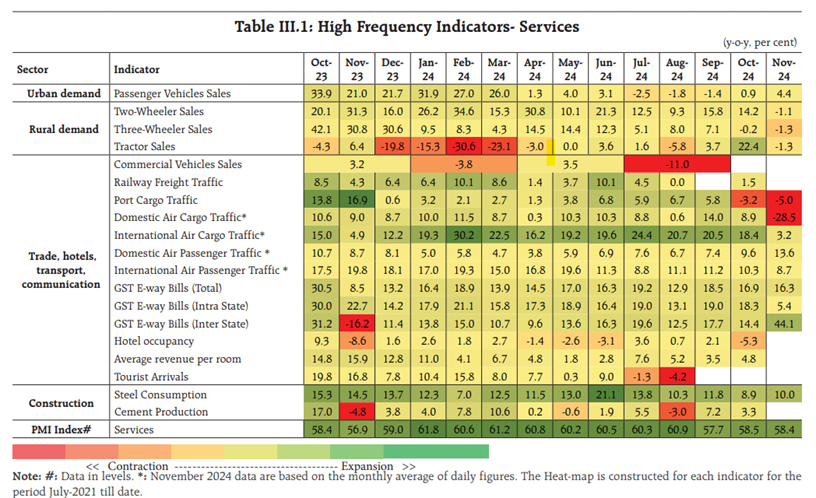

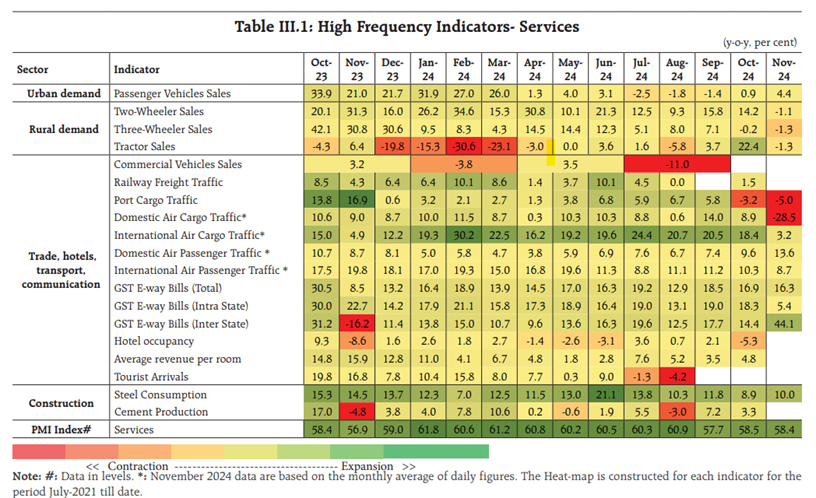

H1FY25 corporate results were weaker as consumption emerged as a weak spot. On an aggregate level, the Nifty 50 index reported single-digit growth of just ~4% in EBITDA/ PAT (EBITDA: Earnings before taxes, interest and depreciation; PAT: Profit After Tax).2 Most of the earnings slowdown could be attributed to the materials sector. Excluding metals and oil & gas however, the Nifty posted a respectable ~11% in earnings growth, with the largest contribution coming from BFSI (Banking, Financial Services & Insurance) and other sectors like health care & capital goods.3 A slowdown in consumption in urban areas, weaker government capex spending and unexpected rainfall were the biggest contributors to the woes of H1FY25 earnings. Lingering inflation and a regulatory-driven slowdown in credit growth also impacted economic and consumption activity.

Capex growth also slowed to 6.8% in H1FY25 from 9% in FY24. This was largely driven by a contraction in government capex spending in H1FY25 due to the general elections. Though India's capex as a % of nominal GDP reached a decade high of 30.8% in FY24, it is still far from the past peak of 35% in 2008.4 We expect government capex to pick up significantly in H2FY25 in an effort to meet the budgeted target. As the housing cycle remains strong (inventories at 14 years low) and bank approvals for private capex continue to rise, there appears to be signals of a revival in private capex.5

Sector and Theme Review

Q2FY25 was a respectable quarter for the Indian IT sector, which appears to reinforce the recovery trajectory.6 Nonetheless, the general market outlook remains slightly guarded, a sign that uncertainties persist. Going forward in 2025, a recovery is expected with the gradual return of modernisation and discretionary spending in selected pockets. The BFSI sector looks to be one of the most promising sectors given the cyclical and structural upside. With most of the Reserve Bank of India's monetary tightening played out, the outlook for banks, especially larger banks, looks positive with valuations below their long-term average. In the materials sector, production volumes for metal and mining companies witnessed a Q-o-Q decline given muted demand and rising import costs.7 Looking ahead, a recovery in China and domestic capacity expansion remain the key catalysts in the new year. FMCG companies also came under pressure this year as companies faced a slack in urban demand and were unable to pass on the rising input costs, putting pressure on operating margins. Other factors, such as the rapid growth of E-Commerce and quick commerce channels, also impacted firms operating across traditional mediums within the industry. Looking elsewhere, 2024 was a good year for India's real estate sector as the market witnessed recording-breaking leases, strong sales and robust investment growth.8 However, the second half of the year saw slower growth and mid-year sales drop post-election. But going forward, as RBI is expected to announce rate-cuts, and housing inventories are near 14-year lows, the real estate sector may be an area worth watching. The pharmaceutical sector is expected to remain resilient for the next 2-3 quarters on the back of stable demand and better pricing power, although input costs might start rising. The telecom sector reported strongly in Q2FY25 with revenue and EBITDA growth of 8-10% as the partial benefits of tariff hikes were factored in.9

India witnessed a K-Shaped demand recovery in FY24, as such, the consumption sector may face challenges in the near term. Urban middle-class consumers, a key driver of demand for mass-market brands, are curbing their spending, while inflation continues to affect purchasing power. Although rural demand remains strong, it is unlikely to offset the decline in urban consumption. Consumption data for the next few quarters should be keenly watched to see if there is any sign of longer-term weakness in urban areas or if there is recovery during festive seasons.

Auto earnings were mixed with the 2-wheeler segment posting higher volumes and better earnings than passenger vehicles/commercial vehicles. The passenger vehicle volume drop was somewhat buffered by higher SUV sales. Overall, EBITA margins came under pressure this year due to higher raw materials and operational costs.10 2-wheeler demand is expected to remain steady in 2025 while car volume growth may remain muted.

Orders growth was a mixed bag for India's manufacturing sector. Government spending was a positive, picking up throughout Q2 with electricity, renewable energy, data centres, real estate and defence sectors providing the majority of momentum.11 However, exports were soft due to global inventory destocking and weakness in developed markets. Luckily, these are showing signs of bottoming out. Market commentary on the order pipeline remains optimistic overall. Stable commodity prices, a healthier pricing environment and improving product mix may provide support to margins in the near term.

2025 Outlook

A pickup in government capex in H2FY25 alongside improved market liquidity is expected to drive a recovery in India's GDP to the range of 6.5-7% with total FY25 GDP forecasted to be 6.3-6.5%.12 Strong housing demand and private investment is likely beneficial for the capex cycle. And with the RBI's stance becoming supportive of liquidity infusion, a reduction in drag on credit growth and stronger rural consumption due to good weather conditions, should drive a recovery in consumption, especially in the rural economy. The urban economy, however, remains a laggard and will need to be keenly tracked for any sign of a sustained slowdown.

Domestic investment inflows have supported the markets (annualised to ~US$100 billion in 2024), however equity supply has also increased. With marginally positive Foreign Portfolio Investment (FPI) flows in 2024 (after significant outflow in October and November 2024), FPI ownership in India's equity market now sits just below 20%, which may act as a buffer in case of corrections.

Additional risk for Indian equities comes from external catalysts, especially the new policies which may stem from the yet-to-be-installed Trump Administration. Overall, the Fed's slowing pace of rate cuts, potential tariffs impacting India, a stronger US dollar, and market expectations of US exceptionalism potentially act as a drag on Indian equity markets.

The Nifty 50 Index's earnings growth is projected to rise to 9-10% in FY25 and 13-15% in FY26.13 The valuations for Nifty 50 Index are currently trading at 22.3xВ one-year forward P/E (Price-to-earnings ratio), which represents a premium of 3-5% over the past 5-year.14 We expected markets to remain volatile due to the aforementioned risks - especially at the start of 2025. В However, we find comfort in Nifty 50 valuations and that expectations in the near term are likely in line with the earnings growth, hence returns should stabilise. In sectors, we prefer allocation to BFSI segment due to lower valuations and favourable liquidity. Overall, investors can expect moderate returns in 2025 and may use volatility to invest for medium to long term allocations.