The start of a new year has an interesting way of making us reflective. We promise ourselves we’ll exercise more, eat better and spend less time on our phones. But just like most New Year’s resolutions, they don’t survive past February.

Instead of grand predictions or dramatic portfolio changes, think of the new year as a simple reset. A chance to review, tidy up, and gently put your investments in a better position for the year ahead. Think less “new year, new me” and more “what should I keep doing, stop doing, and do a little better?”

Download the checklist here, or read on as we deep dive into three practical steps everyday investors can implement and stick to.

Step 1: Portfolio Audit and Health Check

Before you think about what to buy next, start by looking at what you already own. Don’t focus solely on returns and kicking yourself for missing out. It’s about understanding your portfolio and making sure it still makes sense for you.

Start with a simple question: “What helped my portfolio in 2025 and what hurt it?”

Compare your portfolio’s returns to a like-for-like benchmark with a similar risk profile. Many super funds or diversified index funds publish their annual returns, which can be a useful sense-check to see how you stacked up.

You might find shares had a strong year while bonds lagged, that one theme outperformed another, or that you didn’t own enough gold. You may also have had a few shocker stock picks along the way, with well-known companies like WiseTech, James Hardie or CSL having had a tough year. This is a good reminder of how hard stock-picking really is. Individual companies can disappoint for reasons that are impossible to predict. Broad-based index investing helps smooth out these bumps by spreading your exposure across hundreds or thousands of companies, rather than relying on a handful of picks to get everything right.

Check your asset allocation (i.e. your mix of growth and defensive holdings) and rebalance if needed. Over time, portfolios naturally drift. If shares had a strong year, you might now have more risk than you intended. Rebalancing helps reduce risk after strong market runs, top up under-represented areas and bring your portfolio back in line with your long-term goals.

Check the one thing you can control – fees. Returns are unpredictable, but fees aren’t. One of the most overlooked parts of an end-of-year review is understanding how much you’re paying to invest.

Ask yourself the following: “Do I know the fees I’m paying?” and “Am I paying extra for something that genuinely adds value, or can I achieve similar exposure at a lower cost?”

We found Australian investors could collectively save around $4 billion per year by moving from expensive actively managed funds into lower-cost ETFs1. Fees are like termites that nibble at your returns every day, so the quicker you can exterminate them, the more money left in your back pocket.

Step 2: Positioning for 2026

Every year, investors ask the same question: “What will markets do next?”

The honest answer? No one knows.

Instead of trying to predict short-term moves, the better question is: “Is my portfolio prepared for a range of outcomes?”

Markets don’t move in straight lines. There will be surprises, headlines, and moments that test investors' patience and tolerance for risk. Preparation involves diversifying across asset classes and different regions, avoiding concentration in a single idea and making sure your portfolio doesn’t rely on one particular macroeconomic or company outcome to succeed.

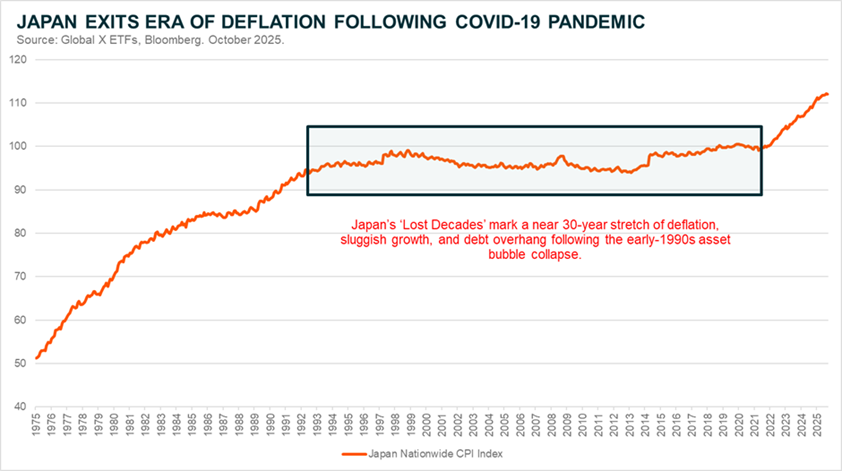

It's also important to remain exposed to long-term structural themes. While short-term market moves are noisy, long-term trends tend to be more reliable. Think about forces that are reshaping the world over years and decades, such as Artificial Intelligence (AI), robotics and automation, electrification etc…

This is also a good time to sanity-check your portfolio against a broader view of the year ahead. We recently published our 2026 Investment Outlook to help investors think about key macroeconomic risks and opportunities, where growth and resilience may come from, and how different investment exposures can help capture opportunities while adding defensive support to portfolios.

You don’t need to agree with every outlook or forecast. The aim is simply to make sure your portfolio has the right building blocks in place to handle the year ahead and stay resilient, whatever comes its way.

Download the Global X 2026 Market Outlook

Step 3: Reset Your Habits – Invest Better in the New Year

Good investing behaviour matters more than brilliant stock picks. Most investing mistakes are caused by bad human behaviour. The new year is the perfect time to reset not just your portfolio, but your habits. Reflect on the lessons from 2025. Ask yourself if you reacted emotionally to market moves, chased performance or panicked during volatility, or abandoned your plan when headlines got loud.

April 2025 was a good reminder of how quickly markets can get ahead of themselves. In response to renewed tariff concerns under Trump, the US share market fell more than 12% in a matter of days. For many investors, it felt uncomfortable. But those who stayed disciplined or even used the sell-off as an opportunity to add to their portfolios were ultimately rewarded. From the April lows, the market rebounded around 37%, finishing the year with a positive return of roughly 18%.

Mistakes are a normal part of investing. What matters is how you respond to them. Every decision should leave you with something - either a profitable gain or a lesson. Great investors aren’t the ones who never get it wrong, but the ones who learn quickly and avoid repeating the same mistakes.

As Roger Federer highlighted in a talk about performance and mindset, despite winning nearly 80% of his matches, he won only around 54% of the points he played.2 Federer learned not to dwell on each missed point and instead focused on what came next. You don’t need to win every point, but instead make fewer unforced errors. Investing works much the same way and quietly compounds over time. Staying invested, avoiding emotional decisions, and letting time in the market do the heavy lifting.

Markets will always give you something to worry about. Short-term headlines are designed to grab attention, not improve outcomes. Constantly reacting to news can lead to over-trading, higher costs, and worse decisions. As a simple rule of thumb - if a headline won’t matter in five or ten years, it probably shouldn’t drive today’s decision.

The best habit for the new year is one that you can actually stick to. You don’t need a complex strategy to be a successful investor. Dollar-cost averaging, dividend reinvestment plan (DRP), broad diversification and low costs may not be exciting, but they’re powerful.

A Fresh Start Without Starting Over

Instead of setting another New Year’s resolution, swap it for a simple past-year review and a clear plan for the year ahead. Run a quick portfolio health check, think about how you’re positioned for 2026, and focus on building better investing habits going forward.

This isn’t about tearing everything up and starting again. It’s a tidy-up checklist, not a complete transformation. The most successful investors tend to invest like optimists – making small, sensible decisions and sticking with them consistently over time.

Following this checklist can help you start the year with confidence. Good investing isn’t just about achieving high absolute return numbers, but rather about giving yourself the freedom and financial independence to spend time doing what you want, with who you want, for as long as possible. It’s about letting your money work for you, so you can focus on living life, not worrying about it.