Editor’s Note: Popularised by CNBC show “Mad Money” host Jim Cramer, the FANG acronym has been a mainstay in the financial space for referring to a basket of well-known innovative tech titans consisting of Facebook (now Meta), Apple, Amazon, Netflix and Google since the early-2010s. But today, the term FANG has evolved to encompass more than just these five US tech giants, and instead includes a variety of technology-oriented companies with strong foundations and high potential for growth e.g., Microsoft, Tesla, Nvidia etc. This article will be referring to the Global X FANG + ETF (FANG) index of companies when using the term FANG. For more information on Global X’s FANG+ ETF and its top ten holdings, click here.

FANG stocks have experienced significant volatility over the last 12 months, with valuations falling harshly during early 2022 as Covid-investing enthusiasm dwindled and markets digested aggressive rate hikes from the US Federal Reserve (the Fed). But as we approach this midpoint of 2023, it appears FANG stocks are ready to return to the spotlight. Global X FANG+ ETF (FANG), which tracks a basket of FANG and FANG-like tech titans, has returned over 40% year-to-date.1 How have the FANGs managed to rebound so well despite the uncertainty of the global economy, and will they continue to perform in the future?

Steady Growth Proves Valuable in Tough Times

The backdrop of weaker global economic growth is setting the tone for many industries, however the latest reporting season saw FANG stocks deliver expectation-beating results.

- Microsoft’s revenue grew 7% year over year (YoY), beating expectations. Azure, Microsoft’s rapidly expanding cloud division, also continued its growth at a healthy 31% YoY.2

- Digital advertising giants Meta and Google also beat analyst estimates, both companies grew revenues by 3% YoY.3 4

- Amazon’s earnings showed surprising resilience despite weakening consumer demand and persistent inflation. Total revenue was up 9% YoY, beating consensus.5

While these earnings results have mellowed compared to the Covid-era of low interest rates and record setting revenues, the hostile macroeconomic environment has seen many investors turn away from non-profitable growth stocks in favour of companies with strong balance sheets. This is why FANG and FANG-like companies, which provide stable growth, tend to command a higher premium in a slowing economy.6 We can see this demonstrated in comparisons between growth and value indexes below.

When US GDP growth is above 1% in the quarter, performances between the growth-tilted Nasdaq 100 is similar to that of the all-encompassing S&P 500, yet when GDP dips below 1%, the Nasdaq 100 outperforms the S&P 500. Similar results hold true for the Russell value and growth indexes.

As the current rate hike environment puts a damper on investor sentiment towards unproven and profitless ventures, participants and emulators of FANGs provide a safe harbour for investors who wish to maintain a growth-centric portfolio.

The Best and the Most of S&P 500

Since the big tech boom, companies in the NYSE FANG+ index have traditionally outpaced the rest of the market. Today, the 10 companies of FANG+ account for more than 25% of the S&P 500’s weight (Apple and Microsoft alone combine for a whopping 14%).7 Subsequently, FANGs’ influence on the S&P 500’s performance has also grown. Year to date, the S&P 500 is up almost 8%, but once FANG stocks are removed performance drops to only 2.2%.8 Apple and Microsoft are notable performance drivers, accounting for almost 40% of S&P 500’s gains so far this year; add in the rest of the FANGs and total attribution rises to over 80%.9

As broad-based indexes increasingly rely on these high-performing companies, it highlights how FANG stocks can serve a dual purpose of growth and value. FANG stocks generally outperform when there is confidence in the economy, and when turbulent market conditions arrive, robust balance sheets can help provide some downside protection.

Solid Footings Allow for Future Positioning

Big tech companies are well placed to benefit from increasing adoption and advancements in transformative technological trends. The recent rise of ChatGPT and generative artificial intelligence (AI), for example, demonstrates how FANG stocks can quickly adapt to future megatrends.

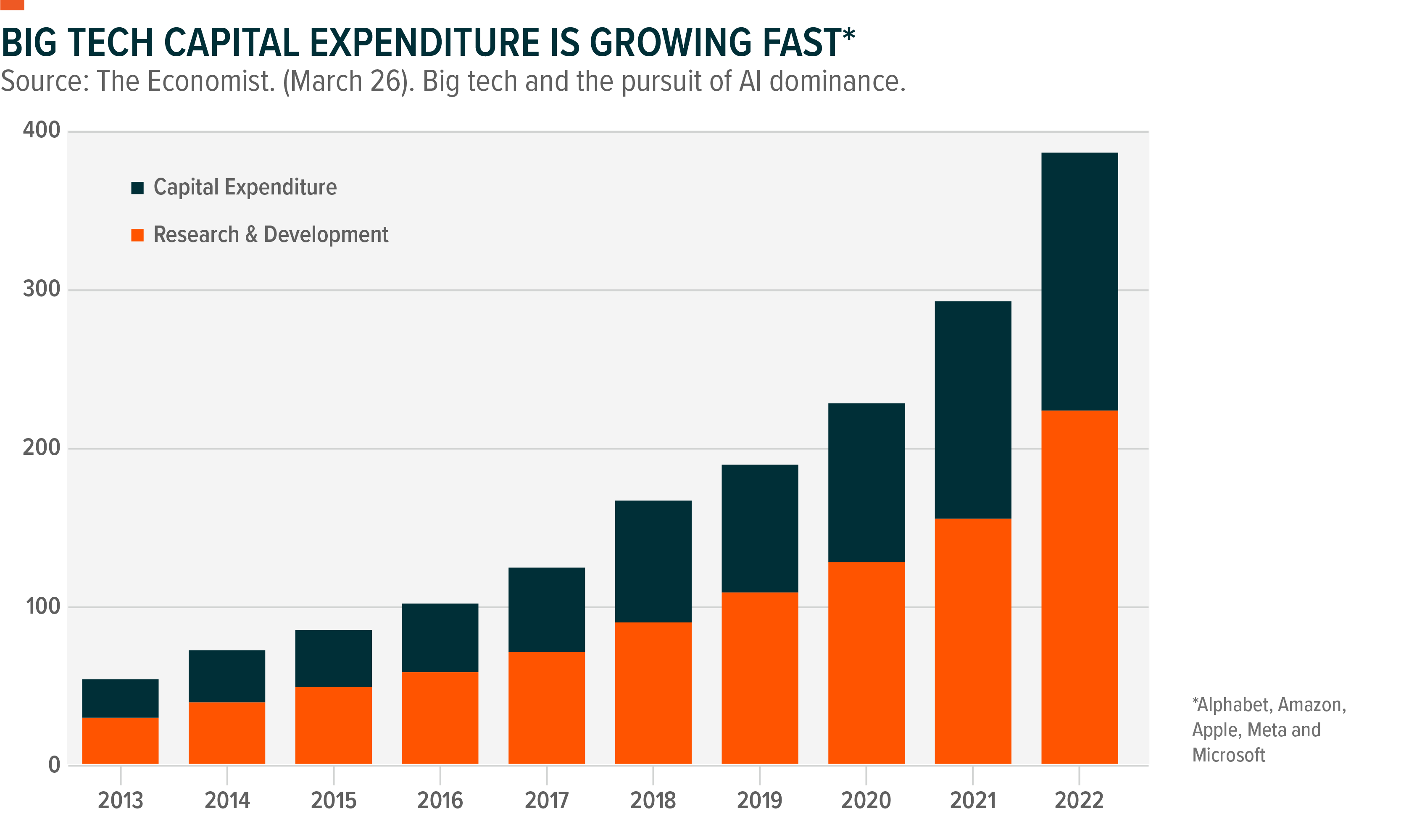

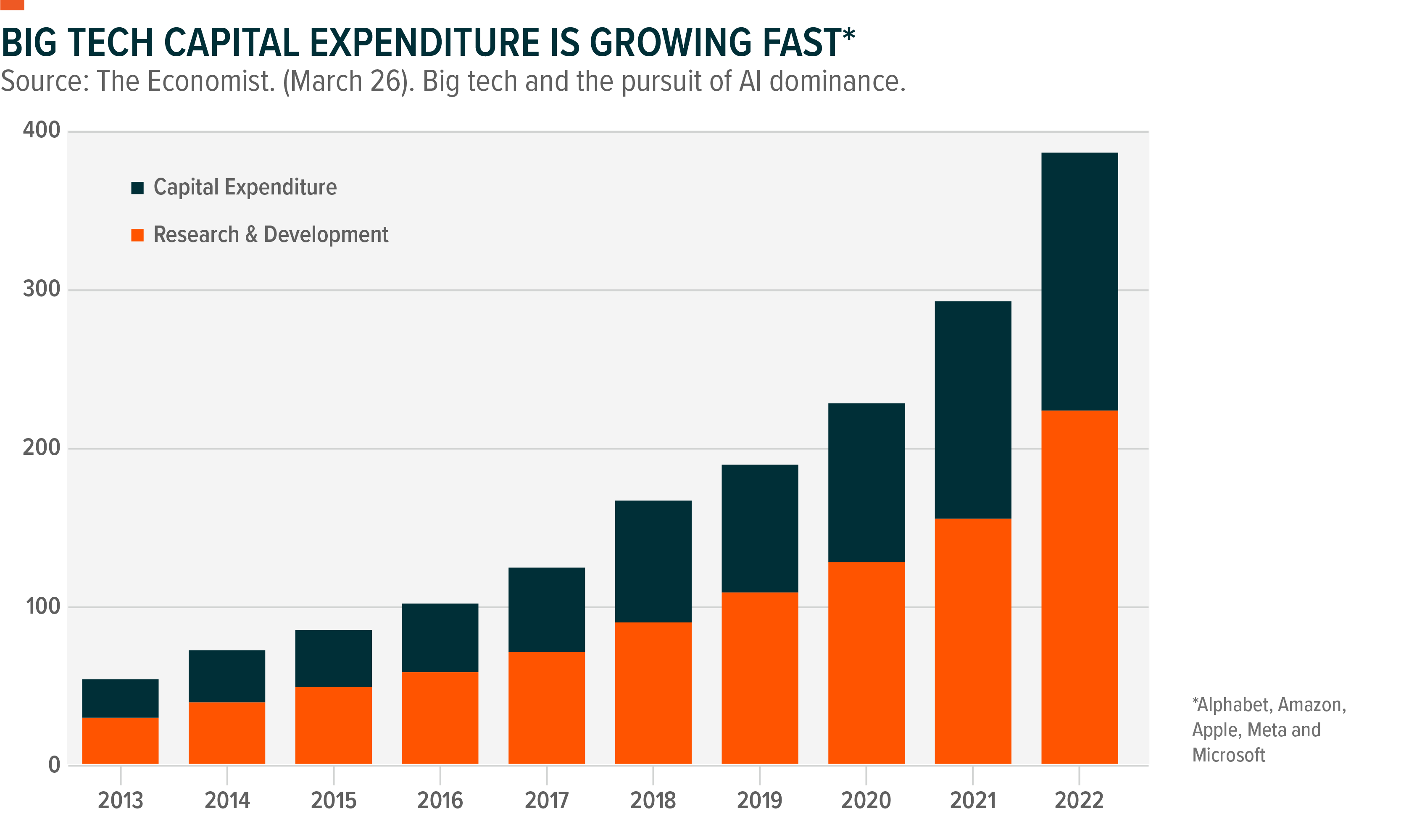

Nearly every participant of the FANG family has made significant and meaningful forays into the AI space since the rise of ChatGPT in November2022. Microsoft recently garnered attention by acquiring a substantial stake in OpenAI, the creators of ChatGPT.10 This strategic move positions Microsoft to leverage OpenAI's expertise and strengthen its presence in the AI landscape. Meanwhile, Google, once considered the undisputed leader in AI, is now engaged in a competitive battle to retain its position with the introduction of its own generative AI project called Bard. Meta and Amazon, both heavily reliant on algorithmic systems, are also integrating AI to enhance user experiences and optimize content delivery. Furthermore, semiconductor companies such as Nvidia and AMD are in line to profit from AI by playing the pivotal roles of both hardware enablers and software developers for the emerging technology.

Overall, FANG companies’ ability to make substantial investments, quick strategic pivots and collaborate with key industry players, positions them as frontrunners in capitalising on any opportunities presented by emerging technologies.

Investing in FANGs: The Peerless Amalgams

Despite many calling for the end of growth in current macroeconomic conditions, FANG and FANG-like stocks have raced out of the gates in 2023. What makes these companies unique is their combination of strong growth prospects and firm financial backbone, positioning them as rarities in the market. Instead of having to choose between value and growth, or steady goers and trailblazers, FANG provides investors with the opportunity to invest in a lucrative combination of all these traits.