After years of underperformance relative to its yellow counterpart, silver has begun to re-emerge as a focal point for investors, with spot prices recently breaking above the nominal highs last seen during the Hunt Brothers–driven spike of 1980. This renewed strength comes at a time when silver’s role in the global economy has expanded materially. Beyond its traditional monetary and store-of-value characteristics, silver has become a critical input into the energy transition and a range of advanced technologies, fundamentally reshaping demand dynamics at a time when supply has struggled to respond.

Global X currently provides one of the world’s leading pure-play physical silver exposures through Global X Physical Silver Structured (ASX: ETPMAG). The launch of the Global X Silver Miners ETF (ASX: SLVM) offers investors an alternative avenue for accessing the theme, capturing the operating leverage inherent in mining equities and providing exposure to the renewed strategic importance of silver as a critical commodity.

Key Takeaways

- Silver miners may offer greater upside participation through operating leverage, with smaller producers and explorers particularly well positioned as higher price levels improve project viability.

- Silver’s demand dynamics have evolved alongside the growth of photovoltaics, grid expansion and semiconductor manufacturing, reshaping investor perceptions and underpinning a more structural, long-term investment case for the metal.

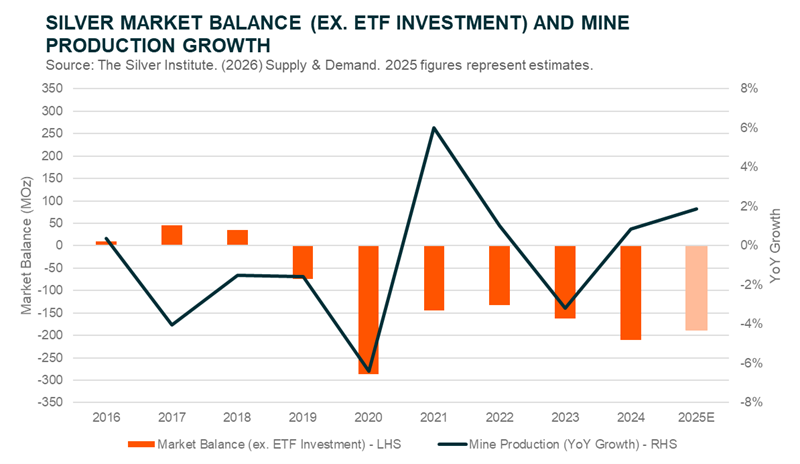

- Silver’s chronic supply deficit since 2021 highlights the challenges of scaling production and could provide further upside as demand continues to outstrip supply.

Why Miners at All

The first question many investors may ask is why consider silver miners at all? Investing in mining companies introduces idiosyncratic risks, ranging from management execution to geological quality, whereas buying the metal outright, or gaining exposure through futures, offers a more direct and often more transparent link to spot prices. Mining companies also face high sustaining and development costs, which can erode profitability when commodity prices are insufficiently high.

While these concerns are valid, they are not insurmountable. Nor do they negate the potential advantages of investing in silver miners, which can offer differentiated exposure under the right market conditions

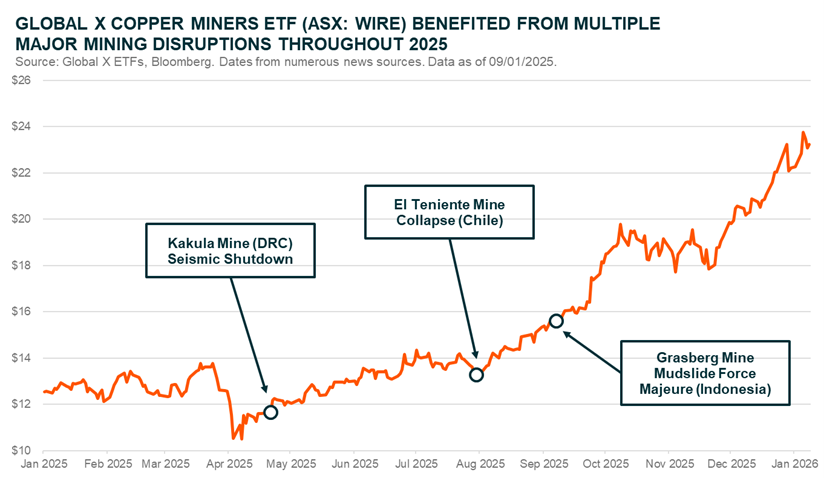

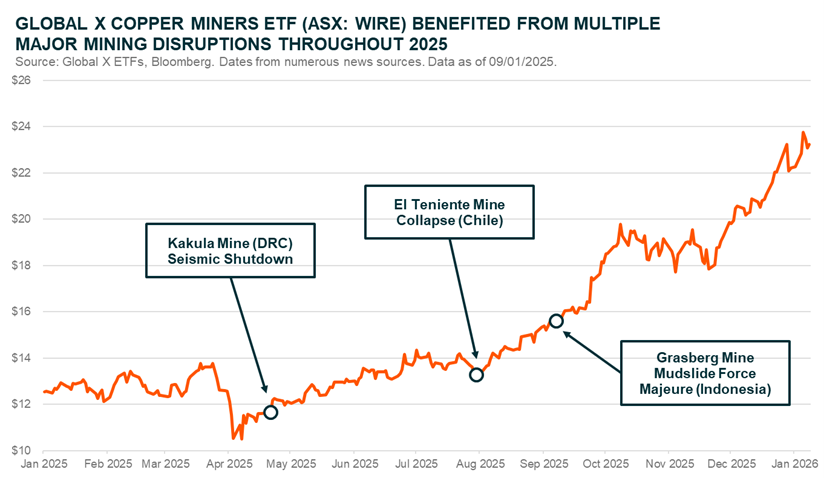

First, consider idiosyncratic risk. Investors familiar with commodities will appreciate how variable the operating conditions for mining companies can be. Within a short period, miners may face geopolitical flare-ups, particularly as many resource-rich regions are located in politically unstable jurisdictions, as well as weather-related disruptions, natural disasters, labour disputes, and other operational challenges. Any one of these events can trigger sharp share-price declines, often with little warning.

This risk, however, can be mitigated through diversification. Investing in a broad basket of miners focused on the same commodity reduces reliance on the outcomes of any single company. Diversification is particularly powerful in commodity markets, as the misfortune of one producer often represents a supply disruption that supports higher commodity prices and improved margins for the rest of the industry. We have seen this dynamic repeatedly in recent years, with copper and lithium providing notable examples.

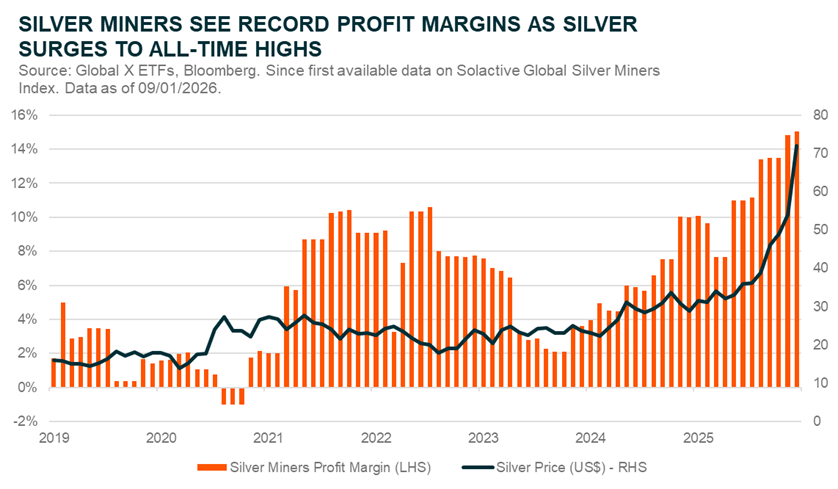

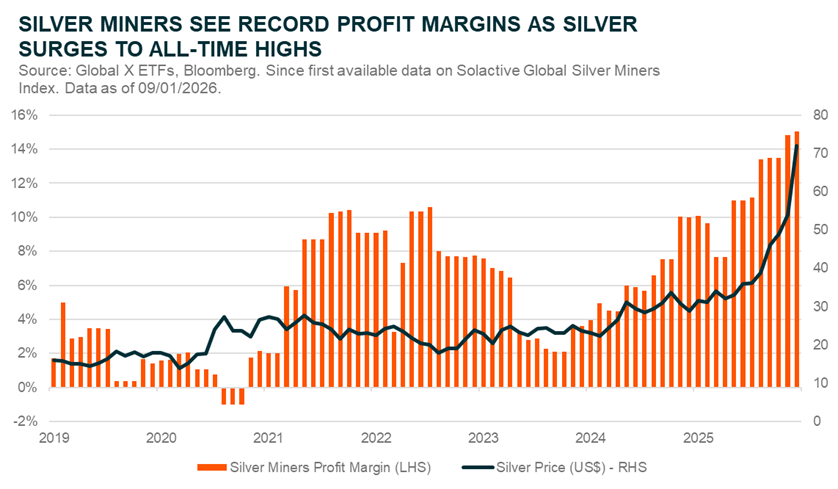

Second, while mining companies contend with significant ongoing costs to maintain operations, these expenses tend to be relatively stable and well forecast. This cost visibility provides a high degree of earnings clarity and underpins the powerful operating leverage inherent in the mining business. When the price of a miner’s underlying commodity rises, revenues increase immediately, while the majority of operating costs remain largely unchanged. As a result, incremental price gains can translate into disproportionately large increases in profitability.

In the case of silver miners, profit margins have expanded from a low of ~2% in 2024 to a record 15% as silver prices rallied, despite the persistence of a high-interest rate environment.

Mining company valuations can respond both directly and strongly to movements in the underlying commodity price. In periods of rising prices, miners can offer amplified and more convex exposure compared with holding the physical metal alone, particularly when commodity prices move above marginal cost levels.

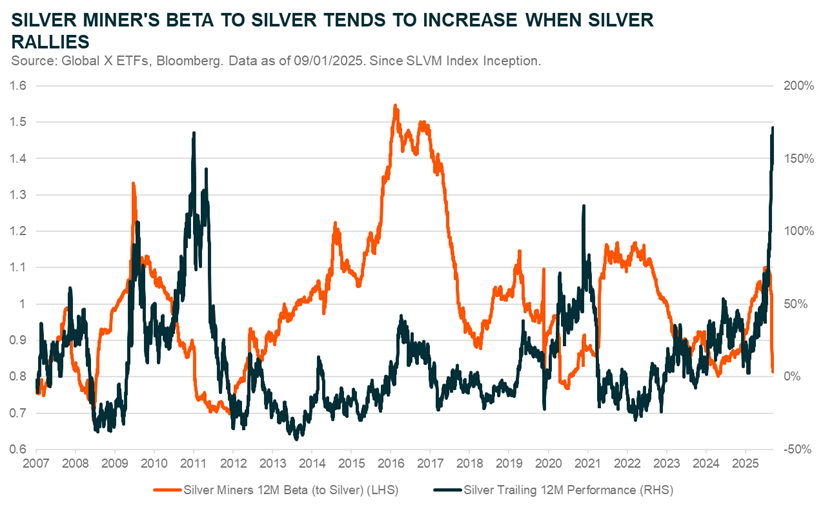

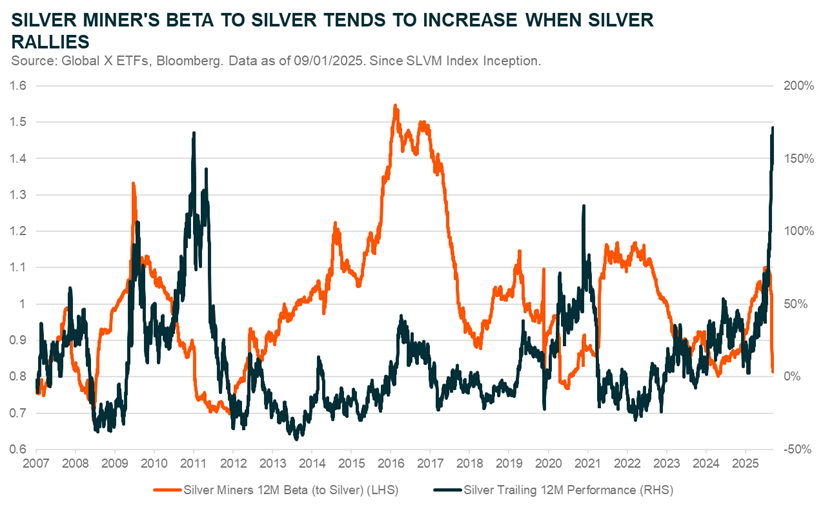

Over the past 20 years, silver miners as a group have seen their beta to the silver price grow during period of silver strength, making them an attractive vehicle for investors seeking leveraged exposure to silver price upside.

A deeper look at the data shows that, on a rolling 360-day basis over the past 20 years, SLVM’s index has outperformed the silver price by an average of 1.8%.1 In periods when silver is rising, the index has delivered average outperformance of 11.3%, while in down markets it has underperformed by 9.9%. This asymmetry provides tactical traders with a modest but meaningful advantage during defined silver bull phases.

A New Era for Silver

For much of modern history, silver was viewed largely as a cheaper alternative to gold, with limited uses beyond niche applications such as photographic film. This perception, combined with episodes of sharp volatility that were at times amplified by market manipulation, relegated silver to a realm of mostly retail speculation rather than genuine investability. In the past decade, however, silver has taken on a renewed role as a critical input in the energy transition and an essential material underpinning some of the most advanced technologies in use today.

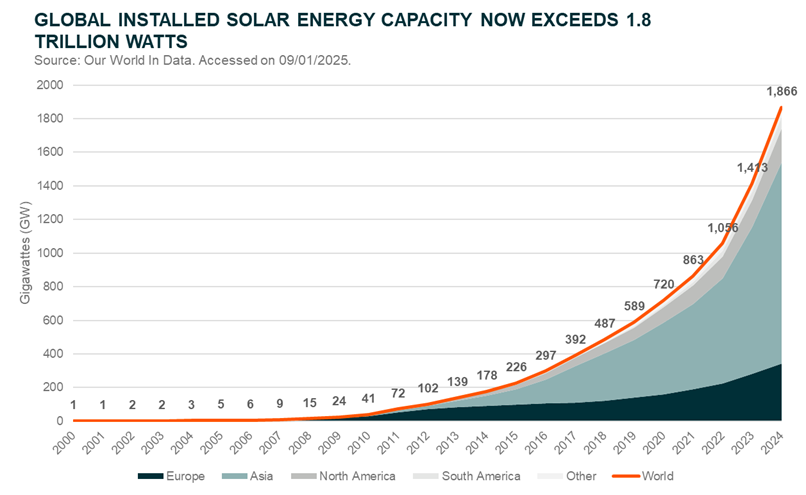

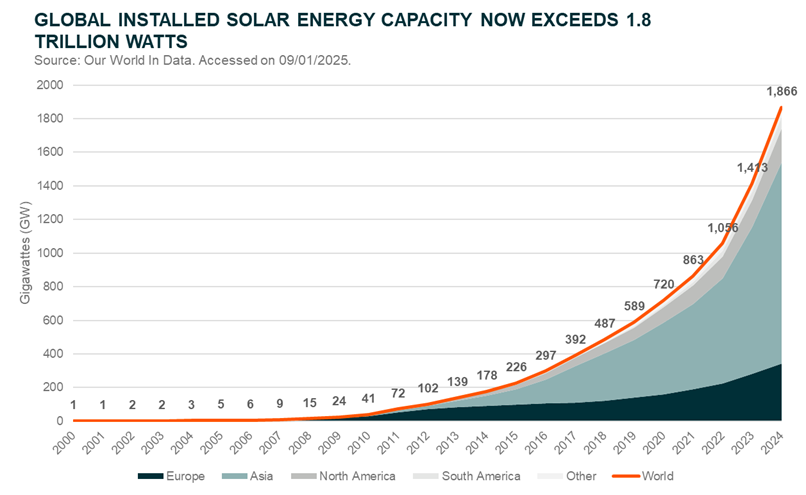

Silver used in photovoltaics (aka solar panels), for example, has grown at approximately 19% compound annual growth rate (CAGR) in the five years since 2020, and now exceeds 195 million ounces (~5500 metric tonnes) annually. That growth compares to a CAGR of just 0.2% in the 5 years prior to 2020 and has culminated in approximately 17% of the total demand and almost a quarter of all silver produced in 2025.2 This demand base is likely to continue expanding, or at least remain structurally elevated, as solar capacity continues to be deployed at a faster pace than any other energy technology in history.

For reference: Since the signing of the Paris Agreement in 2016, solar installed capacity has grown at a CAGR of 24% compared to 11% for wind, 2% for hydro and 0.4% for nuclear.3 Overall, global solar install base has grown tenfold in the past decade, surpassing 1.8 Terawatts (1.8 trillion watts) as of 2024.4 For more on how silver is used in the solar industry, and the growth of that demand base, see insight: “Silver Gets Its Time in The Sun”.

Further, silver is used extensively in electrical contacts and plays a critical role in grid expansion at a time when electrification is placing unprecedented demands on global infrastructure. The metal’s unique status as the most conductive material available has also positioned it as an essential input in the design and fabrication of advanced semiconductors, linking silver directly to the ongoing expansion of high-performance computing and the AI megatrend.

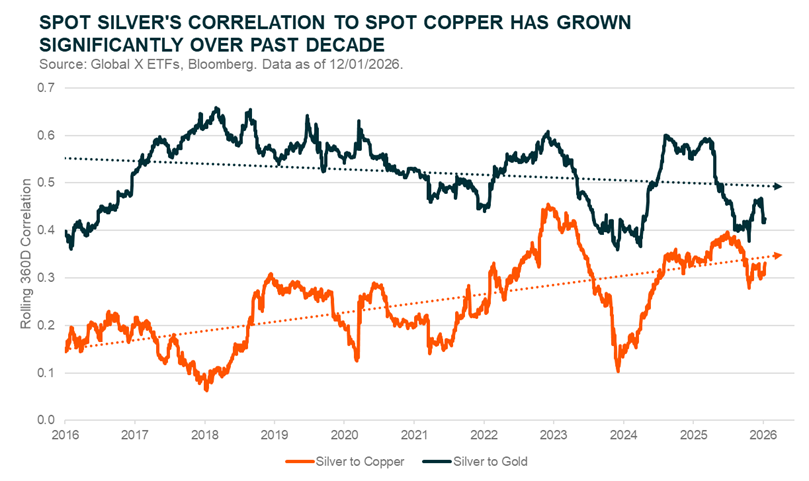

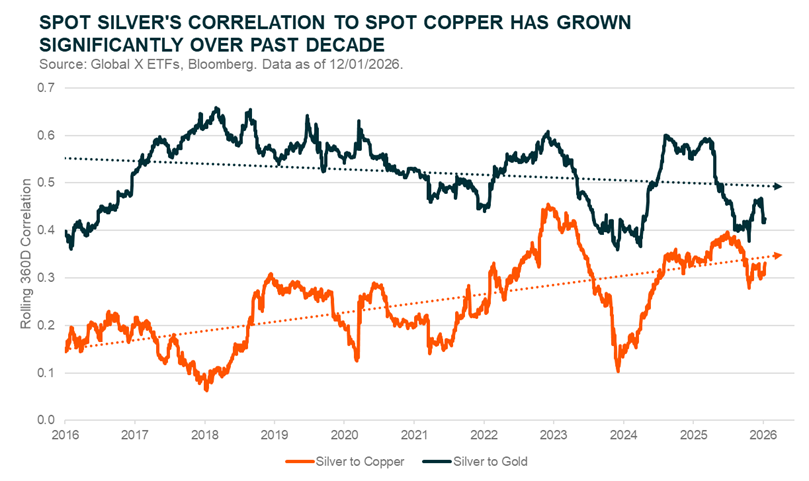

All of these new drivers have created a new era of growth for silver demand and has aligned it more than ever with the status of an industrial metal, rather than purely a vehicle of speculation or proxy to gold as a monetary metal. Those forces, of course, still exist, however investor perception appears to be updating. This can be observed in silver’s correlation with copper (the marquee industrial metal) which has been rising rapidly, while its correlation with gold has remained stable.

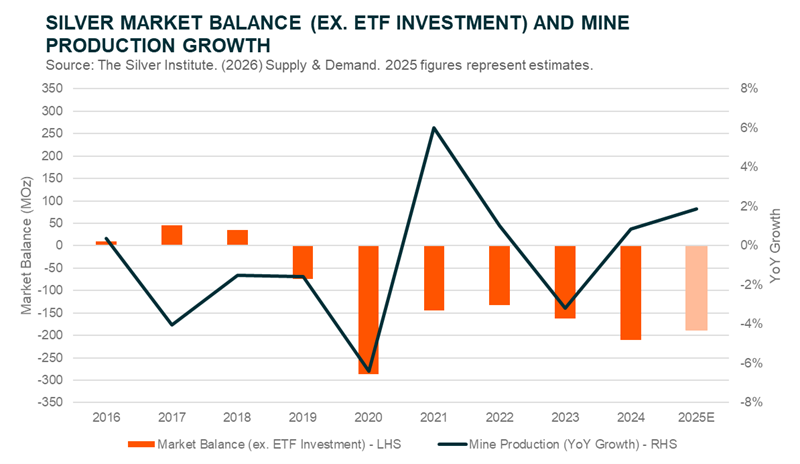

The rise of silver as an industrial metal comes amid stagnant mine supply growth, setting 2026 up as a possible eighth consecutive year of a net supply deficit (excluding ETF investment demand).

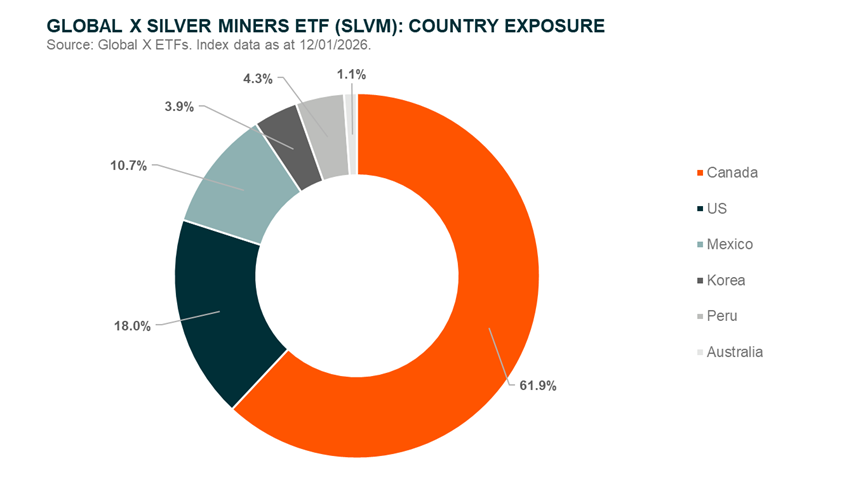

This dynamic provides a further structural tailwind for the metal as physical supply comes under increasing pressure. With interest rates on a downward path across major economies including Canada, the United States and Mexico, and silver prices supporting strong profit margins, silver miners are well positioned to expand production capitalise on, and monetise the ongoing bull market.

Investing in Silver Miners

For investors seeking exposure to the structural opportunities in silver or looking to capitalise on the operating leverage of mining companies for tactical positioning in the silver price, the Global X Silver Miners ETF (SLVM) may be worth considering. The fund offers a diversified “picks and shovels” approach to silver exposure that would otherwise be largely inaccessible in the Australian share market.

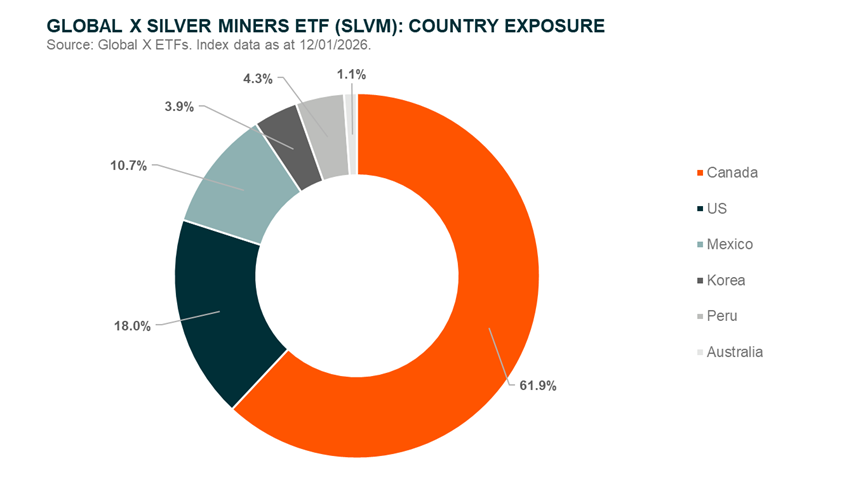

The Global X Silver Miners ETF (ASX: SLVM) seeks to invest in an international basket of companies active in exploration, mining and/or refining of silver. The index employs an adjusted market capitalisation weighting scheme and holds between 20 and 40 members depending on size and liquidity criteria.