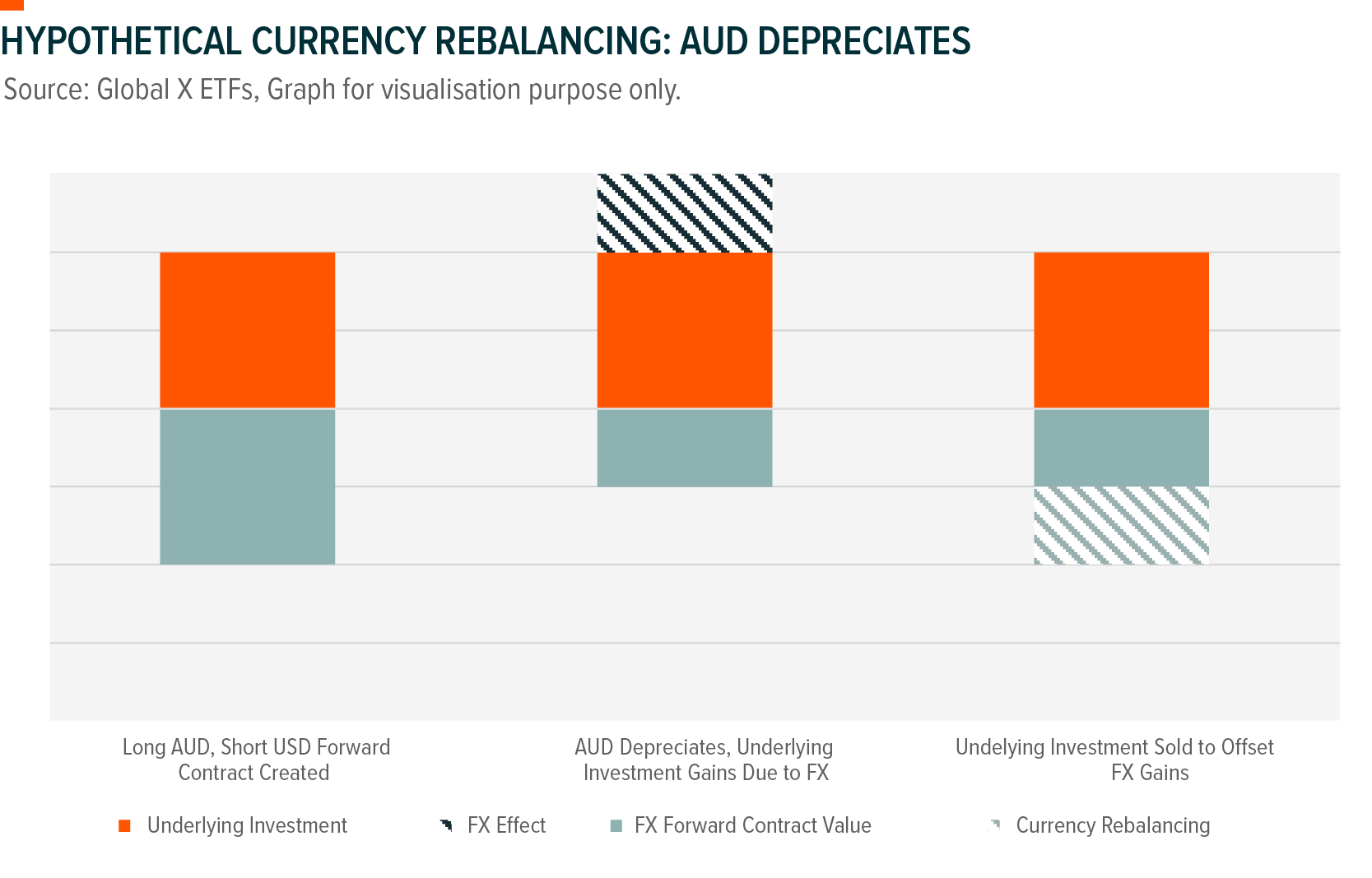

These examples are extreme, and such volatility is rarely observed in foreign exchange (outside of emerging markets), but they demonstrate the unpredictability of unhedged international exposures and its potential to either boost or, more dangerously, negate the value of your investment. A risk conscious investor can seek to remove this unpredictability by currency hedging their investments. Speculative investors can also use currency hedging to counter the expected appreciation/devaluation of their domestic currency/international currency exposure.

When Should You Currency Hedge Your Investment?

Investors may want to consider tactical currency hedging when they expect significant fluctuations in exchange rates that could impact their returns. For example, if interest rates are rising in their home country but decreasing or unchanged in the country where they hold investments. In this scenario, the home currency may appreciate, reducing the value of their foreign investments. Similarly, differences in inflation rates can also affect currency values; if inflation is higher in the country of the foreign investment, the local currency might weaken, diminishing returns.

For long-term allocations, the concept of “hard” and “soft” currency comes into play. Hard currencies are defined as being able to hold and appreciate in value relative to their currency pairs, while the vice versa is true for soft currencies. Each currency’s status as hard or soft is not a static label. Depending on macroeconomic conditions, particularly interest rates, inflation, or economic demand, dynamics can switch – however such inversions are rare and tend to return to the status quo in the long term. As an international investor, it is generally favourable to have consistent exposure to hard currencies, and less exposure to soft currencies.

Currency Hedging to the Australian Dollar

In the context of the Australian and US dollar, USD has historically demonstrated the properties of a hard currency. As displayed in the chart below, the AUD has consistently depreciated in relation to the USD since 1971 (the furthest Bloomberg data goes back). But there have been pockets on the timeline where AUD was the stronger of the pair.