At Global X, innovation is at the heart of what we do, from pioneering commodity ETFs to offering targeted access to emerging opportunities and thematics. However, we also recognise that building a strong investment portfolio starts with a solid foundation. That’s why we’re proud to launch the Global X Australia 300 ETF (ASX: 300) - a core equity solution designed to give investors broad, low-cost exposure to the Australian share market.

While markets and megatrends evolve, many investors still value the familiarity of investing close to home. For Australian investors, domestic shares remain a cornerstone for wealth building, offering strong income and exposure to key sectors like financials, resources, and healthcare. A300 brings this exposure to life by tracking the largest 300 Australian companies listed on the ASX, helping investors go beyond the traditional 200 companies and unlock greater diversification.

Key Takeaways

- Broad Market Exposure: Invest in the largest 300 Australian companies listed on the ASX, providing exposure to a broader set of companies than the typical 200 Australian companies.

- Attractive Income Profile: Benefit from Australia's attractive dividend landscape, underpinned by high dividend payout ratios and after-tax benefits like franking credits.

- Low-Cost Core Solution: A300 is currently the lowest‑cost ETF in the market tracking the 300 largest Australian ASX‑listed companies1, providing broad Australian equities exposure suitable as a core portfolio holding.

Why Australian Equities Still Matter

Australia has one of the most resilient and resource-rich economies in the developed world. Despite its relatively small population compared to our global peers, Australia is home to world-class companies across financials, resources, healthcare, and more.

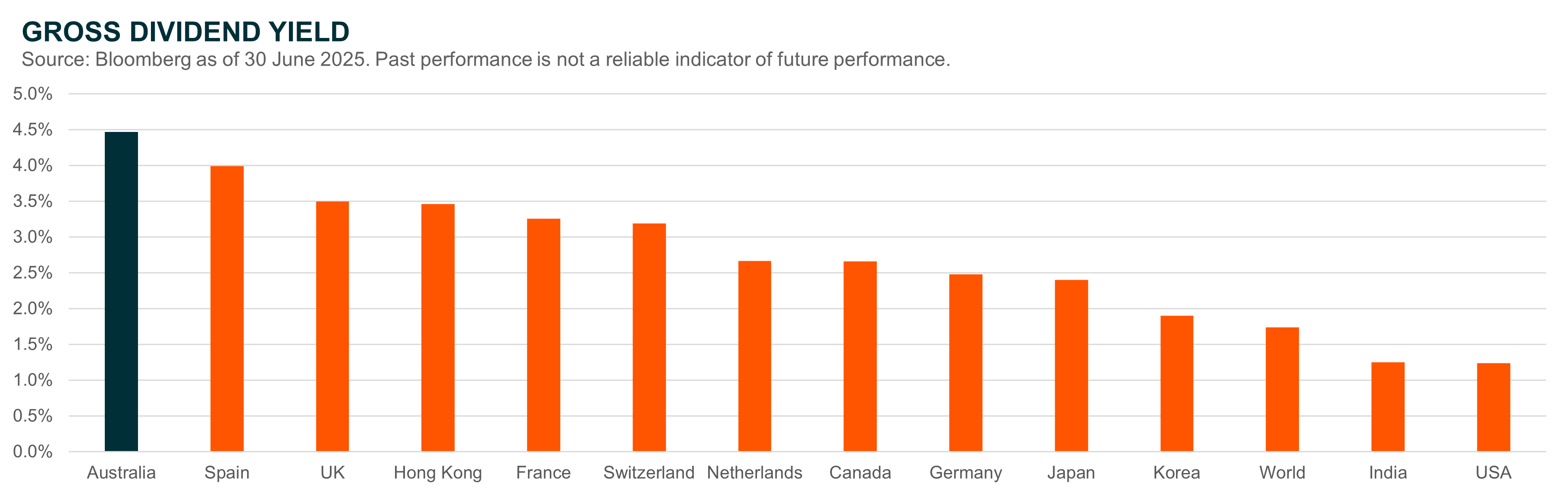

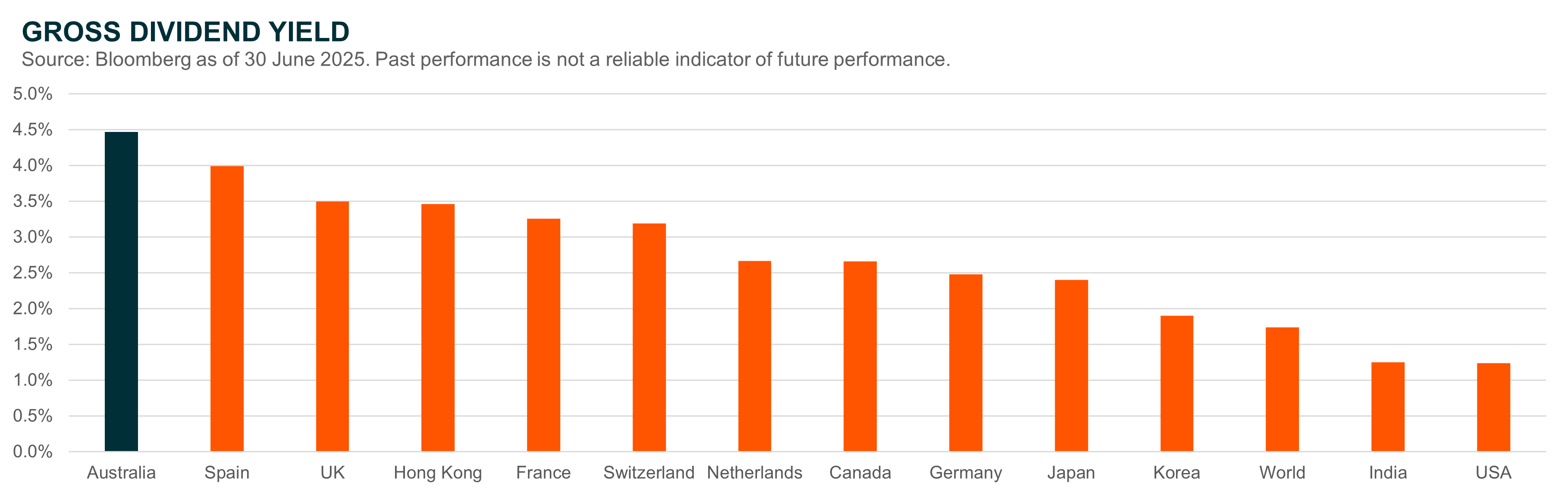

Investors often gravitate toward Australian shares to boost their income, given the market’s consistently high dividend yields relative to other global markets. Australia stands out for its elevated payout ratios, with companies on average distributing over 80% of their earnings to shareholders, more than twice the payout rate seen in the US.2

In addition to strong headline yields, Australia offers a distinctive tax advantage through its franking credit system, which enhances after-tax income, making domestic equities particularly attractive for income-focused investors such as retirees and SMSFs. While the imputation credit system enhances income, the Australian share market has also historically delivered solid long-term capital growth, with historical total nominal returns averaging around 10–11% per year since 1900.3

Going Broader with 300

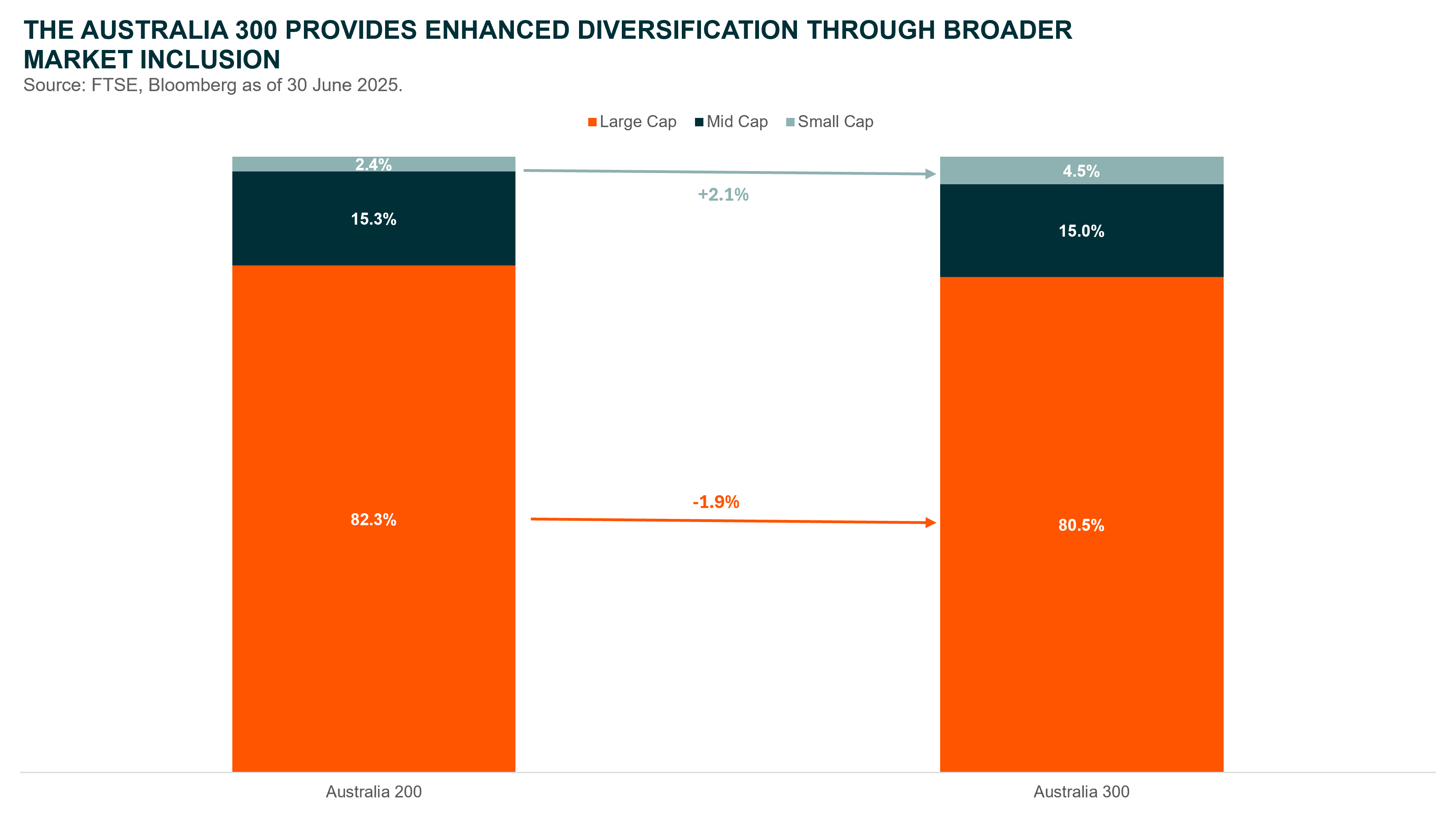

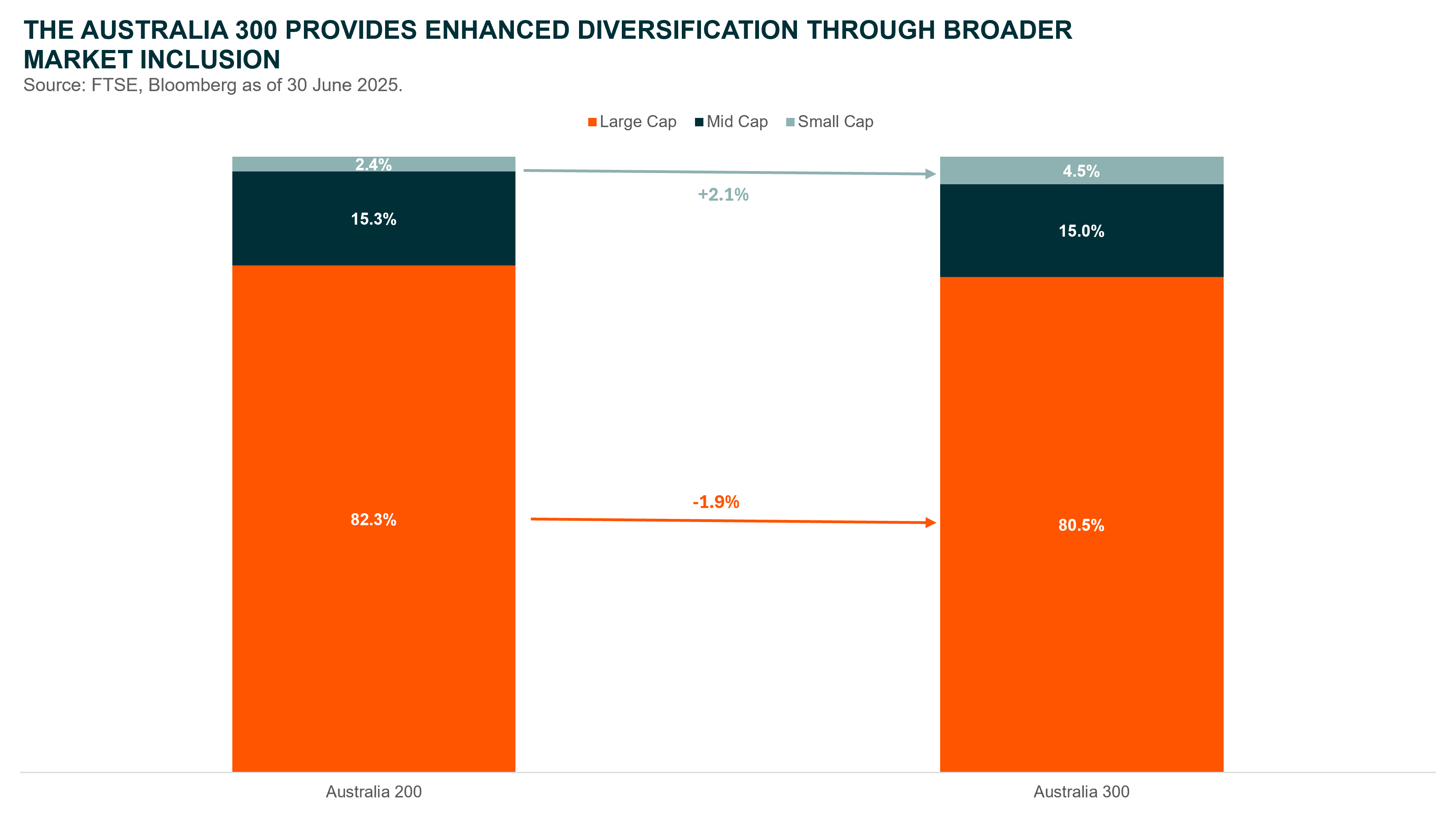

Most Australian equity ETFs focus on the top 200 companies, which means they miss a meaningful slice of the market. The Global X Australia 300 ETF (ASX: 300) takes a broader approach by extending exposure to the top 300 Australian companies, capturing an additional 100 mid and small-cap stocks. This expansion offers investors deeper diversification across sectors and company sizes.

By going beyond the top 200, the Australia 300 also helps reduce concentration risk. The largest 200 companies are heavily weighted toward a few dominant sectors, particularly financials and materials, which means investors are often overly reliant on the performance of the big banks and miners. Including a wider set of companies broadens the opportunity set and provides a more balanced representation of the Australian economy.

Importantly, the additional exposure to mid and small-cap companies may also improve growth potential over the long term. These companies often have more room to expand and can benefit from both domestic growth trends and rising global demand for Australian exports. While large caps can sometimes lead performance, historical comparisons suggest there’s no consistent edge in whether the top 200 or the broader 300 will outperform over any given period4, making the case for wider exposure even stronger.

Low Cost. High Impact.

At a time when investors are increasingly fee-conscious, the Global X Australia 300 ETF (ASX: 300) offers broad-based exposure at a low fee of 0.04% per year, marking it as the lowest‑cost ETF in the market tracking the 300 largest Australian ASX‑listed companies. In contrast, the average actively managed Australian equity fund charges fees close to 1% per year, despite the majority failing to outperform a typical index over the long term5. Fees can be like termites quietly eating into investor returns, so the less investors pay in fees, the more they can keep in their back pocket.

Offering a compelling foundation for both strategic asset allocation and long-term investing, the Global X Australia 300 ETF (ASX: 300) is designed to sit at the core of an Australian equity portfolio. It delivers broad market exposure and cost efficiency in one simple solution. Whether investors are aiming to build wealth, generate income, or diversify smartly, A300 provides the tools to do so, all in a single trade.

Related Fund

A300: The Global X Australia 300 ETF (ASX: A300) provides investors with exposure to the largest 300 Australian companies listed on the ASX.