Robots have existed for decades. In fact, the word “robot” was first introduced in 1920 by Czech playwright Karel Čapek in his play Rossum’s Universal Robots to describe human-looking machines used for mundane labour.1 Since then, technological innovation has expanded robotic systems beyond basic industrial applications to the point where humanoid robots in our workplaces and homes is not some far-fetched idea. Though still in the development phase, the rapid acceleration of humanoid technology, driven by the dynamic convergence of robotics and artificial intelligence (AI), is bringing industry leaders closer to mass application, production, and market entry. Improving systems understanding, coupled with declining robotics hardware costs, is also making commercial scale production and application practical.

Key Takeaways

- Recent technological breakthroughs and decreasing production costs make mass production and adoption of humanoid robots more of a reality than ever.

- Historical automobile industry trends and the growth of collaborative robots suggest that humanoids are poised for mainstream adoption, fuelled by technological advancements, supply chain challenges, wage inflation, and aging population.

- Investors looking for exposure to the humanoid market can find opportunities across the supply chain, particularly in robotic manufacturers, AI chipmakers, sensor developers, and related component and material suppliers. Cloud infrastructure and data management software providers are also in line to potentially benefit from the increase in data generation.

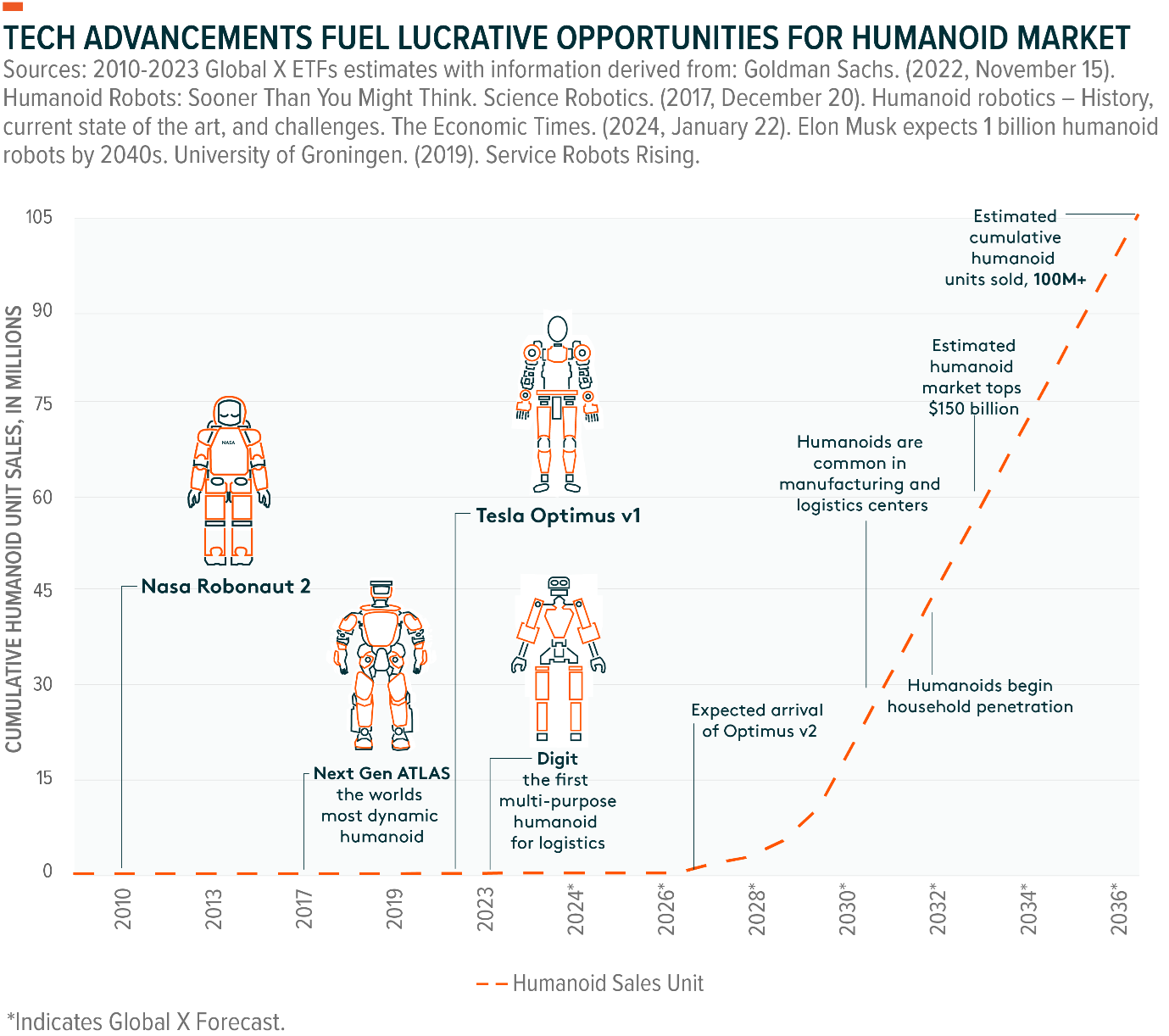

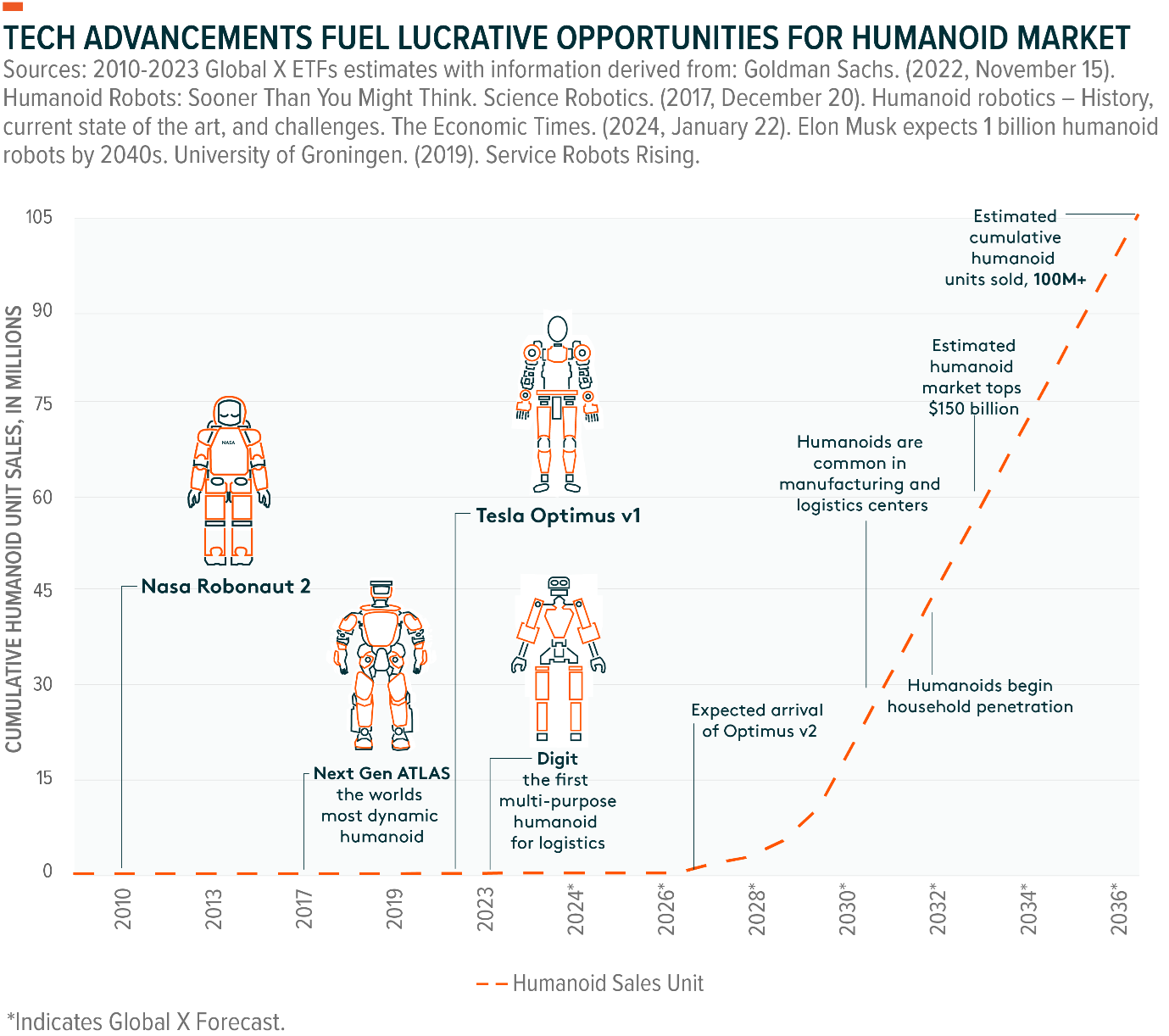

Humanoid Market Growth Expected to Go on the Fast Track

Humanoids are advanced robotic machines capable of emulating human actions, reasoning, and operations. They represent the convergence of technologies like AI, biomechanics, machine learning, and sensor connectivity with learning, cognitive development, and behavioural studies. Humanoids are crafted to mimic the human shape, aligning with the human-centric design of our world, from tools to building to homes. This not only is meant to facilitate their seamless integration into our environment, but a robot that resembles a human might gain quicker social acceptance compared to a radically different form.

The potential market opportunity for humanoids is massive, and it’s accelerating. Tesla CEO Elon Musk and industry stakeholders believe there could be over 1 billion humanoids on Earth by the 2040s.2 While adoption of single-purpose collaborative robots (cobots) is already widespread in industrial settings, the potential of general-purpose humanoid robotics remains largely untapped, with their appeal being their versatility. Once considered a futuristic vision, humanoids are now a tangible reality, capable of working in diverse settings like hazardous factories, and elderly homes, bringing innovative solutions to sectors like logistics, manufacturing, and healthcare.

Considering the global manufacturing (industrial) workforce, which we expect will grow from 252 million workers in 2024 to 400 million by 2035, the industrial humanoids total addressable market (TAM) is roughly US$1.75 trillion.3,4 Our estimate assumes that humanoids could potentially impact 35% of workers, in most cases by elevating them to more meaningful tasks, with humanoids selling at an average selling price (ASP) in the range of US$10,000-$15,000.5

Similarly, in the context of households, we expect humanoids to command an ASP in the same range as industrial ones, despite differences in functionality. Industrial robots are designed for heavy lifting and more power, whereas household humanoids may be tailored for friendly interaction and domestic tasks like monitoring and housework, leading to distinct technical and systematic differences. Assuming humanoids can penetrate up to 15% of the 1.5 billion global households by 2035, 225 million household humanoids could be possible.6 At the same ASP of US$10,000-$15,000, the TAM for household humanoids could reach US$2.8 trillion.

Humanoid Penetration Likely to Parallel Early Automobile, Cobot Trends

We believe humanoid utility will eventually prove as valuable to the average household as the automobile. Patented in 1886, gas-powered vehicles achieved commercial sales a mere seven years later in 1893, before quickly evolving into a household necessity with widespread consumer sales.7 In the process, the automobile transformed economies by making the transportation of goods, services, and people more accessible, efficient, and cost-effective, boosting economic productivity at scale.

The latest disruption in the automobile industry is the increasing proliferation of electric vehicles (EVs), an innovation also once considered futuristic. Today, EV’s not only represent a major automotive milestone, but they’re also advancing the affordability and sophistication of AI chips, advanced sensors, and batteries, all key components used in robots.

Similarly, cobots took only about 10 years to evolve from their initial commercial release to widespread sales, despite facing scepticism upon ideation.8 We expect the same catalysts that propelled cobots adoption – technological advancements, supply chain challenges, wage inflation, and demographic shifts – to fuel humanoid adoption in the coming decade.

Humanoids are already working alongside humans in warehouses and auto plants as part of pilot programs, tackling repetitive and dangerous tasks, such as moving heavy containers. An example is Amazon’s Digit, a bipedal robot developed by Agility Robotics for transporting and recycling eCommerce totes.9 High demand for Digit, the first commercially available humanoid designed for warehouse tasks, led Agility to build a dedicated factory with plans to produce 10,000 units annually.10 Businesses that join Agility’s Partner Program, which allows Digit’s capabilities to be customised, can expect robot deliveries in 2024, with a broader market rollout slated for 2025.11 Additionally, robotics startup Figure recently signed an agreement with BMW to pilot its general-purpose humanoids in BMW’s South Carolina manufacturing facility to assist with automotive production.12

Demand for humanoids in factories is likely to steadily increase into the mid-2030s.13 Thereafter, technological unlocks should bring humanoids to the service industry and into households, being capable of performing tasks like cooking, cleaning, and gardening. This transition towards household applications is expected to extend into the 2050s, albeit at a slower pace due to the intricate challenges they pose.14

The Humanoid Industry’s Momentum is Building

Widespread adoption of humanoids requires several key improvements. In the future, we believe the leading humanoid prototypes will be those that excel in seamlessly integrating mobility and agility movements with elite cognitive abilities, a combination yet to be mastered by today’s models. For that to happen, battery life must improve drastically or adapt to a fast-charging cycle that allows for a full day of work before recharging. Today’s humanoids, particularly those equipped with hydraulic actuators, can typically only work in short two-hour bursts.15

Further enhancements in mobility, agility, and processing capabilities are essential, along with better depth cameras, force feedback, and communication sensors. Computation gains are also needed for efficient navigation, task completion, and the ability to respond to questions. This type of computation requires more progress in end-to-end AI for software systems to not only execute tasks originating from initial commands, but also to seamlessly adapt to evolving scenarios in real time.

Household and service applications present complex physical scenarios, require sophisticated object recognition, and demand advanced mobility, dexterity, and balance. Understanding how different individuals interact with and respond to humanoids adds another layer of complexity, necessitating a high degree of personalisation.16 However, the household and services category is a promising market opportunity, particularly because the global population aged 60 and older is projected to double to 2.1 billion by 2050.17 This cohort can be a prime market for humanoid-aided assistance with daily tasks.

Finally, to enhance the financial viability of these robots, production costs must continue to decrease to ensure that their value output surpasses their input costs. Today, building humanoid robots ranges from US$30,000 for a basic model to US$150,000 for a high-end one, which is already a significant decrease from 2022’s range of US$50,000-$150,000.18,19 Further cost reductions can reduce barriers to adoption and lead to a positive market response, especially within the household setting. Like the automobile, we anticipate that households will begin to have the financial capacity to purchase personal humanoids within the next 15 years.

Companies Leading the Rise of Humanoids

Prominent companies driving the humanoid robotics field include established players like Boston Dynamics, Tesla, and Toyota, and startups like Agility Robotics and Figure, with each company bringing a distinct focus to the space.

For example, introduced by Boston Dynamics in 2013 as part of the DARPA Robotics Challenge, Atlas is the most advanced humanoid robot.20 With its bipedal agility, human-like movement, autonomous navigation, and robust learning abilities, Atlas has gained widespread industry acclaim and has become an internet sensation. Atlas features whole-body skills for swift, dynamic movements, allowing it to lift and carry objects, perform complex exercises like jumping and backflips, and participate in disaster response and industrial tasks that demand dexterity and adaptability.21 Atlas is a research platform and isn’t available for purchase, but it is a catalyst for innovation in the industry.22

Unlike Atlas, Tesla’s second-generation humanoid robot, Optimus Gen 2, is in development for commercial purposes.23 Optimus Gen 2 is a versatile, general-purpose machine capable of assisting in multiple domains, including manufacturing, construction, healthcare, and entertainment.24 The robot offers precise, flexible movement capabilities, and its hands, equipped with 11 degrees of freedom, feature tactile sensors and high-speed actuators, enhancing its object manipulation skills.25 Optimus runs on the same neural networks powering Tesla’s cars, and the company’s expertise in battery technology, sensing, and computing is expected to allow it to operate more cost-effectively than competitors. CEO Elon Musk stated that the prototype could cost only US$20,000 upon launch. Additionally, Tesla has plans to deploy the humanoids within its auto manufacturing facilities, which could also help expedite adoption.26

Unravelling the Investment Opportunities Across the Humanoid Value Chain

Investors interested in the humanoid market can find opportunities across the supply chain, particularly through robotic manufacturers for industrial, healthcare, or household settings, AI chipmakers, sensor developers, internet of things systems makers, and essential component and material suppliers. Also, we believe companies specialising in AI and machine learning tools that enhance humanoid robot capabilities present attractive opportunities.

We also expect cloud infrastructure and data management software providers to benefit from humanoid implementation, particularly in household settings. The demand for custom, personalised AI models for consumer-based humanoids will likely lead to a significant increase in data generation, fuelling a substantial rise in expenditures on cloud computing resources and data management tools.

From Sci-Fi Dreams to Economic Reality

The remarkable progress in humanoid technology, fuelled by groundbreaking technical advancements and cost reductions, signals the potential for disruptive shifts across industries. Despite current challenges in combining mobility and cognitive abilities, we expect innovation to continue and broad-based adoption to follow. By 2035, we expect the TAM for the global humanoid robotics market to approach US$4.85 trillion.27 As humanoids transition from industrial applications to household assistants, we believe that their assimilation into society can bring economic advantages, including new ways to address global challenges like supply chain disruptions and inflation. In that sense, we believe these machines can put a new spin on the word “robot.”

Related ETFs

ROBO: The Global X ROBO Global Robotics & Automation ETF (ASX: ROBO) invests in robotics and artificial intelligence companies, including those involved with industrial robotics and automation, non-industrial robots, and autonomous vehicles.

Forecasts are not guaranteed and undue reliance should not be placed on them. This information is based on views held by Global X as at 22/03/2024. Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss. Brokerage commissions will reduce returns.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalised investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.