Since Global X launched the first global broad-based index exchange traded fund (ETF) in Australia employing a Growth at a Reasonable Price (GARP) investment framework in September 2024, the strategy has shown impressive performance in its early stages. By targeting companies with strong growth, solid quality metrics, and attractive valuations, GARP's fundamentals may be an appealing opportunity for investors wanting global exposure to growing companies while maintaining a valuation discipline.

Key Takeaways

- GARP's portfolio outperformed the broader market by ~5% since its launch and has outperformed other factor-based strategies, driven by strong contributions from companies in multiple sectors.

- A rules-based rebalancing approach has enabled GARP to stay true-to-label to its core strategy allowing investors to gain exposure to quality global companies while removing those with heightened valuations, declining or slowing growth, and weakening fundamentals.

- GARP's portfolio showcases robust and appealing underlying metrics such as a Price-to-Earning (PE) ratio of 15.6x while delivering double-digit revenue and earnings growth.

Strong Start: GARP's Impressive Performance to Date

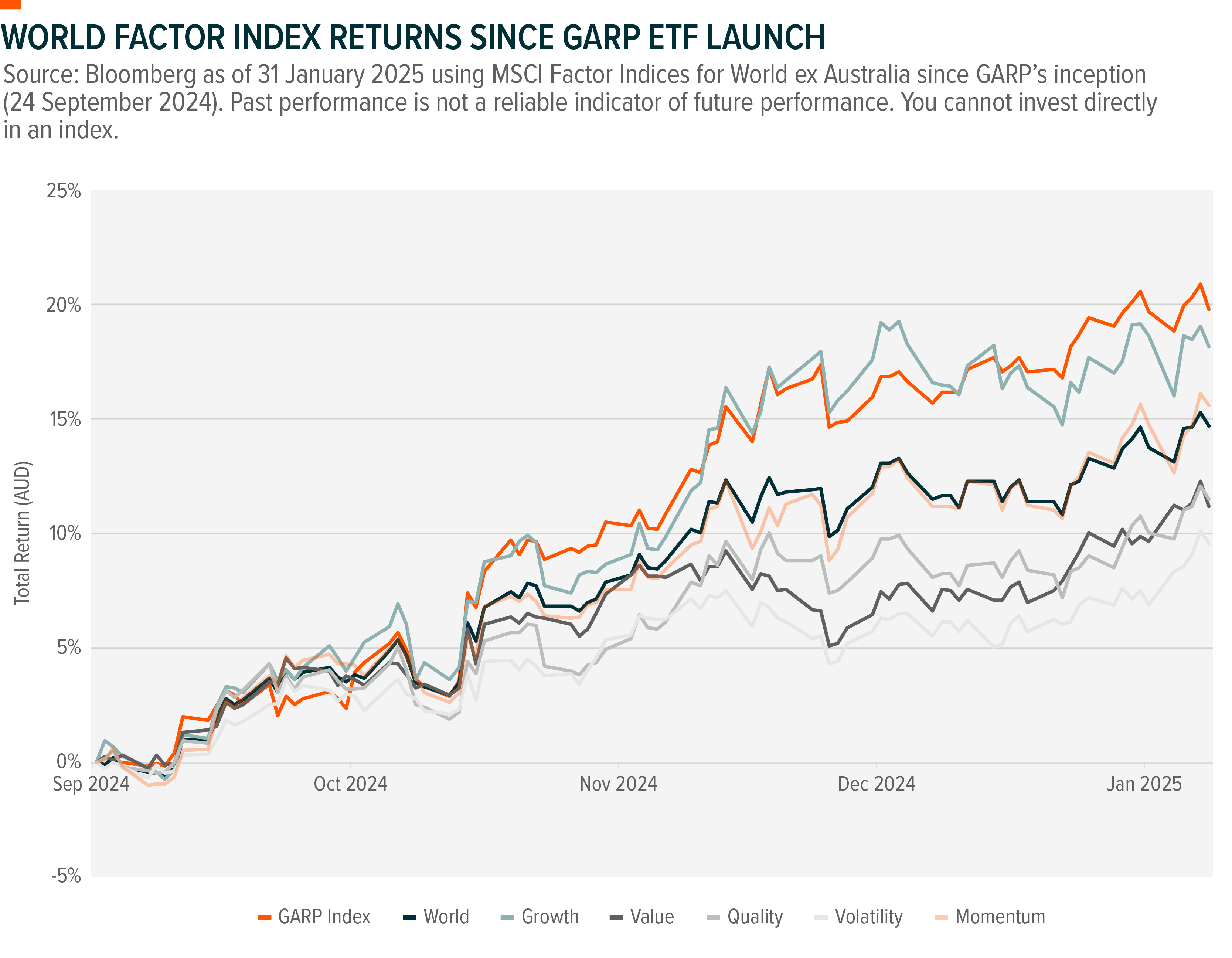

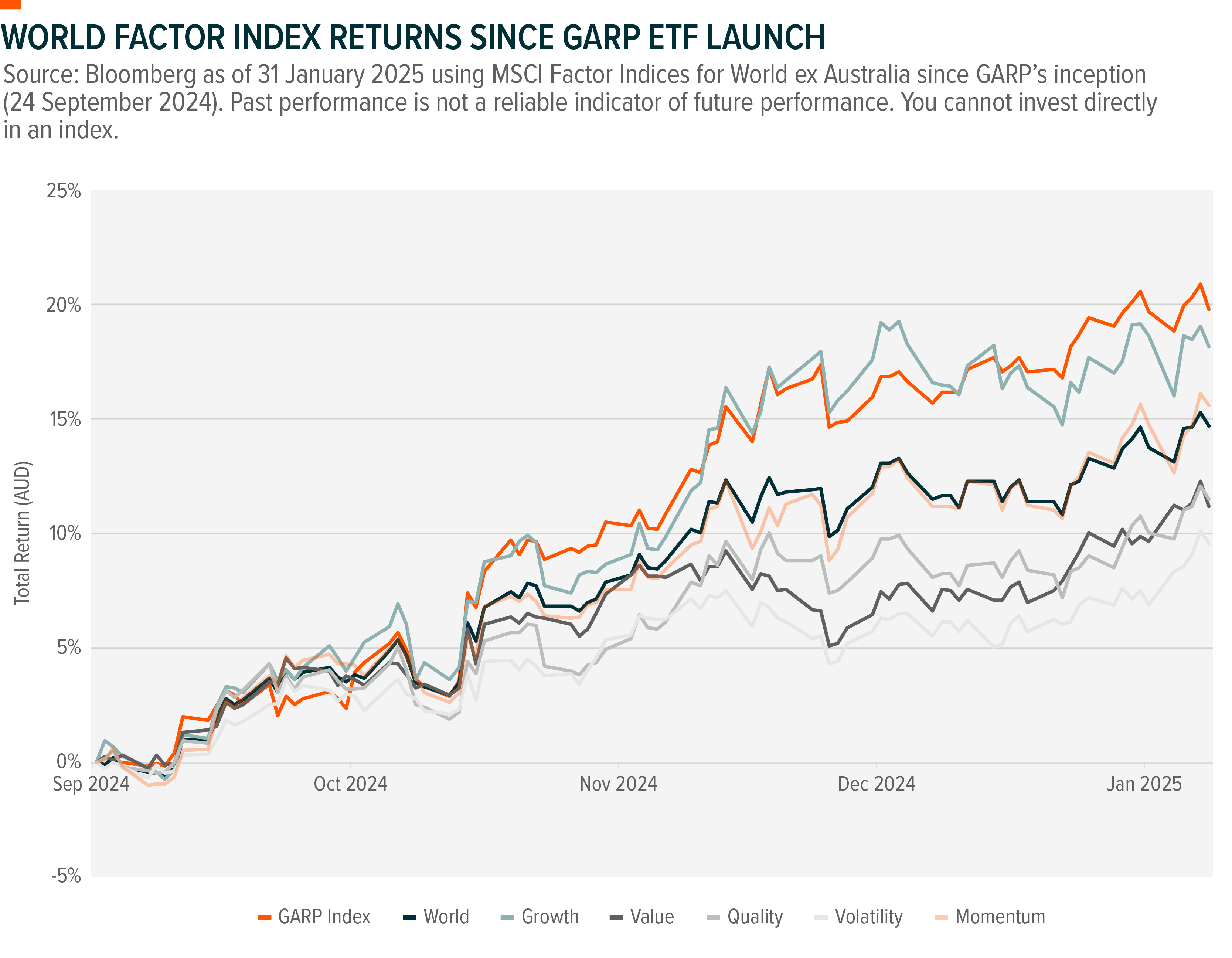

While global equity markets rallied at the end of 2024, GARP has outperformed the broader market and other factors such as quality, rising ~20% since the ETF launched.

While having positions in many of the mega-cap names such as Tesla, Meta, Alphabet, Apple, Netflix and Nvidia helped GARP achieve strong numbers, other holdings such as Visa, Berkshire Hathaway and Mastercard were meaningful contributors too. In fact, compared to a broader world ETF, GARP's outperformance wasn't driven by technology, but by broader sectors such as consumer, financials, and communication. While Tesla played a significant role in the Consumer Discretionary attribution, the chart below highlights the broader sectoral contributions.

Measuring performance alone doesn't accurately reflect the level of risk investors may have taken in an investment. When examining GARP's volatility, it's delivered superior returns without taking on excessive risk, achieving a higher Sharpe Ratio compared to the broader market and other factors.1

GARP's well-balanced risk-return profile is driven by its systematic methodology, which carefully selects companies based on growth, value and quality metrics, aiming to ensure that only those with the strongest metrics are included in the portfolio and those with poorer metrics are removed.

December 2024 Additions and Deletions

Like any other index-based ETF, GARP will go through a periodic rebalancing process. Every six months, it will identify the stock universe and determine the key constituents for the portfolio. It may add in new companies eligible into the strategy while subsequently kick companies out of the strategy if they fail to meet the growth, value or quality metrics.

For example, in the December 2024 rebalance the GARP Index deleted companies like Tesla, ServiceNow and Costco because of valuation concerns, while also deleting Apple, QUALCOMM and Nike which experienced declining revenue and earnings growth. This rebalancing was fortuitous with some securities like Tesla falling by over 20% since the deletion from GARP's index.

There were also some new additions the GARP portfolio of high-quality companies that exhibit strong revenue and earnings growth but are also trading at reasonable prices. These include:

- Uber Technologies - The world's largest ride-hailing platform and second-largest food delivery service in the US, achieved its first year of profitability with strong revenue growth, expanding delivery services and increasing advertising revenue and deploying stringent cost-control measures to counteract slowing margins.2

- Coca-Cola - Leading global beverage manufacturer selling more than 3,000 products in over 200 countries has recorded double-digit organic sales growth and strong margins, while maintaining efficiency in advertising and leveraging productivity levers to sustain profitability and low debt.3

- Banco Bilbao Vizcaya Argentaria (BBVA) - The 6th largest euro-zone bank, boasting strong growth with double digit revenue and earnings growth, a solid capital base, with potential acquisition opportunities, all while trading at PE ratio in the single digits.4

- PayPal - A leading digital payment platform with over 430 million accounts, focusing on profitable growth under its new CEO, expanding value-added services, driving rising payment volumes, and using share buybacks while exploring long-term M&A opportunities.5

While companies may come and go during the rebalancing process, the core strategy of GARP remains intact, allowing investors to gain exposure to leading global companies without the need for actively managing it themselves, simplifying the investment process.

Strong Fundamentals Across Growth, Value and Quality

The updated GARP portfolio of 250 global companies demonstrates robust fundamentals, outshining the broader global market in some key areas. With impressive double-digit earnings per share (EPS) and sales growth, strong profitability metrics and margins, all while trading at an attractive valuation nearly a third lower than the broader market, GARP stands out as a solid well-rounded investment strategy.

With some markets like the US trading above their 90th percentile in terms of valuations6, and potential concerns around whether growth companies can continue to beat their expectations, investors may want to look to diversify their exposure to incorporate a level of valuation discipline whilst still ensuring owning companies that are growing their top and bottom line.

Markets can sometimes be complex, and its tough to make sense of all the news headlines. During earnings season, some companies can face short-term setbacks if they fail to produce solid numbers that may fall short of expectations. GARP investing helps cut through the noise by focusing on businesses with both sustainable growth and reasonable valuations in a non-biased systematic way. GARP offers a disciplined approach to help investors navigate market fluctuations, balancing growth and value to try capture sustainable, long-term investment opportunities.