Innovation has become the defining story of global markets, but it is no longer concentrated in a single geography or expressed through a single model. The United States and China now sit at the centre of the technology race, each advancing in its own distinct way. In the US, disruption has been driven by the commercialisation of artificial intelligence, the relentless build-out of hyperscale data centres, and the dominance of semiconductor designers operating at the frontier of global supply chains. In China, the push for innovation has been shaped as much by necessity as by ambition, with policymakers directing resources toward domestic self-sufficiency, efficiency-focused AI models, and the large-scale deployment of new technologies across industry and society.

The divide is not only geopolitical but reflects two competing approaches to harnessing the same technological forces that will define global growth for decades to come. For investors, the challenge is less about choosing sides and more about capturing the complementary strengths of both while managing the distinct risks each presents.

Key Takeaways

- The US innovation model continues to dominate frontier breakthroughs in AI and semiconductors, supported by hyperscaler spending and private-sector capital.

- China's strategy emphasises efficiency and scale, diffusing innovation rapidly across industries even under hardware restrictions.

- Exposure to both markets may provide investors with balance: frontier growth from the US alongside broader adoption from China.

Two Models of Artificial Intelligence and Semiconductors

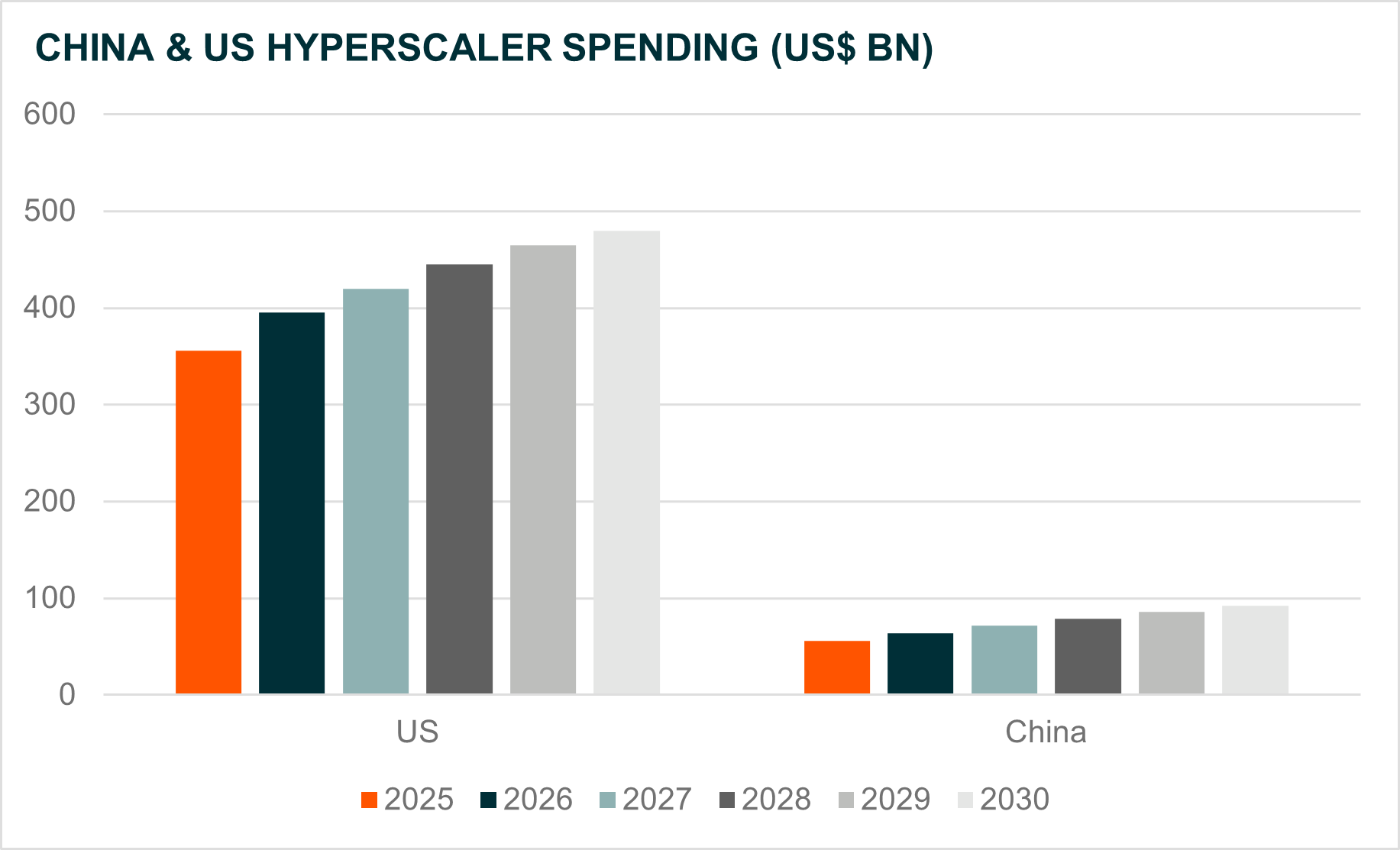

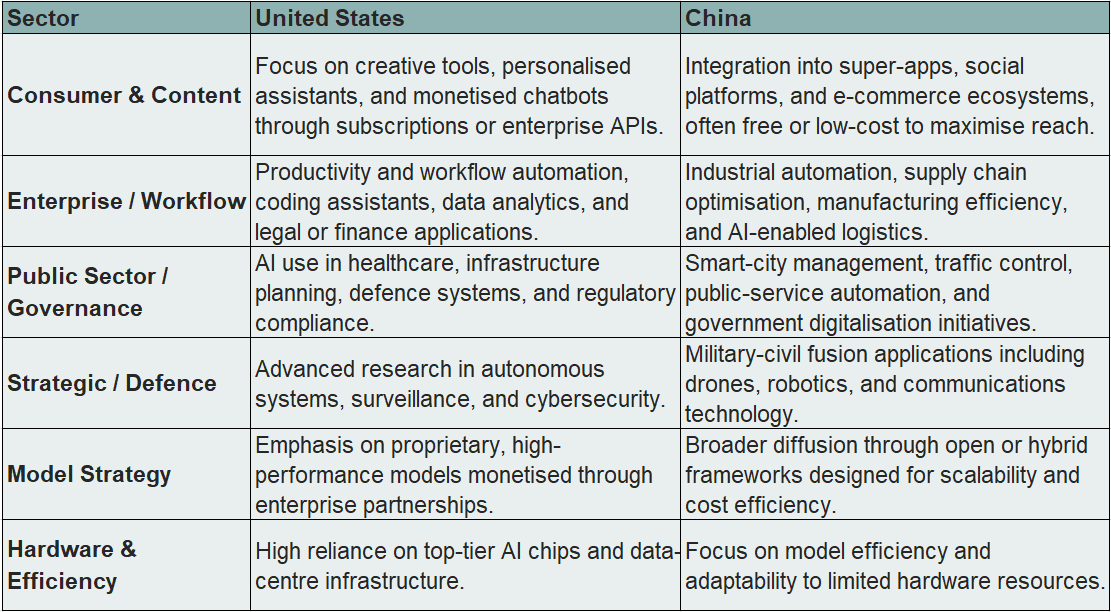

Artificial intelligence and semiconductors best capture how the US and China have taken different paths in developing their technology sectors. In the US, the focus has been on acceleration. Since the emergence of generative AI in late 2022, hyperscalers have committed large sums to the infrastructure needed to train and run new models1. That spending has driven upgrades to revenue forecasts for chip designers and hardware suppliers, lifting valuations across the core of the AI ecosystem2. The cycle already resembles earlier technology build-outs, where heavy investment lays the groundwork for future applications but raises questions about whether expectations are running ahead of earnings.

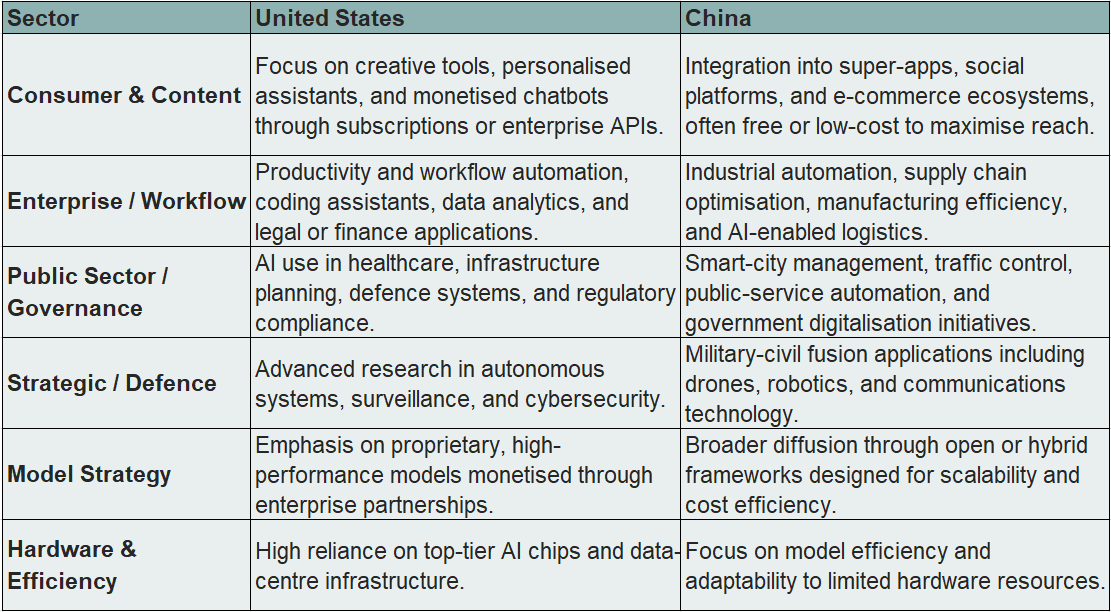

China’s AI strategy has evolved under the constraint of limited access to advanced US chips. Rather than fall behind, Chinese firms have pushed efficiency-based innovation, developing models that run on less powerful hardware and using open-source frameworks to cut costs and expand adoption3. This approach has produced a broader AI landscape, with breakthroughs such as the DeepSeek model reducing usage costs and embedding AI tools in consumer apps, manufacturing, and government services. While China lacks the same level of chip performance, it is compensating through rapid diffusion and wide-scale application.

For investors, the US represents access to the most advanced technologies but with valuations linked to a costly investment cycle that could ease as growth normalises. China offers exposure to mass-market adoption and policy-driven expansion, balanced by the risks of intervention, geopolitical tension, and domestic capacity limits. Both are shaping the AI era, just through different routes. The distinction extends beyond hardware and investment cycles to how each economy is applying AI across industries.

Source: Global X ETFs

Infrastructure as the Enabler of Innovation

The commercial potential of technology ultimately depends on the infrastructure that supports it, and on this front the US and China have taken different paths.

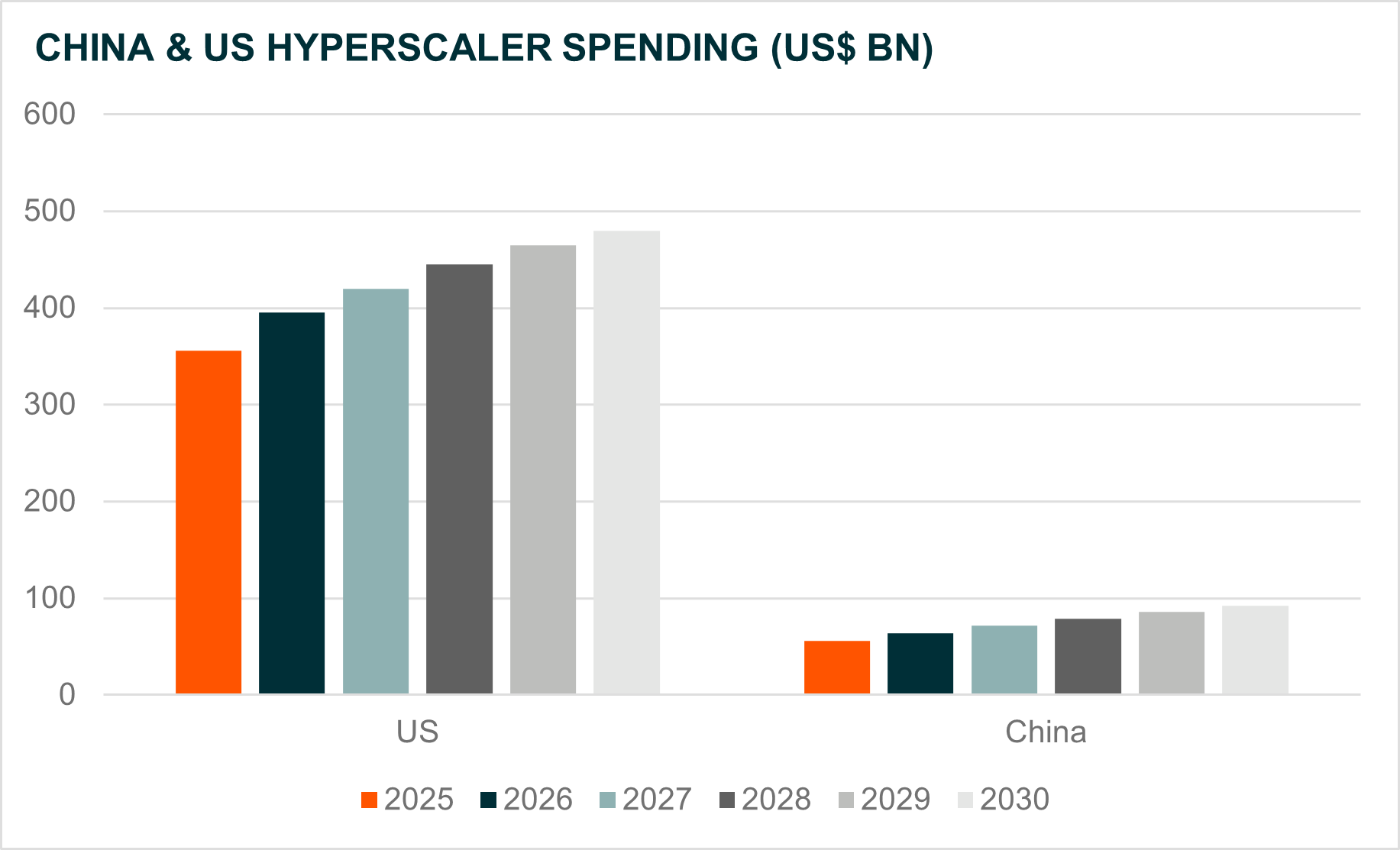

In the US, hyperscaler investment in cloud and data centres has consistently exceeded expectations. Forecasts for capital expenditure have been revised higher as demand for AI training and inference capacity keeps climbing4. These commitments have built the digital backbone for global enterprises, keeping US firms at the forefront of AI deployment. Even so, infrastructure spending tends to move in cycles, and the current phase of expansion could slow before monetisation from new AI applications fully takes hold.

China’s build-out has followed a different pattern but is just as important. Major internet companies are expanding data centre capacity, with AI now absorbing a growing share of total investment. Backed by the world’s largest 5G network and relatively low energy costs, this effort is enabling AI integration across both consumer and industrial sectors. Unlike in the US, where hyperscalers dominate, China’s growth is spread more broadly across super-app ecosystems and enterprise platforms5. That diffusion may allow adoption to move faster through the wider economy, even if margins are thinner and profitability less predictable.

For investors, infrastructure highlights the complementary strengths of both models. The US remains the leader in scale and performance, while China is embedding digital capability across industries at remarkable speed. Together they are shaping the next phase of the global technology cycle and offering distinct yet connected opportunities.

Source: Reuters, Company Data

Why Investors Should Consider Both

The rivalry between the US and China is often framed as a contest with a single winner. For investors, however, the reality is more nuanced. Each country represents a distinct model of innovation, with the US driving frontier breakthroughs and China diffusing technology widely across its economy. Each model carries risks, from US valuations to Chinese policy constraints, but also opportunities that are difficult to capture in isolation.

For this reason, portfolios may benefit from exposure to both. Global X’s FANG+ ETF (FANG) offers investors a way to access the world’s leading technology innovators, from semiconductor designers to platform companies, reflecting the strengths of the US model. Global X’s China Technology ETF (DRGN) captures the domestic champions that stand at the heart of China’s innovation drive, offering targeted exposure to its efficiency-led, state-supported pathway.

Together, these funds provide investors with a balanced lens on the future of global technology. Innovation may not follow a single track, but by understanding and combining these divergent models, investors can position themselves to participate in disruption wherever it takes root.

Source: Global X ETFs

Source: Global X ETFs

Source: Reuters, Company Data

Source: Reuters, Company Data