With headlines flying fast and loud—tariffs rising, elections looming, and central banks recalibrating—investors may be forgiven for feeling overwhelmed. In times like these, staying glued to the news cycle can do more harm than good. While it’s tempting to track every new policy twist or market dip, savvy investors know that long-term outcomes hinge more on sound portfolio construction than on the latest headline. Rather than reacting to each new development, focusing on strategic asset allocation can offer a steadier path through uncertainty.

In this article, we explore three time-tested strategies designed to help portfolios weather volatility: the enduring appeal of gold as a hedge, the defensive characteristics of high-yield low-volatility ETFs, and the income-generating potential of covered call strategies. Each offers a distinct way to help investors stay grounded when markets get noisy—and keep portfolios positioned for both protection and potential upside.

Key Takeaways

- Gold has proven itself as the go-to macro hedge for investors over the past two years, with strong, consistent performance despite high interest rates and historic market volatility.

- Dividend generating equities that exhibit low historical beta to the market can help portfolios weather market downturns and even outperform as investors seek stability and total return buffers.

- As market volatility surges, covered call strategies allow investors to capitalise on high option premiums and protect on the downside during drawdowns.

Gold’s Enduring Lustre

In a repeat of its stellar performance in 2024, gold is once again one of the top performing assets, returning 16.2% year-to-date. In comparison, the S&P 500 has returned a sombre -7% over the same period. Equities outside the US haven’t fared much better, with the MSCI World index also dropping -6.4% for the year thus far.

Gold has long been known as a resilient macro hedge and a powerful diversification tool for investors to navigate complex environments such as geopolitical turmoil and economic uncertainties. With Trump kicking sand into the gears of the global economy and eroding global trust in the US financial institution, there has never been a more relevant moment for gold to make its way back into investor portfolios.

Not only is gold an appealing diversifier due to its low correlation to traditional portfolio exposures but in times of geopolitical and economic turbulence, gold is viewed as a safe haven asset due to its high liquidity and non-existent credit risk. Further, with both equities and bonds falling in tandem this year, investors have had very few places to hide away. As such, for investors who are looking to weather the storm of market moving headlines and economic warfare this year, a meaningful allocation to gold could help ease the pain.

Low Volatility, High Yield

For investors which wish to stay invested in equities despite the market volatility, an alternate approach may be to look for equities that have historically had a low beta (sensitivity to market swings) to the stock market. Simply put, stocks that have historically had high beta with the stock market (i.e. Beta > 1) tend to be more volatile than the market – that is, it goes up more when the market goes up, but also down more when the market falls. On the other hand, stocks with lower betas are more resilient to market downturns, and those with negative betas may even appreciate while the broader market experiences a drawdown. In general, lower beta translates to lower volatility relative to the broader market – which may be attractive to investors who wish to limit the effect of massive swings in market sentiment that we’ve witnessed in recent weeks.

As a complement to low volatility exposures, companies offering high, consistent dividend yields can also perform better during periods of economic stress.

Their ability to sustain regular payouts typically reflects underlying financial strength, operational resilience, and mature business models. These firms are commonly found in traditionally defensive sectors such as utilities, consumer staples, and healthcare—areas known for stable earnings regardless of the economic cycle. In times of slowing growth or heightened uncertainty, investors tend to rotate into these dividend-paying stocks for their steady income and relative stability, making them a dependable anchor within broader equity allocations.

Beyond their income appeal, they also serve as total return buffers—helping to cushion overall portfolio performance when capital gains are limited or negative. In volatile markets, dividends can make up a meaningful share of total returns, providing downside support even when share prices face pressure.

Source: Global X ETFs. Using data from Bloomberg. Accessed on 11/04/2025.

Investors which opted for a combination of both approach over the past 12 months would have seen their portfolios outperform the market quite handily as of April 2025. Despite the widespread selloff, a low volatility strategy such as the Global X S&P 500 High Yield Low Volatility ETF (ASX: ZYUS) has managed to return 14%, which is quite a feat considering the performance of broad equity indices.

Harvesting Volatility with Covered Calls

In uncertain market environments, investors often look for strategies that can generate income while reducing portfolio risk. One such approach is the covered call strategy, which involves selling call options on stocks already held in a portfolio. This allows investors to collect option premiums, creating a supplementary income stream that can enhance overall returns—especially in sideways or range-bound markets where capital appreciation may be limited.

This strategy also becomes particularly relevant when market volatility is elevated, as it is today. With volatility near record highs, driven in part by the unpredictable nature of President Trump's on-and-off tariff policies, option premiums have risen sharply. These higher premiums mean greater income potential for investors writing covered calls. At the same time, the strategy provides a cushion against short-term drawdowns—an appealing feature as global markets react to shifting trade rhetoric and policy uncertainty. While covered calls do cap some upside potential if markets rally sharply, they offer a pragmatic way to harness volatility and uncertainty, turning a source of risk into a source of return.

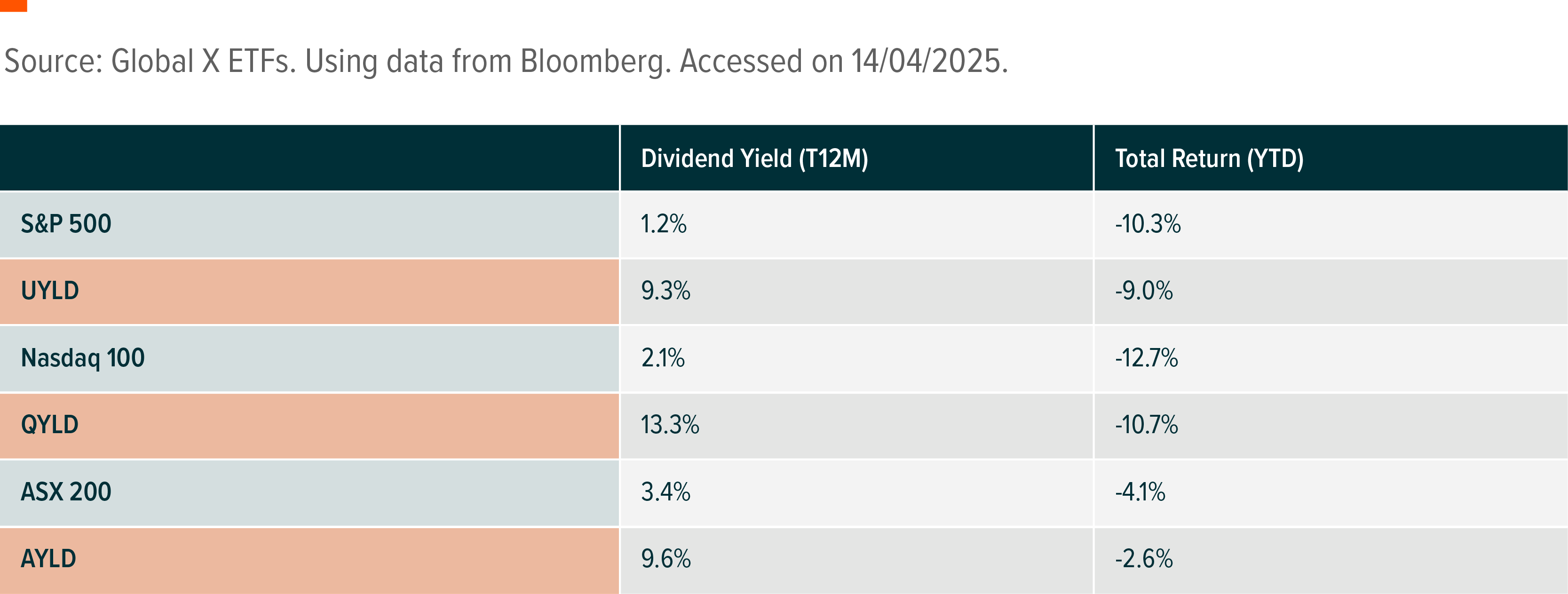

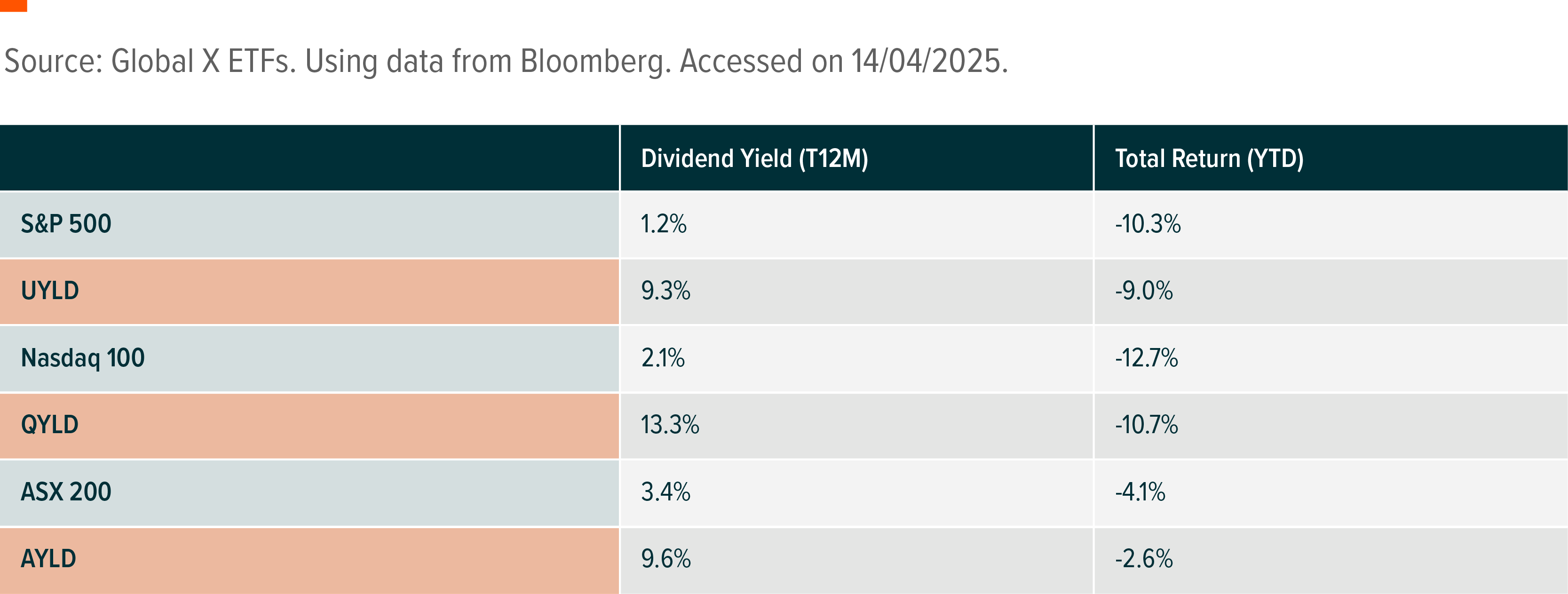

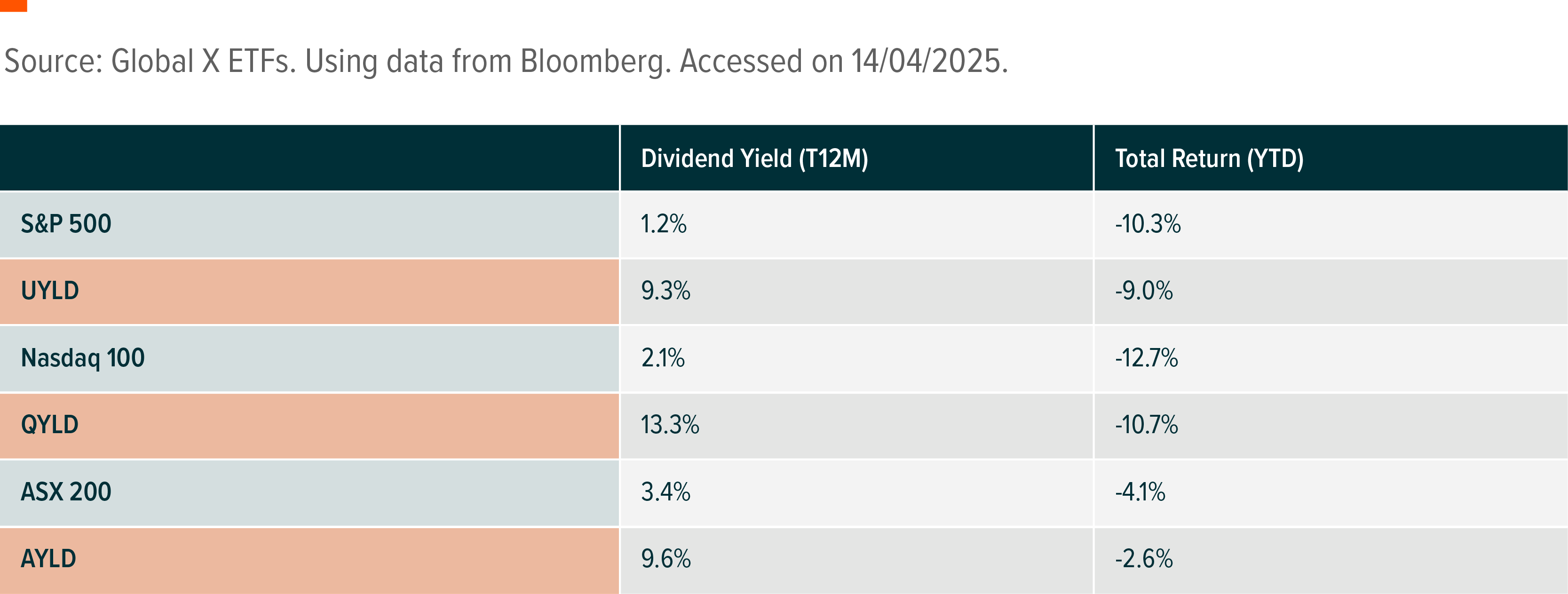

As of April 2025, the Global X covered calls ETF suite consisting of Global X S&P 500 Covered Call Complex ETF (ASX: UYLD), Global X Nasdaq 100 Covered Call Complex ETF (ASX: QYLD), and Global X S&P/ASX 200 Covered Call Complex ETF (ASX: AYLD) have produced respectable trailing 12-month yields of 9.3%, 13.3% and 9.6% respectively. By taking advantage of elevated options premiums, investors would have both outperformed market indices this year-to-date, while also securing strong dividend income.

Positioning Portfolios for Resilience and Performance

Even when markets are gripped by volatility and uncertainty—driven by shifting trade policies, geopolitical shocks, or economic crosswinds—investors are not without options. As this article has explored, strategies like allocating to gold, targeting high-yield low-volatility equities, and implementing covered call overlays can help transform a reactive stance into a proactive one. Each approach offers a distinct way to navigate risk while remaining invested: gold as a time-tested macro hedge, dividend-paying low beta stocks as total return stabilisers, and covered calls as a means to monetise turbulence. Together, they provide a multi-layered toolkit for investors looking to position portfolios for resilience and performance.

Related Fund

AYLD: The Global X S&P/ASX 200 Covered Call ETF (ASX: AYLD) invests in at-the-money call options written over the S&P/ASX 200 Index.

GOLD: The Global X Physical Gold (ASX: GOLD) invests in physical gold via the stock exchange.

QYLD: The Global X Nasdaq 100 Covered Call ETF (ASX: QYLD) invests in at-the-money call options written over the Nasdaq 100 Index.

UYLD: The Global X S&P 500 Covered Call ETF (ASX: UYLD) invests in at-the-money call options written over the S&P 500 Index.

ZYUS: The Global X S&P 500 High Yield Low Volatility ETF (ASX: ZYUS) invests in 50 of the highest dividend yielding equity securities from the S&P 500 Index.