Bitcoin is beginning to look a lot like gold.

Not exactly, of course. It remains more volatile than traditional assets and has yet to fully establish itself as a reliable store of value. But there’s growing evidence that investors are beginning to treat it less as a vehicle for speculative excess and more as a strategic asset with a role to play in diversified portfolios.

This shift has long been anticipated by Bitcoin’s most ardent supporters, who have argued for years that it represents a kind of “digital gold.” Like gold, Bitcoin is a non-sovereign, liquid asset with a finite supply and no ties to any central authority. It isn’t subject to the distortions of monetary policy, nor can it be inflated at will. In theory, it should act as a hedge against economic instability and offer ballast when traditional markets falter.

Until recently, that theory remained largely aspirational. Bitcoin’s sharp price cycles, murky regulatory environment, and close correlation with risk-on assets kept it on the margins of mainstream asset allocation. But that narrative is beginning to shift. With increasing policy engagement, ETF adoption, and signs of behavioural decoupling from traditional risk assets, Bitcoin’s underlying attributes are starting to come into focus, helping position it as a credible, albeit still evolving, alternative asset in its own right.

Key Takeaways

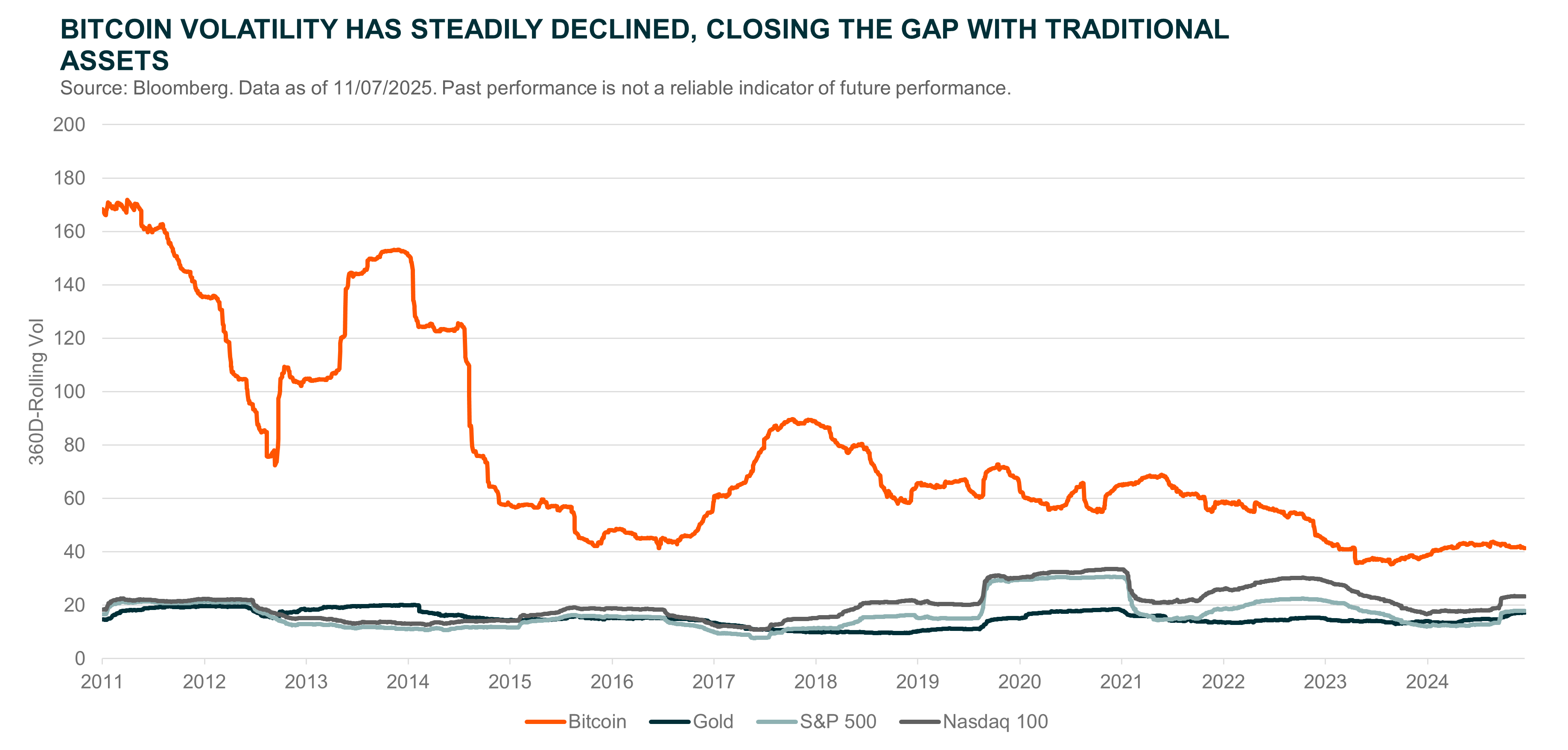

- Growing investor adoption and policy clarity has lowered the volatility of Bitcoin, supporting its evolution toward a more stable “store-of-value”.

- Bitcoin’s resilience in 2025 suggests a shift in investor mindset, with greater emphasis on its underlying fundamentals – positioning it more as a strategic allocation than a speculative trade.

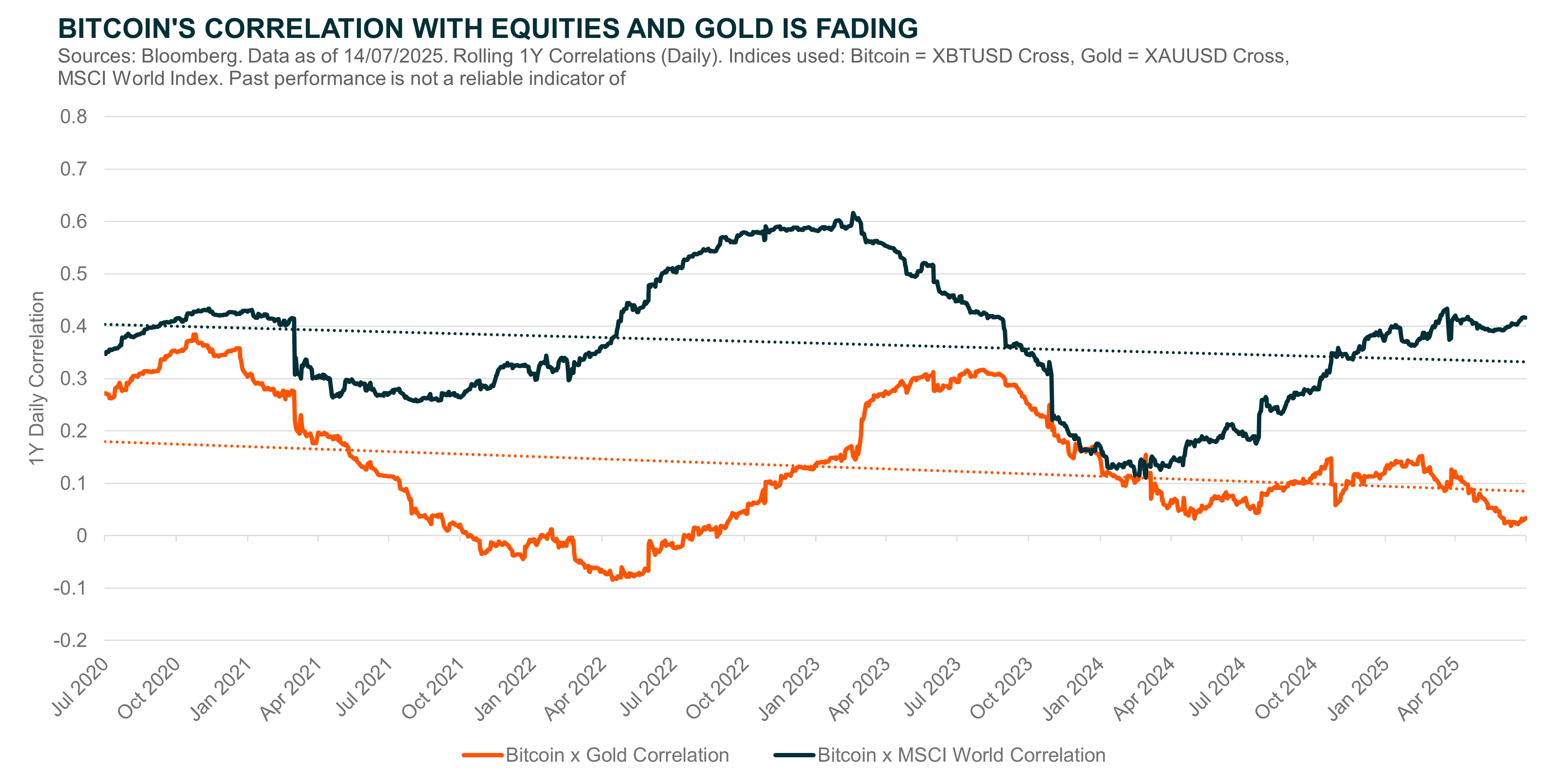

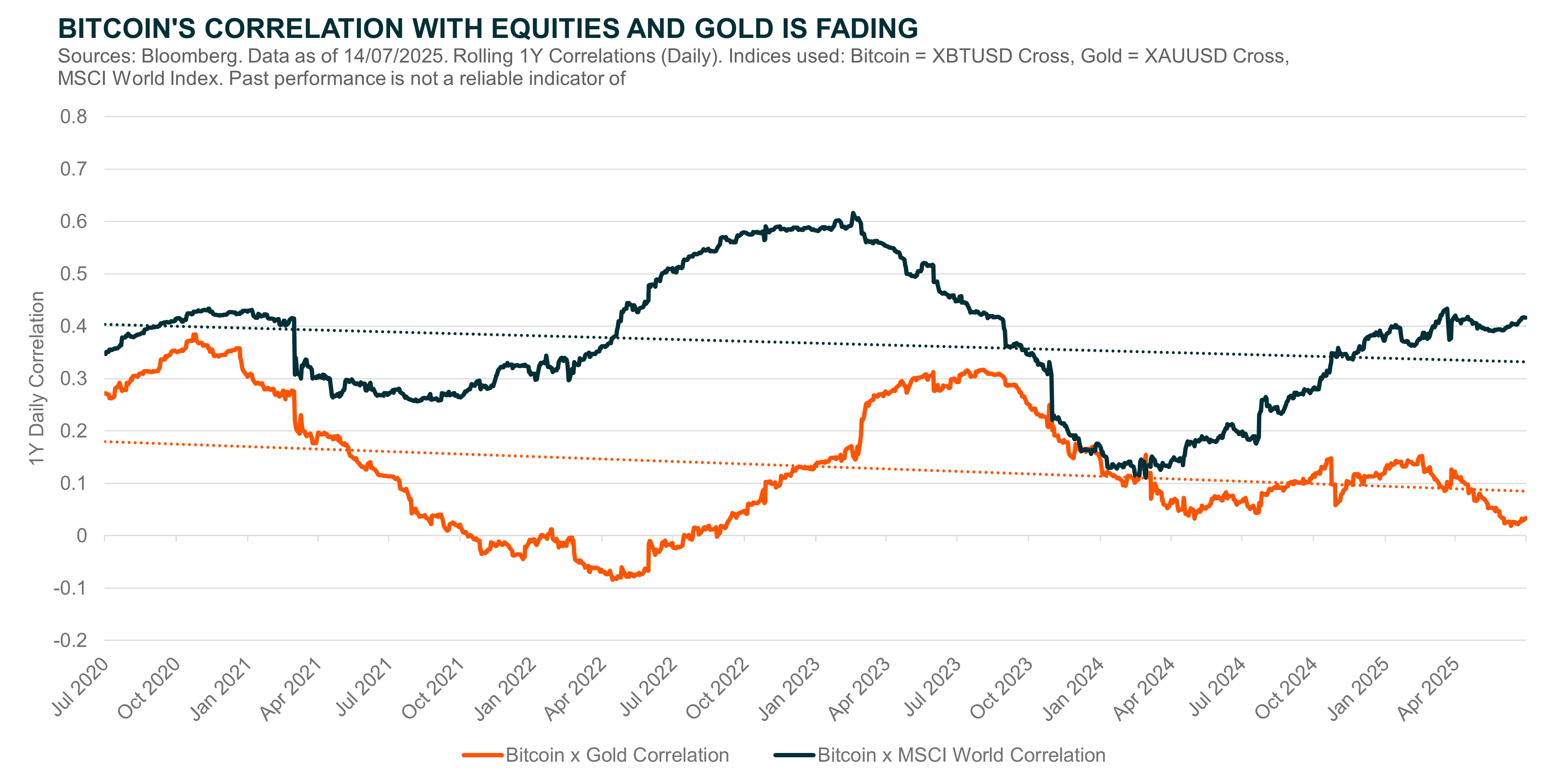

- Bitcoin’s declining correlation with both risk assets and gold since 2020 highlights its emergence as a truly unique asset class, strengthening the case for its inclusion as a powerful portfolio diversifier.

The Path to Becoming a Store of Value

To be considered a strong store of value, an asset must satisfy three key criteria.

First, it must be durable – resistant to inflation and capable of maintaining purchasing power over time. Second, it must be transactable and widely recognised, with sufficient liquidity to be used and converted efficiently. Third, it must exhibit price stability, with low enough volatility to give investors’ confidence in its value.

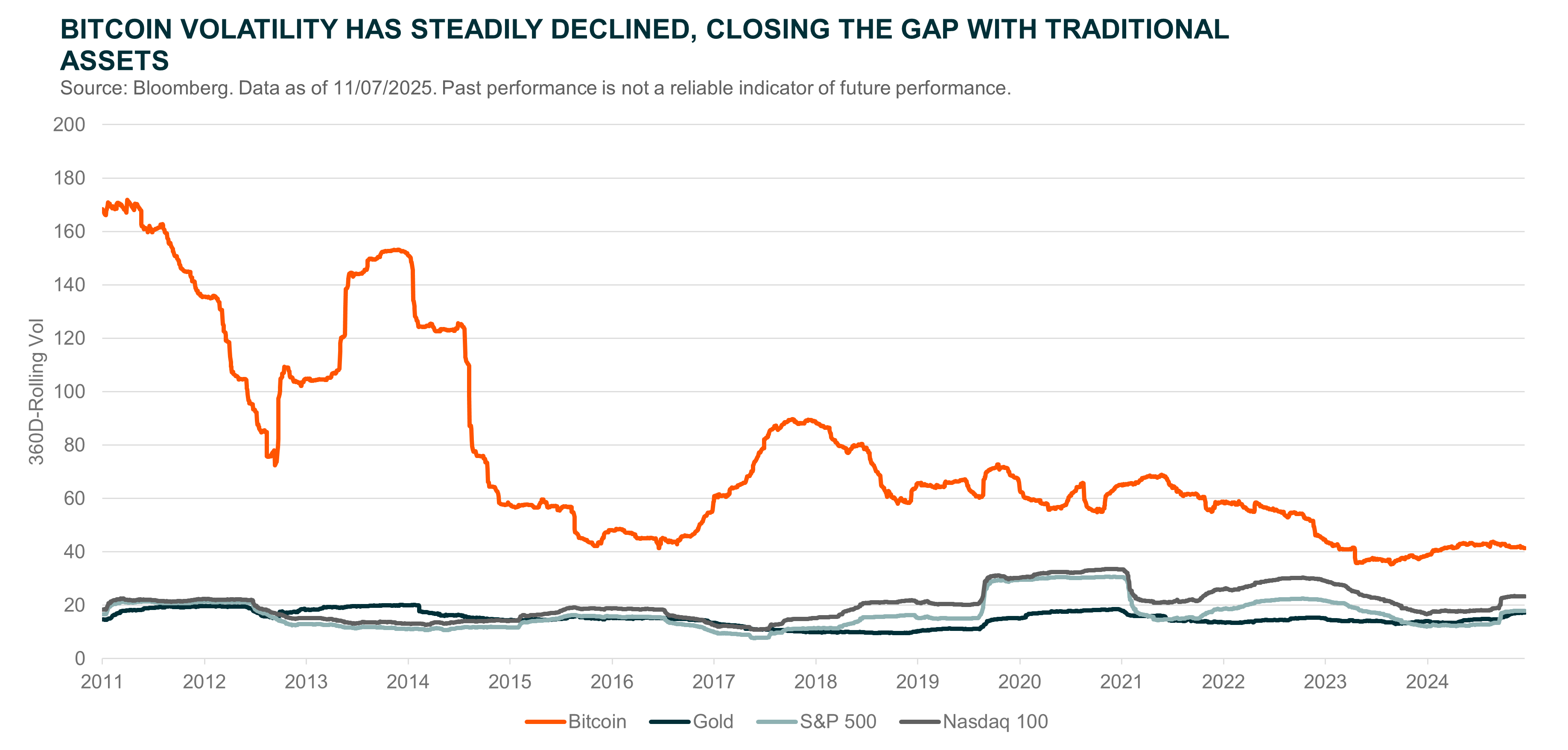

For more than half-a-decade, Bitcoin has satisfied the first two criteria. It is durable by design, with a fixed supply of 21 million coins, and has grown into a highly liquid asset with deep global markets. The one criterion that it has struggled to meet is stability. But that dynamic is starting to shift. As adoption grows, Bitcoin’s volatility is steadily declining.

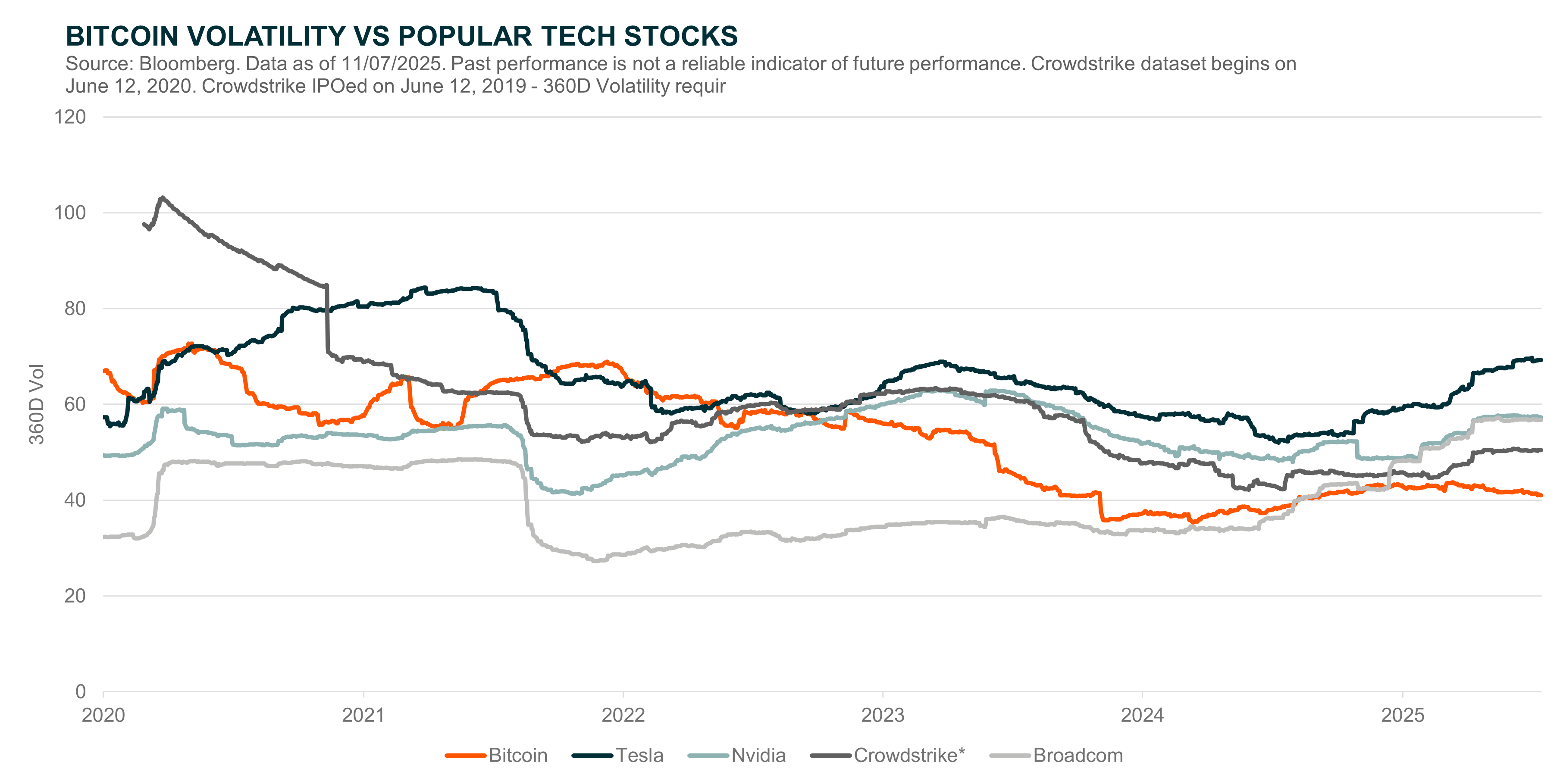

In 2010, when Bitcoin was still a fledgling concept with a market capitalisation of just US$100 million, it was notoriously volatile, with a rolling 360-day volatility exceeding 160%.1 In practical terms, that meant its returns could swing by ±160% over any given year – far too erratic to be considered anything but a speculative asset. Today, Bitcoin’s 1-year volatility has fallen to around 40%. That’s despite the unpredictable geopolitical climate and a murky economic backdrop.

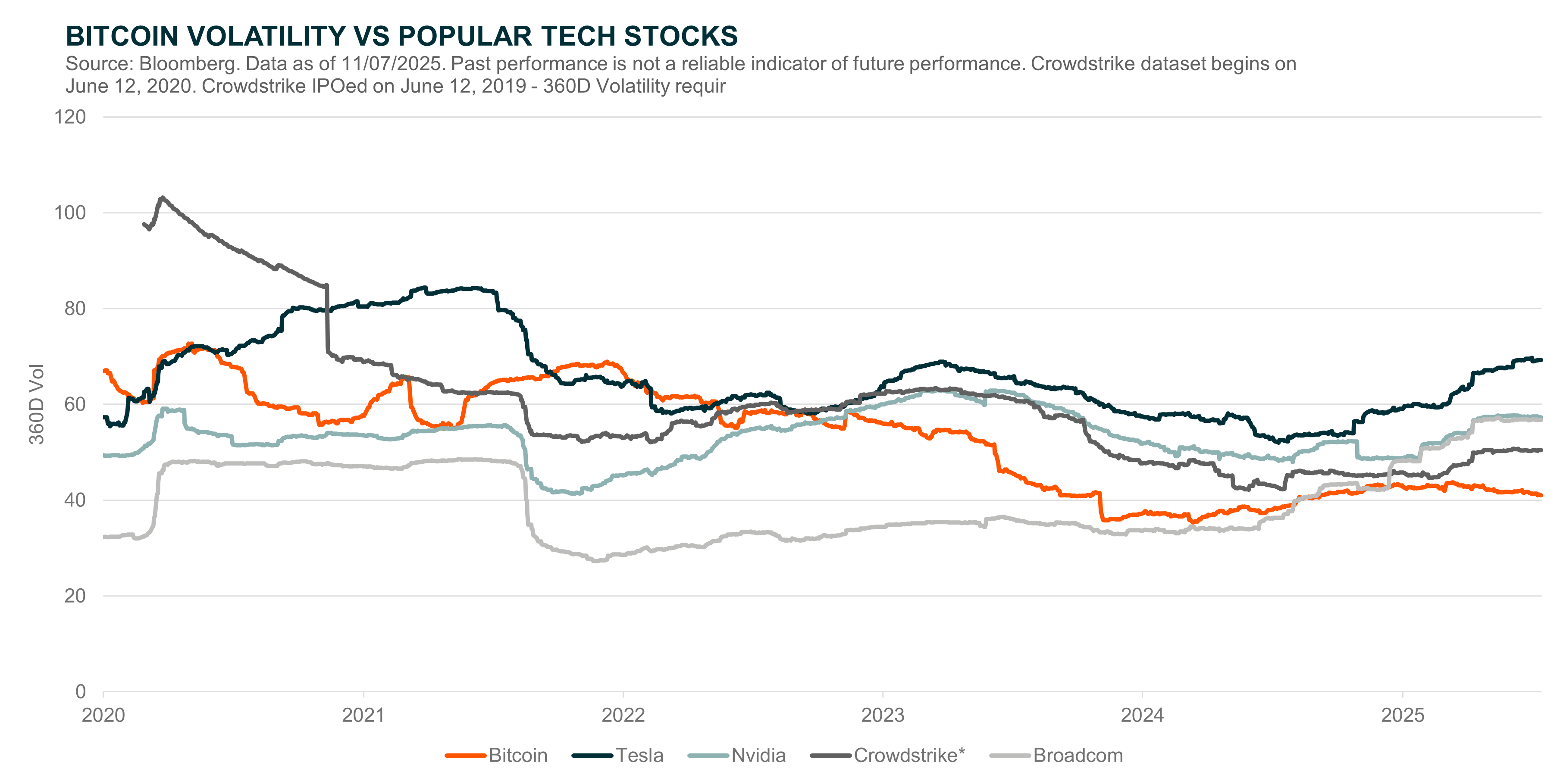

Admittedly, that figure remains elevated compared to broad equity benchmarks like the S&P 500, Nasdaq 100, or traditional safe havens such as gold. However, it is well within the bounds of what’s acceptable for risk-on portfolios. In fact, when compared to some of the market’s hottest tech exposures, like cybersecurity firm CrowdStrike or EV maker Tesla, Bitcoin might even look relatively subdued.

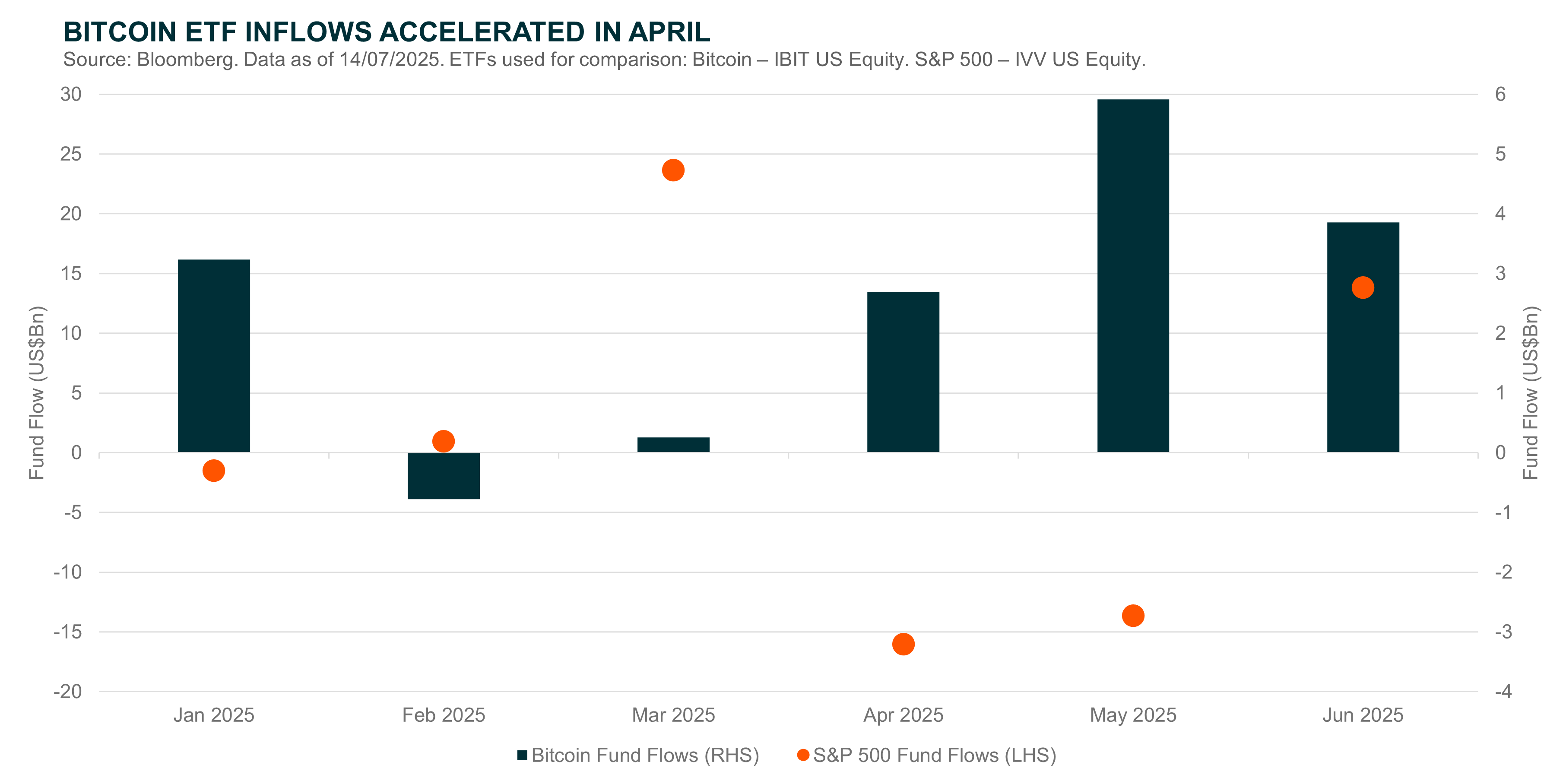

Looking ahead, the rapid growth of Bitcoin ETFs may accelerate the ongoing trend of declining volatility. Volatility typically falls as an asset’s market capitalisation and investor base expand – both of which are being driven by the influx of capital into these new investment vehicles. The largest US-listed Bitcoin ETF, for example, has already amassed an impressive US$75 billion in assets in under 380 trading days.2 For comparison, that’s a milestone that took the leading physical gold ETFs more than six years, or roughly 1,500 trading days, to reach.3

Improved regulatory clarity is also playing a key role in driving crypto adoption. In 2025, the US has made and continues to make significant progress on this front. Below are some of the most notable developments that could further cement crypto’s legitimacy as a mainstream financial asset:

- The GENIUS Act is a bipartisan US bill creating the first federal regulatory framework for payment stablecoins, with strict reserve, audit, and licensing requirements.4 It passed the Senate on June 17, 2025, and headed to the House in July.

- The STABLE Act is another bipartisan House bill that mandates federal-chartered issuers, one-to-one reserve backing in safe liquid assets, monthly disclosure, capital and liquidity requirements, redemption rules, and more.5 It passed the House Financial Services Committee on April 2, 2025, and awaits full House floor consideration.

- The CLARITY Act (Digital Asset Market Clarity Act of 2025) is a bipartisan House bill that clearly delineates responsibilities between the SEC and CFTC: it classifies digital assets and streamlines registration and disclosure for exchanges and intermediaries, including DeFi entities.6 It passed House committee markups and is set for a full House vote.

The combination of surging investor adoption and improved regulatory certainty is a powerful force – one that’s likely to further stabilise Bitcoin’s performance and cement its status as a portfolio mainstay.

Shock Resilience and Shifting Investor Views

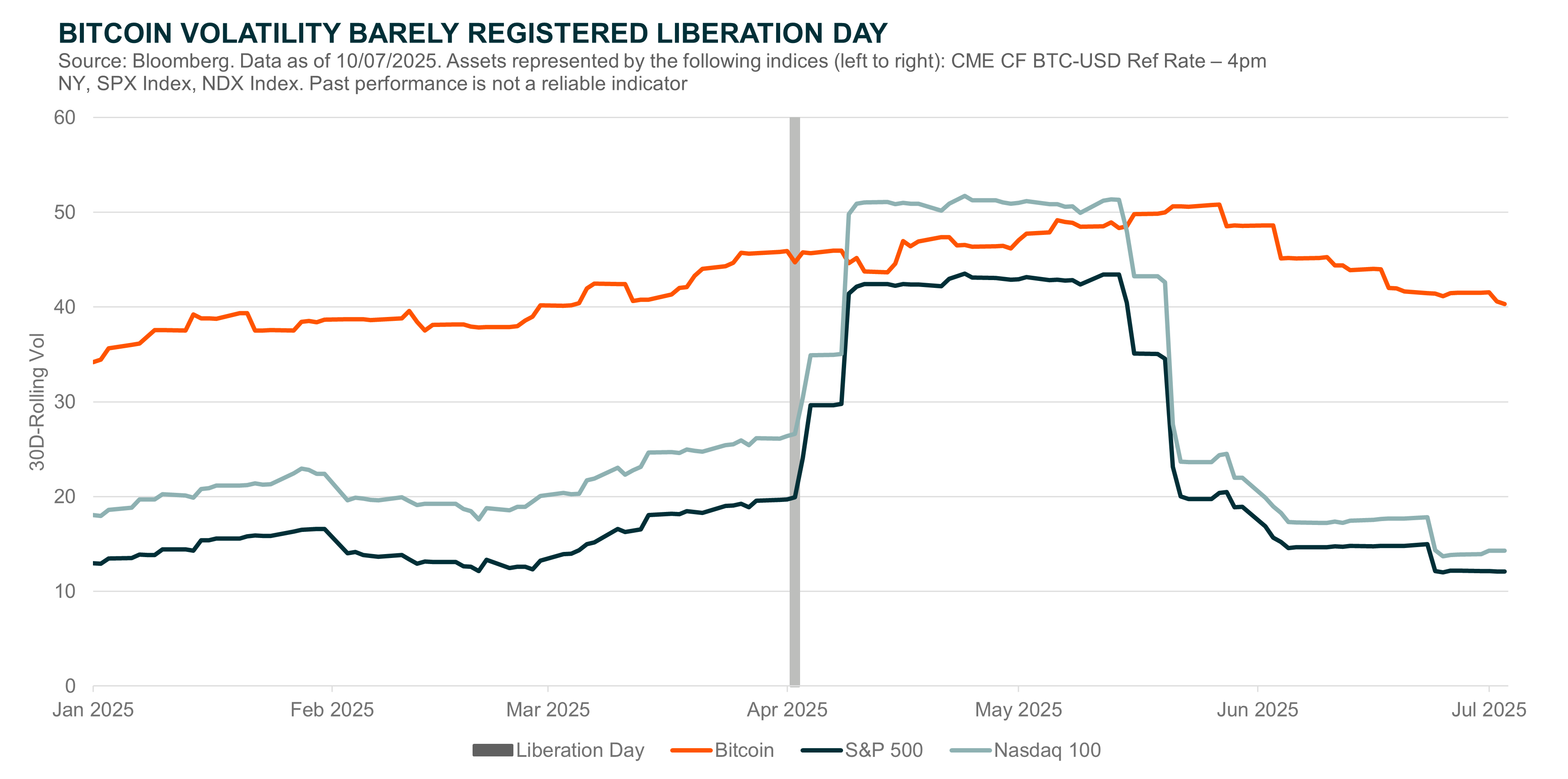

2025 is proving to be a defining year for Bitcoin. For the first time, investors are valuing it for its fundamental strengths, rather than blindly pricing it in line with broader risk-on assets. This shift in mindset is most evident in two areas – investor flows and volatility – with April 2nd’s “Liberation Day” serving as the key test.

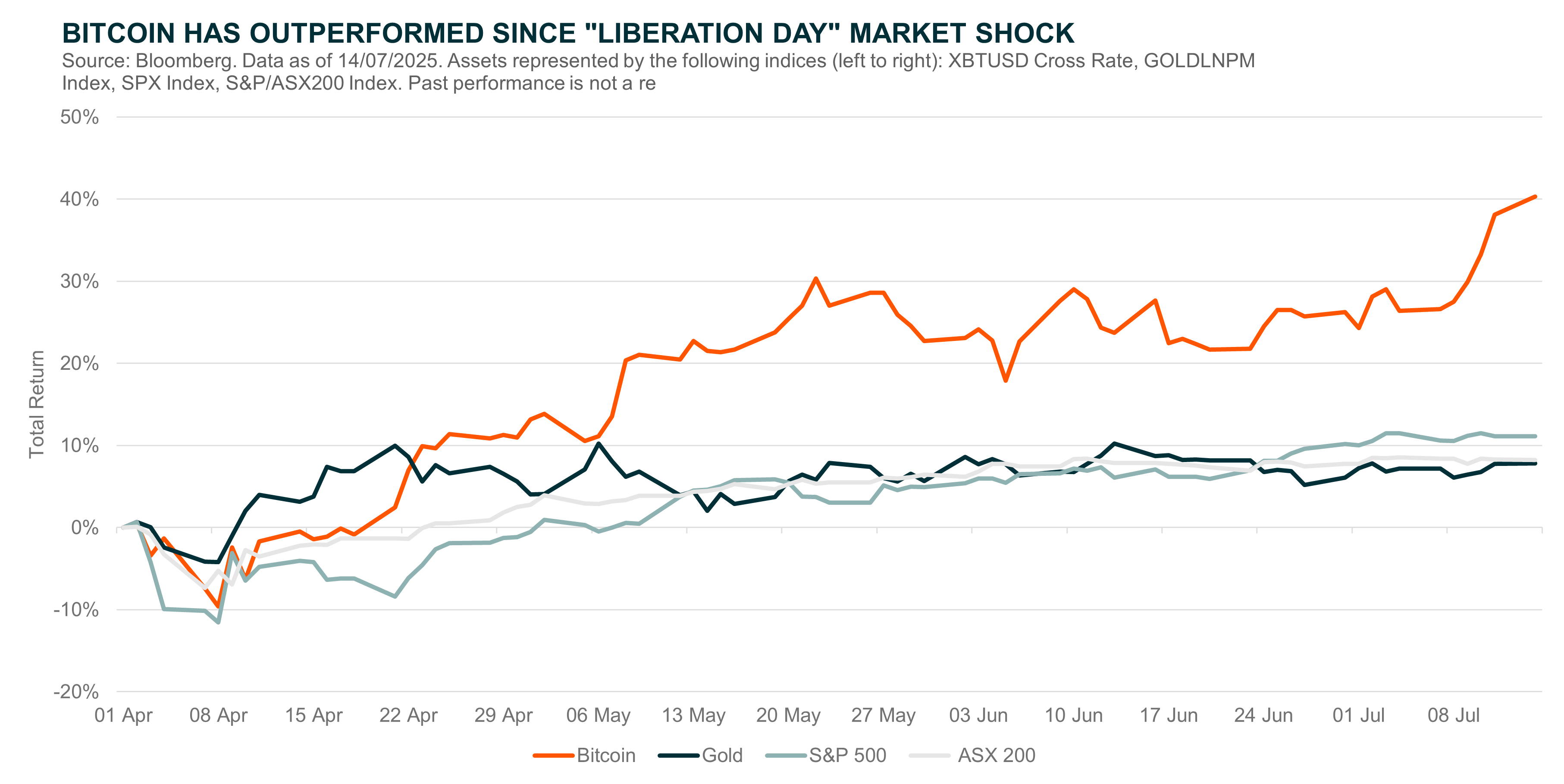

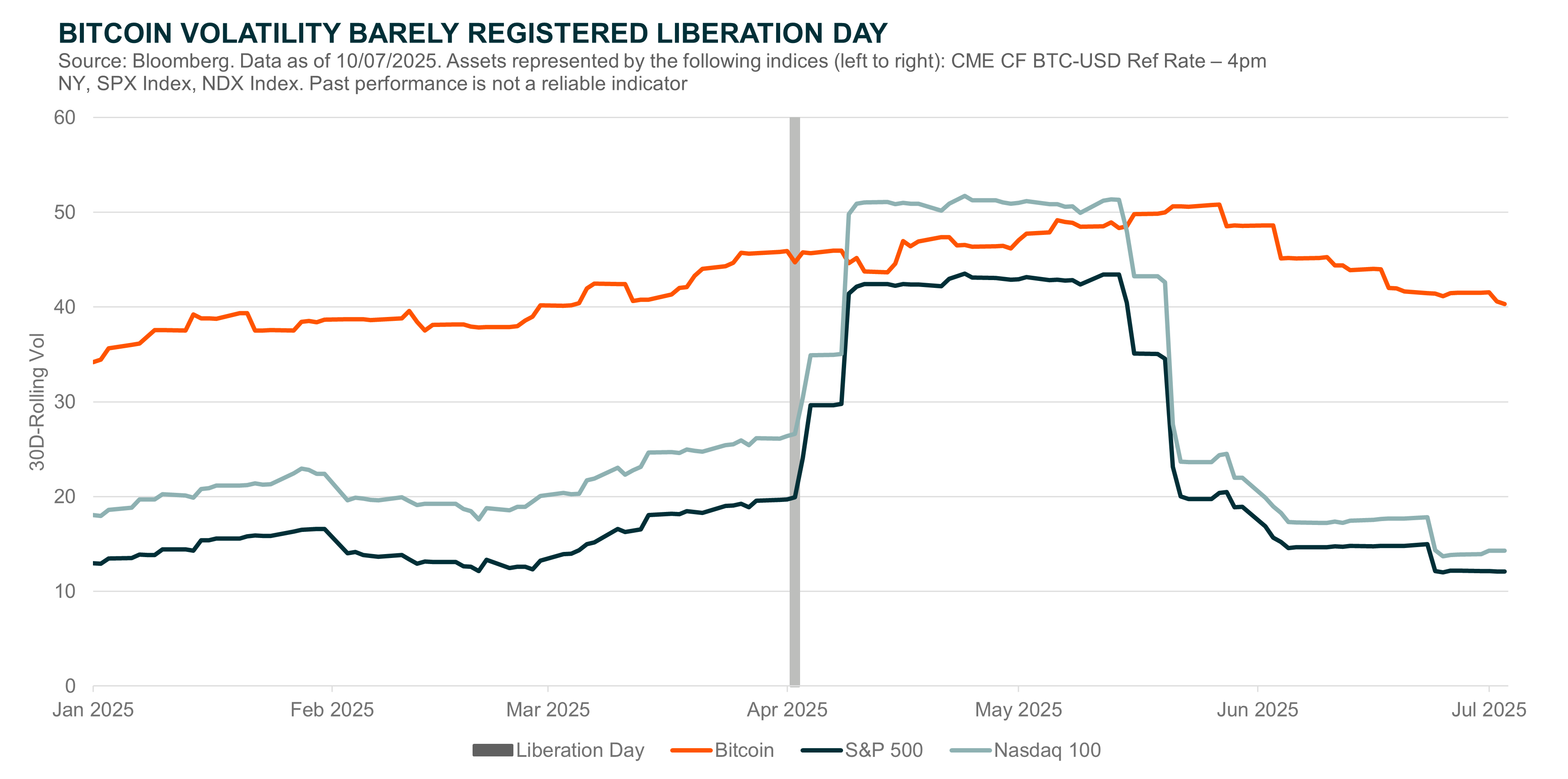

When President Trump stunned global markets with his “reciprocal” tariff rates on April 2nd, the immediate reaction was one of shock and fear. Equity indices plunged at the open, and volatility surged to levels not seen since 2022.7 Given Bitcoin’s historically high beta to risk-on equities, a similar spike in its volatility seemed likely. Instead, Bitcoin did the unexpected – it barely moved.

From a top-down perspective, the lack of reaction makes perfect sense. Bitcoin isn’t the product of any one nation, it’s unaffected by trade wars, and its value proposition has little to do with US earnings. But since when have crypto markets behaved rationally? Since when has Bitcoin traded on fundamentals? For long-time Bitcoin investors, the absence of a reaction may have been the most surprising reaction of all.

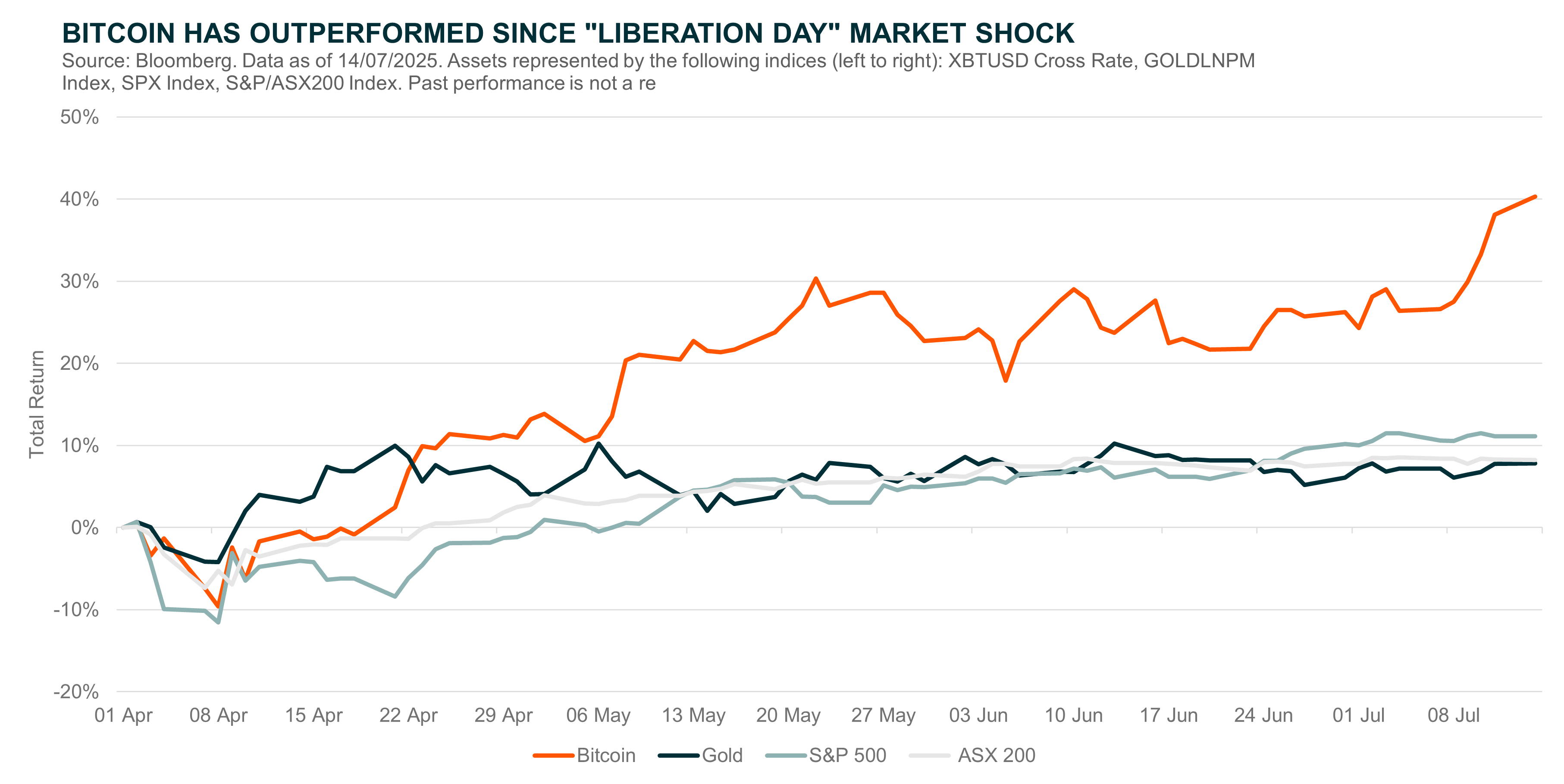

From a price perspective, market watchers will note that Bitcoin did eventually follow equities lower, declining by around 10% in the week after Trump’s shock announcement. However, we note that gold also experienced a drawdown of 4% over the same period.8 Is gold not a safe haven asset meant to appreciate in these times of uncertainty? Perhaps then, the real reason was more a matter of liquidity than fundamentals, with investors likely exiting positions indiscriminately amid growing fears of broader market instability. More notable is how strongly Bitcoin rebounded, a clear sign of strong investor confidence despite an increasingly murky economic outlook.

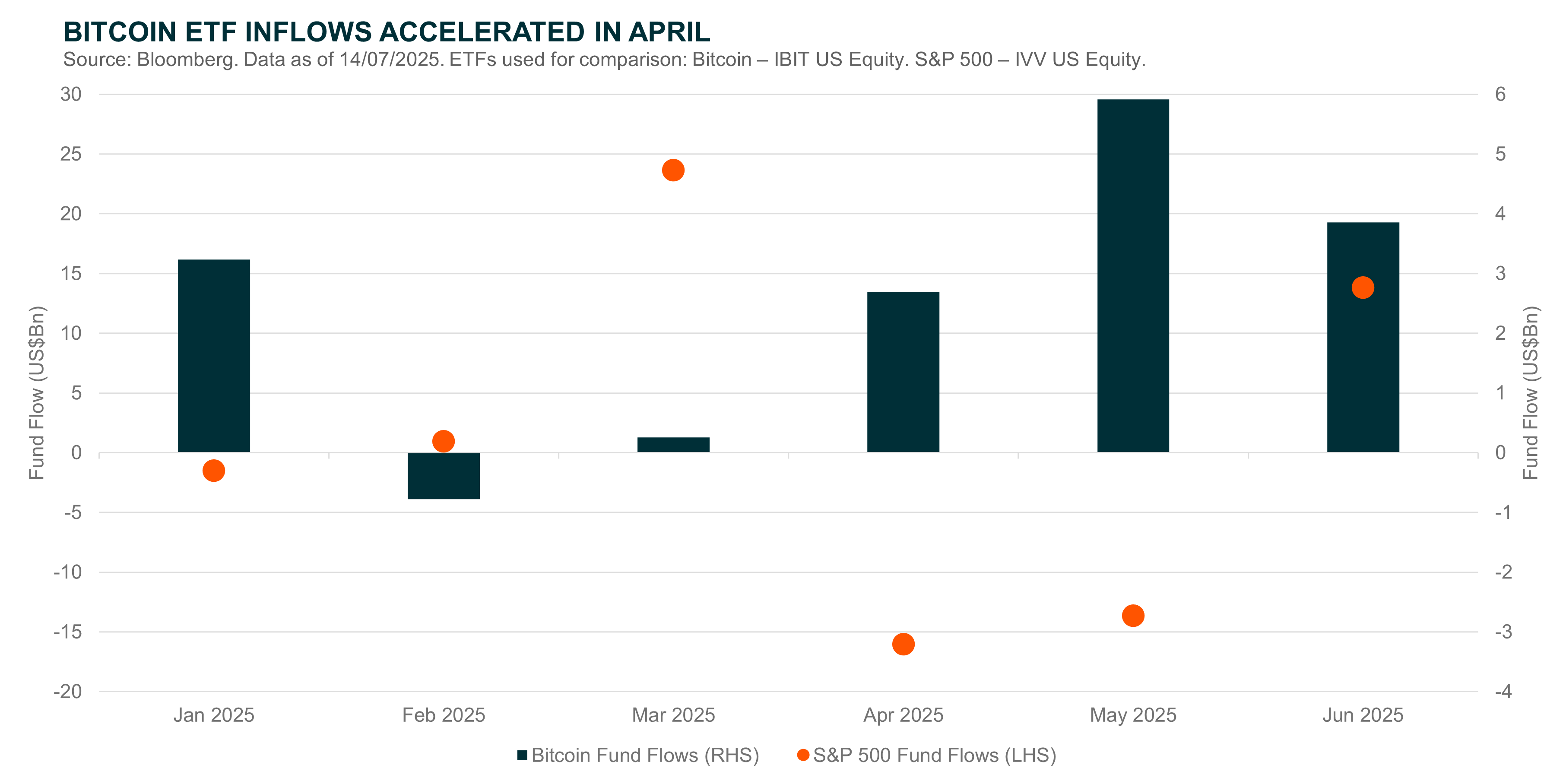

What about investor flows? While price performance tells part of the story, many would argue that fund flows are the truest gauge of investor conviction. To explore this, we compared the flows of the world’s largest fund manager’s Bitcoin ETF with their ETF tracking the S&P 500. What we found was a striking divergence. Although Bitcoin ETF flows were soft early in the year, they surged sharply following “Liberation Day” in April. Meanwhile, the S&P 500 ETF saw meaningful outflows across both April and May. To us, this is yet another sign that Bitcoin is increasingly being treated as a distinct asset from equities – one valued for its core fundamentals, including its non-sovereign nature and fixed, inflation-resistant supply.

Becoming a Unique Asset

What does all of this mean for Bitcoin going forward? We think the combination of a rapid rise of ETF adoption, improving regulatory clarity, and change in investor perception is steadily repositioning Bitcoin as a truly unique alternative asset. This view is supported not only by the evidence outlined throughout this piece, but also by the long-term decline in Bitcoin’s correlation with both equities and gold.

If Bitcoin continues to evolve into an asset that is detached from traditional markets (and gold) while still offering meaningful growth potential, it will present a value proposition that is both rare and compelling – especially when combined with its inflation resistance and politically neutral stance. For now, gold remains the ultimate benchmark for diversification with its tendency to rally in risk-off environments, and near-zero correlation to equities and bonds, but Bitcoin is making a strong case in 2025.