The Global X Russell 2000 ETF (RSSL) provides Australian investors with a unique opportunity to access US small cap equities through the Russell 2000 RIC Capped Index. Small cap companies represent a dynamic and agile segment of the market, often positioned to capitalise on emerging opportunities. These businesses are key drivers of economic growth, making RSSL a compelling addition to portfolios seeking both diversification and exposure to long-term growth opportunities.

While primarily designed for long-term diversification, RSSL also allows investors to capitalise on situations where small caps may offer relative value compared to large caps.1 This flexibility ensures that RSSL is a versatile tool for those seeking structural growth or strategic portfolio enhancements without being positioned as purely tactical.

Key Takeaways

- Broaden Portfolio Horizons: Access the dynamic growth potential of US small caps while diversifying away from Australia's concentrated large-cap equity market.2

- Aligned for Opportunity: Small caps often demonstrate resilience and adaptability during economic recoveries and periods of domestic growth.3

- Efficient and Balanced Exposure: RSSL provides access to companies in the Russell 2000 Index with disciplined risk management and sector diversification.

Broadening Your Investment Horizons

Small caps offer access to a dynamic and innovative segment of the market, particularly through the Russell 2000 Index. This index includes higher weightings in sectors such as Financials, Industrials, and Health Care, which are often underrepresented in large-cap indices like the S&P 500. By allocating to these sectors, investors can reduce their over-reliance on mega-cap technology stocks and achieve greater sector balance.

Small caps provide meaningful diversification benefits as they tend to move independently from large-cap and global equities. The Russell 2000 Index has historically had a weaker connection to broader global markets, meaning it can perform differently from large multinational companies. This makes small caps particularly valuable in a portfolio, offering exposure to domestic US growth while reducing reliance on major global market trends. For Australian investors, this diversification is even more relevant given the high concentration of financial and resource stocks in the local equity market.

When Small Caps Make Sense

Small cap equities have demonstrated resilience and strong performance during favourable economic conditions, such as periods of recovery or when domestic growth accelerates. The Russell 2000 Index, known for its representation of small cap performance, thrives in these environments, showcasing the adaptability and growth potential of its constituents.4

Contrary to perceptions of financial weakness, many Russell 2000 companies maintain balance sheets comparable to larger counterparts, dispelling concerns about their stability. This financial strength enables them to navigate economic challenges effectively while positioning for robust growth during recoveries.

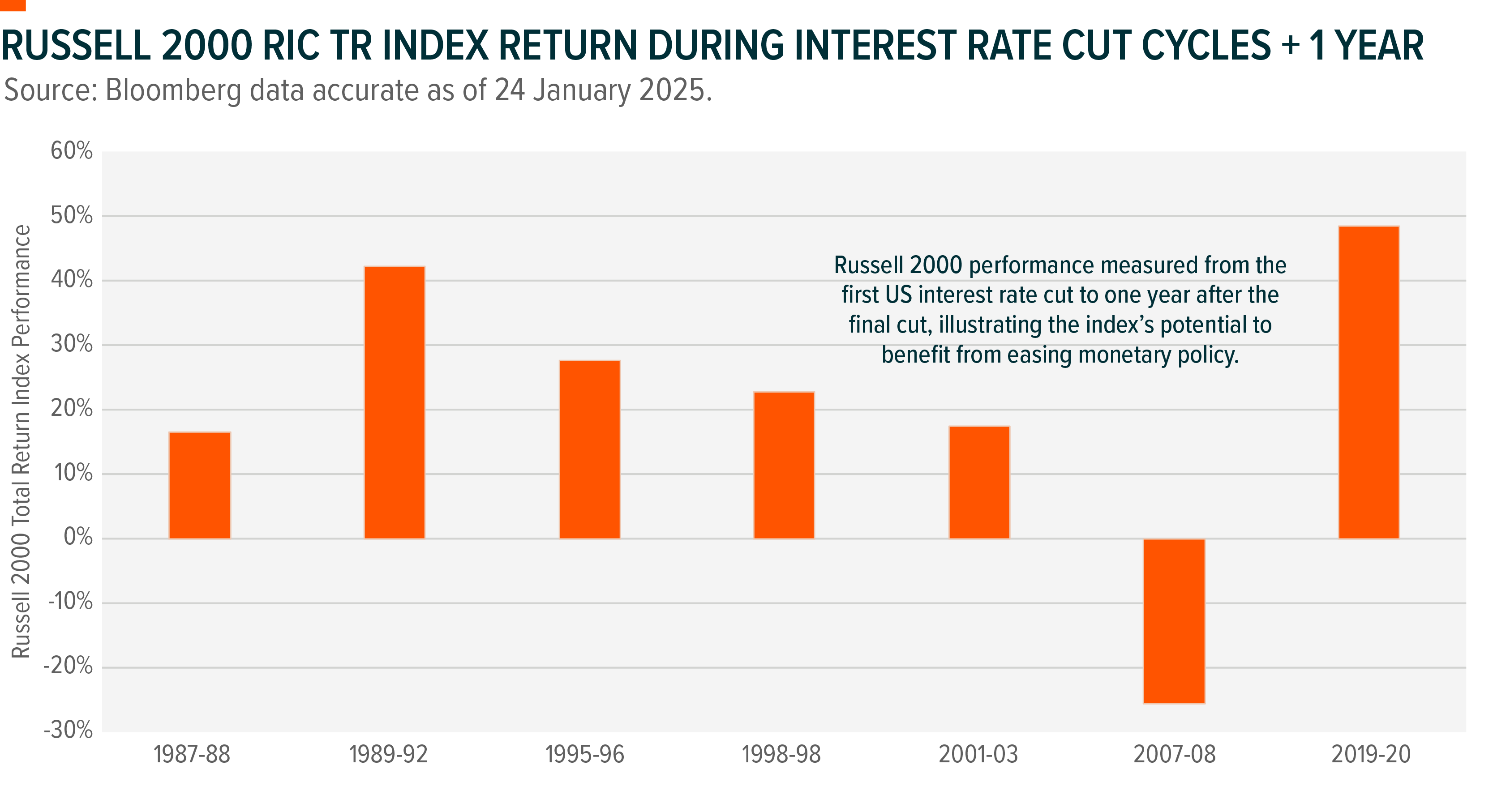

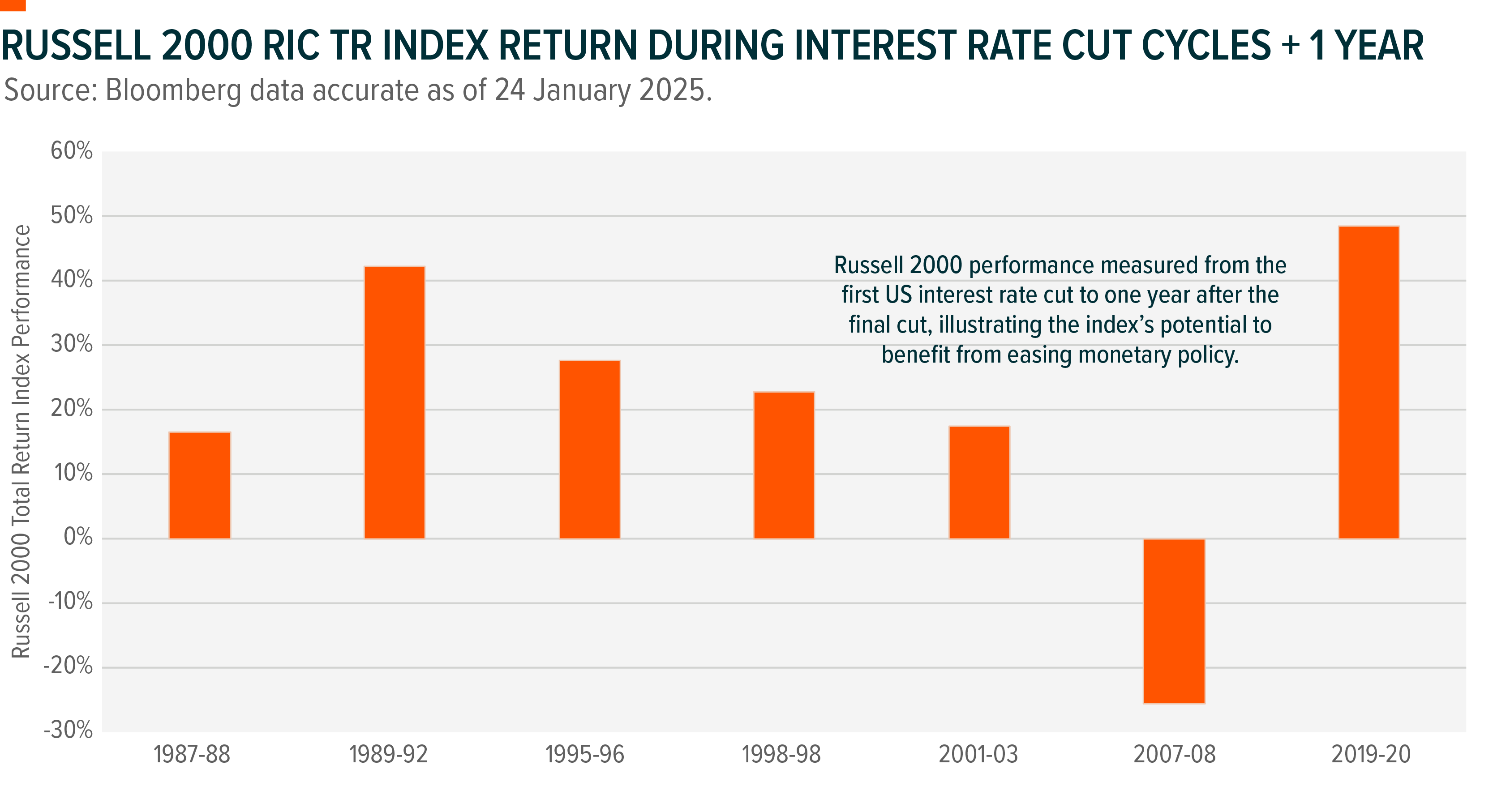

In addition, small caps often benefit from changes in monetary policy. During periods of monetary easing, lower interest rates reduce borrowing costs, potentially creating opportunities for reinvestment and innovation. This sensitivity to interest rate changes further enhances their appeal as a growth-oriented allocation in diverse market conditions.

Built for Balanced Small Cap Exposure

The Global X Russell 2000 ETF is designed to provide investors with efficient and balanced exposure to US small cap equities.

The RIC Capped Index methodology ensures no single stock exceeds 20% of the total index weight, maintaining balanced exposure and mitigating concentration risk. This disciplined approach ensures the fund remains aligned with the broader Russell 2000 Index while aiming to deliver consistent exposure aligned with the broader Russell 2000 Index.

Australian equity markets are heavily concentrated in financials and materials, limiting diversification opportunities. RSSL offers an avenue to access innovative and growth-oriented US companies across a broader range of sectors. This exposure complements existing domestic portfolios by reducing concentration risk and introducing industries not typically represented in Australian indices.

Conclusion

The Global X Russell 2000 ETF offers a compelling opportunity for Australian investors to diversify their portfolios with exposure to US small cap equities. Combining broader industry representation, competitive pricing, and alignment with favourable long-term economic trends, RSSL serves as a powerful tool for enhancing portfolio performance. By incorporating RSSL, investors can capture the innovative and growth potential of small caps while achieving greater diversification and long-term value.