The SEC's approval of Ethereum ETFs marks a significant development, opening new avenues for Ethereum similar to the transformative introduction of Bitcoin ETFs. This approval is crucial for widening Ethereum's exposure and integrating it into more diverse investment portfolios.

Key Takeaways

- Ethereum ETFs Expand Investment Opportunities: With the SEC's approval, Ethereum ETFs are set to launch in the US, expanding investment opportunities and enhancing market stability.

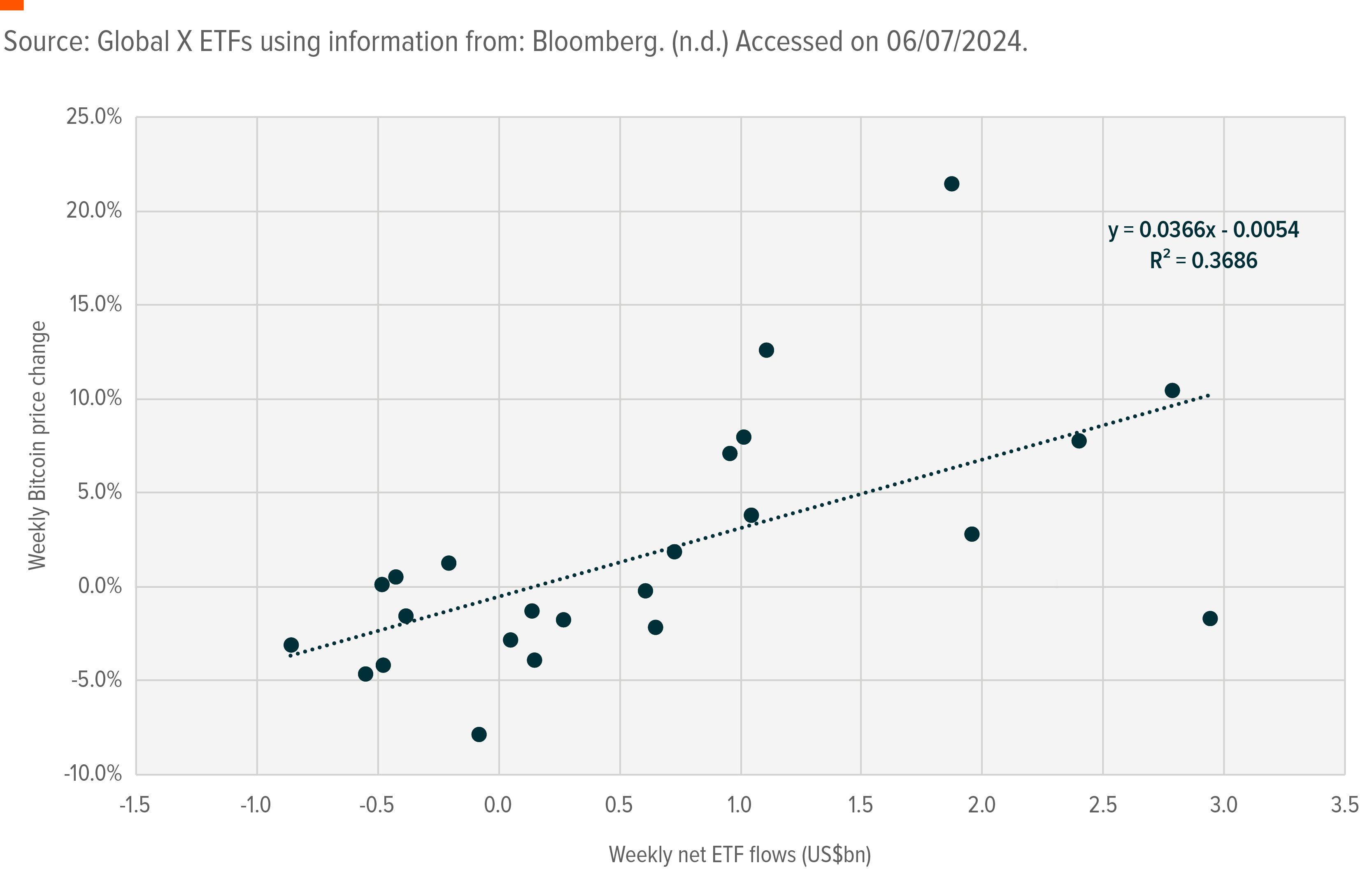

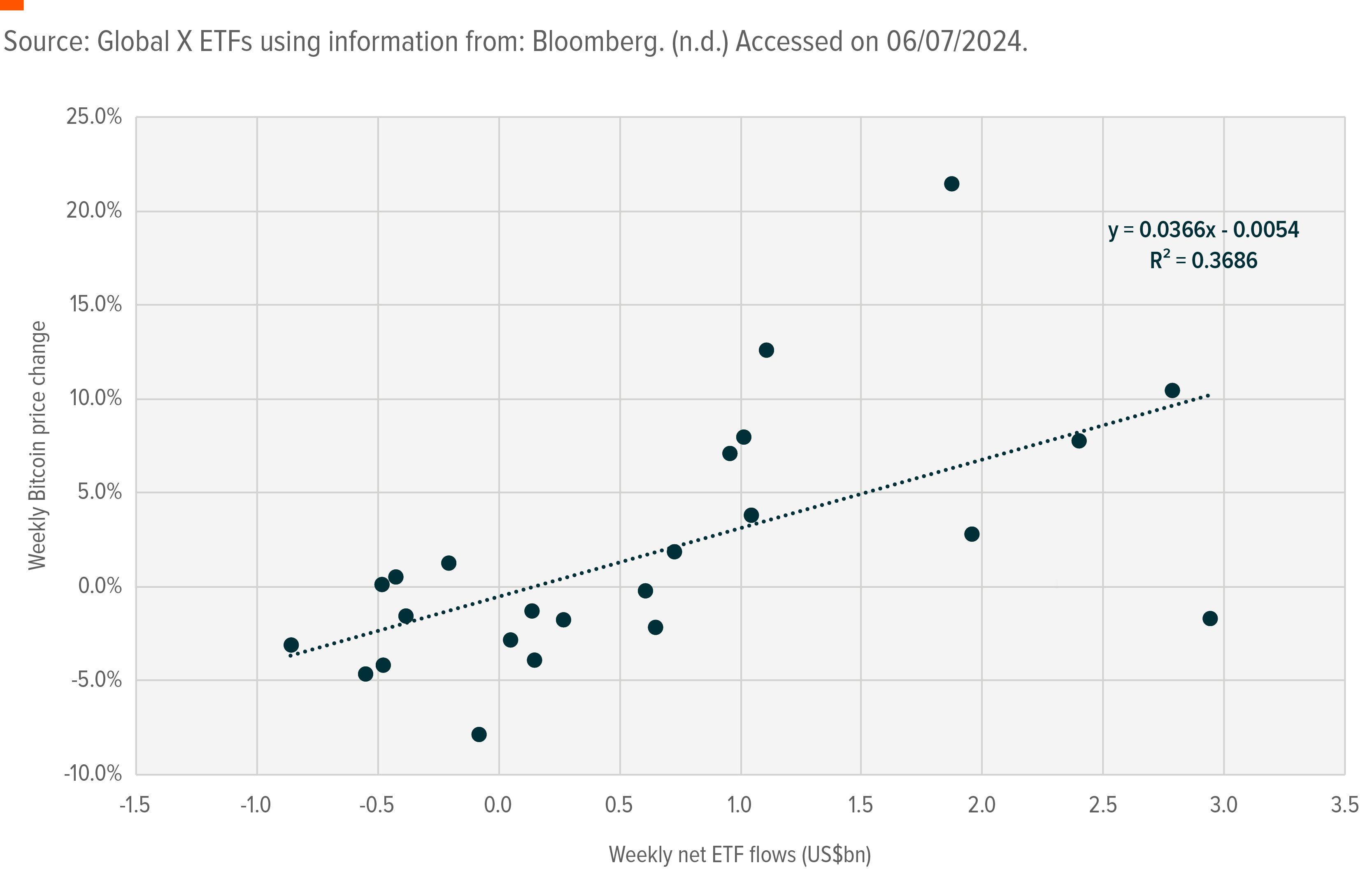

- Influence from Bitcoin ETFs: Capital inflows into Bitcoin ETFs have had a measurable impact on market prices since the SEC approved Bitcoin ETFs in the US. Our analysis shows roughly a 3.7% increase in Bitcoin's weekly price per US$1 billion in inflows.1

- Potential Market Impact on Ethereum: If Ethereum attracts comparable ETF inflows, its market could experience similar positive shifts, with an estimated price increase of around 19.8% based on projected inflows.2

Expanding Investment Horizons with Ethereum ETFs

Following the SEC's approval on May 23, 20243, Ethereum ETFs are positioned to attract substantial initial investment. These ETFs are expected to open new channels for investors, blending traditional investment frameworks with digital asset exposure, which may enhance market stability and attract new investments.

Lessons from Bitcoin's ETF Success

Our analysis of Bitcoin ETF inflows reveals a significant correlation between capital inflows and market price adjustments. Year to date Bitcoin ETF inflows totalled approximately US$16.4 billion4, with each billion dollars resulting in roughly a 3.7% price increase. This relationship highlights how structured financial products like ETFs can have a significant influence on cryptocurrency markets by creating demand and increasing liquidity.

Bitcoin ETFs in the US have Attracted over US$16bn of Net Inflows Since Start of This Year

Year to date, roughly 36% of Bitcoin’s price change can be explained by US Bitcoin ETF inflows

Projected Impact on Ethereum's Market

Given Ethereum's market cap is roughly 33% of Bitcoin's, if Ethereum attracts proportional ETF inflows similar to Bitcoin since the launch of US Bitcoin ETFs, it could see a comparable positive effect. Assuming the price impact Bitcoin experienced from US Bitcoin ETF launches, projected inflows of around US$5.4 billion (i.e., 33% of US Bitcoin ETF inflows year-to-date) could potentially lead to a 19.8% increase in Ethereum's price (derived by applying Bitcoin's observed price increase of 3.7% per US$1 billion inflows). This increase would be driven by rising demand, enhanced liquidity, and broader investor participation, potentially raising Ethereum's price to approximately US$3,716.

Ethereum Price Trend and Projected Increase Based on Anticipated ETF Inflows

A New Chapter for Ethereum Investors

The introduction of Ethereum ETFs represents more than just a new product offering; it is a potential catalyst for substantial growth and stabilisation within Ethereum's market. Drawing on the quantifiable impacts observed with Bitcoin ETFs, the Ethereum community is optimistic about the transformative potential of its own ETFs, ready to welcome a broader spectrum of investors to the fold.