While concerns around Big-tech valuations persist, the reality is that many of these stocks are more reasonably priced than they may appear. After a period of heightened valuations, the market has reset, offering investors an opportunity to reconsider these companies as more attractively valued. Despite some moderation in growth, many of these businesses remain well-positioned for potential long-term gains.

Key Takeaways

- Valuations Have Corrected: Many Big-tech companies are now trading below historical averages and even previous trough levels, making them more attractive for long-term investors.

- Growth Outlook Remains Solid: While growth has moderated, projections show many Big-tech names still outpacing the broader market, driven by innovation and strong earnings potential.

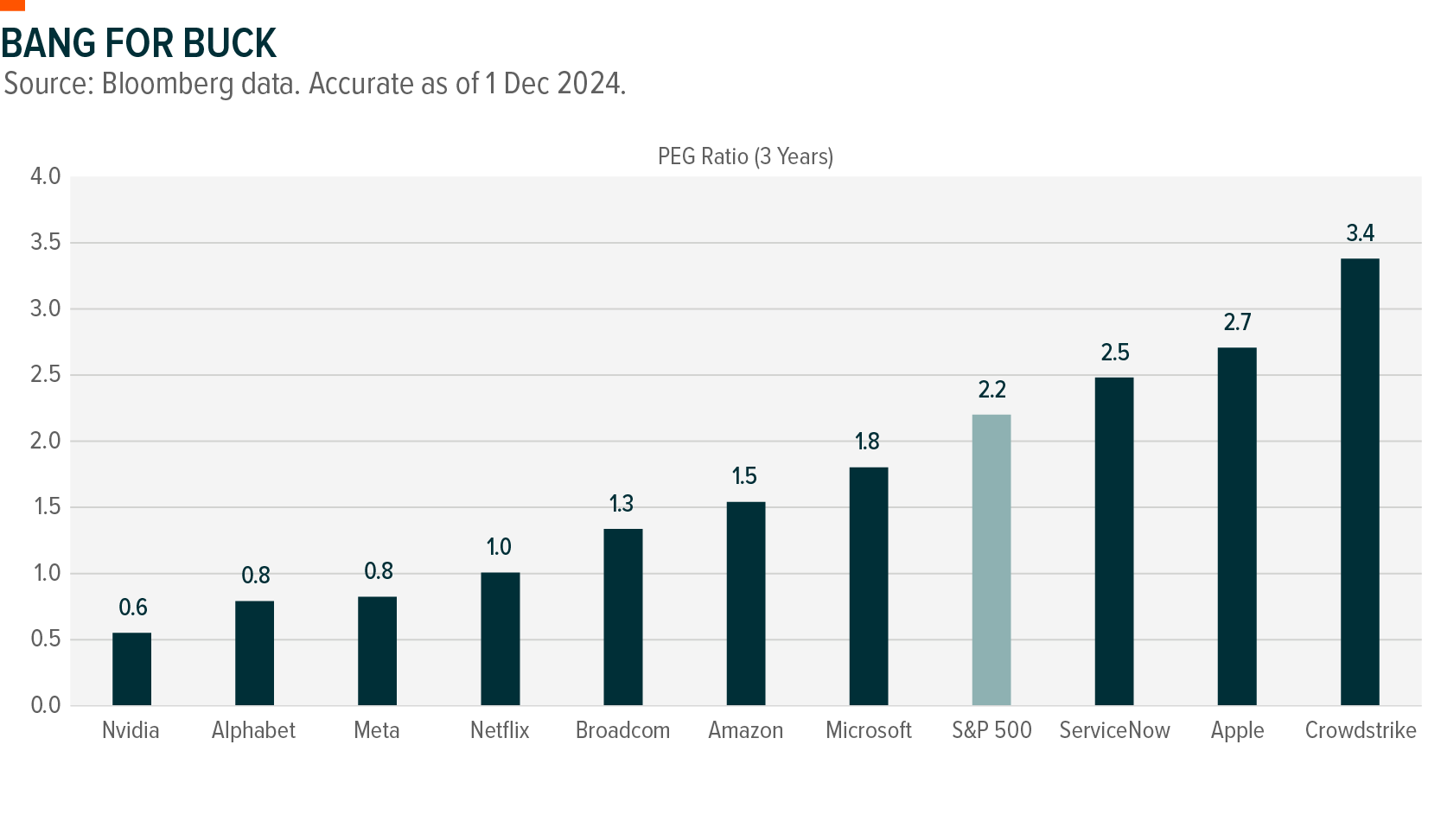

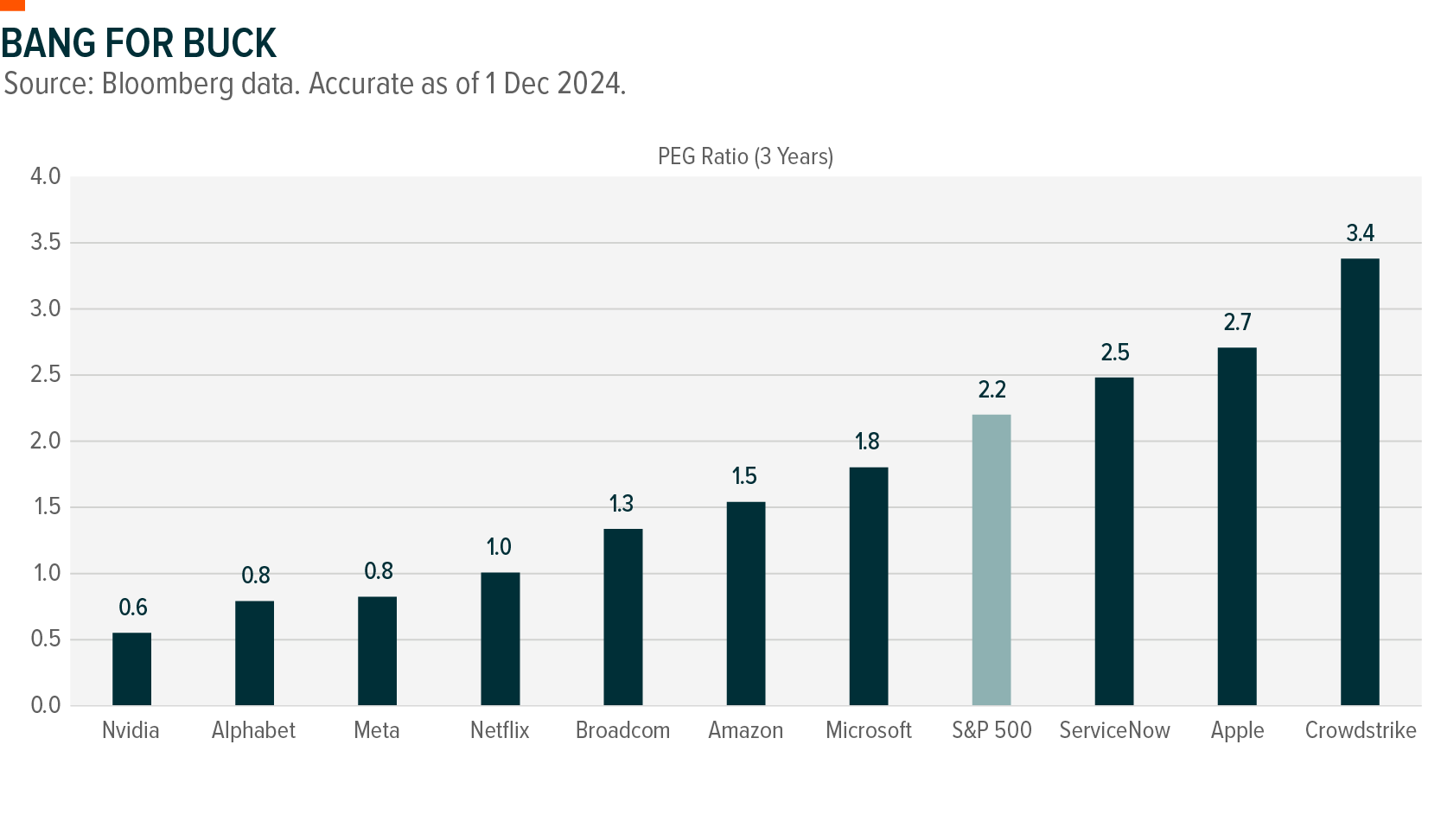

- Attractive Growth Premiums: With valuations normalising, Big-tech stocks are trading at more reasonable PEG (Price/Earnings to Growth) ratios, offering investors a better bang for their buck compared to the broader market.

Valuations Have Pulled Back

There's a common perception that Big-tech valuations are still too high, but this isn't necessarily the case. Over the past three years, many of these companies have seen significant valuation corrections, with several now trading below their historical averages. This is not limited to just a few stocks but applies broadly across the Big-tech sector. In fact, companies like Crowdstrike, ServiceNow, and Amazon are now trading below even their previous trough levels, reflecting a market reset.

With many of these companies now trading at more reasonable P/E ratios, investors have the opportunity to enter or re-enter these stocks at more balanced levels.

Is the Growth Story Still Intact?

While earnings growth for several Big-tech names has moderated in recent quarters, projections for the next few years remain solid. Most of the sector is expected to outpace the S&P 500's estimated 10% average earnings growth over the next three years. For example, companies like Netflix (32% growth), Nvidia (61%), and Meta (27%) are forecast to see impressive growth, positioning them well for strong earnings expansion2.

Even companies with more conservative growth estimates, such as Apple and Amazon, are still expected to perform above the broader market average. This suggests that the valuation pullback isn't solely due to declining growth expectations. In fact, it may be that some of these stocks are currently undervalued, presenting an opportunity for investors to gain exposure at more attractive levels.

The Value of Growth Premiums: PEG Ratio Insights

Valuation is ultimately about growth. For high-quality, high-growth companies, paying a premium is often necessary, but is that premium justified? The PEG (Price/Earnings to Growth) ratio is a useful tool to determine whether the growth justifies the price.

Many Big-tech companies are trading at more attractive valuations relative to their three-year average PEG ratios, especially when compared to the S&P 500. This suggests that investors may be getting better growth potential for their investment compared to broader market averages.

Conclusion: Big Tech Remains a Compelling Opportunity

While some growth moderation has been seen in Big-tech stocks, many companies are experiencing a normalisation of growth, with the potential for re-acceleration driven by product innovation, especially in AI.

It's important for investors to look past short-term fluctuations and focus on the long-term growth potential of these companies. While small- and mid-cap stocks (SMID) may see increased attention, Big-tech remains a strong segment for those seeking exposure to high-growth opportunities at more balanced valuations.