Electronic and autonomous vehicles (EV/AVs) highlight the Mobility theme’s potential, as they represent an entirely new class of everyday consumer goods and services that use artificial intelligence (AI) for their core functionality. The EV/AV revolution runs parallel to electrification via lithium-based batteries, a similarly influential component of Mobility. As disruption in the transportation sector takes hold, we expect the benefits of EVs, AVs, and lithium battery technologies to proliferate across the global economy.

Key Takeaways

- Consumer appetite for EVs is high. A recent survey revealed that 7 out of 10 U.S. drivers would be interested in buying when EV charging infrastructure expand, and EV costs drop.1

- Better lithium-ion technology will increase the amount of lithium used in each EV battery. Lithium demand is expected to more than double from 300,000 mt in 2020 to 1 million mt by 2025 and reach 2 million mt by 2030.2

- We expect the integration of robotics, AI, and internet of things (IoT) technologies to propel the Mobility theme and eventually the adoption of fully autonomous EVs.

Why AV and EVs Are Such Powerful Forces

Mobility is becoming cleaner, smarter, and more autonomous.

Using AI to compute billions of data points per second supplied from an array of sensors, cameras, and radar systems, AVs can effectively see the road and respond accordingly to changing conditions. By communicating with and integrating data from neighboring vehicles and even the roadways at large, AVs are expected to reduce accident rates, increase throughput and decrease travel time.

Fully autonomous vehicles remain years away, but it’s not too early to project the economic efficiencies they could bring. Trucking company Ryder estimates a fully autonomous truck and transfer hub network could reduce costs by 29–40%, decreasing empty trailer time while increasing flexibility.3 Such efficiency gains would revolutionize domestic supply chains, increasing the availability of lower-priced goods. Effective AV technology will also allow non-commercial drivers to reclaim hours each day spent commuting, which currently total 70 billion hours per year in the U.S.4 This found personal time represents a massive opportunity because it creates a distinct space for rest, relaxation, content consumption and productivity.

Regulation remains a key consideration for the development of autonomous vehicles. Recently, the U.S. National Highway Traffic Safety Administration (NHTSA) issued new rules for future fully autonomous vehicles, providing some regulatory clarity to AV OEMs. The new rules eliminate the requirement for driverless vehicles to include manual controls, such as pedals and steering wheels. This change could accelerate the path-to-market for AVs by bringing regulatory policy more in line with the AV development cycle, while ensuring safety standards.

EVs are nearing broad market adoption.

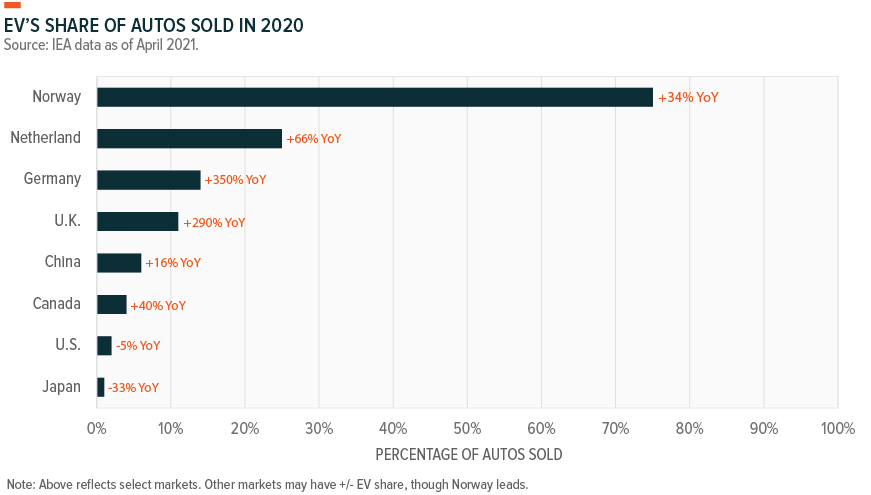

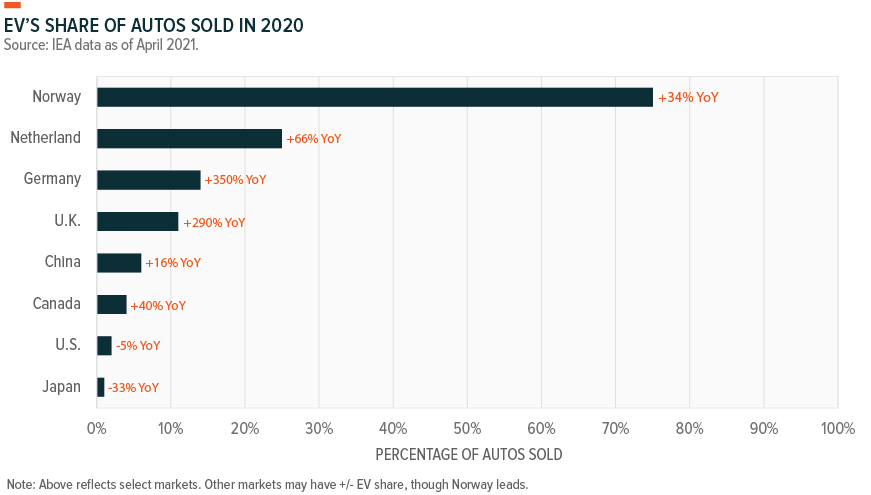

With over 1.8 million EVs registered in the U.S. as of the end of 2020, many Americans are already zooming around in emission-free vehicles.5 U.S. adoption of electric vehicles slowed in 2021 despite increasing in other regions of the globe. Given polls showing that 7 out of 10 U.S. drivers are interested in buying an EV should charging infrastructure proliferate and costs drop, we believe that a confluence of policy changes and technological advancement will spark higher adoption rates.6

Norway, the global leader in EV adoption, offers a roadmap. In 2020, 75% of cars sold in Norway were electric.7 The country plans to sell its last internal combustion engine (ICE) vehicle in 2025, a rapid transition sped up by aggressive policy changes. Polices include an exemption of EVs from a value added tax (VAT) and vehicle purchase taxes, which in some cases can lower the purchase cost by nearly 50% compared to an equivalent ICE vehicle. Another perk is EV access to bus lanes, which can shorten travel times.8 The World Economic Forum believes these polices closed the price gap between EVs and ICE vehicles in Norway.9

U.S. to ramp up investment in charging infrastructure.

The U.S. lags many European nations due in part to limited EV incentive structures. Forty-five states and D.C. offer some form of incentive, but the federal government hasn’t passed any new subsidies since 2009, and many popular EV models are no longer eligible.10 President Biden’s Build Back Better bill may be able to address this relative shortfall by restructuring incentive programs and offering expanded tax credits should vehicles meet a wider set of conditions. The bill’s passage remains uncertain, but it indicates that policy makers recognize that an enhanced incentive program is key to spur domestic EV adoption.

In the geographically expansive U.S., the build-out of charging infrastructure will take time. The number of public charging stations has more than tripled since 2015, but the U.S. has a long way to go. EV charging stations total roughly 48,400, with just 5,398 classed as DC Fast Chargers, compared to more than 150,000 gas stations.11,12 More DC Fast Chargers are essential, as less powerful options can take substantial time to recharge, increasing the perceived inconvenience of EVs. The USD $7.5 billion in grant funding for a national network of charging stations contained in the Infrastructure Investment and Jobs Act will not solve the charger shortage. However, it is the first federally lead investment in charging infrastructure, and it could portend the strategic direction of future funding.

Private investment is following suit with original equipment auto manufacturers and independent charging companies expanding their networks. Tesla and Electrify America, a subsidiary of Volkswagen, pledged to triple and double the size of their charging networks, respectively, over the next two years. Sizable private investment alongside public support will likely be able to address infrastructure shortfalls in the coming years.

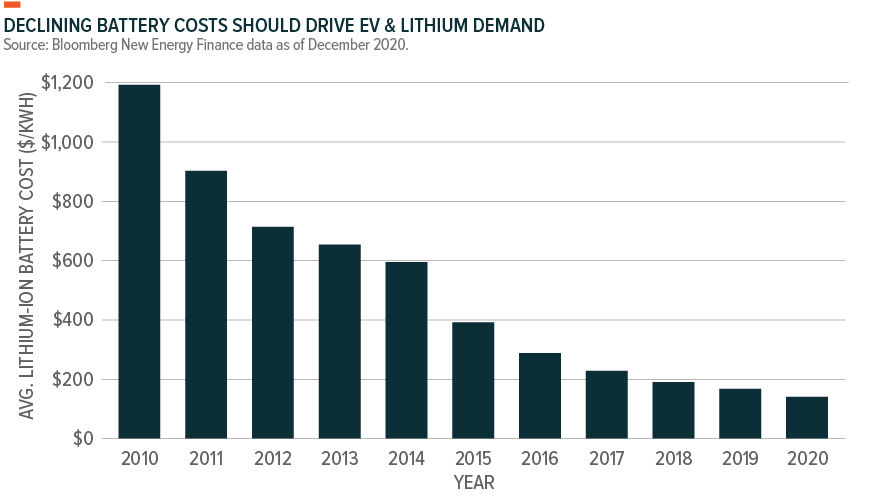

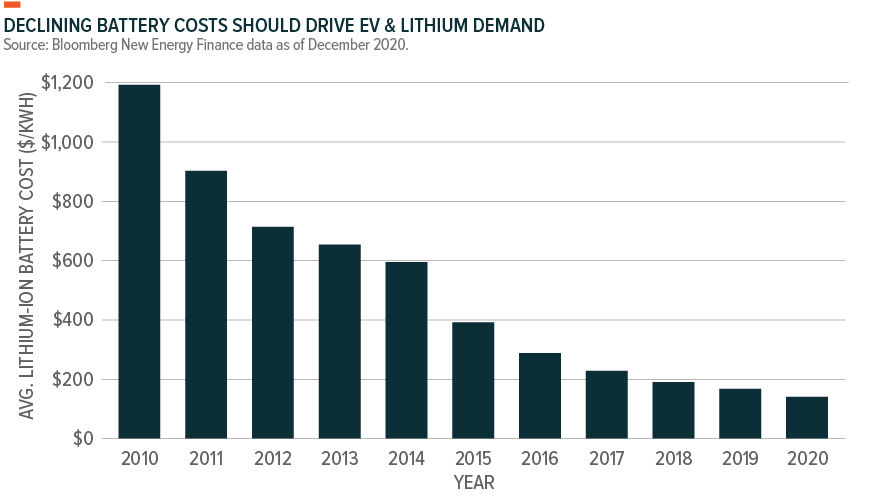

Another factor working against large-scale adoption of EVs thus far in the U.S. and elsewhere is their premium cost. Incentives such as tax breaks and rebates may help close this gap, based on the success of such programs in Europe and China. But even without subsidies, EVs are expected to be cheaper than ICE vehicles in only about five years as battery costs continue to fall.13

Cheaper batteries are expected to lower EV prices.

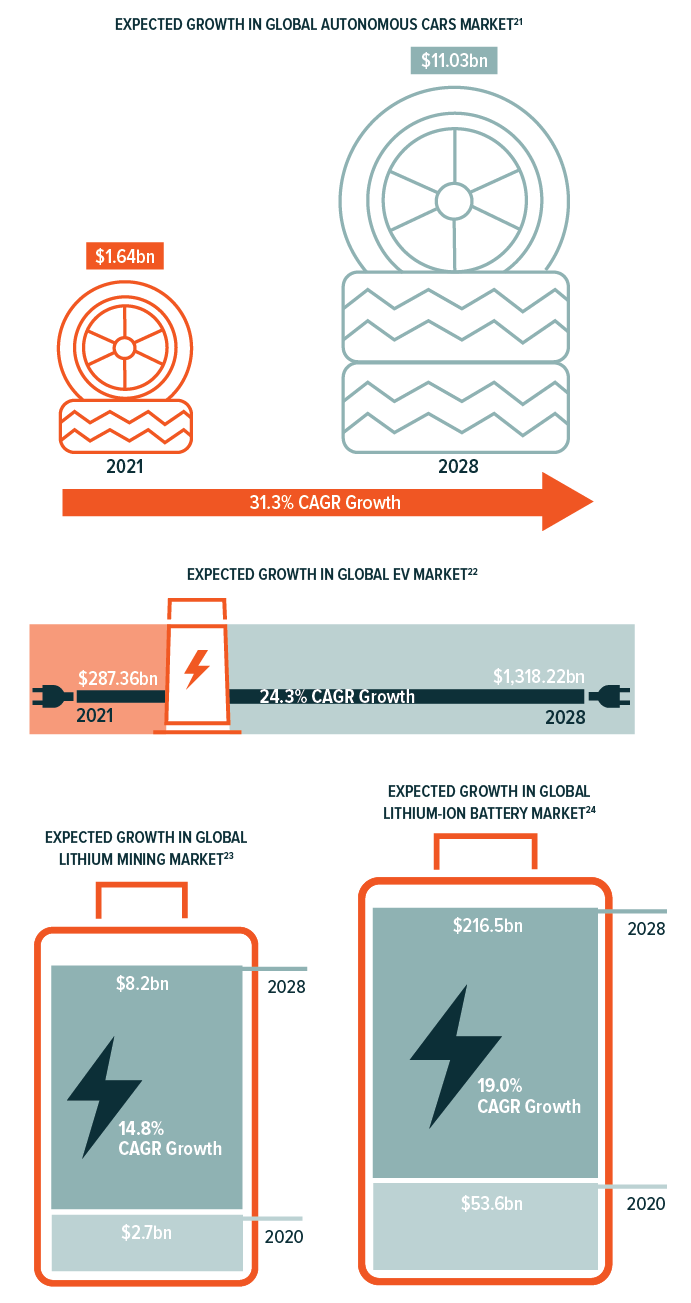

Global X Research estimates that battery costs could be cut in half by 2030.14 Worldwide, the lithium battery market is expected to grow by a factor of 5–10x over the next decade.15 As of this writing, supply restrictions and rising demand increased lithium prices by 225% in 2021.16 Lithium demand is expected to more than double from 300,000 mt in 2020 to 1 million mt by 2025, and then reach 2 million mt by 2030.17

At the core of each battery is lithium metal. As demand grows, EVs could use up to 75% of all newly mined lithium by 2025.18 As the 33rd most common element in the Earth’s crust, there is no shortage.19 But it takes time to bring additional supply online. Improvements to lithium-ion technology will increase per battery lithium utilization. Currently, most batteries use lithium in the cathode component, while next-generation batteries will likely place lithium in the anode as well.

Transitioning to a green energy economy will also require massive capacity of long-duration, grid-scale storage. Lithium-ion batteries are the most common battery storage option today, accounting for more than 90% of global grid battery storage.20 Lightweight and energy dense, lithium-ion batteries discharge quickly and can be assembled into modular and flexible energy storage systems.

The Hornsdale Power Reserve in Australia, the largest lithium-ion battery installation in the world when built, prevented a cascading blackout in 2017 when a large coal power plant fell offline. The storage system supplied several megawatts of power within milliseconds and supported the grid until another plant came online. This capability demonstrates the benefits of battery storage, even outside of a renewables context.

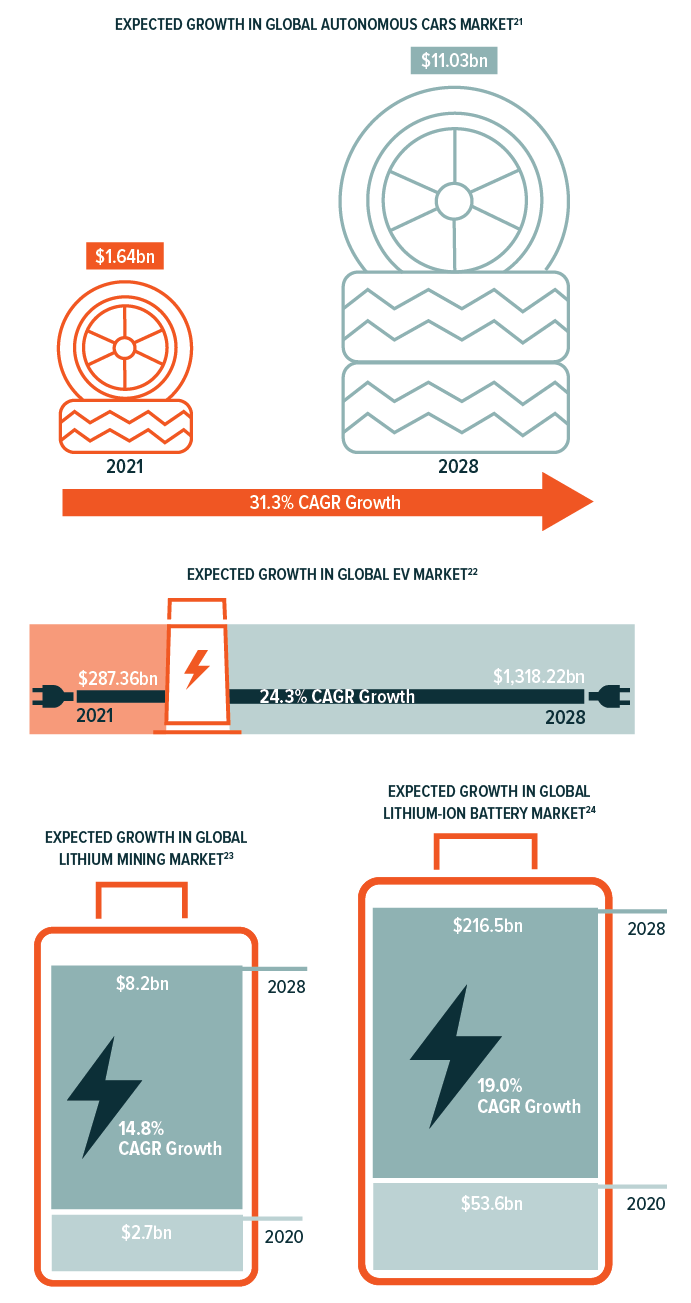

Visualizing the Market Opportunity

Risks to the Mobility Theme

Restrictive regulations could stunt adoption.

We believe the main risk to the adoption of fully autonomous vehicles is a mismatch between their technological advancement and consumer expectations. According to the National Highway Traffic Safety Administration (NHTSA), the highest level of autonomous systems currently available in the U.S. is Level 3, where the automated driving system can perform all aspects of driving under some conditions. However, a human driver must be ready to take back control at any time.25

Object detection and classification failures by autonomous systems have led to driver and pedestrian fatalities due to driver negligence. Such events are rare but well-publicized, and they can result in state governments restricting autonomous vehicle testing on their roads. For example, California banned a leading ride share company’s self-driving cars for nearly two years following a 2018 crash that resulted in the first documented death of a pedestrian.26

Environmental costs can be high.

EVs and battery technology represent green tech, but another risk to the Mobility theme is that they have their environmental problems, too. Extraction and processing of any raw material creates externalities, and lithium is no different. The two most common extraction methods source the metal from underground brine reservoirs or mined lithium containing rocks.

Both methods create carbon emissions while using water and land resources. On average, producing a ton of lithium from hard rock sources yields 9 tons of CO2, reducing emissions savings of end-use applications.27 Newer methods such as brine recovery limit emissions to a third of traditional methods, but they can cause other issues such as watershed contamination.28 With focus shifting to more holistic supply chains, these issues may grow in stature.

Connected vehicles create opportunities for cybercriminals.

Like other themes that rely on connectivity, cybersecurity is a risk for Mobility. In a now-famous story from 2015, Wired magazine worked with a hacker group to demonstrate the vulnerabilities in connected vehicles.29 Remotely accessing a Jeep while it was traveling 70 mph on a highway, the hackers cut engine power, engaged and then removed access to breaks, and changed radio and climate settings. This specific vulnerability was patched, but it illustrates the potential risks consumers face as vehicles become increasingly computerized and connected. To identify and mitigate similar risks, we expect cybersecurity investments from automobile OEMs to increase.

Thematic Intersection with Mobility

Robotics & AI

At the heart of modern-day vehicles is a digital brain powered by a specifically trained AI, the most advanced of which currently enables driver-assist features such as lane departure monitoring. Eventually, this technology could enable full self-driving capabilities. Improvements in these deep learning-based image recognition systems and EV-specific semiconductors could dramatically increase operations per second performance, boosting the speed and ability with which autos model the road environment. This software layer can be improved more rapidly than hardware, and it can be updated and enhanced after a car rolls off of the lot.

Internet of Things

The Internet of Things theme is central to autonomous driving systems, particularly the use of sensor technology. Aggregating real-time traffic data could allow vehicles to more accurately model the world, planning out routes to increase traffic flow and improve safety. Connected sensor-based EV charging stations could monitor the number of EVs in route for a recharge, reducing downtime by automatically scheduling charger maintenance when expected vehicle demand is low. Sensors could also help route incoming vehicles to ideal charging locations with current availability.

Mobility in a Portfolio Context

The Mobility theme is earlier on in its life cycle than others within our coverage. While adoption of electric vehicles is gaining steam, the theme remains in the Innovators phase, held back by today’s self-driving limitations. There are few pure-play EV/AV companies and even fewer are publicly traded. The space is dominated by a large pioneer, while more classical auto OEMs play catchup. Lithium and battery technology is slightly farther along, entering the Early Adopters phase as commercial uses grow and begin to scale. Over the coming years we expect both Mobility themes to progress further into the Early Adopters stage where growth accelerates while remaining at a low absolute level.

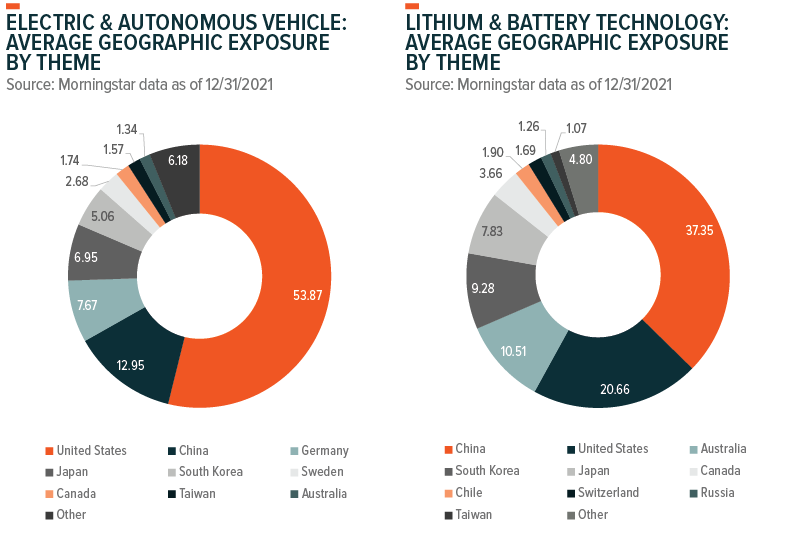

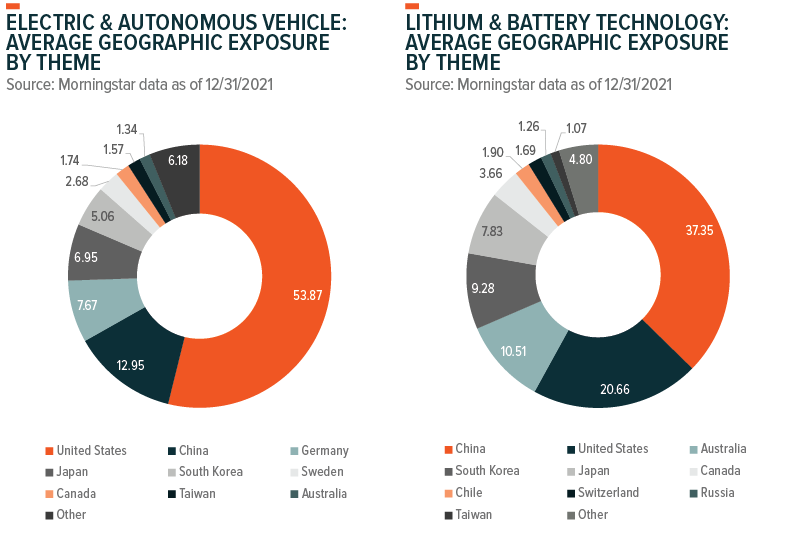

Mobility technologies are global and stand to benefit as thematic adoption rises across the world. The pie charts, on the next page, break down the geographic exposure of the largest Mobility thematic ETF products. We believe there is ample innovation occurring outside of the states, and that limiting exposure to the U.S. will exclude key players to the detriment of investors over the long term.

In our view, thematic equity should be targeted, using screens to ensure the underlying companies provide the desired exposure. This pure play focus minimizes overlap between themes while also differentiating the exposure provided by the theme relative to broad beta products. We conducted an overlap analysis between Mobility thematic ETFs, the S&P 500, MSCI ACWI and the most applicable S&P 500 sector ETFs for each exposure, XLY & XLK (Consumer Discretionary and Technology Select Sector SPDR Funds) for electric and autonomous vehicles, and XLB (Materials Select Sector SPDR Fund) for lithium and battery technology. We found that average overlap by weight for EV/AVs was 8.3% when compared to the S&P 500, 6.7% vs. the MSCI ACWI, 7.4% vs. XLY and 8.3% vs XLK. Much of this overlap stems from traditional vehicle OEMs and large technology companies innovating in the space. Lithium and battery technology scored lower across the board, 2.0% when compared to the S&P 500, 1.6% vs. the MSCI ACWI and 1.9% compared to XLB.30 These low levels of overlap with broad indexes reflect the benefits of thematic exposure, as sector indexes have yet to include substantial exposures towards Mobility themes.

Mobility innovation represents one of the most tangible areas of technological advancement for the average consumer. Battery costs are falling, while technology and performance are improving dramatically. Soon, EVs won’t be a luxury choice, but an economical one. Over the next decade, electrification and automation technologies may merge to forever alter nearly all forms of transportation. The ways we commute, travel and trade could receive an upgrade, powered by a new generation of lithium-based batteries and artificial intelligence. Electric vehicles are at the precipice of transforming the automobile market, and look to be an attractive investment opportunity for years to come.

References to dollars or “$” in this document shall mean United States dollars.