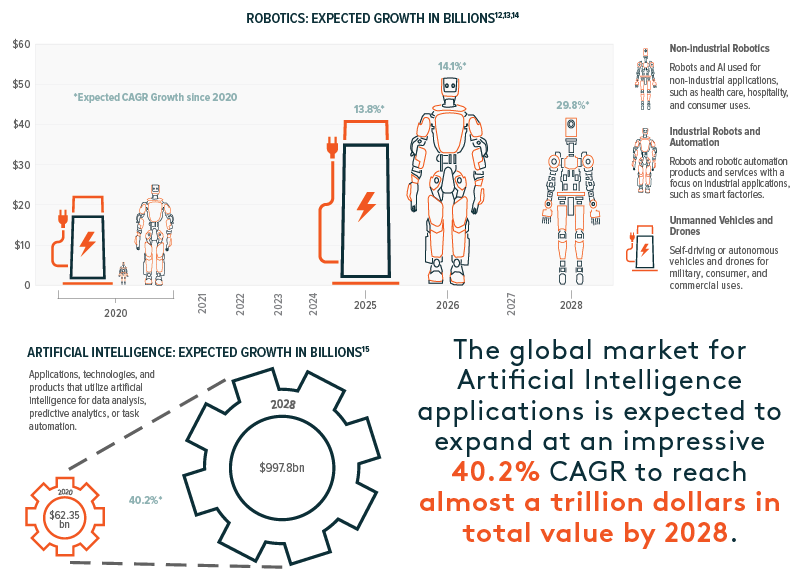

A constant throughout history is that humans continually look for ways to make work more efficient. With Robotics & AI themes creeping into everyday life, we believe automation is the next step in society’s technological evolution. The adoption of robotic and AI tools combined with internet of things (IoT)-based sensors and massive scale cloud computing is sparking the Fourth Industrial Revolution (Industry 4.0), which we expect to increase the efficiency and effectiveness of factory-based production.

Key Takeaways

- Robotics solutions look increasingly appealing as their costs fall while wages rise, populations age, and supply chain pressures persist, the result of which is likely a reshoring of manufacturing.

- By leveraging internet of things and cloud computing technologies, automated production systems can gain in efficiency, capability, and performance.

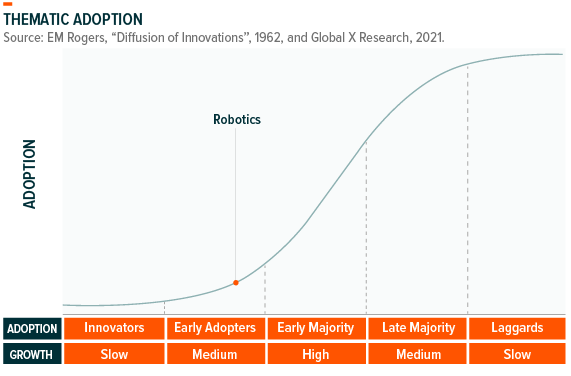

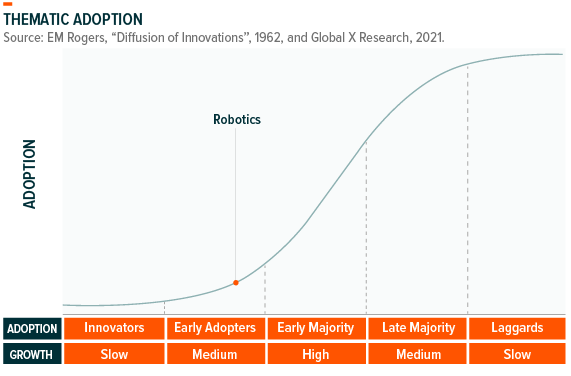

- The Robotics & AI theme is experiencing accelerating adoption, indicating entrance into the Early Majority stage, and signaling an attractive opportunity for portfolio positioning.

Why Robotics & AI is Such a Powerful Force

Robotics and AI are the engines behind an impending Fourth Industrial Revolution.

Like previous revolutions, the integration of new technologies could define Industry 4.0, key among them robotics and the internet of things. Together, these technologies are expected to create interconnected manufacturing systems that communicate, analyze, and use data to create positive feedback loops, adapt to changing needs, and increase productivity.

The pinnacle of effective robotic and networking integration is the smart factory — a completely automated production facility that uses data from connected devices to learn and adapt. With this predictive flexibility, smart factories may reduce downtime by auto-scheduling repairs and maintenance when input levels are low or finished product levels are high.

This next-generation production comes as trade wars, supply shocks, and a pandemic reminded the global economy of the fragility and interconnectivity of manufacturing networks. Globalisation peaked around 2008, and since then countries have rethought their international trade dependence, reducing the global value of exported goods relative to GDP.1 COVID-19 only expedited the deglobalisation trend. In a 2020 Thomas Industrial survey of 746 manufacturing and industrial companies, 69% of respondents said that they were looking to bring production back to America, and 55% said that they were likely to invest in automation.2

Robot economics are becoming more cost-effective.

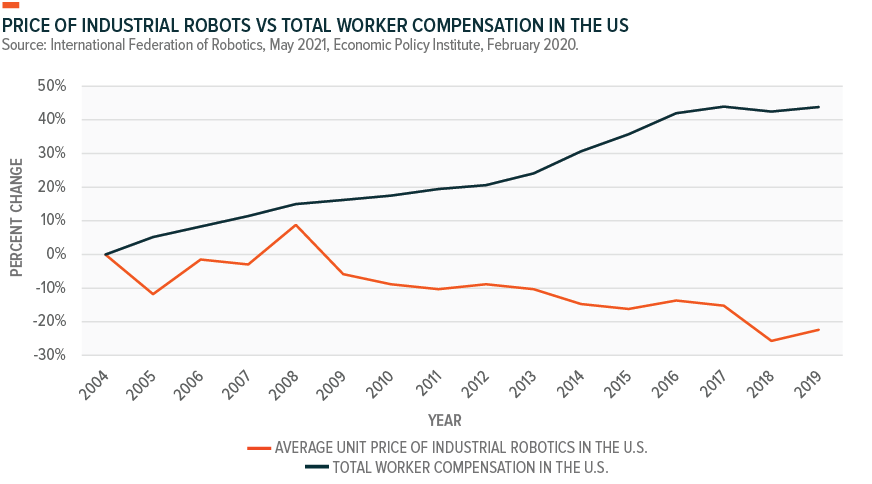

As manufacturers eye domestic production, the significant cost differential between human and robotic labour grows in stature. Higher wages for humans make automated labour more attractive as firms look for ways to maintain price competitiveness. The average yearly U.S. manufacturing wage neared USD $50,400 in September 2021, up from USD $46,600 at the beginning of 2020.3 So, for example, despite an estimated upfront cost of USD $250,000 for a sophisticated industrial robotic arm, a company could potentially break even in less than two years compared to what traditional labour costs.4

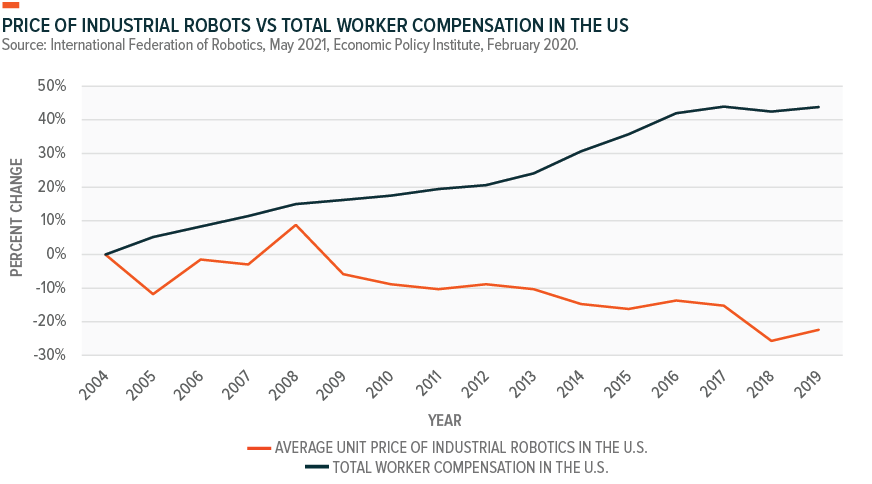

These economics are likely to become more attractive as robotics improve in function and affordability. The average robot price has fallen by more than 50% in real terms over the last 30 years, while labour costs have increased by more than 100%.5 These cheaper robots are significantly more advanced than older versions. Along with higher dexterity, advanced 3D vision capabilities and swappable end-of-arm tooling create more dynamic robots that are able to perform multiple functions with the capability to improve with software updates.

Robotics can improve human productivity.

Collaborative robots, also known as cobots, work alongside humans, taking on repetitive tasks that are prime sources of boredom and injury. This combination approach plays to the strengths of both labour sources because it decreases the error rate while increasing production efficiency.6

An increasingly automated future may be necessary given the world’s rapidly aging workforce. The World Health Organisation (WHO) predicts that between 2015 and 2030 the proportion of the global population aged over 60 will nearly double from 12% to 22%.7 Domestically, 65+ age bracket comprises an even larger percentage of the population at 16.3% as of the 2020 census, and it’s expected to grow to 20%+ by 2030, surpassing the under 18 age group.8,9

This trend is positive overall because it suggests that people are living longer and healthier lives due to advancements in healthcare. However, with age comes metabolic and cellular decline that can compromise physical and mental capacity, which the workplace can expose. This lower productivity at the individual worker level translates into lower GDP growth nationally. A 10% increase in the fraction of the population aged 60+ decreases the growth rate of GDP per capita by 5.5%.10 Robotics adoption can help offset these declines. A 1-unit increase in robotic density, or the number of robots per 10,000 manufacturing workers, increases labour productivity by 0.04% while potentially freeing up labour for use elsewhere in the economy.11

Risks to the Robotics & AI Theme

A China slowdown could have an outsized impact.

China is the largest and fastest-growing global market for robotics, having installed more industrial robots than the next four countries combined.16 In Q1 2020, when Chinese factories were shuddered due to COVID-19, industrial robotic sales there fell by 20% year-over-year, and international suppliers felt the decline.17 Then, as the rest of the world shut down and China returned to life, it installed more industrial robotics than the next 15 largest markets combined.18 This surge resulted in the five largest industrial robotics suppliers by revenue deriving roughly 20% of their income on average from Chinese purchases during 2020.19

Regulatory risks could dampen U.S. adoption.

The U.S. could catch up to China as reshoring of manufacturing continues. However, a risk to large increases in domestic robot density is that it can result in public backlash. We see the potential for robotics adoption to rise alongside income inequality, and we see the potential for policy makers to respond by enacting new taxes and regulations. So-called robot taxes would serve two purposes: To disincentivise firms from replacing workers with robots and to supplement lost payroll tax revenue. By design, these policies would be destructive for the Robotics & AI theme. While not a near-term issue, if such policies were to have any chance of passing in the future, the stock price reaction would likely be dramatic.

Manufacturing is particularly exposed to cyber threats.

Like any technology, robotics manufacturers can be hijacked by malicious actors, whether cybercriminals, competing companies, or foreign states. Verizon data shows that the manufacturing industry had the third-highest level of large-scale data breaches in 2020, with system intrusions due to hacking and malware especially common.20 Unauthorised access is a particular concern because most robotic systems are designed to interact with and manipulate objects in the real world.

However, cybersecurity programs remain underfunded. Manufacturers typically operate on thin margins, leaving cybersecurity a lower priority than capex spending that can increase productivity or output. According to information technology solutions company CDW, just 22% of manufacturing firms who experienced an attack in recent years increased their cybersecurity budgets, while about half did nothing at all.21 As production continues to automate, securing connected devices will require additional investment.

Thematic Intersection with Robotics & AI

Internet of Things and Cloud Computing.

The Robotics & AI, IoT, and Cloud Computing themes fit together perfectly. The IoT theme likely represents the biggest integration opportunity because IoT sensors are core to Industry 4.0 and smart factory trends. As sensor costs continue to fall, the accuracy and availability of data captured from robotic systems may increase. These developments should create a positive feedback loop spurring robotic purchases as updated sensor packages increase the effectiveness of machines young and old.

Cheaper processing power due to further maturation of the Cloud Computing theme allows AI tools to make quicker and more accurate judgements from sensor data. We expect such insights to drive efficiency gains, and increased factory performance could promote expansion via further robotics spending.

Cybersecurity

The downside of all this connectivity is that manufacturers are regular targets for digital intrusions. We expect their responses to this growing threat to improve significantly due to the increasing cost of malicious activity and the growing integration of technology in production. To this end, increased spending on robotics necessitates increased spending on cybersecurity initiatives. Co-positioning with the Cybersecurity theme may help to lessen cybersecurity risks from the roboticised manufacturing space.

Robotics & AI in a Portfolio Context

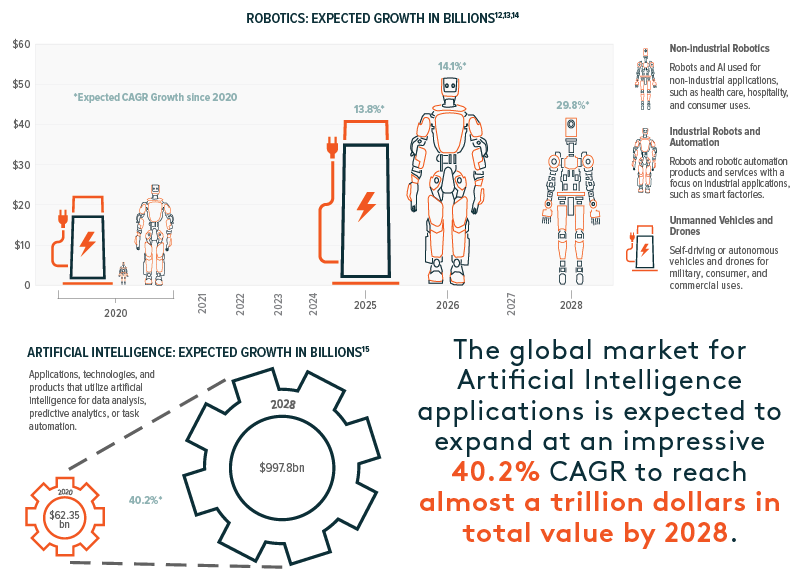

The Robotics & AI theme is quietly humming along, integrating itself into the global economy. Falling squarely into the Early Adopters phase, robotic penetration levels are moderate today, but are accelerating quickly, as technological advancements enable Robotics & AI to play increasingly impactful roles. We believe that adoption levels are set to expand rapidly in the coming years, as firms and individuals leverage robot and AI tech in new and exciting ways.

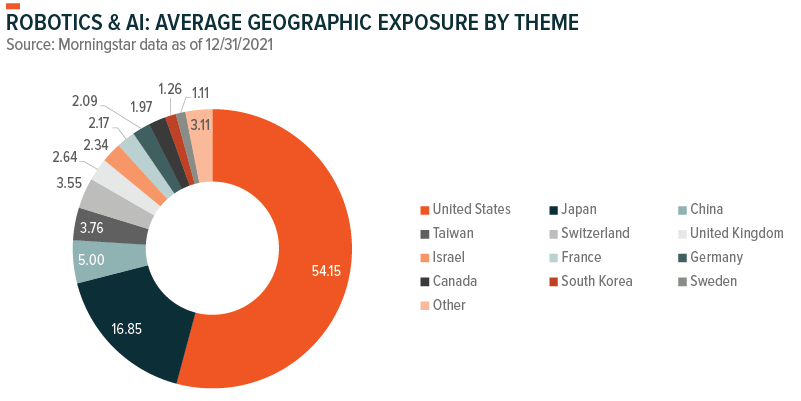

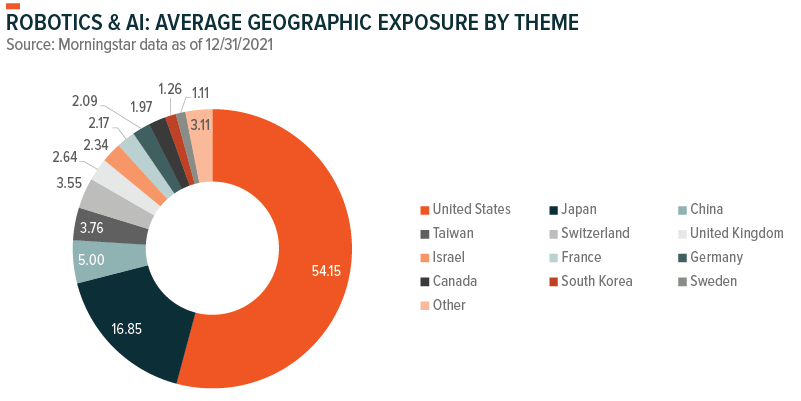

The companies implementing Robotics and AI technologies are global and stand to benefit as thematic adoption rises across the world. The pie chart breaks down the geographic exposure of the largest Robotics and AI thematic ETF products. We believe there is ample innovation occurring outside of the states, and that limiting exposure to the U.S. will exclude key players to the detriment of investors over the long term.

In our view, thematic equity should be targeted, using screens to ensure the underlying companies provide the desired exposure. This pure play focus minimises overlap between themes, while also differentiating the exposure provided by the theme relative to broad beta products. We conducted an overlap analysis between Robotics and AI thematic ETFs, the S&P 500, MSCI ACWI and the most applicable S&P 500 sector ETF, XLI (Industrial Select Sector SPDR Fund). We found that average overlap by weight for Robotics and AI focused ETFs was 5.7% when compared to the S&P 500, 5.2% vs. the MSCI ACWI, and 2.4% vs. XLI.22 Common holdings included medically focused robotics producers, semiconductor firms that produce AI chips, and heavy machinery manufacturers, collectively totaling just a handful of individual companies. These low levels of overlap with broad indexes reflect the benefits of thematic exposure.

The Robotics & AI theme sits at the crossroads of multiple structural trends that are expected to increase adoption in the coming years. Rising inflation, supply chain disruptions, deglobalisation, and aging populations have firms exploring solutions to enhance manufacturing efficiency and reduce costs. As automation becomes increasingly capable, cheaper, and easier to implement, reshoring will likely accelerate as firms see that the benefits of more localised manufacturing outweigh the risks of producing goods far abroad.

From this perspective, the space looks primed for investment as catalysts drive Robotics and AI adoption into the Early Majority stage. The global average robotic density is at just 126 per 10,000 employees, illustrating the scale of the opportunity as automation begins to answer the problems of today with the machines of tomorrow.23

Read the next section of the Thematic Investing Whitepaper on the Mobility (EV/AVs & Lithium/Battery Technology) theme.